- Home

- »

- IT Services & Applications

- »

-

Work Order Management Systems Market Size Report, 2030GVR Report cover

![Work Order Management Systems Market Size, Share & Trends Report]()

Work Order Management Systems Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Solution, Services), By Deployment Mode, By Organization Size, By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-569-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

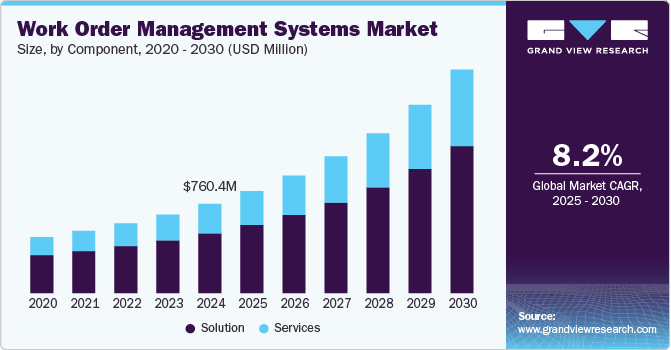

The global work order management systems market size was estimated at USD 760.4 million in 2024 and is projected to grow at a CAGR of 8.2% from 2025 to 2030. WOMS enables organizations to efficiently initiate, schedule, assign, track, and close work orders related to maintenance, field services, asset management, and operations. Traditionally rooted in paper-based or on-premises legacy systems, the market has transitioned rapidly toward cloud-based, mobile-first platforms that offer real-time visibility and integration with enterprise systems like ERP, EAM, and IoT platforms.

The work order management systems industry is witnessing significant growth due to the rapid digitization of asset-intensive industries, such as manufacturing, energy, utilities, and transportation. These sectors heavily rely on the consistent performance of complex machinery and infrastructure, making equipment uptime and maintenance efficiency critical to operational success. As organizations increasingly prioritize reducing unplanned downtime and optimizing labor resources, digital work order systems have become essential tools for scheduling, tracking, and managing maintenance tasks.

The advent of Industry 4.0 has significantly accelerated this shift by enabling the integration of Internet of Things sensors and smart devices into industrial environments. These technologies provide real-time visibility into asset performance and health, allowing for condition-based monitoring rather than time-based maintenance. When anomalies or thresholds are detected, modern WOMS platforms can automatically generate and assign work orders, ensuring quick response times and minimizing disruptions. This level of automation and intelligence not only enhances operational efficiency but also supports predictive maintenance strategies that reduce long-term costs and extend asset life cycles, making WOMS a cornerstone of modern industrial operations.

As organizations increasingly focus on data-driven decision-making, predictive maintenance, and improving customer experience, Work Order Management Systems (WOMS) have evolved beyond basic maintenance tools. They are now viewed as strategic assets that drive business continuity, operational efficiency, and service excellence. By providing real-time visibility, automation, and integration across systems, WOMS enables proactive issue resolution and streamlined workflows. This transformation has led to strong market demand, not only from large enterprises but also from small and medium-sized businesses, especially those operating in asset-intensive sectors such as manufacturing, utilities, transportation, and facilities management, where uptime and efficiency are mission-critical.Integration with AI and machine learning is expected to drive predictive maintenance capabilities, enabling systems to anticipate failures and auto-generate work orders based on data patterns.

A major restraint in adopting modern Work Order Management Systems (WOMS) is the complexity of integrating them with legacy IT infrastructure. Organizations, especially mid-sized companies, often face significant costs and operational disruptions when connecting WOMS with existing ERP, CRM, or asset management systems. This integration challenge can delay implementation timelines, strain IT resources, and hinder the realization of expected efficiency gains, making some businesses hesitant to adopt modern solutions fully.

Component Insights

The solution segment led the market with the largest revenue share of 74.0% in 2024. The growing mobile workforce across industries such as utilities, construction, manufacturing, and logistics is significantly driving demand for mobile-enabled Work Order Management Systems (WOMS). As field operations become more decentralized, organizations require solutions that enable technicians and service personnel to perform tasks efficiently from remote locations. Mobile-enabled WOMS allow workers to access, update, and close work orders in real time using smartphones or tablets, eliminating the delays and inefficiencies of paper-based or desktop-only systems. This instant access to work details, asset history, and checklists not only enhances productivity but also improves communication between field staff and back-office teams. Ultimately, mobile WOMS increase accountability, reduce operational downtime, and support faster, data-driven decision-making on the ground.

The services segment is anticipated to grow at the fastest CAGR of 8.6% during the forecast period. As reliance on Work Order Management Systems (WOMS) increases, businesses are prioritizing ongoing system optimization to maintain performance and reliability. This is driving strong demand for managed services that offer continuous support, scalability, updates, and health monitoring. Vendors providing proactive maintenance, real-time troubleshooting, and performance tuning are gaining traction, particularly among small and medium-sized enterprises (SMEs) that often lack dedicated IT teams. These services help ensure system uptime, streamline operations, and allow organizations to focus on core activities without technical disruptions.

Deployment Insights

The cloud segment accounted for the largest market share in 2024. Cloud-based Work Order Management Systems (WOMS) significantly reduce costs by eliminating the need for expensive on-premise servers, IT maintenance, and dedicated IT staff. Unlike traditional on-premise solutions that require large upfront capital expenditures (CapEx), cloud WOMS operates on a subscription-based SaaS model, converting costs into manageable operational expenses (OpEx). This pay-as-you-go approach makes it especially attractive for SMEs with limited budgets, while large enterprises benefit from scalability without heavy infrastructure investments. In addition, cloud solutions remove costs related to software updates, security patches, and hardware upgrades, as these are handled by the provider. This cost efficiency accelerates ROI, enabling businesses to allocate resources more effectively while maintaining modern, always-updated work order management capabilities.

The on-premises segment is expected to register at the fastest CAGR of 5.9% during the forecast period. On-premises Work Order Management Systems (WOMS) excel in environments where real-time responsiveness and uninterrupted operations are critical. Industries like manufacturing and utilities rely on these systems for instant data processing without cloud latency or internet dependency. In remote facilities or areas with poor connectivity, on-premises WOMS ensure continuous functionality, preventing costly downtime. By keeping all data and processing locally hosted, these systems deliver high-speed performance for time-sensitive maintenance operations, making them indispensable for mission-critical infrastructure and industrial applications where delays are unacceptable.

Organization Size Insights

The large enterprises segment led the market with the largest revenue share of 59% in 2024. Large enterprises often manage vast networks of physical assets spread across multiple locations, making asset and infrastructure management highly complex. Work Order Management Systems (WOMS) help streamline both preventive and reactive maintenance tasks, minimizing unplanned downtime and extending asset life cycles. This ensures operational continuity and enhances customer satisfaction. In addition, for global and multi-site enterprises, centralized WOMS platforms provide multi-language capabilities, compliance tracking, and site-specific customization. This allows organizations to standardize maintenance workflows, ensure regulatory adherence, and gain unified visibility into operations across all regions. These capabilities make WOMS indispensable for large enterprises aiming to improve efficiency, control, and performance at scale.

The SMEs segment is expected to grow at the fastest CAGR during the forecast period. SMEs are increasingly adopting cloud-based Work Order Management Systems (WOMS) due to their affordability and scalability. These solutions eliminate the need for costly infrastructure and offer flexible, pay-as-you-go pricing, making advanced maintenance tools accessible to smaller businesses. In addition, with limited staff and resources, SMEs prioritize efficiency. WOMS platforms help automate task scheduling, minimize manual processes, and streamline maintenance workflows. This enables teams to operate more productively, reduce downtime, and focus on strategic operations, enhancing overall business performance and service delivery.

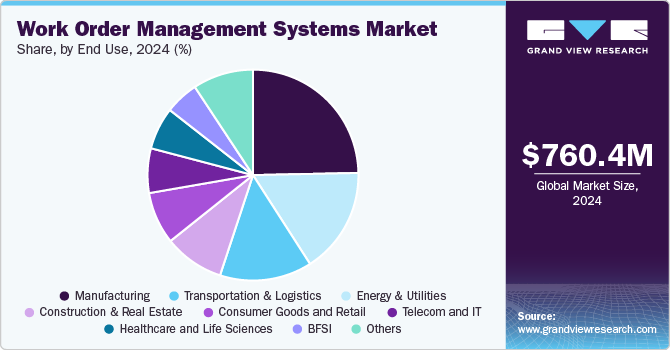

End Use Insights

The manufacturing segment accounted for the largest market share in 2024. Manufacturers operate in highly asset-intensive environments where machinery and production lines are central to operations. Any equipment failure or downtime can halt production, leading to significant financial losses. Work Order Management Systems (WOMS) play a critical role in minimizing these disruptions by enabling streamlined preventive and predictive maintenance, helping extend asset lifespans, and maintaining continuous production. In addition, the advent of Industry 4.0 has revolutionized manufacturing with the integration of IoT sensors, automation, and real-time data analytics. WOMS platforms that can interpret equipment data and trigger condition-based maintenance workflows are now vital for supporting smart factory ecosystems, enhancing efficiency, and driving digital transformation across the manufacturing value chain.

The energy and utilities segment is expected to grow at the fastest CAGR during the forecast period. Field Workforce Management Systems (WOMS) enable utilities to coordinate real-time work orders, allocate resources efficiently, and provide remote access to field crews, enhancing response times, safety, and workforce productivity. As utilities adopt smart grids and embrace digital transformation, integrating WOMS with IoT and SCADA systems enables condition-based maintenance, optimizing asset performance. This approach supports renewable energy integration and real-time monitoring, driving operational efficiency and improving decision-making in asset management and maintenance activities.

Regional Insights

North America dominated the work order management systems market with the largest revenue share of 35.19% in 2024. North America's industrial and energy sectors-including oil & gas, utilities, and manufacturing-drive WOMS demand for asset-intensive operations, regulatory compliance, and predictive maintenance. Simultaneously, smart city initiatives and infrastructure modernization (e.g., upgraded grids, intelligent transportation) fuel adoption in public utilities and facilities. Government-funded projects prioritize digital WOMS to enhance maintenance efficiency, reduce downtime, and support sustainable urban development, making North America a key growth market for advanced work order solutions.

U.S. Work Order Management Systems Market Trends

The work order management systems market in the U.S. is expected to grow at a significant CAGR from 2025 to 2030. Organizations in sectors like utilities, manufacturing, and facilities management are embracing digital solutions to improve operational efficiency, streamline processes, and lower costs. This shift toward digital transformation in the U.S. is driving the demand for Work Order Management Systems (WOMS) to optimize workflows, enhance productivity, and support real-time decision-making in these industries.

Europe Work Order Management Systems Market Trends

The work order management systems marketin Europe is expected to register at a significant CAGR of 8.4% from 2025 to 2030. European organizations are heavily investing in IT and software solutions to optimize operations and boost efficiency. In 2024, spending is expected to reach USD 1.1 trillion, with a notable increase in investments in software and IT services. This digital transformation drives demand for solutions like Work Order Management Systems.

The UK work order management systems industry is expected to grow at a rapid CAGR during the forecast period. The UK smart city initiatives (National Infrastructure Strategy, 5G deployment) are accelerating WOMS adoption in utilities and public transport, enabling real-time asset monitoring and efficient maintenance. Simultaneously, the "Made Smarter" program fuels Industry 4.0 transformation, integrating WOMS with IoT and AI for predictive maintenance in manufacturing. These dual drivers-infrastructure digitization and factory automation-position the UK as a key growth market for advanced work order management solutions.

The work order management systems market in Germany held a substantial market share in 2024. Germany's leadership in Industry 4.0 is accelerating adoption of AI and IoT-enabled Work Order Management Systems (WOMS) across its manufacturing sector. As pioneer in smart factories, German manufacturers require advanced WOMS for predictive maintenance, real-time equipment monitoring, and automated workflow optimization. These intelligent systems minimize downtime, enhance production efficiency, and support autonomous decision-making in complex industrial environments. The integration of WOMS with digital twins and cyber-physical systems further strengthens Germany's competitive edge in advanced manufacturing while setting global benchmarks for industrial maintenance innovation.

Asia Pacific Work Order Management Systems Market Trends

The work order management systems marketin the Asia Pacific is expected to register at the fastest CAGR of 9.1% from 2025 to 2030. Asia-Pacific's rapid industrialization is driving WOMS adoption in manufacturing hubs like China and India to streamline maintenance and enhance supply chain efficiency. Concurrently, smart city initiatives (e.g., India’s Smart Cities Mission, China’s Digital Silk Road) are accelerating WOMS deployment for urban infrastructure and utility management, fueling regional market growth through digital transformation and IoT integration.

The China work order management systems market held a substantial market share in 2024. The “Made in China 2025" strategy is accelerating smart factory development, fueling demand for AI and IoT-powered WOMS to enable predictive maintenance, real-time equipment monitoring, and automated workflow optimization. This national manufacturing upgrade positions China as a global leader in intelligent industrial maintenance systems, driving rapid WOMS market growth.

The work order management systems market in Japan held a substantial market share in 2024. Japan's aging workforce is accelerating the adoption of WOMS to automate maintenance tasks amid labor shortages. Concurrently, the Society 5.0 initiative drives smart factories with IoT-connected WOMS and AI-driven predictive maintenance, positioning Japan as a leader in automated industrial upkeep. These dual forces-demographic challenges and digital transformation-fuel advanced WOMS demand.

The India work order management systems market is growing due to "Make in India" initiative fueling massive factory investments, creating strong demand for automated WOMS to streamline maintenance workflows. As the manufacturing sector is expanding, companies are adopting AI-powered work order systems to minimize downtime, enhance equipment reliability, and boost production efficiency making WOMS a critical tool for India's industrial growth.

Key Work Order Management Systems Company Insight

The key players operating in the global work order management systems industry include IBM Corporation, Oracle, SAP SE, IFS, ServiceNow, PTC, UpKeep, Infor Inc., eMaint Enterprises, LLC, Astea, and Lula. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals.

Key Work Order Management Systems Companies:

The following are the leading companies in the work order management systems market. These companies collectively hold the largest market share and dictate industry trends.

- Astea

- eMaint Enterprises, LLC

- IBM Corporation

- IFS

- Infor Inc.

- Lula

- Oracle

- PTC

- SAP SE

- ServiceNow

- UpKeep

Recent Development

-

In April 2024, Rockwell Automation announced Fiix Asset Risk Predictor now includes GenAI-powered prescriptive maintenance, converting AI-driven failure predictions into actionable work orders. This integration enhances operational efficiency by reducing unplanned downtime and bridging the maintenance knowledge gap, benefiting teams regardless of experience levels.

-

In June 2024, Lula introduced Foresight, an AI-driven work order management system designed to revolutionize property maintenance operations. Foresight automates scheduling, prioritizes tasks using AI triage, and manages both full-time and contract technicians. It also offers real-time support through an AI assistant, integrates seamlessly with existing property management systems, and streamlines quoting and invoicing processes. This comprehensive solution aims to enhance efficiency and profitability for property managers and investors.

-

In February 2023, Ecom Express, celebrating its 10th anniversary, launched Ecom Magnum-a cloud-based SaaS platform offering end-to-end Warehouse and Order Management Solutions. Designed for seamless integration with e-marketplaces, it provides scalable inventory control, real-time tracking, and access to Ecom Express’s network of 60+ fulfillment centers across 27,000+ PIN codes in India.

Work Order Management Systems Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 801.5 million

Market size forecast in 2030

USD 1,187.0 million

Growth rate

CAGR of 8.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Market Size in USD million/billion and CAGR from 2025 to 2030

Report coverage

Market Size forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, deployment mode, organization size, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; and South Africa

Key companies profiled

IBM Corporation; Oracle; SAP SE; IFS; ServiceNow; PTC; UpKeep; Infor Inc.; eMaint Enterprises, LLC; Astea; Lula

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Work Order Management Systems Market Report Segmentation

This report forecasts market size growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the work order management systems market report based on component, deployment mode, organization size, end use, and region.

-

Component Outlook (Market Size, USD Million, 2018 - 2030)

-

Solution

-

Services

-

-

Deployment Mode Outlook (Market Size, USD Million, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Organization Size Outlook (Market Size, USD Million, 2018 - 2030)

-

SMEs

-

Large enterprises

-

-

End Use Outlook (Market Size, USD Million, 2018 - 2030)

-

Manufacturing

-

Energy and Utilities

-

Transportation and Logistics

-

Construction and Real Estate

-

Consumer Goods and Retail

-

Healthcare and Life Sciences

-

Banking, Financial Services, and Insurance (BFSI)

-

Telecom and IT

-

Others

-

-

Regional Outlook (Market Size, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

U.A.E

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global work order management systems market size was valued at USD 760.40 million in 2024 and is expected to reach USD 801.46 million in 2025.

b. The global work order management systems market is expected to witness a compound annual growth rate of 8.2% from 2025 to 2030 to reach USD 1,186.99 million by 2030.

b. The solution segment dominated the work order management systems market with a share of 74.04% in 2024. The growing mobile workforce across industries such as utilities, construction, manufacturing, and logistics is significantly driving demand for mobile-enabled Work Order Management Systems (WOMS).

b. The key market players in the global work order management systems market include IBM Corporation, Oracle, SAP SE, IFS, ServiceNow, PTC, UpKeep, Infor Inc., eMaint Enterprises, LLC, Astea, and Lula.

b. The work order management systems market is witnessing significant growth due to rapid digitization of asset-intensive industries, such as manufacturing, energy, utilities, and transportation. These sectors heavily rely on the consistent performance of complex machinery and infrastructure, making equipment uptime and maintenance efficiency critical to operational success.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.