- Home

- »

- Next Generation Technologies

- »

-

WAN Optimization Market Size & Share Report, 2020-2027GVR Report cover

![Wide Area Network Optimization Market Size, Share & Trends Report]()

Wide Area Network Optimization Market (2020 - 2027) Size, Share & Trends Analysis Report By Component (Solution, Services), By Deployment Type (Cloud-based, On-premise), By Enterprise Size, By Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-954-8

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global wide area network optimization market size is valued at USD 2.35 billion in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 9.5% from 2020 to 2027. The growth is primarily driven by the rapidly increasing demand for solutions that help businesses to efficiently monitor and manage data center networks. Moreover, amidst the COVID-19 outbreak, enterprises worldwide have allowed their employees to work from home. The arrangement of allowing employees to work from home has facilitated business organizations to invest in IT infrastructure and consequently a wide area network (WAN) optimization solutions for monitoring each employee’s work remotely. WAN optimization solutions play an important role in managing enterprise networks. It helps enterprises to minimize the total operational expenses by delivering optimal efficient networks.

Further, several large enterprises have their Strategic Business Units (SBU) spread across the globe. Employees of these companies work on a common platform wherein many employees operating from remote locations find it difficult to deliver good Quality of Service (QoS) due to the non-optimal distribution of bandwidth on the network while accessing centralized applications. Therefore, the implementation of WAN optimization software allows enterprises to accelerate the performance of their centralized applications and provide an enhanced user experience to employees.

With the emergence of next-generation 5G networks, several communication service providers worldwide are significantly deploying virtualized Radio Access Network (RAN) and core network to reduce overall infrastructure and other indirect costs involved. Additionally, the demand for edge computing is substantially increasing among enterprises to minimize latency during the computation of data. Therefore, to optimize their network efficiently by ensuring minimum downtime, communication service providers and enterprises worldwide are increasingly implementing optimization solutions.

In the wake of the ongoing COVID-19, business organizations are seeking efficient ways to optimize their network and mitigate the overall response time to customers. Consequently, the adoption of WAN optimization software across these enterprises has increased significantly. These solutions also assist enterprises in delivering enhanced network capacity that helps boost the overall operational efficiency and employee productivity.

Component Insights

The solution segment accounted for more than 70% of the global revenue share in 2019. This is attributed to the surging deployment of software-defined wide area networks (SD-WAN) among enterprises globally. WAN optimization solutions encompass SD-WAN and traditional WAN. SD-WAN is a virtual network architecture and enables companies to leverage a combination of network services including Long Term Evolution (LTE), 5G, Multiprotocol Label Switching (MPLS), and broadband services. The virtualized architecture of SD-WAN eliminates the backhaul infrastructure costs, thereby enticing business organizations to deploy it. Thus, SD-WAN optimization software is expected to experience strong growth over the forecast period.

With the introduction of the 5G network, several telecom operators such as AT&T Inc.; Deutsche Telekom AG; and Verizon Communications are actively deploying SD-WAN as a part of their end to end next-generation network. The SD-WAN deployment helps telecom operators to deliver improved quality of network experience to customers. On the other hand, the growing popularity of work from home arrangements has increased the demand for training and support services required for operating the solution properly. This, in turn, is expected to have a positive impact on the growth of the service segment over the forecast period.

Deployment Type Insights

The on-premise segment held a revenue share exceeding 65% of the global revenue in 2019. This is attributable to a substantial rise in the implementation of on-premise solutions across large enterprises to access and transmit data securely within the premise. On the contrary, due to the high license and maintenance costs associated with on-premise installations, the demand for on-premise solutions is estimated to exhibit relatively moderate growth over the forecast period.

On the other hand, the demand for Software as a Service (SaaS) has grown remarkably over the past few years. Also, the demand for cloud-based WAN optimization software is gaining high popularity across enterprises on the back of benefits offered in terms of infrastructure costs, faster implementation, and accessibility. With several large enterprises favoring cloud-based solutions, the trend has slowly but steadily extended to SMEs, especially in developing countries. The trend shall prolong, thereby further driving demand for cloud-based solutions over the forecast period.

Enterprise-Size Insights

Large enterprises segment attained a market share of over 70% in 2019. This is attributed to the high adoption of WAN optimization software among large technology firms, banks, hospitals, and e-commerce retailers. The use of these solutions has been helping these firms to reduce the total cost of ownership and latency challenges while improving network efficiency. Moreover, large enterprises deploy software purchased from multiple vendors for different areas of application. WAN optimization solutions offer the interoperability required for different software to operate in synchronization. Therefore, increasing the need for interoperability in carrying out multiple operations is anticipated to propel the demand in large enterprises segment from 2020 to 2027.

With a large number of employees on-board and a huge customer base, large enterprises generate a substantial chunk of data. Subsequently, to manage the existing extensive IT infrastructure and applications efficiently, large enterprises increasingly implement optimization solutions. Moreover, in the wake of the ongoing COVID-19 pandemic, the requisite focus on managing staff remotely is further expected to boost the adoption of WAN optimization solutions among enterprises.

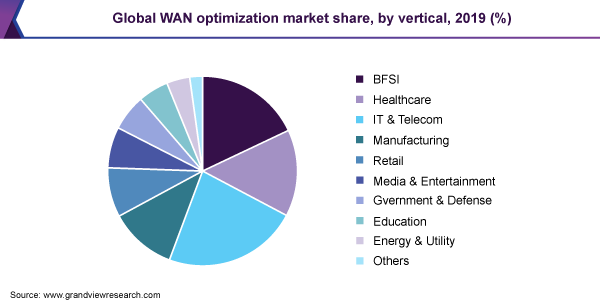

Vertical Insights

The IT and telecom segments captured over 20% of the revenue share in 2019. This is attributed to surging use of WAN optimization solutions for several IT and Telecom enterprise applications including data management during disaster recoveries, application performance acceleration, and bandwidth management over networks. Moreover, rising demand for WAN solutions to support end-to-end next-generation 5G networks is further expected to amplify the growth in the IT & Telecom segment over the forecast period.

The demand for remote patient monitoring and remote surgeries has witnessed an unprecedented rise amidst the global pandemic. To provide seamless connectivity for such critical applications, hospitals are actively investing in deploying robust network infrastructure. This, in turn, is expected to boost demand for WAN optimization solutions required to optimize and monitor the entire network competently at healthcare facilities. Moreover, the rising adoption of industrial Internet of Things (IIoT) and collaborative robots at industrial facilities has necessitated the deployment of huge on-premise network infrastructure. As a result, to efficiently monitor network and enhance overall productivity, demand for WAN optimization solutions is expected to surge in the coming years.

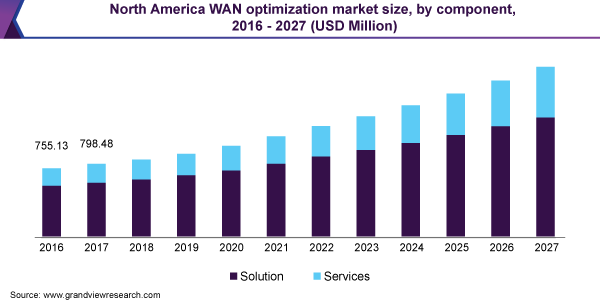

Regional Insights

North America accounted for a revenue share of over 35% in 2019. The significant share is attributed to a multitude of investments made by the leading players such as Cisco Systems, Inc.; Silver Peak; and Riverbed Technology in the field of network optimization. The increasing need for network monitoring solutions in the wake of increasing technology adoption across industry verticals, such as banking, telecom, and healthcare has helped North America gain significant market share. Moreover, the demand for advanced network optimization solutions is substantially rising across several educational institutions in the U.S. to provide high user experience during e-learning processes.

Asia Pacific market is estimated to witness the highest growth from 2020 to 2027. Increasing adoption of cloud-based WAN optimization solutions among enterprises is the major factor driving the Asia Pacific market demand. With growing awareness regarding the benefits associated with the cloud-based model, both SMEs and large enterprises are increasingly deploying cloud-based network optimization solutions. In addition, sighting potential growth opportunities in the Asia Pacific several large enterprises are investing heavily and establishing their business units in the region. Consequently, the need to deploy large area networks to manage businesses remotely is bound to support the demand for optimization solutions.

Key Companies & Market Share Insights

The WAN Optimization market is consolidated with the top four market players accounting for over 50% of the revenue share in 2019. Major market players are strategically focusing on partnerships and collaborations to increase their overall market presence and revenue share. For instance, leading players including Cisco Systems, Inc, Citrix Systems, Inc., and Silver Peak have entered into partnerships with Microsoft Corporation to integrate their SD-WAN solutions with Microsoft Azure and Office 365 platform. This has helped these players to increase their overall customer base and ensure significant revenue share in the market space.

Moreover, in a bid to expand their overall product portfolios and regional presence, leading players to aggressively target mergers and acquisitions. For instance, in July 2020, Hewlett Packard Enterprise announced its plan to acquire Silver Peak, a U.S.-based SD-WAN solution provider. The acquisition deal closed at an amount of USD 925 million is aimed at expanding its overall SD-WAN solution portfolio. Some of the prominent players in the wide area network optimization market include:

-

Cisco Systems, Inc.

-

HPE (Silver Peak)

-

Riverbed Technology

-

Citrix Systems, Inc.

-

Fortinet

-

Vmware Inc.

-

Broadcom (Symantec Enterprise)

-

FatPipe Networks Inc.

-

Versa Networks, Inc

-

Exinda

-

Blue Coat System

-

Infovista Corporation

-

NTT Communications

-

Aryaka Networks, Inc.

-

Circadence Corporation

-

Array Networks, Inc.

-

Sangfor Technologies Inc.

Wide Area Network Optimization Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 2.58 billion

Revenue forecast in 2027

USD 4.88 billion

Growth Rate

CAGR of 9.5% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Revenue in USD million and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company share analysis, competitive landscape, growth factors, and trends

Segments covered

Component, deployment type, enterprise size, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; China; Japan; India; South Korea; Brazil; Mexico

Key companies profiled

Cisco Systems, Inc.; HPE (Silver Peak); Riverbed Technology; Citrix Systems, Inc.; Fortinet; Vmware Inc.; Broadcom (Symantec Enterprise); FatPipe Networks Inc.; Versa Networks, Inc.; Exinda; Blue Coat System; Infovista Corporation; NTT Communications; Aryaka Networks, Inc.; Circadence Corporation; Array Networks, Inc.; Sangfor Technologies Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global wide area network optimization market report based on component, deployment type, enterprise size, vertical, and region:

-

Component Outlook (Revenue, USD Million, 2016 - 2027)

-

Solution

-

Traditional WAN

-

SD-WAN

-

-

Services

-

Advisory Services

-

Implementation & Integration

-

Training & Support

-

-

-

Deployment Type Outlook (Revenue, USD Million, 2016 - 2027)

-

Cloud-based

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Million, 2016 - 2027)

-

Large Enterprises

-

SMEs

-

-

Vertical Outlook (Revenue, USD Million, 2016 - 2027)

-

BFSI

-

Healthcare

-

IT & Telecom

-

Manufacturing

-

Retail

-

Media & Entertainment

-

Government & Defense

-

Education

-

Energy & Utility

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2027)

-

North America

-

The U.S.

-

Canada

-

-

Europe

-

The U.K.

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

The Middle East & Africa (MEA)

-

Frequently Asked Questions About This Report

b. The global wide area network optimization market size was estimated at USD 2,347.26 million in 2019 and is expected to reach USD 2,584.94 million in 2020.

b. The global wide area network optimization market is expected to grow at a compound annual growth rate of 9.5% from 2020 to 2027 to reach USD 4,884.37 million by 2027.

b. North America dominated the wide area network optimization market with a share of over 35.0% in 2019. This is attributable to a multitude of investments made by the leading players such as Cisco Systems, Inc., Silver Peak, and Riverbed Technology, among others in the field of network optimization.

b. Some key players operating in the wide area network optimization market include Cisco Systems, Inc., HPE (Silver Peak), Riverbed Technology, Citrix Systems, Inc., Fortinet, Vmware Inc., Broadcom (Symantec Enterprise), FatPipe Networks Inc., Versa Networks, Inc, Exinda, Blue Coat System, Infovista Corporation, NTT Communications, Aryaka Networks, Inc., Circadence Corporation, and Array Networks, Inc.

b. Key factors that are driving the market growth include rapidly growing adoption of advanced network and application performance solutions across enterprises and speedy deployment of virtualized next generation 5G network infrastructure worldwide.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.