- Home

- »

- Medical Devices

- »

-

Healthcare Third-party Logistics Market Size Report, 2030GVR Report cover

![Healthcare Third-party Logistics Market Size, Share & Trends Report]()

Healthcare Third-party Logistics Market (2025 - 2030) Size, Share & Trends Analysis Report By Industry (Biopharmaceutical, Pharmaceutical, Medical Device), By Supply Chain (Cold Chain, Non-cold Chain), By Service (Transportation), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-974-0

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

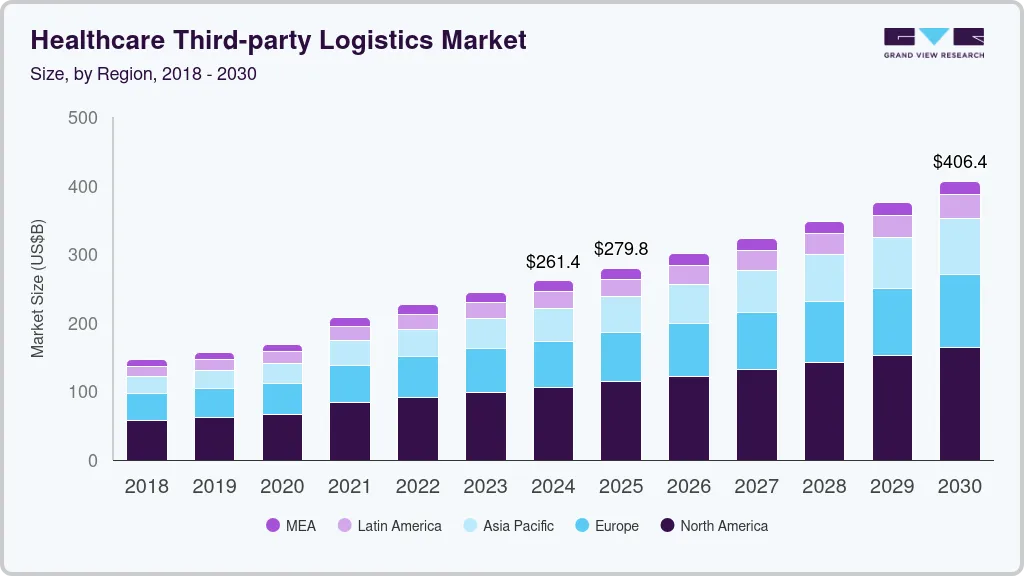

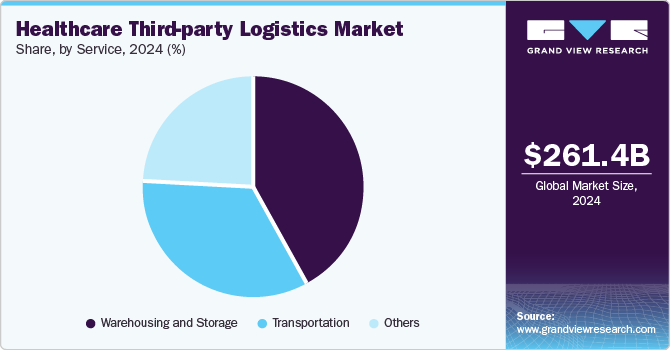

The global healthcare third-party logistics market size was estimated at USD 261.39 billion in 2024 and is projected to reach USD 406.36 billion by 2030, growing at a CAGR of 7.75% from 2025 to 2030. The growth of the market is due to the rising trend of outsourcing logistics and the increasing use of advanced technology by integrating information between manufacturers, suppliers, retailers, and wholesalers have led to the growth of the industry.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, U.S. is expected to register the significant CAGR from 2025 to 2030.

- By industry, the biopharmaceutical segment accounted for the largest market share of 54.84% in 2024.

- By supply chain, the non-cold chain logistics segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 261.39 Billion

- 2030 Projected Market Size: USD 406.36 Billion

- CAGR (2025-2030): 7.75%

- North America: Largest market in 2024

Additionally, pharmaceutical logistics companies are increasingly adopting retrieval systems and automated storage solutions, which are garnering substantial attention.

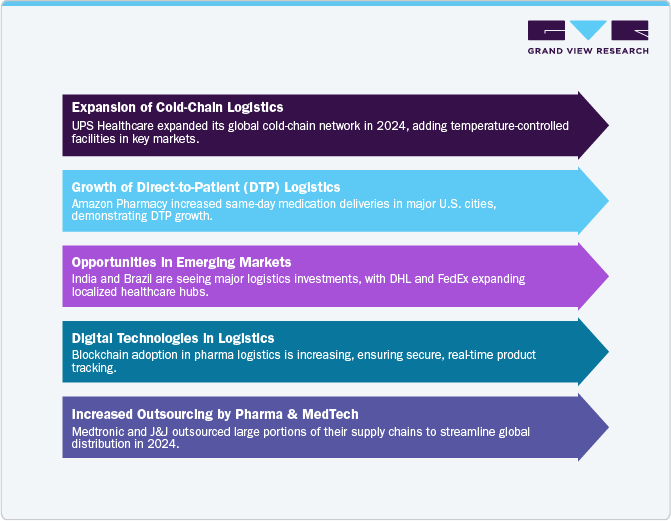

Furthermore, expansion of global pharmaceutical and medical device supply chains has boosted the demand for specialized third-party logistics (3PL) providers. Regulatory requirements vary significantly across regions, requiring logistics partners with deep expertise in compliance, temperature-controlled transport, and supply chain visibility. Many pharmaceutical companies prefer outsourcing logistics to ensure compliance with Good Distribution Practice (GDP) and other regional regulations. The growing prevalence of complex biologics, cell and gene therapies, and personalized medicine has intensified the need for sophisticated cold-chain logistics. Specialized 3PL providers offer proper shipping solutions, real-time monitoring, and end-to-end tracking to minimize risks in transit.

The rising need for biopharmaceuticals and vaccines has intensified the focus on specialized cold chain logistics solutions. Companies invest in advanced refrigeration and monitoring systems to maintain product efficacy during transportation. Furthermore, a push toward digital transformation enhances supply chain visibility and inventory management. Patient-centric logistics and sustainability practices are also gaining prominence, requiring collaborations that meet regulatory compliance and promote environment-friendly initiatives.

The growing application of reverse logistics in the biopharmaceutical industry is driving significant growth in the third-party logistics market, focusing on critical needs for cost efficiency, regulatory compliance, and environmental responsibility. Reverse logistics, which involves product return, disposal, and recycling, is increasingly important due to rising product recalls and unused drug stockpiles. Product recalls, often due to shorter product life cycles and increased product variety, necessitate robust reverse logistics systems to manage returns effectively.

Opportunity Analysis

The healthcare third-party logistics (3PL) market is experiencing significant opportunities driven by rising demand for temperature-controlled logistics, the growth of biosimilars, and the expansion of home healthcare services. The increasing adoption of biologics, biosimilars, and specialty drugs requires stringent handling and distribution, creating a strong need for GDP-compliant cold chain logistics, real-time monitoring, and advanced packaging solutions. Additionally, the shift toward home-based treatments, direct-to-patient deliveries, and telemedicine is fuelling the demand for efficient last-mile logistics. Companies that leverage AI, blockchain, and IoT for supply chain optimization, real-time tracking, and automated inventory management stand to gain a competitive edge. Furthermore, as emerging markets in Asia-Pacific and Latin America expand their pharmaceutical production, global 3PL providers have the opportunity to establish themselves as key players in these regions.

Regulatory compliance and sustainability are becoming critical differentiators in the 3PL market. Stricter global regulations, such as the EU’s Falsified Medicines Directive (FMD) and the U.S. Drug Supply Chain Security Act (DSCSA), are increasing compliance complexities, driving pharmaceutical and biotech companies to seek logistics partners with expertise in serialization and track-and-trace solutions. As companies focus on core R&D and commercialization efforts, outsourcing logistics to specialized 3PL providers allows for greater efficiency and cost savings. Additionally, sustainability initiatives, such as eco-friendly logistics solutions, electric vehicle fleets, and energy-efficient cold storage, are gaining traction as pharmaceutical companies prioritize ESG goals. Providers that invest in green logistics and regulatory compliance expertise will be well-positioned to capitalize on these evolving industry demands.

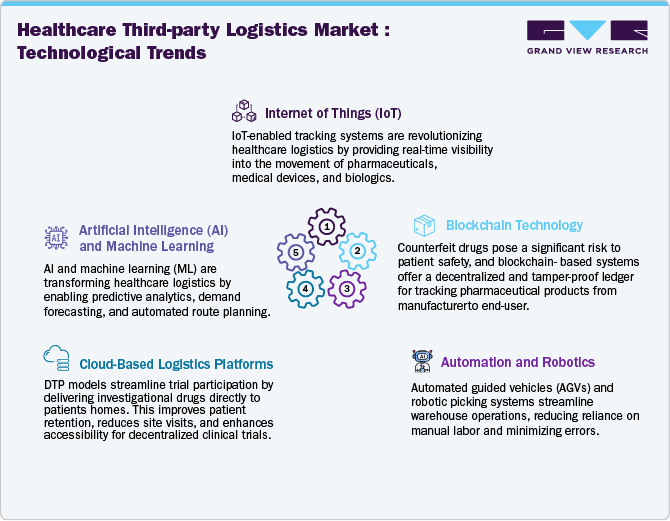

Technological Advancements

The healthcare third-party logistics (3PL) market is undertaking rapid technological advancements to enhance efficiency, compliance, and cost-effectiveness. Key innovations include IoT-enabled smart sensors for real-time tracking of temperature-sensitive shipments, AI and ML for demand forecasting and route optimization, and blockchain for supply chain transparency. Automation and robotics streamline warehouse operations, while cloud-based logistics management systems provide end-to-end visibility. Cold chain logistics innovations, such as cryogenic storage and advanced refrigerated transport, enhance the safe distribution of biologics and vaccines.

Additionally, digital twin technology enables simulation and optimization of logistics operations, while last-mile delivery solutions, including drones and autonomous vehicles, enhance medical shipments. Regulatory compliance tools and data analytics help 3PL providers adhere to stringent healthcare regulations. Sustainability is also gaining momentum with eco-friendly packaging, fuel-efficient transportation, and carbon footprint tracking. Such technological advancements is crucial for 3PL providers to maintain a competitive edge in delivering critical healthcare products safely and efficiently.

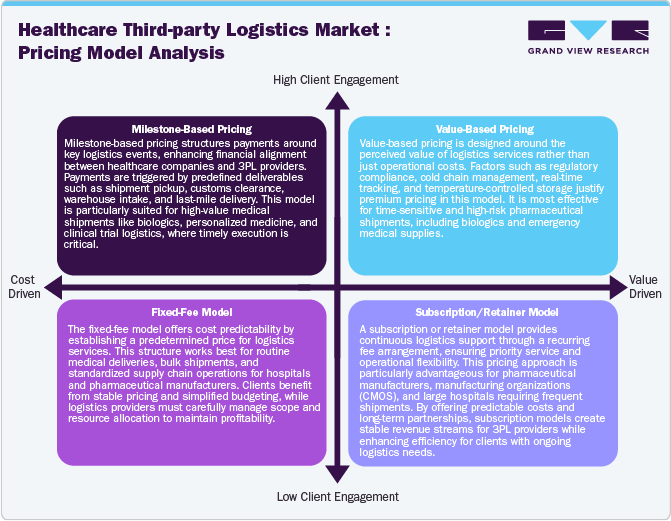

Pricing Analysis

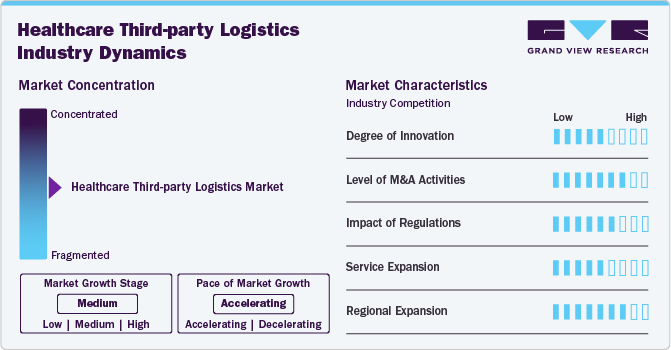

Market Concentration & Characteristics

Innovation cis driven by advancements in cold chain logistics, real-time tracking, and automation. The integration of IoT, AI-driven route optimization, and blockchain for shipment verification has enhanced supply chain transparency.

The healthcare 3PL market has witnessed high levels of mergers and acquisitions, as logistics providers seek to expand service capabilities and geographic reach. Major players such as UPS Healthcare, FedEx, and DHL Supply Chain acquired specialized cold chain and clinical trial logistics firms to strengthen their presence in niche markets.

Regulatory compliance plays a defining role in shaping the healthcare 3PL industry. Strict guidelines such as Good Distribution Practices (GDP), Good Manufacturing Practices (GMP), FDA requirements, and EU pharmaceutical logistics standards drive investments in validated storage, temperature monitoring, and serialization technologies. Compliance with evolving drug traceability laws, such as the U.S. Drug Supply Chain Security Act (DSCSA) and the EU Falsified Medicines Directive (FMD), adds complexity to logistics operations.

Leading healthcare 3PL providers are expanding their service offerings to include clinical trial logistics, specialty drug distribution, and home healthcare delivery. The rise of direct-to-patient (DTP) models and decentralized clinical trials has pushed logistics providers to develop last-mile solutions, temperature-controlled packaging, and patient-centric delivery systems.

Healthcare 3PL providers are aggressively expanding in Asia-Pacific, Latin America, and the Middle East & Africa to support the growing pharmaceutical markets in these regions. Investments in cold chain infrastructure, regional distribution hubs, and regulatory expertise are helping global logistics firms strengthen their foothold in emerging markets. The increasing outsourcing of pharmaceutical manufacturing to India and China is also driving demand for specialized logistics solutions in these regions.

Industry Insights

The biopharmaceutical segment accounted for the largest market share of 54.84% in the healthcare third party logistics industry in 2024. The growth is driven by factors such as the increasing demand for temperature-controlled logistics services to expanding distribution networks of biopharmaceutical companies to increase their sales and transport biologics in various geographical areas. Furthermore, several service providers are focusing on partnerships with biopharmaceutical companies to support their logistical concerns regarding newly approved biologics.

The medical device segment is projected to witness the fastest growth due to increasing demand for advanced medical technologies, stricter regulatory requirements, and the need for efficient global distribution. With rising adoption of high-value and temperature-sensitive devices, manufacturers are relying on specialized 3PL providers for cold chain logistics, real-time tracking, and compliance management.

Supply Chain Insights

The non-cold chain logistics segment dominated the healthcare third party logistics industry in 2024. The segment’s growth is due to the rising demand for medical devices, over-the-counter (OTC) drugs, and general pharmaceutical distribution. Unlike temperature-sensitive biologics, a large portion of healthcare products, including surgical instruments, hospital supplies, and generic medications-do not require specialized cold chain solutions, making non-cold chain logistics more scalable and cost-effective.

The cold chain logistics segment is expected to showcase the fastest growth rate during the forecast period. The growth is due to the increasing demand for biologics, vaccines, cell and gene therapies, and temperature-sensitive pharmaceuticals. Strict regulatory requirements, including Good Distribution Practices (GDP) and FDA guidelines, are pushing companies to invest in specialized temperature-controlled storage, real-time monitoring, and validated packaging solutions.

Service Insights

The warehousing and storage segment dominated the healthcare third party logistics industry in 2024. The market is driven by the growing demand for temperature-controlled storage, regulatory compliance, and inventory management solutions. The increasing production of biologics, specialty drugs, and medical devices led to higher investments in GMP-compliant and GDP-certified warehouses. In addition, the expansion of regional distribution hubs, automation in storage facilities, and just-in-time inventory models has strengthened this segment’s market leadership. With pharmaceutical and medtech companies outsourcing logistics to focus on core R&D and manufacturing, warehousing remains a critical component of the healthcare supply chain.

The other services segment is expected to experience a considerable growth rate during the forecast period. This segment includes packaging, custom & duty management, procurement services, and other value-added services. Packaging is one of the crucial elements of healthcare logistics since the transportation of healthcare products depends on the storage facilities and the packaging of the product.

Regional Insights

North America accounted for the largest market share of 40.67% in 2024 due to the strong presence of pharmaceutical and medical device manufacturers, advanced healthcare infrastructure, and stringent regulatory frameworks. The region's high demand for cold chain logistics, driven by the growth of biologics, vaccines, and precision medicine, has further boosted market dominance. Moreover, major logistics providers such as UPS Healthcare, FedEx, and DHL Supply Chain have expanded their GDP-compliant warehousing, last-mile delivery solutions, and technology-driven supply chain management, ensuring efficient and compliant healthcare product distribution

U.S. Healthcare Third-party Logistics Market Trends

The healthcare third-party logistics market in the U.S. is driven due to the country’s highly developed regulatory landscape (FDA, GDP, GMP) that mandates strict cold chain compliance. In addition, rising pharmaceutical exports and increased outsourcing of logistics operations to specialized 3PL providers are further accelerating the market growth.

Europe Healthcare Third-party Logistics Market Trends

The healthcare third-party logistics market in Europe is experiencing lucrative market growth opportunities. The region witnessed a surge in investments in GDP-compliant cold storage facilities and last-mile delivery solutions. The European Medicines Agency (EMA) enforces strict guidelines, compelling logistics providers to adopt real-time temperature monitoring and risk mitigation strategies.

The healthcare third-party logistics marketin the UK held a significant share in 2024. The country’s market growth is due to its robust pharmaceutical supply chain, with high demand for cold chain logistics due to its strong biotech and vaccine production industry. The impact of Brexit led to increased complexities in cross-border pharmaceutical trade, making efficient cold chain management essential.

The healthcare third-party logisticsmarket in France is driven due to the country’s growing biologics and vaccine production sector. The government’s focus on domestic pharmaceutical manufacturing and R&D investments is increasing the demand for specialized cold chain services.

The healthcare third-party logisticsmarket in Germany is anticipated to grow significantly over the forecast period. The country’s logistics firms are increasingly adopting automation, AI-driven supply chain analytics, and IoT-based monitoring to enhance efficiency. Sustainability is a major focus, with investments in hydrogen-powered refrigerated trucks and green warehousing solutions.

Asia Pacific Healthcare Third-party Logistics Market Trends

The Asia Pacific healthcare third-party logistics market is projected to grow at the highest CAGR over the forecast period. The growth of the market is due to rising pharmaceutical manufacturing, vaccine exports, and increasing demand for biologics. The region is witnessing massive investments in temperature-controlled warehouses, IoT-based tracking systems, and express cold chain transportation.

The healthcare third-party logisticsmarket in China is expected to grow over the forecast period. The country is rapidly expanding its cold storage and refrigerated transport infrastructure to meet rising demand. Government regulations on pharmaceutical cold chain compliance are becoming stricter, further driving the investments in GDP-certified logistics solutions.

Japan healthcare third-party logisticsmarket is witnessing significant growth over the forecast period. The country has advanced regulatory compliance, high-tech logistics solutions, and increasing demand for regenerative medicine. The country has one of the most sophisticated cold chain infrastructures, with extensive use of robotic cold storage, AI-driven logistics management, and RFID-based tracking.

India healthcare third-party logisticsmarket is witnessing a considerable growth due to the increasing government support. The government’s "Make in India" initiative is accelerating the development of domestic cold chain infrastructure. The growth of online pharmacy platforms and e-commerce-driven drug deliveries is increasing the need for last-mile cold chain solutions.

Latin America Healthcare Third-party Logistics Market Trends

The Latin America healthcare third-party logistics market is projected to grow over the forecast period. The growth in the region is due to rising vaccine distribution, increasing pharmaceutical imports, and expanding healthcare access. Countries like Brazil and Mexico are leading investments in cold storage and refrigerated transportation. Challenges such as infrastructure gaps, regulatory variations, and high logistics costs are advancing providers to adopt cost-effective, region-specific cold chain strategies.

The healthcare third-party logistics market in Brazil is expected to grow over the forecast period. The country has a rapidly expanding biologics and vaccine distribution network, necessitating better cold chain storage and compliance-driven logistics solutions. Regulatory reforms and increased pharmaceutical trade agreements are enhancing international logistics operations.

Key Healthcare Third-party Logistics Company Insights

Key players in the market are actively enhancing their service offerings to meet the growing demand for temperature-sensitive pharmaceutical products. Companies such as Cardinal Health, DHL Group, Agility, are investing in advanced technologies like IoT-enabled tracking systems, real-time temperature monitoring, and automated warehousing solutions. These innovations aim to ensure the integrity and safety of healthcare products during transit. For instance, in October 2024, UPS acquired Frigo-Trans and its sister company BPL. This strategic initiative aims to enhance UPS Healthcare's end-to-end temperature-controlled and time-critical transportation solutions, addressing the growing demands of the pharmaceutical and biotech industries.

Key Healthcare Third-party Logistics Companies:

The following are the leading companies in the healthcare third-party logistics market. These companies collectively hold the largest market share and dictate industry trends.

- Cardinal Health

- DHL Group

- Agility

- SF Express

- Kinesis Medical B.V.

- United Parcel Service of America, Inc.

- Barrett Distribution

- Cencora

- DB Schenker

- FedEx

- KUEHNE + NAGEL

- Kerry Logistics Network Ltd.

- Freight Logistics Solutions

Recent Developments

-

In March 2025, Kerry Logistics Network Limited entered into a partnership agreement with Teva to enhance pharmaceutical supply chain efficiency across the Guangdong-Hong Kong-Macao Greater Bay Area, ensuring faster, more reliable access to essential medicines for millions of patients. This collaboration strengthens regional distribution networks, streamlines logistics operations, and supports the growing demand for high-quality pharmaceutical supply chain solutions.

-

In October 2024, UPS announced to expand its healthcare logistics business through internal growth and strategic acquisitions to enhance profitability. The company aimed to reduce reliance on volatile sectors by strengthening its presence in healthcare logistics.

- In September 2023, Kuehne+Nagel announced to expand its Chicago facility further adding a new GxP-compliant area to strengthen its healthcare logistics capabilities.

Healthcare Third-party Logistics Market Report Scope

Report Attribute

Details

Market size in 2025

USD 279.85 billion

Revenue forecast in 2030

USD 406.36 billion

Growth rate

CAGR of 7.75% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Industry, supply chain, service, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Cardinal Health; DHL International GmbH; Agility; SF Express; Kinesis Medical B.V.; United Parcel Service of America, Inc.; Barrett Distribution; Cencora; DB Schenker; FedEx; KUEHNE + NAGEL; Kerry Logistics Network Ltd.; Freight Logistics Solutions

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

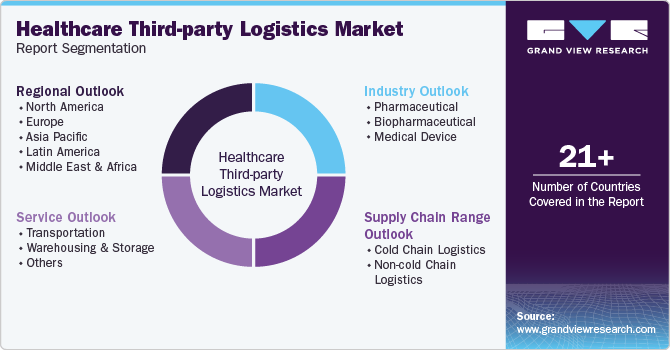

Global Healthcare Third-party Logistics Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the healthcare third-party logistics market on the basis of industry, supply chain, service type, and region.

-

Industry Outlook (Revenue, USD Million; 2018 - 2030)

-

Pharmaceutical

-

Biopharmaceutical

-

Vaccines

-

Biosimilars

-

Plasma Derived Products

-

Others

-

-

Medical Device

-

Class I

-

Class II

-

Class III

-

-

-

Supply Chain Range Outlook (Revenue, USD Million; 2018 - 2030)

-

Cold Chain Logistics

-

Non-cold Chain Logistics

-

-

Service Outlook (Revenue, USD Million; 2018 - 2030)

-

Transportation

-

Air Freight

-

Sea Freight

-

Overland

-

-

Warehousing and Storage

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global healthcare third-party logistics market size was estimated at USD 261.39 billion in 2024 and is expected to reach USD 279.85 billion in 2025.

b. The global healthcare third-party logistics market is expected to grow at a compound annual growth rate of 7.75% from 2025 to 2030 to reach USD 406.36 billion by 2030.

b. North America dominated the healthcare 3PL market with a share of 40.67% in 2024. This is attributable to the rising demand for temperature-controlled logistic services to transport biologics in various regions.

b. Some key players operating in the healthcare third-party logistics market include DHL International GmbH., SF Express, United Parcel Service of America, Inc, AmerisourceBergen Corporation, DB Schenker, Kuehne and Nagel, Kerry logistics network limited, and Agility.

b. Key factors that are driving the healthcare third-party logistics market growth include growing distribution networks of biopharmaceutical companies to improve their sales. Rising adoption of automated storage and retrieval systems in emerging countries, and the trend of shifting from small molecule drugs to biopharmaceuticals, mainly vaccines, and biologics.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.