- Home

- »

- Next Generation Technologies

- »

-

3D Rendering Market Size And Share, Industry Report, 2033GVR Report cover

![3D Rendering Market Size, Share & Trends Report]()

3D Rendering Market (2026 - 2033) Size, Share & Trends Analysis Report By Component, By Operating System, By Organization Size, By Application, By End-user, By Industry Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-411-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

3D Rendering Market Summary

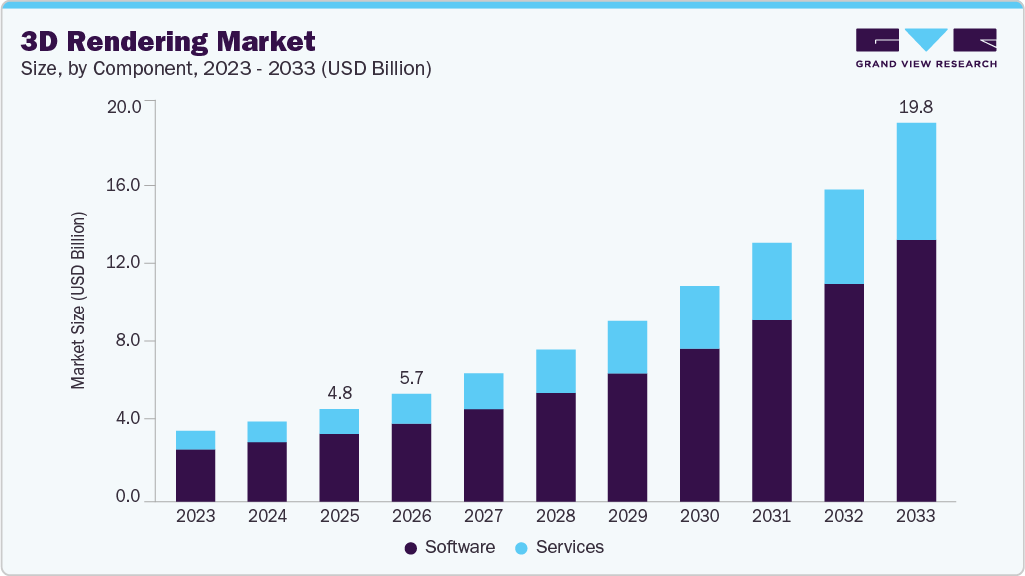

The global 3D rendering market size was estimated at USD 4.85 billion in 2025 and is projected to reach USD 19.82 billion by 2033, growing at a CAGR of 19.6% from 2026 to 2033. The advancement of cloud computing is fueling growth in the 3D rendering market.

Key Market Trends & Insights

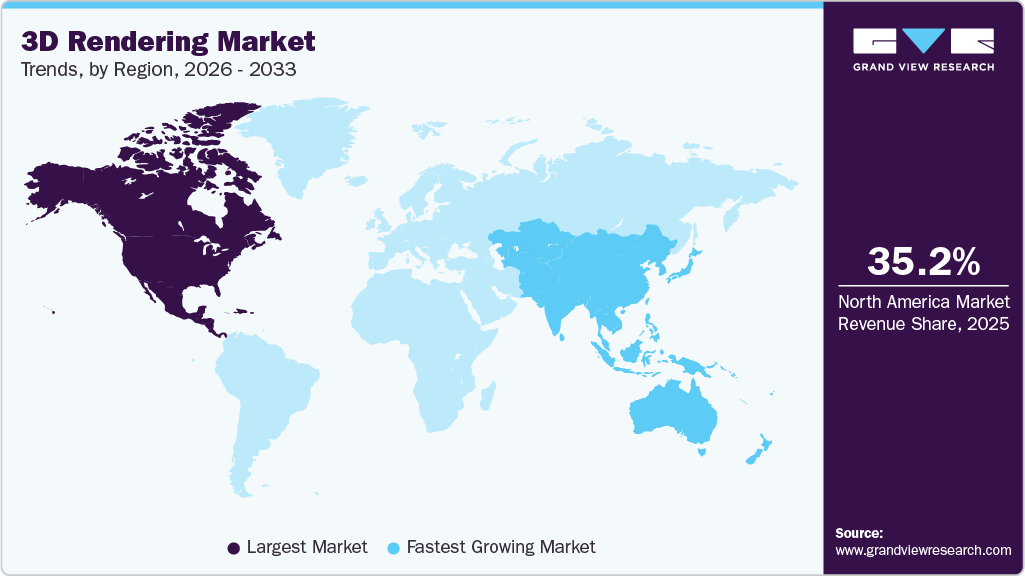

- North America held a 35.2% revenue share of the global 3D rendering market in 2025.

- The U.S. market is driven by growing education and healthcare industries who are adopting rendering solutions to enhance STEM learning, while hospitals and medical researchers are leveraging 3D rendering for surgical planning, diagnostics, and patient education.

- By component, the software segment held the largest revenue share of 77.3% in 2025.

- By operating system, the windows segment held the largest revenue share in 2025.

- By organization size, the large enterprises management segment accounted for the largest share of 67.3% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 4.85 Billion

- 2033 Projected Market Size: USD 19.82 Billion

- CAGR (2026-2033): 19.6%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Cloud-based rendering solutions provide scalability, speed, and cost efficiency by allowing organizations to process complex rendering tasks without investing in expensive on-premises infrastructure. The integration of AI and cloud technologies is transforming 3D rendering by drastically improving both efficiency and quality. AI-driven engines can automatically optimize lighting, textures, and scene details, reduce manual effort and accelerating design iterations, while cloud platforms provide virtually unlimited computing power for rendering complex projects at scale. This combination allows businesses to access high-performance rendering without investing heavily in costly local hardware, making it more cost-effective and accessible to smaller firms. For instance, in May 2024, Autodesk, Inc. acquired Wonder Dynamics, the company behind Wonder Studio, an AI-powered cloud platform for 3D animation and VFX. The tool integrates seamlessly with software such as Autodesk Maya, enabling creators to animate and composite 3D characters in live-action footage with greater ease

One of the significant growth drivers in the 3D rendering market is the rising demand for photorealistic visuals across industries. In the competitive landscape, businesses in architecture, real estate, automotive, manufacturing, and marketing rely heavily on lifelike imagery to communicate ideas effectively. Photorealistic rendering allows companies to showcase unbuilt structures, products, or concepts in a way that looks nearly indistinguishable from reality. For architects and real estate developers, high-quality visuals help potential clients experience buildings and interiors before construction begins, which significantly enhances sales and marketing efforts. Similarly, in product design, photorealistic renders allow manufacturers to test consumer response and refine prototypes without investing in costly physical models.

For instance, Geopogo leveraging Unreal Engine 5 and Google Maps, is changing the way architects, designers, and urban planners showcase their projects by enabling high-quality renderings and animations within realistic 3D cityscapes. With its digital twin solution, Geopogo Cities, the company offers interactive urban environments that seamlessly connect conceptual design with real-world settings. Guided by core values of affordability, accessibility, collaboration, and transparency, the platform empowers users to create photorealistic visualizations quickly while fostering better stakeholder engagement and decision-making.

Component Insights

The software segment accounted for the largest revenue share of 77.3% in the global 3D rendering market in 2025, owing to the growing emphasis on real-time rendering capabilities, which is a standard expectation in 3D rendering solutions, is driving segment growth. Customers increasingly demand immersive and interactive experiences, whether in product design, entertainment, or real estate. Solutions offering real-time rendering enable instant visualization of changes, reducing delays and rework during the creative process. This immediacy is particularly valuable in client presentations and stakeholder discussions, as it allows decision-makers to visualize design modifications instantly, speeding up approvals and project timelines. The ability to produce high-quality, interactive renders directly within the solution ecosystem is a key factor fueling adoption.

Recent product launches and continuous software innovation further strengthen the dominance of the software segment by addressing performance, efficiency, and industry-specific requirements. For instance, May 2023, ZWSOFT launched ZW3D 2024, an updated all-in-one CAD/CAE/CAM platform for the competitive 3D design software sector. Key upgrades include a new rendering engine for smoother handling of large assemblies, 80% faster pattern generation, added chordal and face fillets, better CAM toolpaths, plus specialized modules for structure, harness, and piping design. New fatigue and random vibration simulations assist industrial equipment firms optimize early-stage performance.

The services segment is anticipated to register at the fastest CAGR during the forecast period, as organizations increasingly recognize the value of outsourcing specialized expertise to optimize their visualization workflows. Many companies, particularly those in architecture, engineering, real estate, and entertainment, may not have the in-house resources or technical skills to leverage advanced rendering tools fully. As a result, they turn to professional services providers for support in implementation, customization, training, and consulting. These services ensure that businesses can maximize the return on their technology investments by aligning visualization capabilities with project-specific needs, enabling higher-quality output and more efficient processes.

Operating System Insights

The windows segment accounted for the largest market share of 71.0% in the global 3D rendering market in 2025, driven by the increasing enterprise adoption of Windows in corporate IT infrastructures play a key role in driving the segment. Large organizations often prefer Windows for its centralized management tools, security features, and enterprise-level support, which makes it easier to integrate rendering workflows into existing digital ecosystems. This compatibility reduces implementation barriers and ensures smooth collaboration across teams using diverse visualization tools. In addition, since most employees are already familiar with the Windows environment, businesses face fewer training challenges when deploying rendering and visualization solutions. Ongoing advancements in Windows-based graphics APIs and GPU-accelerated rendering technologies continue to reinforce this preference among enterprises and developers. For instance, in March 2025, NVIDIA announced advancements in RTX neural rendering and digital human technologies at GDC 2025, including DirectX support for neural shading via Microsoft's Agility SDK preview in April. Updates to RTX Kit enhance texture streaming, filtering, and path tracing for developers building detailed game worlds. DLSS 4 exceeds 100 titles, while RTX Remix and ACE tools improve remastering and AI characters. These advancements are expected to strengthen the Windows segment's dominance in the 3D rendering market by enabling superior AI-accelerated graphics performance on the dominant platform.

The macOS segment in the global 3D rendering market is expected to grow at a substantial CAGR over the forecast period due to the growing popularity of macOS among creative professionals is driving the segment growth. Many leading 3D rendering applications, such as Cinema 4D, Blender, and Autodesk Maya, have optimized their software for macOS, ensuring smooth performance and efficient use of system resources. The ecosystem also benefits from Apple’s continuous investments in Metal, its graphics API, which enhances rendering speeds and allows developers to create more advanced visualization tools tailored specifically for Mac users.

Organization Size Insights

The large enterprises management segment accounted for the largest share of 67.3% in the global 3D rendering market in 2025, due to the increasing complexity and scale of projects undertaken by major corporations. Large enterprises in industries such as automotive, aerospace, construction, and consumer electronics are adopting 3D rendering and visualization solutions to streamline design, prototyping, and product development processes. These organizations often handle multiple projects simultaneously, requiring advanced visualization tools to coordinate teams, simulate scenarios, and maintain consistency across diverse product lines. The ability to create highly detailed and accurate visual representations enables enterprises to reduce errors, accelerate decision-making, and enhance collaboration between geographically distributed teams, which is critical for maintaining competitiveness. In line with this trend, leading technology providers are introducing immersive and integrated rendering solutions tailored to the needs of large, complex organizations. For instance, in January 2025, Siemens partnered with Sony to introduce immersive engineering solutions that integrate Siemens’ NX software with Sony’s high-resolution XR head-mounted display. The offering enables real-time, realistic 3D rendering and collaborative product design, supporting large enterprises in improving visualization, engineering accuracy, and design efficiency. This collaboration is expected to accelerate adoption of 3D rendering solutions among large enterprises and support market growth by enabling immersive, scalable, and collaborative engineering workflows.

The small and medium enterprises (SMEs) segment is expected to grow to the fastest CAGR during the forecast period, driven by the growing adoption of marketing and e-commerce strategies that leverage immersive visual content is driving segment growth. SMEs are using 3D rendering to enhance their online presence, allowing customers to interact with products in virtual environments or view realistic product simulations from multiple angles. This ability to showcase products digitally enable SMEs compete with larger brands that have traditionally dominated physical showrooms and advertising channels. The enhanced visual communication also reduces misunderstandings between clients and producers, improving customer satisfaction and reducing returns or rework, which is vital for smaller organizations managing tight margins.

Application Insights

The product design segment accounted for the largest market share of 25.4% in the global 3D Rendering market in 2025, driven by the growing importance of remote and distributed workforces is pushing the adoption of 3D rendering in product design. Designers, engineers, and project managers often work across different locations, and sharing physical models or conducting in-person design reviews can be inefficient and costly. 3D rendering allows teams to interact with realistic digital models from anywhere, providing a shared platform for feedback, collaboration, and decision-making. This capability enhances productivity and supports continuity of operations in scenarios where remote work is necessary, making it a crucial tool for modern product design practices. Companies across consumer-focused industries are increasingly partnering with advanced technology providers to enhance digital product design and visualization capabilities. For instance, in June 2025, L’Oréal Groupe announced a partnership with NVIDIA to advance AI applications in beauty. The collaboration focuses on using NVIDIA's AI Enterprise platform to scale 3D digital rendering of products, blending generative and physical AI to boost creativity in product design and expand options in the growing 3D rendering market. This partnership likely to accelerate innovation in the beauty product design segment, enabling faster prototyping and personalized concepts that strengthen market competitiveness.

The animation & visual effects segment is projected to register the fastest CAGR over the forecast period, driven by the rising popularity of streaming platforms and on-demand digital content drives the animation and VFX segment growth. The explosion of OTT platforms has led to a significant increase in the production of high-quality shows, films, and digital advertisements, all of which rely heavily on advanced visual effects to engage viewers. Studios are leveraging 3D rendering to accelerate production workflows, manage complex scenes, and deliver consistent, high-resolution visual content within tight deadlines. The ability to efficiently render and preview complex visual sequences has become critical for meeting the increasing pace and scale of digital content production.

Industry Vertical Insights

The architecture segment accounted for the largest market share in the global 3D Rendering market in 2025, driven by the growing trend of experiential architecture is driving demand for 3D visualization. Beyond functional design, architects are increasingly expected to create environments that evoke emotion and enhance user experience, whether in public spaces, museums, or commercial complexes. 3D rendering allows designers to simulate lighting, acoustics, movement patterns, and human interactions within a space, helping them refine design choices for sensory impact. By providing clients with immersive previews of how spaces will feel and function, architects can make informed decisions and optimize designs to meet both aesthetic and experiential objectives, further driving adoption of visualization technologies. Technology providers are responding to this shift by enhancing BIM and visualization platforms with integrated AI and real-time rendering capabilities that support experiential design requirements. For instance, in October 2025, Graphisoft launched Archicad 29, a major update to its leading Building Information Modeling (BIM) software for architecture. The release introduces productivity tools, better documentation, enhanced collaboration, a new integrated MEP Designer for engineers, and a beta AI Assistant with in-app guidance and AI Visualizer for quick 3D renderings from text prompts. It is expected to boost efficiency and creativity in the architecture segment, driving further adoption of AI-integrated tools and intensifying competition in the market.

The advertising and marketing segment is projected to register the fastest CAGR over the forecast period, driven by the rising trend of hyper-localized and region-specific campaigns is contributing to higher adoption of 3D rendering technologies. 3D rendering allows teams to modify elements such as product placement, lighting, or backgrounds digitally to cater to regional tastes without incurring the costs of separate photoshoots. This flexibility enables faster turnaround times for local campaigns and supports more targeted marketing, making visualization tools indispensable for modern marketing strategies. According to Salesforce’s 2024 report, 73% of global consumers expect brands to understand their unique preferences, underscoring the need for hyper-localized campaigns that resonate on a personal level.

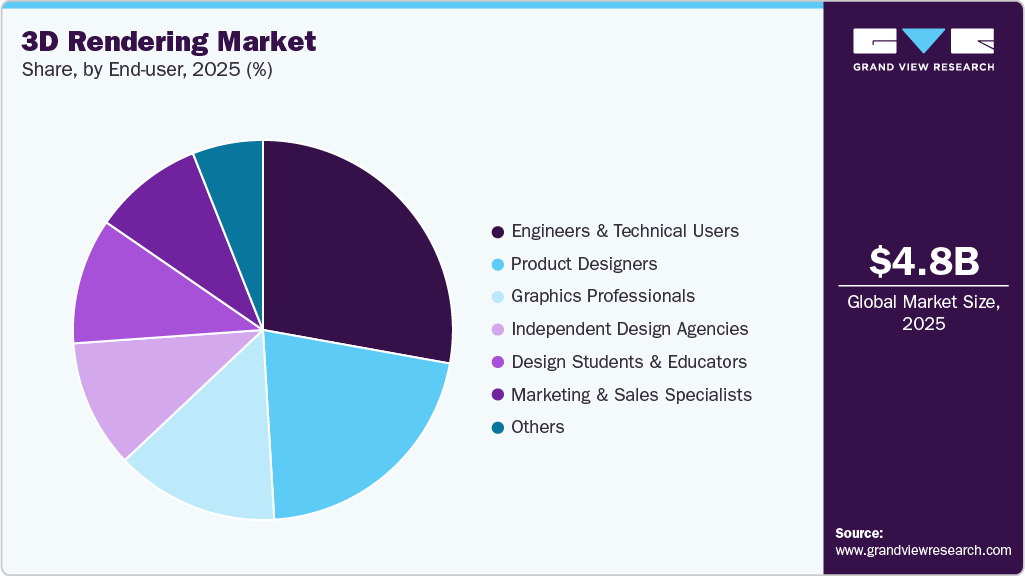

End-user Insights

The engineers & technical users segment accounted for the largest market share in the global 3D rendering market in 2025, driven by the increasing adoption of virtual prototyping and digital twin technologies propels the segment growth. Engineers utilize 3D visualization to create virtual replicas of physical systems, enabling real-time monitoring, predictive maintenance, and iterative design testing. Digital twins allow technical users to simulate operational conditions, assess performance under varying loads, and optimize designs for efficiency, safety, and reliability. This approach minimizes physical testing requirements, reduces material waste, and supports sustainable engineering practices, all of which are becoming essential considerations in modern industrial operations.

The marketing & sales specialists segment is expected to register the fastest during the forecast period in the global 3D rendering market, driven by the rising importance of personalized marketing is fueling the use of 3D rendering among sales specialists. Consumers increasingly expect tailored experiences, and visualization tools enable the customization of marketing assets to reflect different demographics, preferences, and geographies. For example, the same product can be displayed in multiple colors, materials, or configurations without additional photoshoots, enabling highly targeted campaigns at scale. This flexibility reduces content creation costs while empowering sales teams to adapt to evolving customer needs quickly. It also supports the growing use of data-driven marketing strategies, where insights from customer behavior are integrated with 3D visual assets to maximize conversion rates.

Regional Insights

North America 3D rendering marketaccounted for the largest market share of 35.2% in 2025 in the global 3D rendering market. The real estate and construction industries in North America are major contributors to the growth of this market. With rising urban development and growing demand for virtual walkthroughs, architects and developers are using 3D rendering to showcase projects before completion. This trend not only supports more efficient design and collaboration but also provides clients with a clearer understanding of layouts and aesthetics, strengthening decision-making and accelerating project approvals. Companies across the region are forming strategic partnerships to integrate advanced 3D rendering and AI technologies into industry-specific platforms. For instance, in December 2024, Fovia, Inc. and Konica Minolta Healthcare Americas announced a strategic partnership at RSNA 2024 to integrate Fovia’s advanced 3D visualization and AI-powered segmentation tools into Konica Minolta’s cloud-based Exa PACS platform. This collaboration brings secure, scalable, zero-footprint 3D rendering capabilities to healthcare providers across North America. This partnership is expected to strengthen the adoption of advanced 3D rendering solutions in the North American medical imaging market, driving greater diagnostic efficiency and better patient care.

U.S. 3D Rendering Market Trends

The U.S. 3D rendering market accounted for the largest share within North America in 2025. The education and healthcare industries in the U.S. are contributing to the growth of the market. Universities and training institutes are adopting rendering solutions to enhance STEM learning, while hospitals and medical researchers are leveraging 3D rendering for surgical planning, diagnostics, and patient education. The convergence of digital learning, telemedicine, and advanced visualization tools is expanding the reach of rendering applications, further reinforcing the U.S. as one of the most dynamic markets for 3D rendering and visualization technologies. This momentum is further supported by increased investments and partnerships that expand the use of 3D rendering beyond traditional sectors into consumer-facing and commercial applications. For instance, in May 2024, La-Z-Boy partnered with 3D Cloud to advance 3D commerce in furniture retail. The company has rolled out augmented reality apps, interactive product configurators, room planners, and virtual reality tools for associates, all built on shared 3D assets for online and in-store use. This partnership strengthens La-Z-Boy's position in a competitive market where shoppers demand realistic previews before buying big-ticket items. Such innovations drive sales growth across various industries.

Europe 3D Rendering Market Trends

The 3D rendering market in Europe is anticipated to register significant growth from 2026 to 2033. The growing adoption of remote collaboration and virtual prototyping, accelerated by the shift to hybrid working models, is driving the market growth in Europe. With cross-border operations common in industries such as automotive, aerospace, and industrial manufacturing, companies are using 3D rendering to enable teams to collaborate on designs and product development without physical presence. This trend has been further reinforced by the need to reduce travel costs and carbon emissions, which aligns with Europe’s broader sustainability goals. By allowing stakeholders to review and iterate designs virtually, businesses can accelerate decision-making, improve productivity, and maintain high-quality standards across geographically dispersed teams. At the regional level, public initiatives and collaborative frameworks are also playing a key role in accelerating the adoption of immersive and visualization technologies. For instance, in December 2025, European Commission launched the European Partnership for Virtual Worlds, uniting industry, researchers, and users to drive advances in immersive technologies, including key 3D visualization tools essential for realistic virtual environments in healthcare, manufacturing, education, and culture.

The UK 3D rendering market is being shaped by the UK’s financial services and insurance industries. Companies in these sectors are using rendering tools to simulate complex risk scenarios, assess property and asset conditions, and improve client presentations. Realistic 3D models help insurers evaluate potential damages, optimize risk management strategies, and communicate findings to stakeholders with greater clarity. The combination of financial modeling with visualization not only enhances decision-making but also supports innovative client engagement strategies in competitive markets.

The 3D Rendering market in Germany is increasingly propelled by the automotive sector’s push for advanced design and customer experience solutions. Automotive manufacturers are adopting 3D visualization for internal design and prototyping and for enhancing consumer experience through virtual showrooms and configurators. By allowing potential buyers to explore vehicle features, customize interiors, and view realistic simulations of performance and aesthetics, these tools allow automotive companies differentiate themselves in a competitive market. The shift toward electric vehicles (EVs) and next-generation mobility solutions has further increased reliance on 3D visualization to communicate complex technical innovations to stakeholders and end consumers alike. Beyond the automotive sector, collaborations and partnerships are driving the adoption of 3D rendering technologies across healthcare, research, and specialized industrial applications. For instance, in May 2024, InSphero AG, based in Zürich, announced a partnership with Frankfurt-based Genome Biologics. This deal allows InSphero to market Genome Biologics' advanced TrueCardium 3D Cardiac Organoid Platform, strengthening offerings in disease-specific models for drug discovery and toxicology.

Asia Pacific 3D Rendering Market Trends

Asia Pacific is expected to register the fastest CAGR of from 2026 to 2033, driven by the booming real estate and property development sectors across Asia Pacific are also fueling the uptake of visualization technologies. In densely populated urban hubs such as Shanghai, Mumbai, and Bangkok, developers are turning to rendering solutions to present photorealistic models of apartments, commercial spaces, and infrastructure projects. This not only aids in marketing properties to prospective buyers but also supports planners and architects in assessing structural design, sustainability features, and aesthetic appeal before construction begins. The visualization of large-scale developments allows stakeholders to align more effectively, reducing costly missteps during execution. Beyond real estate or other industry, key cultural and entertainment sectors are also leveraging advanced 3D visualization to engage audiences and create immersive digital experiences. For instance, in March 2024, Matterport announced that ARTOGO, Asia's leading virtual exhibition platform, has selected its Digital Twin Platform as the preferred 3D technology to transform the arts industry. ARTOGO uses Matterport's tools to deliver immersive online art experiences, hosting over 450 virtual exhibits with more than four million views across Asian museums and galleries. This adoption demonstrates growing demand for 3D visualization and digital twin solutions, driving innovation, revenue opportunities, and wider acceptance of immersive 3D rendering technologies across the region.

The 3D Rendering market in Japan is poised for robust growth from 2026 to 2033 owing to the expansion of Japan’s gaming and anime industries is driving the market growth. With a global fanbase and a highly competitive domestic market, content creators are adopting 3D visualization to produce detailed environments, lifelike characters, and immersive experiences for video games, animated films, and VR experiences. The demand for high-fidelity visuals that maintain artistic integrity while reducing production time is pushing studios to rely on advanced rendering technologies. This streamlines the creative workflow and allows for the integration of interactive storytelling elements, enabling consumers to engage with content in new, dynamic ways.

China 3D rendering market is being shaped by the government’s push for digital transformation across multiple sectors, which includes the integration of advanced visualization tools into national development strategies. Initiatives such as smart city projects and large-scale infrastructure development require detailed simulations and design accuracy, and 3D rendering technologies provide a critical foundation for this digital planning. Municipal governments and state-backed enterprises are increasingly adopting these tools to model transportation systems, energy grids, and urban planning projects, which accelerates demand for rendering platforms tailored to large-scale civil engineering and public works. To meet these growing digital infrastructure needs, companies are partnering to develop advanced 3D rendering and real-time visualization solutions for large-scale urban and industrial projects. For instance, in September 2024, VIZZIO Technologies has formed a strategic partnership with ASRock Industrial to advance real-time digital twin and 3D surveillance solutions for smart cities and AIoT manufacturing. By integrating VIZZIO's POLYTRON LIVE 3D cameras with Intel-powered edge platforms, the collaboration delivers accurate city-scale modeling and immersive visualization. This partnership will accelerate adoption in China's rapidly expanding 3D rendering market, supporting smart city initiatives and industrial efficiency.

3D rendering market in India is characterized by the rapid adoption of digital marketing and social media is fueling demand for 3D rendering in India. Brands are increasingly using immersive content, virtual demonstrations, and interactive campaigns to capture the attention of digitally savvy consumers. 3D rendering enables marketers to produce high-quality visuals for campaigns that can be deployed across platforms such as Instagram, YouTube, and TikTok, helping companies communicate product features, innovations, and brand narratives more effectively. This shift toward digital-first marketing is particularly strong among younger demographics who prioritize visually engaging and interactive content.

Key 3D Rendering Company Insights

Key players operating in the 3D Rendering industry are Adobe Inc., Advanced Micro Devices Inc., Autodesk Inc., and others. Companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In August 2025, Autodesk Inc. launched a new, more accessible pricing model for Autodesk Flow Studio. Autodesk Flow Studio harnesses AI to streamline complex VFX processes, including motion capture, camera tracking, and character animation, allowing users to concentrate on storytelling rather than technical intricacies. With just a video clip and a few simple clicks, creators can seamlessly integrate CG characters into live-action footage and render them, making high-quality 3D animation and VFX accessible to everyone.

-

In July 2025, Chaos Software EOOD acquired EvolveLAB, enhancing its design-to-visualization capabilities while broadening its reach into BIM automation. EvolveLAB’s solutions integrate fully with the Chaos ecosystem, allowing users to perform real-time visualization, photorealistic rendering, and automated AI-powered documentation within a unified environment. This integration streamlines workflows and minimizes the need for multiple disconnected tools.

-

In June 2025, PTC Inc. partnered with NVIDIA to integrate NVIDIA Omniverse technologies into its Creo CAD and Windchill PLM platforms. This collaboration allows users to perform real-time, photorealistic visualization and simulation of complex products, including AI infrastructure hardware, directly within Windchill. By utilizing OpenUSD standards, Omniverse RTX libraries, and digital twin workflows, PTC aims to facilitate seamless team collaboration, provide access to version-controlled 3D data, and accelerate product development while enhancing quality and minimizing risk.

Key 3D Rendering Companies:

The following key companies have been profiled for this study on the 3D rendering market.

- Adobe Inc.

- Advanced Micro Devices Inc.

- Autodesk Inc.

- Chaos Software EOOD

- Christie Digital Systems USA, Inc.

- D5 Render

- Disney-Pixar

- Epic Games, Inc.

- Graphisoft SE

- Intel Corporation

- KeyShot

- Maxon Computer GmbH

- NVIDIA Corporation

- OTOY Inc.

- PTC Inc.

- SideFX

3D Rendering Market Report Scope

Report Attribute

Details

Market size in 2026

USD 5.67 billion

Revenue forecast in 2033

USD 19.82 billion

Growth rate

CAGR of 19.6% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2026 to 2033

Report Coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, operating system, organization size, end-user, industry vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

Adobe Inc.; Advanced Micro Devices Inc.; Autodesk Inc.; Chaos Software EOOD; Christie Digital Systems USA, Inc.; D5 Render; Disney-Pixar; Epic Games, Inc.; Graphisoft SE; Intel Corporation; KeyShot; Maxon Computer GmbH; NVIDIA Corporation; OTOY Inc.; PTC Inc.; SideFX

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global 3D Rendering Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the 3D Rendering market report based on component, operating system, organization size, end-user, industry vertical, and region.

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Software

-

Services

-

-

Operating System Outlook (Revenue, USD Million, 2021 - 2033)

-

Windows

-

MacOS

-

Linux

-

-

Organization Size Outlook (Revenue, USD Million, 2021 - 2033)

-

Small and Medium Enterprises (SMEs)

-

Large Enterprises

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Product Design

-

Industrial Design

-

Consumer Product Design

-

Packaging Design

-

-

Architectural & Interior Design

-

Residential Architecture

-

Commercial Architectures

-

Urban Planning & Design

-

Interior Residential Design

-

Interior Commercial Design

-

Exhibition & Event Space Design

-

Retail/Consumer Interior Design

-

-

Animation & Visual Effects

-

2D Animation

-

3D Animmation

-

Visual Effects (VFX)

-

Motion Graphics

-

Character Design

-

Game Animation

-

-

Others

-

-

End-user Outlook (Revenue, USD Million, 2021 - 2033)

-

Design Students & Educators

-

Engineers & Technical Users

-

Product Designers

-

Marketing & Sales Specialists

-

Graphics Professionals

-

Independent Design Agencies

-

Others

-

-

Industry Vertical Outlook (Revenue, USD Million, 2021 - 2033)

-

Advertising and Marketing

-

Fashion & Apparel

-

Architecture

-

Automotive & Utility Vehicles

-

Construction

-

Consumer Packaged Goods (CPG)

-

Jewelry

-

Footwear

-

Electronics

-

Manufacturing

-

Media and Entertainment

-

Retail

-

Technology

-

Machinery

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global 3D rendering market is expected to grow at a compound annual growth rate of 19.6% from 2026 to 2033 to reach USD 19.82 billion by 2033.

b. The software segment dominated the 3D rendering market in 2025 driven by increasing demand for advanced visualization tools, real-time rendering capabilities, and photorealistic modelling across architecture, gaming, film, and industrial design applications.

b. Some key players operating in the market include Adobe Inc., Advanced Micro Devices Inc., Autodesk Inc., Chaos Software EOOD, Christie Digital Systems USA, Inc., D5 Render, Disney-Pixar, Epic Games, Inc., Graphisoft SE, Intel Corporation, KeyShot, Maxon Computer GmbH, NVIDIA Corporation, OTOY Inc., PTC Inc., SideFX, and Others

b. The global 3D rendering market size was estimated at USD 4.85 billion in 2025 and is expected to reach USD 5.67 billion in 2026.

b. Factors such as increasing demand for immersive visualization, adoption of AI and real-time rendering technologies, expansion of virtual and augmented reality applications and rising need for remote collaboration and digital prototyping play a key role in accelerating the 3D rendering market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.