- Home

- »

- Reports

- »

-

Data Center Hosting & Storage Services Category Report, 2030

![Data Center Hosting & Storage Services Category Report, 2030]()

Data Center Hosting & Storage Services Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Published Date: Aug, 2023

- Base Year for Estimate: 2022

- Report ID: GVR-P-10531

- Format: Electronic (PDF)

- Historical Data: 2020 - 2021

- Number of Pages: 60

Data Center Hosting & Storage Services Category Overview

“Data centers, as an essential facility underlying the digital economy, play an important role in offering new AI technologies to consumers and enterprises.”

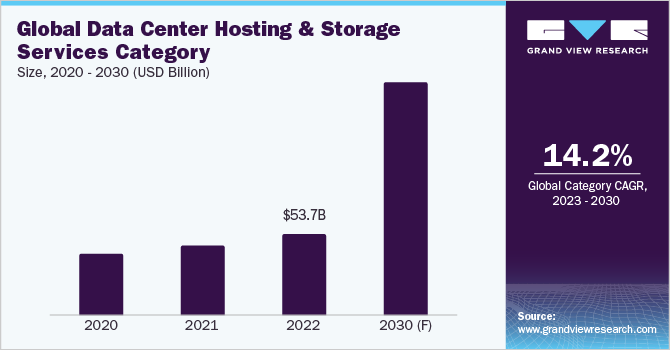

The data center hosting & storage services category is expected to grow at a CAGR of 14.2% from 2023 to 2030. In the growing virtual world with more and more users connected to the internet, a large amount of data is received and transmitted, increasing the need for fast communication lines and data transmission technologies. This is where data center hosting takes place by providing managed hosting or cloud services. Modern technology allows more users and apps to run on a single blade. Large, medium, and small businesses demand high-power, wider communication channels with productive solutions making the category role increasingly important. Companies of all sizes prefer third-party apps for the deployment of their IT infrastructure, to create their own data center.

The global data center hosting and storage services category size was valued at USD 53.70 billion in 2022. Companies and clouds can offer users services and data center solutions in a variety of ways to consume and deliver IT, all from the same infrastructure. Based on workload demands, the options that can be selected include infrastructure as a service (IaaS), platform as a service (PaaS), and software as a service (SaaS). These services can be made available in a private data center, or through cloud computing in a private, public, hybrid, or multi-cloud environment. The facility is supplied by the data center hosting provider with power supplies and other essentials for operation. The provider can allocate unique resources for each client or use a common infrastructure. Following then, clients can access these resources through a network or the internet.

Data is business in the 21st century, any small or big development in the category benefits the users. Some of the latest technological advancements are:

-

Server Virtualization: Contrary to the conventional, inefficient practice of providing one server to each user, it enables the service providers to house, numerous users, by segmenting servers on a single server. The distribution of workloads across various servers makes scaling easier.

-

Edge Computing: It is one of the most significant technological advancements for data centers. Large organizations such as AWS (Amazon Web Services) or American Tower, possess the resources to have an impact on edge computing and are currently moving towards the deployment phase.

-

Intelligent Monitoring: Another future trend that is rising is intelligent monitoring. Businesses are now utilizing automated, intelligent, and live monitoring techniques that enable them to access their data through a straightforward mobile application. It helps in effectively predicting the needs and issue areas using real-time information.

-

5G Network: Edge computing will be further supported by the fifth-generation (5G) mobile communication network, which will enable faster data rates and prompt access. For the data centers to be interconnected with the 5G network, new hardware, software, and network components must be installed.

-

Green Data Center: A data center that uses the least amount of energy possible while having the least impact on the environment. Investors and stakeholders in data centers are equally dedicated to bringing about sustainable solutions that support climate resilience. This establishes a new trend, and an increase in the number of data centers utilizing renewable resources and energy-efficient technologies is anticipated.

Supplier Intelligence

“What type of category do data center hosting and storage services belong to? What steps do the suppliers in this category take?”

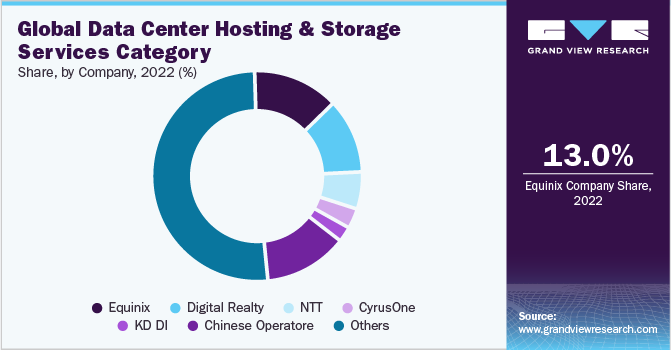

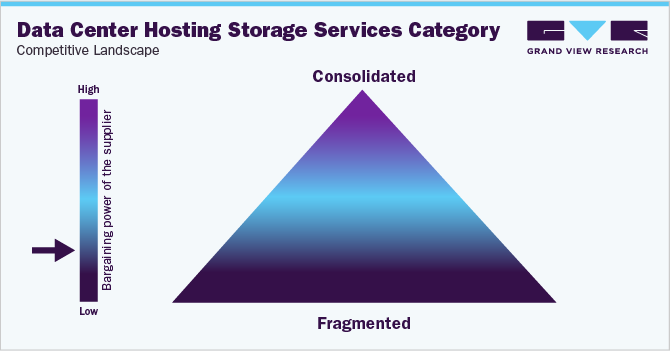

The data center sector is more active than ever. With more new companies joining the sector, the category has become one of the most competitive areas, resulting in reduced prices on large deals. The data center businesses in the sector provide both wholesale and retail colocation. The most popular alternative is retail colocation, where customers rent space in a data center's shared data hall, commonly known as the "white floor." The business has the option of renting either one caged-off cabinet or the complete data hall. Wholesale colocation is when a business rents a complete data center from a data center provider, or a private, customized area within a data center. According to supplier intelligence of the category as a whole, pricing for data center capacity remains stable, especially for smaller requirements and business deals. Competition can be witnessed among major competitors for transactions with hyperscale clients, who lease significant amounts of data center capacity and have no reluctance on negotiating bulk discounts.

Enterprise firms are investing in data centers as there are no signs that the rising cloud business will slow down. In May 2023, Aurum Equity Partners, an Indian investment company, announced the opening of its USD 250 million global private equity fund plan. The fund would invest in data centers and other infrastructure.

In February 2022, CDN provider Akamai expands into the cloud market with the acquisition of Linode for USD 900 million.

Key suppliers covered in the category:

-

Equinix

-

Digital Realty

-

Microsoft Azure

-

NTT Global Data Centers

-

Telehouse/KDDI

-

CoreSite (American Tower)

-

Google Cloud Platform

-

CyrusOne

-

GDS Holdings

-

Amazon Web Services

-

365 Data Centers

Pricing and Cost Intelligence

“What are some of the significant costs associated with creating or using this technology? What variables affect data center hosting & storage services development costs?”

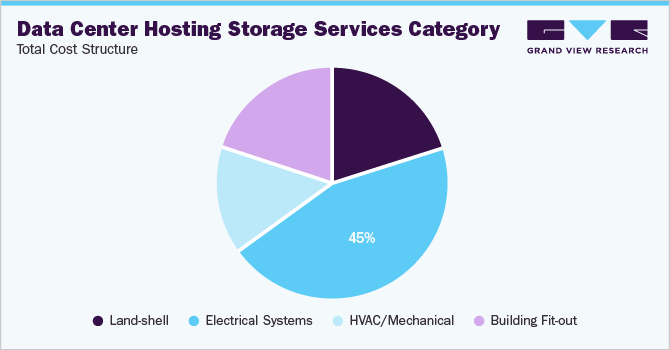

Building a data center can be divided into four primary areas: land and building shell, electrical systems, HVAC / mechanical / cooling systems, and building fit-out. These categories include all necessary infrastructure and parts needed for the functioning of the facility. The data center build costs in relative terms are based on square feet (sqft) and megawatts (MW). This is because scale offers a build cost advantage in a variety of data center types, including retail and wholesale, as well as facility sizes, including 1-megawatt and 50-megawatt.

Building a data center typically costs between USD 600 - 1,100 per gross square foot and USD 7 - 12 million per megawatt of commissioned IT load. In addition to these costs, connectivity, bandwidth, setup & maintenance fees, disaster recovery, security & compliance, and deployment type also sum up the total.

The key cost heads associated with installing data center hosting & storage services are shown in the chart below:

Electrical systems comprise the majority component of data center improvements, with costs per gross sqft ranging between USD 280 to USD 460. Another primary system, HVAC (heating, ventilation, and air conditioning), adds additional costs of USD 125 to USD 215 per gross sqft. Fire suppression is a less expensive component that adds another USD 15 to USD 25 per gross square foot.

The pricing of the service can be tiered-based depending on the GB used. Cloud-based storage frequently comes with a number of extra features that are essential to its operation. In addition, a lot of vendors have variable prices depending on how much data is transferred or how much bandwidth is used, whether it is downloaded or uploaded to the cloud. AWS storage costs vary by region and are different for the vendor hosting data centers and servers in various geographic regions. Prices for 50TB of storage start at USD 0.023 per GB, 450TB at USD 0.022 per GB, and 500TB at USD 0.021 per GB.

The Data Center Hosting & Storage Services Procurement Intelligence report provides a detailed analysis of the cost structure of business intelligence and the pricing models adopted by prominent suppliers in this category.

Sourcing Intelligence

“Which regions are the main sourcing hubs for the development of data center hosting & storage services?”

Outsourcing of the data center hosting and storage services has become a frequent operation for enterprises of all sizes, across industries.Tech industry leaders outsource the service to reduce staff augmentation, costs and focus on their own capabilities and innovation. The organizations are free to select the type, tier, and related services that best fit their priorities, objectives, and financial constraints. Outsourcing to a data center has many benefits. One benefit of outsourcing is less expensive capital costs for businesses. They are not required to buy costly structures with redundant electrical, cooling, and other infrastructure, or to install or maintain a data center facilities team. Tenants pay set monthly fees while the provider of the data center absorbs these costs.

Additionally, when businesses outsource, they have more connectivity alternatives because many data center providers give clients access to significant cloud providers and a variety of fiber suppliers. The Data can be outsourced in five ways: Hosting (leasing storage and computing resources on a server run by a third party, this group includes the cloud), Colocation (renting space, electricity, and bandwidth from a provider of a data center), Modular Services (a service in combination with colocation), Edge and Enterprise. A business manages its data center environment with the assistance of a third party (MSP). Companies are actively searching for more readily available, dense, hybrid, green, and data center facilities.

Timelines for the development of new colocation facilities, cloud campuses, and on-premises expansions have been prolonged due to supply chain problems. Furthermore, it has delayed the installation of utility substations and transformers, as well as the completion of enterprise IT projects and the building of new data centers. Every business in the digital economy is driven by data-driven digital transformation. 70% of the global GDP was digitalized by the end of 2022, and by 2025, there will be 200+ zettabytes or more of data stored in the cloud.

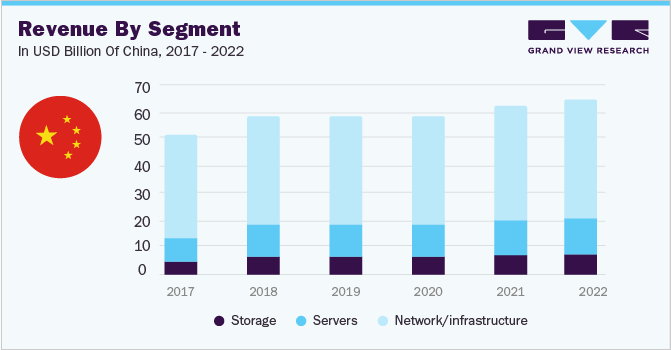

The biggest data center in the world owned by China Telecom, is utilized by huge financial, cloud computing, and telecom companies that produce enormous amounts of data. China Telecom holds a 50% market share in the Chinese data center sector and has a vast worldwide network of 400 data centers.

North America, particularly the USA, has remained home to most of the technological advancement and invention. It was also the first nation in the development of internet and data centers. The United States was the first to create and deploy internet technology. It was quickly able to set up the infrastructure needed for data centers around the nation. Many U.S.-based data center firms among the prominent ones, named AWS, Microsoft Azure, Equinix, Google, and IBM have expanded their services internationally. Besides, many multinational corporations, especially those from Europe, Asia, or Australia, have chosen to construct or rent data center facilities in the United States. Microsoft provides new customers with a free account for the first 30 days after signing up, which includes USD 200 in credit as well as 5 GB of Storage with around 2 million read, write, and list operations per month for the first 12 months. Standard storage for Google Cloud Storage in North America costs USD 0.02 per gigabyte per month.

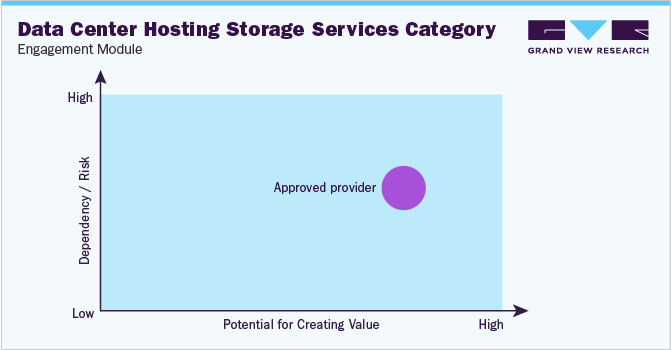

An approved provider model is the most common operating model for this category since it increases value production. According to this paradigm, the data center hosting and storage services provider must meet the customizable and scalability requirement, platform access, costs, budget, agreed-upon privacy constraints, and a number of other standards. There is a significant risk involved in the security and disaster recovery of the data.

The adoption of cloud services, the IoT, artificial intelligence, and 5G, among other developments and technologies, is directly tied to the expansion of the category across Europe. All of those are accelerating the digitalization process on a global scale. Data that is more sensitive needs to be protected, such as financial information, medical records, or the personal information of clients in the EU. For that, suppliers must adhere to local, national, and global security requirements like ISO27001, GDPR, or HIPAA.

Most providers allow to choose amongst services to build a customized hosting setup that is ideal for the user. Sourcing intelligence for the category must consider computing and storage resources, hosting necessities (bandwidth, electricity, cooling, ventilation, connectivity, etc.), app performance and server monitoring, and backup (both for power and data). Disaster recovery, cybersecurity, and hardware setup and maintenance should also be taken into account.

The Data Center Hosting & Storage Services Procurement Intelligence report also provides details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis.

Data Center Hosting & Storage Services Procurement Intelligence Report Scope

Report Attribute

Details

Data Center Hosting & Storage Services Category Growth Rate

CAGR of 14.2% from 2023 to 2030

Base Year for Estimation

2022

Pricing Growth Outlook

10% - 12%(annual)

Pricing Models

Value-based pricing model, performance-based model, dynamic pricing model, subscription-based pricing

Supplier Selection Scope

Cost and pricing, past engagements, setup geographical presence

Supplier Selection Criteria

Type, scalability, technical expertise, security measures, cost and value, support and maintenance, regulatory compliance, and others

Report Coverage

Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Key Companies Profiled

Equinix, Digital Realty, Microsoft Azure, NTT Global Data Centers, Telehouse/KDDI, CoreSite (American Tower), Google Cloud Platform, CyrusOne, GDS Holdings, Amazon Web Services, and 365 Data Centers

Regional Scope

Global

Historical Data

2020 - 2021

Revenue Forecast in 2030

USD 155.4 billion

Quantitative Units

Revenue in USD billion and CAGR from 2023 to 2030

Customization Scope

Up to 48 hours of customization free with every report.

Pricing and Purchase Options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Frequently Asked Questions About This Report

b. The global data center hosting & storage services category size was valued at approximately USD 53.7 billion in 2022 and is estimated to witness a CAGR of 14.2% from 2023 to 2030.

b. The increasing data demand amongst modern businesses, the safety and security of data, growing awareness of latest technologies and generative AI tools are some of the reasons for category growth.

b. According to the LCC/BCC sourcing analysis, China, United States, and Germany are the ideal destinations for sourcing data center hosting & storage services development.

b. This category is highly fragmented with the presence of many large players competing for the market share and emerging medium and small-scale providers. Some of the key players are Digital Reality, Equinix, Amazon Web Services, Microsoft Azure, NTT Global Data Centers, Telehouse/KDDI, CoreSite (American Tower), Google Cloud Platform, CyrusOne, GDS Holdings and 365 Data Centers

b. Electrical system, HVAC/ Cooling/ Mechanical system, land & infrastructure are the key cost components of the category. Other cost factors involve connectivity, bandwidth, security/ compliance, and others.

b. What are the best sourcing practices considered in the data center hosting & storage services category? Less expensive capital costs for businesses and considering computing and storage resources, hosting necessities (bandwidth, electricity, cooling, ventilation, connectivity, etc.) are some of the best practices that are considered while sourcing this category.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself...

Add-on Services

Should Cost Analysis

Component wise cost break down for better negotiation for the client, highlights the key cost drivers in the market with future price fluctuation for different materials (e.g.: steel, aluminum, etc.) used in the production process

Rate Benchmarking

Offering cost transparency for different products / services procured by the client. A typical report involves 2-3 case scenarios helping clients to select the best suited engagement with the supplier

Salary Benchmarking

Determining and forecasting salaries for specific skill set labor to make decision on outsourcing vs in-house.

Supplier Newsletter

A typical newsletter study by capturing latest information for specific suppliers related to: M&As, technological innovations, expansion, litigations, bankruptcy etc.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified