- Home

- »

- Next Generation Technologies

- »

-

Warehouse Robotics Market Size & Trends Report, 2030GVR Report cover

![Warehouse Robotics Market Size, Share & Trends Report]()

Warehouse Robotics Market (2023 - 2030) Size, Share & Trends Analysis Report By Product, By Function (Pick & Place, Transportation, Packaging), By Payload Capacity, By Component, By Software, By Application, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-923-4

- Number of Report Pages: 171

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Warehouse Robotics Market Summary

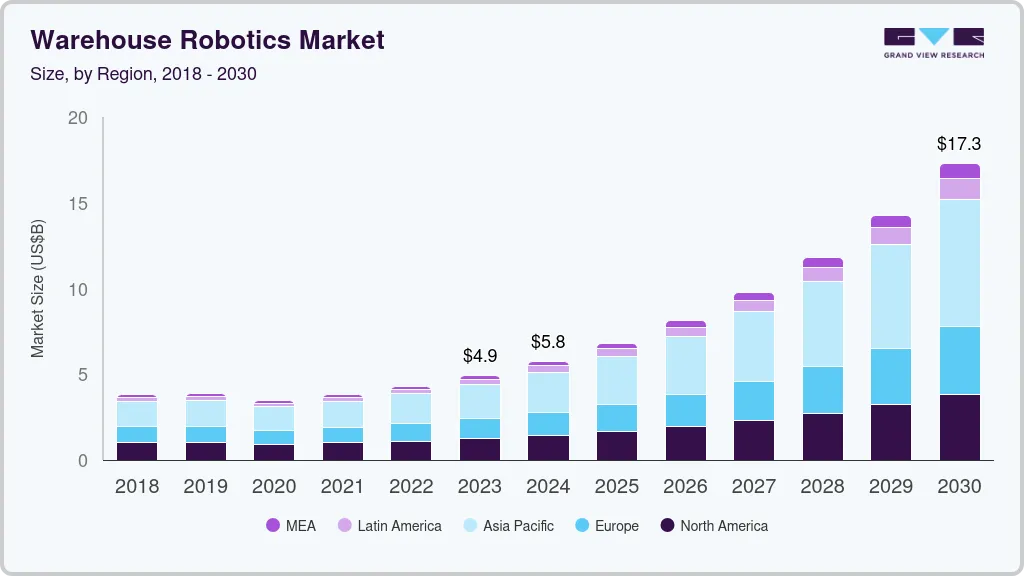

The global warehouse robotics market size was estimated at USD 4.31 billion in 2022 and is projected to reach USD 17.29 billion by 2030, growing at a CAGR of 19.6% from 2023 to 2030. Factors including the growing e-commerce and retail industries, labor shortage, and rising demand to increase the throughput of warehouse operations are fueling the market growth.

Key Market Trends & Insights

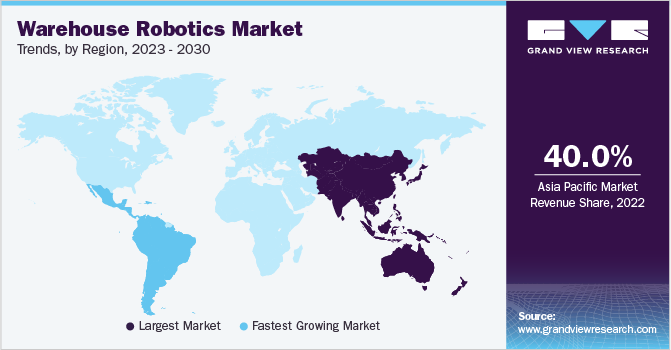

- In terms of region, Asia Pacific was the largest revenue generating market in 2022.

- The Latin America region is expected to witness the highest CAGR from 2023 to 2030.

- In terms of product, mobile robots accounted for the highest market share in 2022.

- The Cartesian robots segment is expected to witness a CAGR of more than 20.0% from 2023 to 2030.

Market Size & Forecast

- 2022 Market Size: USD 4.31 Billion

- 2030 Projected Market Size: USD 17.29 Billion

- CAGR (2023-2030): 19.6%

- Asia Pacific: Largest market in 2022

Warehouse robotics offers enhanced facility safety as it takes over hazardous jobs that put workers at risk.

The growing e-commerce industry owing wide availability of websites and choices results in technological developments. The technologies such as Virtual Reality (VR), Augmented Reality (AR), blockchain technology, Machine Learning (ML), and Artificial Intelligence (AI) are helping marketers to enhance the shopping experience.

Due to aforementioned reason, the warehouse robotics market players are constantly looking for new methods to reduce operational costs, delivery time, and risks to the workers. Robots offer cost-effective, smart alternatives to human labor by automating warehouses in the e-commerce sector. Thus, the growing e-commerce sector is anticipated to drive the growth of the market.

The robots are implemented to automate various tasks in the packing and shipping sector, such as loading, delivery, and unloading. The warehouse industry players are moving towards automation technologies to reduce dependence on workforces. Moreover, the robots are less prone to errors and reduce time and effort during repetitive tasks that are monotonous to the employees. They assist employees in performing heavy and dangerous tasks while providing strength, efficiency, and expertise to maintain employee safety while increasing productivity.

The market players are focusing on enhanced warehouse operations while reducing costs. Delivery errors, picking errors, and transportation damage consumes a lot of time and budget by increasing operational costs and reducing profitability. Further, companies opt for warehouse automation to reduce complexity of processes and eliminate performance burdens. Warehouse robotics has helped companies meet the quality standards of each order, regulate protocols and procedures based on fundamental criteria for various warehouse operations, and enhance the operational productivity of businesses.

Product Insights

The cartesian robots product segment is expected to witness a CAGR of more than 20% from 2023 to 2030. The growth of the segment is attributed to the increasing demand for automation in the packaging, automotive, and pharmaceutical industries. Cartesian robots are widely adopted in such industries due to their accuracy, precision, and ability to handle heavy loads.

Moreover, demand for automated material handling in the industrial sector due to the need for higher productivity, efficiency, and flexibility in warehouse operations is expected to fuel the further growth of cartesian robots over the forecast period.

The mobile robots accounted for the highest market share in 2022. Ongoing technological advancements in the global wearehouse & logistics industry, including machine learning, computer vision, and artificial intelligence is contributing to the development of smarter mobile robots.

The rising need for efficient and cost-effective solutions in logistics and warehousing to increase productivity and profitability, has inspired companies to adopt mobile robots. Moreover, the adoption of mobile robots is growing in various industries, such as manufacturing, healthcare, retail, and agriculture, due to their features such as easy maneuverability and autonomous operation.

Function Insights

In the function segment, the transport segment is anticipated to gain a CAGR of more than 20% from 2023 to 2030. Ongoing growth of the retail and e-commerce sector coupled with the growing demand for automated robots for improved efficiency and reduced costs in logistics has driven growth of the transport segment.

Furthermore, incorporating robots for transport function helps companies overcome labor shortage concerns by automating a variety of tasks. For instance, in November 2022, KNAPP AG collaborated with eMAG.ro, MALL.CZ, HPTRONICS and Alza.cz. This partnership has helped companies to enhance their logistics and operations and hold a strong position as a major technology provider for e-com logistics in Central and South Eastern Europe.

The pick & place accounted for the highest market share in 2022 in the function segment. This growth is attributed to the continuous technological advancements in robots, making them more efficient, accurate, and versatile for pick-and-place activities.

For instance, in December 2022, ABB announced the launch of the SWIFTI CRB1300 industrial collaborative robot; the robot is specially designed for activities from machine tending and palletizing to pick and place and screw driving. Moreover, the cost of pick-and-place robots has decreased over the years; they have become more accessible to smaller businesses and manufacturers, resulting in increased adoption of robots for pick and place activities.

Components Insights

The software segment is estimated to experience a CAGR of approximately 21% over the forecast period. The segment is divided into a warehouse management system, a warehouse control system, and a warehouse execution system. The software tools helps in reducing the manual tasks necessary across warehouse operations.

Thus, need for increased efficiency in warehouse operations and to reduce human errors has contributed to the growth of the warehouse robotics software segment. Furthermore, the incorporation of Artificial Intelligence (AI) is anticipated to boost the growth in the forthcoming years.

The hardware segment is expected to witness a CAGR of more than 17% from 2023 to 2030. The developments in the hardware of robots, such as foldable robots that can change shape and size, making them more versatile, are becoming increasingly popular. Furthermore, the increasing adoption of collaborative robots in a wide range of industries owing to their variety of advantages compared to traditional robots is expected to fuel the growth of the hardware segment from 2023 to 2030.

Application Insights

The healthcare industry is expected to witness the fastest CAGR of approximately 21% in the application segment from 2023 to 2030. Technological developments have enabled machines with remarkable machine dexterity, which allows machines to perform delegated tasks with significant ease in healthcare warehouses. Increasing demand for medications and vaccines, pharmaceutical companies are looking for ways to improve their supply chain and reduce errors in medication dispensing. Warehouse robotics can help automate the process to improve efficiency.

The e-commerce segment accounted for the highest market share in 2022. The growth is attributed to the increased preference for online shopping; the rising demand for fast and efficient order fulfillment has played an important role in automating warehouses and fulfillment centers. E-commerce companies are increasingly adopting warehouse robotics solutions to improve their supply chain management and order fulfillment processes. The increased demand to increase the speed while maintaining accuracy is expected to fuel the further growth of the e-commerce segment over the forecast period.

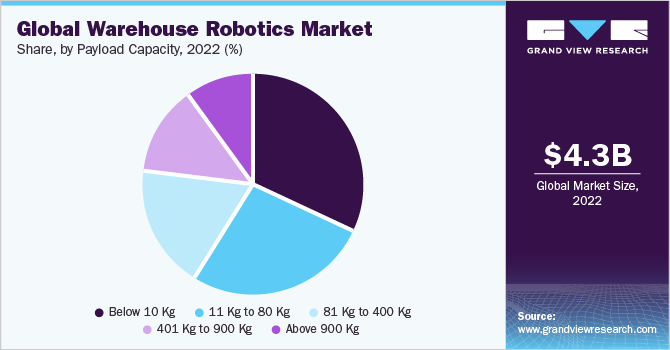

Payload Capacity Insights

The below 10 kg warehouse robots accounted for the highest revenue share in 2022 in payload capacity. The increasing volume of lightweight and small packages that need to be handled in distribution centers and warehouse options owing to the rising adoption of e-commerce shopping is a major driver for the growth of below 10 kg warehouse robots. The increased adoption of lower payload capacity robots in consumer electronics and food & beverages industries is expected to drive the growth of the below 10 kg warehouse robots segment over the forecast period.

The 11 kg to 80 kg warehouse robots is anticipated to witness a CAGR of approximately 20% from 2023 to 2030. The growth is attributed to their ability to efficiently handle medium to heavy-weight items. Moreover, the demand for robots with higher payload capacity is increasing in warehouses of various applications such as manufacturing, healthcare, food, beverages, and more. The continuous technological developments and rising demand for automation in logistics and warehouse operations are expected to support market growth.

Regional Insights

The Asia Pacific region accounted for the highest revenue share in 2022 and is anticipated to maintain its dominance over the forecast period. The increasing installation of warehouse robotics in the region, coupled with the presence of key market players such as Fanuc Corporation, Yaskawa Electric Corporation, Singapore Technologies Engineering Ltd., TOSHIBA CORP., and many others has driven growth of the market. In addition, continuous rise of the retail, manufacturing, and FMCG industries in the region is expected to create lucrative growth opportunities for the market.

The Latin America region is expected to witness the highest CAGR from 2023 to 2030. The region offers lucrative growth opportunities owing to a significant rise in the e-commerce industry. The key players focus on entering a region to add value to the market. For instance, in July 2022, Geek+, the autonomous mobile robot (AMR) technology company, announced a collaboration with Körber Supply Chain to expand into Latin America. The rising research and development investments are expected to create lucrative growth prospects for the market.

Key Players & Market Share Insights

The major players in the market focus on developing innovative collaboration software to attract a more extensive customer base and gain a competitive edge. For instance, in February 2023, Honeywell International Inc. announced the opening of its new research and development facility to advance its technology which helped the warehouse and logistics companies all over Europe. The increasing number of such developments is expected to favor the growth of the market over the forecast period. Some prominent players in the global warehouse robotics market include:

-

ABB

-

Bastian Solutions LLC

-

Daifuku Co. Ltd.

-

Dematic

-

Fetch Robotics Inc.

-

Honeywell International Inc

-

KNAPP AG

-

KUKA AG

-

OMRON Corporation

-

YASKAWA Electric Corporation

-

FANUC Corporation

Warehouse Robotics Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 4.93 billion

Revenue forecast in 2030

USD 17.29 billion

Growth rate

CAGR of 19.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

April 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, function, payload capacity, component, software, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; China; Japan; India; Australia; South Korea; Singapore; Brazil; Mexico

Key companies profiled

ABB; Bastian Solutions LLC; Daifuku Co. Ltd.; Dematic; Fetch Robotics Inc.; Honeywell International Inc.; KNAPP AG; KUKA AG; OMRON Corporation; YASKAWA Electric Corporation; FANUC Corporation

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Warehouse Robotics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global warehouse robotics market report based on product, function, payload capacity, component, software, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Mobile Robots

-

Articulated Robots

-

Cylindrical Robots

-

Scara Robots

-

Parallel Robots

-

Cartesian Robots

-

-

Function Outlook (Revenue, USD Million, 2018 - 2030)

-

Pick & Place

-

Palletizing & De-palletizing

-

Transportation

-

Packaging

-

-

Payload Capacity Outlook (Revenue, USD Million, 2018 - 2030)

-

Below 10 kg

-

11 kg to 80 kg

-

81 kg to 400 kg

-

401 kg to 900 kg

-

Above 900 kg

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

-

Software Outlook (Revenue, USD Million, 2018 - 2030)

-

Warehouse Management System

-

Warehouse Control System

-

Warehouse Execution System

-

-

Application Capacity Outlook (Revenue, USD Million, 2018 - 2030)

-

E-commerce

-

Automotive

-

Consumer Electronics

-

Food & Beverage

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Singapore

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global warehouse robotics market size was estimated at USD 4.31 billion in 2022 and is expected to reach USD 4.93 billion in 2023.

b. The global warehouse robotics market is expected to grow at a compound annual growth rate of 19.6% from 2023 to 2030 to reach USD 17.29 billion by 2030.

b. Asia Pacific dominated the market for warehouse robotics with a revenue share of over 40% in 2022 and is expected to continue leading over the forecast period, owing to the presence of key market players and continuous growth of the retail, manufacturing, and FMCG industries.

b. Some key players operating in the warehouse robotics market include ABB, Honeywell International Inc., KUKA AG, OMRON Corporation, and YASKAWA ELECTRIC CORPORATION.

b. Growth of the global retail and e-commerce industry along with the increased demand for automation due to awareness on safety and superior quality production is fueling the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.