- Home

- »

- Market Trend Reports

- »

-

Competitive Landscape: Healthcare Third-Party Logistics Market

Report Overview

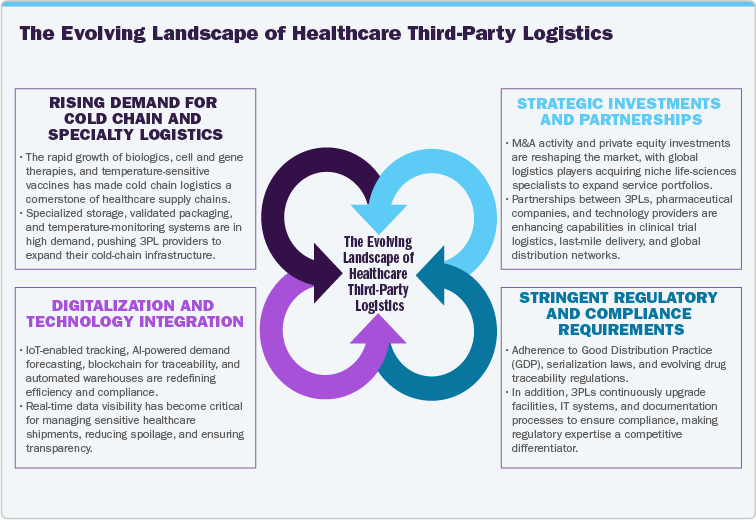

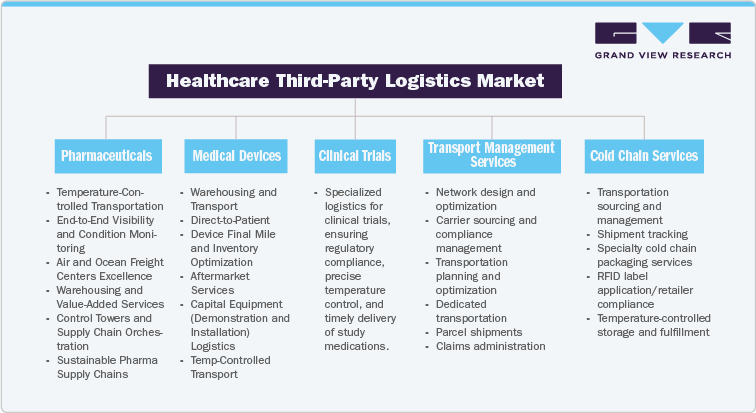

The healthcare third-party logistics (3PL) market is experiencing significant growth due to increased production of pharmaceuticals and medical devices and the globalization of clinical trials. In addition, the increasing prevalence of chronic diseases has led to rising demand for the temperature-sensitive distribution of products such as vaccines, biologics, and specialty therapies, which is expected to drive the market's competitiveness. Moreover, the growing e-commerce presence for medical supplies and the rising demand for fast & dependable fulfillment are expected to drive the 3PL market size and revenues.

In addition, growing technological advancements are reshaping the service offerings, such as real-time telemetry (IoT sensors) and cloud platforms, which provide end-to-end visibility for cold-chain integrity. Besides, AI & advanced analytics enable predictive routing & inventory optimization, while blockchain pilots are being used to strengthen audit trails and counterfeit detection, further supporting the market. Moreover, digital platforms integrating order-to-delivery workflows transform logistics from a commodity into a competitive, high-value service. These trends are expected to enhance the quality of service and minimize the spoilage and compliance risks.

Moreover, growing investment and consolidation have accelerated as strategic buyers and private equity chase scale, specialist capabilities, and geographic reach further fueling the innovation in the market. In addition, established market players and life sciences specialists are focusing on acquisitions to expand cold chain, clinical trial logistics, and controlled substance handling further expanding the market growth. Moreover, growing strategic initiatives include major carriers buying regional pharma logistics firms to bolster their pharmaceutical portfolios. Private equity and strategic M&A are driving roll-ups that create national and multi-regional platforms capable of offering integrated labeling, kitting, cold storage, and controlled distribution at scale.

Furthermore, regulatory & quality requirements remain a defining constraint and differentiator for healthcare 3PLs. As Good Distribution Practice (GDP), stringent temperature-monitoring obligations, serialization and chain-of-custody rules for high-value biologics and controlled substances force operators to invest in validated systems, certified facilities, and auditable processes. In addition, cross-border trade further adds customs, import/export, and licensing complexity, while data-privacy rules around patient and clinical trial information require secure, compliant IT platforms. Thus, as a result, compliance capability has become a primary selection criterion for life-science customers. Such factors are expected to drive the competitive landscape in healthcare third-party logistics market.

Global Scenario: Healthcare Third-Party Logistics Market

The global healthcare third-party logistics market is experiencing significant growth driven by increasing demand for biologics, specialty drugs, and temperature-sensitive vaccines which necessitate the need for advanced cold-chain solutions. Moreover, established companies such as DHL, UPS Healthcare, FedEx, Kuehne + Nagel, and DB Schenker dominate the market due to global networks and specialized compliance competencies. In addition, global players such as Cardinal Health, Yusen Logistics, and Sinotrans contribute by enhancing local distribution & regulatory expertise. Moreover, growing integration of technology such as IoT-enabled tracking, blockchain, and automation is expected to drive visibility, security, and overall efficiency. In addition, growing strategic investments, mergers & acquisitions are transforming the competitive landscape.

The global healthcare 3PL market players include Cardinal Health, DHL Group, Agility, SF Express, Kinesis Medical B.V., United Parcel Service of America, Inc., Barrett Distribution, AmerisourceBergen Corporation (Cencora Corporation), DB SCHENKER, FedEx, Kuehne + Nagel, Kerry Logistics, Freight Logistics Solutions, Cardinal Health, DHL Group, Agility, SF Express, Kinesis Medical B.V., United Parcel Service of America, Inc., Barrett Distribution, AmerisourceBergen Corporation (Cencora Corporation), DB SCHENKER, FedEx, Kuehne + Nagel, Kerry Logistics, Freight Logistics Solutions.

For instance, in the global market, DHL is one of the established companies offering range of services such as cold-chain, specialty pharma supply, and value-added services. In addition, strategic acquisitions such as CryoPDP in the U.S. to strengthen its life sciences & healthcare segment. Moreover, UPS Healthcare is expanding its cold-chain, precision transport, and regulatory compliance capabilities further reinforcing its position in temperature-sensitive and high-value healthcare logistics. Moreover, FedEx, Kuehne + Nagel, DB Schenker, CEVA, and others are differentiating themselves through global network scale, specialized warehouses, and investments in tracking, monitoring, and regulatory compliance tools.

Companies Competitive Scenario: Healthcare Third-Party Logistics Market

The healthcare third-party logistics are the major contributors to the pharmaceutical outsourcing industry. In recent years, healthcare third-party logistics companies have seen growth driven by the rising requirement for complex therapies and biologics. The expansion of services by key market players such as UPS Healthcare, DHL Supply Chain & Global Forwarding, FedEx Supply Chain, Kuehne + Nagel, and DB Schenker is expected to drive the healthcare third-party logistics competition among market players in the region. For instance, in September 2025, DHL agreed to acquire SDS Rx, expanding its life sciences and healthcare capabilities. The acquisition will drive the company's healthcare logistics portfolio under DHL Health Logistics, enhancing the company's ability to deliver integrated, time-critical solutions across every stage of the LSHC supply chain. Thus, healthcare third-party logistics boost pharmaceutical output, ensure supply chain resilience, and enable innovation for drug development & commercialization across global and regional market.

Competitive Landscape Healthcare Third-Party Logistics Report Coverage

Competitive Landscape: Healthcare Third-Party Logistics Market Report Coverage

Market Outlook

Company Categorization

Company Position Matrix

Service Offering Matrix

List of Key CMOs by Region

Company Overview

Key Service Offerings

Financial Reporting

Recent Strategic Developments

SWOT Analysis

Furthermore, the healthcare third-party logistics market is concentrated with the presence of established market players. The below-mentioned healthcare third-party logistics are some of the key market players in terms of overall revenue. The top position of these companies is due to strong service portfolios, the presence of a large number of facilities across the globe and growing strategic initiatives. Key players focus on several strategic initiatives, such as service launches, expansions, collaborations, agreements, partnerships, and mergers & acquisitions, to increase their market share.

Along with these established market players, several emerging Healthcare third-party logistics companies are entering the market with innovative services offering various services such as cold chain and temperature-controlled logistics, warehousing and distribution, clinical trial logistics, packaging and kitting, regulatory compliance services, supply chain visibility solutions, and value-added logistics, among others. Further, companies are focusing on customers who benefit from high levels of expertise with advanced product lifecycles and venturing into the new healthcare third-party logistic

DHL International GmbH

Headquartered: Germany

Establishment Year: 1969

Company Overview:

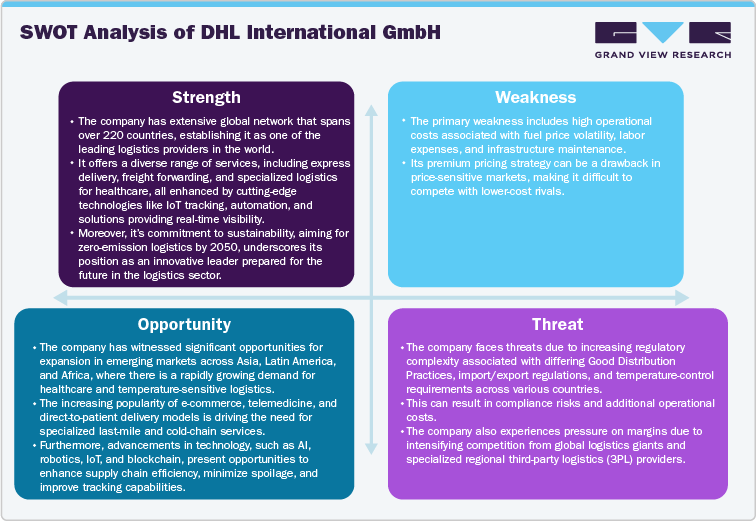

DHL International GmbH is a leading company in contract logistics. The company has a range of divisions, such as DHL Express, DHL Global Forwarding, DHL Supply Chain, and other global divisions. It provides solutions such as warehousing solutions, real estate solutions, transport solutions, packaging solutions, E-commerce fulfillment solutions, service logistics, lead logistics partners, clinical logistics, and regional solutions such as DHL fulfillment network solutions. It serves various sectors such as auto-mobility, energy, engineering and manufacturing, life sciences and healthcare, retail & fashion, and technology. The company has active operations in 50+ countries and has approximately 1,600 Warehouse locations. In addition, the company has around 17M square meters of storage space and approximately 188,000 supply chain experts.

International GmbH

Financial Reporting for DHL International GmbH

Key Financials

Revenue (in USD Million)

As of dated 2025

2023

2024

2025

Net Revenue

89,933.8

92,604.6

23,201.47 (Q2 2025)

Net cash from operating activities

10,834.22

10,206.96

NA

Profit from operating activities (EBIT)

7,422.92

6,888.12

1,672.29

Note: Latest financials as per company annual reports will be provided in the final deliverable

Service Offerings by DHL International GmbH:

Some of the Key Healthcare Third-Party Logistics Development by Lonza:

-

In March 2025, Barrett Distribution Centers, a recognized leader in third-party logistics specializing in e-commerce and omnichannel fulfillment, introduced the E-commerce Accelerator program. This initiative is created to support fast-growing, early-stage brands by scaling their logistics operations effectively and efficiently.

-

In March 2025, DHL Group and Cryoport, Inc. announced that DHL has fully acquired CRYOPDP, a prominent specialty courier specializing in clinical trials, biopharmaceuticals, and cell and gene therapies. In addition, the two companies mention a strategic partnership aimed at enhancing their supply chain services for the global life sciences and healthcare industries.

SWOT Analysis of DHL International GmbH:

An in-depth analysis shall be provided for below listed 25 players in the healthcare third-party logistics market:

-

Cardinal Health

-

DHL Group

-

Agility

-

SF Express

-

Kinesis Medical B.V.

-

United Parcel Service of America, Inc.

-

Barrett Distribution

-

AmerisourceBergen Corporation (Cencora Corporation)

-

DB SCHENKER

-

FedEx

-

CEVA Logistics

-

Kuehne + Nagel

-

Kerry Logistics

-

Freight Logistics Solutions

-

XPO Logistics

-

C.H. Robinson Worldwide

-

Sinotrans Limited

-

Yusen Logistics

-

GEODIS SA

-

Nippon Express Co., Ltd.

-

McKesson Corporation

-

Ryder System, Inc.

-

Americold Logistics

-

Cryoport Systems

-

Lineage Logistics

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

-

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified