- Home

- »

- Reports

- »

-

Courier, Express, & Parcel Services Category Report, 2030

![Courier, Express, & Parcel Services Category Report, 2030]()

Courier, Express, and Parcel Services Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Published Date: Aug, 2023

- Base Year for Estimate: 2022

- Report ID: GVR-P-10527

- Format: Electronic (PDF)

- Historical Data: 2020 - 2021

- Number of Pages: 60

Courier, Express, and Parcel Services Category Overview

“The Courier, Express, and Parcel Services category’s growth is driven by the rising e-commerce industry, increasing urbanization, growing consumers’ expenditure, and development of cross-border trade channels.”

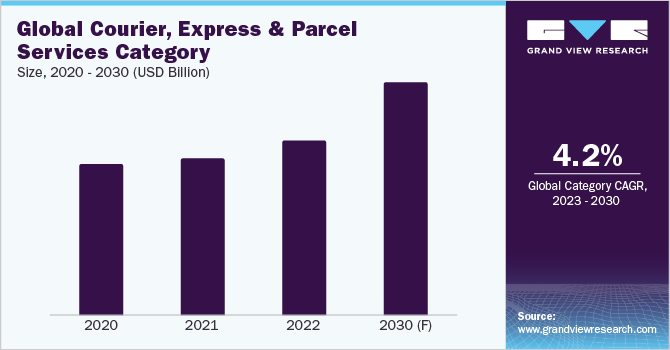

The courier, express, and parcel services category is expected to grow at a CAGR of 4.2% from 2023 to 2030. This category is growing rapidly due to a number of factors. The development of the e-commerce industry is one of the main drivers of the growth. As more and more people shop online, there is a growing need for CEP services to deliver goods quickly and efficiently. This is leading to an increase in demand for same-day and next-day delivery services. Additionally, the rise in trade-related agreements is also driving growth in the category. As more countries enter into trade agreements, there is an increase in the volume of goods being traded internationally. This requires category providers to offer reliable and efficient services to meet the needs of businesses and consumers.

This category size was valued at USD 428.91 billion in 2023. This category is also benefiting from technological advancements which include the use of digital technologies and crowd-sourced delivery models. For example,

-

In June 2022, A partnership between DHL Parcel UK and the e-commerce returns-focused technology platform ZigZag was announced. Through this collaboration, DHL's Just Right Returns service, which offers quick, convenient, and high-quality returns solutions, is now available to ZigZag's network of more than 100 stores, including Selfridges, GAP, and Superdry.

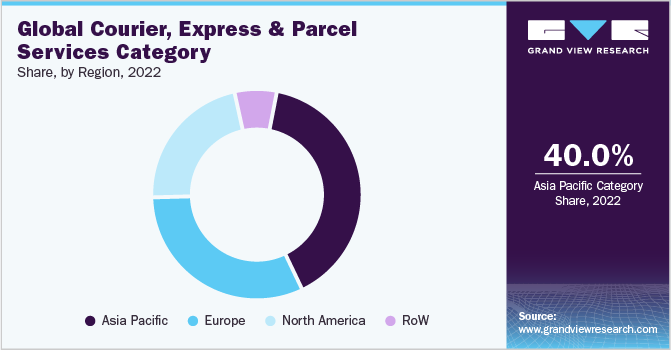

The North American courier, express, and parcel category is expected to continue to grow at a faster pace than other regions due to several factors, including strong economic growth, rising e-commerce sales, and increasing demand for faster and more reliable delivery services. Technological advancements by the key category players in the region, such as the use of self-driving trucks, and government initiatives, such as the construction of new logistics hubs, are also expected to drive category growth.

This category is growing rapidly due to the rise of globalization. Globalization has led to an increase in trade-related activities, which has created a need for reliable and efficient delivery services. Courier, express, and parcel services are essential for businesses and consumers who need to transport goods quickly and safely across borders. The development of the overseas market is also a key factor driving the growth of this category. This is because businesses and consumers in developing countries are increasingly demanding access to a wider range of products and services. The services in this category make it possible to deliver goods quickly and affordably to customers all over the world.

Supplier Intelligence

“How is the nature of the Courier, Express, and Parcel Services category? What are the initiatives taken by the suppliers in this category?”

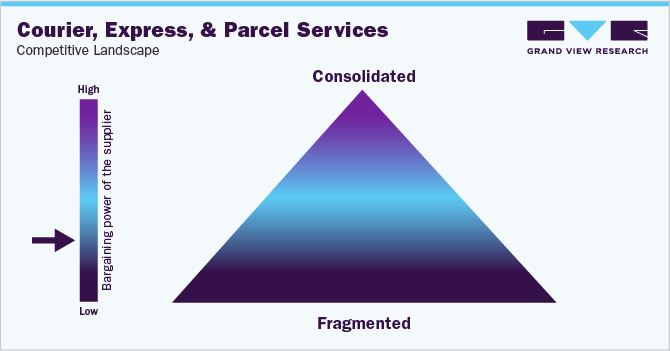

This category is highly competitive and fragmented. It is being driven by the expansion of e-commerce, which has raised demand for prompt and dependable delivery services. Businesses in this category are attempting both inorganic and organic growth to expand their geographic reach, service offerings, and product offerings. A regional logistics network is being built by international firms through strategic investments like the creation of new distribution centers, mergers, and intelligent warehouses. Multinational corporations with relatively well-developed infrastructure offer fierce competition for small- and medium-sized businesses.

-

In November 2022, DHL Supply Chain, the world's leading contract logistics provider, announced the development of a carbon-neutral real estate portfolio of 400,000 square meters. The portfolio is designed to support the growth requirements of DHL's customers across six European Tier 1 markets as well as meet the company's sustainable goals.

-

In June 2022, BrightDrop, a technology startup from General Motors (GM) that is decarbonizing last-mile delivery, delivered FedEx Corp. its first 150 electric delivery trucks. This is a big deal for FedEx since by 2040 the business wants to have an all-electric, zero-emissions fleet for parcel pickup and delivery (PUD).

-

In April 2021, Deutsche Post DHL Group, partnered with Unicargas, a leading logistics company in Africa, to expand its presence in the continent. The partnership will allow DHL GF to offer a wider range of services to its customers in Africa, including air and ocean freight, road transportation, and warehousing. It will also help DHL GF to better meet the needs of its customers in the growing e-commerce market in Africa.

Key suppliers covered in the category:

-

A1 Express Delivery Service Inc

-

Aramex International LLC

-

Deutsche Post DHL Group

-

DTDC Express Ltd

-

FedEx Corp.

-

SF Express (Group) Co. Ltd

-

Poste Italiane SpA

-

Qantas Courier Limited

-

United Parcel Service Inc.

-

SG Holdings Co. Ltd.

Pricing and Cost Intelligence

“What are some of the major cost components in courier, express, and parcel services? Which factors impact the cost for this category?”

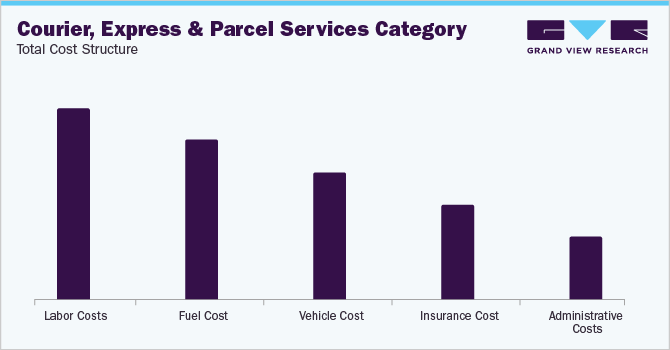

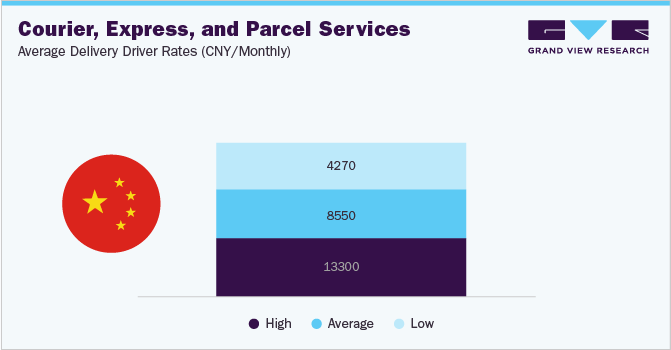

The major cost components in this category are fuel cost, labor cost, vehicle cost, insurance cost, and administrative costs. Fuel costs account for 25% of the total cost, as couriers and delivery drivers often travel long distances, and the cost of fuel can vary by region. Labor costs account for 30%, as drivers are crucial assets to the industry. Vehicle costs account for 20%, as vehicles are a prerequisite to transport goods, and the cost of vehicles varies depending on the type and size of the fleet. Insurance costs account for 15%, as companies insure the drivers, as well as high-value products which can be used during any untoward incidents, and administrative costs, account for 10%, as they need to complete tasks like billing, customer service, and marketing.

The following chart provides various costs incurred in this category. The major cost heads are shown below:

The price of this category varies based on factors such as distance, weight, pack, delivery time, security requirements, and seasonality. Price is also impacted by package size, with larger boxes being more expensive. While security measures, including special handling or insurance, raises the price, delivery times also lengthen with speed. Due to the increasing demand during peak seasons like the holiday season, seasonality also has an impact on shipping charges. In densely populated urban areas, courier services may be more competitive due to higher demand and better logistics infrastructure. In remote or less-developed regions, transportation costs may be higher. Courier prices vary by region, with domestic services in the US ranging from $10 to $30, while international shipments can be around $50 to $150. In Europe, countries like Germany have competitive rates due to well-developed infrastructure, while shipping rates in Asia may differ between countries like Japan and India due to logistics challenges. When comparing quotations from several firms, it is imperative to take all considerations into account.

Sourcing Intelligence

“Which countries are the leading sourcing destination for courier, express, and parcel services?”

China, Japan, and the U.S. are the largest regions in the global courier, express, and parcel services category. China's dominance as a sourcing destination for this category is due to its large and growing manufacturing sector, strategic location in the center of Asia, infrastructure development, and government policies. China's infrastructure, including roads, railways, and airports, has made it easier and faster to ship goods within and to other parts of the world. China is a promising location for courier, express, and parcel services due to government initiatives like tax exemptions, subsidies, and preferential loans that stimulate the growth of the sector.

-

In March 2022, Chinese e-commerce giant Alibaba announced that it had partnered with DHL Express to launch a new express delivery service called "AliExpress Standard Shipping." The service offers door-to-door delivery of goods from China to over 100 countries around the world within 15 days.

Full services outsourcing (FSO) is a comprehensive model where a service provider handles all aspects of the courier, express, and parcel (CEP) shipping process, from pickup to final delivery. This model offers convenience for businesses, as it offloads logistics management complexities to a specialized provider, allowing them to focus on core competencies without diverting resources. CEP providers handle warehousing, inventory management, order processing, and distribution by ensuring timely pickups, tailored shipping options, and last-mile delivery. They also handle unforeseen transit challenges and are well-equipped to handle them. Despite its high costs, full services outsourcing offers numerous benefits for small and medium-sized businesses, startups, and limited resources. By outsourcing shipping tasks to professionals, businesses can improve operational efficiency, and customer satisfaction, and negotiate competitive shipping rates.

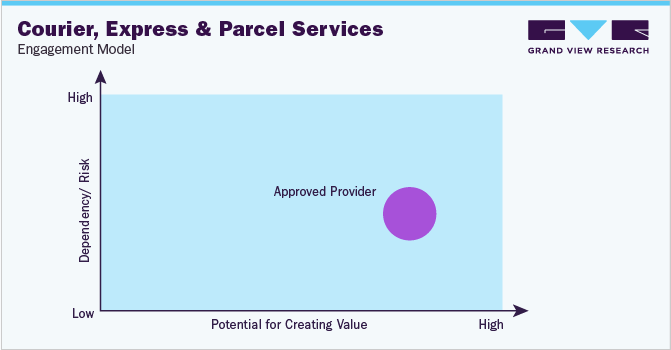

In terms of the courier, express, and parcel category sourcing intelligence, the approved provider model is widely adopted by businesses with moderate shipping volumes and specific service requirements. The CEP (Courier, Express, and Parcel) provider offers a well-defined selection of approved services at pre-established rates, allowing businesses to tailor their shipping solutions to their unique demands. This model provides access to diverse services like next-day delivery, shipment tracking, and insurance coverage by ensuring timely and secure deliveries to customers. The category provider acts as a reliable partner by customizing shipping solutions to meet business needs, fostering operational efficiency and customer satisfaction. This streamlined approach simplifies logistics and establishes a strong foundation for a successful and sustainable shipping strategy. Overall, the approved provider model is favored by businesses seeking specialized shipping services without managing multiple providers, facilitating seamless collaboration between businesses and CEP providers, optimizing shipping processes, and enhancing the overall customer experience.

The report also provides details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis.

Courier, Express, and Parcel Services Procurement Intelligence Report Scope

Report Attribute

Details

Courier, Express, and Parcel Services Category Growth Rate

CAGR of 4.2% from 2023 to 2030

Base Year for Estimation

2022

Pricing Growth Outlook

3% - 4% (Annually)

Pricing Models

Value-based pricing, volume-based pricing

Supplier Selection Scope

Cost and pricing, past engagements, geographical presence

Supplier Selection Criteria

Pricing, network, technology, customer service, flexibility, and security

Report Coverage

Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Key Companies Profiled

A1 Express Delivery Service Inc, Aramex International LLC, Deutsche Post DHL Group, DTDC Express Ltd, FedEx Corp., SF Express (Group) Co. Ltd, Poste Italiane SpA, Qantas, Courier Limited, United Parcel Service Inc., SG Holdings Co. Ltd.

Regional Scope

Global

Historical Data

2020 - 2021

Revenue Forecast in 2030

USD 596.09 billion

Quantitative Units

Revenue in USD billion and CAGR from 2023 to 2030

Customization Scope

Up to 48 hours of customization free with every report.

Pricing and Purchase Options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Frequently Asked Questions About This Report

What is the size and the estimated growth rate of the courier, express and parcel services category?b. The global courier, express and parcel services category size was valued at approximately USD 428.91 billion in 2023 and is estimated to witness a CAGR of 4.2% from 2023 to 2030.

b. The rising of e-commerce industry, increasing urbanization and growing consumers’ expenditure, development of cross-border trade channels and technological advancement are driving the growth of the category.

b. According to the LCC/BCC sourcing analysis China, Japan and U.S are the ideal destinations for sourcing courier, express and parcel services.

b. The courier, express and parcel services category is fragmented and highly competitive. Some of the major suppliers are A1 Express Delivery Service Inc, Aramex International LLC, Deutsche Post DHL Group, DTDC Express Ltd, FedEx Corp., SF Express (Group) Co. Ltd, Poste Italiane SpA, Qantas, Courier Limited, United Parcel Service Inc., SG Holdings Co. Ltd.

b. Fuel costs, labor costs, vehicle costs, insurance costs, and administrative costs are some of the cost components associated with this category.

b. Supplier analysis, engaging in strategic partnerships, considering global suppliers, employing responsible sourcing practices, implementing risk management strategies, continuously monitoring and evaluating suppliers' performance are the best sourcing practices considered in the courier, express and parcel services category.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself...

Add-on Services

Should Cost Analysis

Component wise cost break down for better negotiation for the client, highlights the key cost drivers in the market with future price fluctuation for different materials (e.g.: steel, aluminum, etc.) used in the production process

Rate Benchmarking

Offering cost transparency for different products / services procured by the client. A typical report involves 2-3 case scenarios helping clients to select the best suited engagement with the supplier

Salary Benchmarking

Determining and forecasting salaries for specific skill set labor to make decision on outsourcing vs in-house.

Supplier Newsletter

A typical newsletter study by capturing latest information for specific suppliers related to: M&As, technological innovations, expansion, litigations, bankruptcy etc.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified