- Home

- »

- Market Trend Reports

- »

-

Competitive Landscape: Europe Pharmaceutical Contract Development and Manufacturing Organizations

Report Overview

In Europe, the pharmaceutical industry is evolving with advanced capabilities such as contract development and manufacturing organizations (CDMO). The requirement for CDMO in the region is driven by rising demand for small molecules, biologics, cell and gene therapies, and personalized medicine. In addition, growing demand for high-potency active pharmaceutical ingredients (HPAPIs) and customized drug formulations has led pharmaceutical companies to increasingly rely on CDMOs owing to the complexity of manufacturing HPAPIs and the need for specialized facilities and expertise in handling potent compounds.

In addition, pharmaceutical companies in Europe are increasingly relying on outsourcing production to reduce costs, accelerate time-to-market, and access specialized technologies without capital investment. Furthermore, outsourcing enables pharmaceutical companies in Europe to concentrate on their core strengths while relying on CDMOs for the drug development process, production, packaging, and distribution. This allows the pharmaceutical companies to scalable production according to market demands, providing flexibility that enables companies to adjust output without the burden of maintaining large manufacturing operations.

Moreover, outsourcing helps pharmaceutical companies comply with stringent regulatory requirements for new drug approvals. CDMOs possess in-depth knowledge of local regulations and certifications, ensuring that products adhere to the EU’s stringent standards. This further reduces the pharmaceutical companies’ time and cost needed to navigate the approval process and deliver the product faster to the market. Besides, with the demand for pharmaceutical products, outsourcing supports pharmaceutical companies with enhance expertise, innovation further supporting to scale up of their production. Thus, CDMOs assist several pharmaceutical and biopharmaceutical companies in novel drug development, further accelerating overall market growth.

Country Outlook: Europe Pharmaceutical CDMOs Market

In the pharmaceutical market, Europe is one of the robust regions with extensive drug discoveries, particularly in complex and advanced therapies such as cell and gene therapies. This factor has led to shifting trends towards CDMO facilities for pharmaceutical production in the region. Moreover, the region offers several opportunities for the pharmaceutical CDMO market owing to the increasing number of facilities across various countries, rising public and private investments, and advancements in technology that enhance the competitive landscape of European pharmaceutical CDMOs. For instance, according to pharmasource global data, in Europe, there are 337 CDMO facilities and 552 finished dosage form (FDF) plants. Besides, countries such as Germany, France, and Italy are expanding CDMO facilities due to the presence of an established pharmaceutical industry, stringent regulatory compliance, a skilled workforce, advanced infrastructure, and government support, making these countries preferred locations for pharmaceutical contract manufacturing. In addition, the trend towards the specialization of sterile products, including sterile glass vials, lyophilization, and pre-filled syringes, contributes to the regional growth.

Top 5 European Countries for Pharmaceutical CDMOs Market

Ranking

Country

Number of CDMOs

1

France

84

2

Italy

78

3

Germany

75

4

Spain

54

5

UK

29

Source: Pharma source, secondary Research, Company Annual Reports, Grand View Research

Companies Competitive Scenario: Europe Pharmaceutical CDMOs Market

In recent years, CDMOs in Europe have seen significant growth, driven by the rising demand for complex therapies and biologics. The expansion of cost-effective and advanced technology-integrated services by key market participants such as Recipharm, Lonza, and Catalent is expected further to enhance the growth of pharmaceutical outsourcing in the region. For instance, in January 2024, Recipharm AB, Medspray, and Resyca announced a collaboration agreement to develop nasally delivered drug products using proprietary soft mist technology. The collaboration aimed to accelerate advancements in the nasal delivery of biologics and small molecules. Such collaborations broadened operational capabilities in the region. Similarly, in December 2024, Novo Holdings acquired Catalent for USD 16.5 billion to support premium development and manufacturing solutions for pharma and biotech customers. Furthermore, CDMOs are increasingly adopting automation, sustainability practices, and regulatory compliance to meet the market requirements. Thus, European CDMOs are playing a critical role in boosting pharmaceutical output, ensuring supply chain resilience, and enabling innovation for drug development and commercialization across global and regional markets.

Competitive Landscape Europe Pharmaceutical CDMOs Report Coverage

Competitive Landscape: Europe Pharmaceutical CDMOs Market Report Coverage

Market Outlook

Total Number of CDMO Facilities, by Country

Company Position Matrix

Service Offering Matrix

List of Key CMOs by Region

Company Overview

Key Service Offerings

Financial Reporting

Recent Strategic Developments

SWOT Analysis

Furthermore, the Europe Pharmaceutical CDMOs market is fragmented, with the presence of local and established market players. The top position of these companies is due to strong service portfolios, the presence of a large number of facilities across the region, and growing strategic initiatives. Key players are focusing on several strategic initiatives, such as service launches, expansions, collaborations, agreements, partnerships, and mergers & acquisitions, to increase their market share. Along with these established market players, a number of emerging European Pharmaceutical CDMOs are entering the market with niche services offering for complex and novel drug discovery to commercialization for various European pharmaceutical products.

Lonza Group AG

Headquartered: Switzerland

Establishment Year: 1897

Company Overview

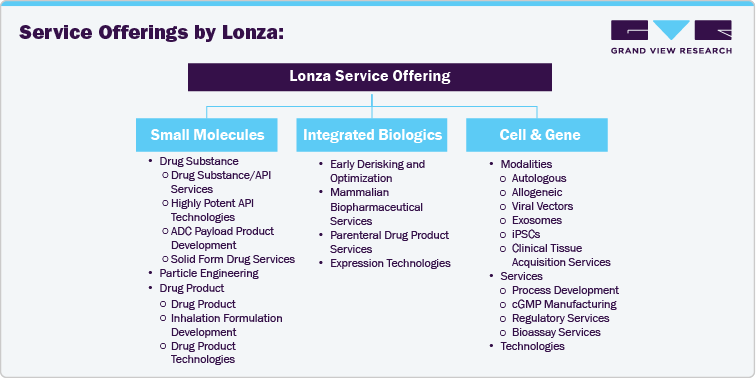

Lonza is a CDMO that provides development and manufacturing services for Europe pharmaceutical, small molecules, and gene therapy, among others. The company provides a wide range of products and services, ranging from early-phase discovery to custom development & manufacturing of Active APIs and finished drug products. The company has worldwide operations in North America, Europe, and Asia, with a strong presence in France, the UK, and other countries.

Financial Reporting for Lonza Group AG

Key Financials

Revenue (in USD Million)

As of 30th June

2022

2023

2024

Total Revenue

5,942.97

6,038.58

5,791.69

EBIT

1,471.66

791.12

849.28

Net Income

1,163.19

588.85

561.20

Cash from Operating Activities

974.10

1,145.33

1,222.83

Cash used in Investing Activities

930.17

2,621.48

965.58

Asset Turnover

0.36

0.40

0.33

Note: The Latest financials as per the company's annual reports will be provided in the final deliverable

Some of the Key Strategic Developments by Lonza:

-

In April 2025, Lonza introduced a new, simplified operating model that involves restructuring into three distinct CDMO business platforms. The company plans to separate its Capsules & Health Ingredients division. This reorganization aimed to enhance customer experience and execution efficiency by implementing a unified go-to-market strategy and improving asset management.

-

In March 2024,Lonza announced an agreement to acquire the Genentech large-scale Europe Pharmaceutical manufacturing site in the U.S. from Roche for USD 1.2 billion. The acquisition increased the company’s large-scale Europe pharmaceutical manufacturing capacity to meet demand for commercial mammalian contract manufacturing from customers with existing commercial products, and molecules currently on the path to commercialization.

-

In April 2023, Lonza collaborated with ABL Bio to support the development and manufacturing of ABL Bio’s new bispecific antibody product. Such collaboration broadened the company’s operational capabilities in the market.

SWOT Analysis of Lonza Group AG:

An in-depth analysis shall be provided for the 30 Europe Pharmaceutical CDMOs listed below:

-

Lonza Group AG

-

Catalent Inc.

-

Rentschler Biopharma

-

Aneova Group

-

Fareva

-

Recipharm AB

-

Thermo Fisher Scientific Inc.

-

Stevanato Group

-

Delpharm

-

Almac Group

-

Eurofins Scientific

-

AGC Biologics

-

Siegfried Holding AG

-

CordenPharma International

-

Cambrex Corporation

-

EuroAPI

-

Vetter Pharma International GmbH

-

Sterling Pharma Solutions

-

Hovione

-

Axplora

-

Rottendorf Pharma GmbH

-

1Q Health Group

-

Upperton Pharma Solutions

-

Onyx Scientific

-

Synerlab

-

Dottikon

-

FIS - Fabbrica Italiana Sintetici S.p.A.

-

Evonik

-

Carbogen Amcis

-

Farmhispania

Share this report with your colleague or friend.

Pricing & Purchase Options

Service Guarantee

-

Insured Buying

This report has a service guarantee. We stand by our report quality.

-

Confidentiality

We are in compliance with GDPR & CCPA norms. All interactions are confidential.

-

Custom research service

Design an exclusive study to serve your research needs.

-

24/5 Research support

Get your queries resolved from an industry expert.

-

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified