- Home

- »

- Communications Infrastructure

- »

-

Global Wireless Mesh Network Market Size Report, 2030GVR Report cover

![Wireless Mesh Network Market Size, Share & Trends Report]()

Wireless Mesh Network Market (2023 - 2030) Size, Share & Trends Analysis Report By Radio Frequency (2.4 GHz, 5 GHz), By Application (Video Surveillance, Home Networking), By End-use (Oil & Gas, Mining), And Segment Forecasts

- Report ID: GVR-1-68038-878-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Wireless Mesh Network Market Summary

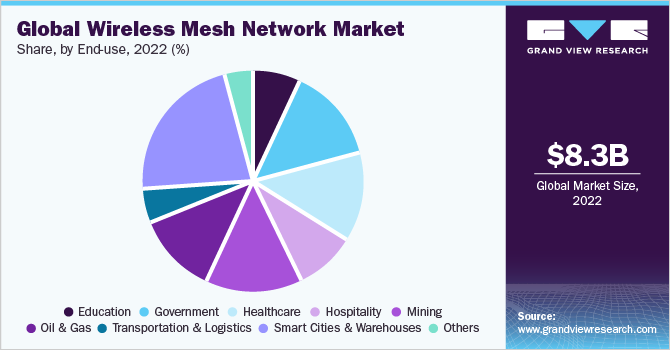

The global wireless mesh network market size was valued at USD 8.29 billion in 2022 and is projected to reach USD 15.95 billion by 2030, growing at a compound annual growth rate (CAGR) of 8.6% from 2023 to 2030. The growth in the global market is attributed to the use of Artificial Intelligence (AI) and Internet of Things (IoT) technology.

Key Market Trends & Insights

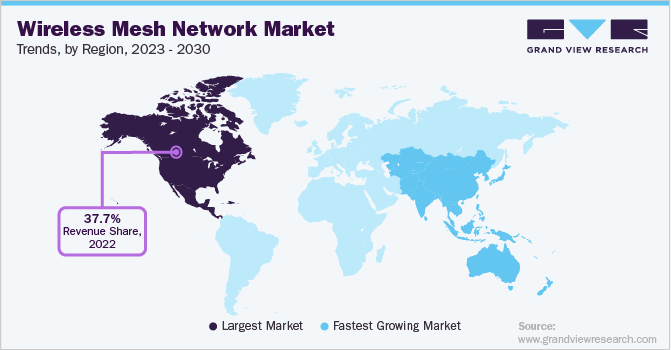

- North America dominated the industry in 2022 and accounted for the largest share of more than 37.65% of the global revenue.

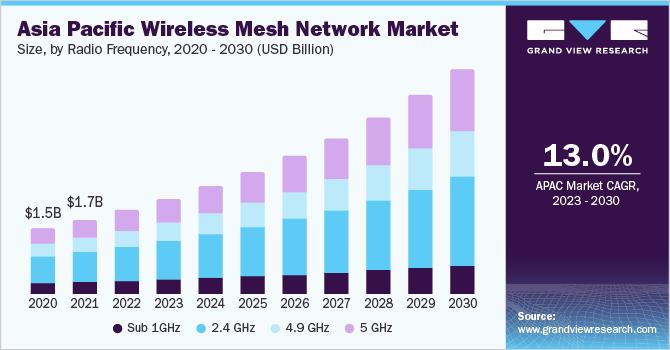

- Asia Pacific is estimated to register the fastest growth rate during the forecast period.

- Based on radio frequency, the 2.4 GHz radio frequency band segment dominated the industry in 2022 and accounted for the maximum share of more than 40.10% of the overall revenue.

- Based on application, the disaster management & rescue operation segment dominated the industry in 2022 and accounted for the largest share of more than 26.20% of the overall revenue.

- Based on end-use, the smart cities and warehouse segment dominated the global industry in 2022 and accounted for the largest share of more than 22.00% of the overall revenue.

Market Size & Forecast

- 2022 Market Size: USD 8.29 Billion

- 2030 Projected Market Size: USD 15.95 Billion

- CAGR (2023-2030): 8.6%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

The increasing usage of mobile and handset devices, as well as the employment of appropriate technology in mobile phones, drive the demand in this market. With the use of a user-friendly application, Wireless Mesh Networks (WMNs) may manage networks without the need for intermediaries. The development of smart cities and smart gadgets, with a focus on improving the manner of communication between government agencies and municipalities, is also fostering the expansion of the WMN industry.

For instance, over the past ten years, Vancouver, Canada, where Orbis Mesh is situated, has gradually become increasingly connected. A $50 million government grant for the creation of Canadian Smart Cities is evidence that the city is headed in a specific direction, whether it be via wireless bike sharing, smart parking meters, or free Wi-Fi throughout the entire city. Other industrial sectors, like oil and gas, chemicals, and mining, use WMNs to improve communication capabilities in remote locations. The popularity of WMNs among organizations has grown over the past few years as a result of their dependability and flexibility. It is made up of several wireless nodes joined to form a network. To provide redundancy and guarantee that there is always a conduit for data to flow, each node in the network can communicate with every other node in the network.

Scalability is one of the main benefits of WMNs. The COVID-19 pandemic had impacted almost every industry, and throughout the projected period, the long-term effects are anticipated to have an impact on industry growth. In the middle of a health and economic crisis, the COVID-19 pandemic forced enterprises to look for work-from-home standards, leading to a significant change in working patterns. Strong demand was seen for WMNs to simplify video surveillance in smart cities and many businesses. The post-pandemic forecast suggests that modern technologies, particularly the cloud, will become more widely used. Industry participants are gaining more traction by using WMNs to accelerate the implementation and modeling of business process applications, automate decision-making, and improve data quality.

Radio Frequency Insights

Based on radio frequencies, the global industry has been further categorized into sub 1GHz, 2.4 GHz, 4.9 GHz, and 5 GHz. The 2.4 GHz radio frequency band segment dominated the industry in 2022 and accounted for the maximum share of more than 40.10% of the overall revenue. As the medical, industrial, and scientific instruments mostly operate in the radio frequency bands, it is expected to be the largest segment. Moreover, the 2.4 GHz segment covers long- and small-range antennae that are used to keep the system compact.

The segment is anticipated to dominate the North America market as the region has the maximum number of innovations in communications infrastructure. 5 GHz is estimated to be the fastest-growing radio frequency segment over the forecast period. According to the World Telecommunications Conference, developed nations were given access to the 5 GHz spectrum for unlicensed use. 5 GHz enables them to fulfill the growing demand for a higher speed of operation. There are more non-overlapping channels at 5 GHz, which significantly reduces congestion. In areas with network congestion, it is a preferred choice.

Application Model Insights

Based on application, the disaster management & rescue operation segment dominated the industry in 2022 and accounted for the largest share of more than 26.20% of the overall revenue. The wireless network is perhaps the most fundamental component of the disaster communication system and consists of several key aspects including its structure, technology, and coverage. With the increasing proportion of climatic disasters due to the rise in temperatures, rescue operations need to be improved with the aid of mesh networks. These networks are also used in military applications for enhancing communication between the team. The primary purpose of Wireless Local Area Networks (WLANs) is to give mobile users access to a fixed network infrastructure.

With untethered broadband network connectivity, these networks let users move around the office or any other area covered by the network without restriction. The video surveillance segment is projected to register the fastest growth rate during the forecast period. It is a human-friendly interface and thus is a preferred security solution over others. It also offers structural flexibility, improved coverage, and a high-speed short-distance transmission capability. Municipalities, public safety organizations, and businesses can deploy IP video surveillance using WMN in a practical and affordable manner.

End-use Insights

The smart cities and warehouse segment dominated the global industry in 2022 and accounted for the largest share of more than 22.00% of the overall revenue. Mesh networks have applications in smart cities since the latest technology and automation are required in smart city infrastructure. It is used for security and safety purposes and smart metering applications in smart cities. The segment also controls traffic congestion situations in smart cities. The oil & gas end-use segment is anticipated to register the fastest growth rate during the forecast period.

The oil & gas segment sees the maximum usage of WMN as the oil & gas market is fluctuating and operators are innovating ways for optimizing production and minimizing costs, something that could be easily achieved with the help of flow meters that use wireless networking. WMN is also used in the government sector for improving the quality of communication and for improving the education sector through the adoption of technologies, such as online courses, webinars, and others. Similarly, its application in the healthcare segment is gaining traction due to wireless mobility that gives quick access to patients’ information at the healthcare facility.

Regional Insights

North America dominated the industry in 2022 and accounted for the largest share of more than 37.65% of the global revenue. The U.S. and Canada are experiencing a significant uptake of WMN technology. Owing to their significant economic supremacy and solid economic foundations, these nations can make heavy investments in research & development activities. The rise of popular technologies like the IoT, network analytics, cloud networking, and Software-as-a-Service (SaaS)-based apps will support the region’s growth. Asia Pacific is estimated to register the fastest growth rate during the forecast period.

The development of the oil & gas industries in this area, as well as the quick acceptance of the smart cities development projects undertaken by the various governments for the promotion of operational efficiency and resource optimization, drive the market in the region. With the increased trade activities and online trading services, the smart warehouses segment is expected to witness a significant rise in this region over the forecast period. Japan and China, for example, have highly developed technological infrastructure, which encourages the adoption of mesh networking solutions across various business verticals in the region.

Key Companies & Market Share Insights

The competitive landscape suggests forward-looking companies will emphasize boosting existing products, launching new products, and optimizing pricing structures. In addition, leading companies could seek outside opportunities, including joint ventures and mergers & acquisitions. Stakeholders could also focus on technological advancements and product differentiation. For gaining a larger share in the industry, companies are expanding both their R&D facilities and their services in the government and defense sectors. For instance, in October 2022, The Oracle Network Suite was unveiled by Oracle Inc. By fusing network function data with AI and Machine Learning (ML), operators can more automatically make informed decisions about the performance and stability of their whole 5G network. Some of the prominent players in the global wireless mesh network market include:

-

Aruba Networks, Inc.

-

BelAir Network Inc.

-

Cisco Systems, Inc.

-

Firetide, Inc.

-

Rajant Corp.

-

Ruckus Wireless, Inc.

-

Strix Wireless Systems Private Ltd.

-

Synapse Wireless, Inc.

-

Tropos Networks, Inc.

-

ZIH Corp.

Wireless Mesh Network Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 8.96 billion

Revenue forecast in 2030

USD 15.95 billion

Growth rate

CAGR of 8.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segment scope

Radiofrequency, application, end-use, region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; U.K.; China; Japan; India; Brazil

Key companies profiled

Aruba Networks; BelAir Networks, Inc.; Cisco Systems, Inc.; Firetide, Inc.; Rajant Corporation; Ruckus Wireless, Inc.; Strix Wireless Systems Pvt Ltd; Synapse Wireless, Inc.; Tropos Networks (ABB Group); ZIH Corp (Zebra Technologies Corporation)

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

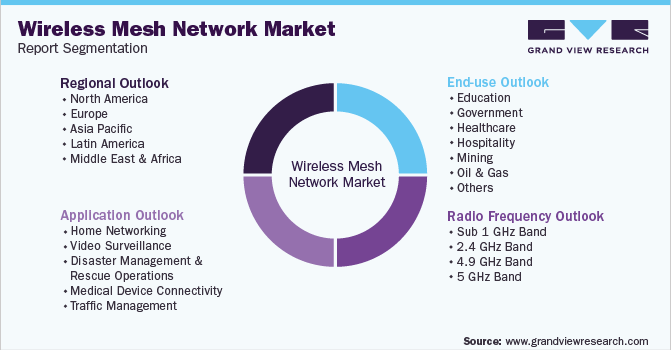

Global Wireless Mesh Network Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global wireless mesh network market report based on radio frequency, application, end-use, and region:

-

Radio Frequency Outlook (Revenue, USD Million, 2017 - 2030)

-

Sub 1 GHz Band

-

2.4 GHz Band

-

4.9 GHz Band

-

5 GHz Band

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Home Networking

-

Video Surveillance

-

Disaster Management & Rescue Operations

-

Medical Device Connectivity

-

Traffic Management

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Education

-

Government

-

Healthcare

-

Hospitality

-

Mining

-

Oil & Gas

-

Transportation & Logistics

-

Smart Cities & Smart Warehouses

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

Frequently Asked Questions About This Report

b. The global wireless mesh network market size was estimated at USD 8.29 billion in 2022 and is expected to reach USD 8.96 billion in 2023.

b. The global wireless mesh network market is expected to witness a compound annual growth rate of 8.6% from 2023 to 2030 to reach USD 15.9 billion by 2030

b. The 2.4 GHz segment in the radio frequency dominated the market in 2022 and is expected to hold nearly 40.1% of the market share. Growing demand for wireless mobility by using basic radio frequency and by overcoming essential limitations to achieve cost-efficiency, throughput, and flexibility is propelling the segment.

b. Key vendors in the wireless mesh network market include Cisco Systems, Inc.; Aruba, a Hewlett Packard Enterprise company; Ruckus Wireless, Inc.; Nortel Networks; Synapse Wireless, Inc.; Rajant Corporation; Tropos Networks, Inc.; Zebra Technologies; and Strix Systems among others

b. The rise in consumer adoption of connected devices has led to the implementation of wireless mesh network infrastructure. Furthermore, the growing investments towards developing wearable technology such as smart watches, smart wallets, and smart luggage will positively favor the development of wireless mesh technology for robust connectivity and communication.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.