- Home

- »

- Green Building Materials

- »

-

Wood Based Panel Market Size, Share, Industry Report 2030GVR Report cover

![Wood Based Panel Market Size, Share & Trends Report]()

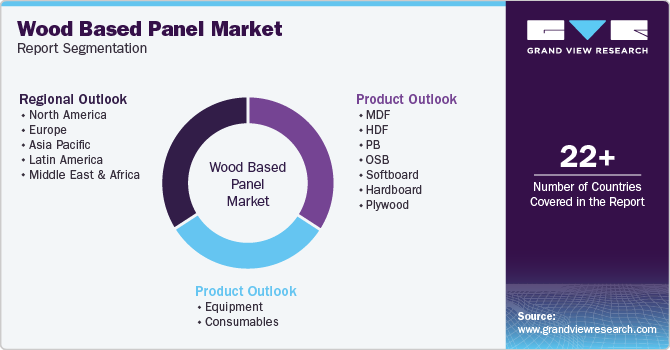

Wood Based Panel Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Plywood, MDF, HDF, Particleboard, OSB, Softboard, Hardboard), By Application (Furniture, Construction, Packaging), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-180-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Wood Based Panel Market Summary

The global wood based panel market size was estimated at USD 198.0 billion in 2024 and is projected to reach USD 284.1 billion by 2030, growing at a CAGR of 5.9% from 2025 to 2030. This growth can be attributed to the Increasing urbanization and rising construction activities worldwide, which are significant contributors, as more affordable housing solutions are needed.

Key Market Trends & Insights

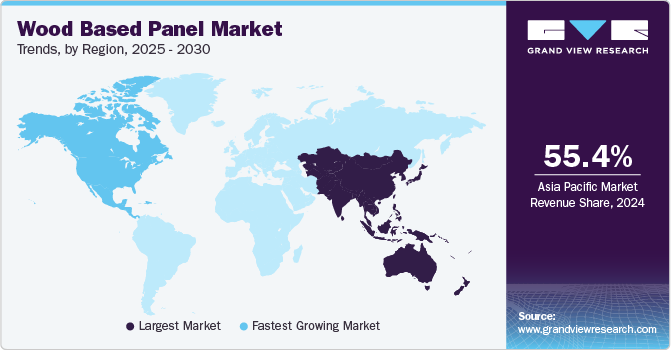

- The Asia Pacific wood based panel market dominated the global market and held the largest revenue share of 55.4% in 2024.

- The wood based panel market in the U.S. led the North American market and accounted for the largest revenue share in 2024.

- By product, the plywood segment dominated the global wood based panel industry and accounted for the largest revenue share of 40.5% in 2024.

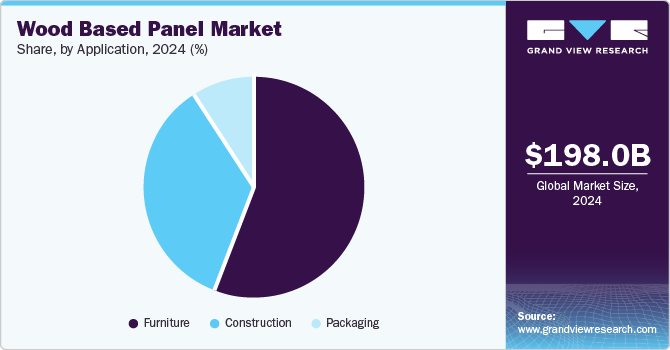

- By application, the furniture application segment led the market and accounted for the largest revenue share of 56.5% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 198.0 Billion

- 2030 Projected Market Size: USD 284.1 Billion

- CAGR (2025-2030): 5.9%

- Asia Pacific: Largest market in 2024

In addition, the demand for sustainable materials is propelling the market, with consumers favoring eco-friendly wood based panels. Furthermore, technological advancements in manufacturing processes and innovations in adhesive technologies also play a crucial role.

Wood based panels are engineered products made from wood fibers, strands, or veneers bonded together with adhesives. The wood based Panel Market is experiencing notable trends driven by various factors. The automotive sector increasingly incorporates these panels due to their lightweight and aesthetic qualities, using materials such as MDF and plywood for components such as dashboards and door panels. In the packaging industry, particle boards and medium-density fiberboards are favored for creating durable shipping crates and pallets, spurred by the growth in global trade and e-commerce.

Technological advancements now allow for customizing wood panels in thickness, color, texture, and size, catering to the diverse needs of furniture manufacturers and interior designers. Additionally, innovations in manufacturing processes have made wood based panels more cost-effective than traditional materials such as metal and glass.

In addition, a significant driver of market growth is the rise in consumer spending on home renovations. The wood panel industry encompasses various products, including plywood sheets, engineered wood panels, and decorative laminates. As consumers invest more in home improvements, there is a corresponding increase in demand for wood based panels in both residential and commercial buildings.

Furthermore, balanced trade practices among nations have facilitated the exchange of wood products, with emerging markets in regions such as China and Eastern Europe showing increased demand. Moreover, partnerships between governments and private organizations are essential for advancing infrastructure projects, increasing the demand for high-quality wood based materials.

Product Insights

The plywood segment dominated the global wood based panel industry and accounted for the largest revenue share of 40.5% in 2024, primarily driven by its exceptional strength, versatility, and durability.in addition, as urbanization accelerates, particularly in emerging economies, the demand for plywood in construction applications such as flooring, roofing, and wall sheathing has surged. Furthermore, plywood's resistance to moisture and fire makes it a preferred choice for various structural projects. Moreover, the ongoing investment in infrastructure development further propels the need for this reliable material across residential and commercial sectors.

The oriented strand board (OSB) is expected to grow at a CAGR of 8.1% over the forecast period, owing to rising construction activities and the increasing preference for sustainable building materials. OSB is recognized for its cost-effectiveness and structural integrity, making it an ideal choice for framing, sheathing, and flooring in residential and commercial buildings. In addition, the shift towards environmentally friendly products has also boosted OSB demand, as it can be produced using fast-growing wood species and recycled materials. Furthermore, expanding the housing market and ongoing infrastructure projects worldwide continue to drive the adoption of OSB in various applications.

Application Insights

The furniture application segment led the market and accounted for the largest revenue share of 56.5% in 2024, driven by the increasing consumer demand for aesthetically pleasing and durable furniture products. As consumers prioritize design and functionality, materials such as MDF and particleboard are favored for their smooth surfaces and affordability. Furthermore, the trend towards sustainable furniture has led manufacturers to adopt eco-friendly wood based panels, further boosting market growth. Moreover, the rise in home renovation projects contributes significantly to the demand for innovative furniture solutions.

The construction segment is expected to grow at a CAGR of 7.0% over the forecast period, owing to the ongoing urbanization and significant investments in residential and commercial building projects. Wood based panels are increasingly utilized for their strength, versatility, and cost-effectiveness in various construction applications, including flooring, roofing, and wall sheathing. In addition, the emphasis on sustainable building practices has also led to a preference for wood based materials, as they align with eco-friendly construction goals. Furthermore, public-private partnerships aimed at infrastructure development in emerging economies are enhancing the demand for wood based panels in construction projects.

Regional Insights

North America Wood Based Panel Market Trends

North America wood based panel market is expected to grow at the fastest CAGR of 8.2% over the forecast period, owing to a robust construction sector and rising consumer interest in sustainable building materials In addition, the increasing focus on eco-friendly practices has led to a preference for wood based products over alternatives such as metal and plastic. Furthermore, the region's strong housing market, characterized by renovations and new constructions, drives demand for plywood and engineered wood products. Moreover, the expansion of e-commerce also enhances the distribution channels for these materials, further supporting market growth.

U.S. Wood Based Panel Market Trends

The wood based panel market in the U.S. led the North American market and accounted for the largest revenue share in 2024, primarily driven by a strong emphasis on home improvement projects and renovations. As homeowners invest in upgrading their living spaces, the demand for high-quality wood based panels rises significantly. Furthermore, the construction industry's recovery post-pandemic has led to increased investments in residential and commercial buildings.

Asia Pacific Wood Based Panel Market Trends

The Asia Pacific wood based panel market dominated the global market and held the largest revenue share of 55.4% in 2024. This growth can be attributed to rapid urbanization and the increase in disposable income. In addition, the rising demand for wood based products in construction and furniture manufacturing is significant as consumers seek durable and aesthetically pleasing materials. Furthermore, substantial investments in infrastructure projects across countries such as India and Indonesia further enhance the market's potential. The growing trend of home renovations also contributes to the increased consumption of wood based panels in residential settings.

The wood based panel market in China led the Asia Pacific market and accounted for the largest revenue share in 2024, driven by its booming construction and furniture industries. The country's rapid urbanization has led to a surge in housing demand, driving the need for wood based panels in various applications. Furthermore, rising consumer spending on home renovations and furniture upgrades significantly contributes to market growth. Moreover, the government's initiatives to boost infrastructure development also play a crucial role, as they create opportunities for increased use of wood based panels in commercial and residential projects.

Europe Wood Based Panel Market Trends

Europe wood based panel marketis expected to witness substantial growth over the forecast period, due to the development of the furniture industry and increasing construction activities. Countries such as Germany are at the forefront, with a strong demand for both residential and commercial applications of wood based panels. In addition, the focus on sustainability has prompted manufacturers to innovate and produce eco-friendly options that meet consumer expectations. Furthermore, government regulations promoting energy-efficient building practices contribute to the rising use of wood based materials in various regional construction projects.

The growth of the wood based panel market in Germany is expected to be driven by its leading position in the European furniture sector. The demand for high-quality particleboard and MDF is significant as manufacturers seek durable yet cost-effective solutions. Also, ongoing investments in residential construction and renovation projects enhance market growth. Moreover, the industry's emphasis on sustainable practices encourages innovation, leading to the development of environmentally friendly wood based products that cater to consumer preferences and regulatory requirements.

Key Wood Based Panel Company Insights

Key players in the global wood based panel industry include Arauco, Kronospan, Norbord Inc., and others. These companies adopt and employ various strategies to enhance their competitive edge. These include focusing on cost leadership by minimizing production expenses and optimizing supply chains. In addition, companies invest in research and development to innovate and improve product quality, ensuring they meet evolving consumer demands. Furthermore, strategic partnerships and collaborations are also utilized to expand market reach and enhance distribution networks.

-

Ainsworth Lumber Co. Ltd. specializes in manufacturing oriented strand board (OSB) and solid wood products. The company operates primarily in the wood products segment, providing high-quality materials for construction and furniture applications. With a strong emphasis on sustainable practices, the company sources its timber from well-managed forests, ensuring a reliable supply chain while meeting the growing demand for eco-friendly building materials.

-

Arauco produces diverse products, including particleboard, MDF, and plywood. The company operates within the wood products segment, supplying materials for various applications such as furniture, flooring, and construction. The company’s extensive operations span multiple countries, enhancing its ability to serve international markets effectively.

Key Wood Based Panel Companies:

The following are the leading companies in the wood based panel market. These companies collectively hold the largest market share and dictate industry trends.

- Ainsworth Lumber Co. Ltd.

- Arauco

- Boise Cascade Company

- EGGER Group

- Georgia-Pacific LLC (Koch Industries)

- Kronospan

- Louisiana-Pacific Corporation (LP)

- Norbord Inc.

- Panels & Furniture Group (PFM Group)

- Pfleiderer Group S.A.

- Roseburg Forest Products

- Swiss Krono Group

- U.S. Lumber Group LLC

- West Fraser Timber Co. Ltd.

- Weyerhaeuser Company

Recent Developments

-

In May 2024, Kronospan announced the acquisition of Woodgrain’s particleboard facility located in Island City, Oregon. This strategic move aims to enhance Kronospan's presence in the North American wood based panel market. CEO Hans Obermaier expressed enthusiasm about integrating the talented workforce from the Island City plant, emphasizing the long-term benefits for stakeholders.

-

In December 2023, Century Plyboards India Ltd inaugurated its largest integrated wood panel manufacturing unit in Badvel, Andhra Pradesh, with a phase-1 investment of rupees one thousand crore. The 100-acre facility aimed at producing MDF, laminates, and PVC boards is further expected to create over 2,000 jobs.

Wood Based Panel Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 213.1 billion

Revenue forecast in 2030

USD 284.2 billion

Growth rate

CAGR of 5.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume, Thousand Cubic Meters, Revenue in USD Million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Asia Pacific; Europe; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; Spain; Italy; France; Russia; China; Japan; India; South Korea; Singapore; Australia; Malaysia; Thailand; Indonesia; Vietnam; Philippines; Pakistan; Taiwan; Brazil; Argentina; Saudi Arabia; South Africa; Qatar; UAE; Kuwait; Oman; Iran; Israel; Algeria; Egypt; Lebanon

Key companies profiled

Ainsworth Lumber Co. Ltd.; Arauco; Boise Cascade Company; EGGER Group; Georgia-Pacific LLC (Koch Industries); Kronospan; Louisiana-Pacific Corporation (LP); Norbord Inc.; Panels & Furniture Group (PFM Group); Pfleiderer Group S.A.; Roseburg Forest Products; Swiss Krono Group; U.S. Lumber Group LLC; West Fraser Timber Co. Ltd.; Weyerhaeuser Company

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Wood Based Panel Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global wood based panel market report based on product, application, and region.

-

Product Outlook (Volume, Thousand Cubic Meters; Revenue, USD Million, 2018 - 2030)

-

MDF

-

HDF

-

PB

-

OSB

-

Softboard

-

Hardboard

-

Plywood

-

-

Application Outlook (Volume, Thousand Cubic Meters; Revenue, USD Million, 2018 - 2030)

-

Furniture

-

Construction

-

Packaging

-

-

Regional Outlook (Volume, Thousand Cubic Meters; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

Spain

-

Italy

-

France

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Singapore

-

Australia

-

Malaysia

-

Thailand

-

Indonesia

-

Vietnam

-

Philippines

-

Pakistan

-

Taiwan

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

Qatar

-

UAE

-

Kuwait

-

Oman

-

Iran

-

Israel

-

Algeria

-

Egypt

-

Lebanon

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.