- Home

- »

- Next Generation Technologies

- »

-

3D Audio Market Size, Share, Growth, Industry Report, 2033GVR Report cover

![3D Audio Market Size, Share & Trends Report]()

3D Audio Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Application (Consumer, Gaming, Media & Entertainment, AR/VR, Automotive), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-632-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

3D Audio Market Summary

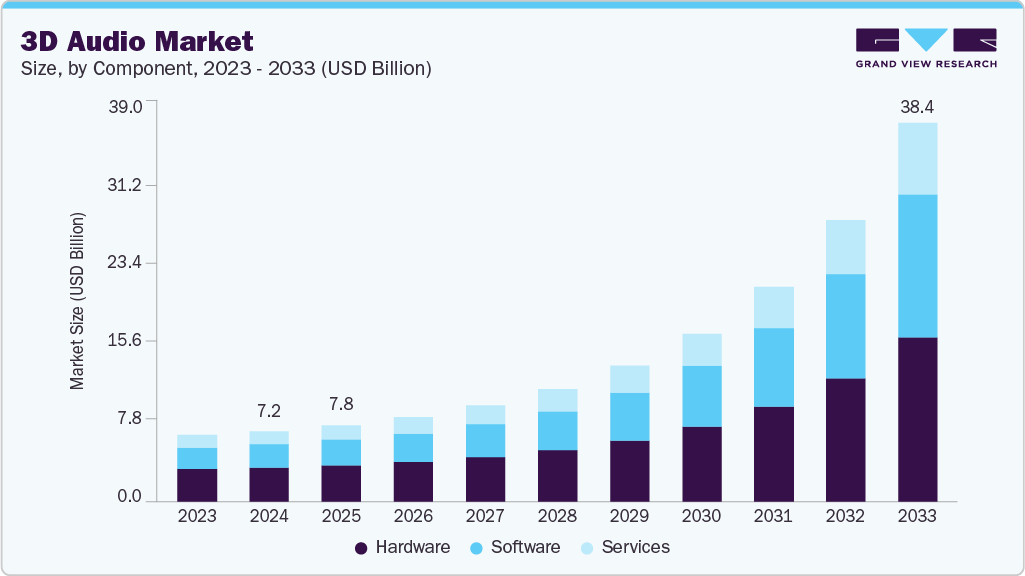

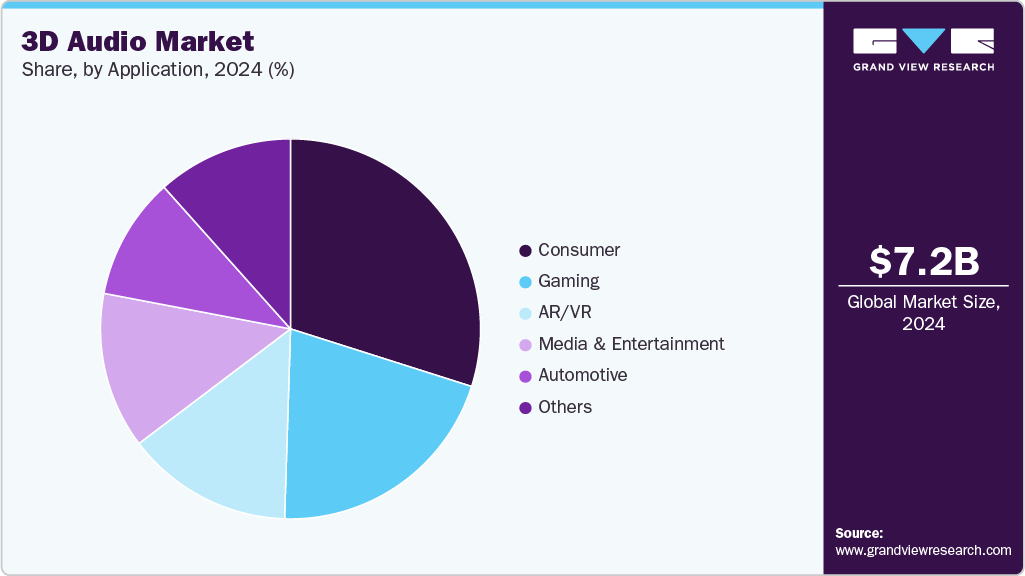

The global 3D audio market size was estimated at USD 7.18 billion in 2024 and is projected to reach USD 38.36 billion by 2033, growing at a CAGR of 22.1% from 2025 to 2033, driven by the increasing demand for immersive entertainment experiences, particularly in gaming, virtual reality (VR), and augmented reality (AR).

Key Market Trends & Insights

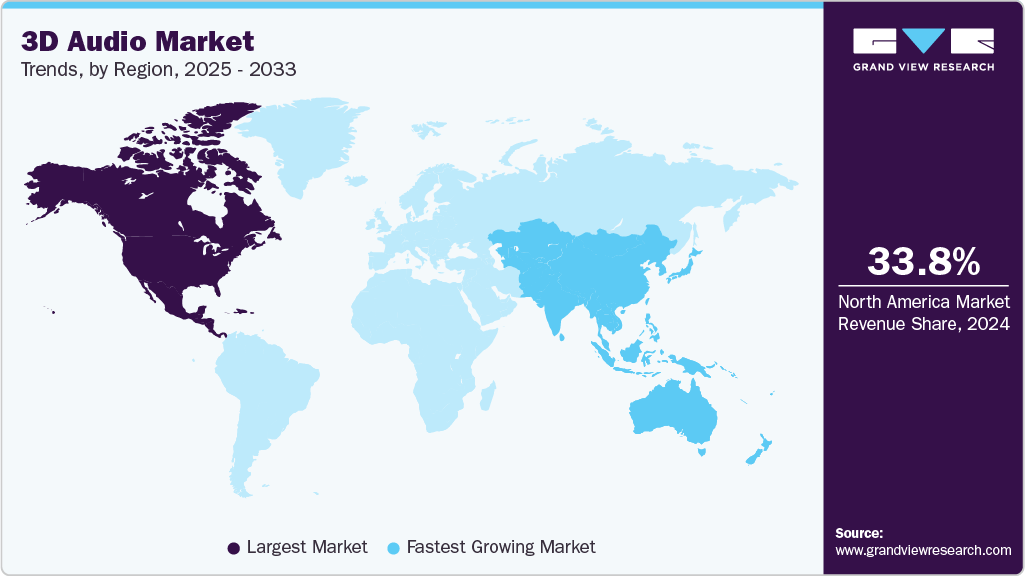

- North America 3D audio dominated the global market with the largest revenue share of 33.8% in 2024.

- The 3D audio market in the U.S. led the North America market and held the largest revenue share in 2024.

- By component, hardware segment led the market and held the largest revenue share of 48.1% in 2024.

- By application, the AR/VR segment is expected to grow at the fastest CAGR from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 7.18 Billion

- 2033 Projected Market Size: USD 38.36 Billion

- CAGR (2025-2033): 22.1%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Gamers and content consumers are seeking more realistic and engaging soundscapes, prompting developers to integrate advanced 3D audio technologies. Additionally, the rise of VR headsets and spatial audio applications has further accelerated adoption, as 3D audio enhances the sense of presence and immersion in virtual environments.The expansion of the music and streaming industries, where artists and platforms are adopting 3D audio to deliver richer, more dynamic listening experiences also contributing to the growth of the 3D audio industry. With the growing popularity of spatial audio in platforms such as Apple Music, Amazon Music, and Tidal, consumers are becoming more accustomed to high-quality 3D sound. This trend is further supported by advancements in audio hardware, including headphones and soundbars equipped with spatial audio capabilities, making the technology more accessible to mainstream audiences.

Technological advancements in audio processing and artificial intelligence (AI) are also fueling market growth. AI-powered algorithms enable real-time 3D audio rendering, improving sound personalization and adaptability across different devices. Moreover, the integration of 3D audio in smart home systems, automotive sound systems, and live events is creating new opportunities for market expansion. As industries prioritize immersive audio experiences, the 3D audio market is poised for sustained growth in the coming years.

Component Insights

The hardware segment dominated the market and accounted for the revenue share of 48.1% in 2024, driven by the growing investment in immersive entertainment content, such as spatial audio music tracks and 3D movies, which necessitates compatible playback hardware. Audio hardware manufacturers are developing innovative products, like binaural microphones and multi-driver earphones that are capable of capturing and reproducing lifelike soundscapes. The music and media industry's shift toward Dolby Atmos and other spatial sound formats further reinforces the need for compatible hardware, prompting consumers and professionals to upgrade their devices. The hardware segment is further bifurcated into hardware, headphones/headsets, loudspeakers, microphones, and others.

The software segment is anticipated to grow at the fastest CAGR of 24.0% during the forecast period, driven by the enterprise and industrial applications, such as virtual training, remote collaboration, and digital twins, which increasingly leverage 3D audio software to enhance spatial awareness and communication. As businesses invest in immersive technologies for training and customer engagement, demand for flexible, scalable audio software solutions continues to rise.

Application Insights

The consumer segment dominated the market and accounted for the largest revenue share in 2024, owing to the increase in mobile device usage. Smartphones and tablets are now capable of supporting spatial audio playback, and consumers are using them as primary platforms for media consumption, particularly in on-the-go environments. This has led to a growing market for compatible hardware such as spatial audio-enabled earbuds and apps that process or simulate 3D sound environments. Manufacturers are responding with increasingly sophisticated solutions that deliver 3D audio experiences through compact and portable devices, expanding the consumer base.

The AR/VR segment is expected to grow at the fastest CAGR over the forecast period due to the expansion of the gaming and entertainment industries into the AR/VR domain. VR gaming, in particular, demands high levels of immersion, where sound must respond dynamically to user actions and the virtual environment. The addition of real-time 3D audio processing enhances gameplay by providing cues about enemy positions, environmental hazards, or interactive objects. This has led to increased adoption of 3D audio engines and software development kits (SDKs) specifically tailored for AR/VR content creation.

Regional Insights

North America 3D Audio Market accounted for the largest revenue share of 33.8% in 2024, driven by continuous technological innovation, high consumer expenditure on immersive entertainment experiences, and the strong presence of a well-established gaming industry. The region hosts major tech players such as Dolby Laboratories and Apple, which have invested heavily in spatial audio solutions across devices and streaming platforms.

U.S. 3D Audio Market Trends

The 3D audio market in the U.S. is expected to grow significantly at a CAGR of 16.9% from 2025 to 2033, driven by the consumer demand for immersive entertainment, especially in home theaters, gaming, and music streaming, which is a primary growth driver. The country is home to a massive base of early tech adopters and content creators who are pushing for spatial audio across platforms such as Apple Music, Netflix, and Xbox.

Europe 3D Audio Market Trends

The 3D audio market in Europe is anticipated to register considerable growth from 2025 to 2033, driven by strong cultural emphasis on high-fidelity audio, growing gaming communities, and the rise of AR/VR in education and healthcare. The European Union’s focus on digital transformation and smart technologies has led to increased funding for immersive tech initiatives.

The UK 3D audio market is expected to grow rapidly in the coming years. Universities and research institutions in the UK are active in AR/VR development, supporting use cases in healthcare, automotive, and training that benefit from 3D audio capabilities. Public and private sector collaborations on immersive media projects further contribute to market growth.

The 3D audio market in Germany held a substantial market share in 2024 due to advanced automotive audio systems, industrial training simulations, and smart home adoption in the country. German car manufacturers are integrating 3D audio into next-generation infotainment systems to improve the in-car experience. The country’s strong engineering base supports innovation in hardware, such as spatial speakers and advanced microphones.

Asia Pacific 3D Audio Market Trends

Asia Pacific is expected to grow at the fastest CAGR of 23.0% from 2025 to 2033, due to the growing consumer electronics industry, rising smartphone penetration, and expanding gaming and entertainment sectors. Countries such as China, Japan, South Korea, and India are seeing increased adoption of smart devices and VR/AR technologies, which heavily rely on spatial audio. The region’s young population, tech-savvy consumers, and growing disposable income are contributing to a surge in demand for immersive experiences across mobile apps, OTT platforms, and gaming.

Japan 3D audio market is expected to grow rapidly in the coming years. The country's major electronics manufacturers-like Sony and Panasonic-are actively developing 3D audio-enabled products, including headphones, soundbars, and gaming consoles. Japan’s thriving anime, music, and gaming culture provides a strong market for spatial sound, while its aging population is also opening up new opportunities for 3D audio in healthcare and virtual companionship solutions.

The 3D audio market in China held a substantial market share in 2024, due to its expansive digital ecosystem, massive mobile user base, and government support for technology innovation. Local tech giants like Huawei and Xiaomi are integrating 3D audio into smartphones, wearables, and smart speakers. Meanwhile, China’s gaming and social media sectors are rapidly evolving, creating demand for spatial audio in multiplayer and immersive experiences.

Key 3D Audio Company Insights

Key players operating in the 3D audio industry are Dolby Laboratories, Inc., Apple Inc., SAMSUNG, Sony Corporation, Qualcomm Technologies, Inc., and DTS, Inc. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In May 2025, Zebronics launched the Zeb Juke Bar 10000, a powerful 1100W RMS soundbar featuring a pioneering 7.2.4 surround sound system. Equipped with Dolby Atmos and DTS:X technologies, this soundbar delivers immersive 3D audio for a cinematic home entertainment experience, offering clear and precise sound across movies, games, and music

-

In January 2025, SAMSUNG announced that its 2025 TVs and soundbars will feature Eclipsa Audio, a cutting-edge 3D audio technology developed in collaboration with Google. This integration allows creators to deliver more immersive audio experiences while providing consumers with enhanced, dynamic sound on Samsung devices.

Key 3D Audio Companies:

The following are the leading companies in the 3D audio market. These companies collectively hold the largest market share and dictate industry trends.

- Apple Inc.

- Auro Technologies

- Bang and Olufsen

- Blue Ripple Sound

- BOSE Corporation

- Dolby Laboratories, Inc.

- DTS, Inc.

- Google LLC

- Magic Leap, Inc.

- Qualcomm Technologies, Inc.

- SAMSUNG

- Sennheiser Electronic GmbH & Co. KG

- Sony Corporation

- VisiSonics Corporation

- Waves Audio Ltd.

3D Audio Market Report Scope

Report Attribute

Details

Market size in 2025

USD 7.76 billion

Revenue forecast in 2033

USD 38.36 billion

Growth rate

CAGR of 22.1% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report enterprise size

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

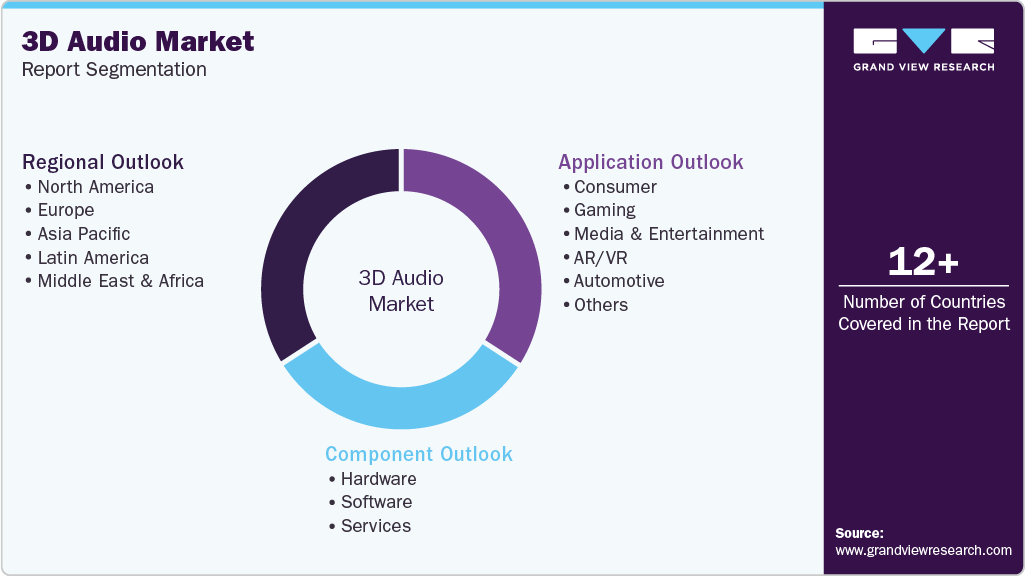

Component, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

Apple Inc.; Auro Technologies; Bang and Olufsen; Blue Ripple Sound; BOSE Corporation; Dolby Laboratories Inc.; DTS, Inc.; Google LLC; Magic Leap, Inc.; Qualcomm Technologies, Inc.; SAMSUNG; Sennheiser Electronic GmbH & Co. KG; Sony Corporation; VisiSonics Corporation; Waves Audio Ltd.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global 3D Audio Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global 3D audio market report based on component, application, and region:

-

3D Audio Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

Hardware

-

Headphones/headsets

-

Loudspeakers

-

Microphones

-

Others

-

-

Software

-

Services

-

-

3D Audio Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Consumer

-

Gaming

-

Media & Entertainment

-

AR/VR

-

Automotive

-

Others

-

-

3D Audio Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global 3D audio market size was estimated at USD 7.18 billion in 2024 and is expected to reach USD 7.76 billion in 2025.

b. The global 3D audio market is expected to grow at a compound annual growth rate of 22.1% from 2025 to 2033 to reach USD 38.36 billion by 2033.

b. The hardware segment dominated the market and accounted for the revenue share of over 48.1% in 2024, driven by the growing investment in immersive entertainment content, such as spatial audio music tracks and 3D movies, which necessitates compatible playback hardware.

b. Some key players operating in the 3D audio market include Apple Inc., Auro Technologies, Bang and Olufsen, Blue Ripple Sound, BOSE Corporation, Dolby Laboratories, Inc., DTS, Inc., Google LLC, Magic Leap, Inc., Qualcomm Technologies, Inc., SAMSUNG, Sennheiser Electronic GmbH & Co. KG, Sony Corporation, VisiSonics Corporation, Waves Audio Ltd.

b. The key growth drivers include the increasing demand for immersive entertainment experiences, particularly in gaming, virtual reality (VR), and augmented reality (AR). Gamers and content consumers are seeking more realistic and engaging soundscapes, prompting developers to integrate advanced 3D audio technologies

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.