- Home

- »

- Market Trend Reports

- »

-

Microbiome Modulation via Pre- & Probiotics: Trends and Competitive Landscape

Report Overview

Microbiome modulation through prebiotics and probiotics involves using ingredients that support the balance of beneficial microorganisms on the skin, which is influenced by gut health. Probiotics are live beneficial bacteria, while prebiotics are substances that promote their growth. When applied through creams or serums, these ingredients help maintain a healthy skin barrier, reduce inflammation, and improve overall skin health by nurturing the skin's natural microbial ecosystem.

The brand and competitive analysis report, compiled by Grand View Research, is a collection of the trends and competitive scenario in more than 20 countries. Qualitative information regarding the trends, competitive strategies, existing competition, and pipeline analysis will be provided in the report. Within the purview of the database, such information is systematically analyzed and provided in the form of outlook reports and summary presentations on individual areas of research.

Microbiome Modulation via Pre- & Probiotics: Trends And Competitive Analysis Report Scope

Attributes

Details

Areas of Research

Industry trends, market opportunity, aesthetic penetration across countries, competitive and product revenue analysis

Report Representation

Consolidated report in PDF format

Country Coverage

20+ Countries

Product Coverage

- Prebiotics

- Probiotics

Highlights of Report (Competitive & Revenue Landscape, by Product)

- Product Revenues from 2018 to 2030

- U.S. Probiotic Import and Export Data

- Product Market Share Evolution

- Consumer Behavior Analysis

- Sales Volume Vs Production Volume Per Country for Microbiome Skincare Products

- Strategic Initiatives from 2018 to 2024

Microbiome Modulation via Pre- & Probiotics: Trends and Competitive Analysis Coverage Snapshot

The rising global burden of Inflammatory Bowel Disease (IBD) drives the market's growth. According to the Springer Nature Limited article published in April 2025, Inflammatory Bowel Disease (IBD), encompassing Crohn’s disease and ulcerative colitis, affects over seven million people globally and continues to grow in prevalence. This chronic condition is closely linked to gut microbiota imbalances, crucial in triggering and sustaining intestinal inflammation. Growing scientific evidence highlights the potential of microbiome-targeted therapies, such as probiotics and prebiotics, in managing IBD by restoring microbial equilibrium and supporting immune regulation. The increasing global burden of IBD fuels the demand for microbiome modulation strategies, positioning prebiotic and probiotic products as valuable components in disease management and health maintenance.

IBD Incidence in the U.S. 2024

Metric

Value

Lifetime prevalence of IBD in Americans

>0.7%

Total Americans with IBD

2.39 million

– With Ulcerative Colitis (UC)

1.25 million

– With Crohn’s Disease (CD)

1.01 million

U.S. IBD prevalence rate

721 per 100,000 person-years

Source: Gastroenterology Advisor & GVR

U.S. Probiotic Import and Export Data

The following table presents the latest available data on U.S. probiotic imports and exports in 2024:

Metric

Value

Probiotic Exports

8,920 shipments

Probiotic Imports

2,349 shipments

Source: Volza Grow Global & GVR

Increasing R&D drives the growth of the market. According to the Gut Microbiota for Health article published in June 2024, between 2014 and 2024, scientific exploration into the gut microbiome has expanded rapidly, signaling a paradigm shift in understanding human health. Over 53,000 microbiome-related publications have been indexed in PubMed during this period, representing nearly 80% of all microbiome studies published in the past 40 years. This explosion of research highlights the increasing recognition of the microbiome’s role in influencing metabolic functions, immunity, skin health, and even mental well-being. The upward trajectory of interest reflects scientific curiosity and a growing consensus on the therapeutic potential of microbiome modulation in preventive healthcare, including cosmetics and skin care.

Introducing major international research initiatives has further strengthened momentum in this field. In 2024, programs such as the Human Microbiome Action and the World Microbiome Partnership were established to accelerate innovation and foster global collaboration. Regional projects like Le French Gut and the Integrative Human Microbiome Project (iHMP) generate crucial insights into microbial diversity and its interactions with human biology. These large-scale efforts are equipping researchers and industries, including the beauty and skincare sectors, with more profound knowledge that can be applied to product development to improve skin barrier function, reduce inflammation, and enhance overall skin health through microbiome-friendly ingredients.

Public awareness of microbiome science has grown significantly due to extensive media coverage, yet the portrayal of findings is not always scientifically balanced. Media narratives often simplify or misrepresent complex research, creating confusion around the efficacy and safety of probiotic and prebiotic products. Accurate, evidence-based communication will be essential as consumers are interested in microbiome-focused cosmetics and skincare. With rising demand for natural, health-oriented solutions, integrating microbiome research into beauty routines presents a strong opportunity, provided education and product claims remain transparent and supported by credible science.

Consumer Behavior Analysis

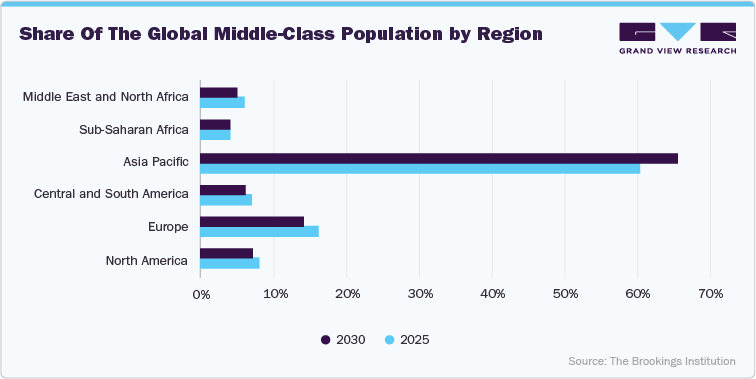

Global Middle-Class Growth: According to the European Commission's article published in 2023, the global middle-class population is expected to exceed 5 billion, according to the European Commission's 2023 report. India is projected to become the largest consumer market, while over 70% of China’s population will belong to the middle class. This significant demographic shift will increase purchasing power, especially for nonessential products like cosmetics, health supplements, and probiotics.

Increased Consumer Spending: In 2020, the global middle class accounted for USD 44 trillion, representing 68% of the world’s total consumer expenditure (Visual Capitalist, 2022). By 2030, this spending is expected to rise by 50%, reaching USD 62 trillion. This increase in spending will naturally lead to higher demand for health-focused products like prebiotics and probiotics, as more consumers prioritize wellness.

Rising Demand in Emerging Markets: Emerging markets, particularly in Asia, are witnessing a boom in middle-class populations. Southeast Asia and China are key regions where demand for products like probiotics is expected to rise due to greater awareness of gut health and immunity. Market players are already adapting by expanding production to cater to these regions, signaling a shift in focus toward the Asian middle class as a primary consumer base.

Informed and Digitally Connected Consumers: Middle-class consumers increasingly rely on social media, influencers, and digital dermatology platforms for product recommendations. The demand for transparent ingredient lists and clinical efficacy shapes the product development pipeline in microbiome-centric beauty.

Cosmetic Brands Leveraging Microbiome Claims: Consumers are drawn to brands promoting microbiome-friendly, clean-label, and pH-balanced products. There's a rising preference for fermented ingredients, natural bioactives, and symbiotic skincare (prebiotics + probiotics), perceived as gentle, effective, and aligned with healthy skin ecosystems.

Market Growth Potential: With the growing middle class, especially in Asia, there is significant potential for market growth in microbiome modulation via prebiotics and probiotics, making it a key target for companies looking to capitalize on emerging consumer behavior trends.

Middle Class Spending In USD Trillion

Consumer Group

Total Spending (2020)

Total Spending (2030P)

Upper Middle Class

18

27

Lower Middle Class

26

35

Upper Class + Poor/Vulnerable

20

29

Total

64

91

Source: Visual Capitalist article published in 2022 & GVR

Sales Volume Vs Production Volume Per Country for Microbiome Skincare Products

Sr No.

Country

Sales Volume (Million Units), 2024

Production Volume (Million Units), 2024

1

U.S.

6.49

9.1-9.3

2

Canada

1.04

0.67-0.69

3

Mexico

0.34

0.15-0.17

4

UK

1.48

1.59-1.61

5

Germany

1.70

2.10-2.12

6

France

0.77

1.07-1.09

7

Italy

0.62

0.79-0.81

8

Spain

0.55

0.65-0.67

9

Japan

2.01

3.05-3.07

10

China

2.02

1.22-1.24

11

India

1.38

1.71-1.73

12

Brazil

0.56

0.44-0.46

13

Argentina

0.20

0.10-0.12

14

South Africa

0.22

0.24-0.26

15

Saudi Arabia

0.31

0.11-0.13

Sales Volume - The sales volume is the total number (units) of microbiome skincare products sold by manufacturers in the above countries in 2024. The microbiome products considered while analyzing the sales volume are serums, creams, and others.

Production Volume - The total number of microbiome skincare products produced/manufactured in each country in 2024. We estimated the total production volume for each country by combining assumptions with data from secondary sources. This data includes the number of manufacturers, major key manufacturers' presence, manufacturing capacity, and production rates. Based on this information, we derived an overall production volume range for each country for 2024. Also, we have considered the import & export of overall skincare products to understand the trend for sales volume and production volume in each country.

Some of the key developments recorded in the microbiome modulation via pre & probiotics industry:

Companies

Year

Month

Details

L'Oréal Group

2023

December

L'Oréal acquired Lactobio, a Denmark-based leader in precision probiotics. This acquisition aims to strengthen L'Oréal's leadership in microbiome research and open new avenues for cosmetic innovation.

Unilever

2022

June

Vaseline, under Unilever, launched its Microbiome Care lotion. This prebiotic-enriched formulation aims to restore the skin's microbiome balance, enhancing its resilience and boosting beneficial microbial activity. These launches demonstrate the growing recognition of prebiotics' role in nurturing the skin's microbiome, marking a new era in skincare science.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified