- Home

- »

- Next Generation Technologies

- »

-

3D CAD Software Market Size, Share Forecast Report, 2030GVR Report cover

![3D CAD Software Market Size, Share & Trends Report]()

3D CAD Software Market (2023 - 2030) Size, Share & Trends Analysis Report By Deployment (Cloud, On-premises), By Application (AEC, Manufacturing, Automotive, Healthcare, Media & Entertainment), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-563-2

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

3D CAD Software Market Summary

The global 3d cad software market size was estimated at USD 10.38 billion in 2022 and is projected to reach USD 17.34 billion by 2030, growing at a CAGR of 6.7% from 2023 to 2030. The growth is expected to remain strong in the future as industries continue to rely on digital technologies to streamline their operations and improve their products and services.

Key Market Trends & Insights

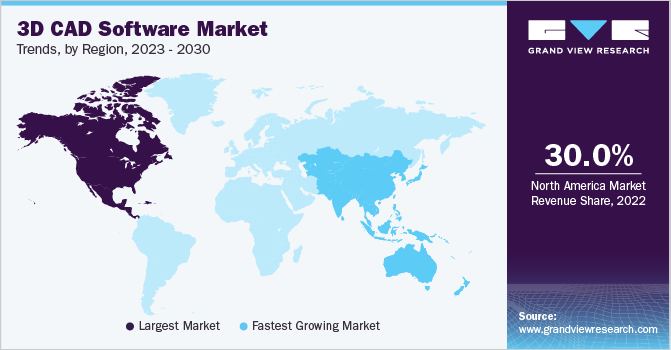

- North America is gaining market traction by acquiring market revenue of more than 30% in 2022.

- Asia Pacific is the fastest-growing market, with a CAGR of around 8.0% during 2023-2030.

- By deployment, the on-premises deployment segment is gaining market traction with an outstanding revenue share of around 70% in 2022.

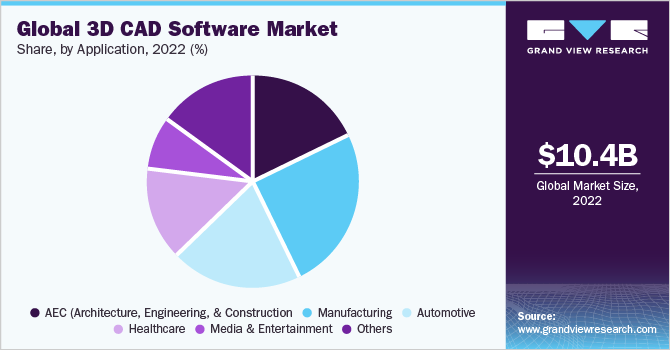

- By application, the manufacturing application segment accounts for a revenue share of nearly 26% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 10.38 Billion

- 2030 Projected Market Size: 17.34 Billion

- CAGR (2023-2030): 6.7%

- North America: Largest market in 2022

3D CAD software is used by designers, engineers, architects, and other professionals to create and edit 3D models of products, buildings, and other structures. It is an essential tool in many industries, including manufacturing, construction, and engineering. Several factors, such as the growth of the manufacturing industry, the increase in infrastructure development, and the adoption of advanced technologies such as 3D printing and virtual reality, influence the demand.

The shift towards remote work and cloud-based solutions has also impacted the market growth. The market's growth is also driven by the increasing adoption of cloud-based CAD modeling, which provides greater flexibility. Integration of artificial intelligence and machine learning technologies in modeling is expected to fuel the market's growth by enabling more advanced and efficient design processes.

The use of automation in manufacturing is on the rise, and 3D modeling software plays an essential role in designing the components and machines used in automated processes. As more companies automate their manufacturing processes, the demand for CAD software is expected to increase. Additionally, 3D printing is becoming more prevalent across industries, and 3D modeling software is a critical tool for creating 3D printable models. As the adoption of 3D printing continues to increase, the demand for this software is expected to grow simultaneously.

Automotive manufacturers use 3D CAD software extensively for designing and developing new vehicles, from the initial concept stage to the final manufacturing process. This software allows designers and engineers to create highly detailed 3D models of new cars, including parts and components, and test them virtually before building physical prototypes. The automotive industry increasingly adopts 3D printing technology to provide complex parts and components. For example, using this software to design the parts, Volkswagen has used 3D printing to produce metal parts for its vehicles, such as gearshift knobs and engine components.

AI and machine learning technologies are being integrated into this software to automate tasks, improve accuracy, and suggest design optimization. For instance, AI can analyze a design and suggest changes to improve its performance or reduce its weight. 3D CAD software creates virtual and augmented reality experiences, allowing designers to visualize and test their designs in a virtual environment. This technology can help to identify potential design flaws and improve collaboration among team members.

Deployment Insights

The on-premises deployment segment is gaining market traction with an outstanding revenue share of around 70% in 2022. The companies can have complete control over their software & data and can customize the software to their specific needs and requirements. On-premises deployment can be limited in terms of scalability. Companies may need to invest in more hardware and servers to support their increasing user base. It also has limited mobility as users are tied to their physical workstations or devices. It requires significant maintenance, updates, and troubleshooting efforts which can be complex and time-consuming.

The cloud-based deployment segment is attributed to growing at the fastest growth rate with a CAGR of around 8.0% during 2023-2030. The cloud-based deployment eliminates the need for expensive hardware and IT infrastructure, reducing upfront and ongoing maintenance costs. It also enables collaboration between designers, engineers, and other stakeholders, regardless of their location. They improve communication and collaboration, leading to better designs. It also offers advanced security measures, such as encryption and multi-factor authentication, to protect designs and intellectual property from unauthorized access.

Application Insights

The manufacturing application segment accounts for a revenue share of nearly 26% in 2022, owing to the increasing adoption of additive manufacturing technologies such as 3D printing. CAD software is an essential tool for designing 3D printable parts, and as the use of 3D printing continues to grow in various industries, so does the demand for the software. The increasing demand for customization in manufacturing 3D modeling software enables manufacturers to easily create custom designs and variations of products, allowing them to better meet their customers' needs. Furthermore, advancements in cloud computing and virtual reality technology have also contributed to the market's growth. Cloud-based software enables easy collaboration and access to design data from anywhere. At the same time, virtual reality allows designers and engineers to visualize and test their designs in a realistic and immersive environment.

The healthcare application segment is the highest-growing market, with a CAGR of around 7.5% from 2023-2030. The ability to create detailed 3D models of patient anatomy using medical imaging data has revolutionized the medical device industry allowing for the creation of customized implants and devices that is individual patients' needs. The software enables the device and implant placement simulation, allowing surgeons to plan and prepare for procedures more accurately and efficiently.

In addition, 3D printing technology has also found application in healthcare, particularly in the production of prosthetics, implants, and surgical tools. This software is essential for designing 3D printable medical devices and implants. This software helped create realistic anatomical models and simulations to train medical professionals in procedures and surgical techniques.

Regional Insights

North America is gaining market traction by acquiring market revenue of more than 30% in 2022, attributed to the increasing adoption of cloud-based solutions, rising demand for automation and efficiency in the manufacturing industry, and the growth of the aerospace and defense industries. In addition, the increasing investment in research and development activities for developing advanced CAD software is likely to offer significant growth opportunities in the region. The support offered by the U.S. government for deploying digitization solutions to enhance the development of the manufacturing industry in the region is expected to encourage the implementation of 3D CAD software solutions across the end-use industries. The major players operating in the region include Autodesk Inc, Dassault Systemes SE, PTC Inc., and Siemens.

Asia Pacific is the fastest-growing market, with a CAGR of around 8.0% during 2023-2030, owing to the increasing adoption of digital design tools, the rise of industry 4.0, and the expanding use of 3D printing across various industries. Software such as Solidworks, Autodesk Inventor, CATIA, PTC Creo, and Siemens NX are majorly used in automotive, aerospace, and industrial design industries for product design, simulation, and analysis. The extensive growth in the region’s engineering, design, and development sectors is anticipated to boost the adoption of designing and modeling tools over the forecast period.

Key Companies And Market Share Insights

Key players in the global 3D CAD software market are focusing on mergers, acquisitions, and research and development, which helps them to attract new users. With the help of 3D CAD software, companies focus on minimizing production errors, leading to efficient use of technology and resources. The key players have procurement teams based in major revenue-generating economies to procure goods and services from different suppliers based on criteria such as sustainability, the total cost of ownership, credentials, suppliers’ creativity and innovation, contractual commitments, and quality and completeness of the solution. The key market players sell their products and services through direct and indirect channels consisting of resellers and distributors. Some of the key players in the global 3D CAD software market include:

-

Autodesk Inc.

-

Bentley Systems, Inc.

-

Bricsvs NV.

-

Beijing generous Digital Technology Co., Ltd. (CAXA)

-

Dassault Systemes

-

Graphisoft

-

Hexagon AB

-

Oracle

-

PTC

-

Schott Systeme GmbH

-

Siemens

-

Dassault Systemes Solidworks Corporation

-

ZWSOFT Co., Ltd.

3D CAD Software Market Report Scope

Report Attribute

Details

The market size value in 2023

USD 11.04 billion

The revenue forecast in 2030

USD 17.34 billion

Growth rate

CAGR of 6.7% from 2023 to 2030

The base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Deployment, application, region

Regional Scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; China; Japan; India; South Korea; Brazil; Mexico; UAE; South Africa; Saudi Arabia

Key companies profiled

Autodesk Inc; Bentley Systems Inc.; Bricsys NV.; Beijing generous Digital Technology Co. Ltd. (CAXA); Graphisoft; Hexagon AB; Oracle; PTC; Schott Systeme GmbH; Siemens; Dassault Systemes Solidworks Corporation; ZWSOFT Co. Ltd.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

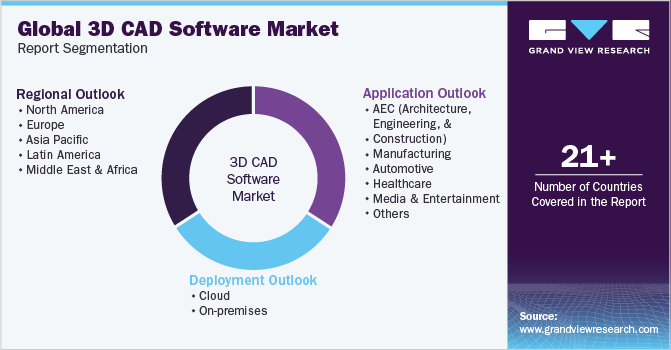

Global 3D CAD Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global 3D CAD software market report based on deployment, application, and region:

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cloud

-

On-premises

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

AEC (Architecture, Engineering, & Construction)

-

Manufacturing

-

Automotive

-

Healthcare

-

Media & Entertainment

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global 3D CAD software market size was estimated at USD 10.38 billion in 2022 and is expected to reach USD 11.04 billion in 2023.

b. The global 3D CAD software market is expected to grow at a compound annual growth rate of 6.7% from 2023 to 2030 to reach USD 17.34 billion by 2030.

b. North America dominated the 3D CAD software market with a share of more than 34% in 2022. This is attributable to the growing initiatives by the U.S. government for the implementation of digitization solutions in the manufacturing sector of the country, thereby stimulating the adoption of 3D CAD software.

b. Some of the key players in the global 3D CAD software market include Dassault Systemes; Autodesk Inc.; Siemens PLM Software Inc.; PTC Inc.; Bentley Systems, Incorporated; and Oracle Corporation.

b. Factors such as increased penetration of cloud-based designing in the manufacturing sector and growing adoption of additive manufacturing are driving the growth of the 3D CAD software market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.