- Home

- »

- Agrochemicals & Fertilizers

- »

-

Water-based Adhesives Market Size, Industry Report, 2030GVR Report cover

![Water-based Adhesives Market Size, Share & Trends Report]()

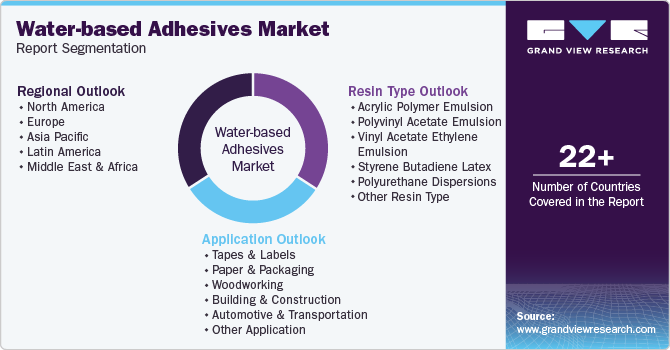

Water-based Adhesives Market (2025 - 2030) Size, Share & Trends Analysis Report By Resin Type (Acrylic Polymer Emulsion, Vinyl Acetate Ethylene Emulsion), By Application (Tapes & Labels, Paper & Packaging, Woodworking), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-526-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Water-based Adhesives Market Summary

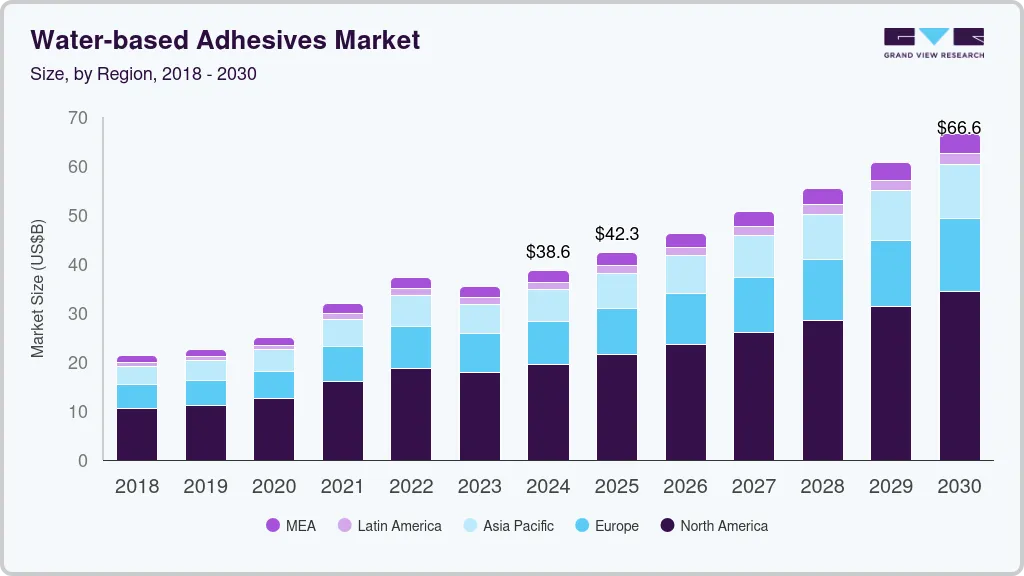

The global water-based adhesives market size was estimated at USD 38.63 billion in 2024 and is projected to reach USD 66.59 billion by 2030, growing at a CAGR of 9.5% from 2025 to 2030. The water-based adhesives industry is expected to grow due to increasing demand for environmentally friendly, non-toxic, and low-VOC (volatile organic compound) adhesives across various industries.

Key Market Trends & Insights

- North America arc welding equipment industry dominated with a revenue share of 50.7% in 2024.

- The growth of the U.S. water-based adhesives industry can be attributed to several factors, particularly the booming packaging industry.

- By resin type, the acrylic polymer emulsion segment accounted for the largest revenue share of 37.4% in 2024.

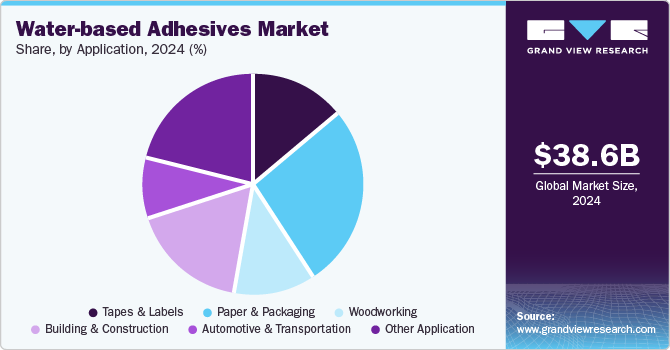

- By application, the tapes and labels segment dominated the market with a share of 14.3% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 38.63 Billion

- 2030 Projected Market Size: USD 66.59 Billion

- CAGR (2025-2030): 9.5%

- North America: Largest market in 2024

These adhesives use water as a carrier instead of harmful solvents, making them more sustainable and safer for applications in packaging, construction, automotive, and consumer goods. Water-based or water-borne adhesives are primarily made from soluble synthetic or natural polymers. They are commonly used to bond various substrates in various applications, including woodworking, tapes and labels, paper and packaging, construction, and the transportation and automotive industries.

Water-based adhesives require at least one substrate to be water-permeable to facilitate the escape of water from the bond line as they work through wet bonding. Due to their flexibility and quick setting time, water-based adhesives see significant use in the paper and packaging, construction, automotive, and woodworking sectors.

Drivers, Opportunities & Restraints

The increasing emphasis on environmentally friendly products is driving demand for water-based adhesives, which are lightweight and have low pollutant emissions. Industries are shifting towards sustainable materials to meet regulatory standards and consumer preferences, further boosting the market growth. As manufacturers prioritize eco-friendly solutions, the water-based adhesive sector is expected to experience significant growth.

Water-based adhesives typically dry slower than solvent-based options. This extended drying period can be advantageous, allowing for more precise application and adjustments during assembly. However, it may also lead to longer production cycles, which manufacturers must account for in their processes. Overcoming this challenge often involves optimizing formulation or applying techniques to accelerate drying without compromising bond strength.

The water-based adhesives market presents substantial opportunities due to rising demand for eco-friendly, low-VOC adhesives in the packaging, construction, and automotive industries. Growth in e-commerce and sustainable packaging is driving higher adoption, while green building regulations boost demand in construction. Additionally, advancements in bio-based and high-performance adhesives open new possibilities in medical, aerospace, and electronics applications, enhancing market expansion.

Resin Type Insights

The acrylic polymer emulsion segment accounted for the largest revenue share of 37.4% in 2024 and is expected to continue dominating the industry over the forecast period. This growth is due to its high durability, water resistance, and strong adhesion properties across the packaging, construction, and automotive industries. Key market growth drivers are the rising demand for low VOC, eco-friendly adhesives, and increasing adoption of pressure-sensitive applications such as labels and tapes. Additionally, advancements in polymer technology are enhancing performance, making acrylic emulsions a preferred choice for sustainable adhesive solutions.

The polyvinyl acetate (PVA) emulsion segment in the water-based adhesives industry is growing due to its strong bonding strength, flexibility, and cost-effectiveness. It is ideal for woodworking, paper and packaging, and construction applications. The increasing demand for eco-friendly and low-VOC adhesives and rising use in the furniture and bookbinding industries are driving market expansion. Additionally, advancements in PVA formulations improve water resistance and durability, further boosting adoption.

Application Insights

The tapes and labels segment dominated the market with a share of 14.3% in 2024. The segment in the water-based adhesives market is expected to grow due to the rising demand for eco-friendly and high-performance adhesives in packaging, logistics, and consumer goods. Growth in e-commerce and retail industries drives the need for durable, moisture-resistant labels and pressure-sensitive tapes. Additionally, stringent environmental regulations promoting low-VOC adhesives and advancements in fast-drying water-based formulations are accelerating market adoption.

The woodworking segment in the water-based adhesives market is growing due to increasing demand for strong, flexible, eco-friendly adhesives in furniture manufacturing, cabinetry, and flooring applications. A key market driver is the shift toward low-VOC and formaldehyde-free adhesives driven by green building certifications (LEED, BREEAM). Additionally, advancements in polyvinyl acetate (PVA) and acrylic emulsions enhance bond strength and moisture resistance, making water-based adhesives a preferred choice in the woodworking industry.

Regional Insights

The North America water-based adhesives industry is growing due to strict environmental regulations promoting low-VOC and sustainable adhesives, particularly in the packaging, construction, and automotive industries. The rise in e-commerce and demand for eco-friendly packaging solutions is a key driver, boosting the use of water-based adhesives in tapes and labels. Additionally, advancements in adhesive technology and the increasing adoption of green building materials are further propelling regional market expansion.

U.S. Water-based Adhesives Market Trends

The growth of the U.S. water-based adhesives industry can be attributed to several factors, particularly the booming packaging industry, which significantly benefits from their effectiveness in bonding various materials such as plastics and paper products. Key sectors contributing to this expansion include the construction Industry, which is expected to experience substantial growth as water-based adhesives are increasingly used in applications ranging from roofing to prefabricated components.

Asia Pacific Water-Based Adhesives Market Trends

The Asia Pacific region dominates the water-based adhesives industry in 2024, driven by rapid industrialization, booming packaging and construction sectors, and increasing demand for eco-friendly adhesives—rising e-commerce and infrastructure projects in countries like China, India, and Southeast Asia fuel market growth. Additionally, strict environmental regulations and the shift toward low-VOC, sustainable adhesives are accelerating adoption, making the region a key growth hub for water-based manufacturers.

The China water-based adhesives market isexpected to grow significantly over the forecast period,due to various factors. Environmental initiatives, the expansion of end-user industries, technological advancements, urbanization trends, and growth in the automotive sector all contribute to this thriving market. As these elements unite, manufacturers must keep innovating and adapting their product offerings to meet the market's changing demands.

Europe Water-Based Adhesives Market Trends

The demand for furniture and interior decorations in Europe has been driven by several factors, including a growing population, improving living standards, and evolving lifestyle preferences. Water-based wood adhesives are essential in furniture manufacturing, as they help bond various wood components such as panels, veneers, and joints. Additionally, these adhesives provide improved moisture resistance, heat resistance, and bonding strength, ensuring the final products' longevity and quality.

Latin America Water-Based Adhesives Market Trends

In Latin America, spending on residential construction and renovation is anticipated to stay high due to the growing middle-class population, increasing disposable income, and a heightened awareness of sustainable renovation materials. As more people invest in home ownership, the demand for these services rises. Additionally, governments in South America are supporting the real estate market by providing cash incentives to local councils to approve new housing developments.

Middle East & Africa Water-Based Adhesives Market Trends

The construction industry in the Middle East and Africa region is expected to experience significant growth, primarily due to increased government engagement and investments in sectors such as education, healthcare, and infrastructure. These initiatives aim to diversify the region's economy and reduce reliance on traditional oil activities, thereby supporting overall economic growth.

Key Water-based Adhesives Company Insights

Some of the key players operating in the market include Henkel AG & Co. KgaA and Sika AG.

-

Henkel AG & Co., KGaA operates through three business segments: adhesive technologies, beauty care, and laundry & home care. The adhesive technologies business segment is further divided into two segments: adhesives for consumers & craftsmen and building & industrial businesses. The company’s operations are spread across Western Europe, Eastern Europe, the Middle East & Africa, North America, Latin America, and Asia Pacific. The company operates through 185 production sites across 56 countries, of which 141 facilities are dedicated to adhesive technologies, 11 to beauty care, and 33 to laundry & home care.

-

Sika AG is a specialty chemicals company that manufactures products targeting seven markets, which include concrete, waterproofing, roofing, flooring, sealing & bonding, refurbishment, and industry. The company has several subsidiaries across 100 countries and has over 200 factories.

Key Water-based Adhesives Companies:

The following are the leading companies in the water-based adhesives market. These companies collectively hold the largest market share and dictate industry trends.

- Henkel AG & Co. KgaA

- H.B. Fuller

- Arkema

- Dow

- Ashland

- Bayer AG

- PPG Industries

- Sika AG

- Akzo Nobel N.V.

- 3M

- DuPont

Recent Developments

-

In November 2024, Henkel Corporation partnered with Celanese Corporation to produce water-based adhesives from captured CO2 emissions. This collaboration opens new opportunities for customers in the packaging and consumer goods sectors, allowing them to increase the renewable content of their products by incorporating CO2 emissions into the production process.

-

In September 2024, H.B. Fuller acquired Sanglier Limited, a UK-based company that manufactures sprayable industrial adhesives. This acquisition strengthens H.B. Fuller's innovation capabilities and expands its product portfolio in the UK and Europe, particularly in the Construction and Engineering Adhesives sectors.

Water-based Adhesives Report Scope

Report Attribute

Details

Market size value in 2025

USD 42.25 billion

Revenue forecast in 2030

USD 66.59 billion

Growth rate

CAGR of 9.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Resin type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Henkel AG & Co. KgaA; H.B. Fuller; Arkema; Dow; Ashland; Bayer AG; PPG Industries; Sika AG; Akzo Nobel N.V.; 3M; DuPont

Customization scope

Free report customization (equivalent to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Water-based Adhesives Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global water-based adhesives market report based on resin type, application, and region:

-

Resin Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Acrylic Polymer Emulsion

-

Polyvinyl Acetate Emulsion

-

Vinyl Acetate Ethylene Emulsion

-

Styrene Butadiene Latex

-

Polyurethane Dispersions

-

Other Resin Type

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Tapes & Labels

-

Paper & Packaging

-

Woodworking

-

Building & Construction

-

Automotive & Transportation

-

Other Application

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global market for water-based adhesives was estimated at USD 38.63 billion in 2024 and is expected to reach USD 42.25 billion in 2025.

b. The global water-based adhesives market is expected to grow at a compound annual growth rate of 9.5% from 2025 to 2030, reaching USD 66.59 billion in 2030.

b. North America dominated the water-based adhesives market with a share of 50.7% in 2024. This is attributed to strict environmental regulations promoting low-VOC and sustainable adhesives, particularly in the packaging, construction, and automotive industries.

b. The market is expected to grow due to increasing demand for environmentally friendly, non-toxic, and low-VOC (volatile organic compound) adhesives across various industries. These adhesives use water as a carrier instead of harmful solvents, making them more sustainable and safer for applications in packaging, construction, automotive, and consumer goods.

b. Some key players operating in the polyurethane market include Henkel AG & Co. KgaA, 3M, Emerson Electric Co., Dow, Ashland, Bayer AG, PPG Industries, Sika AG, H.B. Fuller, 3M, Oriental International (Pvt) Ltd., and Akzo Nobel N.V.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.