- Home

- »

- Medical Devices

- »

-

Whole Body Imaging Market Size, Industry Report, 2030GVR Report cover

![Whole Body Imaging Market Size, Share & Trends Report]()

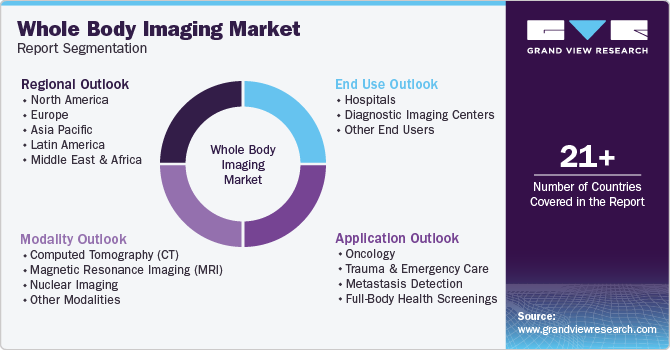

Whole Body Imaging Market (2025 - 2030) Size, Share & Trends Analysis Report By Modality (CT, MRI, Nuclear Imaging), By Application (Oncology, Trauma And Emergency Care, Metastasis Detection), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-502-8

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Whole Body Imaging Market Size & Trends

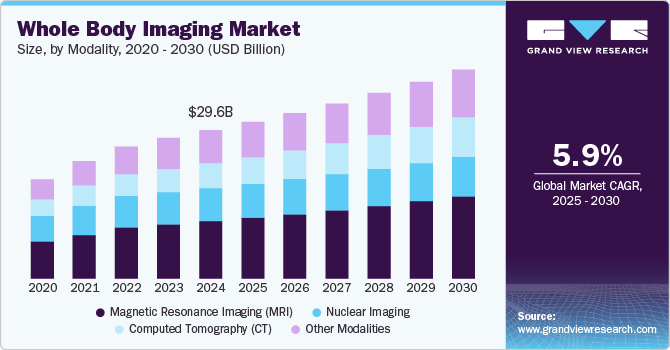

The global whole body imaging market size was valued at USD 29.58 billion in 2024 and is expected to grow at a CAGR of 5.94% from 2025 to 2030. Major factors driving the growth of the industry include rapid technological advancements that enhance diagnostic accuracy and efficiency. Rising awareness of preventive health checkups is fueling demand for early detection and monitoring of diseases. Additionally, the growing prevalence of chronic disorders such as cancer and cardiovascular diseases necessitates advanced imaging solutions. The aging population, being more prone to various health conditions, further contributes to the increased adoption of whole-body imaging technologies for timely diagnosis and treatment planning.

Whole-body imaging systems are more efficient than localized imaging techniques as they offer a comprehensive view of the entire body in a single session. This eliminates the need for multiple scans targeting specific regions, reducing patient exposure to repeated procedures and minimizing diagnostic delays. These systems are particularly effective in identifying systemic diseases such as cancer, where metastatic spread across multiple organs must be assessed. They also aid in detecting abnormalities that might be overlooked in regional scans, such as hidden lesions, vascular conditions, or inflammatory diseases affecting multiple systems.

Technological advancements in CT and MRI are further contributing to market growth as they enhance imaging precision, reduce scan times, and improve patient comfort. Innovations such as high-resolution imaging, AI-powered diagnostic tools, and advanced 3D imaging capabilities enable early and accurate detection of complex conditions. Additionally, reduced radiation doses in CT and improved contrast imaging in MRI ensure safer and more effective diagnostic procedures, further driving their adoption across diverse medical applications.

The increasing prevalence of chronic disorders, such as cancer, cardiovascular diseases, diabetes, and neurological conditions, is also a key factor contributing to the growth of the whole-body imaging industry. As these diseases often require ongoing monitoring and early detection for effective management, the demand for advanced imaging technologies like CT and MRI rises. Whole-body imaging plays a crucial role in diagnosing, staging, and tracking the progression of chronic disorders, allowing for timely interventions and improved patient outcomes, thereby fueling market expansion.

Market Concentration & Characteristics

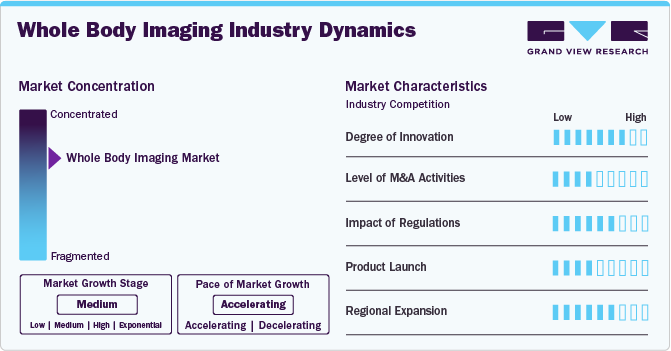

The whole-body imaging industry is accelerating at a significant rate, driven by technological advancements in imaging modalities like CT and MRI, increasing prevalence of chronic disorders, a growing aging population, and rising awareness of preventive healthcare. These factors, combined with the demand for early diagnosis, personalized treatment, and comprehensive disease monitoring, are fueling the widespread adoption of whole-body imaging systems across healthcare settings.

Companies are strategically focusing on launching new products and seeking government approvals to secure a significant market share in the whole-body imaging industry. For instance, in March 2024, Siemens Healthineers announced FDA clearance for the MAGNETOM Terra.X, a second-generation clinical 7-tesla MRI scanner. This advanced system enhances the capabilities of 7T MR scanning by incorporating advanced hardware and the new XA60A software, offering improved image resolution and better diagnostic accuracy. Such innovations aim to meet the growing demand for more precise, high-performance imaging systems and enhancing companies’ competitive position in the market.

The degree of innovation in the whole-body imaging industry is high, with continuous advancements in imaging technologies, software, and system integration. Key innovations include the development of ultra-high-field MRI systems (such as 7T and 9T), AI-driven diagnostic tools that enhance image processing and interpretation, and hybrid imaging systems like PET/CT that combine multiple modalities for more accurate and comprehensive results.

Industry players are actively pursuing mergers and acquisitions as a strategic approach to enhance their market position, expand their product portfolios, and drive growth. For instance, in January 2023, GE HealthCare reached an agreement to acquire IMACTIS, a France-based company known for its innovations in the rapidly growing field of Computed Tomography (CT) interventional guidance across various healthcare settings.

Regulations have a significant impact on whole-body imaging devices by ensuring safety, accuracy, and reliability through compliance with safety and performance standards. While the regulatory process can delay product launches and increase costs, it helps foster trust and long-term growth in the healthcare market.

Manufacturers are actively launching new products to expand their offerings. For instance, in July 2024, Fujifilm Holdings Corporation announced the U.S. launch of the APERTO Lucent, a high-performance 0.4T open MRI system designed to enhance imaging capabilities.

The geographical reach of the whole-body imaging industry is expanding, driven by strong demand in emerging markets, technological advancements, and increasing healthcare investments. As the need for advanced diagnostic tools grows, companies are expanding their presence in regions such as Asia-Pacific, Latin America, and the Middle East, where healthcare infrastructure is rapidly improving and the demand for high-quality imaging solutions is on the rise.

Modality Insights

The Magnetic Resonance Imaging (MRI) segment dominated the industry and accounted for the largest revenue share of 38.8% in 2024. This can be attributed to its superior imaging capabilities, non-invasive nature, and ability to provide detailed visualization of soft tissues, organs, and complex anatomical structures. The growing adoption of advanced MRI systems equipped with AI integration, higher field strength, and faster scanning technologies further contributes to its leadership. Additionally, the increasing prevalence of chronic conditions such as neurological disorders, cancer, and cardiovascular diseases has driven demand for precise diagnostic tools like MRI.

The Computed Tomography (CT) segment is expected to grow at the fastest CAGR of 7.9% over the forecast period. This growth is driven by its ability to provide high-resolution, detailed cross-sectional images for accurate diagnosis and treatment planning. The increasing adoption of advanced CT systems with faster scanning speeds, lower radiation doses, and AI-powered imaging enhancements further fuels market demand. Additionally, the rising prevalence of chronic diseases, growing emphasis on early detection, and expanding applications in oncology, cardiology, and emergency care contribute to the rapid growth of the CT segment.

Application Insights

The oncology segment dominated the industry and accounted for the largest revenue share of 44.9% in 2024. This is due to the rising global prevalence of cancer, increasing demand for early detection and accurate staging of tumors, and advancements in imaging technologies such as MRI, CT, and PET scans. Whole-body imaging plays a critical role in monitoring disease progression, evaluating treatment efficacy, and guiding therapeutic interventions. Additionally, growing investments in cancer research and the adoption of AI-driven diagnostic tools have further strengthened the oncology segment's market growth.

The metastasis detection segment is expected to grow at the fastest CAGR of over 7.2% during the forecast period. This is due to the increasing prevalence of metastatic cancers, rising demand for advanced imaging technologies capable of detecting secondary tumors, and the growing emphasis on early and accurate diagnosis. Advancements in imaging modalities such as PET-CT, MRI, and AI-powered systems have significantly improved the precision and efficiency of detecting metastases, driving segment growth. Additionally, the expanding use of whole-body imaging in personalized cancer treatment and monitoring further contributes to its rapid expansion.

End-use Insights

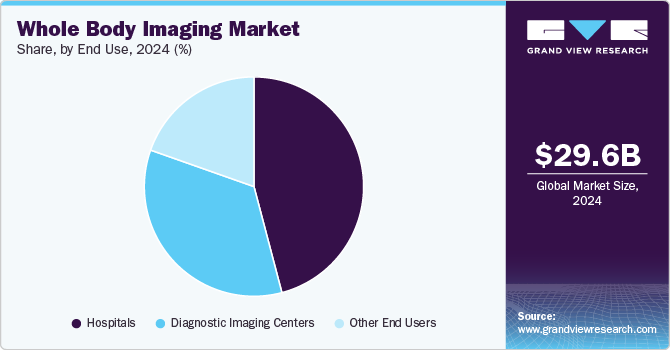

The hospitals segment held the largest revenue share of 45.9% in 2024, owing to the availability of advanced imaging infrastructure, higher patient inflow, and a wide range of diagnostic and treatment services provided under one roof. Hospitals are increasingly adopting state-of-the-art imaging technologies, such as MRI, CT, and PET-CT, to improve diagnostic accuracy and patient outcomes. Additionally, the growing prevalence of chronic diseases, coupled with government funding and initiatives to enhance healthcare infrastructure, has further strengthened the dominance of the hospital segment in the whole-body imaging market.

The diagnostic imaging centers segment is expected to witness a fastest CAGR of 6.61% during the forecast period. This growth is driven by the increasing demand for cost-effective and accessible imaging services, the rising prevalence of chronic diseases requiring regular monitoring, and the growing preference for outpatient diagnostic facilities. Additionally, advancements in imaging technologies, such as portable and AI-enabled systems, and the focus on reducing patient wait times contribute to the segment's rapid expansion. Diagnostic imaging centers also benefit from their ability to offer specialized services, making them an attractive option for both patients and healthcare providers.

Regional Insights

North America whole body imaging market held the largest share of 34.4% in 2024, driven by advanced healthcare infrastructure, widespread adoption of innovative imaging technologies, and significant investments in research and development. The region benefits from the presence of leading market players such as Philips, GE Healthcare, and Siemens, who are actively developing and launching advanced whole-body imaging solutions. Additionally, the increasing demand for early disease detection, coupled with a focus on improving patient outcomes through non-invasive diagnostic methods, further fuels market growth in North America.

U.S. Whole Body Imaging Market Trends

Thewhole body imaging market in the U.S. held the largest market share in 2024 in the North America region. This is attributed to the country’s advanced healthcare infrastructure, high healthcare spending, and early adoption of advanced imaging technologies. The growing prevalence of chronic diseases, a strong focus on early diagnosis, and a rising demand for non-invasive diagnostic procedures further contribute to the market's expansion.

Europe Whole Body Imaging Market Trends

The whole body imaging market in Europe held a significant market share in 2024. This is owing to the presence of both major global players and strong local companies competing to capture a substantial portion of the market. The region's competitive landscape is further fueled by continuous innovation and strategic initiatives by key players. Additionally, the increasing adoption of advanced imaging technologies, such as AI-powered MRI and CT systems, along with the growing demand for non-invasive diagnostic solutions, are key factors driving the market's growth in Europe.

The UK whole body imaging market is experiencing significant growth, driven by factors such as the increasing prevalence of chronic diseases, including cancer and cardiovascular conditions. The growing aging population, along with rising awareness of the benefits of early disease detection, further fuels demand for advanced imaging technologies. Additionally, the UK’s strong healthcare system, investment in innovative diagnostic solutions, and the adoption of AI-enhanced imaging systems contribute to the market’s expansion.

The whole body imaging market in France is expected to grow over the forecast period, driven by the increasing prevalence of chronic diseases, advancements in imaging technology, and rising demand for early diagnostic tools. Additionally, government initiatives to modernize healthcare infrastructure and improve patient outcomes further expands market growth in the country.

Germany whole body imaging market is experiencing significant growth, driven by factors such as the rising prevalence of urological disorders like prostate cancer, kidney stones, and bladder diseases. The country’s advanced healthcare infrastructure, high adoption of innovative ultrasound technologies, and strong focus on early diagnosis and non-invasive treatment methods contribute to this growth.

Asia Pacific Whole Body Imaging Market Trends

The whole body imaging market in Asia Pacific is expected to witness the fastest growth of CAGR 6.82% over the forecast period. This growth is driven by increasing healthcare investments, the rising prevalence of chronic diseases, and a growing aging population. Expanding access to advanced diagnostic technologies in emerging economies such as China, India, and Southeast Asia, coupled with a growing focus on early detection and preventive healthcare, further accelerates the market. Additionally, government initiatives to improve healthcare infrastructure and the adoption of innovative imaging systems contribute to the region's rapid growth.

China whole body imaging market is expected to grow at a significant rate over the forecast period, driven by the increasing prevalence of chronic diseases, such as cancer and cardiovascular conditions, and a rising aging population. Government initiatives aimed at modernizing healthcare infrastructure and improving access to advanced diagnostic technologies further support market growth.

The whole body imaging market in Japan is significantly driven by technological advancements, the increasing adoption of innovative imaging systems, and a strong focus on early disease detection. The country’s aging population and rising prevalence of chronic conditions, such as cancer and cardiovascular diseases, are key factors fueling demand for advanced diagnostic tools. Additionally, Japan’s emphasis on research and development in medical imaging technologies, including AI integration and high-resolution imaging systems, further propels market growth.

Latin America Whole Body Imaging Market Trends

The whole body imaging market in Latin Americais expected to grow steadily, driven by increasing awareness of advanced diagnostic technologies and their benefits in improving patient outcomes. The rising prevalence of chronic diseases, coupled with growing healthcare investments, supports the adoption of whole-body imaging systems in the region. Additionally, efforts to modernize healthcare infrastructure and expand access to advanced diagnostic tools, particularly in emerging economies such as Brazil and Mexico, further contribute to market growth.

Middle East & Africa Whole Body Imaging Market Trends

The whole body imaging market in the Middle East & Africa is experiencing notable growth, driven by the increasing adoption of advanced medical imaging technologies and substantial investments in healthcare infrastructure. The modernization of healthcare systems, particularly in Gulf Cooperation Council (GCC) countries, and a growing focus on early disease detection contribute to the market’s expansion. Additionally, government initiatives to enhance diagnostic capabilities and reduce reliance on medical tourism by developing locally advanced healthcare facilities are further fueling market growth in the region.

Key Whole Body Imaging Company Insights

The leading players in the whole-body imaging industry are actively expanding their product portfolios through technological innovations, strategic mergers and acquisitions, and the development of advanced imaging systems. They are focusing on integrating AI and machine learning capabilities, launching high-resolution and portable imaging solutions, and obtaining regulatory approvals for new products to meet the growing demand for precise and non-invasive diagnostics. Additionally, these companies are forming partnerships and collaborations to accelerate innovation and strengthen their market presence globally.

Key Whole Body Imaging Companies:

The following are the leading companies in the whole body imaging market. These companies collectively hold the largest market share and dictate industry trends.

- GE Healthcare

- Siemens Healthineers

- Philips Healthcare

- Canon Medical Systems Corporation

- Fujifilm Holdings Corporation

- Mediso Ltd.

- NeuroLogica (a subsidiary of Samsung Electronics)

- United Imaging Healthcare

- Shimadzu Corporation

Recent Developments

-

In May 2024, Shanghai United Imaging Healthcare Co., LTD received FDA clearance for its uMR Jupiter 5T MRI system. This groundbreaking whole-body MRI system overcomes the traditional limitations of ultra-high-field imaging, marking a significant advancement in diagnostic radiology.

-

In November 2024, Shanghai United Imaging Healthcare Co., LTD received Health Canada approval for several digital PET/CT models within the uMI Panorama product family.

-

In February 2024, GE Healthcare announced that Virtua Health, based in New Jersey, has installed the cutting-edge Omni Legend digital PET/CT system-marking the first Omni Legend installation in the state-and the Revolution Apex platform, a CT system with 1-beat cardiac imaging capability, to enhance the advanced capabilities of their cardiology facility in Moorestown, New Jersey.

Whole Body Imaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 31.22 billion

Revenue forecast in 2030

USD 41.66 billion

Growth Rate

CAGR of 5.94% from 2025 to 2030

Actual period

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Modality, application, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

GE Healthcare; Siemens Healthineers; Philips Healthcare; Canon Medical Systems Corporation; Fujifilm Holdings Corporation; Mediso Ltd.; NeuroLogica (a subsidiary of Samsung Electronics); United Imaging Healthcare; Shimadzu Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Whole Body Imaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global whole body imaging market report on the basis of modality, application, end-use, and region:

-

Modality Outlook (Revenue, USD Million, 2018 - 2030)

-

Computed Tomography (CT)

-

Magnetic Resonance Imaging (MRI)

-

Nuclear Imaging

-

Other Modalities

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Trauma & Emergency Care

-

Metastasis Detection

-

Full-Body Health Screenings

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostic Imaging Centers

-

Other End Users

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global whole body imaging market size was estimated at USD 29.58 billion in 2024 and is expected to reach USD 31.22 billion in 2025.

b. The global whole body imaging market is expected to grow at a compound annual growth rate of 5.94% from 2025 to 2030 to reach USD 41.66 billion by 2030.

b. North America whole body imaging market held the largest share of 34.4% in 2024. This can be attributed to advanced healthcare infrastructure, widespread adoption of innovative imaging technologies, and significant investments in research and development

b. Some key players operating in the whole body imaging market include GE Healthcare; Siemens Healthineers; Philips Healthcare; Canon Medical Systems Corporation; Fujifilm Holdings Corporation; Mediso Ltd.; NeuroLogica (a subsidiary of Samsung Electronics); United Imaging Healthcare; Shimadzu Corporation

b. Key factors that are driving the market growth include rapid technological advancements that enhance diagnostic accuracy and efficiency. Rising awareness of preventive health checkups is fueling demand for early detection and monitoring of diseases.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.