- Home

- »

- Next Generation Technologies

- »

-

Wires And Cables Market Size, Share, Industry Report, 2033GVR Report cover

![Wires And Cables Market Size, Share & Trends Report]()

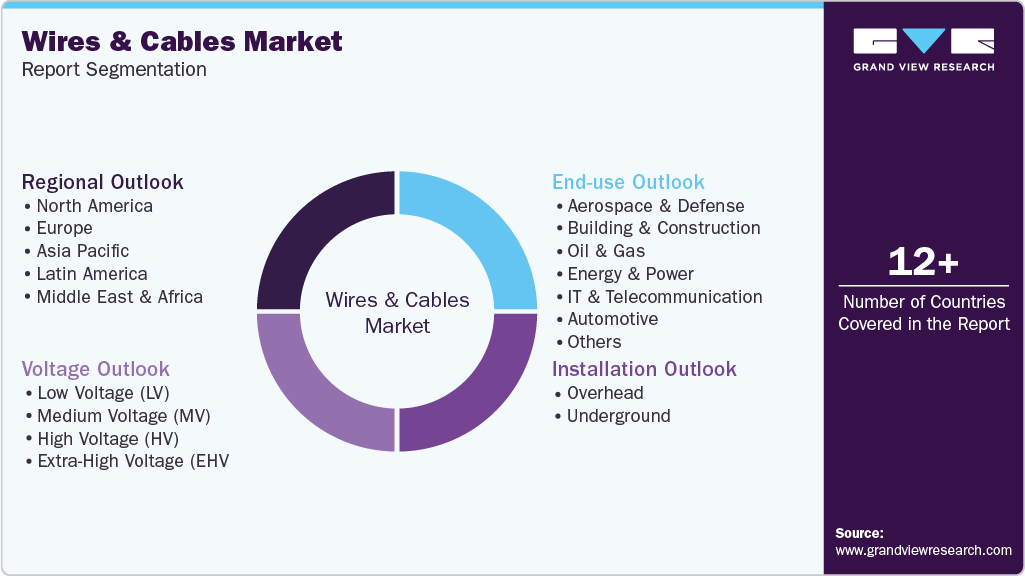

Wires And Cables Market (2026 - 2033) Size, Share & Trends Analysis Report By Voltage (Low, Medium, High, Extra-High), By Installation (Overhead, Underground), By End Use (Aerospace and Defense, Building & Construction), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-704-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Wires and Cables Market Summary

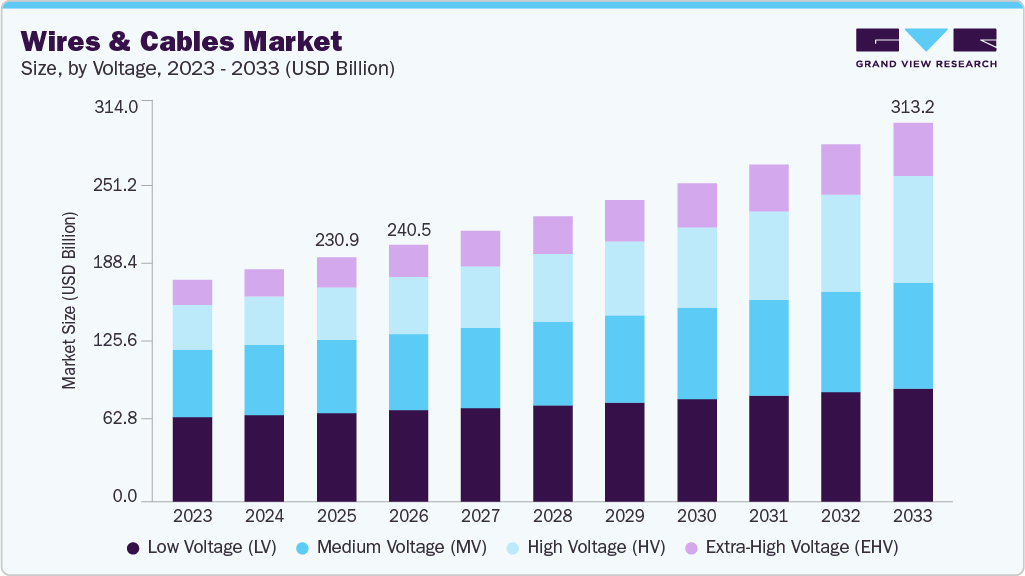

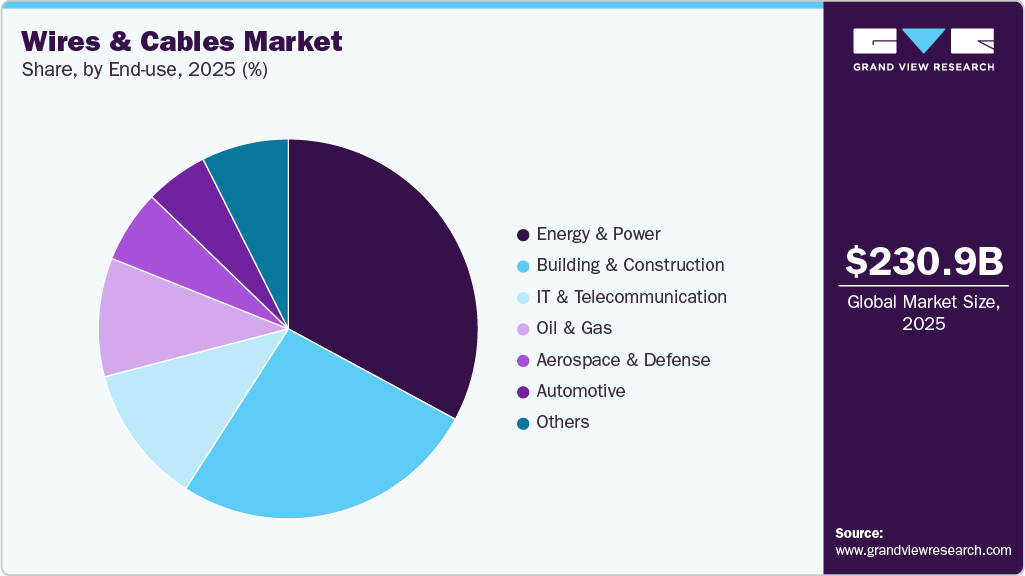

The global wires and cables market size was valued at USD 230.90 billion in 2025 and is projected to reach USD 313.19 billion by 2033, growing at a CAGR of 3.8% from 2026 to 2033. Increased investments in smart upgrading of the power transmission and distribution systems and development of smart grids are anticipated to drive the market's growth.

Key Market Trends & Insights

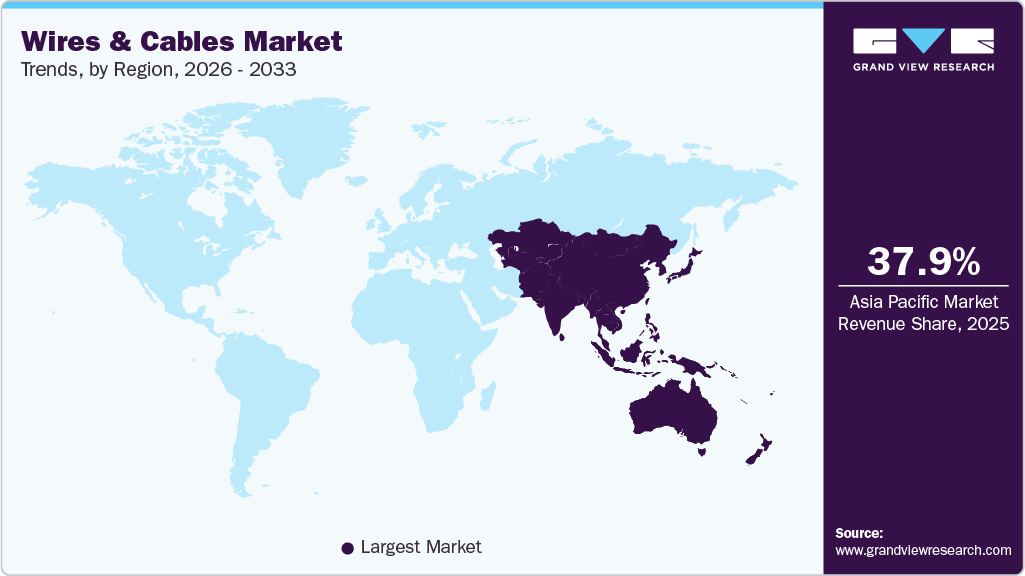

- Asia Pacific dominated the global wires and cables market with the largest revenue share of 37.85% in 2025.

- The wires and cables market in the China led the Asia Pacific market and held the largest revenue share in 2025.

- By voltage, the low voltage (LV) segment led the market and held the largest revenue share of 43.75% in 2025.

- By installation, the overhead segment held the dominant position in the market and accounted for the leading revenue share of 63.62% in 2025.

- By end use, the automotive segment is expected to grow at the fastest CAGR of 4.7% from 2026 to 2033.

Market Size & Forecast

- 2025 Market Size: USD 230.90 Billion

- 2033 Projected Market Size: USD 313.19 Billion

- CAGR (2026-2033): 3.8%

- Asia Pacific: Largest Market in 2025

Implementation of smart grid technology has met the increasing need for grid interconnections, thus resulting in rising investments in the new underground and submarine cables.Rising urbanization and growing infrastructure worldwide are some of the major factors driving the market. The said factors have impacted on the power and energy demand in commercial, industrial, and residential sectors. Technological advancement in grids is necessary to reduce the frequency and duration of storm impacts, power outages, and restore service quickly after outages. The functioning of the entire globe depends on the timely delivery of electric supply.

Furthermore, the increasing population leads to a rise in demand for power. The smart grid is an electric grid that includes controls, automation, computers, and innovative equipment & technologies that function together and offer efficient electricity transmission. Smart grid helps generate efficient renewable power, reliable power, reducing carbon footprint, using a mix of energy sources, working with smart devices and smart homes, and encouraging the use of electric vehicles.

Additionally, growing consumer preference for energy management solutions and real-time monitoring systems is raising demand for smarter grid infrastructures. Increasing adoption of distributed energy resources, such as rooftop solar panels and home battery storage, is encouraging grid modernization efforts. Enhanced regulatory frameworks and government incentives aimed at promoting sustainable energy practices also support market expansion.

Voltage Insights

The low voltage segment led the market and accounted for 43.75% of the global revenue in 2025. Increasing urbanization demands reliable power distribution in dense areas, where low voltage wires and cables provide essential mechanical protection through steel wire armour (SWA) and aluminium wire armour (AWA) for direct burial installations. For instance, in December 2025, ABB introduced Kabeldon NXT, a cable distribution cabinet designed for utility low voltage systems with a 29% reduced carbon manufacturing footprint. The cabinet uses low-carbon steel made with 100% renewable energy and 75% recycled materials, reducing CO2 emissions by 78 kg during production.

The extra high voltage segment is predicted to foresee significant growth in the forecast period. The market is rising due to technological advancements in insulation materials, and high-temperature superconductors enhance efficiency, reliability, and predictive maintenance. For instance, in July 2025, Nexans and RTE collaborated to recycle aluminum from power cables in France. The cables used in the country’s electricity transmission network are collected and recycled, then used again to make new cables for RTE’s high and extra-high voltage lines. This initiative helps reduce waste and supports more sustainable energy infrastructure.

Installation Insights

The overhead segment accounted for the largest market revenue share in 2025. Overhead installation techniques are the most widely used as they are easiest and cheapest form of installation. For instance, in November 2025, Sumcab launched tough ground and overground cables that support direct underground trench installation in various soils and resist rodent damage, water, low temperatures, crushing, and abrasion with 35 joules of impact resistance.

The underground segment is predicted to foresee significant growth in the forecast period. The underground cables installation lowers the maintenance costs, incurs less transmission losses, and hence, effortlessly sustains the power loads. For instance, in August 2025, ABB introduced new electrical solutions that focus on improving scalability, reliability, and installation efficiency in data centers, supporting the demands of growing data volumes and advanced technologies that simplify connections between underground and above-ground conduits.

End Use Insights

The energy and power segments accounted for the largest market revenue share in 2025. Several technological upgrades such as shifting the old transmission lines to high/extra high voltage lines to avoid the transmission losses are being made in the electricity T&D ecosystem. For instance, in December 2024, NKT collaborated with ABB Distribution Solutions to provide the electrical infrastructure needed for expanding its high-voltage submarine power cable factory in Karlskrona, Sweden, allowing the facility to produce enough cables to connect offshore wind farms with a combined capacity of 20 GW.

The automotive segment is projected to grow significantly over the forecast period. The demand is due to the rising adoption of electric vehicles (EVs) and hybrids, which demand high-voltage cables for battery systems, powertrains, and charging infrastructure. For instance, in March 2025, BMW Group Plant Debrecen in Hungary advanced its assembly line operations for the Neue Klasse architecture, incorporating modularization, reduced connecting elements, and a zonal wiring harness that uses 600 fewer meters of wiring and weighs 30 percent less than prior generations.

Regional Insights

The wires and cables market in North America is primarily driven by the modernization of power grids, increased investment in renewable energy, and the expansion of data centers. Infrastructure upgrades and the adoption of electric vehicles (EVs) are also contributing to the rising demand for specialty cables. The region’s focus on smart technologies and IoT further propels the growth of fiber-optic cables for high-speed communication.

U.S. Wires and Cables Market Trends

The U.S. wires and cables market is heavily influenced by investments in energy-efficient systems and renewable power generation. Government initiatives to boost electric vehicle (EV) adoption and upgrade the national power infrastructure are key drivers. Additionally, the 5G rollout is creating significant demand for fiber optic wires and cables to support high-speed data transmission.

Europe Wires and Cables Market Trends

Europe’s wires and cables market is driven by stringent regulations promoting renewable energy and efficiency. The region is witnessing significant demand from the automotive sector, especially with the growing production of electric vehicles (EVs). Countries such as Germany, France, and the UK are focusing on smart grids, data centers, and upgrading aging power infrastructure, fueling further growth.

Asia Pacific Wires and Cables Market Trends

Asia Pacific dominated the market by 37.85% revenue share in 2025, due to rapid industrialization, urbanization, and infrastructure development in countries such as China and India. The expansion of renewable energy projects, alongside government initiatives in smart city development, drives demand for power and fiber-optic cables. The region’s strong automotive and telecom industries further contribute to its market growth.

Key Wires and Cables Market Company Insights

Some key companies in the wires and cables industry are American Wire Group, Nexans, KEI Industries Ltd., Sumitomo Electric Industries, Ltd.

-

KEI Industries manufactures a range of electrical wires and cables, including EHV up to 400 kV, medium voltage, low voltage power cables, control and instrumentation cables, rubber cables, house wiring, and stainless steel wires. Operations extent domestic retail, institutional, and export segments, serving power utilities, infrastructure, railways, refineries, petrochemicals, mining, cement, and steel sectors. KEI also provides end-to-end EPC services for turnkey power transmission and distribution projects, encompassing engineering, procurement, construction, and commissioning.

-

Sumitomo Electric Industries operations comprise product development, manufacturing of electric wires and cables, optical fiber cables, automotive wiring harnesses, compound semiconductors, cutting tools, and anti-vibration rubber components. Operates across five primary business segments: automotive, info communications, electronics, environment & energy, and industrial materials & others. Business activities support energy infrastructure, telecommunications networks, automotive production, and advanced materials applications globally.

Key Wires and Cables Companies:

The following are the leading companies in the wires and cables market. These companies collectively hold the largest market share and dictate industry trends.

- American Wire Group

- Amphenol TPC.

- Belden Inc.

- Encore Wire Corporation

- Finolex Cables.

- Fujikura Ltd.

- Furukawa Electric Co., Ltd.

- KEI Industries Limited.

- LEONI AG

- LS Cable & System Ltd.

- Nexans

- NKT A/S

- Prysmian S.p. A

- Sumitomo Electric Industries Ltd.

- Southwire Company, LLC

Recent Developments

-

In December 2025, LS Cable & System India launched 400 kV EHV cables and HTLS overhead conductor solutions, which complement its comprehensive cable-system portfolio, which includes joints, terminations, and related materials, enabling end-to-end supply from engineering through implementation.

-

In July 2025, Sumitomo Electric Industries, Ltd. began installing a 525 kV XLPE high-voltage DC wires and cable system. The contract from transmission operator Amprion covers roughly 300 km of HVDC cables linking the converter stations in Petkum (Emden) and Osterath near Düsseldorf, representing a project value of more than EUR 500 billion.

-

In April 2024, Encore Wire entered a definitive merger agreement with Prysmian, under which Prysmian acquired all outstanding shares of Encore Wire common stock. Encore Wire manufactures copper and aluminum electrical wire and cables for power generation and distribution at its vertically integrated Texas campus. The transaction expands Prysmian's North American operations and product portfolio while maintaining Encore Wire's McKinney facility.

Wires and Cables Market Report Scope

Report Attribute

Details

Market size in 2026

USD 240.46 billion

Revenue forecast in 2033

USD 313.19 billion

Growth rate

CAGR of 3.8% from 2026 to 2033

Base year for estimation

2025

Actual data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Voltage, Installation, End Use, and Regional.

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Europe; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

American Wire Group; Amphenol TPC.; Belden Inc.; Encore Wire Corporation; Finolex Cables.; Fujikura Ltd.; Furukawa Electric Co., Ltd.; KEI Industries Limited.; LEONI AG; LS Cable & System Ltd.; Nexans; NKT A/S; Prysmian S.p. A; Sumitomo Electric Industries, Ltd.; Southwire Company, LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Wires And Cables Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global wires and cables market report based on voltage, installation, end use, and region:

-

Voltage Outlook (Revenue, USD Billion, 2021 - 2033)

-

Low Voltage (LV)

-

Medium Voltage (MV)

-

High Voltage (HV)

-

Extra-High Voltage (EHV)

-

-

Installation Outlook (Revenue, USD Billion, 2021 - 2033)

-

Overhead

-

Underground

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Aerospace and Defense

-

Building & Construction

-

Oil and Gas

-

Energy and Power

-

IT & Telecommunication

-

Automotive

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global wires and cables market was estimated at USD 230.90 billion in 2025 and is expected to reach USD 240.46 billion in 2026.

b. The global wires and cables market is expected to witness a compound annual growth rate of 3.8% from 2026 to 2033, reaching USD 313.19 billion by 2033.

b. The Asia Pacific dominated the wires and cables market with a share of 37.8% in 2025. This is attributable to the growing demand for light, power, and communication in the region.

b. Key players operating in the wires & cables market are American Wire Group; Belden Inc.; Encore Wire Corporation; Fujikura Ltd.; KEI Industries Limited; LS Cable & System Ltd.; Nexans; NKT A/S, Prysmian S.p. A; Sumitomo Electric Industries Ltd.

b. Key factors that are driving the wires & cables market growth include the implementation of smart grid technology has met the increasing need for grid interconnections, thus resulting in rising investments in the new underground and submarine cables.

b. The low voltage segment accounted for the largest revenue share of around 43.7% in the wires & cables market in 2025, owing to the high usage of low voltage cables in building wires, LAN cables, appliance wires, distribution networks, and others.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.