- Home

- »

- Next Generation Technologies

- »

-

White Box Server Market Size, Share & Growth Report, 2030GVR Report cover

![White Box Server Market Size, Share & Trends Report]()

White Box Server Market (2024 - 2030) Size, Share & Trends Analysis Report By Type, By Processor, By Operating System (Linux, Windows, UNIX, Others), By Application, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-643-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

White Box Server Market Summary

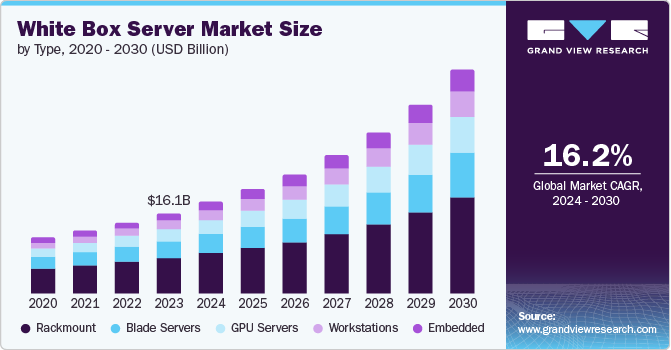

The global white box server market size was valued at USD 16.06 billion in 2023 and is estimated to reach USD 44.81 billion by 2030, growing at a CAGR of 16.2% from 2024 to 2030. The rising demand for affordable and highly customizable servers among SMEs is a key market-driving factor.

Key Market Trends & Insights

- North America held the largest market revenue share of 38.3% in 2023.

- U.S. dominated the regional market in 2023.

- Based on type, the rackmount segment held the largest market revenue share of 44.2% in 2023.

- Based on processor, X86 servers segment held the largest market revenue share in 2023.

- Based on operating system, the linux segment held the largest market revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 16.06 Billion

- 2030 Projected Market Size: USD 44.81 Billion

- CAGR (2024-2030): 16.2%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

White box servers, unbranded and often custom-built systems, offer a high degree of flexibility and cost efficiency that benefit a wide range of businesses, particularly those in the data center and cloud computing sectors. The trend towards hyper-converged infrastructure (HCI) is also bolstering the demand for white box servers. HCI integrates computing, storage, and networking into a single system, simplifying data center management and reducing costs. White box servers are well-suited for HCI deployments due to their flexibility and compatibility with various software-defined solutions. This compatibility allows businesses to build robust, scalable infrastructures that adapt quickly to evolving technological needs. The proliferation of edge computing is another significant driver. As more devices connect to the internet of things (IoT) and generate vast amounts of data, there is an increasing need for decentralized computing power closer to the data source. White box servers are used for these deployments. They offer the necessary processing power and storage capabilities while maintaining cost-effectiveness and scalability.

Furthermore, the cost savings associated with white box servers drive the demand. Businesses, especially large-scale enterprises and hyperscale data centers, constantly seek ways to reduce capital expenditures and operational costs. White box servers provide a viable solution by eliminating the brand markup and allowing organizations to negotiate directly with original design manufacturers (ODMs) for better pricing and tailored specifications.

Lastly, the open-source movement and the rise of software-defined everything (SDx) contribute to the increased adoption of white box servers. Deploying open-source software on white box hardware enables businesses to avoid vendor lock-in and create highly customizable and agile IT environments. This flexibility is particularly valuable in a rapidly changing technological landscape, where quickly adapting to new software and hardware innovations is crucial.

Type Insights

The rackmount segment held the largest market revenue share of 44.2% in 2023. The increasing popularity of cloud computing is rapidly increasing the need for rackmount servers. These servers play a vital role in cloud infrastructure by offering the required computing power and storage capacity for cloud services and applications. The increasing use of edge computing designs in different sectors is contributing to the rise of the rackmount servers market. Edge computing relies on dependable and effective solutions that rackmount servers can deliver.

The embedded segment is projected to grow at the fastest CAGR of 18.2% over the forecast period. Businesses need servers that provide high levels of uptime and reliability. White box servers fulfill these requirements, thus increasing their popularity. The growing need for data centers and cloud services is a significant contributor. With the increasing shift of businesses to the cloud, the demand for scalable and efficient server solutions is rising. The demand for energy-efficient and high-performance computing solutions is increasing. Embedded white box servers are frequently able to fulfill these criteria, resulting in the market growth.

Processor Insights

X86 servers held the largest market revenue share in 2023. Initiatives such as the open compute project encourage the adoption of open platforms that work with white box servers. This trend promotes the expansion of x86 servers by fostering creativity and lowering expenses. X86 servers, in particular, tend to be less expensive than branded servers. Businesses seeking to expand their data center capacity can benefit from this cost advantage to avoid high expenses.

The non-X86 servers segment is projected to grow at the fastest CAGR over the forecast period. Non-X86 servers provide significant customization, enabling companies to personalize their servers according to specific requirements. This flexibility is especially beneficial for organizations that have specific needs. The growing amount of digital information and the growth of data centers require server solutions that are both scalable and efficient. Non-X86 servers are well-equipped to fulfill these requirements because of their high performance and efficiency.

Operating System Insights

The linux segment held the largest market revenue share in 2023. Linux offers superior customization and flexibility, allowing businesses to tailor their server environments to specific needs without the constraints of proprietary software. This adaptability is particularly beneficial in the white box server market, where cost efficiency and optimization are critical. Also, Linux's open-source nature means lower licensing costs, making it an attractive option for companies seeking to reduce operational expenses. Moreover, Linux's robust security features and strong community support increase its popularity as organizations prioritize reliability and scalability in their server infrastructures.

The windows segment is projected to grow at a significant CAGR over the forecast period. Windows Server OS primarily offers robust performance, reliability, and security features essential for enterprise-level applications. Its compatibility with a wide range of hardware and software environments makes it an attractive option for businesses looking to build scalable and efficient server infrastructures. Additionally, the familiarity and widespread use of Windows OS in various organizational settings reduce training and transition costs, further increasing its demand. The comprehensive support and frequent updates provided by Microsoft also play a significant role in ensuring the systems remain secure and up-to-date, which is critical for maintaining operational continuity and protecting sensitive data.

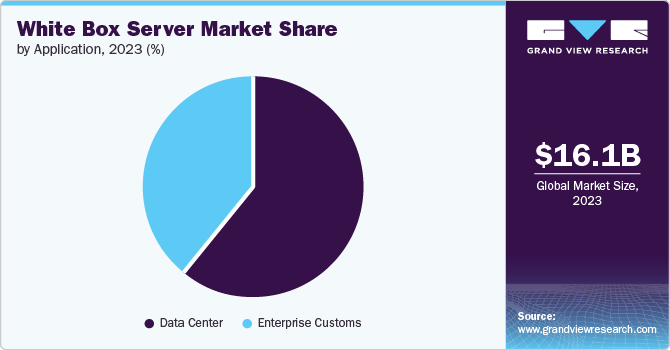

Application Insights

The data center segment held the largest market revenue share in 2023. The growing need for scalable and cost-effective infrastructure to support the exponential increase in data generation and processing drives segment growth. White box servers offer customizable and flexible solutions, allowing data centers to tailor hardware configurations to specific requirements, which enhances performance and efficiency. The push towards cloud computing, big data analytics, and the internet of things (IoT) has also intensified the demand for robust and adaptable server solutions. These servers also provide a competitive edge by reducing dependency on traditional OEM vendors, leading to cost savings and greater control over the supply chain.

The enterprise customer segment is projected to grow at a significant CAGR over the forecast period. Enterprise customers increasingly seek cost-effective, customizable solutions to meet their specific needs, which white box servers provide. These servers offer flexibility and scalability, allowing businesses to tailor hardware configurations to their unique workloads and operational requirements. Additionally, the growing emphasis on cloud computing and data center expansion drives the demand for efficient, high-performance servers that can be rapidly deployed and scaled.

Regional Insights

North America held the largest market revenue share of 38.3% in 2023. The demand for white box servers in North America is on the rise primarily due to major technology companies' growing adoption of cloud services, edge computing, and large-scale data centers. These servers, often custom-built by Original Design Manufacturers (ODMs), offer significant cost advantages and flexibility compared to traditional branded servers. Large enterprises and hyperscale data center operators increasingly opt for white box solutions to tailor hardware configurations to their specific needs, enhancing efficiency and reducing operational costs. Furthermore, the expansion of 5G networks and the Internet of Things (IoT) has driven the need for more scalable and adaptable server infrastructures, which white box servers efficiently provide.

U.S. White Box Server Market Trends

U.S. dominated the regional market in 2023. The increasing adoption of cloud computing and large-scale data centers by enterprises necessitates more cost-effective and customizable server solutions, which white box servers provide. These servers offer significant flexibility and scalability, allowing businesses to tailor hardware to specific workloads without the premium costs associated with branded servers. The drive for digital transformation across industries further fuels this demand as companies seek to optimize their IT infrastructure while managing budgets effectively.

Europe White Box Server Market Trends

The European market held a significant market share in 2023. European enterprises seek cost-effective and customizable solutions to manage their growing data needs. Additionally, the rise of cloud computing, big data analytics, and edge computing is driving the need for scalable and flexible server solutions. European companies also value the ability to tailor white box servers to specific workloads, enhancing performance and efficiency. Moreover, the increasing focus on data sovereignty and compliance with stringent European data protection regulations encourages businesses to adopt locally assembled white box servers, ensuring better control over their IT infrastructure.

The UK white box server market is projected to grow rapidly over the forecast period. The rise in data centers in the UK, fueled by the need for cloud services and big data analytics, is a major contributing factor. White box servers are frequently chosen for data centers because they are cost-effective and scalable. The nation’s involvement in projects such as the Open Compute Project, which promotes open platforms, aids in the advancement and implementation of white box servers. These platforms help decrease power usage and lower infrastructure expenses.

Asia Pacific White Box Server Market Trends

Asia Pacific is projected to grow with the fastest CAGR over the forecast period. The rapid expansion of e-commerce in the region is driving the need for strong IT systems to handle e-commerce transactions, data management, and customer service. The increasing popularity of edge computing, where data is processed closer to its origin rather than in centralized data centers, is driving the need for white box servers that can be used in different places. Ongoing developments in server technology, such as enhancements in processing power, storage options, and networking features, are increasing the use of white box servers.

China white box server market is anticipated to witness a significant growth in the coming years. The rapid growth of the region's cloud computing and data center expansion drives the need for cost-effective and customizable server solutions. China's strong push towards technological self-reliance and reducing dependence on foreign technology has also spurred local enterprises to adopt homegrown solutions. Furthermore, the rise of emerging technologies such as artificial intelligence (AI), big data analytics, and the Internet of Things (IoT) necessitates scalable and efficient server infrastructure, which white box servers aptly provide.

Key White Box Server Company Insights

Some of the key companies in the white box server market include Super Micro Computer, Inc.; Quanta Computer lnc.; Equus Computer Systems; Inventec; SMART Global Holdings, Inc.; and others

-

Super Micro Computer, Inc. provides architecturally designed server systems, subsystems and components with increased dependability and scalability, which allows users to benefit in the compute performance, density, thermal management and power efficiency to lower the operational cost.

-

Quanta Computer lnc. with its data center product lines offer a wide range of servers, storage devices and network switches, which helps in product development, manufacturing operations, integration and optimization to assist its data center customers to reach modern design and operational challenges.

Key White Box Server Companies:

The following are the leading companies in the white box server market. These companies collectively hold the largest market share and dictate industry trends.

- Super Micro Computer, Inc.

- Quanta Computer lnc.

- Equus Computer Systems

- Inventec

- SMART Global Holdings, Inc.

- Advantech Co., Ltd.

- Radisys Corporation

- hyve solutions

- Celestica Inc.

White Box Server Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 18.23 billion

Revenue forecast in 2030

USD 44.81 billion

Growth rate

CAGR of 16.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, Processor, Operating System, Application, Region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, China, India, Japan, Australia, South Korea, Brazil, UAE, Saudi Arabia, South Africa.

Key companies profiled

Super Micro Computer, Inc.; Quanta Computer lnc.; Equus Computer Systems; Inventec; SMART Global Holdings, Inc.; Advantech Co., Ltd.; Radisys Corporation; hyve solutions; Celestica Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global White Box Server Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the white box server market report based on type, processor, operating system, application, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Rackmount

-

GPU Servers

-

Workstations

-

Embedded

-

Blade Servers

-

-

Processor Outlook (Revenue, USD Million, 2018 - 2030)

-

X86 servers

-

Non-X86 servers

-

-

Operating System Outlook (Revenue, USD Million, 2018 - 2030)

-

Linux

-

Windows

-

UNIX

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Enterprise Customs

-

Data Center

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.