- Home

- »

- Communications Infrastructure

- »

-

Data Center Networking Market Size, Industry Report, 2033GVR Report cover

![Data Center Networking Market Size, Share & Trends Report]()

Data Center Networking Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By End-use (BFSI, IT & Telecom, Healthcare, Retail, Education, Government), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-548-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Data Center Networking Market Summary

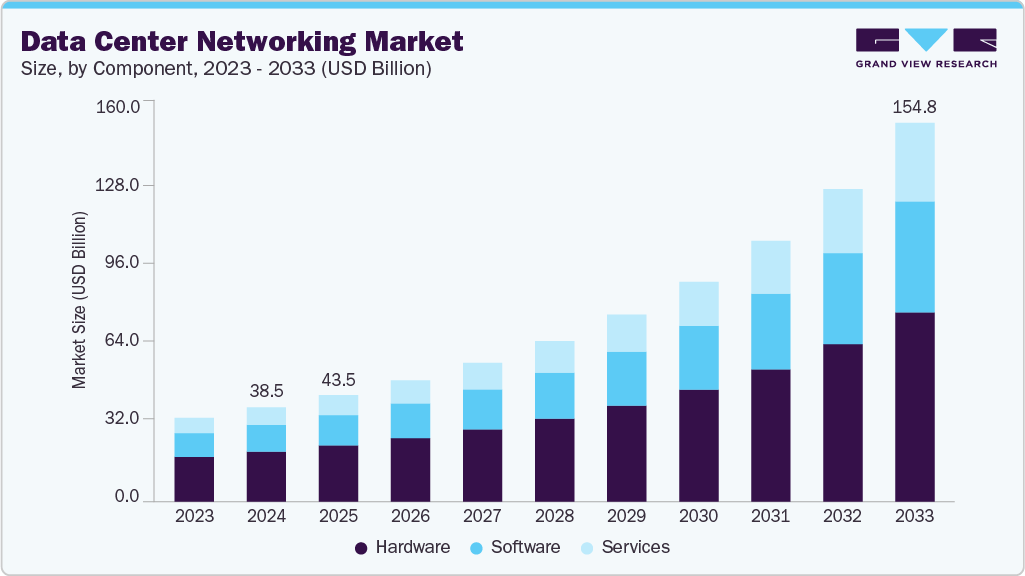

The global data center networking market size was estimated at USD 38.49 billion in 2024 and is projected to reach USD 154.83 billion by 2033, growing at a CAGR of 17.2% from 2025 to 2033 due to the exponential growth in global data traffic, driven by increased internet usage, IoT devices, video streaming, and enterprise digital transformation. Businesses are rapidly migrating workloads to cloud platforms such as AWS, Microsoft Azure, and Google Cloud.

Key Market Trends & Insights

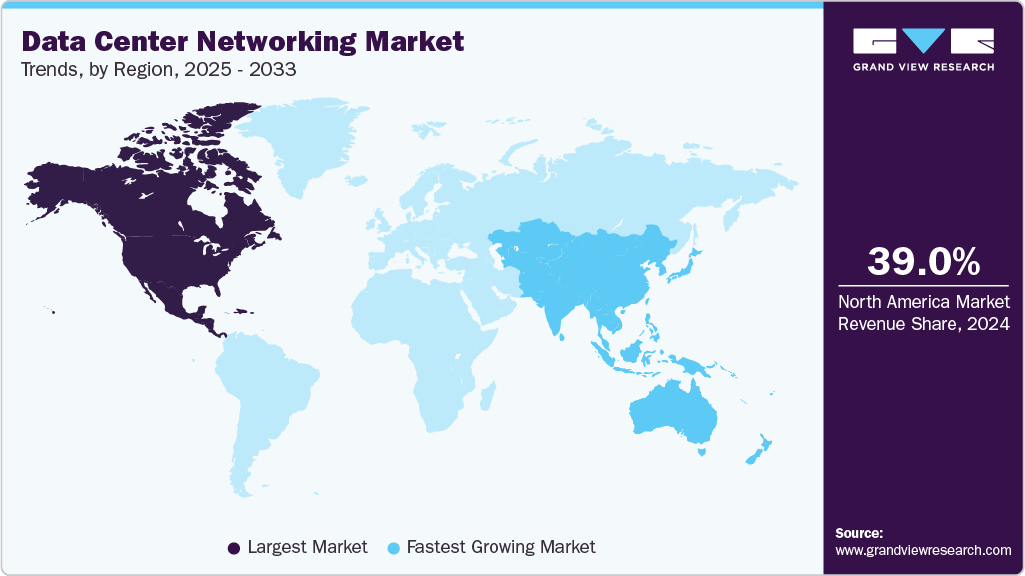

- North America data center networking dominated the global market with the largest revenue share of 39.0% in 2024.

- The data center networking market in the U.S. is expected to grow significantly at a CAGR of 16.0% from 2025 to 2033.

- By component, hardware led the market and held the largest revenue share of 53.0% in 2024.

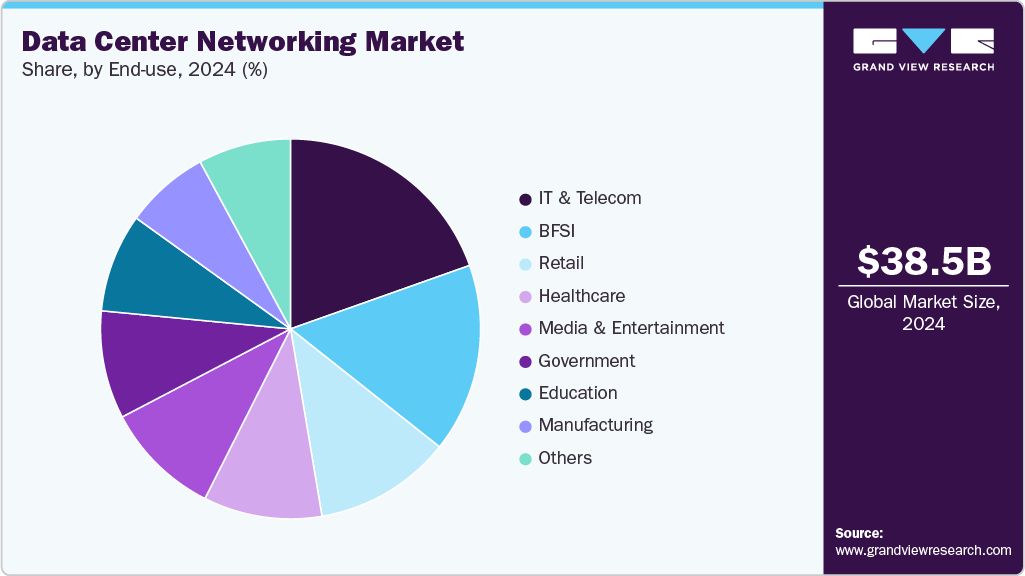

- By end use, IT & telecom led the market and held the largest revenue share of 19.6% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 38.49 Billion

- 2033 Projected Market Size: USD 154.83 Billion

- CAGR (2025-2033): 17.2%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

This requires a robust networking infrastructure to ensure low latency, high availability, and secure data flow between on-premises and cloud environments. Therefore, demand for high-bandwidth, scalable, and intelligent networking solutions such as SDN (Software-Defined Networking) and NFV (Network Functions Virtualization) is surging. The ongoing expansion of hyperscale data centers by companies such as Amazon, Meta, and Google significantly contributes to the data center networking industry's growth. These facilities require ultra-high-speed interconnects, advanced Ethernet switches, and dynamic traffic routing capabilities. Moreover, the rise of edge computing, driven by applications such as autonomous vehicles, smart cities, and real-time analytics, is pushing investments in distributed micro-data centers that need fast, agile, and localized networking solutions.These trends create a parallel demand for centralized and edge-oriented networking architectures. For instance, in June 2025, Digital Edge (Singapore) Holdings Pte. Ltd., a pan-Asian data center platform, entered into a strategic joint venture with B.Grimm Power Public Company Limited, an energy producer in Thailand. The newly formed entity, Digital Edge B.Grimm (TH) Holding Pte. Ltd., is set to lead the development of cutting-edge, AI-ready hyperscale data center campuses across Thailand. This initiative addresses the region's rapidly growing demand for advanced digital infrastructure.

The global deployment of 5G networks is another significant driver for data center networking. 5G requires ultra-low latency and high-throughput connectivity, which can only be supported by highly resilient and flexible data center networks. To handle the massive increase in connected devices and support 5G backhaul and core functions, telecom operators and governments invest heavily in next-gen network infrastructure, including data centers with advanced routing, switching, and optical transmission technologies.

The growing adoption of artificial intelligence (AI), machine learning (ML), and big data analytics is accelerating demand for high-performance computing environments that rely on low-latency, high-throughput networking infrastructure. These workloads require faster data movement between servers, GPUs, and storage systems, necessitating innovations such as high-speed Ethernet (e.g., 400G/800G), InfiniBand, and intelligent network fabrics. Data center operators are thus increasingly modernizing their networks to support these demanding applications.

Component Insights

The hardware segment dominated the market and accounted for the revenue share of 53.0% in 2024. With the rise of latency-sensitive applications like autonomous vehicles, augmented reality, and industrial IoT, there is growing investment in edge data centers that bring computing resources closer to the end-users. These edge facilities rely on compact, ruggedized networking hardware such as micro-switches, optical transceivers, and small form-factor pluggable (SFP) modules. As organizations deploy decentralized infrastructure to support real-time data processing, the demand for edge-specific networking hardware is expected to rise significantly. The hardware segment is further segmented into Ethernet, switch, router, storage area network (SAN), Network security equipment, application delivery controller (ADC), and others.

The services segment is anticipated to grow at the highest CAGR during the forecast period. As data center networks become increasingly complex due to cloud migration, virtualization, and hybrid IT models, enterprises seek expert guidance to plan, architect, and implement efficient networking solutions. This has led to a surge in demand for professional services such as network design, architecture consulting, system integration, and migration planning. Vendors and managed service providers are capitalizing on this need by offering end-to-end solutions tailored to customers’ specific application workloads, security requirements, and scalability goals, driving growth in the services segment. The services segment is further segmented into installation & integration, training & consulting, and support & maintenance.

End-use Insights

The IT & telecom segment dominated the market and accounted for the largest revenue share of 19.6% in 2024, driven by telecom operators' rapid deployment of network function virtualization (NFV) and cloud-native architectures to modernize their core networks. This shift requires robust, scalable networking within data centers to handle dynamic workloads, virtualized services, and real-time subscriber data processing. Moreover, the proliferation of OTT (over-the-top) platforms, online gaming, and real-time communication tools places unprecedented demand on telecom data centers to deliver low-latency, high-bandwidth connections.

The manufacturing segment is expected to grow at a significant CAGR over the forecast period due to the acceleration of Industry 4.0 initiatives. Smart factories rely on connected sensors, robots, and control systems that generate massive volumes of machine and process data in real time. This data must be transmitted, processed, and analyzed with minimal delay to ensure uninterrupted production workflows, predictive maintenance, and adaptive process optimization. This drives demand for low-latency, high-throughput networking infrastructure in edge and core data centers. Moreover, adopting digital twins, automated supply chain systems, and remote monitoring tools has become widespread among manufacturers aiming to improve operational efficiency and responsiveness.

Regional Insights

North America dominated the global market with the largest revenue share of 39.0% in 2024, driven by the widespread integration of hybrid and multi-cloud strategies across enterprises, government agencies, and educational institutions. Organizations increasingly deploy cloud-native applications across distributed environments, which requires seamless and secure interconnectivity between public cloud providers and private data centers. This demand accelerates investments in advanced networking technologies such as fabric automation, inter-data center connectivity, and programmable switching.

U.S. Data Center Networking Market Trends

The data center networking market in the U.S. is expected to grow significantly at a CAGR of 16.0% from 2025 to 2033, due to the expansion of AI research hubs and high-performance computing clusters, particularly in sectors such as healthcare, defense, and academia. These environments demand robust, low-latency interconnects to process massive real-time datasets.

Europe Data Center Networking Market Trends

The data center networking market in Europe is anticipated to register considerable growth from 2025 to 2033, supported by regulatory frameworks favoring data sovereignty and digital autonomy. Initiatives such as GAIA-X and EU Cloud Federation encourage the development of regional data centers with advanced networking capabilities that comply with strict data protection laws. The emphasis on building a self-sufficient digital ecosystem across EU countries is boosting demand for secure, locally governed, and interoperable networking solutions in private and colocation data centers.

The UK data center networking market is expected to grow rapidly in the coming years, owing to fintech companies and digital-first startups, key drivers of data center networking investments. These firms require ultra-reliable and scalable networking environments to support latency-sensitive applications like digital payments, algorithmic trading, and real-time analytics.

The data center networking market in Germany held a substantial market share in 2024 due to the strong demand for industrial IoT integration within the manufacturing sector, backed by initiatives such as Industrie 4.0. The country’s industrial backbone is rapidly digitizing production lines, warehouses, and logistics operations, requiring reliable networking infrastructure in centralized and on-premise data centers.

Asia Pacific Data Center Networking Market Trends

The data center networking market in Asia Pacific held a significant share in the global market in 2024, due to the surge in digital economy initiatives, and urban tech infrastructure is a major growth driver. Governments across the region are implementing smart city projects, rolling out 5G, and promoting digital inclusivity, which increases demand for robust data center networking to support new digital services. Moreover, the rise of domestic tech giants in India, Southeast Asia, and Australia creates a competitive push toward high-performance, cloud-ready networking environments to serve growing user bases.

Japan data center networking market is expected to grow rapidly in the coming years, driven by the nation’s push toward digital government transformation and public-sector cloud adoption. The government’s Digital Agency is advancing cloud-based e-governance systems that require secure, scalable networking solutions within national and local government data centers.

The data center networking market in China held a substantial market share in 2024, due to the country's focus on technological self-sufficiency and domestic cloud ecosystem expansion. With national policies such as the New Infrastructure initiative and the drive for digital industrialization, Chinese cloud providers and hyperscalers heavily invest in proprietary data centers with advanced networking systems.

Key Data Center Networking Company Insights

Key players operating in the data center networking industry are ALE International, Cisco Systems, Inc., Equinix, Inc., Fujitsu, Hewlett Packard Enterprise Development LP. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In June 2025, ALE International expanded its strategic partnership with Versa, a U.S.-based Universal Secure Access Service Edge (SASE) technology provider. The collaboration now offers ALE customers expanded access to Versa’s advanced solutions, including Secure SD-WAN and Zero Trust Network Access (ZTNA). By integrating these capabilities with ALE’s established LAN and WLAN access controls, the partnership aims to deliver comprehensive, Zero Trust security across diverse enterprise environments, spanning multi-site networks and cloud-based infrastructures.

-

In February 2025, Cisco Systems, Inc. and NVIDIA Corporation strengthened their collaboration to accelerate AI adoption in enterprises. The partnership aims to deliver secure, low-latency infrastructure optimized for AI workloads by integrating Cisco's networking technologies with NVIDIA's Spectrum-X platform. It also includes developing reference architectures and embedding security across all layers of the AI stack.

Key Data Center Networking Companies:

The following are the leading companies in the data center networking market. These companies collectively hold the largest market share and dictate industry trends.

- ALE International

- Arista Networks, Inc.

- Broadcom

- Cisco Systems, Inc.

- Dell Inc.

- Equinix, Inc.

- Extreme Networks, Inc.

- Fortinet, Inc.

- Fujitsu

- Hewlett-Packard Enterprise Development LP

- Hitachi Vantara LLC

- Intel Corporation

- Juniper Networks, Inc.

- NVIDIA Corporation

- Super Micro Computer, Inc.

Data Center Networking Market Report Scope

Report Attribute

Details

Market size in 2025

USD 43.54 billion

Revenue forecast in 2033

USD 154.83 billion

Growth rate

CAGR of 17.2% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report enterprise size

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

ALE International; Arista Networks, Inc.; Broadcom; Cisco Systems, Inc.; Dell Inc.; Equinix, Inc.; Extreme Networks, Inc.; Fortinet, Inc.; Fujitsu; Hewlett Packard Enterprise Development LP; Hitachi Vantara LLC; Intel Corporation; Juniper Networks, Inc.; NVIDIA Corporation; Super Micro Computer, Inc.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Data Center Networking Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global data center networking market report based on component, end-use, and region:

-

Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

Hardware

-

Ethernet Switch

-

Router

-

Storage Area Network (SAN)

-

Network Security Equipment

-

Application Delivery Controller (ADC)

-

Others

-

-

Software

-

Switching Operating System (OS)

-

Virtual Switch

-

Management Software

-

Controller

-

-

Services

-

Installation & Integration

-

Training & Consulting

-

Support & Maintenance

-

-

-

End-use Outlook (Revenue, USD Billion, 2021 - 2033)

-

BFSI

-

IT & Telecom

-

Healthcare

-

Retail

-

Education

-

Government

-

Media & Entertainment

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global data center networking market size was estimated at USD 38.49 billion in 2024 and is expected to reach USD 43.54 billion in 2025.

b. The global data center networking market is expected to grow at a compound annual growth rate of 17.2% from 2025 to 2033 to reach USD 154.83 billion in 2033.

b. North America dominated the global market with the largest revenue share of 39.0% in 2024, driven by the he widespread integration of hybrid and multi-cloud strategies across enterprises, government agencies, and educational institutions.

b. Some key players operating in the data center networking market include ALE International, Arista Networks, Inc., Broadcom, Cisco Systems, Inc., Dell Inc., Equinix, Inc., Extreme Networks, Inc., Fortinet, Inc., Fujitsu, Hewlett Packard Enterprise Development LP, Hitachi Vantara LLC, Intel Corporation, Juniper Networks, Inc., NVIDIA Corporation, Super Micro Computer, Inc.

b. Key factors that are driving the market growth include rising adoption of cloud computing across various industry verticals, growing trend of data center virtualization, and adoption of advanced data center operating models worldwide.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.