- Home

- »

- Next Generation Technologies

- »

-

Wearable Payments Devices Market Size, Share Report 2030GVR Report cover

![Wearable Payments Devices Market Size, Share & Trends Report]()

Wearable Payments Devices Market (2025 - 2030) Size, Share & Trends Analysis Report By Device (Fitness Tracker, Smart Watches), By Technology (NFC, RFID, QR Codes), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-284-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Wearable Payments Devices Market Summary

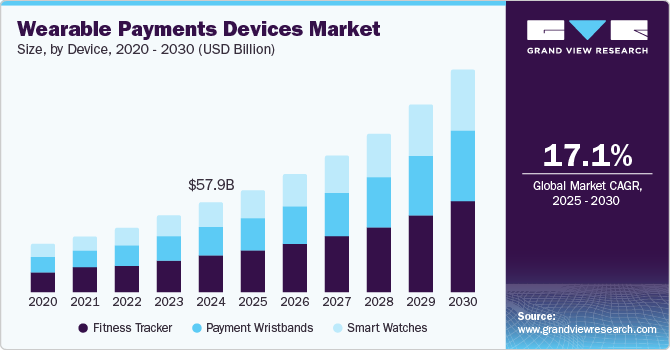

The global wearable payments devices market size was estimated at USD 57.98 billion in 2024 and is projected to reach USD 148.88 billion by 2030, growing at a CAGR of 17.1% from 2025 to 2030. Increasing demand for Host Card Emulation (HCE) technology and extensive adoption of cashless transactions have ensured strong market growth.

Key Market Trends & Insights

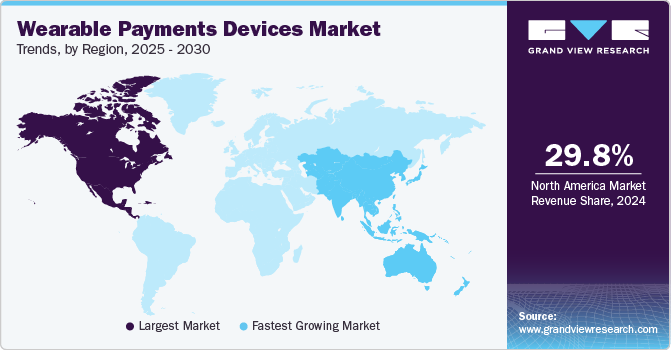

- In terms of region, North America was the largest revenue generating market in 2024.

- Asia Pacific is anticipated to witness the fastest growth rate over the forecast period.

- In terms of devices, the fitness tracker segment accounted for a leading revenue share of 41.9% in 2024.

- Smart Watches is the most lucrative device type segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 57.98 Billion

- 2030 Projected Market Size: USD 148.88 Billion

- CAGR (2025-2030): 17.1%

- North America: Largest market in 2024

Consumers are recognizing the fast payment capabilities of wearables, including fitness trackers and smartwatches, encouraging manufacturers to include these features while maintaining the highest level of security in such devices. E-banking platforms are also increasingly adopting wearable payment devices through the integration of Near Field Communication (NFC) technology into their transaction operations, facilitating seamless payments. Businesses widely utilize NFC to transfer data from their device to contactless payment terminals such as smartphones and NFC tags.

As governments globally focus on digitizing the payment infrastructure, creating regulations and policies to ensure consumer privacy has enabled positive developments in the industry. For instance, regulations such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the U.S. govern how companies collect, store, and use personal data, including data from wearable devices. Moreover, the EU Payment Services Directive (PSD2) enhances consumer protection and promotes innovations in payment services across Europe, impacting the manner of payment handling by wearables. Wearable payments have become a convenient solution, particularly for carrying out small- and medium-sized transactions. Their range of benefits has encouraged underdeveloped and developing economies to invest in these technologies, driving awareness regarding the market. For instance, in October 2024, Mastercard and Tappy Technologies partnered with Premier Bank, a Somalian bank, to launch the ‘Tap2Pay’ tokenized payment wearables. This solution, the first in Somalia, combines NFC technology with bracelets, eyeglasses, rings, phone cases, and smartwatch straps to help consumers make secure and quick purchases.

The use of smart technologies, along with rapid Internet penetration worldwide, has led to a steadily rising adoption of connected devices. Wearable such as smartwatches and wrist straps have found widespread application in payment and authentication scenarios at festivals and exhibitions. Many festivals issue RFID (Radio-Frequency Identification) wristbands that attendees can preload with funds. These wristbands can be scanned at vendor locations for quick, cashless payments. Festivals often provide apps that allow attendees to manage their wristband accounts, check balances, and top up funds remotely. This integration helps keep track of spending and enhances the overall experience. Additionally, they offer robust security features, as RFID wristbands are typically secure and linked to a unique account, minimizing the risk of fraud compared to cash transactions. Also, these events have protocols for reporting lost wristbands, allowing attendees to recover their funds or receive a replacement.

Device Insights

The fitness tracker segment accounted for a leading revenue share of 41.9% in the global market in 2024. These devices have witnessed a strong growth in demand in recent years, owing to the increasing fitness-focused demographic globally and the extensive use of fitness devices. Fitness trackers offer high convenience for consumers by offering quick access to payment options during workouts or while on the go. Moreover, device makers are increasingly incorporating tokenization and biometric authentication features to ensure fast & secure transactions, driving their appeal. Fitbit, one of the leading fitness trackers globally, supports Google Wallet, allowing payments to be made through both debit and credit cards that can be added to select Fitbit devices. Numerous vendors in this market have started integrating mobile payment features into their fitness trackers. In October 2024, Tappy Technologies, a Canada-based wearable contactless payment solutions provider, launched its integrated payment and fitness ring at the Hong Kong Fintech Week 2024. The company has collaborated with Thales to equip the ring with the latter’s secure element chips. The device can be tokenized with the credit, debit, and prepaid cards of users, offering a seamless payment experience.

Meanwhile, the smartwatch segment is expected to advance at the fastest CAGR from 2025 to 2030. The increased accessibility and convenience offered by these products through a combination of NFC technology, digital wallet integration, and robust security measures has ensured substantial sales of these devices. Rising focus of manufacturers on introducing economical and multifunctional smartwatches has led to substantial sales of these products, particularly in price-sensitive economies such as India. According to a report by Watch Faces, as of January 2023, around 22.5% of Internet users worldwide, or 1.2 billion people, owned a smartwatch. This was an increase of 9% from the preceding year, with the UAE, Czech Republic, Hong Kong, India, and Poland leading in terms of adoption. Smartwatches can be conveniently connected to smartphones via NFC, Bluetooth, or radiofrequency (RF), making it easier for users to pay bills and conduct other payments. Most smartwatches equipped with payment features use NFC technology, allowing users to tap their watch against a compatible payment terminal to complete a transaction. They can be used at any merchant that accepts contactless payments, which has become increasingly common in many retail businesses.

Technology Insights

The barcode segment accounted for a leading revenue share in the global market in 2024. Retailers aim to improve customer experience at their establishments by removing payment friction at checkout points, leading to the significant adoption of barcodes. Wearable devices are encoded with barcode scanners that leverage scan-and-go technology, enabling customers to scan products while shopping seamlessly. This helps avoid various challenges associated with conventional processes, such as increased waiting times, lack of space at payment sections, and non-availability of staff. Barcode technology offers enhanced security, easy and quick reading, and large data storage capacity. Various devices can read them, making them versatile for different retail environments. Unlike NFC, which requires specific terminal capabilities, many existing barcode scanners are widely available in retail settings. The technology can also be used for loyalty programs, enabling users to earn points or discounts while making purchases.

The contactless Point of Sale (POS) terminals segment is anticipated to witness the highest CAGR during the forecast period. The increasing proliferation of smartphones and wearables and awareness regarding digital transformation has led to the evolution of the transaction and payment landscape globally. Retailers are facing increased competition to drive product sales, necessitating improvements in customer experience, with the deployment of contactless payment systems being a widely adopted strategy. Another notable factor driving segment expansion is the rapid integration of NFC and IoT-based contactless payment capabilities into wearables. Merchants are upgrading their POS terminals to Contactless POS (CPOS) to address consumer demand for payments using smart wearables. Contactless POS terminals leverage NFC technology to allow secure tap-to-pay transactions. When a user holds a wearable device such as a fitness tracker or smartwatch near the terminal, the two devices communicate wirelessly. The wearable sends tokenized payment information to the terminal, which almost instantly processes the transaction. Thus, the technology enables quick completion of transactions, often in seconds, making the checkout process faster for merchants and customers.

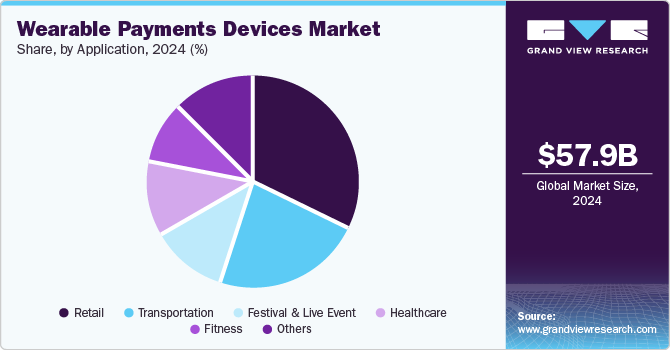

Application Insights

The retail segment accounted for a leading revenue share in the global market in 2024 and is expected to grow at the fastest CAGR during the forecast period, owing to the increasing pace of innovations in this sector. Wearable payments offer significant transparency and convenience for consumers, allowing them to carry out transactions easily at any location and monitor where those transactions are taking place. For retailers, these technologies enable them to find new avenues to connect and interact with customers. According to Deloitte, data gathered from wearable devices can aid retailers in promoting tailored coupon offers or visual marketing to customers as they approach stores, boosting traffic. Consumers are increasingly demanding cashless and contactless payment solutions in local shops and supermarkets to avoid the hassle of carrying cash and standing in long queues. A research report by Accenture published in December 2022 stated that the number of buyers using advanced payment options as the primary in-person method would increase from 9% in 2022 to 20% in 2025. This showcases the strong growth potential for wearable payments in retail businesses.

The transportation segment is anticipated to account for a substantial contribution to the global market, as wearables present a convenient solution for both passengers and operators. Consumers can use their wearable devices to pay for their fares without requiring to carry any separate device or physical card. Wearable devices leverage NFC technology, which means that even if the device's battery is depleted, the payment can still be completed. NFC readers can also read wearable devices, which avoids requirement of any additional equipment. With constantly increasing investments in the modernization of public transport, citizens expect payment methods to become quick and hassle-free. According to Visa’s 3rd edition of Future of Urban Mobility Survey conducted in May 2023, more than half (51%) of public transit riders used at least four payment methods every month for their trips. Additionally, 94% of riders expected that public transit would include contactless payment options in the near future, while 65% stated their inclination to use these options during the succeeding 12 months. These consumer trends are expected to positively shape demand for wearables in this application area.

Regional Insights

North America wearable payments devices market accounted for the leading revenue share of 29.8% in the global wearable payments devices market in 2024. Increasing awareness regarding wearable technologies and incorporation of advanced payment solutions by leading banks and financial institutions has enabled strong market growth in economies such as the U.S. and Canada. Moreover, rising focus on health and fitness has driven the adoption of smart watches and fitness trackers among regional consumers. These devices are now including a number of additional features that allow transactions to be carried out in areas such as retail, transportation, and music festivals or exhibitions. The presence of key companies such as Apple, Google, Fitbit, and Tappy Technologies has increased market competition, thereby driving innovative developments. In Canada, contactless payments in the retail sector have become a highly preferred option for citizens, as highlighted in the Canadian Payment Methods and Trends Report published by Payments Canada. The report stated that in 2023, the contactless mode accounted for 53% of retail transactions, while wearables such as smart watches and fitness trackers were used in 44 million payment instances in the country. These trends highlight substantial developments in the regional industry.

U.S. Wearable Payments Devices Market Trends

The U.S. wearable payments devices market accounted for a dominant revenue share in the regional market for wearable payment devices in 2024. The country has witnessed a significant adoption of devices such as smart watches and fitness trackers, which has encouraged manufacturers to include payment features that present an easy and convenient way to conduct transactions. A report by Watch Faces published in June 2023 found that the rate of smartwatch ownership in the country stood at 26%, which translates to almost 81 million people. Moreover, the financial infrastructure in the country is also well-developed, with a number of regulations being established under broader financial and consumer protection laws to ensure secure and seamless transactions and prevention of fraud and security breaches. For instance, the Payment Card Industry Data Security Standard (PCI DSS) standard applies to any company that processes credit card information, including wearable payment devices. Manufacturers and service providers must ensure that their devices meet strict security protocols to protect user data. The Federal Trade Commission (FTC) also enforces regulations against deceptive practices and ensures that marketing related to wearable payments is not misleading.

Europe Wearable Payments Devices Market Trends

Europe is anticipated to advance at a substantial CAGR during the forecast period, aided by the presence of a robust financial technology infrastructure and a notable shift toward digital payments among regional consumers. An increasing number of retailers and service providers in leading European economies are adopting systems that accept wearable payments, encouraging consumer use. European tech companies and fashion brands are increasingly integrating payment technologies into wearables, such as smartwatches, fitness trackers, and even jewelry, appealing to a wide range of consumers. Technologies such as near-field communication (NFC), QR codes, and radio frequency identification (RFID) are being leveraged to offer quick and convenient payment solutions for customers. The European Union has been highly supportive of digital payment innovations, with regulations that promote security and interoperability further encouraging the adoption of wearable payment devices.

Asia Pacific Wearable Payments Devices Market Trends

The Asia Pacific wearable payments devices market is anticipated to advance at the fastest growth rate from 2025 to 2030. Constant technological advancements in regional economies such as China, South Korea, and India, coupled with increasing disposable income levels, have increased wearables sales that integrate payment features. Consumers in the region have become fitness-conscious, driving sales of products that can monitor various health metrics. As a result, regional companies aim to increase the value of their products by adding payment features.

The India wearable payments devices market is expected to expand at a substantial CAGR from 2025 to 2030. In India, the rapid expansion of the digital payments ecosystem and growing demand for smartwatches and fitness trackers have led consumer electronics brands to launch products with advanced payment features. According to an article by Mastercard, in 2023, the economy’s wearables market grew strongly by 34%. This resulted in smartwatch shipments rising to 73.7%, leading to around 54 million devices in the Indian market. Consumer electronics companies collaborate with banks and financial institutes to launch their services. For instance, in August 2024, Airtel Payments Bank partnered with Noise and the National Payments Corporation of India (NPCI) to launch the NCMC (National Common Mobility Card)-enabled smartwatch, integrated with the RuPay chip. Similar developments in other economies are expected to aid substantial regional market growth.

Key Wearable Payments Devices Company Insights

Some of the major companies involved in the global wearable payment devices market include Apple, Google, and Mastercard, among others.

-

Apple is a major global designer and manufacturer of smartphones, personal computers, tablets, and wearable devices. The company’s product portfolio includes iPhone, Mac, iPad, Apple TV, and the Apple Watch. Apple also provides payment, advertising, and cloud services as well as various professional and consumer software applications, including iOS, macOS, watchOS, iCloud, and Apple Pay. The Apple Watch is the most prominent wearable offered by the company with payment capabilities. Users can add their credit or debit cards to the Wallet app and make contactless payments using Apple Pay.

-

Google is a leading provider of search and advertising services on the Internet. The company's operates across a number of areas, including search, advertising, platforms and operating systems, and enterprise and hardware products. The Google Pay solution can be integrated with different wearable devices such as smartwatches to allow seamless contactless payments. Smartwatches running on Wear OS, which is Google's smartwatch operating system, can support Google Pay. This includes devices from brands such as Fossil, Samsung, Oppo, and Mobvoi, among others. Fitbit is a subsidiary of Google that develops fitness and health solutions for consumers to keep track of health parameters. The brand’s portfolio includes Fitbit Versa 3, Fitbit Versa 2, Fitbit Inspire 2, and Fitbit Charge 4. Fitbit payments are facilitated through ‘Google Wallet,’ which allows users to make contactless payments directly from their Fitbit devices.

Key Wearable Payments Devices Companies:

The following are the leading companies in the wearable payments devices market. These companies collectively hold the largest market share and dictate industry trends.

- Apple Inc.

- Barclays PLC

- Thales

- Google LLC

- Mastercard

- Nymi, Inc.

- PayPal Holdings, Inc.

- SAMSUNG

- Visa

- Garmin Ltd.

Recent Developments

-

In August 2024, Mastercard announced its collaboration with the Indian consumer electronics firm boAt to enable the tap-and-pay feature on the latter’s smartwatch offerings. As per the deal, Mastercard cardholders utilizing boAt’s payment-enabled smartwatches can leverage this contactless payment feature via boAt’s Crest Pay application. Users can tokenize their existing credit and debit cards from supported banks and enable the tap-and-pay feature on their boAt smartwatches.

-

In April 2024, Garmin Vietnam announced that it had expanded its partnership with five leading national banks, namely MB, ACB, Techcombank, Vietcombank, and Sacombank. This cooperation allowed Garmin to offer more options for secure and convenient one-touch payment through its application Garmin Pay on a number of its smartwatch offerings. The company has made rapid progress in Vietnam since the introduction of Garmin Pay through an agreement with VPBank in November 2023 that received a very positive response among consumers.

Wearable Payments Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 67.75 billion

Revenue forecast in 2030

USD 148.88 billion

Growth rate

CAGR of 17.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Device, technology, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, Australia, South Korea, Brazil, UAE, Saudi Arabia, South Africa

Key companies profiled

Apple Inc.; Barclays PLC; Thales; Google LLC; Mastercard; Nymi, Inc.; PayPal Holdings, Inc.; SAMSUNG; Visa; Garmin Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

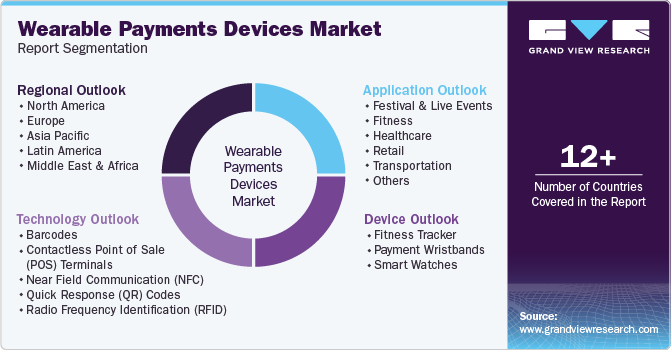

Global Wearable Payments Devices Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the wearable payments devices market report based on device, technology, application, and region:

-

Device Outlook (Revenue, USD Million, 2018 - 2030)

-

Fitness Tracker

-

Payment Wristbands

-

Smart Watches

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Barcodes

-

Contactless Point of Sale (POS) Terminals

-

Near Field Communication (NFC)

-

Quick Response (QR) Codes

-

Radio Frequency Identification (RFID)

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Festival & Live Events

-

Fitness

-

Healthcare

-

Retail

-

Transportation

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global wearable payments devices market size was estimated at USD 57.98 billion in 2024 and is expected to reach USD 67.75 billion in 2025.

b. The global wearable payments devices market is expected to grow at a compound annual growth rate of 17.1% from 2025 to 2030 to reach USD 148.88 billion by 2030.

b. North America dominated the wearable payments devices market with a share of 29.8% in 2024. This is attributable to the presence of key market players and technological availability.

b. Some key players operating in the wearable payments devices market include Apple, Inc., Barclays PLC, Gemalto NV, Google LLC, Mastercard, Nymi, PayPal Holdings Inc., Samsung Electronics, Visa Inc., and Wirecard.

b. Key factors driving the wearable payments devices market growth include reducing costs of Near Field Communication (NFC) technology deployment, increasing demand for contactless payments, and a rise in demand for host card emulation (HCE).

b. The outbreak of COVID-19 has favorably impacted the wearable payment devices market growth as customers across the globe are preferring contactless payments as a mode of payment and is driving the adoption of wearable payment devices.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.