- Home

- »

- Nutraceuticals & Functional Foods

- »

-

U.S. Dietary Supplements Market Size, Industry Report, 2033GVR Report cover

![U.S. Dietary Supplements Market Size, Share & Trends Report]()

U.S. Dietary Supplements Market (2026 - 2033) Size, Share & Trends Analysis Report By Ingredient (Single Ingredient, Multi-Ingredients), By Application, By End Use, By Form, By Type, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-052-0

- Number of Report Pages: 190

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Dietary Supplements Market Summary

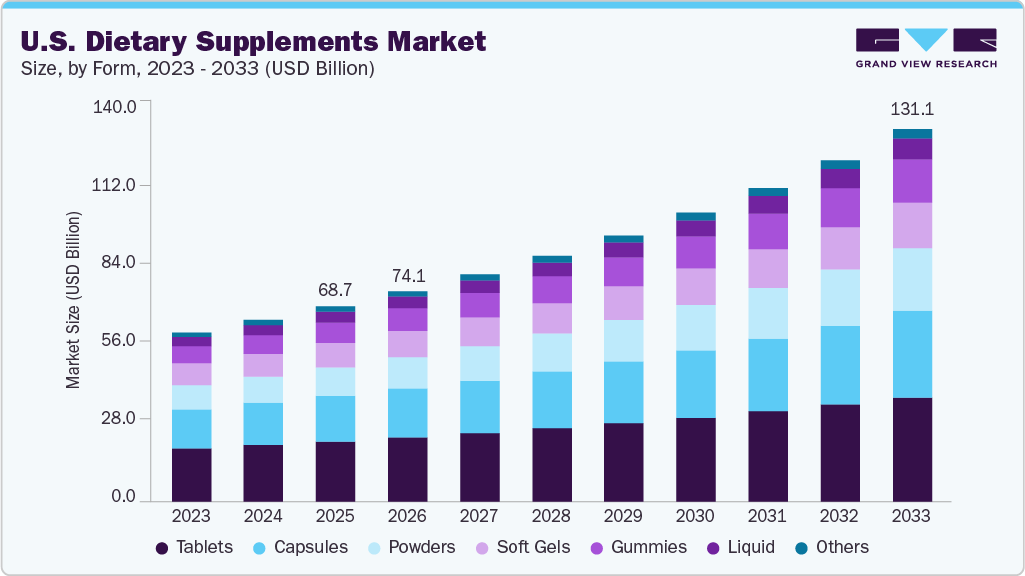

The U.S. dietary supplements market size was estimated at USD 68.74 billion in 2025 and is projected to reach USD 131.08 billion by 2033, growing at a CAGR of 8.5% from 2026 to 2033. The market is primarily driven by rising health consciousness, an aging population, an increasing prevalence of lifestyle-related conditions, and a growing focus on preventive healthcare.

Key Market Trends & Insights

- By ingredients, vitamin supplements accounted for a share of 28.1% in 2025.

- By type, Over-the-counter (OTC) dietary supplements accounted for the largest revenue share of 75.7% in 2025.

- By distribution channel, the sales of dietary supplements through offline channels accounted for a share of around 77.1% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 68.74 Billion

- 2033 Projected Market Size: USD 131.08 Billion

- CAGR (2026-2033): 8.5%

Consumers are proactively seeking ways to boost immunity, improve mental well-being, manage stress, and support overall health, especially after the COVID-19 pandemic. In addition, the popularity of fitness and wellness culture, coupled with greater access to health information through digital platforms, has empowered individuals to take control of their nutritional needs. The expansion of e-commerce, advancements in personalized nutrition, and the availability of innovative product formats like gummies and functional beverages have further fueled market growth.Nutraceuticals are active components that offer various health benefits. Owing to their safety profile, nutritional benefits, and therapeutic effects, nutraceutical products have gained recognition across the globe. They are known to provide nutrition, support therapy for treatment, prevent a wide range of diseases, and reduce side effects caused by cancer radiotherapy and chemotherapy.

Health and wellness awareness has risen significantly among consumers adopting supplements that align with their goals of staying healthy and fit. As a result, the U.S. dietary supplements industry is poised for continued expansion. Supplement brands and entrepreneurs closely monitor these shifts, identifying new product opportunities within this dynamic sector. In addition, consumers are actively seeking supplement solutions to address evolving lifestyles and cope with heightened stress levels. Consumers further believe that dietary supplements are essential and help in maintaining health. The demand for immune-boosting supplements has surged, driven by concerns about COVID-19, diabetes, and other infectious diseases. Particularly popular are supplements targeting respiratory health. In addition, the trend of stress, sleep, and mental health support has gained momentum, with consumers seeking convenient solutions to enhance mood and overall well-being. This has resulted in a demand for supplements that address these concerns.

Herbal supplements, including Ginseng, Ashwagandha, Bacopa, and Lion’s Mane, alongside ingredients such as melatonin, valerian root, glycine, and B complex vitamins, are experiencing increased popularity in the U.S. as they support cognitive health, stress relief, and better sleep.

In February 2024, the FDA launched the "Information on Select Dietary Supplement Ingredients and Other Substances," a new directory of ingredients used in dietary supplements. This directory replaces the previous Dietary Supplement Ingredient Directory released in 2023 and aims to provide the public with information on FDA commentary and actions regarding specific ingredients in dietary supplements. By providing a comprehensive directory of ingredients used in dietary supplements along with FDA commentary and actions, this initiative aims to provide consumers with valuable information to make informed choices about supplement consumption. Moreover, it underscores the FDA's commitment to ensuring the safety and proper regulation of dietary supplement ingredients, particularly focusing on new dietary ingredients. This initiative is expected to raise industry standards, promote consumer confidence, and ultimately contribute to a safer and more regulated dietary supplements industry in the U.S.

Furthermore, the pandemic resulted in inactive lifestyles, leading to increased weight gain and joint stiffness among consumers. As a result, a surge in demand for joint health products, including supplements, was observed. As consumers strive to regain fitness and vitality, adopting dietary supplements continues to rise, driving market growth. Consumers are increasingly engaging in healthy behavior, such as exercising regularly and incorporating a healthy diet, resulting in high penetration of dietary supplements.

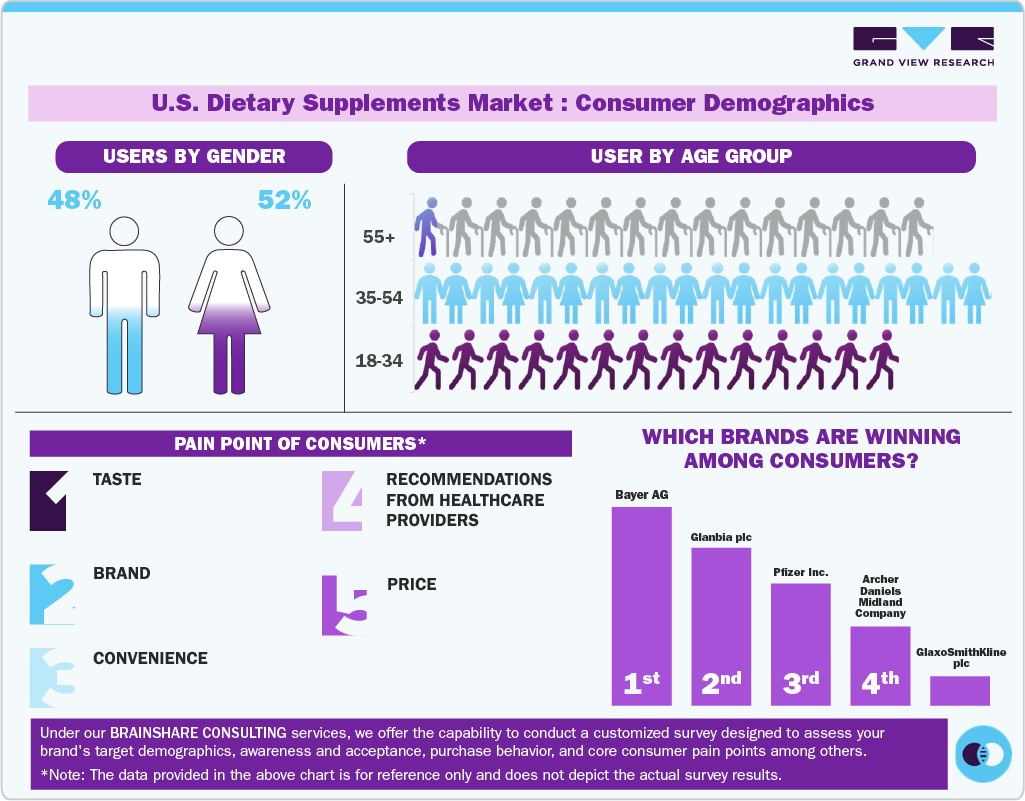

Consumer Insights

Across various demographics, there is a notable trend of seeking supplements tailored to specific wellness needs. Baby Boomers, for instance, prioritize supplements supporting bone health, memory, and cognitive function. In contrast, Millennials are drawn to products addressing concerns such as anxiety, stress, and energy levels.

Millennials approach health assessment differently from previous generations. While Baby Boomers rely on quantitative measures like BMI, weight, and blood tests, Millennials adopt a more holistic perspective. They emphasize experiential factors such as energy levels and digestive health, reflecting a broader understanding of well-being.

This holistic approach resonates with the consumption of dietary supplements. Millennials take pride in health management, attributing their purchasing decisions, such as choosing plant-based or locally sourced foods, to responsible self-care. This mindset aligns well with the market principles, driving its growth among Millennial consumers.

Various consumers seek to enhance their immune health through supplementation. This is more significant among the younger demographic, who show concern for their health and purchase a higher volume of these products despite being at a lower risk than other age groups.

Moreover, the Council for Responsible Nutrition (CRN), the primary trade association representing the dietary supplement and functional food industry, has unveiled results from a yearly survey of American adults conducted by Ipsos. Key findings from the 2023 CRN Consumer Survey on Dietary Supplements affirm the widespread acceptance of supplements and their significant role in the lives of the majority of Americans. The survey reveals that 74% of adults in the U.S. use dietary supplements, with 55% classified as “regular users.”

Furthermore, the survey reveals a growing trend in specialty supplements, with over half of the supplement users acknowledging their use of specialty supplements in the past year. Among these specialty supplements, the most favored options include omega-3s, probiotics, melatonin, and fiber.

Multivitamins continue to dominate as the most widely used type of supplement, with 70% of supplement users confirming their usage of multivitamins in the past year. In addition, there has been a notable increase in the use of sports nutrition supplements, which has risen by five percentage points to reach 39% since the previous year's survey.

Ingredient Insights

Vitamin supplements accounted for a share of 28.1% in 2025. This dominance is driven by their widespread use for general wellness, immune support, and nutritional deficiency prevention. Multivitamins, vitamin D, and vitamin C remain popular among all age groups due to their perceived role in boosting energy, immunity, and overall health.

The demand for protein & amino acids products is expected to grow at a CAGR of 12.5% from 2026 to 2033, fueled by increasing interest in fitness, muscle recovery, weight management, and active lifestyles. These supplements are especially popular among younger consumers, athletes, and gym-goers. The rise of plant-based and clean-label protein options has further expanded their appeal, attracting both fitness enthusiasts and health-conscious individuals seeking muscle support and improved performance.

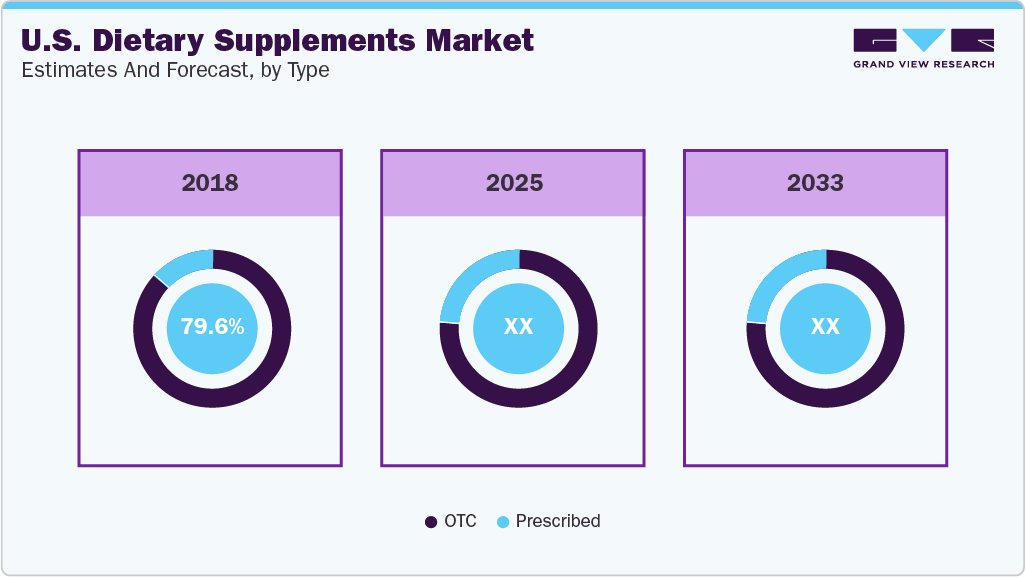

Type Insights

Over-the-counter (OTC) dietary supplements accounted for the largest revenue share of 75.7% in 2025. OTC dietary supplements are easily available in pharmacies, supermarkets, and online stores, making it convenient for consumers to purchase them without needing a prescription or a visit to a healthcare provider.

The demand for prescribed dietary supplements is projected to grow at a CAGR of 9.1% from 2026 to 2033. Prescribed dietary supplements target specific health conditions or deficiencies, ensuring patients get the exact nutrients they need in the right doses.

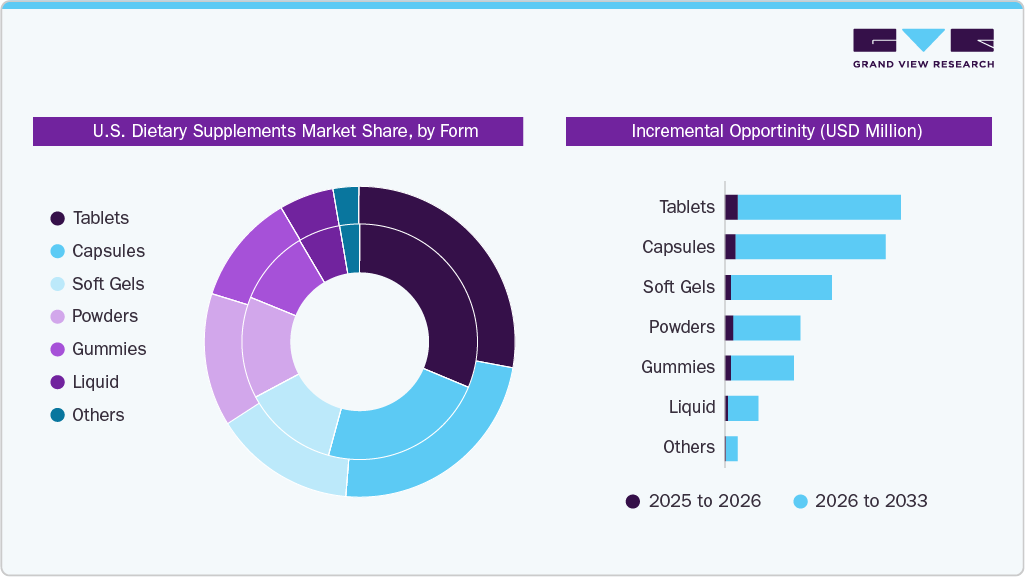

Form Insights

Tablet supplements accounted for the largest revenue share of 31.0% in 2025, reflecting their long-standing popularity, convenience, and cost-effectiveness. Tablets are easy to produce, offer a longer shelf life, and can deliver precise dosages, making them a preferred choice among manufacturers and consumers. Their familiarity and availability across retail and online platforms have helped maintain their strong market position despite the rising popularity of newer formats.

Powdered supplements are projected to grow at a CAGR of 10.2% from 2026 to 2033, driven by their versatility, faster absorption, and increasing use in fitness, wellness, and meal replacement routines. Powders can be easily mixed into drinks, smoothies, or food, making them attractive to health-conscious consumers seeking customizable and functional nutrition. This format is especially popular for protein, collagen, greens, and pre-and post-workout supplements and is gaining traction due to the clean-label and plant-based product trends.

Application Insights

Dietary supplements for immunity accounted for a share of 10.9% of the U.S. revenue in 2025 due to continued consumer focus on immune health in the post-pandemic era. Products containing vitamin C, vitamin D, zinc, elderberry, and probiotics remain in high demand as individuals prioritize protection against infections and seasonal illnesses. This segment appeals to a wide demographic, including children, adults, and the elderly, and is supported by increasing awareness of the role of micronutrients in maintaining a strong immune system.

Dietary supplements for prenatal health are projected to grow at a CAGR of 12.8% from 2026 to 2033, driven by rising awareness around maternal nutrition and fetal development. Expecting mothers increasingly turn to prenatal vitamins and supplements rich in folic acid, iron, calcium, and DHA to support a healthy pregnancy. The growth is also fueled by recommendations from healthcare providers, improved access to women’s health education, and the launch of specialized, clean-label prenatal formulations designed to meet specific nutritional needs during pregnancy.

End User Insights

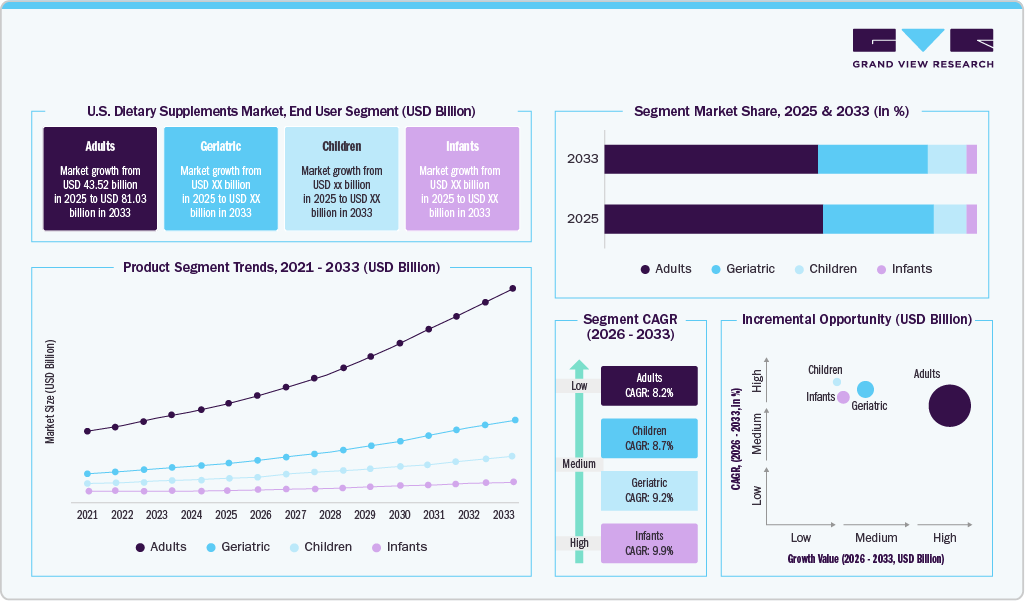

Dietary supplements for adults accounted for a share of 63.3% of the U.S. revenue in 2025. This growth is driven by increased health awareness among adults seeking to manage stress, boost immunity, improve energy, and address age-related concerns such as heart, bone, and cognitive health. The wide range of product offerings, ranging from multivitamins to specialty supplements, caters to varying lifestyles and health goals, contributing to strong demand across the adult population.

Dietary supplements for infants are projected to grow at a CAGR of 9.9% from 2026 to 2033, supported by a growing parental focus on early childhood development and nutrition. As more parents seek products that support immunity, digestion, and brain development, demand for infant-safe probiotics, vitamin D drops, and DHA supplements is rising. Pediatricians’ recommendations and increased product availability in clean-label and allergen-free formulations further fuel this segment's growth.

Distribution Channel Insights

The sales of dietary supplements through offline channels accounted for a share of around 77.1% in 2025 due to the dominance of brick-and-mortar stores such as pharmacies, supermarkets, health food stores, and specialty retailers. Many consumers prefer offline purchases for immediate access, in-person consultations, and the ability to physically examine products. Established retail presence and consumer trust in well-known chains contribute to the strong performance of this channel.

The sales of dietary supplements through online channels are projected to grow at a CAGR of 9.6% from 2026 to 2033, driven by the rising popularity of e-commerce, subscription models, and personalized nutrition services. Consumers increasingly turn to digital platforms for convenience, wider product selection, and access to detailed product information and reviews. Integrating AI-driven recommendations, loyalty programs, and targeted wellness bundles enhances the online shopping experience, particularly among younger and tech-savvy demographics.

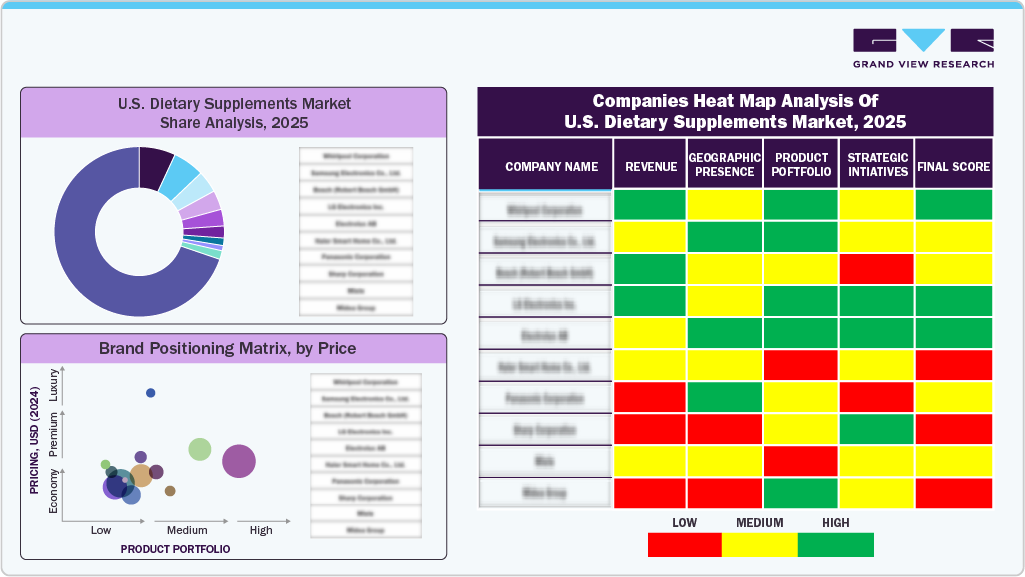

Key U.S. Dietary Supplements Companies Insights

The U.S. dietary supplements industry is becoming increasingly competitive as established companies and emerging players focus on product innovation, quality assurance, and strategic pricing to capture consumer attention and market share. Companies invest heavily in advanced manufacturing technologies, automation, and skilled workforce development to maintain high production standards, enhance operational efficiency, and comply with evolving regulatory requirements to remain competitive. This investment-intensive environment raises the entry barrier while pushing innovation forward.

Simultaneously, rising consumer awareness about chronic health conditions such as diabetes, obesity, cardiovascular disease, and micronutrient deficiencies is reshaping purchasing behavior. Consumers are now proactively seeking targeted, preventive nutrition, leading to increased demand for specialized supplement formulations. Products that are plant-based, allergen-free, organic, and tailored to specific health concerns are gaining popularity, particularly among younger, health-conscious demographics. This shift opens new opportunities for brands that align with evolving wellness trends and offer clean-label, condition-specific, and personalized nutrition solutions.

Key U.S. Dietary Supplements Companies:

- Bayer AG

- Glanbia plc

- Pfizer Inc.

- Archer Daniels Midland Company

- GlaxoSmithKline plc

- NU SKIN

- Herbalife Nutrition

- Nature’s Sunshine Products Inc.

- DuPont de Nemours Inc.

- NOW Foods

Recent Developments

-

In February 2025, Vitaboom and GetHealthy announced a strategic partnership to transform the personalized nutrition industry. By combining Vitaboom’s expertise in nutritional supplements with GetHealthy’s advanced digital health platform, the collaboration aims to deliver customized supplement recommendations and wellness plans to consumers. The partnership leverages AI-driven insights and user data to create tailored nutrition solutions, making it easier for individuals to achieve their health goals. This initiative is expected to set a new standard for personalized wellness and improve overall health outcomes for users.

-

In May 2024, Bayer launched a One A Day social media campaign featuring former NFL star Julian Edelman to combat wellness misinformation. The campaign ran across major social platforms, including Instagram, Facebook, and TikTok. Its primary objective was to inspire individuals to share honest accounts of their wellness experiences, countering the often unrealistic or pseudoscientific claims in online wellness spaces.

-

In May 2024, NOW Foods reaffirmed its commitment to independent retailers by launching 20 product sizes exclusively available for sale in brick-and-mortar stores. These specially tailored products, which include popular items like 5HTP, CoQ10, probiotics, and vitamin D, fill a niche between the typical small and large bottle quantities offered by NOW. Each product prominently features an "In store only" logo on its label.

-

In February 2024, Herbalife Nutrition unveiled a new line of food and supplement combinations, dubbed the 'GLP-1 Nutrition Companion', specifically tailored to support the nutritional needs of individuals using GLP-1 and other weight-loss medications. This innovative range features Herbalife's signature protein shake, recognized globally for its quality and effectiveness, and a carefully curated selection of other nutritional supplements.

U.S. Dietary Supplements MarketReport Scope

Report Attribute

Details

Market size value in 2026

USD 74.06 billion

Revenue forecast in 2033

USD 131.08 billion

Growth rate

CAGR of 8.5% from 2026 to 2033

Actuals

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Ingredient, form, application, end use, type, distribution channel, Product-Form, Form-End User, and Form-Application

Country scope

U.S.

Key companies profiled

Bayer AG; Glanbia plc; Pfizer Inc.; Archer Daniels Midland Company; GlaxoSmithKline plc; NU SKIN; Herbalife Nutrition; Nature’s Sunshine Products Inc.; DuPont de Nemours Inc.; NOW Foods

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Dietary Supplements Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. dietary supplements market report on the basis of ingredient, form, application, end use, type, and distribution channel.

-

Ingredient Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Form Outlook (Revenue, USD Million, 2021 - 2033)

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

OTC

-

Prescribed

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/ Hair/ Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

-

Others

-

-

End User Outlook (Revenue, USD Million, 2021 - 2033)

-

Adults

-

Millennials

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

Gen X

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

Gen Z

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

Boomers

-

Male

-

Female

-

-

Geriatric

-

Children

-

Infants

-

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Offline

-

Hypermarkets/Supermarkets

-

Pharmacies

-

Specialty Stores

-

Practioner

-

Others (Direct to Consumer, MLM)

-

-

Online

-

Amazon

-

Other Online Retail Stores

-

-

-

Ingredient-Form Outlook (Revenue, USD Million, 2021 - 2033)

-

Vitamin

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

Multivitamin

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

Vitamin A

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

Vitamin B

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

Vitamin C

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

Vitamin D

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

Vitamin K

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

Vitamin E

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

- Others

-

-

-

-

Mineral

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

Calcium

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

Potassium

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

Magnesium

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

Iron

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

Zinc

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

Others (selenium, chromium, copper)

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

-

-

Botanicals

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

Protein & amino acids

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

Collagen

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

Others

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

-

-

Fibers & Specialty Carbohydrates

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

Omega Fatty Acids

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

Probiotics

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

Prebiotics & Postbiotics

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

Others

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

-

Form-End User Outlook (Revenue, USD Million, 2021 - 2033)

-

Tablets

-

Adults

-

Millennials

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

Gen X

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

Gen Z

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

Boomers

-

Male

-

Female

-

-

Geriatric

-

Children

-

Infants

-

-

-

Capsules

-

Adults

-

Millennials

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

Gen X

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

Gen Z

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

Boomers

-

Male

-

Female

-

-

Geriatric

-

Children

-

Infants

-

-

Soft Gels

- Adults

-

Millennials

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

Gen X

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

Gen Z

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

Boomers

-

Male

-

Female

-

-

Geriatric

-

Children

-

Infants

-

-

Powders

-

Adults

-

Millennials

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

Gen X

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

Gen Z

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

Boomers

-

Male

-

Female

-

-

Geriatric

-

Children

-

Infants

-

-

Gummies

-

Adults

-

Millennials

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

Gen X

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

Gen Z

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

Boomers

-

Male

-

Female

-

-

Geriatric

-

Children

-

Infants

-

-

Liquid

-

Adults

-

Millennials

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

Gen X

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

Gen Z

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

Boomers

-

Male

-

Female

-

-

Geriatric

-

Children

-

Infants

-

-

Others

-

Adults

-

Millennials

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

Gen X

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

Gen Z

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

Boomers

-

Male

-

Female

-

-

Geriatric

-

Children

-

Infants

-

-

-

Form-Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Tablets

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/ Hair/ Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

-

Others

-

-

Capsules

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/ Hair/ Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

-

Others

-

-

Soft Gel

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/ Hair/ Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

-

Others

-

-

Powder

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/ Hair/ Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

-

Others

-

-

Gummies

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/ Hair/ Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

-

Others

-

-

Liquid

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/ Hair/ Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

- Others

-

-

Others

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/ Hair/ Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

-

Others

-

-

Frequently Asked Questions About This Report

b. The U.S. dietary supplements market is worth USD 63.92 billion in 2024 and is projected to reach USD 68.74 billion in 2025

b. The U.S. dietary supplements market is expected to grow at a compound annual growth rate of 7.7% from 2025 to 2033 to reach USD 124.22 billion by 2033

b. Vitamin supplements accounted for a share of 37.5% of the U.S. revenues in 2024. This dominance is driven by their widespread use for general wellness, immune support, and nutritional deficiency prevention. Multivitamins, vitamin D, and vitamin C remain popular among all age groups due to their perceived role in boosting energy, immunity, and overall health.

b. Some of the key market players in the U.S. dietary supplements market are Amway, Abbott, Bayer AG, Glanbia plc, Pfizer Inc., GlaxoSmithKline plc., NU SKIN, and NOW Foods.

b. Key factors that are driving the dietary supplements market growth in the U.S. are increasing geriatric population, increasing consumer awareness regarding nutrition, health & wellness and increasing demand for sports nutritional supplements

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.