- Home

- »

- Reports

- »

-

IT Services Outsourcing Procurement Intelligence Report, 2030

![IT Services Outsourcing Procurement Intelligence Report, 2030]()

IT Services Outsourcing Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Published Date: Dec, 2023

- Base Year for Estimate: 2022

- Report ID: GVR-P-10564

- Format: Electronic (PDF)

- Historical Data: 2020 - 2021

- Number of Pages: 60

IT Services Outsourcing Category Overview

“Higher adoption of cloud initiatives and digital technologies is fueling the category’s growth.”

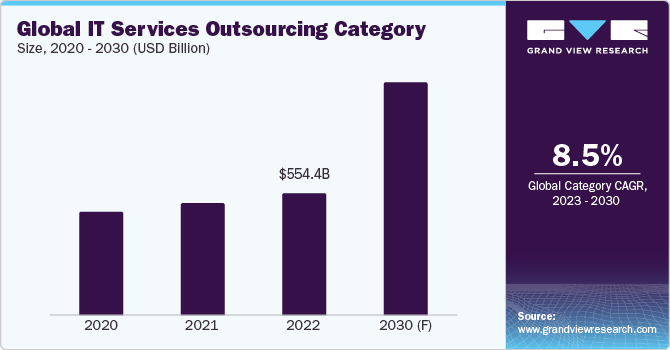

The global IT services outsourcing category is anticipated to grow at a CAGR of 8.52% from 2023 to 2030. Factors that determine this growth include higher adoption of cloud initiatives and digital technologies by the business enterprises across the globe, rising need to cut operating expenses, and increased awareness of the need for data security and customer centricity in projects, particularly in the BFSI, aerospace and defense industries. In addition, the category is also witnessing growth due to steady rise in demand for projects involving consultants. Consultants play a key role in facilitating a seamless and successful digital transition by offering the advisory required on enterprise architecture, expertise in developing & optimizing IT strategy, and portfolio consulting.

One of the key end-user sectors experiencing a large shift in the adoption of IT services outsourcing is banking, financial services, and insurance (BFSI). This is mostly because of the impact of the pandemic and the changing competitive landscape. As per a recent report, IT investments in the BFSI sector are also witnessing rise. The practice of financial institutions outsourcing their operations and services to other parties is growing. Banks are able to contract out everything, including payment processing and mailing campaigns. Only banks with a strong and comprehensive in-house IT department or reliable outside partners who could support their day-to-day operations in an efficient & sophisticated way are able to thrive and draw in customers for them. In addition, the BFSI industry is moving toward the cloud, creating new market prospects. As per a recent survey by the Google Cloud in the U.S., over 53.9% of financial services organizations that use cloud strategy have all of their workloads fully deployed on the cloud.

The global IT services outsourcing category was estimated at USD 554.4 billion in 2022. Business enterprises are becoming more and more dependent on the services offered by the companies operating in this category due to their assistance in offering the IT applications that are utilized in various sectors. They are utilizing cloud services more frequently as it is the most economical option and supports in the growth of the business and deliver better services to the customers. In addition, maintenance is one of functions that are outsourced most by the businesses. Businesses across the globe are also increasingly outsourcing the process of application development that too during the time when the category has done fairly well in Europe as well as North America in recent past. Majority of businesses need help with cloud service maintenance and use, and they heavily rely on IT firms to provide these services.

Technologies that are driving the growth of this category include cloud computing, automation, blockchain, data analytics, artificial intelligence (AI) & machine learning (ML), and internet of things (IoT). High investments on cloud services and cloud computing are anticipated to be witnessed in the coming times, making cloud revolution a key trend. In addition, the companies will make advantage of cloud services including SaaS, IaaS, and PaaS. This outsourcing trend will solve a lot of IT problems by giving firms flexibility and scalability while streamlining intricate business processes. Furthermore, another crucial trend in the industry is ‘process automation’ which businesses are outsourcing to obtain advanced global technical skillset. Few of the top players are leveraging robotic process automation to support businesses in the enhancement of accuracy, scalability, work speed, efficiency, and cost savings.

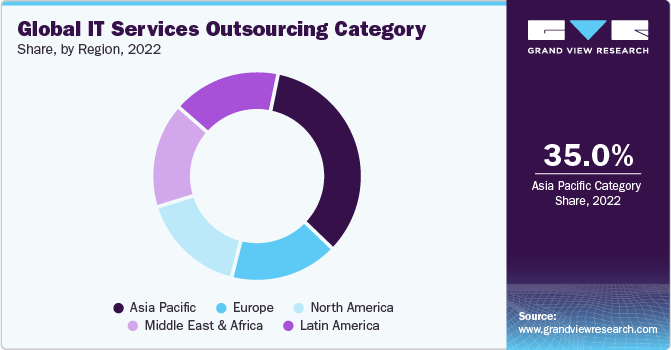

Asia Pacific dominates the global category, holding a substantial revenue share. China is one of the major outsourcing destinations in the region. The benefits (such as large pool of talent, low cost of labor, high proficiency in English, etc.) that most U.S. corporations find attractive are taken into by the business enterprises who are looking to outsource their IT services.Retaining the true advantages of outsourcing depends heavily on reducing the software development costs. In addition, India offers a wide array of possibilities and is a reputable, well-established global location for IT outsourcing. Players in the region are continuously expanding their operational presence across the globe due to rising need for qualified software developers in other regions. The presence of talented large pool of reasonably priced, highly skilled IT workers, particularly in the nations such as India, Philippines, and China has turned the region as a popular outsourcing location, particularly for IT maintenance, customer support, and software development.

Supplier Intelligence

“What best describes the nature of the IT services outsourcing category? Who are some of the main participants?”

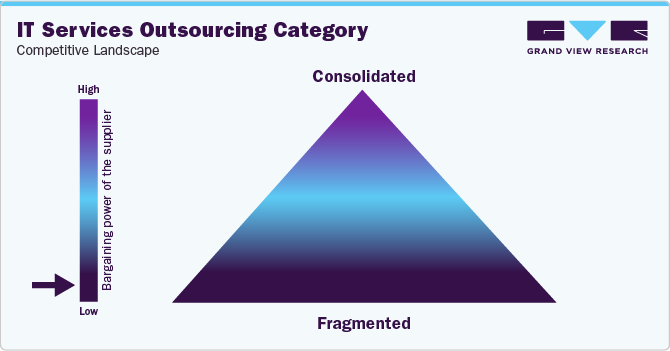

The global category for IT services outsourcing is fragmented, exhibit an intense level of competition among the service providers. As a result, the service providers are emphasizing on the service quality, innovation and cost-effectiveness. In addition, they are developing new operational and pricing strategies to gain competitive advantage. The players are using range of tactics, including mergers & acquisitions, joint ventures, service portfolio expansions, and product line expansions to develop long-term competitive advantage. Also, players that are offering IT services outsourcing and the business enterprises that are seeking the services offered in this category, are both trying to take advantage of variations in contracting structures to ensure more interpersonal and value-driven subcontracting. The focus of new initiatives is increasingly on risk sharing and accountability between the vendor and the client. This increases the level of competition in the already crowded market and forces service providers to deliver value.

Buyers have significant negotiating power and the potential to put pressure on prices for traditional IT service providers. Considering the example of India (one of leaders in IT outsourcing space), the buyer sets most of the prices and has essentially eliminated the benefits offered by foreign service providers who have sophisticated global delivery models, due to their experience of working with both foreign and Indian IT service providers. Foreign IT businesses have also undermined the advantage gained by Indian IT service providers through their captive centers in India and around the world. The customer is king in this sector particularly when it comes to traditional IT services. The non-conventional service providers, such as those that offer emerging technologies (enterprise mobility or data analytics), have the ability to stand out from the competition and earn larger profit margins.

Key suppliers covered in the category:

-

Accenture plc

-

Atos SE

-

Capgemini Services SAS

-

Cognizant Technology Solutions Corporation

-

DXC Technology Company

-

HCL Technologies Limited

-

Infosys Limited

-

International Business Machines (IBM) Corporation

-

NTT DATA Group Corporation

-

TATA Consultancy Services Limited

-

Wipro Limited

-

WNS (Holdings) Ltd.

Pricing and Cost Intelligence

“What is the cost structure for IT services outsourcing? What variables affect the prices?”

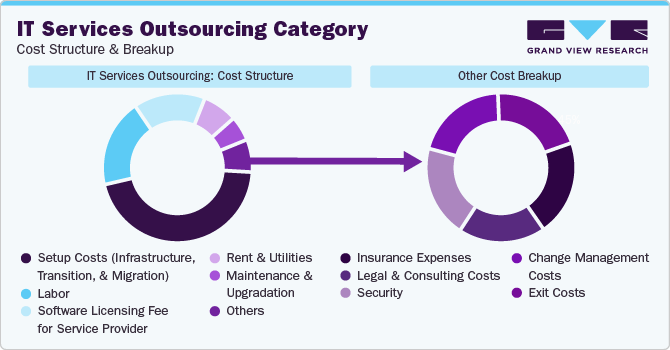

The cost structure of the global IT services outsourcing category is constituted by setup costs (infrastructure, transition, and migration), labor, software licensing fee for service provider, rent & utilities, maintenance & upgradation, and other costs as the key components. Other costs are further bifurcated into insurance expenses, legal & consulting costs, security, change management costs, and exit costs. The setup cost is the largest cost component. This cost is related to establishing the outsourcing contract. These could cover the price of setting up the infrastructure and moving services, functions, or data to the outsourced business. In addition, there are lot of hidden costs associated with the category, such as expenses incurred on overseeing and organizing service providers, warranties and additional benefits, expense incurred on improper operations & sales strategy, etc.

Key variables that affect the price of services include scope & complexity of the project, service provider’s geographic location, tools & technology stack, level of expertise & skillset, timeline of the project, unique customization requirements, flexibility & scalability, collaboration & communication needs, considerations pertaining to compliance, and maintenance & support required post implementation of the project. Businesses can obtain more accurate price estimates for their IT outsourcing projects by understanding these aspects and carefully examining project requirements. By understanding these variables, they are better equipped to make educated judgments, which in turn helps their outsourced IT projects succeed. However, many businesses are still hesitant to decide whether to hire an internal team or outsource.

Comprehending the expenses associated with outsourcing IT is imperative for making well-informed judgments, guaranteeing financial congruence, and optimizing return on investment (ROI). IT Services Outsourcing prices vary by the type of service provider a business enterprise selects:

a) Break-fix IT service provider: This costs between USD 19 - USD 49 per hour per technician

b) Co-managed IT service provider: This costs between USD 89 - USD 109 per user per month

c) Managed IT service provider: This costs between USD 129 - USD 249 per user per month

d) Direct Outsourcing service provider: This costs between USD 799 - USD 2,999 per month per contractor

The cost structure is broken down in the accompanying chart. Other costs can depend on multiple cost components, which have been illustrated below:

The report provides a detailed analysis of the cost structure and the pricing models adopted by prominent suppliers in this category.

Sourcing Intelligence

“How do IT services outsourcing providers engage? What is the type of engagement model?”

In terms of global IT services outsourcing category sourcing intelligence, businesses follow full services outsourcing model to engage with their suppliers rather than keeping few things in-house. Full services outsourcing of IT services is an affordable option for companies that need specialized expertise, need to handle short-term projects, wish to cut costs, and want flexibility in resource allocation. Outsourcing offers significant cost-savings in comparison to hiring a team in-house. Full services outsourcing enables businesses to easily locate a subject matter expert who is willing to work for less money than local programmers. For instance, highly qualified developers from Eastern Europe are typically more affordable than American IT specialists of a comparable caliber.

“In the full services outsourcing model, the client outsources the complete operation/manufacturing to single or multiple companies.”

Strategic outsourcing can assist firms in improving their operations when it comes to specialized knowledge or in-demand talents, which may be in software development, web development, or digital marketing. The degree to which outsourcing is successful and a win-win situation relies on how many factors each business considers before deciding to hire an outsourcing service provider. Few strategies that businesses need to follow in order to ensure that the process of outsourcing is successful includes being certain to outsource for appropriate purpose, setting up clear expectations, compiling all necessary paperwork and requirements in order to move on with the development, ensuring that the service provider can meet all the required business needs and can take any complicated tasks as & when required, developing an effective contract terms, and continuously monitoring the progress of the work.

India is the preferred low-cost / best-cost country for sourcing IT services outsourcing service provider. The nation is well-known for having a robust IT sector, offering access to a sizable talent pool of intelligent people with a background in technology, including engineers, data analysts, and software developers. In addition, it is a cost-effective outsourcing destination for businesses due to its competitive labor costs, which result in significant cost savings. Also, the workforce in India is renowned for having a strong command of the English language, which facilitates cooperation and communication. Furthermore, the nation's attraction is further increased by its well-developed infrastructure and emphasis on quality and innovation. Companies also value India's capacity to adjust to different time zones, as it allows for 24/7 service delivery.

The report also provides details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis.

IT Services Outsourcing Category Procurement Intelligence Report Scope

Report Attribute

Details

IT Services Outsourcing Category Growth Rate

CAGR of 8.52% from 2023 to 2030

Base Year for Estimation

2022

Pricing Growth Outlook

5% - 10% increase (Annually)

Pricing Models

Fixed pricing, time & materials pricing

Supplier Selection Scope

Cost and pricing, past engagements, productivity, geographical presence

Supplier Selection Criteria

Geographic service provision, industries served, years in service, certifications, custom software development, infrastructure management, cloud services, cybersecurity, quality assurance & testing, technical support, and others

Report Coverage

Revenue forecast, supplier ranking, supplier matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Key Companies Profiled

Accenture plc, Atos SE, Capgemini Services SAS, Cognizant Technology Solutions Corporation, DXC Technology Company, HCL Technologies Limited, Infosys Limited, International Business Machines (IBM) Corporation, NTT DATA Group Corporation, TATA Consultancy Services Limited, Wipro Limited, and WNS (Holdings) Ltd.

Regional Scope

Global

Revenue Forecast in 2030

USD 1,066.4 billion

Historical Data

2020 - 2021

Quantitative Units

Revenue in USD billion and CAGR from 2023 to 2030

Customization Scope

Up to 48 hours of customization free with every report.

Pricing and Purchase Options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Frequently Asked Questions About This Report

b. The global IT services outsourcing category size was valued at approximately USD 554.4 billion in 2022 and is estimated to witness a CAGR of 8.52% from 2023 to 2030.

b. Higher adoption of cloud initiatives and digital technologies by the business enterprises across the globe, rising need to cut operating expenses, and increased awareness of the need for data security and customer centricity in projects, particularly in the BFSI, aerospace and defense industries are driving the growth of the category.

b. According to the LCC/BCC sourcing analysis, India and Philippines are the ideal destinations for sourcing IT services outsourcing.

b. This category is fragmented, with intense level of competition. Some of the key players are Accenture plc, Atos SE, Capgemini Services SAS, Cognizant Technology Solutions Corporation, DXC Technology Company, HCL Technologies Limited, Infosys Limited, International Business Machines (IBM) Corporation, NTT DATA Group Corporation, TATA Consultancy Services Limited, Wipro Limited, and WNS (Holdings) Ltd.

b. Setup costs (infrastructure, transition, and migration), labor, software licensing fee for service provider, rent & utilities, maintenance & upgradation, and other costs are the major cost components of IT services outsourcing.

b. Assessing the range of services offered by a service provider, requesting testimonials, and references of the supplier’s clients, evaluating a vendor’s location capabilities (onshoring / offshoring), and negotiating over best pricing terms are some of the key sourcing practices considered in this category.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself...

Add-on Services

Should Cost Analysis

Component wise cost break down for better negotiation for the client, highlights the key cost drivers in the market with future price fluctuation for different materials (e.g.: steel, aluminum, etc.) used in the production process

Rate Benchmarking

Offering cost transparency for different products / services procured by the client. A typical report involves 2-3 case scenarios helping clients to select the best suited engagement with the supplier

Salary Benchmarking

Determining and forecasting salaries for specific skill set labor to make decision on outsourcing vs in-house.

Supplier Newsletter

A typical newsletter study by capturing latest information for specific suppliers related to: M&As, technological innovations, expansion, litigations, bankruptcy etc.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified