- Home

- »

- Electronic & Electrical

- »

-

Water Flosser Market Size, Industry Report, 2021-2028GVR Report cover

![Water Flosser Market Size, Share & Trends Report]()

Water Flosser Market (2021 - 2028) Size, Share & Trends Analysis Report By Product (Cordless, Countertop), By Application (Dental Clinics, Hospitals, Home Care), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-414-7

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2016 - 2019

- Forecast Period: 2021 - 2028

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Water Flosser Market Summary

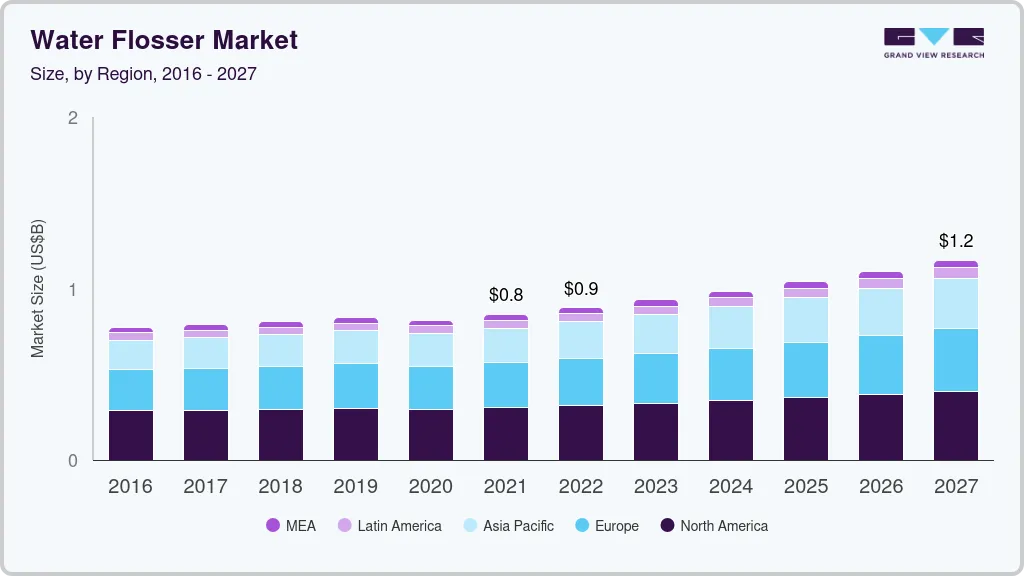

The global water flosser market size was estimated at USD 814.3 million in 2020 and is projected to reach USD 1,234.8 million by 2028, growing at a CAGR of 5.3% from 2020 to 2028. Increasing consumption of tobacco products and rising cases of oral and dental problems are likely to boost the market growth over the forecast period.

Key Market Trends & Insights

- North America dominated the global water flosser market with the largest revenue share of 36.0% in 2020.

- By application, the dental clinic segment led the market, holding the largest revenue share of 56.0% in 2020.

- By product, the countertop water flosser segment is projected to expand at a CAGR of 5.0% from 2021 to 2028.

Market Size & Forecast

- 2020 Market Size: USD 814.3 Million

- 2028 Projected Market Size: USD 1234.8 Million

- CAGR (2021-2028): 5.3%

- North America: Largest market in 2020

Oral diseases, including tooth decay, gum disease, and oral cancers, affect almost half of the global population. Untreated dental decay is emerging as the most common health condition worldwide. Lip and oral cavity cancers are among the top 15 most common cancers in the world. In addition to lower quality of life, oral diseases have a major economic impact on both individuals and the wider healthcare system.

The closure of dental practices and businesses owing to the COVID-19 pandemic and the subsequent lockdown orders has greatly challenged the penetration of water flossers across the commercial segments. The resulting office closures led to unprecedented revenue losses across the sector, thereby challenging the adoption of water flossers. According to a recent survey by the American Association of Endodontists, more than half of all Americans have put off dental check-ups due to the pandemic. With dental hygiene habits and routines severely skewed over the past year, the survey also showed that while 24% of those surveyed were flossing less frequently, about 23% said they were not flossing at all. Such trends pose significant challenges to the market.

Awareness with respect to the importance of dental flossing in order to prevent gum diseases and oral infections has significantly increased with time. This, in turn, is driving the demand for more convenient flossing substitutes for manual flossing, thereby triggering the adoption of water flossers among consumers. A diverse group of end users, including individuals with braces, uneven teeth, dental implants, or any gum diseases, has been shifting from string flossing to water flossers due to the latter’s ease of use and improved efficiency at preventing gum diseases. Water flossers use pressurized irrigation to remove food debris and plaque in areas of the mouth that are harder to get to with a toothbrush, or even high-end, powered toothbrushes.

The sales of water flossers have been ramping up at a healthy rate with the growing popularity of portable and rechargeable flossers among consumers seeking convenience and efficiency. There are three types of water flossers trending in the market: cordless, countertop, and attachable. Countertop water flossers rest on bathroom counters and are plugged into an electrical outlet. These variants often offer the highest number of features. Consumers looking for kid-friendly water flossers usually opt for the Waterpik WP-260, which features a colorful and simple design ideal for children aged six and above. The device is designed with easy control options: an on-and-off switch and three different pressure settings. Additionally, the reservoir can hold enough water for a 60-second session. The WP-260 also comes with an orthodontic tip, making it ideal for kids with braces.

Application Insights

In terms of value, the dental clinic application segment dominated the market with a share of over 56.0% in 2020. This application segment is projected to witness the highest growth over the forecast period. The growing demand for professional dental care due to the rising cases of oral diseases is a key factor driving the segment. According to the United Health Foundation, in 2019, 67.6% of adults in the U.S. reported visiting the dentist or dental clinic that year. Moreover, the rising prevalence of diabetes, which increases the risk of periodontal diseases due to uncontrolled or improper glucose levels, will boost the segment growth over the forecast period. The continued prevalence of periodontal diseases and rapid technological advancements in the dental care industry are significantly strengthening the demand for water flossers. Although in its nascent stage, the market for water flosser is anticipated to witness a notable boost in sales over the coming years.

The hospitals application segment is projected to expand at a CAGR of 5.1% from 2021 to 2028. The market is highly driven by the rise in dental care, growing patient awareness, and the availability of advanced medical technology. Flossing has become a vital part of daily oral hygiene as it removes plaque between the teeth and failure to do so can often lead to various infections and diseases. Periodontal diseases are mainly prevalent in middle- and low-income countries and differ based on social and genetic factors. The prevention of these diseases has emerged as a subject of improved healthcare and economic benefit to both society and the individual. A consumer survey reports that only 2% to 10% of the population flosses regularly and effectively, with a substantial part of the population never flossing at all. A recent American Dental Association (ADA) survey reported that 32.9% of the U.S. population used dental floss or other interdental cleaners only once every day.

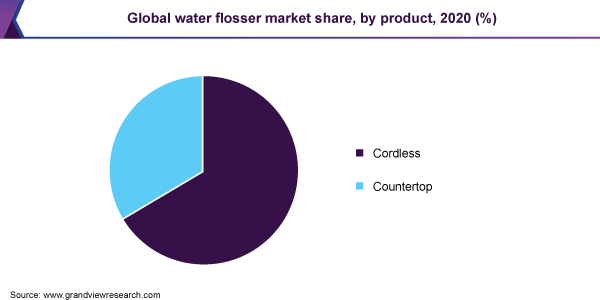

Product Insights

In terms of value, the cordless water flosser segment dominated the market with a share of 66.4% in 2020. This application segment is projected to witness the highest growth over the forecast period. This is attributed to the increasing demand for feasible and portable electronic gadgets. According to clinical findings, these products are 93% more effective in reducing gum bleeding than string floss and 52% more effective in reducing gingivitis. Recognizing the high demand for these products, an increasing number of manufacturers have been aiming to tap into the cordless water flosser segment. Some of the most highly recommended and commonly preferred cordless water flossers are Waterpik Cordless Advanced, Waterpik Cordless Plus, Panasonic Dental Water Flosser EW-DJ10-A, and Waterpik Cordless Freedom.

The countertop water flosser segment is projected to expand at a CAGR of 5.0% from 2021 to 2028. The countertop models offer a much greater range of water pressure, ranging from extra gentle to maximum cleaning. For instance, it has been known that users of the Experienced Waterpik water flosser tend to prefer higher pressure settings, which is why the company offers a wide range of high-pressure integrated countertop flossers. At the same time, consumers with sensitive gums may prefer lower pressure settings offered by a countertop model. Countertop water flossers hold more water compared to a cordless model.

Regional Insights

North America dominated the global market by accounting for a 36.0% share in 2020. Increasing awareness regarding the maintenance of oral health has played a crucial role in propelling sales of water flossers in the region. According to the Canadian Community Health Survey, it was found that 43.0% of the Canadian population flossed their teeth at least once per day. This shows that a large part of the population is sufficiently aware of the importance of flossing to maintain healthy oral hygiene, thereby acting as a favorable factor for the growth of the North American market for water flossers.

The Asia Pacific market is projected to expand at the fastest CAGR of 6.6% from 2021 to 2028. The growing consumption of foods that are considered to be bad for oral health, such as candies, sweets, and starchy food, among the large Asian population has resulted in an increased prevalence of dental problems. This is expected to drive the uptake of water flossers among consumers in the region.

Key Companies & Market Share Insights

The market for water flossers is characterized by the presence of several well-established players. These players account for a significant market share, have diverse product portfolios, and a strong presence across the globe. Moreover, the market includes small to mid-sized players, who offer a selected range of water flossers.

The impact of these major players on the market is quite high as a majority of them have vast distribution networks across the globe to reach out to their large customer bases. Key players operating in the market are focusing on strategic initiatives, such as new product launches, in order to boost revenue growth and reinforce their position in the global market. Some prominent players in the global water flosser market include:

-

The Procter & Gamble Company

-

Koninklijke Philips N.V.

-

Fly Cat Electrical Co., Ltd.

-

Hydro Floss (Oral Care Technologies, Inc.)

-

Panasonic Corporation

-

Water Pik Inc.

-

ToiletTree Products Inc.

-

Aquapick Co. Ltd.

-

JETPIK Corporation

Water Flosser Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 849.3 million

Revenue forecast in 2028

USD 1,234.8 million

Growth Rate

CAGR of 5.3% from 2021 to 2028

Base year for estimation

2020

Historical data

2016 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Germany; U.K.; China; India; Japan; Brazil

Key companies profiled

The Procter & Gamble Company; Koninklijke Philips N.V.; Fly Cat Electrical Co., Ltd.; Hydro Floss (Oral Care Technologies, Inc.); Panasonic Corporation; Water Pik Inc.; ToiletTree Products Inc.; Aquapick Co. Ltd.; The P & G Company; JETPIK Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2028. For the purpose of this study, Grand View Research has segmented the global water flosser market report on the basis of product, application, and region:

-

Product Outlook (Revenue, USD Million, 2016 - 2028)

-

Cordless

-

Countertop

-

-

Application Outlook (Revenue, USD Million, 2016 - 2028)

-

Dental Clinics

-

Hospitals

-

Home Care

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2028)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

U.K.

-

-

Asia Pacific

-

India

-

China

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global water flosser market size was estimated at USD 814.3 million in 2020 and is expected to reach USD 849.3 million in 2021.

b. The global water flosser market is expected to grow at a compound annual growth rate of 5.3% from 2021 to 2028 to reach USD 1,234.8 million by 2028.

b. North America dominated the water flosser market with a share of 36.0% in 2020. This is attributable to the growing target population and awareness about oral care and hygiene, as well as the rising cases of gum diseases in the region.

b. Some key players operating in the water flosser market include Shenzhen Relish Technology Co., Ltd.; Hydro Floss; Water Pik, Inc.; ToiletTree Products, Inc.; Ginsey Home Solutions; Oral Breeze; Koninklijke Philips N.V.; Procter & Gamble; Aquapick; and S. C. Johnson & Son, Inc.

b. Key factors that are driving the water flosser market growth include increasing consumption of tobacco products and cases of oral health issues, along with rising awareness about oral care among consumers.

b. The dental clinic application segment dominated the global water flosser market with a share of over 56.0% in 2020.

b. The cordless water flosser segment dominated the global water flosser market with a share of 66.4% in 2020.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.