- Home

- »

- Reports

- »

-

Insurance Services Procurement Intelligence Report, 2030

![Insurance Services Procurement Intelligence Report, 2030]()

Insurance Services Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Published Date: Oct, 2023

- Base Year for Estimate: 2022

- Report ID: GVR-P-10555

- Format: Electronic (PDF)

- Historical Data: 2020 - 2021

- Number of Pages: 60

Insurance Services Category Overview

“Rising automation and AI for faster claims and increasing focus on personalized premium is accelerating the growth of insurance services category.”

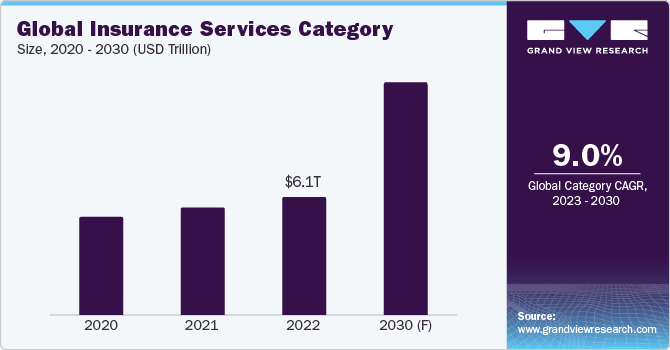

The insurance services category is expected to grow at a CAGR of 9.0% from 2023 to 2030. The rising automation such as the Digital First business model, Artificial Intelligence (AI), and collaboration between traditional insurance and InsurTech firms is transforming the sector. Instead of one-size-fits-all products, customers prefer personalized coverage. Additionally, with usage-based coverage, insurers are leveraging machine learning, advanced analytics, and the Internet of Things (IoT) to develop more accurate individual risk profiles.

The global insurance services category size was estimated at USD 6,130.04 billion in 2022. Blockchain technology helps ensure secure data management across various interfaces and participants without compromising data integrity. It can be applied to various aspects of policy management, including identity verification, underwriting, claims processing, fraud detection, and maintaining reliable data accessibility. This technology also brings about cost savings in operations. Blockchain introduces additional advantages like Decentralized Autonomous Organizations (DAOs) and smart contracts in policy management.

Artificial intelligence has changed the category, driven by newer data channels, advanced AI algorithms, and better data processing. AI can help leverage large amounts of consumer data and create personalized experiences based on consumer habits. Additionally, AI can expedite the processing of claims and underwriting procedures. AI tools minimize data retrieval times, resulting in shorter reporting periods, and they streamline payment procedures, accelerating disbursements through automated estimation and inspection processes. Speed in payment processing is emerging as a pivotal factor setting insurance companies apart. The swifter resolution of claims translates to greater customer satisfaction.

For instance, Lemonade, an InsurTech firm that incorporates AI and behavioral economics at the heart of its business strategy. AI, for instance, streamlines the process by eliminating the need for intermediaries and paperwork, while its behavioral economics features serve to mitigate fraud such as fake claims, resulting in decreased time, resources, and expenses. In June 2023, Lemonade broke the record by settling insurance claims through machine learning and AI within two seconds.

Premiums are anticipated to undergo a significant transformation, becoming increasingly tailored by emerging sources of technology-driven data like the Internet of Things, mobile-based InsurTech applications, and wearable devices. As the connected devices industry is expected to experience substantial growth in the coming five years, Property and Casualty (P&C) service providers will gain the ability to access real-time and precise information about individual consumers' risk exposure. This newfound capability will empower them to take proactive measures and offer highly personalized solutions promptly.

Insurance industry dynamics are transforming through the adoption of insurance software solutions and the evolution of insurance analytics trends. While certain trends have already found their footing, they are progressively becoming standard across the industry. Most insurers must explore and incorporate one or more InsurTech trends to maintain a competitive edge.

Supplier Intelligence

“What are the characteristics of the insurance services category?”

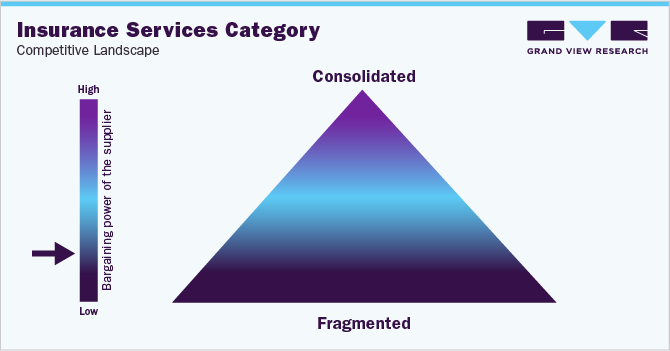

The global insurance services category is fragmented. Companies rely on reinsurance companies to manage their risk exposure. The bargaining power of reinsurance companies can impact the profitability of service providers. For instance, in health and auto insurance, healthcare providers and automotive repair shops have some bargaining power in negotiating reimbursement rates and fees.

The insurance industry is highly competitive, with numerous companies vying for market share. Competition often centers on price, customer service, and product innovation. Companies may seek to differentiate themselves by offering unique coverage options, bundling services, or providing superior customer experiences. Companies not only compete with each other but also with the government authorities, self-insurance, and risk retention groups. For instance, government authorities provide coverage for the risk that companies are not willing or cannot cover such as earthquakes, hurricanes, and floods. Many large organizations and businesses offer self-insurance to their employee as benefits, which further increases the competition among the companies.

Key suppliers covered in the category:

-

Allianz

-

Manulife

-

Cigna

-

Humana

-

AXA Insurance Company

-

MetLife

-

Zurich Insurance Company

-

State Farm

-

Nippon Life Insurance Company

-

Generali Group

Pricing and Cost Intelligence

“What are some of the major cost components in insurance services? How are these components impacting the category?”

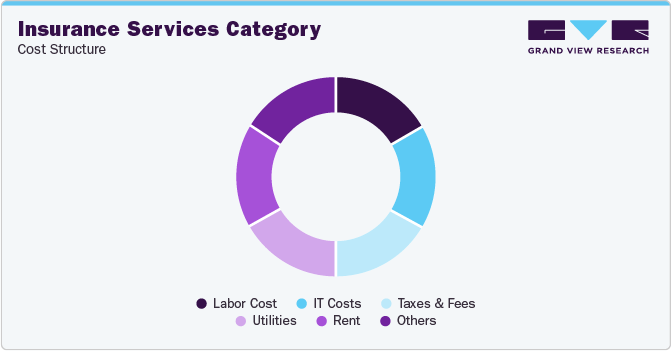

Labor costs, IT costs, taxes & fees, utilities, and rent, among others, are some of the cost components incurred in providing category services. Taxes, fees, utilities, rent which are a part of general and administrative expenses account for around 30% of the operating cost. For property and casualty insurers, operations such as policy management, and claims account for 40%, and for life insurers, it accounts for 20% of the cost.

Insurance service providers also incur underwriting activity expenses such as loss payments arising from claims, and loss adjustment expenses. Loss payments arising from claims account for a major expense. For P&C insurers it accounts for 70% - 80% of their total costs. Loss adjustment costs are the funds required for investigating a specific loss within a claim, such as in the case of property insurance claims. In these instances, a claims representative is tasked with identifying the root cause of the loss and assessing whether it falls within the policy's coverage. If the loss is deemed eligible, the claims representative must then ascertain the amount covered.

The table below indicates the cost breakdown of some common types of insurance for small business owners:

Cost Breakdown of some common types of insurance for small business owners (Example)

Type of Policy

Average Monthly Cost (USD)

Average Annual Cost (USD)

General Liability Insurance

30

360

Commerical Property Insurance

63

756

Inland Marine Insurance

14

169

Cyber Liability Insurance

-

-

Business Interruption Insurance

-

-

Workers Compensation

-

-

Total Average Cost

340.75

4,090

In the short term, there can be an increase in IT development costs due to essential investments in new digital services, the digitization of internal and back-office operations, modernizing the platform, and enhancing IT security measures. By digitalization of the process, claim-processing time can be reduced by 50% - 90%, and processing costs by 40% - 50%, which will simultaneously improve customer service.

In 2022, the average price of individual health insurance in the U.S. was USD 560 per month for a 40-year-old. Similarly, the average price of full coverage car insurance can cost USD 1,780 per year. In 2022, China’s average health insurance premiums for individuals were around USD 5,274, and for families, premiums were around USD 16,241.

The report provides a detailed analysis of the cost structure of insurance services and the pricing models adopted by prominent suppliers in this category.

Sourcing Intelligence

“What are some of the best sourcing practices considered for insurance services?”

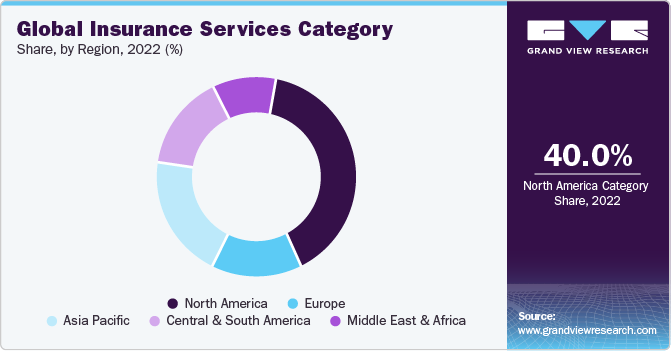

North America dominated the insurance services category in 2022. According to the S&P Global report, the U.S. P&C insurers recorded the lowest expense ratio in five years in 2021. Additionally, according to annuity.org report around 50% of Americans do not have life insurance coverage as of 2022. However, the rising awareness about the importance of life coverage in recent times is indirectly expected to fuel the growth of the category in the future.

In North America, Mexico is the most affordable country due to its healthcare facility. The government of Mexico runs various healthcare programs such as INSABI, which is free and intended for low-income Mexican people who do not have health coverage.

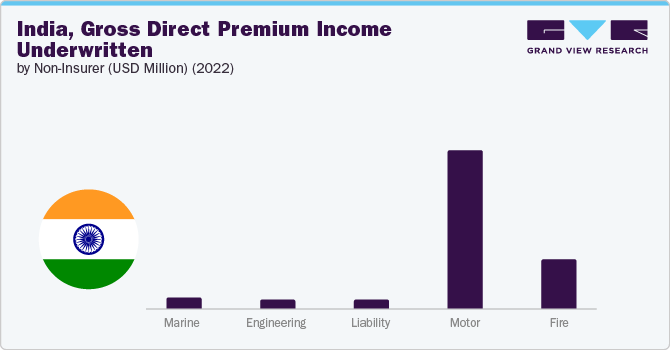

India’s insurance sector is one of the premium sectors, which is experiencing upward growth. According to the IBEF 2023 report, India is the fifth largest life insurance sector in the world, increasing at the rate of 32% - 34% every year. In 2022, the industry has gone through various transformations such as changes in regulation, and new developments that have opened new avenues of growth for the industry in the country.

Japanese companies suffer lower technological improvements in insurance as compared to the U.S., Germany, and China. According to Japan’s Ministry of Internal Affairs and Communications (MIC) 2022 report, 30% of Japanese companies have not achieved digitization benefits. Insurers in the country face higher operating expenses due to inefficiencies in their operations and business processes. Paper-based workflows along with manual intervention dominate the process. With the digitization of the process in the coming years, the category is anticipated to boost in the country.

The Philippines, being a low-cost economy, is one of the best destinations to outsource services. According to a micro-sourcing report, outsourcing to the Philippines could save cost by up to 70% as the country puts high-qualified talent in the team.

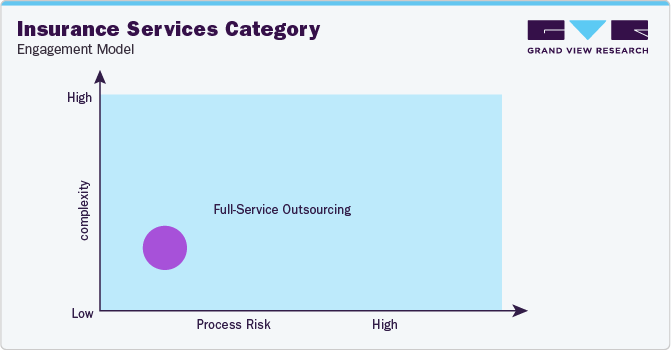

“The full services outsourcing model envisages the client outsourcing the complete operations/manufacturing to single or multiple companies”

In terms of insurance service sourcing intelligence, businesses usually seek to outsource the services as it gives them benefits in various aspects such as cost saving, specialized skills & expertise, and improved focus on core business. From providing various services such as billing, claim management, customer relationship management, and fraud detection, service providers take care of all aspects with skilled manpower, resources, and best-in-class infrastructure. When outsourcing the category, it is important to evaluate the service provider and analyze whether the service provider is reliable enough to meet business standards. Evaluating service providers based on the type of service provided, offering technical support round the clock, quick claim settlement, complying with rules and regulations, and customer service.

An approved provider model is the most common form of the operating model due to its potential for higher value creation. In this model, the service provider must comply with rules and regulations such as the California Insurance Code, California Insurance Regulations, and other laws depending on the country. The California Code of Regulations Title 10, chapter 5 outlines fair claim settlement practices regulations.

The report also provides details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis.

Insurance Services Procurement Intelligence Report Scope

Report Attribute

Details

Insurance Services Category Growth Rate

CAGR of 9.0% from 2023 to 2030

Base Year for Estimation

2022

Pricing Growth Outlook

2% - 3% (Annually)

Pricing Models

Insurance type-based pricing, service-based pricing, competition-based pricing

Supplier Selection Scope

Types of insurance, coverage options, end-to-end service, customization, cost and pricing, compliance, service reliability, and scalability

Supplier Selection Criteria

Types of insurance offered, policyholder information transparency, claims handled by the supplier, claim processing time, coverage options offered, global reach, customization option, services offered, track record and reputation, regulatory compliance, and others

Report Coverage

Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Key Companies Profiled

Allianz, Manulife, Cigna, Humana, AXA Insurance Company, MetLife, Zurich Insurance Company, State Farm, Nippon Life Insurance Company, Generali Group

Regional Scope

Global

Historical Data

2020 - 2021

Revenue Forecast in 2030

USD 12,214.5 billion

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Customization Scope

Up to 48 hours of customization free with every report.

Pricing and Purchase Options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Frequently Asked Questions About This Report

b. The global insurance services category size was valued at approximately USD 6,130.04 billion in 2022 and is estimated to witness a CAGR of 9.0% from 2023 to 2030.

b. Rising awareness of risk management, regulatory requirements, evolving customer needs, technological advancement, and emerging risks such as climate change and cybersecurity threats are driving the growth of the category.

b. According to the LCC/BCC sourcing analysis India, Philippines, and Malaysia are the ideal destinations for sourcing insurance services.

b. This category is fragmented with the presence of numerous players competing for market share. Some of the key players are Allianz, Manulife, Cigna, Humana, AXA Insurance Company, MetLife, Zurich Insurance Company, State Farm, Nippon Life Insurance Company, and Generali Group

b. Labor costs, IT costs, taxes & fees, utilities, rent, and others are some of the key cost components of this category.

b. Looking for suppliers offering various types of insurance, and customization facilities, while procuring insurance services buyers usually look for suppliers that take less time for claim processing, keep transparency in the policy information, offer value-added services and continuous customer support, purchasing from low-cost nations, and selecting suppliers that adhere to thorough standards and assurance practices are some of the best practices.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself...

Add-on Services

Should Cost Analysis

Component wise cost break down for better negotiation for the client, highlights the key cost drivers in the market with future price fluctuation for different materials (e.g.: steel, aluminum, etc.) used in the production process

Rate Benchmarking

Offering cost transparency for different products / services procured by the client. A typical report involves 2-3 case scenarios helping clients to select the best suited engagement with the supplier

Salary Benchmarking

Determining and forecasting salaries for specific skill set labor to make decision on outsourcing vs in-house.

Supplier Newsletter

A typical newsletter study by capturing latest information for specific suppliers related to: M&As, technological innovations, expansion, litigations, bankruptcy etc.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified