- Home

- »

- Plastics, Polymers & Resins

- »

-

Window Film Market Size, Share And Trends Report, 2030GVR Report cover

![Window Film Market Size, Share & Trends Report]()

Window Film Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Sun Control, Decorative, Security & Safety, Privacy), By Application (Automotive, Residential, Commercial, Marine), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-199-3

- Number of Report Pages: 145

- Format: PDF

- Historical Range: 2019 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Window Film Market Summary

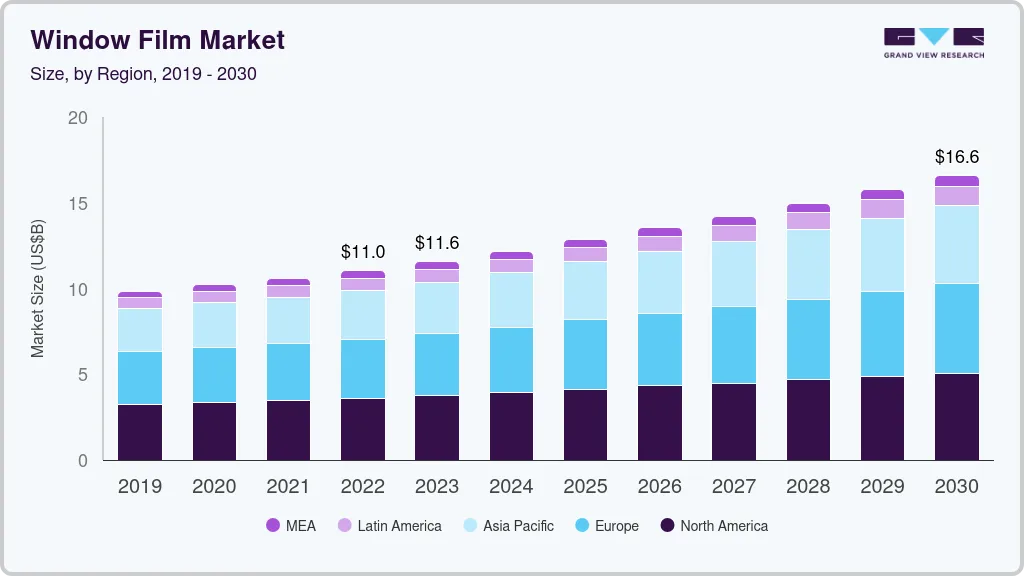

The global window film market size was valued at USD 11.56 billion in 2023 and is projected to reach USD 16.56 billion by 2030, growing at a CAGR of 5.3% from 2023 to 2030. Increasing demand for energy-efficient window films is expected to propel market growth during the forecast period.

Key Market Trends & Insights

- North America dominated the Market and accounted for over 32.0% share of the global revenue in 2023.

- By product, sun control product segment led the market and accounted for more than 46.0% share of the global revenue in 2023.

- By material, the polyester segment accounted for the largest market share in 2023.

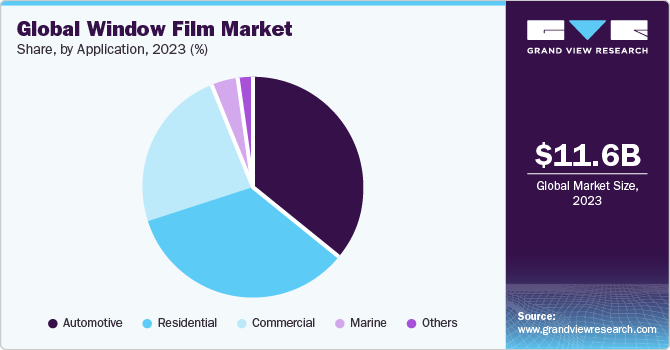

- By application, automotive application segment led the market and accounted for more than 35.8% share of the global revenue in 2023.

Market Size & Forecast

- 2024 Market Size: USD 11.25 Billion

- 2030 Projected Market Size: USD 16.56 Billion

- CAGR (2023-2030): 5.3%

- North America: Largest market in 2023

Window films are widely utilized for energy efficiency in heating and cooling purposes in residential and commercial applications, commonly in vehicles and windows. According to the U.S. Department of Energy, window films facilitate the average consumption of 30% of heat loss that occurs through windows and doors at homes. Improvements in window films enable the reduction in solar heat gain & winter heat loss in commercial & residential buildings, which is expected to provide sustainable growth over the forecast years. Building Energy Management System (BEMS) effectively conserves energy and improves energy efficiency by creating a stable and sustainable environment in both commercial & residential buildings.

The increasing number of green building constructions and the development of net zero energy buildings are expected to propel the demand for window films. The rising consumer awareness regarding the sustainability and price of window films, coupled with growing environmental awareness regarding carbon dioxide emissions and improving energy efficiency, is expected to drive the market over the forecast years.

Global carbon emission levels have been increasing steadily on account of the population explosion across Asia Pacific and Latin America, coupled with rapid industrialization and an increasing number of passenger cars in recent years. Stringent regulations regarding energy-efficient buildings & vehicles and increasing concerns about the environment and health are anticipated to fuel the demand.

Low emissivity (Low-E) film helps buildings to retain heat during the winter season. It uses special metallic coatings, which block infrared and ultraviolet rays and allows maximum visible light to prevent fading of interiors in residential and commercial buildings. Low-E glasses are replaced with window films owing to a better return on investment and the latter providing 6.6 times greater energy & cost savings than Low-E glasses.

Ultraviolet-A (UVA) filtering window film can help in reducing skin cancer and skin damage. Growing consumer disposable income in emerging economies has prompted a rising adoption of fuel-efficient passenger cars, coupled with an increasing demand for electric vehicles (EV), expected to drive the market for window film over the forecast years. However, the presence of strict regulations on tinted films used in automobiles, which limits visible light transmission (VLT), is expected to impact the market growth.

Manufacturers are focused on manufacturing high-quality and safety products on account of window film industry standards. As per these standards, the product should have a minimum of 15% light transmission. Low visibility can lead to theft or accidents, especially at night. A lower VLT rating tends to have better glare control, whereas a higher rating is preferred for maintaining natural lights. The VLT of a window film is a crucial part of defining the permissibility of heat protection, UV protection, and security concerns.

High VLT in window films allows better attention of the police to ensure public safety in vehicles. Certain countries have exemptions if drivers or passengers are affected by related medical conditions such as lupus, sunlight allergy, photosensitivity, and melanoma. Windows with a high tint can cause dooring incidents for cyclists and pedestrians owing to low visibility inside & across the vehicle.

Window tint products are likely to provide new growth avenues for market participants. These tint products are manufactured after coloring or dying of window film. Addition of tinting materials or colors help to block the sun rays. This benefits in reduction of cooling costs, minimization of glare on screens, and also offer privacy & safety.

Market Concentration & Characteristics

The market growth stage is medium, and the pace of the market growth is accelerating. The degree of innovation is expected to remain moderate to high over the forecast period. Products like decorative films have observed rising interest among automotive and construction industries. Innovative products with safety, privacy and light permeability are anticipated to witness increasing demand in the market.

The market is expected to observe a low level of merger & acquisition activities. The companies in the market are more focused on organic growth strategies such as increasing production capacities, and development of products based on quality offered and technology used for manufacturing the film.

Use of window film has a positive impact on the environment. These products help in reduction of temperature and heat loss in commercial & residential building. Window panels are key components in the building and are responsible for energy performance of facades with around 60% of energy loss. It has been observed that, in such cases use of window films significantly reduces the energy losses and provides cost benefits.

Threat of substitutes in market is low to moderate. Key substitutes include bio-based window film, which is produced using 30% renewable energy feed by co-extrusion process. Energy saving window film offers high returns on investment compared to low emissive glass products thus reducing replacing glass in some infrastructure applications.

End-user concentration in the market is moderate to high. Personal care & cosmetics is the largest end-user segment followed by industrial, food processing, and consumer goods. Manufacturers are using the proper approach to substitute petro-based products by by bio-based products to reduce the reformulation cost and time based on end-user demand.

End-user concentration is expected to remain moderate over the coming years. Automotive industry is expected to remain the largest end-user with vehicle window glass being the major application. Other end-users include tinted glass manufacturers and construction companies among others.

Product Insights

Sun control product segment led the market and accounted for more than 46.0% share of the global revenue in 2023. Sun control window films are mainly utilized to protect the interior of buildings and provide aesthetic value to them. The increasing use of sun control in residential and commercial applications owing to the occurrence of skin diseases is likely to propel the market growth for window film. Furthermore, rising energy costs and the need to reduce power consumption propel the demand for sun control films in residential and commercial applications.

Technological improvements in window films help in reducing solar heat gain & winter heat loss, which promotes a sustainable and comfortable environment in buildings. They find a broad application scope, including restricting fading of furniture, paints & coatings of rooms, and carpets in residential and commercial applications. Rising product demand from the construction industry in emerging economies such as China, India, Japan, Thailand, and Vietnam are expected to drive the sun control window film market in the Asia Pacific region.

In the automotive industry, these films reduce solar heat gain and enhance styling and protection. They also protect interior components such as audio equipment, seats, and other electronic devices. These factors are expected to drive the market for window film over the forecast years.

Material Insights

The polyester segment accounted for the largest market share in 2023 and is likely to grow at lucrative growth rate over the forecast period. A typical window film is manufactured using numerous multiple layers of polyester. Some of these layers are colored or pigmented while some are clear. Additionally, ceramic or metal coating is applied to absorb or reflect the energy. In the last stage, a hard coat is added to provide durability and protection against scratches.

Polyester, also known as PET helps in energy savings and also provides safety. These films come in thin plastic sheet or one large roll. The product is also easy to cut, apply and reposition. Polyester films offer durability and chemical resistance. Frosted window films made from vinyl materials are projected to offer new growth avenues for market participants. These films provide aesthetic performance along with privacy benefits in daylight.

Application Insights

Automotive application segment led the market and accounted for more than 35.8% share of the global revenue in 2023. The growing trend towards manufacturing lightweight vehicle components owing to stringent environmental regulations issued by governments to promote fuel economy is expected to increase the demand for window films.

Safety & security window films are used in automotive applications to avoid damages caused by flying shards. Window films protect from UV rays and superior heat control. The recovery of the automobile sector in European countries such as Germany, France, and Italy due to the adoption of electric vehicles is expected to positively impact the demand for window films over the forecast period.

Major automotive companies have shifted their production facilities to countries such as China, India, Thailand, and Vietnam, owing to cheap labor and favorable government regulations. Increasing per capita income among the middle class in countries like India is anticipated to fuel automotive sales over the forecast period. This is projected to benefit window film market in India over the coming years.

The commercial application segment is expected to grow during the forecast period. Increasing urbanization in emerging economies of the Asia Pacific, the Middle East, and Latin America is expected to drive the window film demand for commercial building applications. There is a growing demand for malls, stores, and supermarkets in these regions, as consumers buy goods from a single outlet destination.

Enormous footfall in malls and increased spending & purchases are observed in these regions. Mall developers are expected to target emerging cities for further development, as urban cities are close to saturation regarding construction. These factors are expected to increase window films demand in commercial applications.

Regional Insights

North America dominated the Market and accounted for over 32.0% share of the global revenue in 2023. New investments are being made in North America, reflecting a recovery in Canada's residential & non-residential construction, owing to capital expenditure cuts in the oil & gas sector and the Liberal government's fiscal stimulus plan to spur new non-residential construction. Furthermore, given the expected rate hikes by the Federal Reserve, the increases in long-term interest rates are likely to remain gradual.

On the plus side, the U.S. economy continues to register job growth, lending standards are easing, market fundamentals for commercial real estate continue to improve, and more funding support is coming from state and local construction bond measures. These factors are expected to drive the demand for specialized window films in the construction sector, especially for solar control and privacy windows. Solar (sun control) film demand is expected to grow due to the increasing use of cleaner energy sources and an aim to reduce carbon emissions.

The region's commercial construction segment is witnessing growth due to continued strength in the tourism & hospitality sector, with the construction of multiple hotels and even malls, among other commercial spaces. These growing segments in the region will drive the demand for window films over the forecast period.

Key Window Film Company Insights

Some of the market participants include Eastman Chemical Company, 3M, and Madico, Inc, among others.

-

3M is a diversified technology company, with business segments, namely industrial, electronics & energy, safety & graphics, health care and consumer. The product portfolio offered by the company includes automotive, commercial and residential window film.

-

Eastman Chemical Company operates through four business segments, namely additives & functional products, advance materials, fibers, and chemical intermediates. The product portfolio of the company includes decorative, safety & security and sun-control window film. The company offer window film under advance materials business segment.

Solar Gard, and Toray Plastics (America), Inc. are some of the emerging market participants in the market.

-

Solar Gard operates as a subsidiary of Saint-Gobain S.A. which was acquired in September 2011. The company is a division of Saint-Gobain Performance Plastics and is involved in the manufacturing Window Film and paint protection film. Its product portfolio includes solar control, safety & security, decorative, anti-graffiti, and paint protection films.

-

Toray Plastics (America), Inc. was founded in 1985 and is headquartered in North Kingstown, the U.S. It is a manufacturer of plastic films and foams. The company’s line of business includes polypropylene films, polyester films, bio-based PET films, metalized OPP films, and polyolefin foams.

Key Window Film Companies:

The following are the leading companies in the window film market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these window film companies are analyzed to map the supply network.

- 3M

- Eastman Chemical Company

- American Standard Window Film

- Saint-Gobain Performance Plastics Corporation (Solar Gard)

- Madico, Inc.

- Toray Plastics (America), Inc.

- Hanita Coatings RCA Ltd. (Avery Dennison Israel Ltd.)

- Johnson Window Films, Inc.

- Armolan Window Films

- Garware Suncontrol

- Reflectiv Window Films

Recent Developments

-

In August 2023, Solar Art announced acquisition of Layr, a window film manufacturing company. Layr has wide customer base including office buildings, schools and high-end retailers. This acquisition helped Solar Art to expand its business East Coast region with infrastructure in New York.

-

In February 2023, Eastman and High Performance Optics, Inc. announced launch of new window film designed specifically for the transportation industry, which features selective High Energy Visible Light (HEVL) filtering in China.

Window Film Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 11.56 billion

Revenue forecast in 2030

USD 16.56 billion

Growth Rate

CAGR of 5.3% from 2023 to 2030

Actual data

2019 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in thousand square meter, revenue in usd million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, material, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Russia; China; India; Japan; South Korea; Australia; Brazil; Argentina; Chile; Colombia; Saudi Arabia; UAE; Africa

Key companies profiled

3M; Eastman Chemical Company; American Standard Window Film; Saint-Gobain Performance Plastics Corporation (Solar Gard); Madico; Inc.; Toray Plastics (America); Inc.; Hanita Coatings RCA Ltd. (Avery Dennison Israel Ltd.); Johnson Window Films; Inc.; Armolan Window Films; Garware Suncontrol; Reflectiv Window Films

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Window Film Market Report Segmentation

This report forecasts revenue and volume growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2019 to 2030. For the purpose of this study, Grand View Research has segmented the global window film market report on the basis of product, application, material and region:

-

Product Outlook (Volume, Thousand Square Meter; Revenue, USD Million, 2019 - 2030)

-

Sun Control

-

Decorative

-

Security & Safety

-

Privacy

-

-

Application Outlook (Volume, Thousand Square Meter; Revenue, USD Million, 2019 - 2030)

-

Automotive

-

Residential

-

Commercial

-

Marine

-

Others

-

-

Material Outlook (Volume, Thousand Square Meter; Revenue, USD Million, 2019 - 2030)

-

Vinyl

-

Polyester

-

Plastic

-

Ceramic

-

Others

-

-

Regional Outlook (Volume, Thousand Square Meter; Revenue, USD Million, 2019 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

Chile

-

Colombia

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

Africa

-

-

Frequently Asked Questions About This Report

b. The global window film market size was estimated at USD 11.04 billion in 2022 and is expected to reach USD 11.56 billion in 2023.

b. The global window film market is expected to grow at a compound annual growth rate of 5.3% from 2023 to 2030 to reach USD 16.56 billion by 2030.

b. North America dominated the window film market with a share of 32.5% in 2022. This is attributable to increasing demand for products across multiple end-use industries such as residential, commercial, automotive, and marine in the region.

b. Some of the key players operating in the window film market include 3M; Eastman Chemical Company; American Standard Window Film; Solar Gard Performance Plastics; Madico Inc; Toray Plastics (America) Inc.; Hanita Coatings; and Armolan Window Film.

b. Key factors that are driving the market growth include window films application to reduce glare and protection against UV rays and enhance the strength and rigidity of windows in various industries such as automotive and construction.

b. The sun control product segment led the window film market and accounted for more than 46.2% share of the global revenue in 2022.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.