- Home

- »

- Organic Chemicals

- »

-

White Oil Market Size, Share & Trends, Industry Report 2033GVR Report cover

![White Oil Market Size, Share & Trends Report]()

White Oil Market (2026 - 2033) Size, Share & Trends Analysis Report By Application (Adhesives, Agriculture, Food, Pharmaceutical, Personal Care, Textile, Polymers, Others), By Region (North America, Europe, Asia Pacific), And Segment Forecasts

- Report ID: GVR-1-68038-203-7

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

White Oil Market Summary

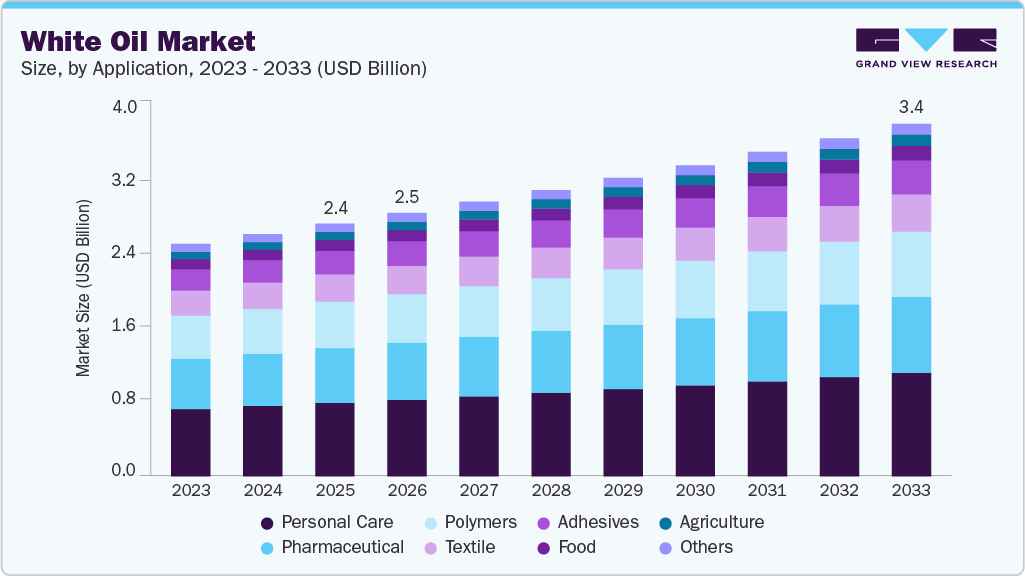

The global white oil market size was estimated at USD 2,427.3 million in 2025 and is projected to reach USD 3,386.3 million by 2033, growing at a CAGR of 4.3% from 2026 to 2033. The global rise in skincare, haircare, and personal care products is fueling the demand for high-purity, safe white oils.

Key Market Trends & Insights

- The Asia Pacific dominated the white oil market, with the largest revenue share of 53.2% in 2025.

- China is expected to grow at the fastest CAGR of 4.6%, in terms of revenue, from 2026 to 2033.

- The Personal Care segment dominated the market, with the largest revenue share of 29.0% in 2024.

- The adhesives segment is expected to grow at the fastest CAGR of 4.6%, in terms of revenue, from 2026 to 2033.

Market Size & Forecast

- 2025 Market Size: USD 2,427.3 Million

- 2033 Projected Market Size: USD 3,386.3 Million

- CAGR (2026-2033): 4.3%

- Asia Pacific: Largest market in 2025

Consumers increasingly prefer products with gentle, non-toxic ingredients, making white oil a key component in lotions, creams, and baby care products. White oil’s non-toxic and odorless nature makes it essential in pharmaceutical formulations (ointments, laxatives) and food processing (coatings, lubricants). Increasing healthcare awareness and food safety standards are driving the adoption of this technology across these sectors.

Rapid urbanization and increasing disposable income in countries such as India, China, and Southeast Asian nations are driving growth in cosmetics, personal care, and pharmaceutical sectors. This creates a significant opportunity for white oil manufacturers to expand production and capture new markets, especially in regions with growing middle-class populations and evolving lifestyle trends.

Market Concentration & Characteristics

The white oil market is moderately concentrated, with a mix of global and regional players dominating different segments. Major companies hold significant shares in high-purity grades used for pharmaceuticals and cosmetics, while smaller regional manufacturers cater to industrial and lubricant applications. This concentration ensures a steady supply and competitive pricing in key regions.

The white oil industry is highly quality-driven, with strict regulatory standards for purity, safety, and compliance, especially in cosmetics, pharmaceuticals, and food applications. Growth is closely tied to industries, technological advancements in refining processes, and the increasing preference for non-toxic, sustainable products, making innovation and compliance key differentiators for market players.

Application Insights

The personal care and cosmetics dominated the white oil market, with a revenue share of 29.0% in 2025, as high-purity, odorless, and non-toxic oils are critical for lotions, creams, baby oils, and hair care products, ensuring product safety and effectiveness, while strong and sustained consumer demand for skincare and hygiene products drives large-scale, consistent adoption across the sector, reinforcing its dominance in the market.

The adhesives segment is expected to grow at the fastest CAGR of 4.6% during the forecast period, driven by rising demand for industrial and construction adhesives that require low-viscosity, high-purity oils for performance and stability. The expansion of manufacturing and infrastructure projects, particularly in emerging markets, is accelerating adoption. Companies are leveraging white oil’s functional properties to enhance product efficiency and compliance with industrial standards.

Regional Insights

The Asia Pacific dominated the white oil market, with the largest revenue share of 53.2% in 2025, as the expansion of the cosmetics, pharmaceuticals, and food processing industries directly increases demand for high-purity white oil. Industrial growth and higher production capacities in these sectors are driving consumption. Companies are adopting advanced refining technologies to meet quality requirements. Continuous innovation in end-use products sustains market growth.

The China white oil market led Asia Pacific, with a revenue share of 50.4% in 2025. This can be attributed to the demand from the cosmetics, pharmaceutical, and food industries. Industrial-scale production and strict quality compliance are key growth factors. Companies are investing in high-purity refining technologies to meet industry standards. Market expansion is supported by strong demand for safe and effective products.

North America White Oil Market Trends

The growth of the North America white oil industry is propelled by stringent regulatory standards across pharmaceuticals, food, and personal care products, creating strong demand for high-purity, refined oils. This regulatory-driven requirement ensures consistent adoption by manufacturers and underpins market stability. The expansion of applications in medical formulations and cosmetic products further fuels consumption, while companies continue to invest in certified production facilities to maintain quality, compliance, and a competitive positioning.

U.S. White Oil Market Trends

In the U.S., demand for white oil is primarily driven by the pharmaceutical and medical manufacturing sectors, where high-purity oils are essential for product safety and efficacy. The growing use of white oil in personal care and baby care products further supports stable market growth. To meet stringent regulatory requirements, manufacturers are investing in advanced purification processes, ensuring consistent product quality and compliance across all applications.

Europe White Oil Market Trends

Regulatory and sustainability mandates across the pharmaceutical and personal care sectors strongly influence the Europe white oil industry. High-purity, premium-grade oils are crucial for meeting stringent EU quality standards. Industrial demand further supports market growth, particularly in applications requiring consistent performance. Companies are investing in eco-friendly processing innovations to enhance efficiency and maintain a competitive advantage.

The Germany white oil market is expected to witness demand, fueled by the country’s leading pharmaceutical and specialty chemical sectors. Companies rely on high-grade oils to comply with strict EU purity and safety standards. Industrial processes and personal care product formulations also contribute significantly to market consumption. Continuous investment in refining and production capabilities ensures a consistent supply and product excellence.

Latin America White Oil Market Trends

White oil consumption in Latin America is rising due to expanding applications in cosmetics, pharmaceuticals, and industrial sectors. Manufacturers are scaling production to address specific industry needs. The use of white oil in food processing, particularly as a release agent, adds further demand. Emphasis on maintaining consistent quality ensures compliance with industrial standards and supports market growth.

Middle East & Africa White Oil Market Trends

The Middle East and Africa represent a significant growth region for white oil, driven by expansion in healthcare, pharmaceuticals, and personal care sectors. Industrial applications, such as lubricants and rust-preventive products, also contribute to the rising demand. Companies are upgrading production capabilities to comply with stringent regulatory and quality standards. The increasing adoption of high-purity oils supports a wide range of end-use industries across the region.

Key White Oil Company Insights

ExxonMobil and Chevron dominate the white oil market due to their large-scale production, advanced purification technologies, and strong global presence in pharmaceuticals, cosmetics, and industrial sectors.

-

ExxonMobil is a leading producer of high-purity white oils, serving pharmaceutical, cosmetic, food, and industrial sectors globally. The company leverages its advanced refining technologies and large-scale production capabilities to ensure consistent quality and compliance with stringent industry standards. Its strong global presence and brand reputation make it a key player in the market.

-

Chevron produces high-quality white oils for diverse applications, including pharmaceuticals, personal care, and industrial uses. The company emphasizes advanced purification processes and robust supply chains to meet global regulatory requirements. Its established market presence and technological expertise position it as a dominant player in the white oil industry.

Key White Oil Companies:

The following are the leading companies in the white oil market. These companies collectively hold the largest market share and dictate industry trends.

- ExxonMobil Corporation

- Chevron Corporation

- Shell plc

- APAR Industries Ltd.

- Savita Oil Technologies Limited

- Gandhar Oil Refinery (India) Limited

- Bharat Petroleum Corporation Limited

- Raj Petro

- Velvex

- Eastern Petroleum Pvt. Ltd.

Recent Developments

- In June 2025, Brenntag SE expanded its distribution partnership with ExxonMobil Corporation for white oils across EMEA (extending to Iberia, the Netherlands & Israel) under GMP‑compliant supply.

White Oil Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 2,529.3 million

Revenue forecast in 2033

USD 3,386.3 million

Growth rate

CAGR of 4.3% from 2026 to 2033

Base year for estimation

2025

Historical data

2018 - 2023

Forecast period

2026 - 2033

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

ExxonMobil Corporation; Chevron Corporation; Shell plc; APAR Industries Ltd.; Savita Oil Technologies Limited; Gandhar Oil Refinery (India) Limited; Bharat Petroleum Corporation Limited;Raj Petro; Velvex; Eastern Petroleum Pvt. Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global White Oil Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global white oil market report based on product, end use, and region.

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Adhesives

-

Agriculture

-

Food

-

Pharmaceutical

-

Personal Care

-

Textile

-

Polymers

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

France

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

India

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global white oil market size was estimated at USD 2,427.3 million in 2025 and is expected to reach USD 2529.3 million in 2026.

b. The global white oil market is expected to grow at a compound annual growth rate of 4.3% from 2026 to 2033 to reach USD 3,386.3 million by 2033.

b. Asia Pacific dominated the market with largest revenue share of 53.2% in 2025, due to expansion in cosmetics, pharmaceuticals, and food processing industries is directly increasing demand for high-purity white oil. Industrial growth and higher production capacities in these sectors are driving consumption

b. Some key players operating in the white oil market include ExxonMobil Corporation, Chevron Corporation, Shell plc, APAR Industries Ltd., Savita Oil Technologies Limited, Gandhar Oil Refinery (India) Limited, Bharat Petroleum Corporation Limited, Raj Petro, Velvex, Eastern Petroleum Pvt. Ltd.

b. The rise in skincare, haircare, and personal care products globally is fueling the need for high-purity, safe white oils. Consumers increasingly prefer products with gentle, non-toxic ingredients, making white oil a key component in lotions, creams, and baby care products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.