- Home

- »

- Biotechnology

- »

-

Women’s Health And Beauty Supplements Market Report, 2030GVR Report cover

![Women’s Health And Beauty Supplements Market Size, Share & Trends Report]()

Women’s Health And Beauty Supplements Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Vitamins, Minerals, Enzymes, Botanicals, Proteins), By Application, By Consumer Group, By Age Group, By Sales Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-680-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Women’s Health And Beauty Supplements Market Summary

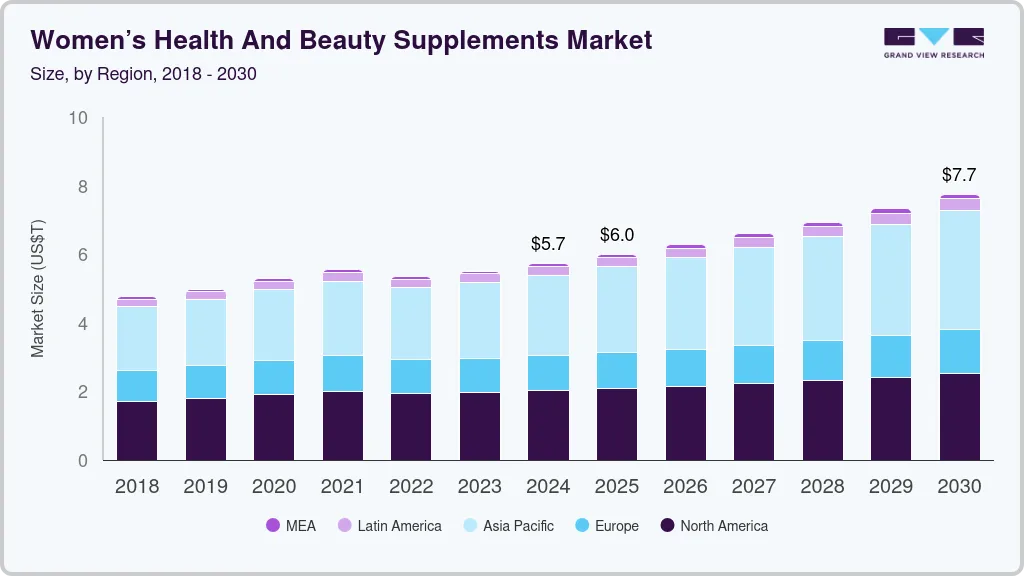

The global women’s health and beauty supplements market size was estimated at USD 57.42 billion in 2024 and is projected to reach USD 77.46 billion by 2030, growing at a CAGR of 5.25% from 2025 to 2030. The rise in health-conscious people is anticipated to propel the global women’s health and beauty supplement market.

Key Market Trends & Insights

- Asia Pacific women’s health and beauty supplements market dominated with the largest revenue share in 2024.

- China women’s health and beauty supplements market is expected to grow significantly.

- By product, the vitamins segment held the largest revenue share of 35.68% in 2024.

- Based on age group segment, the The age 31-50 segment held the largest revenue share of 39.41% in 2024.

- By consumer group, general women’s health dominated the consumer group segment with a 30.33% share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 57.42 Billion

- 2030 Projected Market Size: USD 77.46 Billion

- CAGR (2025-2030): 5.25%

- Asia Pacific: Largest market in 2024

In addition, the increasing nutritional deficiencies among women, rising access to supplements, and increasing number of distribution channels & advertising strategies being implemented by major brands are fueling market growth. Moreover, the rise in R&D efforts to develop newer health products with minimal side effects is another factor propelling the global market.

Rising Adoption of Beauty Supplements Among Australian Women: A Market Perspective

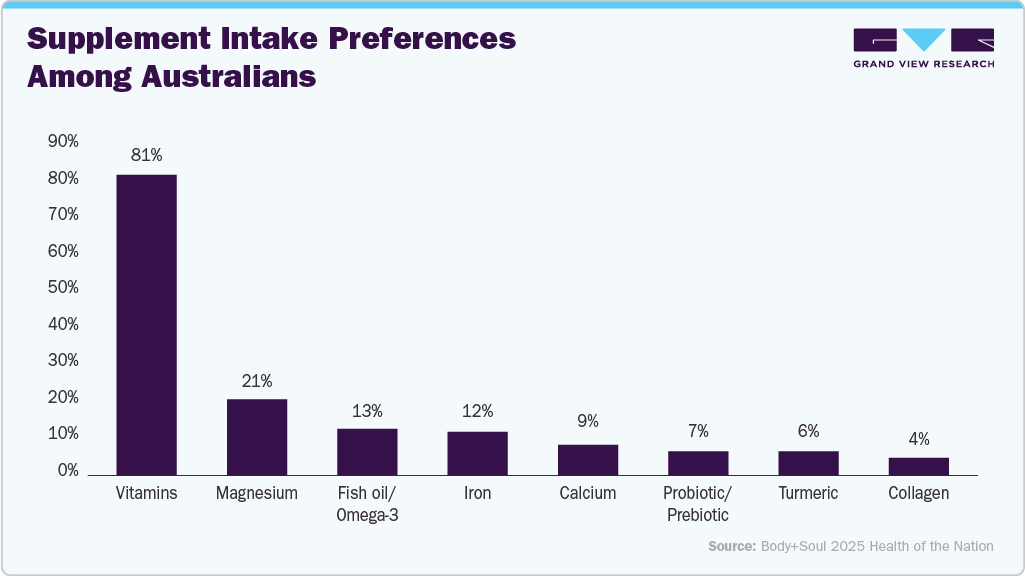

Australia’s women’s health and beauty supplements market is witnessing strong momentum, driven by a rising emphasis on self-care, wellness, and digital influence. Younger women, particularly in the 20-30 age group, are at the forefront of this trend. Their choices are shaped by the growing popularity of collagen, skin health capsules, and ingestible supplements, which are promoted as holistic solutions to enhance appearance from within. The wellness movement and social media's visual culture have normalized supplement intake as part of daily beauty routines. Brands are responding with targeted offers that address aesthetic and preventative health needs.

Supporting this trend, recent survey data highlights that 66% of Australians now take daily supplements, with an average monthly spend of USD 53.77. The most consumed supplements include Vitamin D (27%), Magnesium (21%), and Multivitamins (20%), all of which contribute to skin, hair, bone, and general health. Notably, while currently consumed by a smaller segment (4%), collagen supplements are rapidly gaining attention due to their marketed benefits for youthful skin and elasticity. This demonstrates a clear overlap between beauty goals and broader health awareness. Additionally, the demand for personalized, clean-label, and plant-based supplements continues to expand, particularly among millennials and Gen Z consumers.

Complementing the rise in supplementation is a growing awareness of age-specific health screening. The “Tests by Age” framework illustrates how Australians align health checks such as cervical, breast, and skin cancer screenings with age and life stage. Adult women are increasingly proactive, undergoing tests not only for chronic conditions but also for mental health and immunisation. This pattern reflects a holistic health mindset that merges internal well-being with outward beauty. As a result, the beauty supplements market is now positioned at the intersection of healthcare, lifestyle, and digital engagement.

Table 1 Age-wise interest and trends among women using health and beauty supplements in Australia

Age Group

Trends & Behavior

Popular Supplements

Market Influence

20-30 years

Most active adopters; driven by aesthetics, self-care, and social media influence

Collagen powders, skin + hair capsules

High - drives mainstream market growth

31-40 years

Health-conscious consumers seeking long-term beauty and wellness outcomes

Anti-aging, skin health, gut support

Moderate to high influence

41-50 years

Focus on aging concerns and preventive care

Menopause support, anti-aging blends

Emerging segment

50+ years

Slower adoption, but growing interest in age-related wellness

Bone, joint, hormonal balance support

Niche but rising interest

Looking ahead, Australia's women’s beauty supplement industry is poised for continued growth, supported by innovation, consumer education, and integrated health offerings. Businesses that combine clinical efficacy with aesthetic appeal, while maintaining transparency and sustainability, will be well-positioned to capture market share. Strategic partnerships with healthcare providers, wellness influencers, and digital platforms will further strengthen brand credibility and consumer trust in this rapidly evolving segment.

Rising Micronutrient Deficiencies Fuel Prenatal Supplement Demand

The increasing prevalence of micronutrient deficiencies among pregnant women, particularly iron, folic acid, vitamin D, calcium, and iodine, is a major growth driver in the women’s health supplements market. These deficiencies, common in low- and middle-income regions, elevate risks for both maternal health and fetal development. In response, healthcare professionals and public health initiatives emphasize prenatal supplementation as a standard component of antenatal care. This growing clinical backing and heightened consumer awareness drive strong demand for science-backed, pregnancy-safe products that offer clean-label, high-bioavailability formulations.

To improve compliance and accessibility, brands are innovative with user-friendly formats such as gummies, powders, softgels, and liquid sachets. The rise of digital health platforms and personalized prenatal nutrition plans supports consistent usage among expectant mothers. Additionally, government programs and NGO partnerships targeting maternal malnutrition are expanding market reach in underserved regions across Asia, Africa, and Latin America. These combined efforts-spanning public health, digital access, and commercial innovations solidify prenatal supplements as a high-impact segment in the women’s health market, with sustained growth potential globally.

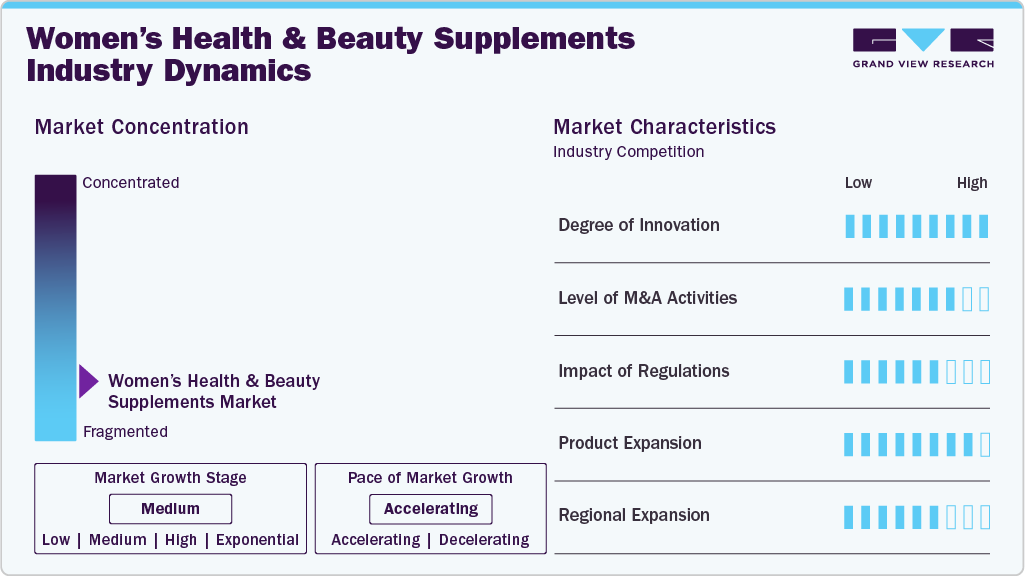

Market Concentration & Characteristics

The women’s health and beauty supplements industry is driven by demand for personalized, clean-label, clinically backed products, advanced delivery systems, and digital health platforms, powered by health-conscious consumers prioritizing transparency, efficacy, and life-stage-specific wellness solutions.

The women’s health and beauty supplements industry is experiencing low to moderate M&A activity, driven by strategic interest in niche brands with strong digital presence, clean-label portfolios, and loyal consumer bases. Larger nutraceutical and wellness companies selectively acquire innovators to expand their product offerings, enter new segments, and enhance market reach.

Regulatory frameworks are crucial in product development and commercialization in the women’s health and beauty supplements industry. Compliance with regional guidelines ensures product safety, efficacy, and labeling accuracy. Stricter regulations around ingredient transparency, health claims, and clinical validation are pushing brands to invest in research, third-party certifications, and clean-label formulations.

The women’s health and beauty supplements industry is expanding continuously, with brands launching targeted supplements for hormonal health, fertility, prenatal care, menopause, and beauty-from-within. This diversification addresses evolving consumer needs and life stages, while innovation in formats like gummies, powders, and personalized packs enhances user experience and strengthens brand differentiation.

Leading women’s health and beauty supplements industry companies are expanding their portfolios through product diversification, strategic acquisitions, and global market penetration. They are focusing on developing science-backed, clean-label products that cater to specific health concerns while investing in digital platforms, personalized nutrition, and innovative delivery formats to enhance consumer engagement.

Product Insights

The vitamins segment held the largest revenue share of 35.68% in 2024. This dominance is driven by growing consumer awareness of vitamins' essential role in overall health, particularly in areas like immunity, skin health, and energy levels. The demand for targeted vitamin supplements, such as prenatal vitamins, vitamin D, and B vitamins, continues to rise as women prioritize proactive health management, boosting the segment’s growth and market share. Additionally, the availability of convenient formats like gummies and softgels further fuels consumer adoption. Moreover, lifestyle factors such as stress, poor diet, limited sun exposure, and aging accelerate the need for supplemental intake of essential vitamins. Beauty-from-within trends have fueled demand for biotin (B7), vitamin C, and vitamin E, which support skin elasticity, hair strength, and nail health.

The botanicals segment is expected to register the fastest growth rate throughout the forecast period. This is driven by rising consumer demand for plant-based, holistic solutions. Botanical ingredients such as ashwagandha, evening primrose oil, turmeric, black cohosh, and dong quai are widely used to address hormonal balance, stress reduction, skin health, and menopausal symptoms. Botanical supplements are also increasingly integrated into beauty-from-within formulations, targeting concerns like inflammation, skin aging, and oxidative stress. Innovation in extraction techniques and standardization processes is helping brands deliver consistent potency and safety, which in turn is boosting consumer confidence in herbal-based products.

Application Insights

The women’s health segment dominated the market among the application category in 2024. With increasing awareness of preventive healthcare and self-managed wellness, more women are proactively incorporating supplements into their routines to mitigate health risks, balance hormones, and boost immunity. This shift is further reinforced by rising rates of micronutrient deficiencies, especially among women of reproductive age and in postmenopausal demographics.

The beauty segment is expected to exhibit the highest growth rate over the forecast period. With rising concerns around aging, environmental stressors, and lifestyle-related skin issues, women are investing in ingestible beauty solutions as part of their daily routines. Brands are responding with clinically backed, multifunctional formulations in convenient formats such as gummies, powders, and drinks, positioning the beauty segment as a high-value, image-driven growth contributor in this evolving market.

Age Group Insights

Based on age group segment, the market is segmented into age 15-30, age 31-50, age 51-70, and above 70 years. The age 31-50 segment held the largest revenue share of 39.41% in 2024, owing to increased health-consciousness during key life stages such as pregnancy, menopause, and aging. This demographic prioritizes supplements for hormonal balance, skin health, bone density, and energy, fueling demand for tailored products. Additionally, growing awareness about the importance of preventive health and the rise of digital health tools have further driven consumption within this age group. Their willingness to invest in high-quality, clinically supported supplements makes this segment a key driver of market growth.

The above 70 years’ segment is likely to be the fastest-growing segment with a CAGR of 5.64% during the coming years, driven by the increasing focus on aging well and maintaining quality of life. As the global elderly population grows, there is a rising demand for supplements that support joint health, cognitive function, heart health, and overall vitality. Additionally, this age group is becoming more proactive about managing age-related health concerns, further boosting the demand for safe, science-backed, and easily consumable supplements. Improved awareness and accessibility to health supplements contribute to the segment's rapid growth.

Consumer Group Insights

General women’s health dominated the consumer group segment with a 30.33% share in 2024. This is attributed to the broad demand for supplements addressing overall wellness, including immune support, energy levels, skin health, and hormonal balance. As women increasingly prioritize proactive health management, the focus on general well-being continues to drive substantial market growth. Additionally, the availability of comprehensive, multi-benefit supplements tailored to women’s specific health needs further supports the segment's leading position. This growing awareness of holistic health is expected to sustain its dominance in the market.

The postnatal segment is expected to exhibit the highest growth rate of 6.40% over the forecast period. The growth is driven by increasing awareness of the importance of maternal health and recovery after childbirth. New mothers seek supplements to support energy levels, immunity, lactation, and overall well-being. The growing focus on postnatal nutrition, rising healthcare initiatives and product innovations designed for this demographic propel demand in this segment. Additionally, the availability of tailored, science-backed formulations in convenient formats further enhances consumer adoption, ensuring sustained growth.

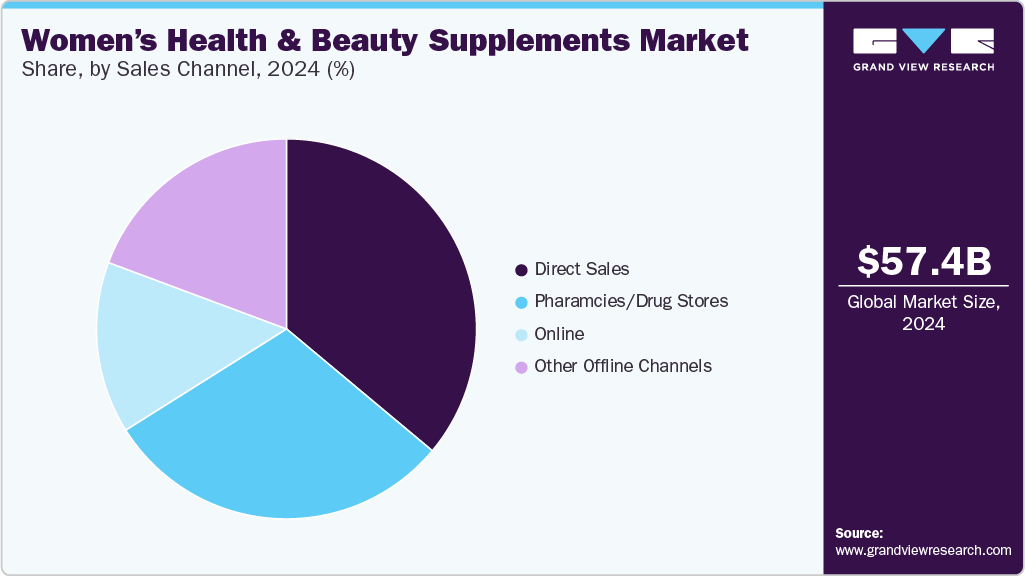

Sales Channel Insights

The direct sales channel segment held the largest revenue share of 36.08% in 2024 and is likely to grow due to the increasing preference for personalized, convenient shopping experiences. Consumers increasingly turn to direct-to-consumer platforms to access tailored recommendations, subscription models, and exclusive products. The rise of e-commerce and social media influences has further boosted direct sales, allowing brands to engage directly with their target audience, improve customer loyalty, and offer personalized nutrition solutions. This shift is expected to drive continued growth in the direct sales segment.

The online segment is expected to exhibit the highest growth rate of 5.82% over the forecast period, driven by the increasing shift toward digital shopping and e-commerce. Consumers are increasingly relying on online platforms for their health supplement needs due to convenience, wider product selections, and the ability to access detailed product information and reviews. Additionally, personalized recommendations, subscription models, and influencer-driven marketing are accelerating consumer engagement in the online space. The continued expansion of digital health platforms and telemedicine further supports the growth of the online segment.

Regional Insights

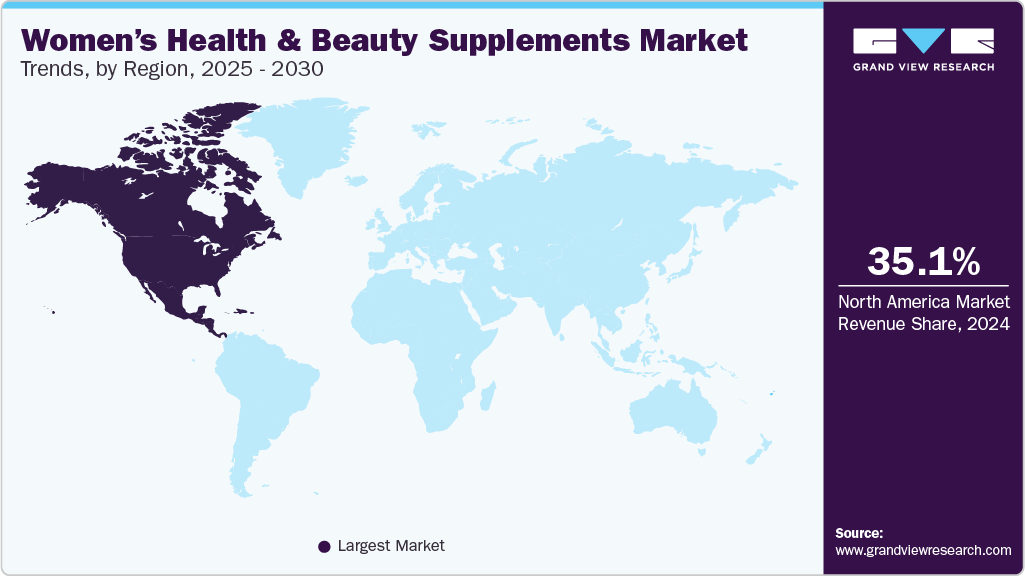

North America women’s health And beauty supplements market is expected to have a revenue share of 35.11% in 2024 due to strong consumer demand for wellness products, increased awareness of health issues, and a high level of disposable income. The region’s well-established healthcare infrastructure and rising interest in preventive health have driven the adoption of supplements targeting skin health, hormonal balance, and aging. Additionally, the growing trend of personalized nutrition and robust e-commerce and direct-to-consumer channels support market growth. High levels of innovation and clinical validation in supplement formulations also contribute to North America's dominant market position.

U.S. Women’s Health and Beauty Supplements Market Trends

The U.S. women’s health and beauty supplements market is driven by strong consumer demand for personalized, science-backed products targeting health concerns like skin vitality, hormonal balance, and aging. With a high focus on preventive health and wellness, the market is poised for continued growth, fueled by innovation and digital engagement.

Europe Women’s Health And Beauty Supplements Market Trends

Europe women’s health and beauty supplements market experiences steady growth in the women’s health and beauty supplements market owing to increasing consumer awareness about health and wellness, particularly in areas like immunity, skin care, and hormonal balance. The region’s aging population, along with a growing emphasis on preventive health, drives demand for supplements targeting age-related concerns, such as bone health and cognitive function.

Additionally, the rise of clean-label, plant-based products aligns with Europe’s strong consumer preference for natural and sustainable offerings. Regulatory standards are stringent, ensuring high product quality and consumer confidence. The growing influence of e-commerce and the adoption of digital health platforms are further accelerating the market’s expansion. European consumers are also increasingly seeking personalized solutions, propelling growth in innovative product formulations and delivery formats. With increasing focus on holistic health and beauty, the market is poised for steady, sustained growth in the coming years.

The UK women’s health and beauty supplements market sees a rising adoption of women’s health and beauty supplements due to growing health awareness, a preference for natural and clean-label products, and increasing demand for supplements targeting skin health, hormonal balance, and anti-aging.

Germany women’s health and beauty supplements market benefits from a strong focus on preventive healthcare, a well-established regulatory framework, and increasing consumer demand for high-quality, scientifically backed products. The rise of plant-based and sustainable supplements further aligns with the country’s health-conscious and environmentally aware consumer base.

Asia Pacific Women’s Health And Beauty Supplements Market Trends

Asia Pacific women’s health and beauty supplements market dominated with the largest revenue share in 2024, owing to a large, diverse consumer base, rising disposable incomes, and increasing health consciousness among women. Growing awareness of wellness, along with a focus on skin care, hormonal balance, and anti-aging, drives demand for supplements. The region's aging population and preference for natural and plant-based products further boost market growth. The rapid expansion of e-commerce platforms and digital health services has enhanced accessibility to these products, making them more popular across urban and rural areas.

China women’s health and beauty supplements market is expected to grow significantly due to increasing disposable incomes, rising health awareness, and growing demand for products targeting skin health, anti-aging, and hormonal balance. The shift toward preventive healthcare and natural, clean-label products further expands the market.

Japan women’s health and beauty supplements market is growing due to a strong emphasis on aging well, high consumer awareness of health and wellness, and increasing demand for products targeting skin vitality, bone health, and cognitive function. Additionally, the popularity of clean-label, natural supplements aligns with cultural preferences for high-quality, scientifically backed formulations.

MEA Women’s Health And Beauty Supplements Market Trends

The Middle East and Africa women’s health and beauty supplements market is projected to drive the demand for women’s health and beauty supplements and grow at the fastest rate of 6.67% due to rising disposable incomes, a growing focus on health and wellness, and increased awareness of skin health, anti-aging, and overall well-being. Additionally, cultural shifts toward preventive healthcare and the availability of modern e-commerce platforms are further accelerating the adoption of supplements across the region.

Kuwait women’s health and beauty supplements market is anticipated to grow steadily, driven by increasing consumer awareness of wellness and a rising preference for preventive healthcare solutions. The market is also benefiting from the availability of high-quality, clean-label products and the growing influence of digital platforms facilitating access to personalized nutrition.

Key Women’s Health And Beauty Supplements Company Insights

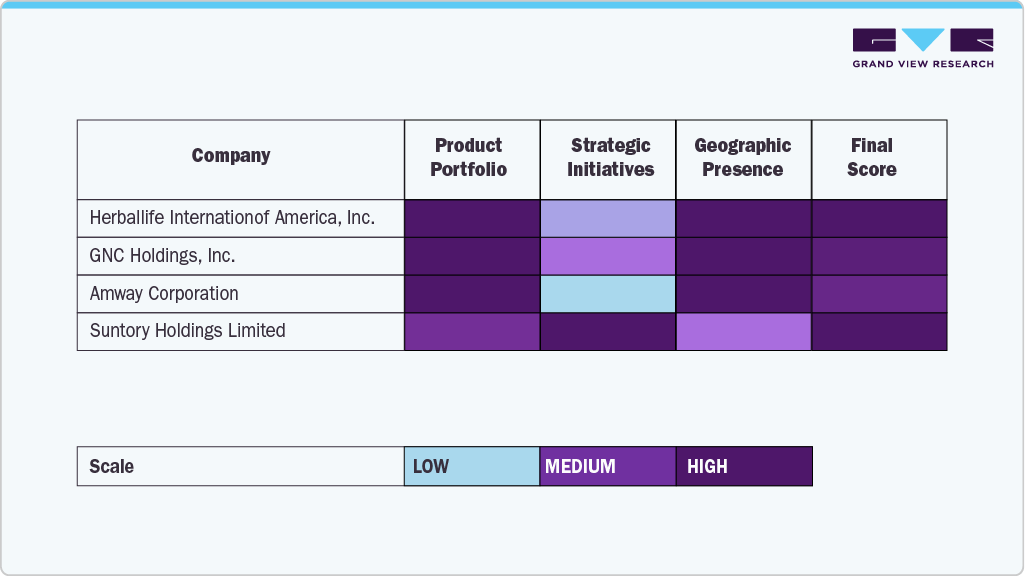

The women’s health and beauty supplements market is highly competitive and moderately fragmented, with both global and regional players striving to capture consumer attention through innovation, personalization, and clean-label formulations. Market leaders are investing heavily in R&D to develop science-backed products that cater to evolving consumer needs across life stages-such as fertility, pregnancy, menopause, and aging. Strategic branding, strong digital presence, and multichannel distribution have become key differentiators in gaining consumer trust and expanding market share.

Leading companies such as Amway, Bayer AG, Nestlé Health Science, and Herbalife dominate the market with expansive portfolios and global reach. These players leverage robust supply chains, clinical research, and strong brand loyalty to maintain their leadership positions. They continue to diversify offerings with targeted supplements and innovative delivery formats like gummies, powders, and capsules, aligned with the demand for convenience and efficacy.

Emerging companies such as HUM Nutrition, Ritual, and Nutrafol are gaining traction by focusing on personalized, transparent, and sustainably sourced solutions tailored for modern women. These brands leverage direct-to-consumer models, influencer marketing, and subscription services to build loyal customer bases and rapidly disrupt traditional players. As consumer preferences shift toward authenticity, science-backed ingredients, and digital convenience, these rising players reshape industry dynamics.

Overall, the market is witnessing a blend of legacy strength and startup agility, with increased M&A activity, partnerships, and product innovations likely to intensify competition further. Companies that balance scientific validation with lifestyle relevance and ethical sourcing will be best positioned to capture long-term value in the evolving women’s health and beauty supplements landscape.

Key Women’s Health And Beauty Supplements Companies:

The following are the leading companies in the women’s health and beauty supplements market. These companies collectively hold the largest market share and dictate industry trends.

- Herbalife International of America, Inc.

- GNC Holdings, Inc

- Amway Corporation

- Suntory Holdings Limited

- Pharmavite LLC

- Blackmores

- Vitabiotics Ltd.

- Asahi Group Holdings, Ltd

- USANA Health Sciences, Inc.

- Nu Skin Enterprise, Inc.

- Unilab, Inc.

- The Himalaya Drug Company

- Vita Life Sciences

- Standard Foods Corporation

- Garden of Life (Nestlé)

Recent Developments

-

In April 2025, Tranont launched a new range of women’s health supplements targeting muscle strength, energy, and hormonal balance. The line includes a menopause support product with EstroG-100 and ashwagandha, a clear whey protein for easier digestion, and a creatine supplement aimed at women over 30 experiencing muscle decline.

-

In January 2025, GNC introduced its new beauty supplement line, Premier Collagen, two specialized formulations available in various formats designed to promote youthful-looking skin.

Women’s Health and Beauty Supplements Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 59.97 billion

Revenue forecast in 2030

USD 77.46 billion

Growth rate

CAGR of 5.25% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, age group, consumer group, sales channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Herbalife International of America, Inc.; GNC Holdings, Inc.; Amway Corporation; Nature’s Bounty; Bayer AG; Suntory Holdings Limited; Taisho Pharmaceutical Co., Ltd; Pharmavite LLC; Pfizer, Inc.; Blackmores; Vitabiotics Ltd; Asahi Group Holdings, Ltd; USANA Health Sciences, Inc.; Nu Skin Enterprise, Inc.; The Himalaya Drug Company; Vita Life Sciences; Standard Foods Corporation; garden of life (Nestlé)

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Women’s Health and Beauty Supplements Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global women’s health and beauty supplements market report based on product, application, age group, consumer group, sales channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Vitamins

-

Mineral

-

Enzymes

-

Botanicals

-

Proteins

-

Omega-3

-

Probiotics

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Beauty

-

Skin Care

-

Hair Care

-

Nail Care

-

Others

-

-

Women’s Health

-

-

Age-Group Outlook (Revenue, USD Million, 2018 - 2030)

-

Age 15-30

-

Age 31-50

-

Age 51-70

-

Above 70 years

-

-

Consumer Group Outlook (Revenue, USD Million, 2018 - 2030)

-

Prenatal

-

Postnatal

-

PMS

-

Perimenopause

-

Postmenopause

-

General Women’s Health

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Direct Sales

-

Pharmacies/Drug Stores

-

Other Offline Channels

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global women's health and beauty supplements market size was estimated at USD 53.4 billion in 2022 and is expected to reach USD 56.0 billion in 2023.

b. The global women's health and beauty supplements market is expected to grow at a compound annual growth rate of 5.1% from 2023 to 2030 to reach USD 79.29 billion by 2030.

b. Asia Pacific dominated the women health and beauty supplements market with a share of 38.8% in 2022. This is attributable to growing women awareness regarding nutritional requirements, rising purchasing power and presence of local manufacturers of supplements and raw materials.

b. Some key players operating in the women health and beauty supplements market include Herbalife International of America, Inc.; Nestle; Pfizer, Inc.; GNC Holdings Inc.; Bayer AG; Nature's Bounty Co., and Blackmores

b. Key factors that are driving the women health and beauty supplements market growth include a rise in disposable income coupled with improved accessibility, rising prevalence of micronutrient deficiencies among women, and growing health consciousness

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.