- Home

- »

- Research

- »

-

3D Printing In Mining Market Size, Industry Report, 2033GVR Report cover

![3D Printing In Mining Market Size, Share & Trends Report]()

3D Printing In Mining Market (2025 - 2033) Size, Share & Trends Analysis Report By Material (Metals, Polymers, Composites, Ceramics & Geopolymers), By End-use (Mining Companies, Equipment OEM, Service Providers), By Region, And Segment Forecasts

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

3D Printing In Mining Market Summary

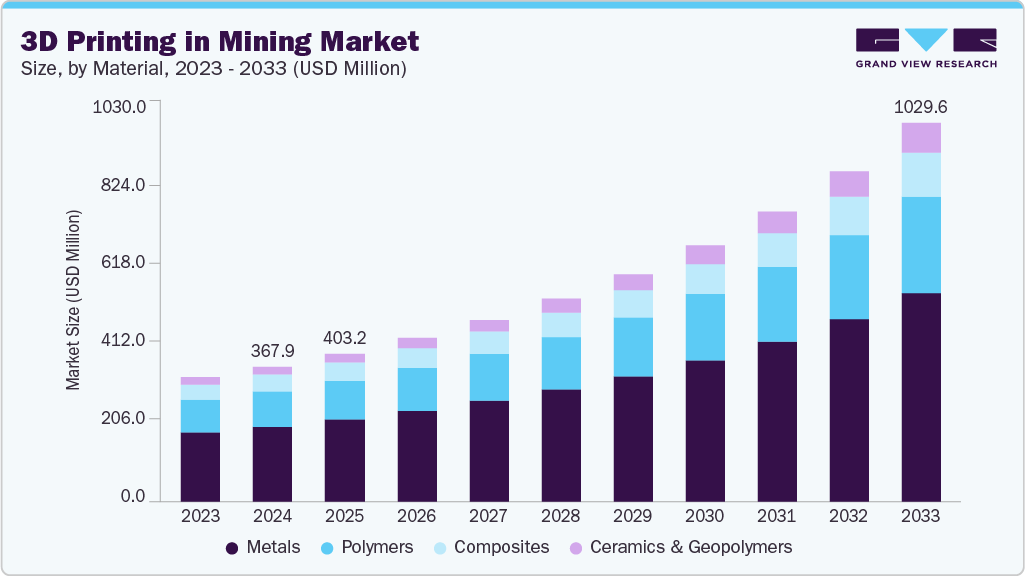

The global 3D printing in mining market size was estimated at USD 367.9 million in 2024 and is projected to reach USD 1,029.6 million by 2033, growing at a CAGR of 12.4% from 2025 to 2033. The adoption of 3D printing in the mining industry is driven by the need to enhance operational efficiency and reduce costs.

Key Market Trends & Insights

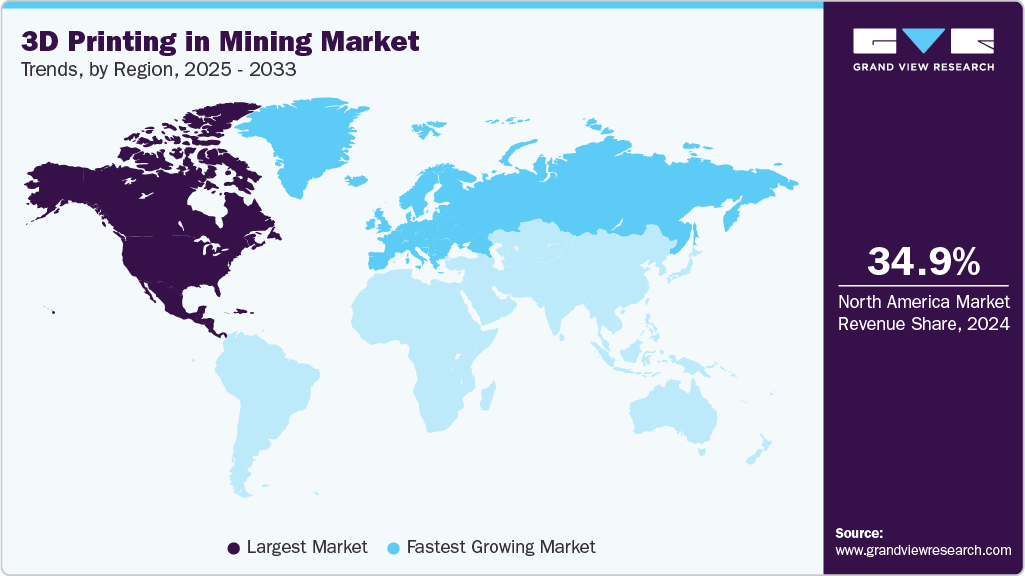

- North America dominated the 3D printing in mining industry with the largest market revenue share of 34.9%.

- The 3D printing in mining industry in U.S. is witnessing significant CAGR over the forecast period.

- By material, the ceramics & geopolymers segment is anticipated to register a CAGR of 16.4% from 2025 to 2033.

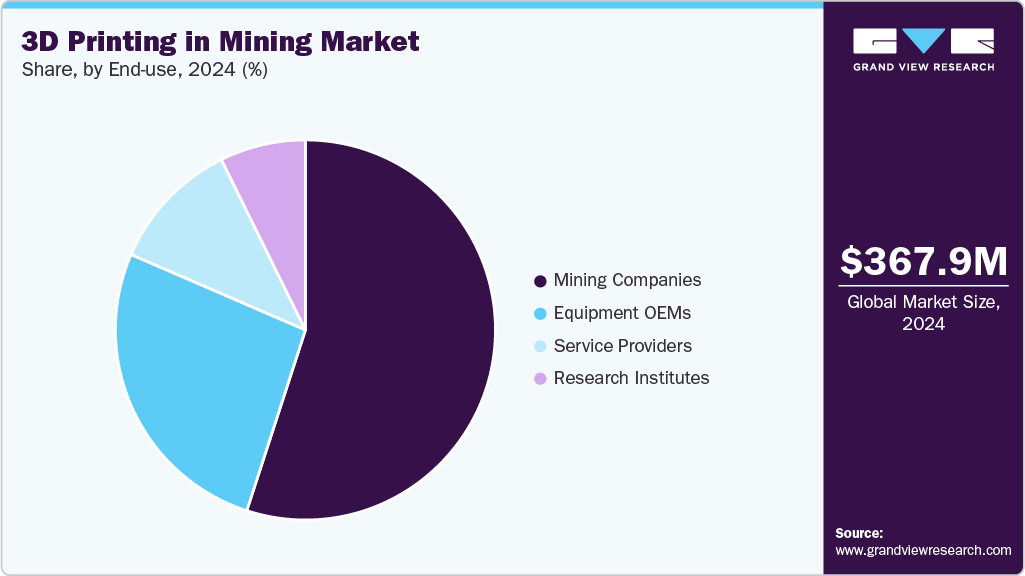

- By end use, mining companies accounted for the largest market revenue share of over 55% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 367.9 Million

- 2033 Projected Market Size: USD 1,029.6 Million

- CAGR (2025-2033): 12.4%

- North America : Largest Market in 2024

- Europe: Fastest Growing Market

Mining operations often rely on complex, customized parts for machinery and equipment. Traditional manufacturing methods can be time-consuming and expensive to produce these parts. 3D printing allows companies to produce components on demand, minimizing downtime and inventory costs while ensuring precise customization for specific machinery requirements.Sustainability and material optimization are becoming increasingly important in mining, and 3D printing addresses both concerns effectively. Unlike traditional subtractive manufacturing methods, which often generate significant waste, additive manufacturing uses only the material needed to create a part. This reduces scrap material and helps mining companies lower their environmental impact. As regulations and stakeholder expectations push the mining sector toward greener practices, the ability to adopt environmentally responsible manufacturing methods enhances the appeal of 3D printing. The reduced material consumption and energy efficiency associated with additive manufacturing also contribute to cost savings, further supporting its adoption in mining operations.

Technological innovations in 3D printing are expanding the possibilities for its application in mining. Advanced methods, including metal additive manufacturing and high-strength polymer printing, allow the production of durable, heat-resistant, and wear-resistant components suitable for harsh mining environments. These developments ensure critical parts, such as wear plates, drill components, and replacement machinery, can withstand extreme conditions while maintaining performance over time. The durability and precision of 3D-printed components reduce maintenance frequency and extend the lifespan of machinery, contributing to operational efficiency and lowering long-term costs for mining companies.

The mining sector’s growing need for rapid prototyping and design flexibility also drives the adoption of 3D printing. Mining equipment and tools are often redesigned to optimize performance, address site-specific challenges, or improve safety. 3D printing allows engineers to quickly produce prototypes and iterate on designs without the long production cycles associated with conventional methods. This capability accelerates innovation and allows companies to experiment on-site with new designs and testing procedures. By shortening the time from concept to implementation, 3D printing supports continuous improvement in mining operations and encourages the development of customized solutions tailored to unique operational needs.

Remote and challenging mining locations present significant logistical challenges, particularly in sourcing replacement parts and critical equipment. 3D printing provides the ability to manufacture components on-site, reducing reliance on external suppliers and complex transportation networks. This on-demand production capability ensures that mining operations can continue without delays caused by supply chain disruptions. 3D printing increases operational resilience, improves equipment uptime, and enhances overall productivity by enabling the local production of essential parts. The ability to maintain uninterrupted operations in remote sites makes 3D printing an increasingly vital technology in the mining sector.

Drivers, Opportunities & Restraints

The 3D printing market in mining is primarily driven by the need to enhance operational efficiency and reduce costs associated with traditional manufacturing methods. Mining equipment often requires complex and customized parts, and 3D printing allows companies to produce these components on demand, reducing lead times and minimizing downtime. The ability to rapidly manufacture precise replacement parts ensures uninterrupted operations and lowers overall maintenance expenses.

Significant opportunities exist in adopting 3D printing for sustainable and resource-efficient practices. Compared to conventional methods, additive manufacturing reduces material waste and energy consumption, supporting environmentally friendly mining operations. In addition, the technology enables rapid prototyping and design flexibility, allowing companies to innovate equipment designs, optimize processes, and tailor solutions for challenging or remote mining sites. On-site manufacturing of critical parts further opens avenues for operational resilience and cost savings.

Despite its advantages, the adoption of 3D printing in mining faces certain restraints. High initial investment costs for 3D printing equipment and materials can be a barrier, particularly for smaller mining operations. Limited availability of skilled personnel to operate and maintain advanced 3D printing systems also restricts widespread implementation. Moreover, material properties and production speed constraints for certain large-scale or highly specialized components can limit the applicability of 3D printing for all mining equipment needs.

Material Insights

The metals segment held the largest revenue share of 55.8% in 2024, driven by technological advancements and increasing demand for complex, high-performance components. Innovations such as developing low-cost metal 3D printing technologies, like Micro-Plasma Metal Additive Manufacturing (MP-MAM) by IIT Indore, are making metal 3D printing more accessible and cost-effective. This technology enables the production of high-quality metal components at reduced costs, benefiting sectors such as aerospace, healthcare, and industrial tooling.

The ceramics & geopolymers segment is anticipated to register the fastest CAGR over the forecast period due to technological advancements and increasing demand for high-performance and durable components. Ceramics are valued for their heat resistance, strength, and wear resistance, making them suitable for aerospace, automotive, and healthcare industries. Advances in 3D printing techniques allow for the fabrication of complex ceramic structures with high precision, enabling manufacturers to produce customized parts efficiently and cost-effectively. The rising need for lightweight and resilient components in industrial applications also drives the adoption of ceramic materials in 3D printing.

End-use Insights

Mining companies held the largest revenue share of 55.0% in 2024. Mining companies increasingly leverage additive manufacturing to produce spare parts on-site, reducing dependency on lengthy supply chains and minimizing downtime. This capability is particularly beneficial in remote mining locations, where traditional procurement methods can lead to extended operational delays. By enabling rapid prototyping and on-demand production, 3D printing enhances equipment maintenance efficiency and supports continuous operations.

Service providers is anticipated to grow significantly over the forecast period. Companies like TheSteelPrinters provide end-to-end metal 3D printing services, focusing on producing critical spare parts such as pump components and cooling casings. Their approach includes part identification, design optimization, and rapid manufacturing, significantly reducing lead times and minimizing downtime risks for mining operations. Similarly, firms like Zeal 3D offer rapid prototyping and on-site production of mining components, utilizing technologies such as FDM, SLS, and SLM.

Regional Insights

North America 3D printing in mining market accounted for the largest market revenue share of 34.9% in 2024, driven by several key factors. Technological advancements in additive manufacturing have enabled the production of complex, durable components tailored to the specific needs of mining operations. These innovations allow for rapid prototyping and the creation of parts that can withstand the harsh conditions prevalent in mining environments.

U.S. 3D Printing in Mining Market Trends

The 3D printing in mining industry in the U.S. is propelled by several key factors. Technological advancements in additive manufacturing have enabled the production of complex, durable components tailored to the specific needs of mining operations. These innovations allow rapid prototyping and the creation of parts that can withstand the harsh conditions in mining environments.

Asia Pacific 3D Printing in Mining Market Trends

The Asia-Pacific 3D printing in mining industry is witnessing significant growth in the adoption of 3D printing technologies, driven by several key factors. The demand for customized solutions has reduced material waste and manufacturing delays, further boosting the adoption of 3D printing technologies. Government initiatives and investments play a crucial role in promoting the use of 3D printing within the region. Countries like China, Japan, and South Korea have established programs to advance manufacturing technologies, including 3D printing.

Europe 3D Printing in Mining Market Trends

The Europe 3D printing in mining industry growth is driven by a combination of technological innovation and strong industrial support. Advances in additive manufacturing have enabled the production of complex, high-performance components tailored to the specific demands of mining operations. This allows mining companies to rapidly prototype and produce parts capable of withstanding harsh operating conditions, reducing downtime and improving operational efficiency. In addition, a mature industrial base in countries such as Germany, France, and the U.K. has facilitated the integration of 3D printing technologies across mining equipment manufacturing and maintenance activities.

Middle East & Africa 3D Printing in Mining Market Trends

The Middle East and Africa (MEA) 3D printing in mining industry is witnessing a significant transformation in its mining sector, driven by the adoption of 3D printing technologies. One of the primary catalysts for this growth is the increasing demand for cost-effective and efficient manufacturing solutions. 3D printing enables the production of complex, durable components tailored to the specific needs of mining operations, reducing material waste and manufacturing delays. This capability particularly benefits regions with limited or costly traditional manufacturing infrastructure. In addition, the rise in mining activities across the MEA region, coupled with a push towards modernization and technological advancement, has spurred the integration of additive manufacturing into mining operations.

Latin America 3D Printing in Mining Market Trends

The 3D printing in mining industry in Latin America is largely driven by increasing regulatory requirements and government initiatives aimed at sustainable mining. Countries such as Brazil, Chile, Peru, and Mexico have introduced stricter environmental laws that require mining companies to restore land, manage water resources, and prevent soil erosion after mining activities. Compliance with these regulations creates a strong demand for professional rehabilitation services. Growing public awareness of environmental impacts and pressure from local communities further motivates mining operators to implement structured land restoration and ecological conservation practices.

Key 3D Printing in Mining Company Insights

Some of the key players operating in the market include Sandvik Mining and Rock Solutions, Boliden AB, and others.

-

Sandvik Mining and Rock Solutions is a global leader in providing equipment, tools, and service solutions for the mining and construction industries. Headquartered in Sweden, the company specializes in rock drilling, excavation, and material handling solutions. Its operations span more than 130 countries, serving underground and surface mining sectors. In the 3D printing space for the mining market, Sandvik offers metal additive manufacturing solutions designed to produce complex parts with high precision and durability. These offerings include wear-resistant components for drills, crushers, and other mining equipment, which help extend service life and reduce downtime.

-

Boliden AB is a Swedish mining and smelting company focused on the exploration, extraction, and processing of base and precious metals, including copper, zinc, lead, gold, and silver. The company operates mines and smelters in Sweden, Finland, and Ireland, with a strong emphasis on sustainable practices, resource efficiency, and minimizing environmental impact. Boliden’s strategy revolves around securing long-term value from its mineral resources through innovative technologies and efficient production processes, making it one of the leading players in the European mining sector.

Key 3D Printing In Mining Companies:

The following are the leading companies in the 3D printing in mining market. These companies collectively hold the largest market share and dictate industry trends.

- AML3D

- Boliden AB

- Caterpillar Inc.

- Epiroc

- FLSmidth

- Fortescue Metals Group

- Global3D

- Nornickel

- Sandvik Mining and Rock Solutions

- TheSteelPrinters

Recent Development

- In June 2024, Materialise and ArcelorMittal Powders signed a memorandum of understanding (MOU) to advance metal additive manufacturing by combining software and steel powder metallurgy expertise. The collaboration aims to optimize laser powder bed fusion (LPBF) technology, enhancing productivity and quality across metal 3D printing processes. As part of the agreement, ArcelorMittal will integrate Materialise’s next-generation build processor software to fine-tune printing parameters and streamline data flow between digital design and manufacturing systems, ensuring higher precision and efficiency in production.

Global 3D Printing In Mining Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 403.2 million

Revenue forecast in 2033

USD 1,029.6 million

Growth rate

CAGR of 12.4% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative Units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

End-use, material, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Brazil; Saudi Arabia, UAE

Market definition

The market size represents the total annual value of 3D printing products and services used within the mining sector.

Key companies profiled

Sandvik Mining and Rock Solutions; Boliden AB; FLSmidth; Caterpillar Inc.; Epiroc; Fortescue Metals Group; Nornickel; TheSteelPrinters; AML3D; Global3D

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global 3D Printing in Mining Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global 3D printing in mining market report based on material, end-use, and region.

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Metals

-

Polymers

-

Composites

-

Ceramics & Geopolymers

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Mining Companies

-

Equipment OEMs

-

Service Providers

-

Research Institutes

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global 3D printing in mining market size was estimated at USD 367.9 million in 2024 and is expected to reach USD 403.2 million in 2025.

b. The global 3D printing in mining market is expected to grow at a compound annual growth rate of 12.4% from 2025 to 2033 to reach USD 1,029.6 million by 2033.

b. The metals segment dominated the market with a revenue share of 55.8% in 2024.

b. Some of the key players of the global 3D printing in mining market are Sandvik Mining and Rock Solutions, Boliden AB, FLSmidth, Caterpillar Inc., Epiroc, Fortescue Metals Group, Nornickel, TheSteelPrinters, AML3D, Global3D, and others.

b. The key factor driving the growth of the global 3D printing in mining market is the increasing emphasis on environmental restoration and sustainable mining practices to reduce the ecological impact of resource extraction.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.