- Home

- »

- Market Trend Reports

- »

-

U.S. Dietary Supplements Market - Consumer Behavior Analysis

Report Overview

The dietary supplements market in the U.S. is undergoing a transformation as consumers shift their focus from reactive to preventive healthcare. Driven by heightened health consciousness, lifestyle-related disorders, and growing interest in wellness, supplements are no longer just a niche category, they have become a daily essential for a wide range of American consumers. The industry, once dominated by basic vitamins and minerals, now encompasses personalized nutrition plans, clean-label products, and functional formats that blend convenience with holistic health benefits.

This report outlines key trends shaping the U.S. dietary supplements landscape in 2025. It covers emerging consumer preferences, product format innovations, demographic behavior, and attitudes toward new technologies and formulations. By examining both behavioral and market shifts, this report provides insights into how supplement brands can remain competitive in an evolving wellness ecosystem.

Consumer Demographics

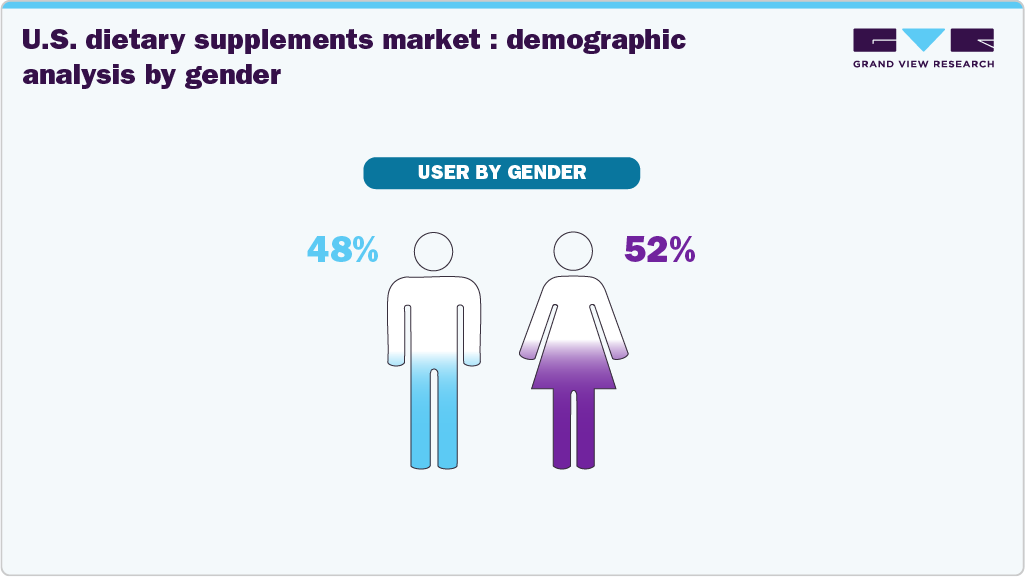

Women are more likely than men to take dietary supplements, particularly vitamins, minerals, and herbal supplements. This is likely due to the fact that women are more likely to be concerned about their health and to make dietary changes to improve their health.

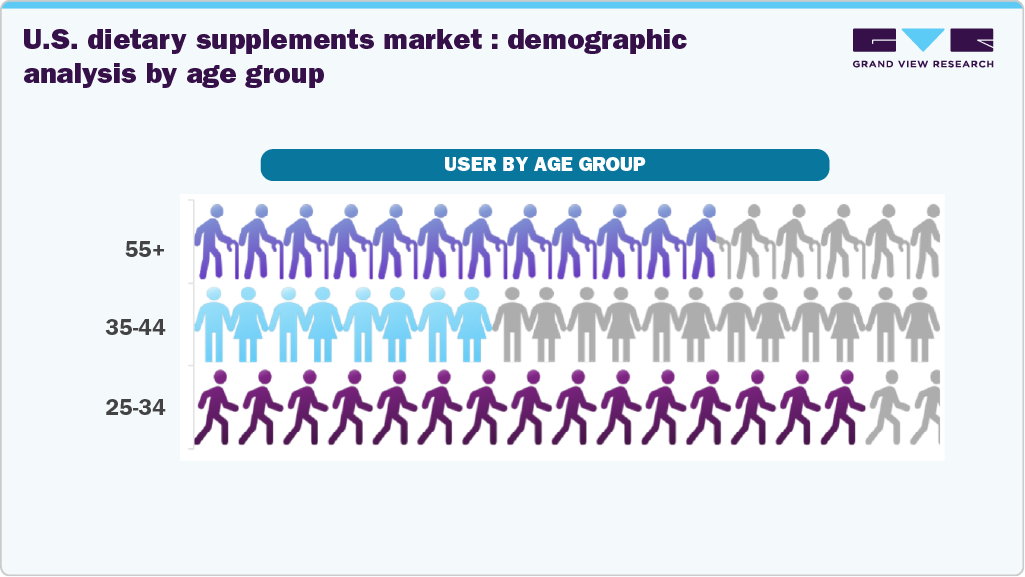

Furthermore, based on a survey conducted by the Council for Responsible Nutrition in 2023, 40% of consumers aged 55 or above consume dietary supplements. These supplements include herbs, vitamins, minerals, amino acids, botanicals, and other ingredients. In addition, consumers aged 35 to 54 are the second largest consumers of dietary supplements.

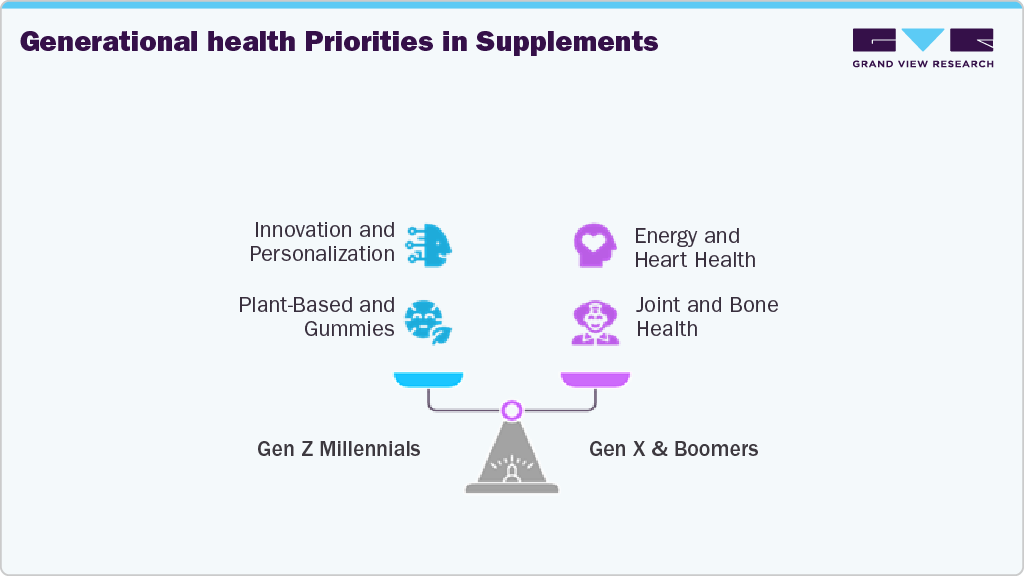

Consumer preferences vary by demographics. Gen Z and Millennials (ages 18-39) are the most open to innovation and are more likely to prefer personalized, plant-based, and gummy-format supplements. Generation X (40-54) shows a preference for energy, weight management, and heart health products.

Baby Boomers (55+) continue to drive demand for joint, bone, vision, and cognitive health supplements. Gender also plays a role-women more often consume supplements for beauty, hormonal balance, and immunity, while men show stronger interest in muscle-building, testosterone support, and sports nutrition.

Consumer Trends & Preferences

One of the defining trends in the U.S. dietary supplements market is the shift toward preventive and holistic wellness. Consumers are increasingly taking supplements to maintain general well-being rather than treat specific deficiencies. This change in mindset has been accelerated by the COVID-19 pandemic, which placed immunity and long-term health in the spotlight. Supplements targeting immune support, digestive health, cognitive function, and stress management are particularly in demand. Ingredients like vitamin D, magnesium, probiotics, ashwagandha, and elderberry have become staples in many households.

Personalized nutrition is rapidly gaining traction in the U.S. as consumers seek supplements tailored to their individual needs. Companies are using data from lifestyle surveys, DNA tests, and wearable health devices to recommend customized supplement regimens. Brands such as Care/of, Persona Nutrition, and Rootine are leading this trend by offering subscription-based, personalized packs. This approach is especially popular among younger consumers who value convenience, digital engagement, and wellness plans that align with their unique health goals.

Modern consumers expect full transparency when it comes to ingredients. There is growing demand for supplements that are non-GMO, organic, vegan, allergen-free, and sustainably sourced. Clean label certifications such as USDA Organic, NSF Certified for Sport, and Non-GMO Project Verified influence purchasing decisions. In addition, brands that openly disclose sourcing practices and perform third-party testing are earning greater consumer trust. This demand for transparency is reshaping how products are marketed and formulated.

Factors Affecting Buying Decision

Health and wellness goals, brand awareness, recommendations from healthcare providers, convenience, price, and sustainable and ethical practices are the major factors affecting consumers' buying decisions. Consumers consider these factors to varying degrees, depending on their preferences, experiences, and occasion, ultimately shaping their choices in the diverse and dynamic dietary supplements market.

Consumer Response to Innovation

Leading the innovation curve are companies like Goli Nutrition, known for apple cider vinegar and ashwagandha gummies; Ritual, which emphasizes transparency and traceable sourcing; and Thorne, offering high-performance supplements supported by clinical data. These brands have successfully captured evolving consumer expectations by blending convenience, science, and lifestyle alignment.

Innovation Type

Consumer Response

Personalized supplements

Highly positive; increases loyalty and perceived effectiveness

Sustainable packaging (compostable, refillable)

Favorable, especially among eco-conscious Gen Z and Millennials

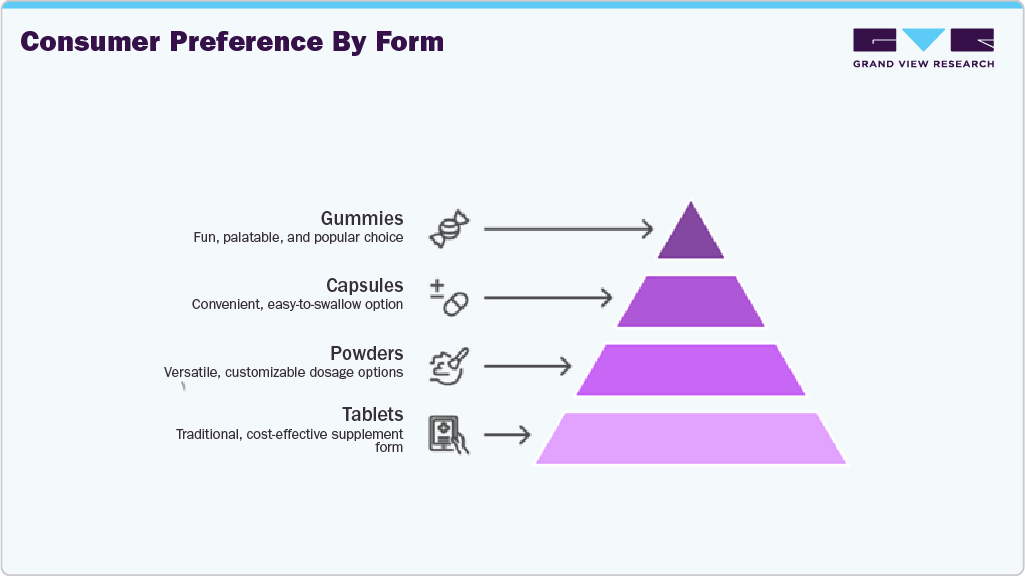

Gummy & chewable formats

Strong growth due to ease of use and taste

AI & wearable integration for supplement plans

Mixed but growing; early adopters are highly engaged

Microdosing and stackable supplements

Gaining niche popularity among biohackers and tech-savvy users

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified