- Home

- »

- Homecare & Decor

- »

-

Whiskey Tourism Market Size, Share & Growth Report, 2030GVR Report cover

![Whiskey Tourism Market Size, Share & Trends Report]()

Whiskey Tourism Market (2024 - 2030) Size, Share & Trends Analysis Report By Experience Type (Distillery Tours/ Tasting Experiences, Whiskey Festival), By Whiskey Type (Single Malt Whiskey, Blended Whiskey, Bourbon, Craft Whiskey), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-423-4

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Whiskey Tourism Market Summary

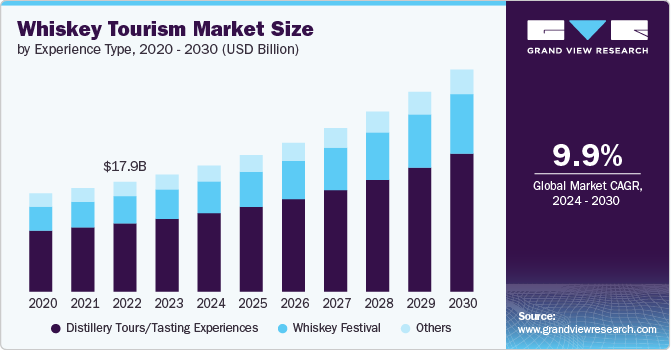

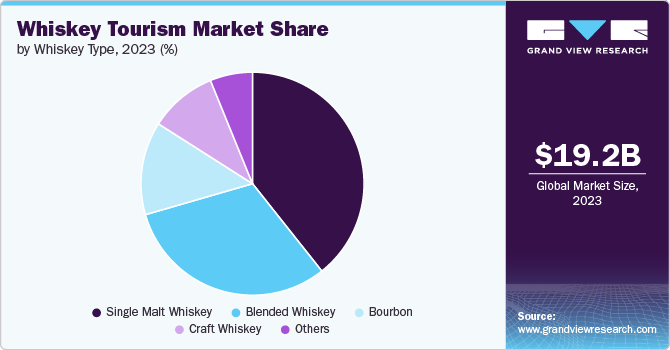

The global whiskey tourism market size was estimated at USD 19.17 billion in 2023 and is projected to reach USD 36.30 billion by 2030, growing at a CAGR of 9.9% from 2024 to 2030. Whiskey tourism is experiencing a surge in popularity, becoming a key driver of cultural and economic growth in regions known for their whiskey production.

Key Market Trends & Insights

- The whiskey tourism market in Europe accounted for a share of about 41% of the overall market.

- The whiskey tourism market in the U.S. held a dominant 70% share of the North American market in 2023.

- By experience type, the distillery tours/tasting experiences accounted for a share of about 62% of the global whiskey tourism market.

- By whiskey type, the single malt whisky tours, like those at Glenfiddich, accounted for a share of about 38% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 19.17 Billion

- 2030 Projected Market Size: USD 36.30 Billion

- CAGR (2024-2030): 9.9%

- Europe: Largest market in 2023

Online interest in whiskey-related travel is robust, with around 133,800 monthly searches combining terms like "whiskey," "whisky," "Scotland," and "Ireland” in 2023. Tours specifically focused on whiskey in Scotland and Ireland attract over 27,000 searches each month, highlighting the growing demand for these experiences.Whiskey tours offer a comprehensive view of the whiskey-making process in addition to tastings. Tourists get to see distilleries in action, discover the process of barrel aging, and discover the artistry that goes into creating various whiskey varieties. These excursions connect guests to the traditional and historical origins of whiskey while also serving as educational and cultural experiences. Distilleries are becoming popular tourist destinations in Scotland and Ireland, providing guided tours, tastings, and interactive experiences.

According to the Scotch Whiskey Association (SWA), more than 2 million people visited Scottish Scotch whiskey tourist centers in 2022-a number that exceeded pre-pandemic levels. The significant increase in foot traffic, which is 114% higher than in 2021, indicates that these centers have combined to become Scotland's top tourist destinations. Spending per capita at such tourist centers has increased by 8.65%, and since 2010, total spending at venues in Scotland's five whiskey areas has increased by 90% to over USD 85 million.

Whiskey tourism is rapidly growing in the U.S., particularly in Tennessee, due to the unique blend of cultural heritage, economic impact, and evolving consumer interest in craft spirits. The Tennessee Whiskey Trail, featuring over 30 distilleries, attracts millions of visitors annually, drawn by the state's rich whiskey-making history and the diverse experiences each distillery offers. The trail fuels tourism and supports local economies through job creation and agricultural ties, as distilleries source grains from local farms and return spent grains as livestock feed. This growth is further bolstered by the increasing interest in authentic, locally-produced spirits and the broader appeal of Tennessee as a destination for both whiskey enthusiasts and general tourists alike.

Whiskey tourism significantly benefits communities, especially in rural areas, by boosting local economies and supporting jobs. With many distilleries sourcing barley locally, the market strengthens ties to agriculture. In Tennessee alone, whiskey tourism attracts around 8 million visitors annually, supporting 30,000 jobs and generating substantial tax revenue. Beyond the economic impact, whiskey tours foster community connections, bringing people together to enjoy local spirits and engage in meaningful conversations, thus enriching the social fabric of these areas. This growing trend shows no signs of slowing, promising continued support for communities across the country.

Experience Type Insights

Distillery tours/tasting experiences accounted for a share of about 62% of the global whiskey tourism market. Such tours are becoming increasingly popular in the market for whiskey tourism, offering visitors more than just a taste of the spirit. With the rise of gastro-distilleries like The Three Chimneys at Talisker, which combines fine dining with distillery visits, these experiences are drawing new audiences by pairing whiskey with high-quality, locally inspired cuisine. This trend highlights a shift towards immersive, sensory-driven tourism, where food and drink are seamlessly integrated to enhance the overall visitor experience.

Travelers' participation in whiskey festivals is set to rise at a CAGR of 10.9% from 2024 to 2030. These are gaining prominence evolving from local community events into major international attractions. Festivals like Spirit of Speyside and Feis Ile now draw thousands of global visitors annually, while curated events like Whisky Live and WhiskyFest bring the distillery experience to diverse locations worldwide. This growth reflects the industry's ability to connect with enthusiasts across regions, suggesting that whisky festivals will continue to expand as they offer unique, immersive experiences that celebrate the spirit's rich culture and heritage.

Whiskey Type Insights

Single malt whisky tours, like those at Glenfiddich, accounted for a share of about 38% in 2023. This is particularly prominent due to the deep connection between tradition, craftsmanship, and family heritage that these distilleries embody. Glenfiddich, still family-owned, stands as the world's most awarded single malt Scotch whisky, showcasing the meticulous process of whisky making. Visitors to Glenfiddich can explore its original warehouse, learn about the generations of cask maturation, and experience the exceptional depth of flavor in a tasting session, making the tour a rich, immersive experience that highlights the legacy and innovation in single malt whisky production.

Whiskey tourism focused on craft whiskey is expected to grow at a CAGR of 10.7% from 2024 to 2030. This is set to rise as more people seek authentic and personalized drinking experiences, and the Detroit area exemplifies this trend with its vibrant craft distillery scene. Distilleries like Detroit City Distillery and Two James Spirits offer unique, locally-sourced products and immersive tours that showcase the artistry behind small-batch spirits. With each distillery providing a distinctive atmosphere and a chance to explore diverse flavor profiles, visitors are increasingly drawn to these hands-on experiences. This growing interest in craft whiskey highlights a broader shift toward appreciating artisanal quality and local craftsmanship.

Regional Insights

North America whiskey tourism market accounted for a market share of around 35% in 2023 in the global market. Whiskey tourism here has surged driven by the immense popularity of experiences like the Kentucky Bourbon Trail, which drew over 2 million visitors in 2022 alone. Distilleries have responded to this demand by investing in immersive, high-quality visitor experiences, such as Angel's Envy, a U.S.-based craft distiller’s USD 8.2 million expansion. This trend is fueled by younger, affluent tourists, many of whom visit in groups and spend significantly during their stays, boosting local economies.

U.S. Whiskey Tourism Market Trends

In 2023, the whiskey tourism market in the U.S. held a dominant 70% share of the North American market. Whiskey tourism in the U.S. is growing due to the rich cultural heritage and craftsmanship associated with whiskey-making, particularly in states like Tennessee and Kentucky. The unique stories behind each distillery, combined with immersive tasting experiences, attract visitors seeking both adventure and a deeper connection to the spirit. The diverse offerings of whiskey trails allow enthusiasts to explore the art of distillation while contributing to local economies, making whiskey tourism a key driver of both travel and economic growth.

Europe Whiskey Tourism Market Trends

The whiskey tourism market in Europe accounted for a share of about 41% of the overall market. Whiskey tourism in Europe is thriving due to its deep cultural roots and the allure of immersive experiences. Visitors are drawn to the rich heritage and craftsmanship of Scottish and Irish distilleries, where they can explore the traditional processes and unique flavors of the spirit. The industry not only offers a taste of local history but also supports rural economies and communities, making it an appealing destination for travelers seeking both authenticity and adventure.

Asia Pacific Whiskey Tourism Market Trends

The whiskey tourism market in Asia Pacific is forecasted to grow at a CAGR of 10.9% from 2024 to 2030. Whiskey tourism in Asia Pacific is poised for growth due to the region's emerging reputation for high-quality, distinctively crafted spirits. As more travelers seek authentic cultural experiences, Japanese distilleries like Yamazaki and Mars Shinshu, with their unique production techniques and scenic locations, are becoming must-visit destinations. The growing global recognition of Asian whiskies, coupled with the allure of exploring these exquisite distilleries, will continue to draw enthusiasts to the region.

Key Whiskey Tourism Company Insights

The whiskey tourism market is fragmented. Many brands have identified untapped opportunities within their service portfolio and are taking steps to address these market gaps. This often involves developing new distilleries, releasing new itineraries, investing in whiskey tourism, and marketing. For instance, in June 2024, Suntory Global Spirits, Inc., through its James B. Beam Distilling Co., unveiled new visitor experiences and an expanded events calendar this year. The offerings included brand-specific tours for Knob Creek and Jim Beam and exclusive "Behind The Beam" events at the Fred B. Noe Distillery, featuring personalized tours and tastings with Master Distillers. Following a multi-million-dollar renovation in 2022, which included updates to the American Outpost and the addition of The Kitchen Table restaurant, daily visits increased by 60%, reflecting the broader surge in post-pandemic tourism.

Key Whiskey Tourism Companies:

The following are the leading companies in the whiskey tourism market. These companies collectively hold the largest market share and dictate industry trends.

- Diageo

- Pernod Ricard

- William Grant & Sons Ltd

- Brown-Forman Corporation

- Suntory Global Spirits, Inc.

- Bacardi Limited

- Edrington Group

- Heaven Hill Brands

- Chivas Brothers Ltd

- LVMH

Recent Developments

-

In July 2024, Bacardi, through its Dewar's Aberfeldy Distillery, opened a new visitor experience that offers guests an in-depth look at the whisky-making process. Located in the historic 1898 warehouse buildings, the tour allows visitors to explore the double-aging process of Dewar’s Blended Scotch whisky. The experience, led by Dewar's master blender provides insights into the casking and maturation process, enhancing the distillery’s offerings in the Perthshire Highlands.

-

In March 2024, Diageo’s Singleton of Glen Ord Distillery earned the title of Scotland’s Leading Distillery Tour 2024 at the World Travel Awards, further enhancing its recent achievements, such as Visitor Attraction of the Year and a Tripadvisor Traveler’s Choice Award. Reopened in 2022 following Diageo’s USD 185-million investment in Scotch tourism, the distillery provides an immersive experience that honors its single malt, which is slow-crafted and rich Highland heritage.

-

In March 2024, Diageo reopened the iconic Port Ellen Distillery after an extensive renovation, reviving a legendary Islay distillery that had been closed since 1983. The project, part of Diageo's USD 185 million investment in Scotch whisky tourism, included the installation of carbon-neutral technology and innovative distillation tools. To mark the occasion, Diageo released a special-edition Port Ellen Gemini, featuring a twin set of 44-year-old Scotch whiskies from 1978.

Whiskey Tourism Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 20.63 billion

Revenue forecast in 2030

USD 36.30 billion

Growth rate

CAGR of 9.9% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Experience type, whiskey type, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S; Canada; Mexico; U.K.; Germany; France; Italy; Spain; Japan; China; India; Australia; Brazil; Argentina; South Africa

Key companies profiled

Diageo; Pernod Ricard; William Grant & Sons Ltd; Brown-Forman Corporation; Suntory Global Spirits, Inc.; Bacardi Limited; Edrington Group; Heaven Hill Brands; Chivas Brothers Ltd; LVMH

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Whiskey Tourism Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global whiskey tourism market report based on experience type, whiskey type, and region.

-

Experience Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Distillery Tours/ Tasting Experiences

-

Whiskey Festival

-

Others

-

-

Whiskey Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Single Malt Whiskey

-

Blended Whiskey

-

Bourbon

-

Craft Whiskey

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global whiskey tourism market was estimated at USD 19.17 billion in 2023 and is expected to reach USD 20.63 billion in 2024.

b. The global whiskey tourism market is expected to grow at a compound annual growth rate of 9.9% from 2024 to 2030 to reach USD 36.30 billion by 2030.

b. Europe dominated the whiskey tourism market with a share of around 41% in 2023. This is due to its rich heritage, historic distilleries, and extensive cultural significance in whiskey production.

b. Key players in the whiskey tourism market are Diageo; Pernod Ricard; William Grant & Sons Ltd; Brown–Forman Corporation; Suntory Global Spirits, Inc.; Bacardi Limited; Edrington Group; Heaven Hill Brands; Chivas Brothers Ltd; LVMH.

b. Key factors that are driving the whiskey tourism market growth include increasing consumer interest in premium and craft spirits, innovative visitor experiences, heritage and historical significance of distilleries, and growing demand for immersive, educational travel experiences.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.