- Home

- »

- Market Trend Reports

- »

-

Sterile Injectables CDMOs: Capability Analysis

Report Overview

The sterile injectables market, a critical segment within the broader pharmaceutical industry, has seen significant growth driven by the rising demand for biologics & specialty drugs, and the increasing complexity of manufacturing processes. This research will delve into the capabilities of key Contract Development and Manufacturing Organizations (CDMOs) involved in the sterile injectables space, providing a comprehensive analysis of their current dynamics, service offerings, technological advancements, and strategic positioning in the market.

The sterile injectables market is witnessing rapid expansion due to the growing adoption of injectable formulations in the treatment of chronic diseases, oncology, and specialty therapeutics. The shift toward biologics and biosimilars further drives the demand for CDMOs with specialized capabilities in aseptic processing, lyophilization, and complex formulation. Companies are continuously evolving to meet these needs by adopting innovative technologies, optimizing production efficiencies, and expanding their service portfolios. In this context, the competitive advantage lies in having the infrastructure to handle the growing complexity of drug delivery, from development through to commercialization.

The companies analyzed in this report are categorized based on their core competencies, including their service offerings, technological strengths, and market positioning. These categories provide insight into how each CDMO differentiates itself through specialized capabilities, such as end-to-end services from drug development to manufacturing, specialized delivery formats such as pre-filled syringes, vials, and cartridges, and their capacity to handle high-volume production for both clinical and commercial phases. These companies are also classified based on their geographic presence, enabling a deeper understanding of market dynamics in different regions and their respective strategic goals.

Each company’s capability is assessed across several dimensions, including development, manufacturing, quality assurance (QA), and logistics. This capability matrix highlights each organization's ability to manage both small-scale clinical trials and large-scale commercial production while adhering to the highest standards of quality and regulatory compliance. For instance, Lonza and Samsung Biologics are recognized for their robust biologics manufacturing platforms, while PCI Pharma Services excels in the flexibility of its sterile fill-finish capabilities. This matrix will allow for a comparative analysis, helping stakeholders understand how each CDMO aligns its operational strengths with market demand.

The service offering matrix focuses on the diverse range of services provided by each CDMO, from pre-clinical development to post-commercialization support. For instance, Catalent Pharma Solutions offers a comprehensive service suite that spans drug formulation, analytical testing, and aseptic fill-finish. Meanwhile, Aurigene Pharmaceutical Services focuses on custom development for biologics and specialty injectables, further underlining the growing trend toward tailor-made solutions for complex products. This matrix highlights how each company is enhancing its portfolio to cater to the shifting needs of pharmaceutical and biotech firms.

Pricing Model Analysis

The pricing models of sterile injectables CDMOs are influenced by the complexity of services offered, production volumes, and regulatory requirements. Companies such as Bora Pharmaceuticals and Delpharm leverage their economies of scale to provide competitive pricing, making them attractive partners for companies needing cost-effective solutions for large-scale production. Meanwhile, more specialized providers, such as Grifols focus on premium pricing for niche services, including highly complex fill-finish operations for biologics. This section will evaluate the different pricing strategies and how they affect market penetration and customer relationships.

Technology Landscape

Technology plays a crucial role in the sterile injectables sector, as companies invest in advanced systems to improve efficiency, ensure quality, and enhance product safety. For instance, Lubrizol Corporation continuous manufacturing processes and automated filling systems, which contribute to both cost savings and shorter production timelines. On the other hand, Emergent BioSolutions has focused on acquiring and integrating state-of-the-art technologies, such as isolator-based aseptic processing and lyophilization capabilities, to manage high-potency biologics. The technology landscape section will explore how the integration of innovative technologies is reshaping service offerings across the industry.

Company Profile:

Company Profile: Ajinomoto Bio-Pharma

Headquarter

U.S.

Year of Establishment

1909

Employee Strength

490

Company Type

Privately owned

Manufacturing Facilities Locations

- U.S.

- India

- Europe

- Japan

Regional Presence

- Americas

- Asia Pacific

- Europe

- Middle East/Africa

The company profiles section will provide an in-depth look at each of the 20 key players, including their business model, financial performance, and growth strategies. For instance, Ajinomoto Bio-Pharma has established itself as a leader in aseptic processing and high-value drug production, with a strong focus on personalized medicine. Their partnership with biotech companies has boosted their service offerings and expanded their manufacturing capabilities to accommodate more complex sterile formulations. Siegfried and Corden Pharma, through strategic investments in their sterile injectables capabilities, have significantly improved their operational scalability, making them well-positioned to handle large-scale global production demands.

Financial Performance and Market Positioning:

Financial performance is a critical indicator of a CDMO’s ability to scale operations and invest in new technologies. By analyzing the revenue streams, investment trends, and overall market share of these companies, this section will offer insights into how financial health correlates with market presence and operational capability. Companies such as Thermo Fisher Scientific are demonstrating robust financial performance through strategic acquisitions and partnerships, enabling them to diversify their service offerings and expand their manufacturing footprint.

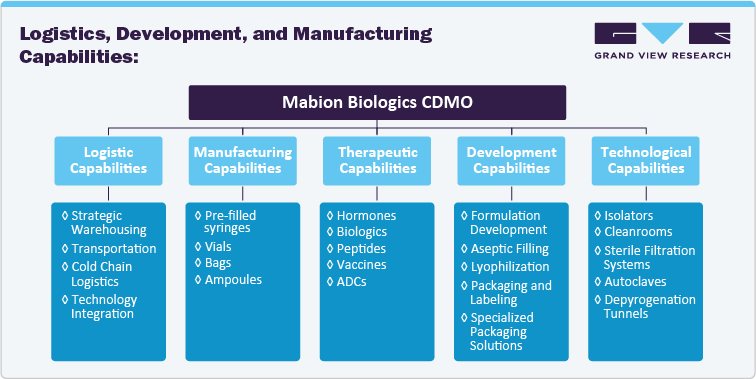

A strong logistics network is essential for CDMOs engaged in sterile injectables, as timely delivery and supply chain reliability are crucial for maintaining production schedules and meeting customer demands. This research will examine the logistics capabilities of each company, focusing on their ability to ensure consistent product delivery, both locally and globally. Additionally, each company’s development capabilities, from formulation to clinical trial management, will be assessed to understand their proficiency in handling new drug applications. Lastly, manufacturing capabilities will be scrutinized for their ability to scale, comply with regulatory standards, and meet the increasing demand for sterile injectables across various therapeutic areas.

An in-depth analysis shall be provided for below listed 20 Sterile Injectables CDMOs:

-

Ajinomoto Bio-Pharma

-

Aurigene Pharmaceutical Services

-

Bora Pharmaceuticals

-

BUSHU PHARMACEUTICALS LTD.

-

CORDEN PHARMA

-

DELPHARM

-

Emergent BioSolutions

-

Eurofins BioPharma Product Testing

-

Grifols

-

LGM Pharma

-

Lubrizol

-

Mabion

-

PCI PHARMA SERVICES

-

SIEGFRIED

-

TERUMO CORPORATION

-

Catalent Pharma Solutions

-

LONZA

-

Thermo Fisher Scientific (PATHEON)

-

SAMSUNG BIOLOGICS CO., LTD

-

TERUMO CORPORATION

Share this report with your colleague or friend.

Pricing & Purchase Options

Service Guarantee

-

Insured Buying

This report has a service guarantee. We stand by our report quality.

-

Confidentiality

We are in compliance with GDPR & CCPA norms. All interactions are confidential.

-

Custom research service

Design an exclusive study to serve your research needs.

-

24/5 Research support

Get your queries resolved from an industry expert.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified