- Home

- »

- Beauty & Personal Care

- »

-

White Label Cosmetics Market Size, Industry Report, 2030GVR Report cover

![White Label Cosmetics Market Size, Share & Trends Report]()

White Label Cosmetics Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Skincare, Haircare, Color Cosmetics, Fragrance), By Type, By End Use (Men, Women), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-584-5

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

White Label Cosmetics Market Summary

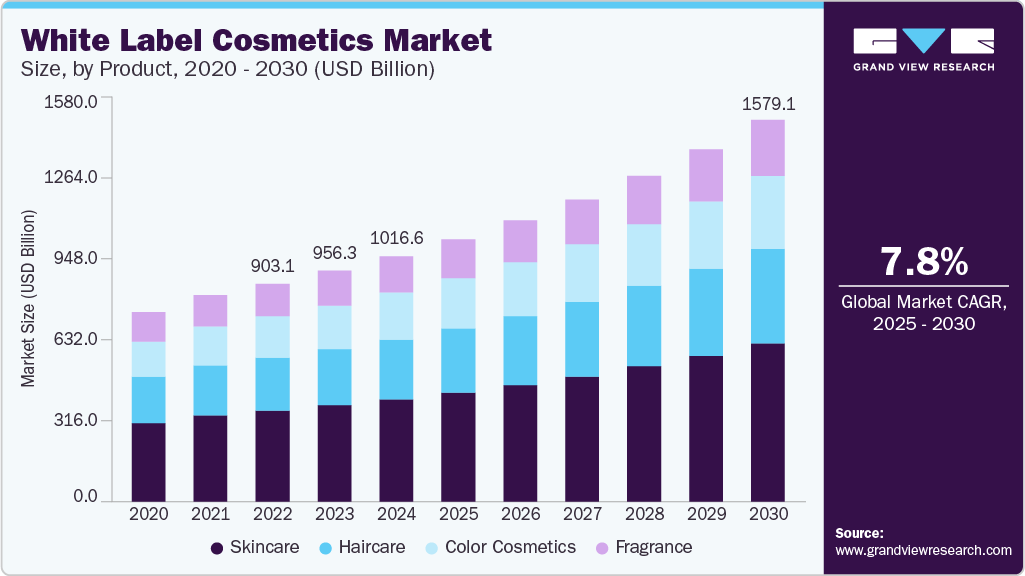

The global white label cosmetics market size was estimated at USD 1.01 billion in 2024 and is projected to reach USD 1.57 billion by 2030, growing at a CAGR of 7.8% from 2025 to 2030. The rise of independent and niche beauty brands contributes to the increasing demand for white label cosmetics..

Key Market Trends & Insights

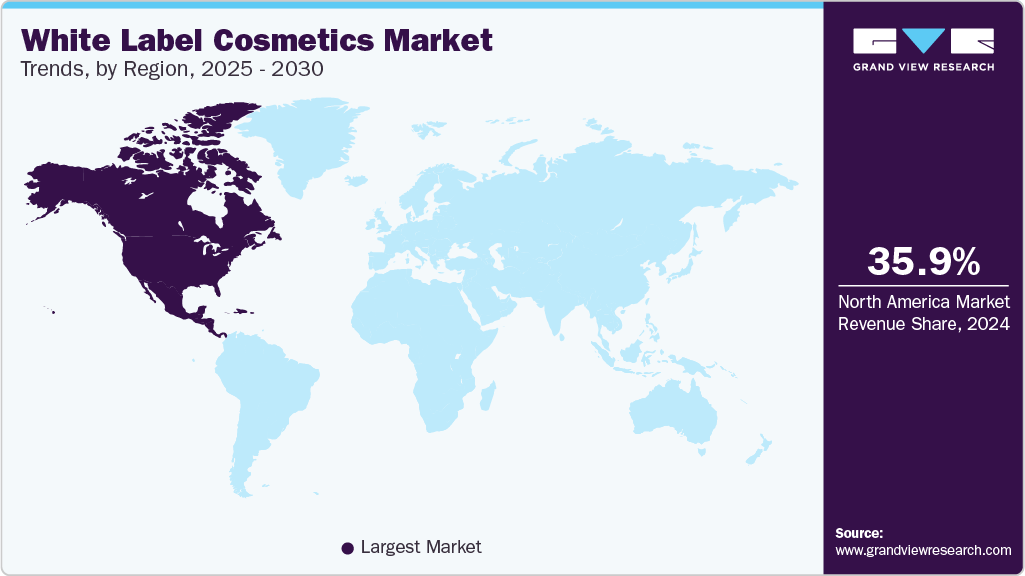

- The white label cosmetics industry in North America held 35.85% of the global revenue in 2024.

- The white label cosmetics industry in the U.S. accounted for a revenue share of 89.24% in the year 2024.

- By product, skincare accounted for a revenue share of 41.70% in the year 2024.

- By type, organic/natural cosmetic products accounted for a revenue share of 85.59% in the year 2024.

- By end use, female consumers accounted for a revenue share of 63.30% in the year 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.01 Billion

- 2030 Projected Market Size: USD 1.57 Billion

- CAGR (2025-2030): 7.8%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

In recent years, the beauty market has seen a fragmentation where smaller, more agile brands are capturing the attention of consumers by offering highly personalized, values-driven products. These indie brands are often built around specific themes such as vegan ingredients, sustainable packaging, or gender-neutral branding. White label manufacturers have kept pace by expanding their offerings to include clean beauty formulations, biodegradable materials, and cruelty-free testing protocols. This makes it possible for emerging brands to enter the market with ethical, premium-quality products that align with current consumer values without needing their own R&D or production facilities.In recent years, the beauty market has seen a fragmentation where smaller, more agile brands are capturing the attention of consumers by offering highly personalized, values-driven products. These indie brands are often built around specific themes such as vegan ingredients, sustainable packaging, or gender-neutral branding. White label manufacturers have kept pace by expanding their offerings to include clean beauty formulations, biodegradable materials, and cruelty-free testing protocols. This makes it possible for emerging brands to enter the market with ethical, premium-quality products that align with current consumer values without needing their own R&D or production facilities.

For instance, in India, brands like CodeSkin and Hyphen are making a significant impact by catering to the specific needs of Indian consumers. CodeSkin’s Hyaluronic 7+ Serum delivers deep, multi-layered hydration using seven types of hyaluronic acid, helping to combat dryness and improve skin elasticity. The brand emphasizes clean, vegan, and dermatologically tested formulations, appealing to health-conscious buyers.

Similarly, hyphen focuses on inclusive beauty with its Vitamin-Infused Peptide Tint, a product designed to suit Indian skin tones while offering skincare benefits like collagen support and antioxidant protection. Their vegan, cruelty-free, and clinically tested formulas have struck a chord with eco-conscious consumers seeking ethical yet effective products. Together, these brands highlight how Indian indie beauty companies leverage white label manufacturing to offer premium, values-driven products tailored to their market.

White label cosmetics are developed and manufactured by one company and sold under another company’s brand, offering a streamlined path for businesses to enter the competitive beauty market without the burdens of full-scale product development and manufacturing. This model is particularly attractive to startups, influencers, retail chains, and entrepreneurs who want to launch branded cosmetic lines quickly and affordably. The increasing appetite for such products is not only due to their cost-effectiveness but also because they provide flexibility, customization options, and access to high-quality formulations that rival those of established beauty giants.

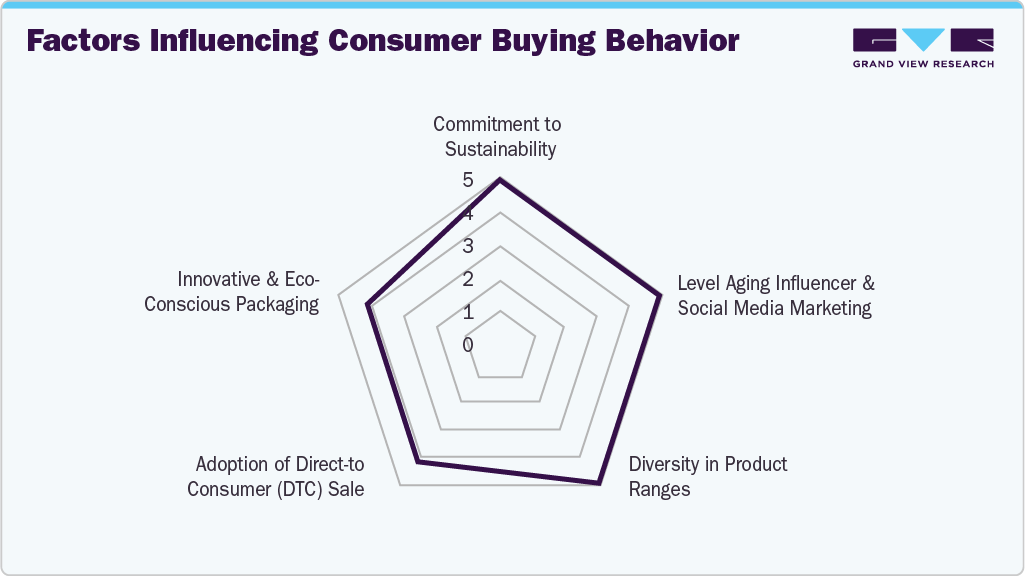

Furthermore, platforms like Instagram, TikTok, and YouTube have transformed how beauty products are discovered, marketed, and sold. Consumers are more influenced by peer recommendations, influencer endorsements, and viral trends than by traditional advertising. This shift has created opportunities for micro-brands and content creators to launch their cosmetic lines with the help of white label partners. Since these individuals already have a built-in audience, the ability to quickly produce and sell branded products allows them to capitalize on trends in real-time. The low minimum order quantities and customizable packaging options offered by many white label manufacturers further support this direct-to-consumer model.

For instance, Emerging brands like Auda.B and Mented Cosmetics leveraged the platform's viral nature to boost their visibility. Auda. B, for instance, reported a 120% increase in sales during Q1 2024, primarily driven by TikTok marketing campaigns and influencer collaborations. Similarly, Mented Cosmetics experienced a 35% growth in product sales through TikTok promotions, highlighting the platform's efficacy in reaching a broad audience.

In addition, the globalization of beauty trends has significantly influenced the private-label cosmetics industry, enabling brands to cater to diverse markets by localizing products according to regional preferences, skin tones, and cultural nuances. In emerging markets such as Asia-Pacific, and the Middle East, private-label cosmetics are experiencing rapid growth due to rising disposable incomes, urbanization, and increasing awareness of personal grooming.

Moreover, consumers themselves are becoming more open to trying new brands. The traditional loyalty to legacy cosmetic labels has weakened, especially among younger generations who prioritize uniqueness, ethical practices, and product efficacy over brand name recognition. White label cosmetics empower brands to respond quickly to market demands and offer innovative products at competitive prices, often without sacrificing quality or transparency. This agility is crucial in today’s beauty landscape, where trends can emerge and fade in a matter of weeks. The ability to rapidly prototype and release new products gives white label brands a strong competitive advantage.

Consumer Insights

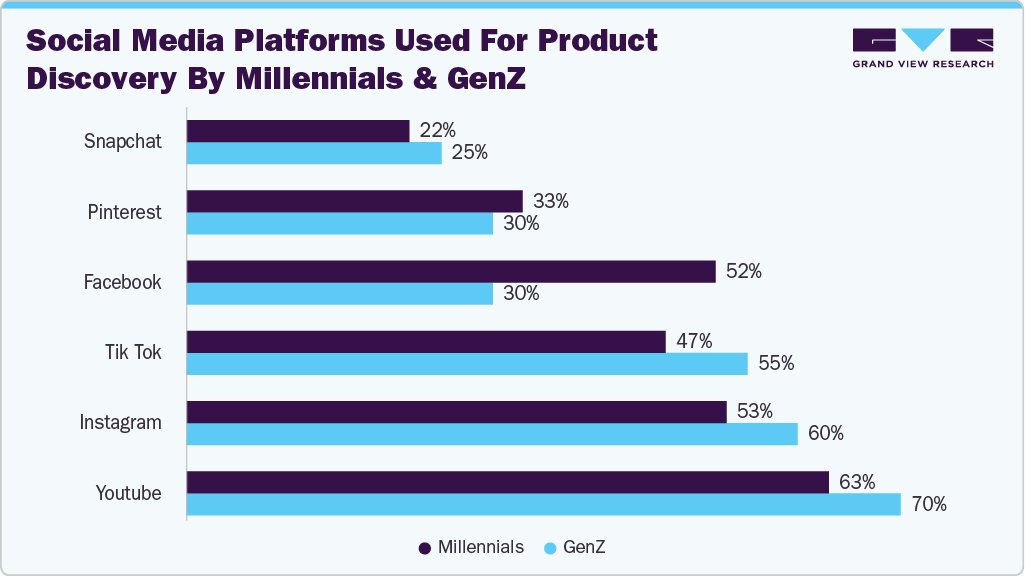

Millennials and Gen Z are reshaping the beauty and cosmetics landscape through their deep engagement with social e-commerce platforms. These generations prioritize authenticity, convenience, and personal values in their purchasing decisions. According to a survey conducted in February 2025, about 82% of consumers use social media for product discovery and research. This reflects how platforms like Instagram, TikTok, and YouTube have become essential spaces where young consumers find and evaluate beauty products before buying.

The influence of social media extends beyond discovery to actual purchasing. Hostinger reports that 55% of Gen Z consumers have made purchases directly through social media platforms. This seamless integration of shopping features allows users to move from seeing a product in a post or video to completing a purchase within seconds, enhancing convenience and boosting impulse buying. YouTube emerges as a key platform, with 70% of Gen Z using it for product discovery, closely followed by TikTok, where 46% engage with beauty-related content.

Influencer endorsements also play a critical role in shaping buying behavior. Hostinger notes that 90% of Gen Z beauty shoppers have bought a product based on an influencer's recommendation. This peer-like trust in influencers often outweighs traditional advertising, as consumers seek authenticity and relatable voices rather than polished marketing messages. User-generated content and peer reviews further reinforce this trust, driving stronger engagement and purchase intent.

Importantly, Millennials and Gen Z care deeply about values like sustainability and brand ethics. Hostinger highlights that 67.7% of Gen Z prioritize sustainability when choosing beauty products, and over half are willing to pay more for products that are sustainable or ethically sourced. Additionally, affordability remains a priority for 55% of Gen Z shoppers, showing that while values matter, price sensitivity is still significant in their purchasing decisions.

Furthermore, consumers are increasingly conscious of environmental and ethical issues. Many emerging white label cosmetics brands have adopted sustainable practices such as using recyclable or biodegradable packaging, sourcing natural and organic ingredients, and ensuring cruelty-free testing processes. A good example is the brand Herbivore Botanicals, which emphasizes eco-friendly packaging and transparency about ingredient sourcing. These commitments appeal particularly to millennials and Gen Z shoppers, who often prioritize ethical values alongside product efficacy. The rise of “clean beauty” has encouraged emerging brands to innovate sustainably, influencing purchasing decisions where consumers prefer to support companies that align with their environmental beliefs.

Emerging white label cosmetics brands have responded to growing consumer demand for inclusivity by offering diverse product lines that cater to all skin tones and types. This trend was notably accelerated by brands like Fenty Beauty, which set a new industry standard with its extensive foundation shade range. Following this example, many white label brands are launching products designed for multicultural audiences, thereby expanding their market reach and resonating with a broader customer base. Inclusivity in product offerings not only addresses long-standing gaps in the cosmetics market but also fosters brand loyalty by making consumers feel seen and valued.

Product Insights

Skincare accounted for a revenue share of 41.70% in the year 2024. This dominance is largely attributed to the growing consumer emphasis on skin health and the increasing popularity of skincare routines across various age groups. The versatility of white label manufacturing allows businesses to offer a wide range of products, such as moisturizers, serums, and cleansers, without the high costs of in-house production, enabling faster entry into the market. Furthermore, the rising demand for clean, vegan, and dermatologically tested formulations has made skincare a preferred choice for both established brands and startups.

Haircare products are projected to grow at a CAGR of 8.1% from 2025 to 2030, fueled by increasing consumer interest in personalized and natural haircare solutions. Rising awareness about hair health, along with a surge in demand for products targeting specific concerns such as hair fall, scalp care, and damage repair, is driving this growth. Moreover, the flexibility offered by white label manufacturing allows brands to quickly adapt to emerging trends and customize formulations, meeting diverse consumer preferences. The growing influence of social media and beauty influencers also plays a crucial role in boosting the popularity of innovative haircare products, further supporting the market’s expansion during the forecast period.

Type Insights

Organic/natural cosmetic products accounted for a revenue share of 85.59% in the year 2024. Consumers are increasingly prioritizing products that are free from harsh chemicals, synthetic additives, and artificial fragrances, opting instead for clean-label alternatives that promote skin health and environmental sustainability. White-label manufacturers have capitalized on this demand by offering ready-to-brand solutions using ethically sourced, natural ingredients, allowing companies to align with clean beauty trends quickly. The appeal of transparency, eco-friendly packaging, and certifications such as organic or vegan has further fueled this growth, positioning natural cosmetics as the preferred choice for both emerging and established brands.

Conventional/synthetic cosmetic products are projected to grow at a CAGR of 7.6% over the forecast period. Despite the rising popularity of natural alternatives, synthetic formulations continue to appeal to a broad consumer base, especially in emerging markets where price sensitivity is higher. These products often offer advanced functionalities, such as longer wear time, vibrant pigmentation, and specialized treatments, that are sometimes difficult to replicate with natural ingredients alone. Additionally, ongoing innovations in synthetic compounds and the ability of white label manufacturers to scale production efficiently support steady market growth, making conventional cosmetics a resilient segment in the evolving beauty landscape.

End Use Insights

Female consumers accounted for a revenue share of 63.30% in the year 2024. The increasing focus on appearance, wellness, and self-expression among women has led to higher spending on cosmetic products. White label brands have effectively catered to this demand by offering diverse, trend-aligned product lines that appeal to female consumers across different age groups and lifestyles. Additionally, the influence of digital beauty content and targeted marketing has reinforced female purchasing power in the cosmetics sector.

Male consumers buying white label cosmetics are projected to grow at a CAGR of 7.5% from 2025 to 2030. More men are embracing cosmetics as part of their daily routine, seeking products that address specific needs such as skin hydration, anti-aging, and hair care. The rise of personalized and convenient grooming solutions, along with targeted marketing campaigns focused on men, has helped remove the stigma around male cosmetic use. White label manufacturers are capitalizing on this trend by offering versatile and customizable product ranges, enabling brands to efficiently cater to the growing male demographic and support sustained market growth.

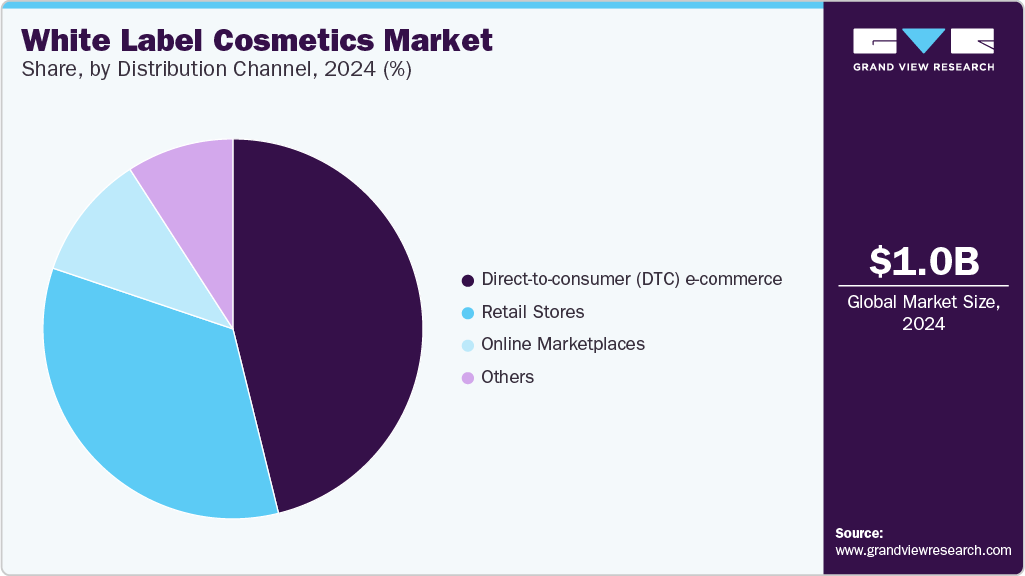

Distribution Channel Insights

Direct-to-consumer (DTC) e-commerce sales of white label cosmetics accounted for a revenue share of 46.15% in 2024. The convenience and accessibility of e-commerce platforms have empowered brands to engage with their customers more personally, bypassing traditional retail intermediaries. This approach allows for greater control over branding, pricing, and customer experience, which is particularly valuable in the competitive cosmetics industry. Additionally, the rise of social media marketing, influencer collaborations, and targeted digital advertising has further driven consumer interest and trust in DTC cosmetic brands. As a result, DTC e-commerce has become a key driver of growth and revenue within the white label cosmetics sector.

Online marketplaces for white label cosmetics are estimated to grow at a CAGR of 8.1% over the forecast period of 2025-2030. These platforms offer brands and entrepreneurs a streamlined way to access a wide range of ready-made cosmetic formulations, enabling faster product launches and reduced time-to-market. The convenience of browsing diverse options in one place, combined with competitive pricing and flexible order quantities, appeals to both small businesses and established companies. Moreover, the rise of digital marketing and influencer-driven sales channels has further boosted the popularity of online marketplaces, making them a vital component of the white label cosmetics industry's growth strategy during the forecast period.

Regional Insights

The white label cosmetics industry in North America held 35.85% of the global revenue in 2024. The region’s growth is supported by a high adoption rate of personalized and innovative cosmetic products and a thriving network of brands utilizing white label manufacturing to accelerate product launches. Robust digital infrastructure and widespread e-commerce usage have also made it easier for companies to reach consumers directly, boosting sales. Furthermore, increasing demand for natural and sustainable beauty products in North America has played a crucial role in maintaining its substantial share of the global white label cosmetics market.

U.S. White Label Cosmetics Market Trends

The white label cosmetics industry in the U.S. accounted for a revenue share of 89.24% in the year 2024. The U.S. market benefits from a well-established white label manufacturing infrastructure and a highly developed e-commerce ecosystem, allowing brands to quickly bring new products to market and reach customers directly. Additionally, the growing influence of social media and beauty influencers in the U.S. has amplified consumer interest in emerging cosmetic brands that utilize white label strategies to stay competitive.

Europe White Label Cosmetics Market Trends

The European white label cosmetics industry accounted for a revenue share of 29.50% in the year 2024. Countries like France, Italy, and Germany, renowned for their cosmetic manufacturing expertise, played a major role in supplying white label solutions to both domestic and international markets. European consumers' increasing preference for vegan, cruelty-free, and sustainably packaged products has also fueled demand for tailored cosmetic lines offered through white label partnerships.

Asia Pacific White Label Cosmetics Market Trends

The Asia Pacific white label cosmetics industry is projected to grow at a CAGR of 8.6% from 2025 to 2030. The region’s strong manufacturing base, coupled with advancements in skincare and beauty technology, allows for rapid product development and customization. Additionally, the influence of K-beauty trends, digital marketing, and the surge in e-commerce adoption are further accelerating market growth throughout Asia Pacific.

Key White Label Cosmetics Company Insights

The white label cosmetics market includes a mix of experienced manufacturers and fast-moving new entrants. Leading companies prioritize the development of tailored product offerings, with a strong focus on innovation, high-quality standards, and distinctive formulations that resonate with evolving consumer preferences. By collaborating with major retail networks and online platforms, these players leverage wide-reaching distribution channels to boost market presence and accessibility. Moreover, their ability to form strategic partnerships and maintain adaptable production processes allows them to cater to specialized consumer needs and seize opportunities in emerging markets.

Key White Label Cosmetics Companies:

The following are the leading companies in the white label cosmetics market. These companies collectively hold the largest market share and dictate industry trends.

- Audrey Morris Cosmetics International.

- NF Skin.

- HSA Cosmetics

- CarasaLab

- Lady Burd

- COSMEWAX S.A.

- kdc/one

- INTERCOS S.P.A

- Onoxa LLC

- Modern Basic Cosmetics.

Recent Developments

-

In October 2024, Audrey Morris Cosmetics International launched a new line of professional-size skincare and makeup products designed for beauty professionals. Made in the USA with natural, paraben-free, gluten-free, and cruelty-free ingredients, these products are ideal for salons and spas. Packaged for easy rebranding, the range offers quality, ethical, and affordable options tailored for professional use.

-

In February 2023, BO International launched a new range of long-lasting color cosmetics for brands looking to create their makeup lines. The collection features lip care, eye makeup, foundation, and blush products made with plant-based ingredients. With support from BO International's in-house team, brands can customize formulas or develop new ones, offering quality beauty solutions at affordable prices.

White Label Cosmetics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.08 billion

Revenue forecast in 2030

USD 1.57 billion

Growth rate

CAGR of 7.8% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, end use, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; South Africa

Key companies profiled

Audrey Morris Cosmetics International.; NF Skin.; HSA Cosmetics; CarasaLab; Lady Burd; COSMEWAX S.A.; kdc/one; INTERCOS S.P.A; Onoxa LLC; Modern Basic Cosmetics

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global White Label Cosmetics Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global white label cosmetics market report based on product, type, end use, distribution channel, and region.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Skincare

-

Haircare

-

Color Cosmetics

-

Fragrance

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Organic/Natural

-

Conventional/Synthetic

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Men

-

Women

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Direct-to-consumer (DTC) e-commerce

-

Retail stores

-

Online marketplaces

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global white label cosmetics market was estimated at USD 1.01 billion in 2024 and is expected to reach USD 1.08 billion in 2025.

b. The global white label cosmetics market is expected to grow at a compound annual growth rate of 7.8% from 2025 to 2030 to reach USD 1.57 billion by 2030.

b. North America dominated the white label cosmetics market with a share of around 35.85% in 2024, driven by high consumer demand for cost-effective and personalized beauty products. The region’s developed retail network and growing online sales contributed significantly to this dominance.

b. Some of the key players operating in the white label cosmetics market include Audrey Morris Cosmetics International., NF Skin., HSA Cosmetics, CarasaLab, Lady Burd, COSMEWAX S.A., kdc/one, INTERCOS S.P.A, Onoxa LLC, Modern Basic Cosmetics.

b. Key factors driving the growth of the white label cosmetics market include increasing consumer demand for affordable, customizable products and the expansion of e-commerce platforms. Additionally, a rising preference for clean, natural ingredients and retailers’ efforts to offer distinctive product lines are fueling market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.