- Home

- »

- Advanced Interior Materials

- »

-

Wind Turbine Composites Market Size, Industry Report, 2030GVR Report cover

![Wind Turbine Composites Market Size, Share & Trends Report]()

Wind Turbine Composites Market (2025 - 2030) Size, Share & Trends Analysis Report By Fiber Type (Glass Fiber, Carbon Fiber), By Application (Blades, Nacelles), By Region (North America, Asia Pacific), And Segment Forecasts

- Report ID: GVR-4-68040-592-0

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Wind Turbine Composites Market Trends

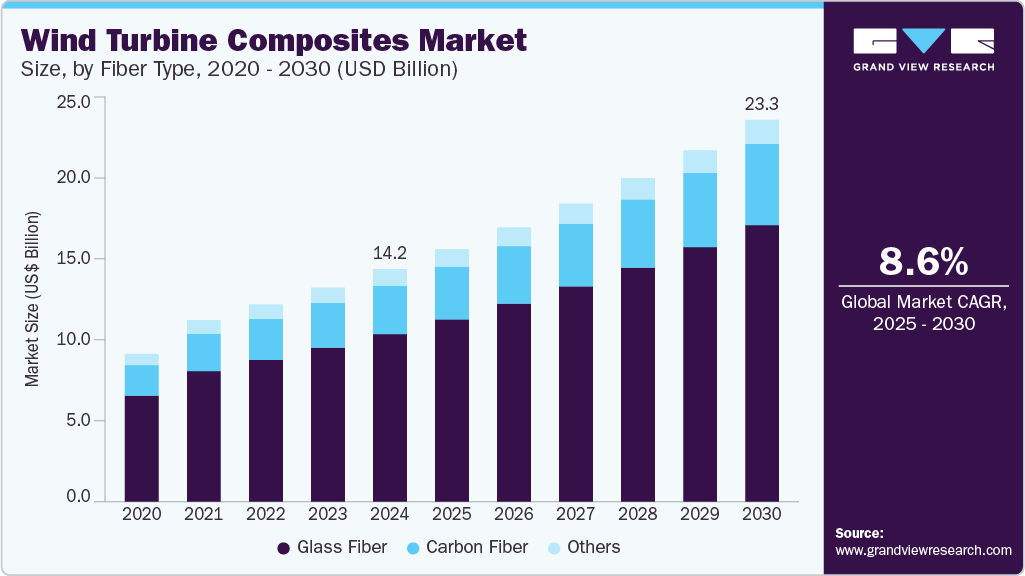

The global wind turbine composites market size was estimated at USD 14.20 billion in 2024 and is expected to grow at a CAGR of 8.6% from 2025 to 2030, driven by the global shift toward renewable energy. As countries aim to reduce carbon emissions and meet climate goals, wind energy has become a key focus.

Key Highlights:

- The wind turbine composites market in Asia Pacific dominated the global industry and accounted for the largest revenue share of about 31.8% in 2024

- China wind turbine composites market is driven by state-driven policies, subsidies, and ambitious net-zero goals

- By fibre type, the glass fiber segment led the market and accounted for the largest revenue share of 72.0% in 2024

- By fibre type, the carbon fiber is the fastest-growing segment with a CAGR of 8.9%, driven by the need for longer, lighter, and more efficient turbine blades

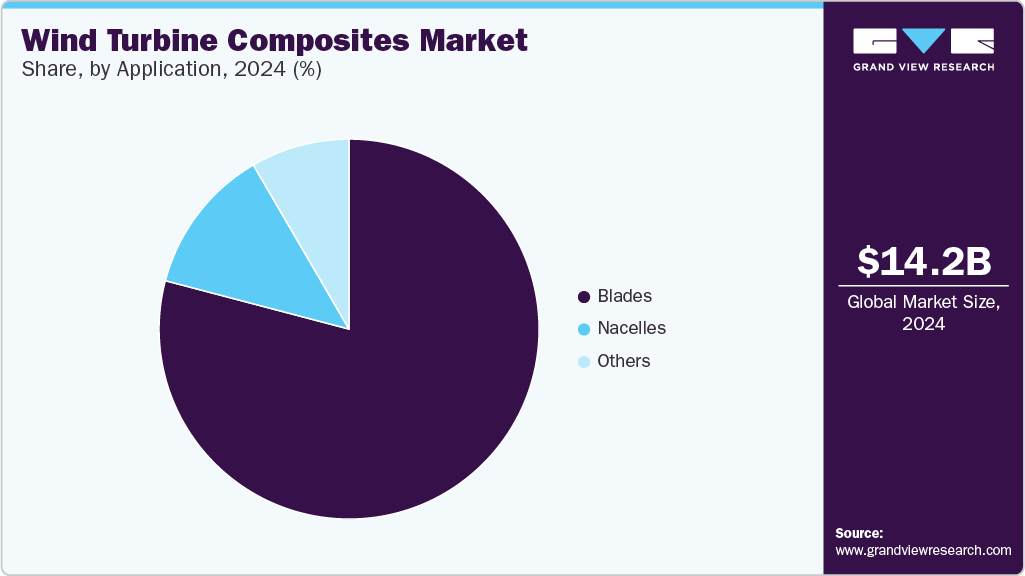

- By application, the blades segment dominated the industry and accounted for the largest revenue share of 79.1% in 2024

This surge in wind energy projects, both onshore and offshore, has led to increased demand for composite materials used in turbine blades and other components. Composites like glass fiber and carbon fiber are favored for their strength-to-weight ratio and durability, essential for efficient energy capture and long-term performance. Regions such as Asia-Pacific, Europe, and North America are leading in wind energy installations.

Government incentives and policies promoting renewable energy adoption have spurred investments in wind energy infrastructure. Advancements in composite materials technology have resulted in lighter, stronger, and more corrosion-resistant components, reducing maintenance costs and improving turbine efficiency. The trend towards larger wind turbines, with blades exceeding 70 meters, necessitates high-performance materials like carbon fiber composites. Additionally, the push for offshore wind farms, which require materials that can withstand harsh marine environments, has further increased the reliance on advanced composites.

Innovation in wind turbine composites is focused on sustainability and manufacturing efficiency. Researchers are developing recyclable and bio-based composites to address environmental concerns associated with traditional materials. For instance, new thermoplastic resins allow for the recycling of turbine blades into various products, including consumer goods. Advanced manufacturing techniques like vacuum injection molding and 3D printing are enhancing production capabilities, enabling the creation of larger and more complex components with reduced waste. These innovations not only improve the environmental footprint of wind energy but also contribute to cost reductions and scalability in turbine production.

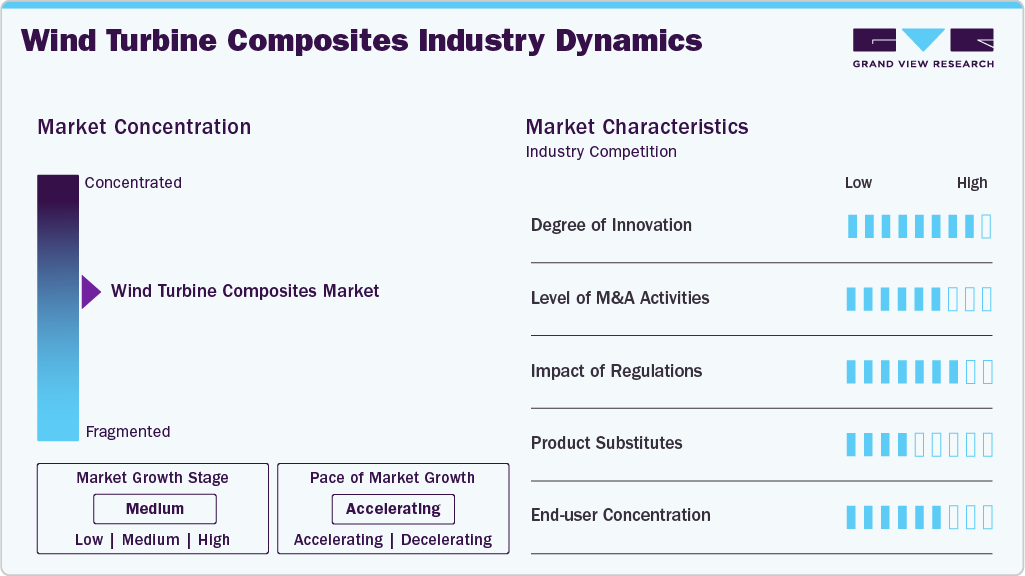

Market Concentration & Characteristics

The industry is moderately concentrated, with a few major players dominating the global supply. Key companies like TPI Composites, LM Wind Power, and Siemens Gamesa control a significant share of the market due to their strong manufacturing capabilities, technological expertise, and long-term partnerships with turbine OEMs. These companies benefit from economies of scale and continuous R&D investments, allowing them to innovate and maintain quality standards.

However, the growing demand for localized production, particularly in Asia-Pacific, is opening opportunities for regional manufacturers to enter the market and challenge the dominance of established players.

Substitution threats in the wind turbine composites industry are relatively low, but alternatives such as metals (e.g., aluminum or steel) and emerging natural fiber composites could compete in certain applications. However, traditional metals are heavier and less efficient in terms of aerodynamic performance and fatigue resistance, making them less suitable for modern turbine blades.

On the other hand, natural fiber composites and thermoplastics are being explored as more sustainable options, but they currently lack the mechanical strength and durability of glass and carbon fiber composites. As a result, while substitutes exist, their adoption remains limited due to performance trade-offs.

Fiber Type Insights

The glass fiber segment led the market and accounted for the largest revenue share of 72.0% in 2024, due to its excellent balance of strength, durability, and cost-effectiveness. It is widely used in turbine blades, nacelles, and other structural components because it offers sufficient mechanical performance while being significantly cheaper than alternatives like carbon fiber. Additionally, glass fiber is easier to process and has an established global supply chain, making it the preferred material for high-volume production, especially in onshore wind installations. Its compatibility with various resins and manufacturing methods further reinforces its dominant position in the market.

Carbon fiber is the fastest-growing segment with a CAGR of 8.9%, driven by the need for longer, lighter, and more efficient turbine blades. Its superior strength-to-weight ratio and fatigue resistance make it ideal for next-generation turbines, particularly in offshore applications where blade length and performance are critical. Although more expensive than glass fiber, the increasing scale of offshore projects and advancements in carbon fiber processing are making it more commercially viable. Moreover, the demand for higher energy output and reduced maintenance costs is pushing manufacturers to invest in carbon fiber-based solutions.

Application Insights

The blades segment dominated the industry and accounted for the largest revenue share of 79.1% in 2024, as they are the largest and most material-intensive components of the turbine. The demand for longer, lighter, and more aerodynamic blades directly influences energy capture efficiency, making the use of high-performance composites essential. Materials like glass and carbon fiber are crucial for ensuring blades can withstand high stress, fatigue, and varying environmental conditions over long lifespans. As turbine sizes increase-especially for offshore projects-the volume of composites used in blades continues to rise, solidifying their leading share in the market.

The nacelle segment is growing due to rising complexity and performance demands in modern wind turbines. As turbines scale in size and are deployed in harsher offshore environments, nacelles must house heavier and more sophisticated components like generators, gearboxes, and control systems. This drives the need for lightweight, durable composite enclosures that protect internal systems from moisture, corrosion, and extreme temperatures. The shift towards modular and maintenance-friendly nacelle designs is also boosting composite use, helping reduce overall turbine weight and operational costs.

Regional Insights

North America wind turbine composites market represents a strong and steadily growing landscape, with the U.S. at the forefront. Wind energy is a key pillar of the region’s decarbonization strategy, especially in the Midwest and coastal states. Composite technology adoption is supported by advanced infrastructure and high investment in renewable R&D. The region also sees rising demand for large, durable turbine blades optimized for extreme climate conditions.

U.S. Wind Turbine Composites Market Trends

The wind turbine composites market in the U.S. is a mature wind energy industry, with growing offshore wind activity, especially in the Northeast. Companies like GE Renewable Energy and TPI Composites play a central role in the domestic production of composite turbine components. Strong federal and state incentives are accelerating wind energy capacity additions. The country is also investing in localizing supply chains for both economic and national security reasons.

Asia Pacific Wind Turbine Composites Market Trends

The wind turbine composites market in Asia Pacific dominated the global industry and accounted for the largest revenue share of about 31.8% in 2024, driven by China’s aggressive investments in renewable energy infrastructure. The region benefits from high wind energy targets, strong government support, and a large-scale manufacturing base. Composite manufacturers in this region enjoy economies of scale and increasing technical capabilities. Rapid urbanization and rising electricity demand further reinforce the region's leadership in wind energy development.

China wind turbine composites market is driven by state-driven policies, subsidies, and ambitious net-zero goals. China has rapidly expanded both onshore and offshore wind farms. It also leads to the production of key composite raw materials like glass fiber, supporting cost-efficient blade manufacturing. Strategic government programs continue to encourage domestic innovation and global export competitiveness.

Europe Wind Turbine Composites Market Trends

The wind turbine composites market in Europe is driven by strong environmental policies and advanced technological capabilities. Countries like Germany, Denmark, and the UK have pioneered wind energy adoption, particularly offshore. European firms are also leaders in blade recycling technologies and high-performance carbon fiber development. The EU’s cohesive energy policy fosters cross-border collaboration and export of composite expertise.

Germany wind turbine composites market is growing. With a strong engineering base and environmental focus, the country invests heavily in developing recyclable, high-strength composite blades. German firms like Siemens Gamesa and SGL Carbon are key innovators in blade design and composite fabrication. The government’s push for energy independence is further catalyzing R&D and domestic production.

Central & South America Wind Turbine Composites Market Trends

The wind turbine composites market in Central & South America is growing, with Brazil, Mexico, and Chile leading the way. The region's vast wind resources and rising energy needs have spurred investments in renewable energy. Foreign direct investment and support from international development agencies are key to advancing wind infrastructure. Composite demand is expected to grow as more localized assembly and manufacturing facilities are established.

Middle East & Africa Wind Turbine Composites Market Trends

The wind turbine composites market in the Middle East & Africa is still in the nascent stage but showing potential, particularly in South Africa, Morocco, and parts of the Gulf region. High solar penetration dominates the renewables mix, but wind projects are gaining traction due to diversification goals and favorable wind conditions in coastal and desert regions. Governments are beginning to include wind in their broader energy transition plans. As more pilot projects succeed, they are expected to pave the way for larger-scale composite demand.

Key Wind Turbine Composites Companies Insights

Key players operating in the wind turbine composites market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Wind Turbine Composites Companies:

The following are the leading companies in the wind turbine composites market. These companies collectively hold the largest market share and dictate industry trends.

- TPI Composites, Inc.

- LM Wind Power

- Vestas

- Siemens Gamesa Renewable Energy

- Hexcel Corporation

- Toray Industries, Inc.

- TEIJIN LIMITED.

- Gurit Services AG

- Suzlon Energy Limited

- Owens Corning

Recent Developments

-

In October 2024, LM Wind Power manufactured a 77-meter blade, incorporating a carbon-Elium resin spar cap and a new adhesive from Arkema’s subsidiary, Bostik. Notably, this blade utilized recycled Elium resin in its shear web, showcasing the feasibility of a closed-loop recycling process.

-

In June 2023, Siemens Gamesa launched the SG 7.0-170 wind turbine, the latest addition to its 5.X platform, offering enhanced performance for medium and high wind sites.

Wind Turbine Composites Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 15.42 billion

Revenue forecast in 2030

USD 23.29 billion

Growth rate

CAGR of 8.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Fiber type, application, and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea

Key companies profiled

TPI Composites, Inc.; LM Wind Power; Vestas; Siemens Gamesa Renewable Energy; Hexcel Corporation; Toray Industries, Inc.; TEIJIN LIMITED.; Gurit Services AG; Owens Corning; Suzlon Energy Limited

Customization scope

Free report customization (equivalent to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Wind Turbine Composites Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global wind turbine composites market report based on fibre type, application, and region.

-

Fiber Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Glass fiber

-

Carbon fiber

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Blades

-

Nacelles

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global wind turbine composites market size was estimated at USD 14.20 billion in 2024 and is expected to reach USD 15.42 billion in 2025.

b. The global wind turbine composites market is expected to grow at a compound annual growth rate of 8.6% from 2025 to 2030 to reach USD 23.29 billion by 2030.

b. The glass fiber segment led the market and accounted for the largest revenue share of 72.0% in 2024, driven by its cost-effectiveness, high strength-to-weight ratio, and corrosion resistance.

b. TPI Composites, Inc., LM Wind Power, Vestas, Siemens Gamesa Renewable Energy, Hexcel Corporation, Toray Industries, Inc., TEIJIN LIMITED, Gurit Services AG, Owens Corning and Suzlon Energy Limited are prominent companies in the wind turbine composites market.

b. Key factors driving the wind turbine composites market include increasing global wind energy installations, demand for lightweight and durable materials, and supportive government policies promoting renewable energy.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.