- Home

- »

- Animal Health

- »

-

Wildlife Health Market Size, Share & Growth Report, 2030GVR Report cover

![Wildlife Health Market Size, Share & Trends Report]()

Wildlife Health Market Size, Share & Trends Analysis Report By Animal Type (Mammals, Birds), By End-use (Wildlife Sanctuaries, Zoos), By Product (Equipment & Consumables, Medicine), By Route Of Administration , By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-076-6

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Wildlife Health Market Size & Trends

The global wildlife health market size was estimated at USD 2.21 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 9.89% from 2023 to 2030. Some of the key factors driving the market include the increasing number of emerging & re-emerging zoonotic diseases from wild animal origins, growing government intervention in protecting wildlife Animal health by acknowledging its interconnectedness with human health, collaboration framework of multiple public sectors to promote wildlife conservation with funded programs, and growing establishments of national parks, zoos, and animal protection sanctuaries with standardized animal care. For instance, the Indian Ministry of Environment, Forest, and Climate has launched the “Vision-Plan 2021 - 2031” strategy that focuses on strengthening Central Zoo Authority and transforming Indian zoos with global standards to have advanced animal care.

The COVID-19 infection brought unprecedented changes in wildlife activities, with extensive lockdown measures and supply chain disruptions. According to an article published on May 2022 by the National Library of Medicine, the pandemic-imposed restrictions on movements have simultaneously reduced the patrolling and monitoring activities in several areas of wildlife facilities. The reduced forest-law enforcement, in turn, has increased the opportunities for illegal wildlife hunting by poachers. Furthermore, the pandemic has delayed funding services for wildlife management in several parts of the globe. For instance, according to the Euro Group for Animals Organization, the pandemic has delayed public funding to provide free emergency care for distressed & injured wild animals.

Organizations, such as OIE (World Organization for Animal Health), have been striving for over a decade to support & improve wildlife health. Their key figures indicate that around 40% of amphibians, 25% of mammals, and 14% of birds are under threat of extinction. To mitigate this, several steps have been taken by governments of various countries along with key wildlife organizations, such as the World Wilde Fund (WWF), Wildlife Conservation Society (WCS), International Union for Conservation of Nature (IUCN), and National Resources Defense Council, Inc. among others, thereby protecting wild animals. In addition, OIE also states that 72% of the emerging infectious diseases around the world have a wildlife origin. Therefore, a well-advanced disease surveillance system and management measures with necessary medications may reduce the burden of life-threatening diseases similar to COVID-19.

The recent report published by the WWF Living Planet on October 2022 revealed that the global wildlife population has declined by 69% since 1970. Therefore, to conserve and protect wild species, the national governments of many countries are implementing measures to establish new biosphere reserves, national parks, sanctuaries, wildlife rehabilitation centers, and other conservation facilities. Moreover, veterinary drugs play an important role in wildlife research and management. Several medicines are used in wildlife facilities for multiple purposes, including capturing & transporting animals, treating injuries, preventing diseases with core wild animal vaccinations, and rehabilitating or rescuing distressed animals, among others. These affirmative factors are significantly contributing to the growth of the market.

Animal Type Insights

In 2022, the mammals segment accounted for the largest revenue share of 45%. Several species of wild mammals, such as lions, elephants, tigers, monkeys, leopards, bears, pandas, giraffes, zebra, wild canines & felines, wild cattle, and whales, among others, are found majorly in the wildlife spaces with enormous protection measures. For instance, FAO states that the ‘Wild Mammals Protection Act 1996’ has been implemented to specifically protect wild mammals against any source of harm. Furthermore, organizations like Wildlife Vets International, Worldwide Veterinary Service, and Smithsonian Institution have been supporting tiger veterinary care projects in India, Bangladesh, Russia, the U.S., and Indonesia, among other countries, to provide vital veterinary medication treatments in local conservations.

The reptiles animal type segment willregister the fastest CAGR of around 11% over the forecast period. The ample availability of non-prescription reptile medicines and the increasing need to protect several reptile species from extinction are some of the factors contributing to the substantial segment growth. In addition, the birds segment is also expected to growsignificantly over the forecast period owing to the increasing number of rehab facilities with trained veterinarians dedicated to protecting captive wild birds. Furthermore, the number of bird protection helplines and rescue centers is growing in developed countries to treat abandoned or injured wild birds immediately.

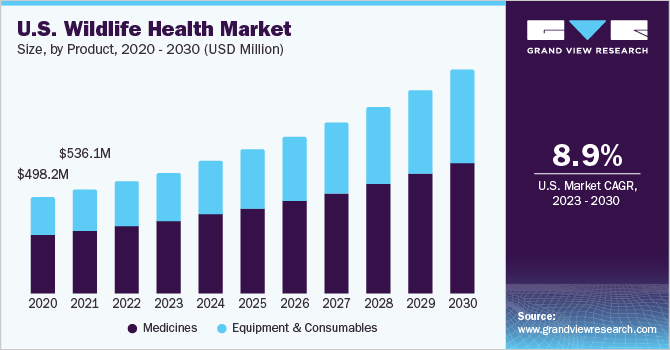

Product Insights

Based on products, the medicine segment dominated the market with the highest revenue share in 2022. According to the guidelines published by the American Association of Zoo Veterinarians, every zoo and aquarium must have on-site veterinary pharmacies to routinely supply basic veterinary drugs, such as antibiotics, anesthetics, emergency resuscitative medications, analgesics, fluids, anthelmintics, and tranquilizers, among others. Immobilizing drugs, such as tranquilizers, sedatives/hypnotics, narcotics, dissociative/combination drugs, and reversals or antagonist drugs, have been extensively used as a part of veterinary practices in wildlife management. The wide usage and requirement of medicines in rehabilitation & rescue centers further contribute to the substantial segment share.

The equipment and consumables segment is anticipated to grow at the fastest CAGR of over 10% during the projected timeline owing to its ample commercial availability for wildlife veterinary purposes. According to the Indian Central Zoo Authority, every mini to large-sized zoo in the country must be equipped with critical care units, diagnostic/vital monitoring systems, surgical supplies, stretchers, medical tool kit, electro-surgical units, medicine baits, color doppler ultrasound, and animal tranquilizing guns, among others. The growing technological advancements in equipment to make wildlife health management easy for zoo keepers, sanctuary veterinarians, and other key personnel in wildlife facilities are further supporting the growth of the segment.

Route Of Administration Insights

The injectable route of administration held the dominant share of over 45% in 2022. The veterinarians and wildlife officers are mostly involved in tranquilizing or sedating animals in national parks, sanctuaries, and zoos, typically using intramuscular or intravenous injections. Some injectable drugs are also provided through a subcutaneous route based on the requirements. In addition, the remote drug delivery system has now become a safe and easy way of delivering vaccines, medicines, and sedatives to wild animals. As per an article published by the National Library of Medicine on March 2022, double dart injection guns are used efficiently at a distance of 5-20 meters to deliver medicines to wild animals.

The oral route of drug administration is anticipated to grow at the fastest CAGR of more than 10% over the projected timeline. The NC Department of Health and Human Services reported on September 2022 that the wildlife services department would be distributing consumable forms of rabies vaccines through 500,000 oral baits in the borders of North Carolina Zones, targeting wild raccoons. Moreover, the World Organization for Animal Health published a report on September 29, 2022, stating that oral vaccine baits have been successfully implemented to prevent rabies from wildlife reservoirs in North America and Europe.

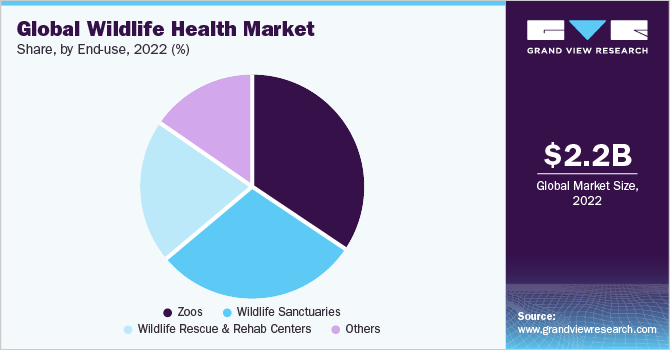

End-use Insights

The zoos segment held the dominant market share of over 30% in 2022. The substantial share is owing to the strict standards & guidelines followed in the zoological parks with employed trained veterinarians to offer medical services for captive animals. With over 2,400 zoos located just in the U.S., all of the animals are provided routine veterinary care with several invasive medical procedures. Moreover, zoos in developing countries like India have on-site veterinary hospitals with the required personnel and laboratory facilities to meet the global standards of wildlife health preventative measures.

The wildlife rescue & rehab centers segment is anticipated to grow at the fastest CAGR of around 10.5% over the forecast period. With the growing number of people valuing wildlife conservation & preventing wild animal extinctions, the count of volunteer wild animal rehabilitators and rescue teams who protects abandoned, injured, or wounded animals is also increasing. According to a study published by the National Library of Medicine in March 2022, millions of native wild animals are rescued, rehabilitated, and protected by wildlife rehabilitators each year globally.

Regional Insights

The North America region held over 30% revenue share of the market in 2022. The significant availability of wildlife veterinary care facilities, advanced technologies in delivering medicines for animals in sanctuaries/zoos, increasing government initiatives to prevent zoonotic diseases from wild reservoirs, ample number of trained wildlife veterinarians, and the growing number of wildlife conservation measures, programs, and funding activities, are some of the key factors contributing to the region’s growth.

On the other side, the Asia Pacific region is anticipated to grow at the fastest CAGR of approximately 11% over the projected period. As a part of the ‘One Health’ approach, wildlife health stakeholders are networking and working together across the Asia region to protect the health of wild animals. The World Organization for Animal Health indicated that the wildlife health framework would enhance the existing networks and their goals to achieve the strategy of protecting animals and associated human health. Moreover, with several biodiverse countries, the region is home to multiple species of wild animals coupled with country-wise wildlife protection systems.

Key Companies & Market Share Insights

The major players, such as Boehringer Ingelheim International GmbH, NexGen Pharmaceuticals, Virbac, and Wedgewood Pharmacy, are constantly implementing strategic measures, such as launching new products and collaborating with government organizations, to mitigate the spread of zoonotic diseases from wild origins. For instance, in May 2022, Ceva Sante Animale acquired Artemis Technologies, Inc., a Canadian oral rabies vaccine manufacturer. This acquisition expanded the company’s veterinary vaccine offerings with ONRAB, a recombinant oral vaccine that showed positive trial results for wild skunks and raccoons in the U.S. Some of the prominent players in the global wildlife health market include:

-

Boehringer Ingelheim International GmbH

-

NexGen Pharmaceuticals

-

Virbac

-

Dong Bang Co., Ltd.

-

Pneu-Dart Inc.

-

DANiNJECT

-

Genia

-

Wedgewood Pharmacy

-

The Pet Apothecary

-

Taylors Pharmacy

Wildlife Health Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 2.41 billion

Revenue forecast in 2030

USD 4.67 billion

Growth rate

CAGR of 9.89% from 2023 to 2030

The base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Animal type, product, route of administration, end-use, region

Regions covered

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; UK; Germany; France; Italy; Spain; China; Japan; India; Australia; South Korea; Brazil; Mexico; South Africa

Key companies profiled

Boehringer Ingelheim International GmbH; NexGen Pharmaceuticals; Virbac; Pneu-Dart Inc.; Dong Bang Co., Ltd.; DANiNJECT; Genia; Wedgewood Pharmacy; The Pet Apothecary; Taylors Pharmacy

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Wildlife Health Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global wildlife health market report based on animal type, product, route of administration, end-use, and region:

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Mammals

-

Birds

-

Fish

-

Reptiles

-

Amphibians

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Medicine

-

Immobilizing Drugs

-

Pharmaceutical Drugs

-

Vaccines

-

Other Medicines

-

-

Equipment & Consumables

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Oral

-

Injectable

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Zoos

-

Wildlife Sanctuaries

-

Wildlife Rescue & Rehab Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

MEA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global wildlife health market size was estimated at USD 2.21 billion in 2022 and is expected to reach USD 2.41 billion in 2023.

b. The global wildlife health market is expected to grow at a compound annual growth rate (CAGR) of 9.89% from 2023 to 2030 to reach USD 4.67 billion by 2030.

b. North American region held over 30% revenue share of the wildlife health market in 2022, owing to the significant availability of wildlife veterinary care facilities, advanced technologies in delivering medicines for animals in sanctuaries/zoos, increasing government initiatives to prevent zoonotic diseases from wild reservoirs, ample number of trained wildlife veterinarians, and the growing number of wildlife conservation measures, programs, and funding activities.

b. Some key players operating in the global wildlife health market include Boehringer Ingelheim International GmbH, NexGen Pharmaceuticals, Virbac, Pneu-Dart Inc., Dong Bang Co., Ltd, Virbac, DANiNJECT, Genia, Wedgewood Pharmacy, The Pet Apothecary, and Taylors Pharmacy, among others.

b. Some of the key factors driving the wildlife health market growth include the increasing number of emerging & re-emerging zoonotic diseases from wild animal origins, growing government intervention in protecting wildlife health, collaboration framework of multiple public sectors to promote wildlife conservation with funded programs, and growing establishments of national parks, zoos, and animal protection sanctuaries with standardized animal care.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."