- Home

- »

- Medical Devices

- »

-

Wide Field Imaging Devices Market Size, Share Report, 2030GVR Report cover

![Wide Field Imaging Devices Market Size, Share & Trends Report]()

Wide Field Imaging Devices Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Diabetic Retinopathy, Retinopathy Of Prematurity), By Modality, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-528-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Wide Field Imaging Devices Market Trends

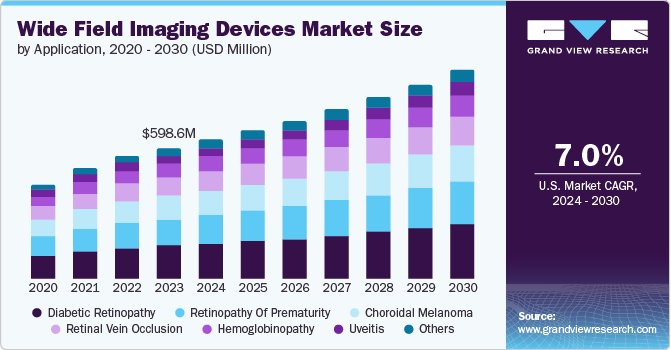

The global wide field imaging devices market size was valued at USD 598.6 million in 2023 and is expected to grow at a CAGR of 7.0% from 2024 to 2030. Some of the key driving factors for the growth of this market are the increasing prevalence of diabetic retinopathy, the growing number of new cases related to visual impairments, the adoption of innovation in the industry, and the presence of an ever increasing geriatric population around the globe.

Wide field imaging (WFI) and Ultra Wide Field Imaging (UWFI) are essential techniques in ophthalmology for capturing detailed retina images. The device aids in diagnosing peripheral eye diseases, including peripheral diabetic eye conditions and peripheral eye tumors. Its posterior pole resolution allows capturing images in two zoom modes: 100 degrees and 200 degrees.

Ophthalmology professionals and clinics extensively use WFI imaging technology to diagnose and treat numerous visual ailments. The technology can more readily reveal peripheral abnormalities in problems such as age-related macular degeneration (AMD). Professionals and businesses prefer this technology as it accurately assists in documenting the degree of retinal involvement in some complicated impairments such as Stargardt disease and retinitis pigmentosa.

The ability of WFI technology to encompass the entire retina in a single image has driven the demand for it since its invention. Lifestyle changes, increased screen time, growing awareness about the significance of eye health, growing availability of healthcare assistance for visual impairments, and increasing government initiatives are expected to fuel growth for this market in the approaching years.

Application Insights

The diabetic retinopathy segment held the largest share of 25.2% in 2023 and is expected to grow at the fastest rate. The rising prevalence of diabetic retinopathy and its projected increase are expected to drive growth for wide field imaging devices. Wide field imaging devices enhance visualization of the retinal periphery, leading to improved diagnosis and management of diabetic retinopathy. According to the American Academy of Ophthalmology, the total number of cases of diabetes mellitus is expected to reach 592 million by 2035. These factors and the growing geriatric population worldwide are projected to generate greater demand for the segment.

The Retinopathy of Prematurity (ROP) segment is expected to experience a significant CAGR from 2024 to 2030. This segment is primarily driven by factors such as the ability of WFI technology to reveal retinal abnormalities, enhanced diagnostics through improved imaging, and the growing adoption of technology over traditional standard ophthalmology techniques, especially for cases related to retinopathy of prematurity. In addition, professionals embrace some novel approaches, such as smartphone-guided wide-field imaging, to enhance the availability and accessibility of ROP diagnostics in low-resource settings.

Modality Insights

Tabletop wide field imaging devices held the largest share in 2023. Prominent wide field imaging devices are often delivered in compact sizes that fit neatly onto a table. These devices stabilize patient movement, ensuring precise image acquisition. Furthermore, the advanced features integrated into these devices assist clinicians in thorough retinal examination. For instance, Silverstone, a product offered by one of the key players in the ophthalmic diagnostic devices industry, Optosis, is an ultra-wide field imaging device. It also combines swept-source OCT for enhanced retina-to-sclera examination. Factors such as ease of use, increased availability, enhanced results gained through stabilized patient movement, and technological advances are expected to drive growth for this segment in upcoming years.

Hand-held wide imaging devices are anticipated to experience a noteworthy CAGR during the forecast period. This is attributed to the growing adoption of hand-held devices by professionals and clinics, increasing government initiatives offering diagnostic services in remote areas, ease of use aspects associated with hand-held devices, and constantly advancing technological features in these devices. Hand-held devices are compact, lighter, easy to handle, and can be assisted through smartphone access.

End Use Insights

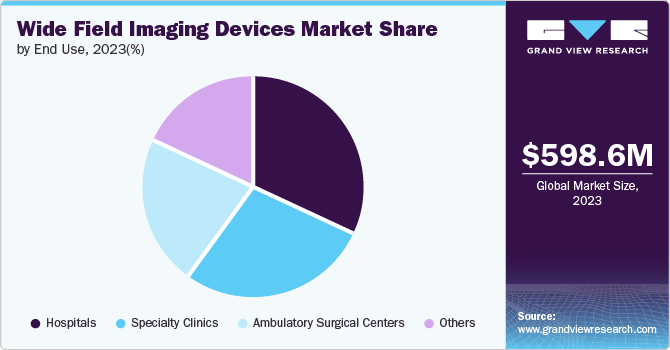

The hospitals segment held the largest share in 2023. The rising incidences of retinal diseases, including diabetic retinopathy, retinopathy of prematurity (ROP), and retinal occlusion, are expected to generate growing demand for advanced diagnostic services offered by resourceful ophthalmology departments in hospitals. An increasing inclination towards including ophthalmic diagnostics and treatment departments in hospitals is expected to fuel the use of wide field imaging devices.

The specialty clinics segment is projected to grow at the fastest CAGR from 2024 to 2030 owing to the development of wide field imaging devices suitable for deployment in various clinical environments, including specialty clinics. Key market players are constantly offering devices that can be installed seamlessly in such clinics with less space than in hospitals. Such clinics are the preferred choice of patients in the local vicinity or with lower-intensity problems related to visual impairments.

Regional Insights

North America held a significant revenue share in 2023. This is attributed to multiple factors, including the large number of patients diagnosed with diabetic retinopathy in the region, the presence of key market participants based in the U.S. and Canada, technological advancements accomplished through continuous research and development, and the increasing adoption of table-top and hand-held wide field imaging devices by professionals and clinics.

U.S. Wide Field Imaging Devices Market Trends

According to the U.S. Centers for Disease Control and Prevention, in 2021, 29.7 million individuals were diagnosed with diabetes. It contributes to 8.9% of the total population in the U.S. Furthermore, the number of children and adolescents younger than age 20 years diagnosed with diabetes was identified as 352,000, out of which 304,000 were diagnosed with type 1 diabetes. This is expected to result in growing cases of diabetic retinopathy, increasing visual impairments, and a rising need for diagnostic and imaging assistance provided by the technology.

Europe Wide Field Imaging Devices Market Trends

The wide field imaging devices market in Europe is expected to experience a significant growth rate during the forecast period. This regional market is primarily driven by a large geriatric population and growing visual impairments. According to Eurostat, the statistical office of the European Union, by 2050, EU-27 countries are anticipated to have half a million centenarians as part of the population. Growth in the aging population, changed lifestyles with increased screen time, growing prevalence of diabetic retinopathy, and other visual impairments are expected to drive growth for this market from 2024 to 2030.

Germany wide field imaging devices market is projected to dominate the regional market in the forecast period. It is attributed to the country's enhanced healthcare facilities and infrastructure, the presence of companies and research institutes focusing on delivering advanced imaging devices and technologies, and growing incidences of age-related macular degeneration, cataracts, and diabetic retinopathy.

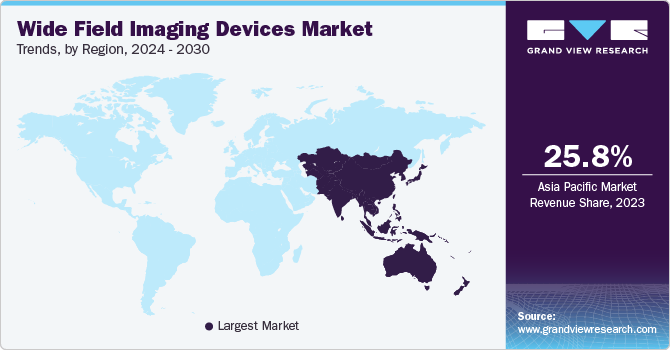

Asia Pacific Wide Field Imaging Devices Market Trends

Asia Pacific dominated the wide field imaging devices market and accounted for 25.8% in 2023 and is expected to experience the fastest CAGR during the forecast period with a CAGR of 8.9%. This regional market is primarily driven by improving healthcare infrastructure in countries such as India and China, the growing availability of wide field imaging technology in developing economies, the presence of a large diabetic population, and increasing awareness regarding the significance of diagnostics and treatments associated with visual impairments.

The India wide field imaging devices market is projected to grow rapidly from 2024 to 2030. This is attributed to an increase in healthcare spending and a growing number of people diagnosed with diabetes in the country. According to WHO, 77 million people who are or are above the age of 18 are suffering from type 2 diabetes in India. In addition, approximately 25 million individuals are at higher risk of acquiring diabetes in the approaching years and are diagnosed with prediabetic conditions.

Key Wide Field Imaging Devices Company Insights

Some of the key companies in the wide field imaging devices market are Heidelberg Engineering GmbH, Carl Zeiss Meditec AG, Inc., Optos, Clarity Medical, and Phoenix MICRON (Phoenix Technology Group, LLC) and others. Owing to unceasing demand for these devices, major market participants are adopting strategies such as substantial investments in R&D, partnerships and collaborations, innovation, enhanced distribution and the addition of novel technologies to their portfolios.

-

Heidelberg Engineering GmbH, an imaging solutions technology organization, offers diagnostic instruments equipped with advanced technology. Some of the company's key technology offerings include confocal microscopy, optical coherence tomography (OCT), electronic medical records (EMR), multimodal image management solutions (PACS), and others.

-

Carl Zeiss Meditec AG is one of the key providers of wide-field imaging devices. It delivers products equipped with high-end ophthalmic diagnostic technologies such as confocal microscopy and scanning lasers. The company's devices are often manufactured while considering the specific needs and requirements of the majority of eye care professionals.

Key Wide Field Imaging Devices Companies:

The following are the leading companies in the wide field imaging devices market. These companies collectively hold the largest market share and dictate industry trends.

- Heidelberg Engineering Inc.

- Visunex Medical Systems, Inc.

- Optos

- Carl Zeiss Meditec AG

- iCare (CENTERVUE S.P.A.)

- Clarity Medical

- MEDIBELL MEDICAL VISION TECHNOLOGIES LTD

- Forus Health Pvt Ltd

- oDocs Eye Care

- Phoenix MICRON (Phoenix Technology Group, LLC)

- Epipole Ltd.

Recent Developments

- In April 2024, Carl Zeiss Meditec AG, one of the prominent players in the medical technology industry, completed the acquisition of D.O.R.C. (Dutch Ophthalmic Research Center. The strategic advancement by the company is expected to result in enhanced workflow solutions for treating numerous eye conditions related to the retina.

- Eye2Gene, a University College London Institute of Ophthalmology and Moorfields Eye Hospital-based project funded by the National Institute for Health and Care Research (NIHR), and Heidelberg Engineering, a prominent industry participant in the ophthalmic imaging and technologies market, entered a collaborative partnership. The collaboration marks the future of ophthalmic diagnostics equipped with artificial intelligence algorithms and advanced imaging technology.

Wide Field Imaging Devices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 636.8 million

Revenue forecast in 2030

USD 954.0 million

Growth Rate

CAGR of 7.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2018 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, modality, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; India; Japan; Thailand; South Korea; Australia; Mexico; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Heidelberg Engineering Inc.; Optos; Carl Zeiss Meditec AG; iCare (CENTERVUE S.P.A.); Clarity Medical; MEDIBELL MEDICAL VISION TECHNOLOGIES LTD; Forus Health Pvt Ltd; oDocs Eye Care; Phoenix MICRON (Phoenix Technology Group, LLC); Epipole Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Wide Field Imaging Devices Market Report Segmentation

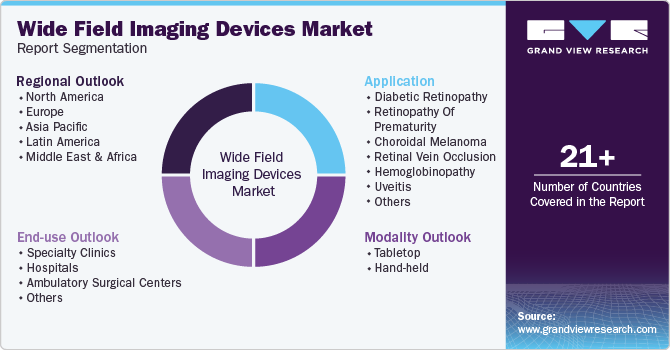

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global wide field imaging devices market report on the basis of application, modality, end use, and region:

-

Application (Revenue, USD Million, 2018 - 2030)

-

Diabetic Retinopathy

-

Retinopathy Of Prematurity

-

Choroidal Melanoma

-

Retinal Vein Occlusion

-

Hemoglobinopathy

-

Uveitis

-

Others

-

-

Modality Outlook (Volume, Units; Revenue in USD Million, 2018 - 2030)

-

Tabletop

-

Hand-held

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Specialty Clinics

-

Hospitals

-

Ambulatory Surgical Centers

-

Others

-

-

Regional Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Thailand

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.