- Home

- »

- Reports

- »

-

Renewable Energy Sourcing & Cost Intelligence Report, 2030

![Renewable Energy Sourcing & Cost Intelligence Report, 2030]()

Renewable Energy Procurement Intelligence Report, 2024 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Published Date: Jul, 2024

- Base Year for Estimate: 2023

- Report ID: GVR-P-10597

- Format: Electronic (PDF)

- Historical Data: 2021 - 2022

- Number of Pages: 60

Renewable Energy - Procurement Trends

“Growing consciousness of the negative environmental effects of fossil fuels is fueling the growth of the industry.”

Procurement of renewable energy reduces the utilization of water and fossil fuels by business enterprises, which results in savings on utility bills; it also limits a company's emission of greenhouse gases. The global market is anticipated to grow at a CAGR of 17.2% from 2024 to 2030. It is attributed to be driven by growing consciousness of the negative environmental effects of fossil fuels, concerted efforts by the public and corporate sectors to reduce carbon emissions, increased necessity of energy security, and robust government programs to encourage the use of green and clean energy.

Increased urbanization and industrialization in developing nations globally and rising investments in projects, including 'pumped storage hydropower' and 'hydropower,' are further fueling the market's expansion. However, factors such as restrictions on the existing grid infrastructure and high initial investments required for setting up renewable energy projects may hinder growth during the forecast timeframe.

Energy storage is essential for renewable energy systems to deliver a steady and dependable power supply, particularly for sources such as wind and solar energy. The global market offers various prospects, such as the possibility of further innovation and funding for energy storage technologies. In addition, there is a chance that the renewable energy industry will experience stronger economic growth and job creation as the demand for renewable energy rises.

With approximately 62% revenue share, the industrial sector application segment dominated the market in 2023. The number of utility projects and the expansion of the PV module throughout the industrial sector are predicted to increase in response to the surging demand for clean electricity. The growing number of power plants under development and in operation is likely to drive the demand for the procurement of solar photovoltaic panels in the industrial application category.

The global renewable energy market size was valued at USD 1.21 trillion in 2023. Based on product type, the solar energy segment dominated the industry. It is inexpensive, provides a "green label" for homes or businesses, and lessens power outages. Solar solutions are more transmission-efficient than grid electricity, which experiences frequent blackouts and even hydroelectric power is prone to blackouts during transmission.

Investments in the installation of solar panels to produce electricity from solar thermal energy are growing all over the world for use in a variety of commercial and residential applications. The need for solar energy is anticipated to increase in the coming years due to government initiatives to construct smart cities in nations such as India, China, and Saudi Arabia. The second spot is held by Hydropower, which offers advantages to communities and plays a crucial role in combating climate change by providing storage, power, and flexibility services.

Emerging technologies supplementing the procurement of renewable energy solutions include advanced photovoltaics, artificial intelligence (AI) and big data, distributed energy storage systems (DESS), advanced robotics, and blockchain. As solar businesses integrate PV systems with all aspects of the environment, they are also lowering the need for more land utilization. Thus, integrated PV, floatovoltaics, and agrivoltaics are all appropriate trends.

Governments are becoming more interested in solar photovoltaic (PV) technologies than in fossil fuels, as they have received substantial investment on a global scale. The electricity grid is one of the most intricate infrastructures, and utilities need to make swift decisions in real time, which is made possible by big data and AI algorithms. Predictive maintenance of renewable energy sources and power consumption forecasting are two further uses of AI in the renewables industry, in addition to grid analytics and management.

Asia Pacific region accounted for the largest share of the global market in 2023. A key factor behind the region's growth is the rising uptake of solar power projects in India and China (two of the world's biggest markets for solar panels) due to increased industrialization, which is resulting in a significant increase in the demand for electricity. In addition, due to recent large expenditures in solar power generation, other nations in the region, such as Japan and Australia, also present significant growth potential. APAC is concentrating on renewable energy sources such as hydropower, solar, bioenergy, and wind because of supply security, price volatility, and environmental concerns. Meanwhile, North America is also anticipated to witness significant growth. Due to the availability of more efficient solar cells and increased industry competitiveness, the industrial sector has seen a spike in the generation of power from solar cells.The demand for renewable energy (in the region) has increased as a result of lower electricity production costs and a wider range of solar panel options.

Supplier Intelligence

“What best describes the nature of renewable energy? Who are the key players operating in the market?”

This industry exhibits a fragmented landscape. It witnesses the presence of a large number of regional and global players and is characterized by a mix of innovative and new players, along with established enterprises who should be reached for the procurement of renewable energy. The competitive environment for renewable energy is dynamic and ever-changing due to the introduction of new technologies and shifting consumer tastes and market conditions. Major players are increasingly collaborating and forming partnerships. For instance, multiple businesses are collaborating to build massive offshore wind farms by pooling their resources and experience. Local utilities and small entrepreneurs are working together to develop community solar projects.In addition, industry players are practicing several other strategic initiatives to expand their foothold, such as mergers and acquisitions and capacity expansions.

The barrier to entry is moderate to low, owing to the numerous government assistance programs available. It depends on product differentiation, government policies, capital investment, and economies of scale. The rivalry is intense due to the emergence of new businesses across the globe. New businesses are flooding the market with offers due to the abundance of incentives and subsidies geared towards renewable energy. Companies are now focusing more on clean energy due to the existence of global warming. Electricity produced by nuclear or fossil fuel power plants would be a logical substitute for renewable energy. This is the industry's most severe threat level due to the financial advantages of renewable energy alternatives. The bargaining power of the buyers is medium as there are a lot of small-sized buyers and energy suppliers. Due to the low cost supplied by the energy supplier, buyers have the opportunity to switch to alternative generators.

Key suppliers covered in the industry:

-

ABB Ltd

-

Acciona, SA

-

Adani Green Energy Limited (AGEL)

-

Enel Green Power S.p.A.

-

ENGIE SA

-

GE Vernova Group

-

Innergex Renewable Energy Inc.

-

Invenergy LLC

-

Siemens Gamesa Renewable Energy, S.A.U.

-

Suzlon Energy Ltd

-

Tata Power Renewable Energy Limited (TPREL)

-

Xcel Energy Inc.

Pricing and Cost Intelligence

“What are the key cost components for renewable energy industry? What factors influence the charges/prices?”

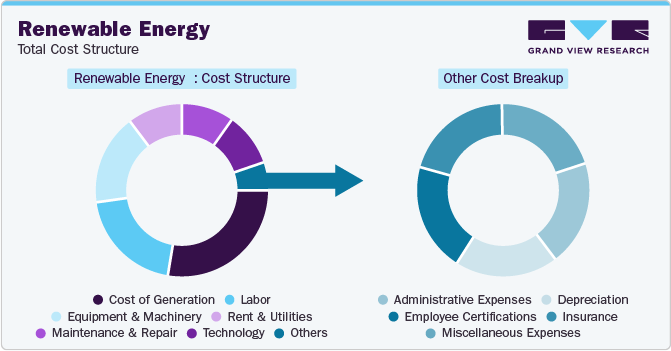

The cost structure of the global renewable energy industry is constituted by cost of generation (including raw materials), labor, equipment and machinery, rent and utilities, maintenance and repair, technology (software platform), and others.Other costs include administrative expenses, depreciation, employee certifications, insurance, and miscellaneous expenses.

The cost of generation forms the largest cost component to be considered in the procurement of renewable energy. The major raw materials utilized in different sources of renewable energy are aluminum, steel, nickel, copper and quartz sand. For instance, a wind turbine is comprised of materials such as aluminum (0.1%-1.9%), copper (0.9%), cast iron/iron (4.9%-16.9%), plastic/resin, fiberglass (10.9%-15.9%), and steel (65.9%-78.9%).

The cost structure is broken down in the accompanying chart. Other costs can depend on multiple cost components, which have been illustrated below:

Factors that influence the prices for renewable energy depend on the type of source (solar energy, wind energy and geothermal energy) that has to be utilized. Prices of polysilicon, metal prices, inflation levels, customs duties, and energy prices are the key variables that influence the prices of 'solar energy.' In the solar photovoltaic (PV) supply chain, polysilicon (a high-purity version of silicon) is a crucial raw material that forms solar cells and solar modules. Therefore, any change in its pricing would have an impact on solar module prices, raising the total cost of solar power.

Many countries aiming to switch to environmentally friendly solar modules are heavily reliant on their imports from a select few manufacturers, particularly China, which holds an 80% market share in all major solar panel manufacturing stages. Therefore, the cost of using solar electricity in the target organization is heavily influenced by individual customs duties.

The prices of aluminum in China ranged between USD 1,546.6 and USD 2,895.5 per ton from May 2019 to May 2024 (an increase of over 80%). An unexpected decline in China's manufacturing output in May, intensified by a severe slowdown in imports, highlights the vulnerability of Chinese consumers and the bleak prospects of Beijing's economic support. However, supply-side issues have kept prices over 13.9% higher since the beginning of Q2 2024. Since the commencement of 2024, the prices of the commodity have climbed by over 5.74%. It was anticipated to trade for USD 2703.69 per ton by the conclusion of Q2 2024. The prices of Steel in China ranged between CNY 3,493.7 per ton and CNY 4,284.9 per ton (initially witnessing an increase by over 35% from 2019 to 2021, then decreasing of over 37% from 2022 to May 2024).

'Spot' pricing is one of the common pricing structures followed in the industry. In a competitive energy market, the price of electricity is established by finding the intersection of the total supply and demand curves, which are created from the combined supply and demand bids for a specific hour in each region of the market as bid in a power/energy exchange.

Spot price optimization is a successful pricing technique for companies operating in highly competitive areas like the energy sector. Power producers can optimize earnings while satisfying consumer demands and expectations by evaluating demand and modifying prices accordingly. The only drawback of this model is a lack of transparency at times. Another pricing structure followed in the industry is 'cost-plus' pricing. It seeks to recoup the fixed and variable expenses related to running and upkeep of the network infrastructure.Though straightforward and uncomplicated, this model might not accurately capture the externalities of the electricity system or the genuine value of the service.

Sourcing Intelligence

“How do buyers of renewable energy engage with their suppliers? Which are the low-cost/best-cost countries for sourcing?”

The sourcing intelligence for renewable energy suggests that business enterprises consider opting for a full-service outsourcing model to engage with the suppliers for the procurement of the power. Renewable energy is typically sourced through a contract mechanism called ‘power-purchase agreement (PPA),’ which are medium or long-term contracts, lasting a minimum of 5 to over 20 years. It is being widely adopted by government organizations, large corporations, and small and medium-sized businesses since it is a dependable method of reducing the carbon footprint associated with electricity usage and contributes towards energy transition. In addition, PPAs are sometimes also referred to as "Green PPAs." Customers who buy these have access to a consistent, predetermined rate of dependable, certified green energy.

"In the full services outsourcing model, the client outsources the complete operation/manufacturing to a single or multiple companies."

Business enterprises can get into a PPA in two different ways: on-site and off-site. When renewable energy producing facilities are placed on a client's property, it is "on-site." In this instance, equipment installation, operation, and design are all funded by energy operators. Customers who own or rent the property consume the energy that is generated. When energy production equipment is not put on a client's property, PPAs are referred to as "off-site."

Nevertheless, when customers agree to purchase a certain amount of green energy generated by a renewable energy facility from an energy supplier, these contracts are referred to as "physical." A notable benefit of an 'off-site' setup is that for customers, it provides evidence of the electricity's renewable source and shows their dedication to localized, short supply chains. These agreements give operators additional leverage to create larger-scale renewable energy parks and to capitalize on the optimal sites for higher-yielding energy production.

In Asia Pacific, China, India and Japan are considered as the low-cost/best-cost countries for sourcing renewable energy. These nations are investing heavily in the production of products required for renewable energy projects. China's manufacturing capabilities and capacity are leading to reduced prices for products such as wind turbines, solar modules, and solar panels. In addition, the cost of deployment for these gets lower as well. The nation currently possesses the finest technologies, which can raise utilization rates.

Similarly, India's human resource potential. government funded initiatives, and continuous development of advanced technologies are leading to the production of renewable energy products, such as solar panels and solutions, wind energy solutions, etc. at a much cheaper rate. In Europe, Germany and Spain are the best nations to be considered for the procurement of solar energy products.

The report also provides details regarding peer analysis, recent supplier developments, supply-demand analysis, competitive landscape, KPIs, SLAs, risk assessment, negotiation strategies, and low-cost/best-cost sourcing analysis. In the report, we have tried to provide a holistic industry perspective, an overview of the supplier landscape - the presence of different types of players and the competitive pressure within the industry as a whole (PORTER’s). The key benefit of procuring renewable energy is that it enhances the reputation of a business enterprise, as stakeholders/consumers identify it as an enterprise that is concerned with the community’s wellbeing. Similarly, the supply chain practices under sourcing and procurement are also covered. One such instance is the operating model that encompasses all the business processes conducted within an organization. It is an integral aspect of the company's operations and plays a crucial role in its success.

Renewable Energy Procurement Intelligence Report Scope

Report Attribute

Details

Growth Rate

CAGR of 17.2% from 2024 to 2030

Base Year for Estimation

2023

Pricing Growth Outlook

5% - 10% increase (Annually)

Pricing Models

Spot pricing, Cost-plus pricing

Supplier Selection Scope

Cost and pricing, Past engagements, Productivity, Geographical presence

Supplier Selection Criteria

Industries served, years in service, geographic service provision, revenue generated, employee strength, certifications, key clients, types (wind power / bioenergy / hydropower / solar power / geothermal / others), electrical support products (enclosures / connection devices / socket outlets / industrial plugs & sockets / others), contract (on-shore / off-shore / others), energy storage solutions, asset optimization, maintenance & support, and others

Report Coverage

Revenue forecast, supplier ranking, supplier matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Key Companies Profiled

ABB Ltd, Acciona, SA, Adani Green Energy Limited (AGEL), Enel Green Power S.p.A., ENGIE SA, GE Vernova Group, Innergex Renewable Energy Inc., Invenergy LLC, Siemens Gamesa Renewable Energy, S.A.U., Suzlon Energy Ltd, Tata Power Renewable Energy Limited (TPREL), and Xcel Energy Inc.

Regional Scope

Global

Revenue Forecast in 2030

USD 3.6 trillion

Historical Data

2021 - 2022

Quantitative Units

Revenue in USD billion and CAGR from 2024 to 2030

Customization Scope

Up to 48 hours of customization free with every report.

Pricing and Purchase Options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Frequently Asked Questions About This Report

b. The global renewable energy market size was valued at approximately USD 1.21 trillion in 2023 and is estimated to witness a CAGR of 17.2% from 2024 to 2030.

b. Growing consciousness of the negative environmental effects of fossil fuels, growing efforts by the public and corporate sectors to reduce carbon emissions, increased necessity of energy security, and increasing government programs to encourage the use of green and clean energy are driving the growth of the industry.

b. According to the LCC/BCC sourcing analysis, China, India, Japan, Germany, and Spain are the ideal destinations for sourcing renewable energy.

b. This industry exhibits a fragmented landscape with intense competition. Some of the key players are ABB Ltd, Acciona, SA, Adani Green Energy Limited (AGEL), Enel Green Power S.p.A., ENGIE SA, GE Vernova Group, Innergex Renewable Energy Inc., Invenergy LLC, Siemens Gamesa Renewable Energy, S.A.U., Suzlon Energy Ltd, Tata Power Renewable Energy Limited (TPREL), and Xcel Energy Inc.

b. Cost of generation (include raw materials), labor, equipment & machinery, rent & utilities, maintenance & repair, technology (software platform), and others are the key cost components for renewable energy. Other costs can be further bifurcated into administrative expenses, depreciation, employee certifications, insurance, and miscellaneous expenses.

b. Defining the parameters and scope of the project, designing a sourcing strategy, conducting workflow to streamline purchase and observing the performance, overseeing the coordination and logistics of the supply chain, and ensuring implementation of measures pertaining to quality control and assurance are some of the best sourcing practices considered by the procurement professionals in this category.

Share this report with your colleague or friend.

GET A FREE SAMPLE

This FREE sample includes market data points, ranging from trend analyses to market estimates & forecasts. See for yourself...

Add-on Services

Should Cost Analysis

Component wise cost break down for better negotiation for the client, highlights the key cost drivers in the market with future price fluctuation for different materials (e.g.: steel, aluminum, etc.) used in the production process

Rate Benchmarking

Offering cost transparency for different products / services procured by the client. A typical report involves 2-3 case scenarios helping clients to select the best suited engagement with the supplier

Salary Benchmarking

Determining and forecasting salaries for specific skill set labor to make decision on outsourcing vs in-house.

Supplier Newsletter

A typical newsletter study by capturing latest information for specific suppliers related to: M&As, technological innovations, expansion, litigations, bankruptcy etc.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities.

Contact us now to get our best pricing.

![esomar icon]()

ESOMAR certified & member

![ISO]()

ISO Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

Client Testimonials

"The quality of research they have done for us has been excellent..."

ISO Certified