- Home

- »

- Biotechnology

- »

-

Whole Exome Sequencing Market Size & Share Report, 2030GVR Report cover

![Whole Exome Sequencing Market Size, Share & Trends Report]()

Whole Exome Sequencing Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Instruments, Consumables, Services), By Technology, By Workflow, By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-070-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Whole Exome Sequencing Market Trends

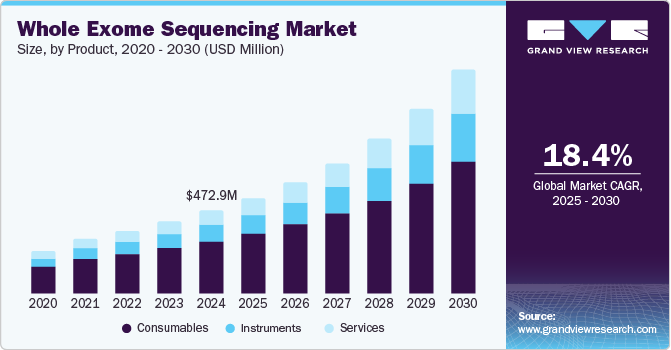

The global whole exome sequencing market size was estimated at USD 472.9 million in 2024 and is expected to grow at a CAGR of 18.44% from 2025 to 2030. In recent years the market has demonstrated a huge expansion potential due to several factors such as new technologies being developed, increasing applications in the field of research and diagnostics, and a decreasing cost of the technology. Furthermore, the increasing need for precise and early detection methods for detection of genetic and chronic diseases is fueling the market.

The COVID-19 pandemic hampered the expansion of the market in 2020 due to the lockdown strictures and decreased research activities due to insufficient funds for research and development. However, the market witnessed a positive effect in 2021 due to the increase in COVID-19 related vaccine and therapeutics research. The pandemic has also brought attention to the promise of whole exome sequence in the fight against infectious diseases, spurring additional investment in this field of study. Growing use of new sequencing technologies in this domain has thus boosted the market growth.

Medical professionals and researchers are using the whole exome sequencing method to discover the genetic variations that are linked with various diseases and to develop a treatment by using patients’ genomic data. In the year 2020, a study published in the Journal of Cancer demonstrated the effect of exome sequencing in identifying a mutation in patients with advanced cancer and predicting their response to immunotherapy. This shows how the whole exome sequencing is being used to create targeted therapies for patients and highlights its potential to revolutionize the field of personalized medicine.

Globally the demand for whole exome sequencing products is growing rapidly due to several key factors but the major factor is the cost. The cost of the whole exome sequencing is decreasing with the help of development in automation, data analysis tools and several technologies. These advancements are making it easier and more affordable for the healthcare facilities and researchers to use the whole exome sequencing to study the genetic information. For instance, a Chinese healthcare provider and BGI Genomics recently announced a partnership in 2022 to deliver whole exome sequencing services for cancer patients. This partnership aims to use whole exome sequences to better understand the genetics of cancer and provide patients individualized and efficient treatment choices. This collaboration is but one illustration of how whole exome sequence is expanding in popularity in clinical settings due to its accessibility and affordability. The use of this technology by medical professionals to diagnose and treat a variety of illnesses is increasing, and it bodes well for the future of genetic medicine in whole exome sequences.

In addition, the market has grown significantly as a result of the desire for personalized care. Medical professionals can study whole exomes to customize treatment recommendations based on a patient's unique genetic alterations and disease susceptibility. Healthcare professionals can offer more specialized and efficient treatments due to whole exome sequencing that helps in complete examination of a patient's DNA.

For instance, Natera's Signatera, a test based on whole exome sequencing has been awarded the FDA's designation of breakthrough device. This test aids in the monitoring of tumor recurrence; for example, a patient who has undergone treatment for a solid tumor may use this test to track cancer recurrence and spot any lingering disease. Using Signatera's analysis of circulating tumor DNA, genetic changes associated with cancer are identified, and the patient's response to therapy is tracked. The FDA's categorization of a breakthrough device as a major regulatory achievement hastens the development and assessment of cutting-edge medical devices. It emphasizes how cancer identification and treatment could be aided by exome sequence-based diagnostics.

Whole exome sequencing market is growing because of the rising demand for personalized treatment. More growth in the market is anticipated as new diagnostics and assays are released. With the aid of whole exome sequences, medical experts can now recognize a patient's particular genetic anomalies and risk factors for disease, enabling them to customize treatment programmed to the needs of the specific patient. Doctors can develop more individualized and successful treatment plans for their patients using whole exomes. Overall, the expanding application of whole exome sequences in personalized medicine is a fascinating breakthrough that has the potential to completely alter the way we approach healthcare.

Product Insights

The consumables segment dominated the market in 2024 with a market share of 62.36%. This is due to whole exome sequencing’s requirement of a variety of consumable items, including reagents, kits, and sample preparation consumables, which are essential for conducting whole exome sequencing investigations. The demand for these consumables continues to grow with the demand for services, fueling the expansion of the consumables market. Recent financial figures from Illumina Inc. demonstrate the importance of the consumables market to the entire exome sequence sector. For instance, due to increased demand for their sequencing consumables, the company reported a significant increase in consumables revenue in its Q4 2021 financial results compared to the prior year.

The services segment is expected to witness the fastest growth rate over the forecast period. The complexity of the procedure is the reason why healthcare practitioners and research organizations are using whole exome sequence services more frequently and the growth of the market is fueled. To effectively analyses and interpret data specialized tools, knowledge, and experience are needed. Due to this, a lot of companies now hire specialized agencies to handle their sequencing needs. The growth of precision medicine and personalized genomics has also increased demand for whole exome sequencing services. To develop specialized treatments, these rely on the discovery of genetic variants that cause disease. As a result, it is anticipated that the whole exome sequencing services market is likely to grow in the near future.

Technology Insights

Sequencing by synthesis segment dominated the market in 2024 with a market share of 73.49%. This is due to the effectiveness and affordability of the sequencing by synthesis approach that has increased its appeal. As a result, more sequencing reads have been produced per run, which take less time, and produce high accuracy. Whole exome sequence is now more frequently used by healthcare organizations and academic institutions to fulfil their sequencing requirements. Identification of disease-causing genetic variations is made possible by whole exome sequencing, which is essential for personalized genomics and precision medicine. The dominance of the sequencing by synthesis segment in the overall market is due to the growing demand for genetic testing services, especially in oncology. For instance, with an anticipated 1.9 million new cancer cases expected in the US in 2022, the need for precise and effective cancer diagnostic and treatment approaches is crucial. Sequencing-by-synthesis technology is the solution to this challenge. In addition, the trend towards population-scale genomic studies is expected to increase the demand for whole exome sequencing services.

ION semiconductor sequencing segment is expected to witness the fastest growth rate over the forecast period. This is due to its ability to provide high throughput screening with less turnaround time and low cost. As a result of major accuracy improvements, this method can now compete with other sequencing technologies. In addition, ION semiconductor sequencing technology is well-suited for targeted sequencing applications, which is important in personalized medicines. As a result, the demand for personalized medicine and targeted sequencing continues to fuel the ION semiconductor sequencing segment.

Workflow Insights

The sequencing segment had a dominating presence in the market in 2024 with a market share of 49.90%, due to the growing demand for genetic testing services and personalized medicine. Whole exome sequencing has the ability to analyze large number of genetic data in a less cost, additionally it allows for more comprehensive analysis of genetic variation. For instance, the company Illumina Inc. is a top supplier in various industries due to the excellent efficiency and affordability of its sequencing systems and related products. Its products have been used in population-scale genomics, rare illness detection, and cancer treatment. With respect to the demand for the technique, the company has ramped up its research and development spending to enhance the precision and speed of its sequencing equipment. Illumina's strong market position and unwavering commitment to innovation make it well-equipped to maintain its leadership in the whole exome sequence market for years to come.

The data analysis segment is expected to witness the fastest growth rate over the forecast period. The market for data analysis has significantly expanded because of improvements in technology's impact on the growth of genetic data. The need for software and data analysis tools among healthcare professionals has accelerated the industry's expansion. This growth has been further fueled by precision medicine, which adapts therapies for distinct people based on genomic data analysis. It is common practice in clinical and research contexts to find disease-causing mutations utilizing tools and services from QIAGEN, a respected supplier of genetic data analysis tools and services. The data analysis sector is anticipated to grow in the future due to continued investment in research and development.

Application Insights

Drug discovery & development segment dominated the market in 2024 with a market share of 47.38% due to it plays a crucial part in advancing the development of new drugs. Whole exome sequencing has become a compelling method for locating gene variations and disease-causing mutations that can be exploited to create tailored treatments. Researchers can more accurately and efficiently discover prospective drug targets and biomarkers by employing this technology. As a result, pharmaceutical and biotech firms engaged in drug research and development are seeing an increase in demand for whole exome sequence services in the market. The expansion of the drug discovery & development segment in the overall whole exome sequencing market is also being aided by developments in data analysis tools.

Clinical diagnostics segment is expected to witness the fastest growth rate over the forecast period, due to the increasing use of whole exome sequencing in clinical settings. Clinicians can now use this technology to pinpoint genetic variations linked to certain diseases and disorders, resulting in more personalized and precise treatment regimens. The widespread use of sequence technology into clinical laboratories' diagnostic procedures has become increasingly feasible and cost-effective because of the falling costs of sequencing technology and the rising availability of data processing software. The need for the technique in clinical diagnostics is anticipated to increase as precision medicine gains prominence in healthcare, fueling the segment's faster growth.

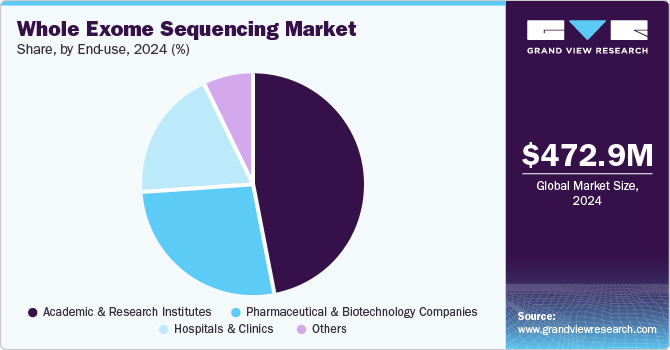

End-use Insights

The academic & research institutes segment in whole exome sequencing market dominated the market in 2024, with a share of 47.32%. The dominance of the segment is due to the increasing demand for personalized medicines and healthcare. Many academic and research institutes are using the technique to identify the genetic variation in patients with some rare diseases, which helps to develop the new targeted therapies. For instance, National Human Genomic Research Institute in U.S. has using whole exome sequencing techniques to study the causes of rare disease from genetic variation and develop the treatment plan for patients. The trend is expected to continue and drive the growth of academic and research institute segment in coming years.

The hospitals & clinics segment is expected to witness the fastest growth rate over the forecast period. One significant factor is the increasing demand for advanced diagnostic and treatment tools in healthcare settings. Whole exome sequence technique helps clinicians to obtain detailed view of patient’s genetic makeup, this makes helpful in diagnosis and treatment process. Along with this the low cost of technology and increase availability of analysis software have made it more reliable and cost effective for hospitals and clinics to incorporate whole exome sequencing in their daily routine clinical practice.

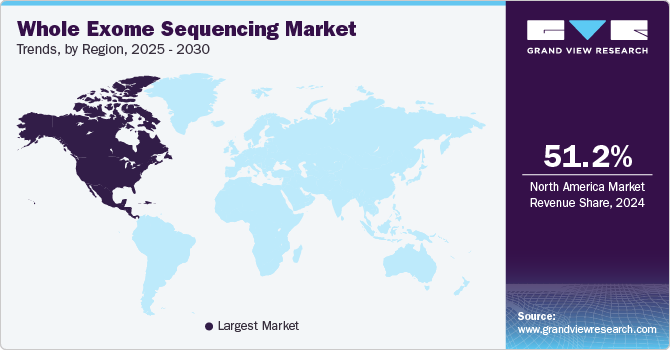

Regional Insights

North America whole exome sequencing market accounted for the largest share of the whole exome sequencing market in 2024 and accounted for around 51.18% of the market size. Due to the presence of cutting-edge healthcare infrastructure, considerable investment, and supportive government initiatives, this is explicable. For instance, the Polygenic Risk Score (PRS) Catalogue, a comprehensive database of genetic variations linked to complex diseases, was introduced by the National Institutes of Health (NIH) in the United States in 2021. In North America, this project is anticipated to increase demand for services. Additionally, the market is anticipated to develop because to the rising frequency of genetic disorders and the growing use of personalized treatments.

U.S. Whole Exome Sequencing Market Trends

The U.S. whole exome sequencing (WES) market is driven by strong demand in personalized medicine, cancer genomics, and rare disease diagnosis. WES is increasingly used in clinical settings due to decreasing costs and enhanced insurance coverage for genetic testing. The push toward precision medicine initiatives, such as the NIH’s “All of Us” program, is encouraging more genomic research and diagnostic applications, which is expanding the WES market.

Europe Whole Exome Sequencing Market Trends

In Europe, the whole exome sequencing market is propelled by regulatory frameworks supporting genomic research and diagnostics, especially for rare and inherited diseases. Countries in the region are actively promoting genomics-based healthcare, with public funding playing a major role in pushing personalized medicine. Thus, boosting the market growth.

The UK market for WES is bolstered by initiatives such as the NHS Genomic Medicine Service, which has integrated WES into its framework for diagnosing genetic conditions. The UK’s strong focus on expanding genomic testing services, particularly for cancer and rare diseases, is a significant market driver. The government's backing of programs like the 100,000 Genomes Project, aimed at enhancing genomic research, creates a favorable environment for WES growth.

France’s WES market is driven by its government’s "France Genomic 2025" initiative, which seeks to integrate genomic data into the healthcare system. WES is increasingly applied in diagnosing rare diseases, oncology, and hereditary conditions. The initiative emphasizes widespread clinical genomic testing, and partnerships between academic institutions, hospitals, and biotech companies have led to significant advancements in genomic medicine.

Germany’s WES market benefits from a strong healthcare system, advanced research capabilities, and substantial investments in genomics. The country is focusing on precision medicine and early disease detection, using WES for genetic disorders and cancer treatment optimization.

Asia Pacific Whole Exome Sequencing Market Trends

Asia Pacific is estimated to grow at the fastest CAGR of 21.63% during 2025 to 2030. This can be attributed to the prevalence of genetic disorder and diseases in the region has created a huge demand of genetic testing and personalized medicines. In addition, the rising healthcare expenditure and large population will drive the market. Furthermore, the government initiatives and funding's for genomic research in countries such as China, Japan and India are further expected to boost the market growth. For example, recently Chinese government has announced a plan to invest a good amount and precision medicine research which helps to fuel the growth of exome sequencing market.

The China whole exome sequencing market is experiencing rapid growth due to the country’s commitment to improving precision medicine and integrating genomics into healthcare. The Chinese government has launched several initiatives promoting genomic research, including the National Precision Medicine Initiative. Growing awareness of genetic disorders, rising healthcare investments, and the availability of low-cost sequencing technologies make WES a valuable tool in healthcare and research.

Japan’s whole exome sequencing market is supported by a strong healthcare system and government-backed genomics initiatives. The country has seen increased adoption of WES in clinical research, particularly in cancer genomics and rare disease diagnostics. Japan's Genomic Medicine Promotion Program aims to create a robust ecosystem for integrating genomic data into medical practice, driving demand for WES in the medical and research sectors.

In India, the growth of the whole exome sequencing market is driven by the increasing prevalence of genetic diseases, cancer research, and the need for early diagnosis. As the healthcare sector expands and awareness of genetic disorders rises, there is a growing demand for cost-effective WES solutions. India’s growing biotechnology industry, coupled with partnerships between healthcare providers and research institutes, also supports market growth.

Middle East & Africa Whole Exome Sequencing Market Trends

In the Middle East and Africa, the whole exome sequencing market is in a nascent stage but is growing due to rising demand for genetic diagnostics and personalized medicine. WES is increasingly used to diagnose rare genetic disorders, with a focus on hereditary diseases prevalent in certain ethnic groups. Government initiatives to modernize healthcare systems and improve diagnostic capabilities are supporting the gradual adoption of WES technology.

Saudi Arabia’s WES market is driven by government-backed initiatives such as the Saudi Human Genome Program, which aims to identify and treat inherited genetic disorders. WES is playing a critical role in diagnosing hereditary diseases, which are more common in the region due to consanguineous marriages. Strong government investment in healthcare modernization and genomics research is fostering growth in this market.

Kuwait is seeing increasing adoption of whole exome sequencing for rare disease diagnosis and research on inherited genetic disorders. The country’s well-funded healthcare system, combined with growing awareness of the benefits of genetic testing, supports WES growth. Collaboration between local healthcare providers and international genomic research institutions is further promoting the integration of WES into medical practice.

Key Whole Exome Sequencing Company Insights

Several major companies are vying for a higher market share in the very competitive and fragmented whole exome sequencing market. Major key companies are undertaking strategic activities such as mergers, acquisitions, and alliances to elevate their market position.

Key Whole Exome Sequencing Companies:

The following are the leading companies in the whole exome sequencing market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific, Inc.

- Illumina, Inc

- Agilent Technologies, Inc

- BGI

- PacBio

- Oxford Nanopore Technologies plc.

- Azenta US Inc. (GENEWIZ)

- CD Genomics

- Novogene Co Ltd

- Eurofins Genomics

Recent Developments

-

In March 2023 Illumina Inc., launched its newly developed NovaSeq 6000 v3 sequencing system. This system offers enhanced sequence precision, accuracy, higher scalability, and top speed, which will strengthen Illumina's leadership in the market.

-

In January 2023, QIAGEN Digital Insights (QDI), the bioinformatics division of QIAGEN, has unveiled an upgraded version of the QIAGEN CLC Genomics Workbench Premium, designed to eliminate the data-analysis bottleneck in next-generation sequencing (NGS). The enhanced platform significantly boosts analysis speed, enabling faster and more efficient interpretation of whole genome sequencing (WGS), whole exome sequencing (WES), and large panel sequencing data.

Whole Exome Sequencing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 545.9 million

Revenue forecast in 2030

USD 1,272.5 million

Growth rate

CAGR of 18.44% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, workflow, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico, Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil, Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Thermo Fisher Scientific, Inc.; Illumina, Inc, Agilent Technologies, Inc, BGI; PacBio; Oxford Nanopore Technologies plc.; Azenta US Inc. (GENEWIZ); CD Genomics; Novogene Co, Ltd; Eurofins Genomics.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Whole Exome Sequencing Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the global whole exome sequencing market report on the basis of product, technology, workflow, application, end use and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

Consumables

-

Services

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Sequencing by Synthesis

-

ION Semiconductor Sequencing

-

Others

-

-

Workflow Outlook (Revenue, USD Million, 2018 - 2030)

-

Pre-Sequencing

-

Sequencing

-

Data Analysis

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Clinical Diagnostics

-

Drug Discovery & Development

-

Personalized Medicines

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Academic And Research Institutes

-

Hospitals & Clinics

-

Pharmaceutical & Biotechnology Companies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global whole exome sequencing market size was estimated at USD 472.9 million in 2024 and is expected to reach USD 545.9 million in 2025.

b. The global whole exome sequencing market is expected to grow at a compound annual growth rate of 18.44% from 2025 to 2030 to reach USD 1,272.5 million by 2030.

b. North America dominated the whole exome sequencing market with a share of 51.18% in 2024. The high adoption of sequencing technology in the region and rising demand for genomics-based applications are driving the market in the region.

b. Some key players operating in the whole exome sequencing market include Thermo Fisher Scientific, Inc.; Illumina, Inc; Agilent Technologies, Inc; BGI; PacBio; Oxford Nanopore Technologies plc.; Azenta US Inc. (GENEWIZ); CD Genomics; Novogene Co Ltd; Eurofins Genomics

b. Whole exome sequencing has applications in clinical diagnostics and genomics research as the technique enables a cost-effective and in-depth analysis of genetic sequences which is expected to fuel the market growth in the coming years.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.