- Home

- »

- Biotechnology

- »

-

3D Cell Culture Market Size, Share & Trends Report, 2030GVR Report cover

![3D Cell Culture Market Size, Share & Trends Report]()

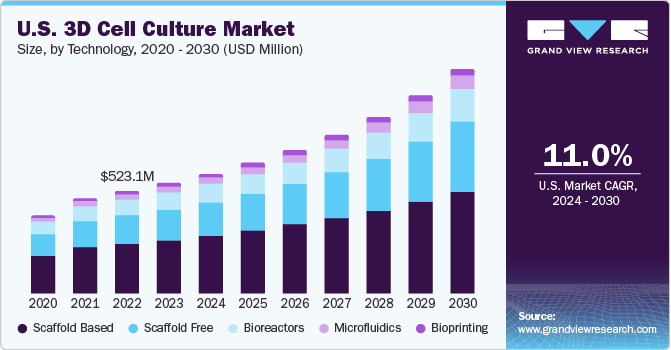

3D Cell Culture Market Size, Share & Trends Analysis Report By Technology (Scaffold Based, Scaffold Free, Bioreactors, Microfluidics, Bioprinting), By Application, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-091-0

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2023 - 2030

- Industry: Healthcare

3D Cell Culture Market Size & Trends

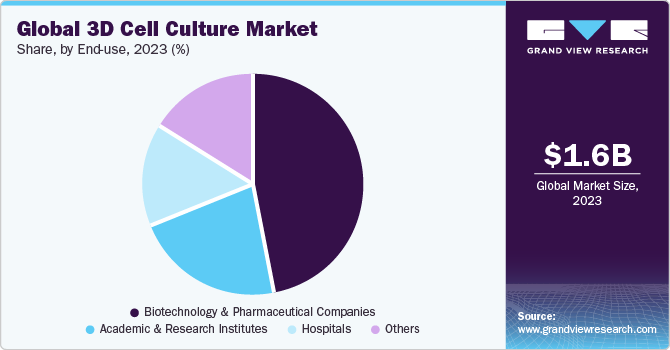

The global 3D cell culture market size was estimated at USD 1.57 billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 11.22% from 2024 to 2030. The growth of the market can be attributed to the rising efforts to develop potential alternatives to animal-based testing and the availability of funding programs for research. Moreover, consistent efforts in R&D activities by biopharmaceutical companies for drug development & discovery, and emphasis on the adoption of 3D cell cultures in cancer research are other factors anticipated to fuel market growth over the projected period. Animal models are largely used in cellular-based studies for studying the outlook of various diseases. However, they carry several demerits such as a lack of response accuracy, differences in response from different species, etc. Thus, to manage these issues, various government organizations are involved in promoting alternative ways for drug development.

The COVID-19 pandemic had a significant impact on the market. The COVID-19 pandemic has presented researchers with the opportunity to investigate the novel contagious virus for the creation of therapeutic and diagnostic tools. Numerous prominent pharmaceutical and biotechnology companies have been engaging in extensive R&D efforts to produce innovative vaccines, therapies, and testing kits. As a result, there has been a substantial increase in the need for cell culture tools in research applications. Furthermore, the pandemic has increased the demand for new cell-based models, organoids, and high-throughput screening platforms for research & drug discovery efforts. The urgency to combat the pandemic increased the demand for bioreactors and culture systems for applications in vaccine production and drug testing.

The rising burden of chronic diseases, and medical ailments such as multiple organ failure has created a robust demand for organ transplants. Whereas the dearth of donors has propelled the demand for alternative solutions, like regenerative medicine and tissue engineering. The 3D cell cultures system has an important role in nurturing organoids and functional tissue constructs for transplantation and drug analysis responses. Moreover, companies are launching products that would significantly boost the applications for tissue culture and tissue engineering. For instance, in June 2023, 3D BioFibR announced the launch of two novel 3D bioprinting collagen fiber products (CollaFibR 3D scaffold and μCollaFibR) for improved 3D cell culture.

Moreover, pharmaceutical companies, academic institutions, and research institutes are partnering to advance 3D cell culture technology. Such efforts accelerate technology advancement, knowledge sharing, and standardization of protocols, resulting in the larger adoption of 3D cell culture techniques. In addition, the supportive government legislation, and funding support from public and private organizations have accelerated the R&D activities in the market. For instance, in March 2023, ZEISS Ventures invested in InSphero to promote 3D cell culture research. Similarly, in November 2023, HeartBeat.bio got an investment of USD 4.94 million (€4.5 million) for the development of a specific type of platform which is 3D human tissue-based drug discovery for heart diseases.

Furthermore, robust demand for in-vitro testing models from a range of end users, and several organic and inorganic initiatives undertaken by market players is anticipated to facilitate market expansion in coming years. For instance, in December 2023, Charles River Laboratories announced their agreement with CELLphenomics, which is anticipated to expand their 3D in vitro services that would be used for drug screening purposes for cancer therapy. Similarly, in October 2020 Merck collaborated with D1 Med to accelerate manufacturing of D1Med’s 3-dimensional cells culture technology applications adopted in the drug development process.

Market Concentration & Characteristics

The market growth stage is medium, and the pace of the market growth is accelerating. The market for 3D cell culture is characterized by a high degree of innovation owing to rapid technological advancements. Moreover, the emergence of microfluidics-based 3D cell model (which is a type of cell culture) has further fueled the growth of the market. Several pharmaceutical companies & researchers are using this platform for better accuracy and is a reliable model for toxicity testing and drug screening. In May 2023, CellFE announced the launch of a new microfluidics cellular engineering platform, Infinity Mtx in the annual meeting of the American Society of Cell and Gene Therapy (ASGCT) 2023.

The market is also characterized by a high level of partnerships and collaboration activity undertaken by the leading players. This is attributed to the rising focus on increasing the company’s products & services portfolio, the need to consolidate in a rapidly growing market, and the increasing strategic importance of 3D cell model. Several companies are undertaking this strategy to strengthen their portfolio. For instance, in May 2023, Kiyatec and AstraZeneca announced their collaboration for multifaceted research which would be using Kiyatec’s 3D spheroid screening platform, KIYA-Predict to develop and commercialize a new therapeutics for cancer.

Regulatory authorities are focusing on establishing stringent guidelines for biosafety, contamination control, cell line authentication, and other factors. Hence, compliance with regulatory standards represents significant challenges that may limit market growth. 3D cell models products intended for clinical or commercial use must comply with rigorous quality and safety standards set by regulatory authorities. These standards may include Good Manufacturing Practices (GMPs) and quality control measures to ensure the consistency, purity, and safety of the final products. Meeting these regulatory requirements necessitates meticulous documentation and validation of procedures, which can increase the complexity and cost of cell culture operations. These factors may lead to limited adoption of 3D cell culture techniques and restrict market growth.

Several companies are expanding their 3D cell culture products. Thus, product expansion in this industry is significant. Companies are including product launches that specifically use 3D cell models for research purposes that are anticipated to drive market growth. For instance, in December 2023, Inventia Life Science, introduced a new product, Inventia Third Dimension Grant. This is projected to assist researchers with their studies regarding drug development or fundamental biology to model and test assumptions using 3D cell culture technology.

Technology Insights

The scaffold-based segment held the largest market share of 48.94% in 2023. The segment is further divided into hydrogels, polymeric scaffolds, micropatterned surfaced microplates, and nanofiber-based scaffolds. Factors such as increasing application of scaffold-based cultures in tissue engineering and regenerative medicine applications, advancements in scaffold materials and fabrication techniques, and increasing research funding and collaboration are anticipated to drive segment growth. The use of hydrogels as a scaffold in 3D cell culture model studies allows the incorporation of biochemical and mechanical signs as a mirror of the native extracellular matrix.

In addition, technological advancements, ongoing research activities, and recent product launches are projected to fuel segment growth. In June 2022, Dolomite Bio launched novel hydrogel-focused reagent kits for high-throughput encapsulation of cells in hydrogel scaffold. Furthermore, ongoing research efforts to develop scaffold-based technologies are another factor supporting 3D cell culture market expansion. For instance, in May 2023, researchers from NUS successfully used common plant protein to 3D print an edible cell culture scaffold.

The scaffold free segment is expected to register the fastest CAGR over the forecast period. Factors such as enhanced cellular interactions, higher throughput, and scalability, rising demand for personalized medicine, and advancements in 3D culture model platforms and technologies are responsible for the fastest growth of the segment. In addition, robust demand for scaffold-free systems across end users such as the biopharmaceutical industry and research institutes is another factor catering to segment demand

Application Insights

Based on application, the market is segmented into cancer research, stem cell research & tissue engineering, drug development & toxicity testing, and others. The stem cell research & tissue engineering segment dominated the market with a share in 2023. The increasing demand for biopharmaceuticals owing to effective treatments like cell and gene therapy and the upswing in innovation that resulted in increased approvals are the key factors contributing to segment growth.

It is expected that the U.S. FDA will be approving around 10 to 20 products of cell and gene therapy each year by 2025 based on the current clinical success rates and the product pipeline. Also, technological advancements, supportive government legislation, and increased funding for stem cell studies have propelled the adoption of 3D culture models. For instance, in March 2023 National Institute of Health granted funding of USD 2.5 million to the research team of Purdue University for stem cell research. The funding will support the investigation of novel therapeutic approaches with stem cells as it has tremendous potential in various life-threatening disorders.

The cancer research segment is expected to register the fastest CAGR over the forecast period. The rising prevalence of cancer and the benefits offered by 3D culture models in cancer research are expected to drive segment expansion. Moreover, the advantages of 3D media in altering cell proliferation and morphology, capturing phenotypic heterogeneity, and flexibility offered by these media further support segment expansion.

End-use Insights

Based on end-use, the market is segmented into biotechnology & pharmaceutical companies, academic & research institutes, hospitals, and others. The biopharmaceutical & pharmaceutical companies segment dominated the market with a share in 2023. The continuous growth and commercial success of biopharmaceuticals coupled with leveraging the portfolio of the major pharmaceutical companies have contributed to the segment growth. 3D model offers benefits such the optimal oxygen & nutrient gradient formation and realistic cellular interactions in comparison to two-dimensional cellular media to study drugs. These factors facilitate the adoption of this method for drug discovery & development, thereby fueling the demand.

The academic & research institutes segment is expected to register the fastest CAGR during the forecast period. Factors such as advancements in biomedical research, increasing research activities, rising industry-academia collaboration, and significant efforts from research institutions in drug modelling and drug screening are anticipated to accelerate segment growth.

Regional Insights

North America dominated the market and accounted for a 38.97% share in 2023. The market is collectively driven by the presence of advanced healthcare infrastructure, developed economies, the presence of key players, and various strategic initiatives undertaken by them. In addition, a supportive regulatory framework, government support for the development of three-dimensional culture models, and a high number of research organizations and universities investigating different stem-cells based approaches are projected to support the regional market. For instance, in April 2023, the American Cancer Society (ACS) announced the funding of more than USD 45 million for 90 novel Extramural Discovery Science (EDS) research at 67 institutes across the U.S.

Asia Pacific is anticipated to witness the fastest growth in the market from 2024 to 2030. The high burden of chronic diseases, the flourishing biotechnology sector in the region, low operating costs, and rising investments by companies in the region are fueling the regional market. Moreover, rising demand for cellular therapies, increasing biobanks, and strong research potential are further contributing to the regional market.

Key 3D Cell Culture Company Insights

Prominent players operating in the market are undertaking strategic activities such as new product launches, partnerships for product development, and investment activities to fuel market growth in the coming years.

Key 3D Cell Culture Companies:

The following are the leading companies in the 3D cell culture market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these 3D cell culture companies are analyzed to map the supply network.

- Thermo Fisher Scientific, Inc.

- Merck KGaA

- PromoCell GmbH

- Lonza

- Corning Incorporated

- Avantor, Inc.

- Tecan Trading AG

- REPROCELL Inc.

- CN Bio Innovations Ltd

- Lena Biosciences

Recent Developments

-

In September 2023, Curi bio announced the launch of two platforms, that is, Nautilus and Stringray. These platforms are anticipated to assist researchers with their 2D or 3D cell culture interrogation on electrophysiology.

-

In July 2023, REPROCELL Inc. entered into a partnership with Vernal Biosciences to deliver mRNA services at scale for clinical and research applications in Japan. This strategy is aligned with REPROCELL’s aim to introduce cutting-edge preclinical & clinical research solutions to the market.

-

In July 2023, 3D BioFibR, a Canada-based company, received an investment of nearly USD 3.52 million to expand the facility and launch collagen fiber products used for 3D bioprinting.

-

In June 2023, Lonza entered into a strategic business collaboration with Vertex Pharmaceuticals Incorporated, with an aim to support the production of Vertex’s range of fully differentiated insulin-producing, investigational stem cell-derived islet cell therapies for individuals with Type 1 diabetes and to speed up the clinical trials.

-

In February 2023, Corning Life Sciences announced its plans to unveil its advanced 3D culture tools and a new Elplasia plate featuring an open-well format for easing spheroid and organoid manipulations.

-

In February 2023, CN Bio announced the commercial product launch of the PhysioMimix - a single-organ higher throughput system. The system is developed to allow the earlier adoption of predictive models of liver Organ-on-a-Chip for humans in drug discovery workflows. By deploying 3D cell culture systems including PhysioMimix, researchers can more efficiently simulate the behavior of organs & tissues, leading to more relevant and reliable preclinical research results.

-

In January 2023, CD BioSciences launched scaffold-based technology to help scientists achieve organotypic co-culture and simulate layered tissue structures.

3D Cell Culture Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.70 billion

Revenue forecast in 2030

USD 3.21 billion

Growth Rate

CAGR of 11.22% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Thermo Fisher Scientific, Inc.; Merck KGaA, PromoCell GmbH; Lonza; Corning Incorporated; Avantor, Inc.; Tecan Trading AG; REPROCELL Inc.; CN Bio Innovations Ltd; Lena Biosciences.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global 3D Cell Culture Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global 3D cell culture market report based on technology, application, end-use, and region.

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Scaffold Based

-

Hydrogels

-

Polymeric Scaffolds

-

Micropatterned Surface Microplates

-

Nanofiber Base Scaffolds

-

-

Scaffold Free

-

Hanging Drop Microplates

-

Spheroid Microplates with ULA Coating

-

Magnetic Levitation

-

-

Bioreactors

-

Microfluidics

-

Bioprinting

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cancer Research

-

Stem Cell Research & Tissue Engineering

-

Drug Development & Toxicity Testing

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Biotechnology and Pharmaceutical Companies

-

Academic & Research Institutes

-

Hospitals

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. Key factors that are driving the 3D cell culture market growth include rising demand for organ transplantation & tissue engineering, technological advancements in scaffold-free technology, and a rise in investments and R&D funding for cell-based research.

b. The global 3D cell culture market size was estimated at USD 1.57 billion in 2023 and is expected to reach USD 1.70 billion by 2024.

b. The global 3D cell culture market is expected to grow at a compound annual growth rate of 11.22% from 2024 to 2030 to reach USD 3.21 billion by 2030.

b. Scaffold-based technology segment dominated the 3D cell culture market with a share of 48.94% in 2023. This is attributable to the availability of a significant number of products for scaffold-based 3D cell culture.

b. Some key players operating in the 3D cell culture market include Thermo Fisher Scientific, Inc.; Merck KGaA, PromoCell GmbH; Lonza; Corning Incorporated; Avantor, Inc.; Tecan Trading AG; REPROCELL Inc.; CN Bio Innovations Ltd; Lena Biosciences.

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation and Scope

1.1.1. Technology Segment

1.1.2. Application Segment

1.1.3. End Use Segment

1.2. Regional Scope

1.3. Estimates and Forecast Timeline

1.4. Research Methodology

1.5. Information Procurement

1.5.1. Purchased Database

1.5.2. GVR’s Internal Database

1.5.3. Secondary Sources

1.5.4. Primary Research

1.6. Information or Data Analysis:

1.6.1. Data Analysis Models

1.7. Market Formulation & Validation

1.8. Model Details

1.8.1. Commodity Flow Analysis

1.9. Objectives

1.9.1. Objective 1

1.9.2. Objective 2

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Snapshot

2.3. Competitive Landscape Snapshot

Chapter 3. Market Variables, Trends, & Scope

3.1. Market Lineage Outlook

3.1.1. Parent Market Outlook

3.1.2. Related/Ancillary Market Outlook

3.2. Market Dynamics

3.2.1. Market Driver Analysis

3.2.1.1. Increasing demand for organ transplantation & tissue engineering

3.2.1.2. Technological advancements in scaffold free technology

3.2.1.3. Rise in investments and R&D funding for cell-based research

3.2.1.4. Increasing focus on developing alternative to animal testing

3.2.2. Market Restraint Analysis

3.2.2.1. High cost associated with implementation

3.2.2.2. Lack of compatibility and consistency

3.3. Industry Analysis Tools

3.3.1. Porter’s Five Forces Analysis

3.3.2. PESTEL Analysis

3.3.3. COVID-19 Impact Analysis

Chapter 4. Technology Business Analysis

4.1. 3D Cell Culture Market: Technology Movement Analysis

4.2. Scaffold Based

4.2.1. Scaffold based market estimates and forecasts, 2018 - 2030 (USD Million)

4.2.2. Hydrogels

4.2.2.1. Hydrogels market estimates and forecasts, 2018 - 2030 (USD Million)

4.2.3. Polymeric Scaffolds

4.2.3.1. Polymeric scaffolds market estimates and forecasts, 2018 - 2030 (USD Million)

4.2.4. Micropatterned Surface Microplates

4.2.4.1. Micropatterned surface microplates market estimates and forecasts, 2018 - 2030 (USD Million)

4.2.5. Nanofiber Based Scaffolds

4.2.5.1. Nanofiber based scaffolds market estimates and forecasts, 2018 - 2030 (USD Million)

4.3. Scaffold Free

4.3.1. Scaffold free market estimates and forecasts, 2018 - 2030 (USD Million)

4.3.2. Hanging Drop Microplates

4.3.2.1. Hanging drop microplates market estimates and forecasts, 2018 - 2030 (USD Million)

4.3.3. Spheroid Microplates with ULA coating

4.3.3.1. Spheroid microplates with ULA coating market estimates and forecasts, 2018 - 2030 (USD Million)

4.3.4. Magnetic Levitation

4.3.4.1. Magnetic levitation market estimates and forecasts, 2018 - 2030 (USD Million)

4.4. Bioreactors

4.4.1. Bioreactors market estimates and forecasts, 2018 - 2030 (USD Million)

4.5. Microfluidics

4.5.1. Microfluidics market estimates and forecasts, 2018 - 2030 (USD Million)

4.6. Bioprinting

4.6.1. Bioprinting market estimates and forecasts, 2018 - 2030 (USD Million)

Chapter 5. Application Business Analysis

5.1. 3D Cell Culture Market: Application Movement Analysis

5.2. Cancer Research

5.2.1. Cancer research market estimates and forecasts, 2018 - 2030 (USD Million)

5.3. Stem Cell Research & Tissue Engineering

5.3.1. Stem cell research & tissue engineering market estimates and forecasts, 2018 - 2030 (USD Million)

5.4. Drug Development & Toxicity Testing

5.4.1. Drug development & toxicity testing market estimates and forecasts, 2018 - 2030 (USD Million)

5.5. Others

5.5.1. Others market estimates and forecasts, 2018 - 2030 (USD Million)

Chapter 6. End-Use Business Analysis

6.1. 3D Cell Culture Market: End-Use Movement Analysis

6.2. Biotechnology & Pharmaceutical Companies

6.2.1. Biotechnology & pharmaceutical companies market estimates and forecasts, 2018 - 2030 (USD Million)

6.3. Academic & Research Institutes

6.3.1. Academic & research institutes market estimates and forecasts, 2018 - 2030 (USD Million)

6.4. Hospitals

6.4.1. Hospitals market estimates and forecasts, 2018 - 2030 (USD Million)

6.5. Others

6.5.1. Others market estimates and forecasts, 2018 - 2030 (USD Million)

Chapter 7. Regional Business Analysis

7.1. 3D Cell Culture Share By Region, 2023 & 2030

7.2. North America

7.2.1. North America 3D Cell Culture, 2018 - 2030 (USD Million)

7.2.2. U.S.

7.2.2.1. Key Country Dynamics

7.2.2.2. Competitive Scenario

7.2.2.3. Target Disease Prevalence

7.2.2.4. U.S. 3D Cell Culture, 2018 - 2030 (USD Million)

7.2.3. Canada

7.2.3.1. Key Country Dynamics

7.2.3.2. Competitive Scenario

7.2.3.3. Target Disease Prevalence

7.2.3.4. Canada 3D Cell Culture, 2018 - 2030 (USD Million)

7.3. Europe

7.3.1. Europe 3D Cell Culture, 2018 - 2030 (USD Million)

7.3.2. UK

7.3.2.1. Key Country Dynamics

7.3.2.2. Competitive Scenario

7.3.2.3. Target Disease Prevalence

7.3.2.4. UK 3D Cell Culture, 2018 - 2030 (USD Million)

7.3.3. Germany

7.3.3.1. Key Country Dynamics

7.3.3.2. Competitive Scenario

7.3.3.3. Target Disease Prevalence

7.3.3.4. Germany 3D Cell Culture, 2018 - 2030 (USD Million)

7.3.4. France

7.3.4.1. Key Country Dynamics

7.3.4.2. Competitive Scenario

7.3.4.3. Target Disease Prevalence

7.3.4.4. France 3D Cell Culture, 2018 - 2030 (USD Million)

7.3.5. Italy

7.3.5.1. Key Country Dynamics

7.3.5.2. Competitive Scenario

7.3.5.3. Target Disease Prevalence

7.3.5.4. Italy 3D Cell Culture, 2018 - 2030 (USD Million)

7.3.6. Spain

7.3.6.1. Key Country Dynamics

7.3.6.2. Competitive Scenario

7.3.6.3. Target Disease Prevalence

7.3.6.4. Spain 3D Cell Culture, 2018 - 2030 (USD Million)

7.3.7. Denmark

7.3.7.1. Key Country Dynamics

7.3.7.2. Competitive Scenario

7.3.7.3. Target Disease Prevalence

7.3.7.4. Denmark 3D Cell Culture, 2018 - 2030 (USD Million)

7.3.8. Sweden

7.3.8.1. Key Country Dynamics

7.3.8.2. Competitive Scenario

7.3.8.3. Target Disease Prevalence

7.3.8.4. Sweden 3D Cell Culture, 2018 - 2030 (USD Million)

7.3.9. Norway

7.3.9.1. Key Country Dynamics

7.3.9.2. Competitive Scenario

7.3.9.3. Target Disease Prevalence

7.3.9.4. Norway 3D Cell Culture, 2018 - 2030 (USD Million)

7.4. Asia Pacific

7.4.1. Asia Pacific 3D Cell Culture, 2018 - 2030 (USD Million)

7.4.2. Japan

7.4.2.1. Key Country Dynamics

7.4.2.2. Competitive Scenario

7.4.2.3. Target Disease Prevalence

7.4.2.4. Japan 3D Cell Culture, 2018 - 2030 (USD Million)

7.4.3. China

7.4.3.1. Key Country Dynamics

7.4.3.2. Competitive Scenario

7.4.3.3. Target Disease Prevalence

7.4.3.4. China 3D Cell Culture, 2018 - 2030 (USD Million)

7.4.4. India

7.4.4.1. Key Country Dynamics

7.4.4.2. Competitive Scenario

7.4.4.3. Target Disease Prevalence

7.4.4.4. India 3D Cell Culture, 2018 - 2030 (USD Million)

7.4.5. Australia

7.4.5.1. Key Country Dynamics

7.4.5.2. Competitive Scenario

7.4.5.3. Target Disease Prevalence

7.4.5.4. Australia 3D Cell Culture, 2018 - 2030 (USD Million)

7.4.6. Thailand

7.4.6.1. Key Country Dynamics

7.4.6.2. Competitive Scenario

7.4.6.3. Target Disease Prevalence

7.4.6.4. Thailand 3D Cell Culture, 2018 - 2030 (USD Million)

7.4.7. South Korea

7.4.7.1. Key Country Dynamics

7.4.7.2. Competitive Scenario

7.4.7.3. Target Disease Prevalence

7.4.7.4. South Korea 3D Cell Culture, 2018 - 2030 (USD Million)

7.5. Latin America

7.5.1. Latin America 3D Cell Culture, 2018 - 2030 (USD Million)

7.5.2. Brazil

7.5.2.1. Key Country Dynamics

7.5.2.2. Competitive Scenario

7.5.2.3. Target Disease Prevalence

7.5.2.4. Brazil 3D Cell Culture, 2018 - 2030 (USD Million)

7.5.3. Mexico

7.5.3.1. Key Country Dynamics

7.5.3.2. Competitive Scenario

7.5.3.3. Target Disease Prevalence

7.5.3.4. Mexico 3D Cell Culture, 2018 - 2030 (USD Million)

7.5.4. Argentina

7.5.4.1. Key Country Dynamics

7.5.4.2. Competitive Scenario

7.5.4.3. Target Disease Prevalence

7.5.4.4. Argentina 3D Cell Culture, 2018 - 2030 (USD Million)

7.6. MEA

7.6.1. MEA 3D Cell Culture, 2018 - 2030 (USD Million)

7.6.2. South Africa

7.6.2.1. Key Country Dynamics

7.6.2.2. Competitive Scenario

7.6.2.3. Target Disease Prevalence

7.6.2.4. South Africa 3D Cell Culture, 2018 - 2030 (USD Million)

7.6.3. Saudi Arabia

7.6.3.1. Key Country Dynamics

7.6.3.2. Competitive Scenario

7.6.3.3. Target Disease Prevalence

7.6.3.4. Saudi Arabia 3D Cell Culture, 2018 - 2030 (USD Million)

7.6.4. UAE

7.6.4.1. Key Country Dynamics

7.6.4.2. Competitive Scenario

7.6.4.3. Target Disease Prevalence

7.6.4.4. UAE 3D Cell Culture, 2018 - 2030 (USD Million)

7.6.5. Kuwait

7.6.5.1. Key Country Dynamics

7.6.5.2. Competitive Scenario

7.6.5.3. Target Disease Prevalence

7.6.5.4. Kuwait 3D Cell Culture, 2018 - 2030 (USD Million)

Chapter 8. Competitive Landscape

8.1. Company Categorization

8.2. Strategy Mapping

8.3. Company Market Position Analysis, 2023

8.4. Company Profiles/Listing

8.4.1. Thermo Fisher Scientific, Inc

8.4.1.1. Overview

8.4.1.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

8.4.1.3. Product Benchmarking

8.4.1.4. Strategic Initiatives

8.4.2. Merck KGaA

8.4.2.1. Overview

8.4.2.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

8.4.2.3. Product Benchmarking

8.4.2.4. Strategic Initiatives

8.4.3. PromoCell GmbH

8.4.3.1. Overview

8.4.3.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

8.4.3.3. Product Benchmarking

8.4.3.4. Strategic Initiatives

8.4.4. Lonza

8.4.4.1. Overview

8.4.4.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

8.4.4.3. Product Benchmarking

8.4.4.4. Strategic Initiatives

8.4.5. Corning Incorporated

8.4.5.1. Overview

8.4.5.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

8.4.5.3. Product Benchmarking

8.4.5.4. Strategic Initiatives

8.4.6. Avantor, Inc.

8.4.6.1. Overview

8.4.6.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

8.4.6.3. Product Benchmarking

8.4.6.4. Strategic Initiatives

8.4.7. Tecan Trading AG

8.4.7.1. Overview

8.4.7.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

8.4.7.3. Product Benchmarking

8.4.7.4. Strategic Initiatives

8.4.8. REPROCELL Inc.

8.4.8.1. Overview

8.4.8.2. Product Benchmarking

8.4.8.3. Strategic Initiatives

8.4.9. CN Bio Innovations Ltd.

8.4.9.1. Overview

8.4.9.2. Product Benchmarking

8.4.9.3. Strategic Initiatives

8.4.10. Lena Biosciences

8.4.10.1. Overview

8.4.10.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

8.4.10.3. Product Benchmarking

8.4.10.4. Strategic Initiatives

List of Tables

Table 1 List of abbreviation

Table 2 Global 3D cell culture market, by region, 2018 - 2030 (USD Million)

Table 3 North America 3D cell culture market, by country, 2018 - 2030 (USD Million)

Table 4 North America 3D cell culture market, by technology, 2018 - 2030 (USD Million)

Table 5 North America 3D cell culture market, by application, 2018 - 2030 (USD Million)

Table 6 North America 3D cell culture market, by end-use, 2018 - 2030 (USD Million)

Table 7 U.S. 3D cell culture market, by technology, 2018 - 2030 (USD Million)

Table 8 U.S. 3D cell culture market, by application, 2018 - 2030 (USD Million)

Table 9 U.S. 3D cell culture market, by end-use, 2018 - 2030 (USD Million)

Table 10 Canada 3D cell culture market, by technology, 2018 - 2030 (USD Million)

Table 11 Canada 3D cell culture market, by application, 2018 - 2030 (USD Million)

Table 12 Canada 3D cell culture market, by end-use, 2018 - 2030 (USD Million)

Table 13 Europe 3D cell culture market, by country, 2018 - 2030 (USD Million)

Table 14 Europe 3D cell culture market, by technology, 2018 - 2030 (USD Million)

Table 15 Europe 3D cell culture market, by application, 2018 - 2030 (USD Million)

Table 16 Europe 3D cell culture market, by end-use, 2018 - 2030 (USD Million)

Table 17 Germany 3D cell culture market, by technology, 2018 - 2030 (USD Million)

Table 18 Germany 3D cell culture market, by application, 2018 - 2030 (USD Million)

Table 19 Germany 3D cell culture market, by end-use, 2018 - 2030 (USD Million)

Table 20 UK 3D cell culture market, by technology, 2018 - 2030 (USD Million)

Table 21 UK 3D cell culture market, by application, 2018 - 2030 (USD Million)

Table 22 UK 3D cell culture market, by end-use, 2018 - 2030 (USD Million)

Table 23 France 3D cell culture market, by technology, 2018 - 2030 (USD Million)

Table 24 France 3D cell culture market, by application, 2018 - 2030 (USD Million)

Table 25 France 3D cell culture market, by end-use, 2018 - 2030 (USD Million)

Table 26 Italy 3D cell culture market, by technology, 2018 - 2030 (USD Million)

Table 27 Italy 3D cell culture market, by application, 2018 - 2030 (USD Million)

Table 28 Italy 3D cell culture market, by end-use, 2018 - 2030 (USD Million)

Table 29 Spain 3D cell culture market, by technology, 2018 - 2030 (USD Million)

Table 30 Spain 3D cell culture market, by application, 2018 - 2030 (USD Million)

Table 31 Spain 3D cell culture market, by end-use, 2018 - 2030 (USD Million)

Table 32 Denmark 3D cell culture market, by technology, 2018 - 2030 (USD Million)

Table 33 Denmark 3D cell culture market, by application, 2018 - 2030 (USD Million)

Table 34 Denmark 3D cell culture market, by end-use, 2018 - 2030 (USD Million)

Table 35 Sweden 3D cell culture market, by technology, 2018 - 2030 (USD Million)

Table 36 Sweden 3D cell culture market, by application, 2018 - 2030 (USD Million)

Table 37 Sweden 3D cell culture market, by end-use, 2018 - 2030 (USD Million)

Table 38 Norway 3D cell culture market, by technology, 2018 - 2030 (USD Million)

Table 39 Norway 3D cell culture market, by application, 2018 - 2030 (USD Million)

Table 40 Norway 3D cell culture market, by end-use, 2018 - 2030 (USD Million)

Table 41 Asia Pacific 3D cell culture market, by country, 2018 - 2030 (USD Million)

Table 42 Asia Pacific 3D cell culture market, by technology, 2018 - 2030 (USD Million)

Table 43 Asia Pacific 3D cell culture market, by application, 2018 - 2030 (USD Million)

Table 44 Asia Pacific 3D cell culture market, by end-use, 2018 - 2030 (USD Million)

Table 45 China 3D cell culture market, by technology, 2018 - 2030 (USD Million)

Table 46 China 3D cell culture market, by application, 2018 - 2030 (USD Million)

Table 47 China 3D cell culture market, by end-use, 2018 - 2030 (USD Million)

Table 48 Japan 3D cell culture market, by technology, 2018 - 2030 (USD Million)

Table 49 Japan 3D cell culture market, by application, 2018 - 2030 (USD Million)

Table 50 Japan 3D cell culture market, by end-use, 2018 - 2030 (USD Million)

Table 51 India 3D cell culture market, by technology, 2018 - 2030 (USD Million)

Table 52 India 3D cell culture market, by application, 2018 - 2030 (USD Million)

Table 53 India 3D cell culture market, by end-use, 2018 - 2030 (USD Million)

Table 54 South Korea 3D cell culture market, by technology, 2018 - 2030 (USD Million)

Table 55 South Korea 3D cell culture market, by application, 2018 - 2030 (USD Million)

Table 56 South Korea 3D cell culture market, by end-use, 2018 - 2030 (USD Million)

Table 57 Australia 3D cell culture market, by technology, 2018 - 2030 (USD Million)

Table 58 Australia 3D cell culture market, by application, 2018 - 2030 (USD Million)

Table 59 Australia 3D cell culture market, by end-use, 2018 - 2030 (USD Million)

Table 60 Thailand 3D cell culture market, by technology, 2018 - 2030 (USD Million)

Table 61 Thailand 3D cell culture market, by application, 2018 - 2030 (USD Million)

Table 62 Thailand 3D cell culture market, by end-use, 2018 - 2030 (USD Million)

Table 63 Latin America 3D cell culture market, by country, 2018 - 2030 (USD Million)

Table 64 Latin America 3D cell culture market, by technology, 2018 - 2030 (USD Million)

Table 65 Latin America 3D cell culture market, by application, 2018 - 2030 (USD Million)

Table 66 Latin America 3D cell culture market, by end-use, 2018 - 2030 (USD Million)

Table 67 Brazil 3D cell culture market, by technology, 2018 - 2030 (USD Million)

Table 68 Brazil 3D cell culture market, by application, 2018 - 2030 (USD Million)

Table 69 Brazil 3D cell culture market, by end-use, 2018 - 2030 (USD Million)

Table 70 Mexico 3D cell culture market, by technology, 2018 - 2030 (USD Million)

Table 71 Mexico 3D cell culture market, by application, 2018 - 2030 (USD Million)

Table 72 Mexico 3D cell culture market, by end-use, 2018 - 2030 (USD Million)

Table 73 Argentina 3D cell culture market, by technology, 2018 - 2030 (USD Million)

Table 74 Argentina 3D cell culture market, by application, 2018 - 2030 (USD Million)

Table 75 Argentina 3D cell culture market, by end-use, 2018 - 2030 (USD Million)

Table 76 MEA 3D cell culture market, by country, 2018 - 2030 (USD Million)

Table 77 MEA 3D cell culture market, by technology, 2018 - 2030 (USD Million)

Table 78 MEA 3D cell culture market, by application, 2018 - 2030 (USD Million)

Table 79 MEA 3D cell culture market, by end-use, 2018 - 2030 (USD Million)

Table 80 South Africa 3D cell culture market, by technology, 2018 - 2030 (USD Million)

Table 81 South Africa 3D cell culture market, by application, 2018 - 2030 (USD Million)

Table 82 South Africa 3D cell culture market, by end-use, 2018 - 2030 (USD Million)

Table 83 Saudi Arabia 3D cell culture market, by technology, 2018 - 2030 (USD Million)

Table 84 Saudi Arabia 3D cell culture market, by application, 2018 - 2030 (USD Million)

Table 85 Saudi Arabia 3D cell culture market, by end-use, 2018 - 2030 (USD Million)

Table 86 UAE 3D cell culture market, by technology, 2018 - 2030 (USD Million)

Table 87 UAE 3D cell culture market, by application, 2018 - 2030 (USD Million)

Table 88 UAE 3D cell culture market, by end-use, 2018 - 2030 (USD Million)

Table 89 Kuwait 3D cell culture market, by technology, 2018 - 2030 (USD Million)

Table 90 Kuwait 3D cell culture market, by application, 2018 - 2030 (USD Million)

Table 91 Kuwait 3D cell culture market, by end-use, 2018 - 2030 (USD Million)

List of Figures

Fig. 1 Market research process

Fig. 2 Data triangulation techniques

Fig. 3 Primary research pattern

Fig. 4 Market research approaches

Fig. 5 Value-chain-based sizing & forecasting

Fig. 6 QFD modeling for market share assessment

Fig. 7 Market formulation & validation

Fig. 8 3D cell culture market: market outlook

Fig. 9 Parent market outlook

Fig. 10 3D cell culture market driver impact

Fig. 11 3D cell culture market restraint impact

Fig. 12 3D cell culture market: technology outlook and key takeaways

Fig. 13 3D cell culture market: technology movement analysis

Fig. 14 Scaffold based market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 15 Hydrogels market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 16 Polymeric scaffolds market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 17 Micropatterned surface microplates market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 18 Nanofiber based scaffolds market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 19 Scaffold free market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 20 Hanging drop microplates market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 21 Spheroid microplates with ULA coating market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 22 Magnetic levitation market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 23 Bioreactors market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 24 Microfluidics market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 25 Bioprinting market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 26 3D cell culture market: application outlook and key takeaways

Fig. 27 3D cell culture market: application movement analysis

Fig. 28 Cancer research market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 29 Stem cell research & tissue engineering market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 30 Drug development & toxicity testing market estimates and forecasts,2018 - 2030 (USD Million)

Fig. 31 Others market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 32 3D cell culture market: end-use outlook and key takeaways

Fig. 33 3D cell culture market: end-use movement analysis

Fig. 34 Biotechnology & pharmaceutical companies market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 35 Academic & research institutes market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 36 Hospitals market estimates and forecasts,2018 - 2030 (USD Million)

Fig. 37 Others market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 38 North America 3D cell culture market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 39 U.S. 3D cell culture market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 40 Canada 3D cell culture market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 41 Europe 3D cell culture market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 42 UK 3D cell culture market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 43 Germany 3D cell culture market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 44 France 3D cell culture market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 45 Italy 3D cell culture market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 46 Spain 3D cell culture market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 47 Denmark 3D cell culture market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 48 Sweden 3D cell culture market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 49 Norway 3D cell culture market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 50 Asia Pacific 3D cell culture market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 51 China 3D cell culture market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 52 Japan 3D cell culture market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 53 India 3D cell culture market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 54 Thailand 3D cell culture market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 55 South Korea 3D cell culture market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 56 Australia 3D cell culture market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 57 Latin America 3D cell culture market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 58 Brazil 3D cell culture market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 59 Mexico 3D cell culture market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 60 Argentina 3D cell culture market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 61 Middle East and Africa 3D cell culture market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 62 South Africa 3D cell culture market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 63 Saudi Arabia 3D cell culture market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 64 UAE 3D cell culture market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 65 Kuwait 3D cell culture market estimates and forecasts, 2018 - 2030 (USD Million)What questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- 3D Cell Culture Technology Outlook (Revenue, USD Million, 2018 - 2030)

- Scaffold Based

- Hydrogels

- Polymeric Scaffolds

- Micropatterned Surface Microplates

- Nanofiber Based Scaffolds

- Scaffold Free

- Hanging Drop Microplates

- Spheroid Microplates with ULA coating

- Magnetic Levitation

- Bioreactors

- Microfluidic

- Bioprinting

- Scaffold Based

- 3D Cell Culture Application Outlook (Revenue, USD Million, 2018 - 2030)

- Cancer Research

- Stem Cell Research & Tissue Engineering

- Drug Development & Toxicity Testing

- Others

- 3D Cell Culture End-Use Outlook (Revenue, USD Million, 2018 - 2030)

- Biotechnology & Pharmaceutical Companies

- Academic & Research Institutes

- Hospitals

- Others

- 3D Cell Culture Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- North America 3D Cell Culture Market, By Technology, 2018 - 2030 (USD Million)

- Scaffold Based

- Hydrogels

- Polymeric Scaffolds

- Micropatterned Surface Microplates

- Nanofiber Based Scaffolds

- Scaffold Free

- Hanging Drop Microplates

- Spheroid Microplates with ULA coating

- Magnetic Levitation

- Bioreactors

- Microfluidics

- Bioprinting

- Scaffold Based

- North America 3D Cell Culture Market, By Application, 2018 - 2030 (USD Million)

- Cancer Research

- Stem Cell Research & Tissue Engineering

- Drug Development & Toxicity Testing

- Others

- North America 3D Cell Culture Market, By End Use, 2018 - 2030 (USD Million)

- Biotechnology & Pharmaceutical Companies

- Academic & Research Institutes

- Hospitals

- Others

- U.S.

- U.S. 3D Cell Culture Market, By Technology, 2018 - 2030 (USD Million)

- Scaffold Based

- Hydrogels

- Polymeric Scaffolds

- Micropatterned Surface Microplates

- Nanofiber Based Scaffolds

- Scaffold Free

- Hanging Drop Microplates

- Spheroid Microplates with ULA coating

- Magnetic Levitation

- Bioreactors

- Microfluidics

- Bioprinting

- Scaffold Based

- U.S. 3D Cell Culture Market, By Application, 2018 - 2030 (USD Million)

- Cancer Research

- Stem Cell Research & Tissue Engineering

- Drug Development & Toxicity Testing

- Others

- U.S. 3D Cell Culture Market, By End Use, 2018 - 2030 (USD Million)

- Biotechnology & Pharmaceutical Companies

- Academic & Research Institutes

- Hospitals

- Others

- U.S. 3D Cell Culture Market, By Technology, 2018 - 2030 (USD Million)

- Canada

- Canada 3D Cell Culture Market, By Technology, 2018 - 2030 (USD Million)

- Scaffold Based

- Hydrogels

- Polymeric Scaffolds

- Micropatterned Surface Microplates

- Nanofiber Based Scaffolds

- Scaffold Free

- Hanging Drop Microplates

- Spheroid Microplates with ULA coating

- Magnetic Levitation

- Bioreactors

- Microfluidics

- Bioprinting

- Scaffold Based

- Canada 3D Cell Culture Market, By Application, 2018 - 2030 (USD Million)

- Cancer Research

- Stem Cell Research & Tissue Engineering

- Drug Development & Toxicity Testing

- Others

- Canada 3D Cell Culture Market, By End Use, 2018 - 2030 (USD Million)

- Biotechnology & Pharmaceutical Companies

- Academic & Research Institutes

- Hospitals

- Others

- Canada 3D Cell Culture Market, By Technology, 2018 - 2030 (USD Million)

- North America 3D Cell Culture Market, By Technology, 2018 - 2030 (USD Million)

- Europe

- Europe 3D Cell Culture Market, By Technology, 2018 - 2030 (USD Million)

- Scaffold Based

- Hydrogels

- Polymeric Scaffolds

- Micropatterned Surface Microplates

- Nanofiber Based Scaffolds

- Scaffold Free

- Hanging Drop Microplates

- Spheroid Microplates with ULA coating

- Magnetic Levitation

- Bioreactors

- Microfluidics

- Bioprinting

- Scaffold Based

- Europe 3D Cell Culture Market, By Application, 2018 - 2030 (USD Million)

- Cancer Research

- Stem Cell Research & Tissue Engineering

- Drug Development & Toxicity Testing

- Others

- Europe 3D Cell Culture Market, By End Use, 2018 - 2030 (USD Million)

- Biotechnology & Pharmaceutical Companies

- Academic & Research Institutes

- Hospitals

- Others

- UK

- UK 3D Cell Culture Market, By Technology, 2018 - 2030 (USD Million)

- Scaffold Based

- Hydrogels

- Polymeric Scaffolds

- Micropatterned Surface Microplates

- Nanofiber Based Scaffolds

- Scaffold Free

- Hanging Drop Microplates

- Spheroid Microplates with ULA coating

- Magnetic Levitation

- Bioreactors

- Microfluidics

- Bioprinting

- Scaffold Based

- UK 3D Cell Culture Market, By Application, 2018 - 2030 (USD Million)

- Cancer Research

- Stem Cell Research & Tissue Engineering

- Drug Development & Toxicity Testing

- Others

- UK 3D Cell Culture Market, By End Use, 2018 - 2030 (USD Million)

- Biotechnology & Pharmaceutical Companies

- Academic & Research Institutes

- Hospitals

- Others

- UK 3D Cell Culture Market, By Technology, 2018 - 2030 (USD Million)

- Germany

- Germany 3D Cell Culture Market, By Technology, 2018 - 2030 (USD Million)

- Scaffold Based

- Hydrogels

- Polymeric Scaffolds

- Micropatterned Surface Microplates

- Nanofiber Based Scaffolds

- Scaffold Free

- Hanging Drop Microplates

- Spheroid Microplates with ULA coating

- Magnetic Levitation

- Bioreactors

- Microfluidics

- Bioprinting

- Scaffold Based

- Germany 3D Cell Culture Market, By Application, 2018 - 2030 (USD Million)

- Cancer Research

- Stem Cell Research & Tissue Engineering

- Drug Development & Toxicity Testing

- Others

- Germany 3D Cell Culture Market, By End Use, 2018 - 2030 (USD Million)

- Biotechnology & Pharmaceutical Companies

- Academic & Research Institutes

- Hospitals

- Others

- Germany 3D Cell Culture Market, By Technology, 2018 - 2030 (USD Million)

- France

- France 3D Cell Culture Market, By Technology, 2018 - 2030 (USD Million)

- Scaffold Based

- Hydrogels

- Polymeric Scaffolds

- Micropatterned Surface Microplates

- Nanofiber Based Scaffolds

- Scaffold Free

- Hanging Drop Microplates

- Spheroid Microplates with ULA coating

- Magnetic Levitation

- Bioreactors

- Microfluidics

- Bioprinting

- Scaffold Based

- France 3D Cell Culture Market, By Application, 2018 - 2030 (USD Million)

- Cancer Research

- Stem Cell Research & Tissue Engineering

- Drug Development & Toxicity Testing

- Others

- France 3D Cell Culture Market, By End Use, 2018 - 2030 (USD Million)

- Biotechnology & Pharmaceutical Companies

- Academic & Research Institutes

- Hospitals

- Others

- France 3D Cell Culture Market, By Technology, 2018 - 2030 (USD Million)

- Italy

- Italy 3D Cell Culture Market, By Technology, 2018 - 2030 (USD Million)

- Scaffold Based

- Hydrogels

- Polymeric Scaffolds

- Micropatterned Surface Microplates

- Nanofiber Based Scaffolds

- Scaffold Free

- Hanging Drop Microplates

- Spheroid Microplates with ULA coating

- Magnetic Levitation

- Bioreactors

- Microfluidics

- Bioprinting

- Scaffold Based

- Italy 3D Cell Culture Market, By Application, 2018 - 2030 (USD Million)

- Cancer Research

- Stem Cell Research & Tissue Engineering

- Drug Development & Toxicity Testing

- Others

- Italy 3D Cell Culture Market, By End Use, 2018 - 2030 (USD Million)

- Biotechnology & Pharmaceutical Companies

- Academic & Research Institutes

- Hospitals

- Others

- Italy 3D Cell Culture Market, By Technology, 2018 - 2030 (USD Million)

- Spain

- Spain 3D Cell Culture Market, By Technology, 2018 - 2030 (USD Million)

- Scaffold Based

- Hydrogels

- Polymeric Scaffolds

- Micropatterned Surface Microplates

- Nanofiber Based Scaffolds

- Scaffold Free

- Hanging Drop Microplates

- Spheroid Microplates with ULA coating

- Magnetic Levitation

- Bioreactors

- Microfluidics

- Bioprinting

- Scaffold Based

- Spain 3D Cell Culture Market, By Application, 2018 - 2030 (USD Million)

- Cancer Research

- Stem Cell Research & Tissue Engineering

- Drug Development & Toxicity Testing

- Others

- Spain 3D Cell Culture Market, By End Use, 2018 - 2030 (USD Million)

- Biotechnology & Pharmaceutical Companies

- Academic & Research Institutes

- Hospitals

- Others

- Spain 3D Cell Culture Market, By Technology, 2018 - 2030 (USD Million)

- Denmark

- Denmark 3D Cell Culture Market, By Technology, 2018 - 2030 (USD Million)

- Scaffold Based

- Hydrogels

- Polymeric Scaffolds

- Micropatterned Surface Microplates

- Nanofiber Based Scaffolds

- Scaffold Free

- Hanging Drop Microplates

- Spheroid Microplates with ULA coating

- Magnetic Levitation

- Bioreactors

- Microfluidics

- Bioprinting

- Scaffold Based

- Denmark 3D Cell Culture Market, By Application, 2018 - 2030 (USD Million)

- Cancer Research

- Stem Cell Research & Tissue Engineering

- Drug Development & Toxicity Testing

- Others

- Denmark 3D Cell Culture Market, By End Use, 2018 - 2030 (USD Million)

- Biotechnology & Pharmaceutical Companies

- Academic & Research Institutes

- Hospitals

- Others

- Denmark 3D Cell Culture Market, By Technology, 2018 - 2030 (USD Million)

- Sweden

- Sweden 3D Cell Culture Market, By Technology, 2018 - 2030 (USD Million)

- Scaffold Based

- Hydrogels

- Polymeric Scaffolds

- Micropatterned Surface Microplates

- Nanofiber Based Scaffolds

- Scaffold Free

- Hanging Drop Microplates

- Spheroid Microplates with ULA coating

- Magnetic Levitation

- Bioreactors

- Microfluidics

- Bioprinting

- Scaffold Based

- Sweden 3D Cell Culture Market, By Application, 2018 - 2030 (USD Million)

- Cancer Research

- Stem Cell Research & Tissue Engineering

- Drug Development & Toxicity Testing

- Others

- Sweden 3D Cell Culture Market, By End Use, 2018 - 2030 (USD Million)

- Biotechnology & Pharmaceutical Companies

- Academic & Research Institutes

- Hospitals

- Others

- Sweden 3D Cell Culture Market, By Technology, 2018 - 2030 (USD Million)

- Norway

- Norway 3D Cell Culture Market, By Technology, 2018 - 2030 (USD Million)

- Scaffold Based

- Hydrogels

- Polymeric Scaffolds

- Micropatterned Surface Microplates

- Nanofiber Based Scaffolds

- Scaffold Free

- Hanging Drop Microplates

- Spheroid Microplates with ULA coating

- Magnetic Levitation

- Bioreactors

- Microfluidics

- Bioprinting

- Scaffold Based

- Norway 3D Cell Culture Market, By Application, 2018 - 2030 (USD Million)

- Cancer Research

- Stem Cell Research & Tissue Engineering

- Drug Development & Toxicity Testing

- Others

- Norway 3D Cell Culture Market, By End Use, 2018 - 2030 (USD Million)

- Biotechnology & Pharmaceutical Companies

- Academic & Research Institutes

- Hospitals

- Others

- Norway 3D Cell Culture Market, By Technology, 2018 - 2030 (USD Million)

- Europe 3D Cell Culture Market, By Technology, 2018 - 2030 (USD Million)

- Asia Pacific

- Asia Pacific 3D Cell Culture Market, By Technology, 2018 - 2030 (USD Million)

- Scaffold Based

- Hydrogels

- Polymeric Scaffolds

- Micropatterned Surface Microplates

- Nanofiber Based Scaffolds

- Scaffold Free

- Hanging Drop Microplates

- Spheroid Microplates with ULA coating

- Magnetic Levitation

- Bioreactors

- Microfluidics

- Bioprinting

- Scaffold Based

- Asia Pacific 3D Cell Culture Market, By Application, 2018 - 2030 (USD Million)

- Cancer Research

- Stem Cell Research & Tissue Engineering

- Drug Development & Toxicity Testing

- Others

- Asia Pacific 3D Cell Culture Market, By End Use, 2018 - 2030 (USD Million)

- Biotechnology & Pharmaceutical Companies

- Academic & Research Institutes

- Hospitals

- Others

- China

- China 3D Cell Culture Market, By Technology, 2018 - 2030 (USD Million)

- Scaffold Based

- Hydrogels

- Polymeric Scaffolds

- Micropatterned Surface Microplates

- Nanofiber Based Scaffolds

- Scaffold Free

- Hanging Drop Microplates

- Spheroid Microplates with ULA coating

- Magnetic Levitation

- Bioreactors

- Microfluidics

- Bioprinting

- Scaffold Based

- China 3D Cell Culture Market, By Application, 2018 - 2030 (USD Million)

- Cancer Research

- Stem Cell Research & Tissue Engineering

- Drug Development & Toxicity Testing

- Others

- China 3D Cell Culture Market, By End Use, 2018 - 2030 (USD Million)

- Biotechnology & Pharmaceutical Companies

- Academic & Research Institutes

- Hospitals

- Others

- China 3D Cell Culture Market, By Technology, 2018 - 2030 (USD Million)

- Japan

- Japan 3D Cell Culture Market, By Technology, 2018 - 2030 (USD Million)

- Scaffold Based

- Hydrogels

- Polymeric Scaffolds

- Micropatterned Surface Microplates

- Nanofiber Based Scaffolds

- Scaffold Free

- Hanging Drop Microplates

- Spheroid Microplates with ULA coating

- Magnetic Levitation

- Bioreactors

- Microfluidics

- Bioprinting

- Scaffold Based

- Japan 3D Cell Culture Market, By Application, 2018 - 2030 (USD Million)

- Cancer Research

- Stem Cell Research & Tissue Engineering

- Drug Development & Toxicity Testing

- Others

- Japan 3D Cell Culture Market, By End Use, 2018 - 2030 (USD Million)

- Biotechnology & Pharmaceutical Companies

- Academic & Research Institutes

- Hospitals

- Others

- Japan 3D Cell Culture Market, By Technology, 2018 - 2030 (USD Million)

- India

- India 3D Cell Culture Market, By Technology, 2018 - 2030 (USD Million)

- Scaffold Based

- Hydrogels

- Polymeric Scaffolds

- Micropatterned Surface Microplates

- Nanofiber Based Scaffolds

- Scaffold Free

- Hanging Drop Microplates

- Spheroid Microplates with ULA coating

- Magnetic Levitation

- Bioreactors

- Microfluidics

- Bioprinting

- Scaffold Based

- India 3D Cell Culture Market, By Application, 2018 - 2030 (USD Million)

- Cancer Research

- Stem Cell Research & Tissue Engineering

- Drug Development & Toxicity Testing

- Others

- India 3D Cell Culture Market, By End Use, 2018 - 2030 (USD Million)

- Biotechnology & Pharmaceutical Companies

- Academic & Research Institutes

- Hospitals

- Others

- India 3D Cell Culture Market, By Technology, 2018 - 2030 (USD Million)

- Australia

- Australia 3D Cell Culture Market, By Technology, 2018 - 2030 (USD Million)

- Scaffold Based

- Hydrogels

- Polymeric Scaffolds

- Micropatterned Surface Microplates

- Nanofiber Based Scaffolds

- Scaffold Free

- Hanging Drop Microplates

- Spheroid Microplates with ULA coating

- Magnetic Levitation

- Bioreactors

- Microfluidics

- Bioprinting

- Scaffold Based

- Australia 3D Cell Culture Market, By Application, 2018 - 2030 (USD Million)

- Cancer Research

- Stem Cell Research & Tissue Engineering

- Drug Development & Toxicity Testing

- Others

- Australia 3D Cell Culture Market, By End Use, 2018 - 2030 (USD Million)

- Biotechnology & Pharmaceutical Companies

- Academic & Research Institutes

- Hospitals

- Others

- Australia 3D Cell Culture Market, By Technology, 2018 - 2030 (USD Million)

- Thailand

- Thailand 3D Cell Culture Market, By Technology, 2018 - 2030 (USD Million)

- Scaffold Based

- Hydrogels

- Polymeric Scaffolds

- Micropatterned Surface Microplates

- Nanofiber Based Scaffolds

- Scaffold Free

- Hanging Drop Microplates

- Spheroid Microplates with ULA coating

- Magnetic Levitation

- Bioreactors

- Microfluidics

- Bioprinting

- Scaffold Based

- Thailand 3D Cell Culture Market, By Application, 2018 - 2030 (USD Million)

- Cancer Research

- Stem Cell Research & Tissue Engineering

- Drug Development & Toxicity Testing

- Others

- Thailand 3D Cell Culture Market, By End Use, 2018 - 2030 (USD Million)

- Biotechnology & Pharmaceutical Companies

- Academic & Research Institutes

- Hospitals

- Others

- Thailand 3D Cell Culture Market, By Technology, 2018 - 2030 (USD Million)

- South Korea

- South Korea 3D Cell Culture Market, By Technology, 2018 - 2030 (USD Million)

- Scaffold Based

- Hydrogels

- Polymeric Scaffolds

- Micropatterned Surface Microplates

- Nanofiber Based Scaffolds

- Scaffold Free

- Hanging Drop Microplates

- Spheroid Microplates with ULA coating

- Magnetic Levitation

- Bioreactors

- Microfluidics

- Bioprinting

- Scaffold Based

- South Korea 3D Cell Culture Market, By Application, 2018 - 2030 (USD Million)

- Cancer Research

- Stem Cell Research & Tissue Engineering

- Drug Development & Toxicity Testing

- Others

- South Korea 3D Cell Culture Market, By End Use, 2018 - 2030 (USD Million)

- Biotechnology & Pharmaceutical Companies

- Academic & Research Institutes

- Hospitals

- Others

- South Korea 3D Cell Culture Market, By Technology, 2018 - 2030 (USD Million)

- Asia Pacific 3D Cell Culture Market, By Technology, 2018 - 2030 (USD Million)

- Latin America

- Latin America 3D Cell Culture Market, By Technology, 2018 - 2030 (USD Million)

- Scaffold Based

- Hydrogels

- Polymeric Scaffolds

- Micropatterned Surface Microplates

- Nanofiber Based Scaffolds

- Scaffold Free

- Hanging Drop Microplates

- Spheroid Microplates with ULA coating

- Magnetic Levitation

- Bioreactors

- Microfluidics

- Bioprinting

- Scaffold Based

- Latin America 3D Cell Culture Market, By Application, 2018 - 2030 (USD Million)

- Cancer Research

- Stem Cell Research & Tissue Engineering

- Drug Development & Toxicity Testing

- Others

- Latin America 3D Cell Culture Market, By End Use, 2018 - 2030 (USD Million)

- Biotechnology & Pharmaceutical Companies

- Academic & Research Institutes

- Hospitals

- Others

- Brazil

- Brazil 3D Cell Culture Market, By Technology, 2018 - 2030 (USD Million)

- Scaffold Based

- Hydrogels

- Polymeric Scaffolds

- Micropatterned Surface Microplates

- Nanofiber Based Scaffolds

- Scaffold Free

- Hanging Drop Microplates

- Spheroid Microplates with ULA coating

- Magnetic Levitation

- Bioreactors

- Microfluidics

- Bioprinting

- Scaffold Based

- Brazil 3D Cell Culture Market, By Application, 2018 - 2030 (USD Million)

- Cancer Research

- Stem Cell Research & Tissue Engineering

- Drug Development & Toxicity Testing

- Others

- Brazil 3D Cell Culture Market, By End Use, 2018 - 2030 (USD Million)

- Biotechnology & Pharmaceutical Companies

- Academic & Research Institutes

- Hospitals

- Others

- Brazil 3D Cell Culture Market, By Technology, 2018 - 2030 (USD Million)

- Mexico

- Mexico 3D Cell Culture Market, By Technology, 2018 - 2030 (USD Million)

- Scaffold Based

- Hydrogels

- Polymeric Scaffolds

- Micropatterned Surface Microplates

- Nanofiber Based Scaffolds

- Scaffold Free

- Hanging Drop Microplates

- Spheroid Microplates with ULA coating

- Magnetic Levitation

- Bioreactors

- Microfluidics

- Bioprinting

- Scaffold Based

- Mexico 3D Cell Culture Market, By Application, 2018 - 2030 (USD Million)

- Cancer Research

- Stem Cell Research & Tissue Engineering

- Drug Development & Toxicity Testing

- Others

- Mexico 3D Cell Culture Market, By End Use, 2018 - 2030 (USD Million)

- Biotechnology & Pharmaceutical Companies

- Academic & Research Institutes

- Hospitals

- Others

- Mexico 3D Cell Culture Market, By Technology, 2018 - 2030 (USD Million)

- Argentina

- Argentina 3D Cell Culture Market, By Technology, 2018 - 2030 (USD Million)

- Scaffold Based

- Hydrogels

- Polymeric Scaffolds

- Micropatterned Surface Microplates

- Nanofiber Based Scaffolds

- Scaffold Free

- Hanging Drop Microplates

- Spheroid Microplates with ULA coating

- Magnetic Levitation

- Bioreactors

- Microfluidics

- Bioprinting

- Scaffold Based

- Argentina 3D Cell Culture Market, By Application, 2018 - 2030 (USD Million)

- Cancer Research

- Stem Cell Research & Tissue Engineering

- Drug Development & Toxicity Testing

- Others

- Argentina 3D Cell Culture Market, By End Use, 2018 - 2030 (USD Million)

- Biotechnology & Pharmaceutical Companies

- Academic & Research Institutes

- Hospitals

- Others

- Argentina 3D Cell Culture Market, By Technology, 2018 - 2030 (USD Million)

- Latin America 3D Cell Culture Market, By Technology, 2018 - 2030 (USD Million)

- Middle East & Africa

- Middle East & Africa 3D Cell Culture Market, By Technology, 2018 - 2030 (USD Million)

- Scaffold Based

- Hydrogels

- Polymeric Scaffolds

- Micropatterned Surface Microplates

- Nanofiber Based Scaffolds

- Scaffold Free

- Hanging Drop Microplates

- Spheroid Microplates with ULA coating

- Magnetic Levitation

- Bioreactors

- Microfluidics

- Bioprinting

- Scaffold Based

- Middle East & Africa 3D Cell Culture Market, By Application, 2018 - 2030 (USD Million)

- Cancer Research

- Stem Cell Research & Tissue Engineering

- Drug Development & Toxicity Testing

- Others

- Middle East & Africa 3D Cell Culture Market, By End Use, 2018 - 2030 (USD Million)

- Biotechnology & Pharmaceutical Companies

- Academic & Research Institutes

- Hospitals

- Others

- South Africa

- South Africa 3D Cell Culture Market, By Technology, 2018 - 2030 (USD Million)

- Scaffold Based

- Hydrogels

- Polymeric Scaffolds

- Micropatterned Surface Microplates

- Nanofiber Based Scaffolds

- Scaffold Free

- Hanging Drop Microplates

- Spheroid Microplates with ULA coating

- Magnetic Levitation

- Bioreactors

- Microfluidics

- Bioprinting

- Scaffold Based

- South Africa 3D Cell Culture Market, By Application, 2018 - 2030 (USD Million)

- Cancer Research

- Stem Cell Research & Tissue Engineering

- Drug Development & Toxicity Testing

- Others

- South Africa 3D Cell Culture Market, By End Use, 2018 - 2030 (USD Million)

- Biotechnology & Pharmaceutical Companies

- Academic & Research Institutes

- Hospitals

- Others

- South Africa 3D Cell Culture Market, By Technology, 2018 - 2030 (USD Million)

- Saudi Arabia

- Saudi Arabia 3D Cell Culture Market, By Technology, 2018 - 2030 (USD Million)

- Scaffold Based

- Hydrogels

- Polymeric Scaffolds

- Micropatterned Surface Microplates

- Nanofiber Based Scaffolds

- Scaffold Free

- Hanging Drop Microplates

- Spheroid Microplates with ULA coating

- Magnetic Levitation

- Bioreactors

- Microfluidics

- Bioprinting

- Scaffold Based

- Saudi Arabia 3D Cell Culture Market, By Application, 2018 - 2030 (USD Million)

- Cancer Research

- Stem Cell Research & Tissue Engineering

- Drug Development & Toxicity Testing

- Others

- Saudi Arabia 3D Cell Culture Market, By End Use, 2018 - 2030 (USD Million)

- Biotechnology & Pharmaceutical Companies

- Academic & Research Institutes

- Hospitals

- Others

- Saudi Arabia 3D Cell Culture Market, By Technology, 2018 - 2030 (USD Million)

- UAE

- UAE 3D Cell Culture Market, By Technology, 2018 - 2030 (USD Million)

- Scaffold Based

- Hydrogels

- Polymeric Scaffolds

- Micropatterned Surface Microplates

- Nanofiber Based Scaffolds

- Scaffold Free

- Hanging Drop Microplates

- Spheroid Microplates with ULA coating

- Magnetic Levitation

- Bioreactors

- Microfluidics

- Bioprinting

- Scaffold Based

- UAE 3D Cell Culture Market, By Application, 2018 - 2030 (USD Million)

- Cancer Research

- Stem Cell Research & Tissue Engineering

- Drug Development & Toxicity Testing

- Others

- UAE 3D Cell Culture Market, By End Use, 2018 - 2030 (USD Million)

- Biotechnology & Pharmaceutical Companies

- Academic & Research Institutes

- Hospitals

- Others

- UAE 3D Cell Culture Market, By Technology, 2018 - 2030 (USD Million)

- Kuwait

- Kuwait 3D Cell Culture Market, By Technology, 2018 - 2030 (USD Million)

- Scaffold Based

- Hydrogels

- Polymeric Scaffolds

- Micropatterned Surface Microplates

- Nanofiber Based Scaffolds

- Scaffold Free

- Hanging Drop Microplates

- Spheroid Microplates with ULA coating

- Magnetic Levitation

- Bioreactors

- Microfluidics

- Bioprinting

- Scaffold Based

- Kuwait 3D Cell Culture Market, By Application, 2018 - 2030 (USD Million)

- Cancer Research

- Stem Cell Research & Tissue Engineering

- Drug Development & Toxicity Testing

- Others

- Kuwait 3D Cell Culture Market, By End Use, 2018 - 2030 (USD Million)

- Biotechnology & Pharmaceutical Companies

- Academic & Research Institutes

- Hospitals

- Others

- Kuwait 3D Cell Culture Market, By Technology, 2018 - 2030 (USD Million)

- Middle East & Africa 3D Cell Culture Market, By Technology, 2018 - 2030 (USD Million)

- North America

3D Cell Culture Market Dynamics

Driver-Rising demand for organ transplantation & tissue engineering

3D cell culture platforms provide advanced tools that help explore key aspects of any disease and enable the elucidation of microenvironmental factors supporting in vivo tumor growth. The 3D concept of artificial cell cultivation offers huge benefits in the investigation of phenotypic heterogeneity of cancer cells and heterotypic intercellular crosstalk. Ability of 3D cellular models to overcome the flaws associated with 2D monolayer cell culture is anticipated to fuel demand for 3D cell culture techniques in the near future. The shift from 2D to 3D technique is rapidly progressing, which is consequently boosting the growth of this market. Application of 3D cell culture techniques in performing real-time mammalian study yields physiologically relevant information that supports the development of effective drugs against diseases, which is anticipated to enhance the market growth in the coming years. Moreover, biomimetic tissue constructs used to generate 3D organotypic structures drove a large number of research entities to adopt 3D cell culture techniques. In addition, the usage of 3D tissue-engineered models for cancer research emerged as an alternative approach to traditional methods and exhibited great potential in providing a relatively simple and inexpensive in vitro tumor-host environment compared to traditional methods. Entry of new market players in this segment due to the high market potential of 3D cell culture is expected to further propel the market.

Driver-Technological advancements in scaffold-free technology

Switching to 3D cell culture techniques from conventional cell culture methods is expected to revolutionize the cell culture market through 2025. Major factors responsible for this growth are its wide applicability in biological research and the launch of new technologies in the 3D cell culture platform. For instance, the Nunclon Sphera 3D culture platform developed by Thermo Fisher Scientific facilitates the easy transition of cell cultures from 2D to 3D without the aid of additional culture conditions, microscope, or media. Similarly, standard 2D analysis methods can easily be applied on RAFT 3D cultures manufactured by Lonza. Therefore, as these novel technologies do not require much changes to the already existing 2D cell culture methods, they are adopted by many laboratories across the globe. In addition, Lonza has also developed 3D cell culture models to enhance research in areas of hepatic signaling pathways and drug-induced liver injury to enhance in vitro hepatotoxicity testing.

Restraint-High cost associated with implementation

Significant growth in terms of product portfolio expansion within the research organizations is supporting the development of advanced techniques in the cell culture market for drug development and toxicity screening. 3D models have played a crucial role in enabling a greater understanding of tumors and cell behavior in diseased conditions, consequently raising the market demand. However, expenses associated with the implementation of 3D cell culture are still not affordable for several regions, which restrains market growth. 3D cell culture materials and scaffolds are more expensive when compared to 2D tissue culture equipment. This is a concern for the pharmaceutical industry where the drug discovery process needs a multitude of experiments and thereby increases the overall cost. Moreover, synthetic hydrogels and ECM proteins further add to the existing cost and also need expert handling skills. Despite this challenge, the rise in global investments, mainly due to governments & funding bodies, and the presence of CROs are supporting the adoption of this technique for cell-based assays.

What Does This Report Include?

This section will provide insights into the contents included in this 3d cell culture market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.

3d cell culture market qualitative analysis

-

Industry overview

-

Industry trends

-

Market drivers and restraints

-

Market size

-

Growth prospects

-

Porter’s analysis

-

PESTEL analysis

-

Key market opportunities prioritized

-

Competitive landscape

-

Company overview

-

Financial performance

-

Product benchmarking

-

Latest strategic developments

-

3d cell culture market quantitative analysis

-

Market size, estimates, and forecast from 2018 to 2030

-

Market estimates and forecast for product segments up to 2030

-

Regional market size and forecast for product segments up to 2030

-

Market estimates and forecast for application segments up to 2030

-

Regional market size and forecast for application segments up to 2030

-

Company financial performance

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationResearch Methodology

A three-pronged approach was followed for deducing the 3d cell culture market estimates and forecasts. The process has three steps: information procurement, analysis, and validation. The whole process is cyclical, and steps repeat until the estimates are validated. The three steps are explained in detail below:

Information procurement: Information procurement is one of the most extensive and important stages in our research process, and quality data is critical for accurate analysis. We followed a multi-channel data collection process for 3d cell culture market to gather the most reliable and current information possible.

- We buy access to paid databases such as Hoover’s and Factiva for company financials, industry information, white papers, industry journals, SME journals, and more.