- Home

- »

- Next Generation Technologies

- »

-

4K Set-top Box Market Size & Share, Industry Report, 2030GVR Report cover

![4K Set-top Box Market Size, Share & Trends Report]()

4K Set-top Box Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Residential, Commercial), By Product (IPTV, Satellite, Cable, OTT, Digital Terrestrial, Hybrid), By Region (North America, Europe, APAC), And Segment Forecasts

- Report ID: 978-1-68038-824-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

4K Set-top Box Market Size & Trends

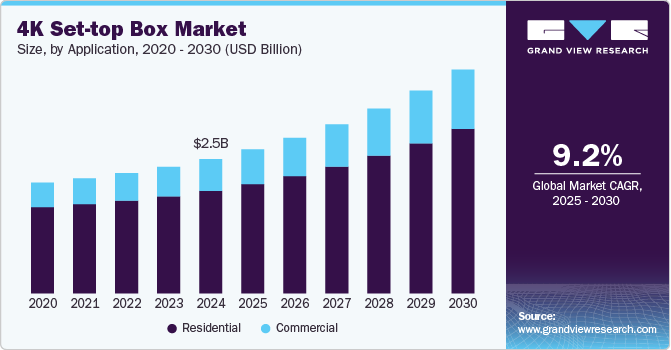

The global 4K set-top box market size was estimated at USD 2.48 billion in 2024 and is expected to register a CAGR of 9.2% from 2025 to 2030. The 4K set-top box industry is witnessing significant growth, fueled by the increasing availability of 4K Ultra HD content from Over-The-Top (OTT) platforms, broadcasters, and content creators. Consumers gravitate toward enhanced visual experiences, particularly streaming and gaming, driving demand for these advanced devices. To meet this demand, manufacturers are incorporating sophisticated codes like HEVC to facilitate smoother delivery of 4K content. This trend is further supported by the rising penetration of high-speed internet and the expansion of fiber-optic networks, making the transition from HD to 4K a key factor influencing consumer preferences.

Technological advancements are reshaping the 4K set-top box industry, with a strong focus on improved processing power and enhanced connectivity. Features such as voice control, smart home integration, and seamless access to diverse content sources increasingly attract consumers. These innovations improve the user experience and enhance the functionality of 4K set-top boxes, broadening their appeal. In addition, the proliferation of high-speed internet, particularly in urban areas with high streaming demand, is accelerating the adoption of these devices. As manufacturers continue to invest in research and development, the capabilities of 4K set-top boxes are expected to expand, driving competitive differentiation and innovation in the market.

The growing preference for OTT platforms is a major trend shaping the 4K set-top box industry as more consumers opt for streaming services over traditional cable subscriptions. This shift has significantly increased demand for devices seamlessly integrating broadcast and streaming content. Set-top boxes featuring internet connectivity and access to multiple OTT services are gaining traction due to their ability to offer users greater flexibility in content consumption. By enabling smooth transitions between different content types, these devices enhance user satisfaction and convenience. Consequently, OTT-centric set-top boxes are projected to achieve the highest growth rates, reflecting the broader trend toward personalized and on-demand viewing experiences.

Regional dynamics also play a pivotal role in developing the 4K set-top box industry. North America dominates the market, benefiting from advanced infrastructure and higher disposable income levels. However, the Asia-Pacific region is rapidly emerging as the fastest-growing market, driven by urbanization and rising demand for premium video content in countries like India and China. The competitive pricing strategies of digital broadcast providers in these markets further stimulate growth. In contrast, Latin America and Africa may witness moderate expansion due to disparities in technological adoption and infrastructure. As these regions develop, they present promising opportunities for the 4K set-top box industry to innovate and expand. Manufacturers must adapt to regional preferences to capture these emerging segments effectively.

Consumer demand for high-quality viewing experiences is another key driver in the 4K set-top box industry. Pursuing superior picture quality and immersive home entertainment influences purchasing decisions, with users favoring devices that elevate their audiovisual experiences. Furthermore, service providers’ promotional efforts encouraging upgrades to 4K devices from older models further fuel this trend. This shift underscores a broader focus on enhancing value through advanced home technology. As manufacturers respond with innovative solutions to align with these evolving preferences, the 4K set-top box industry is expected to sustain robust growth. Delivering high-quality experiences will remain essential for maintaining momentum in this competitive market.

Application Insights

The residential segment accounted for the largest market revenue share of over 76% in 2024. Integrating OTT platforms into 4K set-top boxes has become a pivotal trend within the residential segment. Consumers prefer devices that offer seamless access to popular streaming services, such as Netflix and Amazon Prime Video, alongside traditional broadcast content. This convergence allows users to enjoy a diverse range of programming options from a single device, enhancing convenience and user satisfaction. As service providers incorporate OTT functionalities into their offerings, they are better positioned to attract and retain customers. The ability to switch between various content sources without hassle is driving consumer preference toward these multifunctional devices. This trend is expected to accelerate further as more households adopt streaming services as their primary source of entertainment.

Commercial application is predicted to foresee the highest growth in the coming years. Commercial users increasingly prioritize enhanced user experiences through advanced features offered by 4K set-top boxes. Features such as interactive interfaces, personalized content recommendations, and multi-device connectivity are becoming essential for attracting customers. Businesses are leveraging these capabilities to create engaging environments that encourage longer customer stays and increase consumption of services. In addition, the integration of voice control technology allows for seamless navigation and improved accessibility for users. As technology continues to evolve, businesses that adopt these advanced features will likely gain a competitive edge in the market. This focus on user experience is expected to drive demand for innovative 4K set-top box solutions in commercial settings.

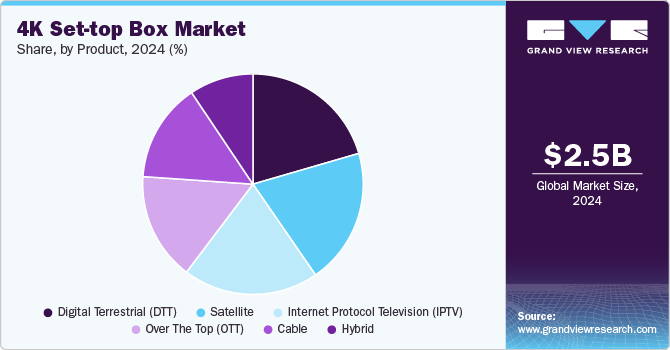

Product Insights

The DTT segment accounted for the largest market revenue share in 2024. The DTT segment is witnessing a surge in demand for high-definition content as consumers increasingly seek superior viewing experiences. This trend is driven by the proliferation of 4K content across various broadcasting platforms, prompting viewers to upgrade their equipment to enjoy enhanced picture quality. As more broadcasters transition to 4K offerings, the need for compatible DTT set-top boxes becomes essential. This shift enhances consumer satisfaction and encourages broader adoption of digital television services. Consequently, manufacturers focus on developing advanced DTT set-top boxes that support ultra-high-definition broadcasts.

The satellite segment is predicted to foresee the highest growth in the coming years. The satellite set-top box (STB) segment is witnessing rapid growth, positioning itself as one of the fastest-growing segments in the market. This growth is largely attributed to the increasing demand for high-quality broadcasts and the ability to access a diverse range of national and international channels. Satellite STBs offer unique advantages, particularly in areas with limited broadband infrastructure, making them an attractive option for consumers seeking reliable television services. Furthermore, advancements in satellite technology are enhancing signal quality and expanding channel offerings, further driving consumer interest. As a result, manufacturers are focusing on developing innovative satellite STBs that cater to these evolving demands.

Regional Insights

North America 4K set-top box market has a significant revenue share of over 21% in 2024. North America remains the largest market for 4K set-top boxes, driven by high disposable incomes and a well-established entertainment infrastructure. The region benefits from the strong presence of major OTT platforms like Netflix and Hulu, which extensively offer 4K content. Moreover, the rapid adoption of smart TVs and high-speed internet enhances the appeal of 4K set-top boxes among consumers. As a result, manufacturers are focusing on developing innovative products that cater to the tech-savvy population in this region.

U.S. 4K Set-top Box Market Trends

The 4K Set-top Box market in the U.S. is expected to grow at a CAGR from 2025 to 2030. In the U.S., there is a strong emphasis on incorporating smart features into 4K set-top boxes to enhance user experience. Consumers are increasingly looking for devices that offer advanced functionalities such as voice control and personalized content recommendations. The widespread availability of high-speed internet supports this trend by enabling seamless streaming of ultra-HD content. As competition among service providers intensifies, focusing on innovative features will be crucial for attracting consumers in this market.

Europe 4K Set-top Box Market Trends

The 4K Set-top Box market in Europe is expected to grow significantly over the forecast period. In Europe, there is a growing trend towards integrating streaming services into 4K set-top boxes, reflecting changing consumer preferences for on-demand content. Consumers increasingly seek devices that provide seamless access to traditional broadcasting and popular OTT platforms. This shift is supported by government initiatives promoting digital broadcasting and improving content accessibility. Consequently, the demand for versatile 4K set-top boxes that cater to diverse viewing habits is expected to rise significantly.

Asia Pacific 4K Set-top Box Market Trends

The 4K Set-top Box market in Asia Pacific is expected to register the highest CAGR over the forecast period. The Asia Pacific region is experiencing rapid market growth, fueled by rising disposable incomes and increasing urbanization. Countries like India and China are witnessing a surge in demand for high-definition content as consumers adopt smart TVs and seek enhanced viewing experiences. Government initiatives to improve digital infrastructure also facilitate this transition from analog to digital broadcasting. This combination of factors positions Asia Pacific as a key growth area for the global market.

Key 4K Set-top Box Company Insights

Leading market companies, including Roku, Amazon, Sagemcom, Technicolor (Vantiva), HUMAX, and EchoStar, are actively implementing strategies to expand their market presence and strengthen their competitive edge. These initiatives involve forming strategic partnerships, pursuing mergers and acquisitions, and collaborating with technology partners. Furthermore, they are focused on innovating and introducing advanced products to meet shifting consumer preferences. By adopting these approaches, these companies aim to stay ahead in a rapidly evolving market and address the growing demand for 4K Set-top Box solutions across various industries.

-

Amazon stands out with its Fire TV devices, offering seamless access to 4K Ultra HD content and integration with its vast Prime Video ecosystem. Its dominance is driven by innovation, user-friendly interfaces, and a robust library of streaming options. With advanced features like Alexa voice control, Amazon continually enhances customer engagement. The company leverages its global distribution network to maintain a strong market presence.

-

ZTE Corporation excels in providing advanced 4K set-top boxes for IPTV and OTT applications, catering to both consumer and enterprise markets. The company integrates cutting-edge technologies like HEVC compression and AI-powered interfaces to deliver superior viewing experiences. Its strategic partnerships with telecom operators enable the seamless deployment of its solutions globally. ZTE's commitment to innovation and reliability positions it as a key player in the market.

Key 4K Set-top Box Companies:

The following are the leading companies in the 4K set-top box market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon.com, Inc.

- Arion Technology Ltd.

- EchoStar Corporation

- HUMAX Electronics Co., Ltd

- Infomir Group

- Inspur Group

- Roku, Inc.

- Sagemcom Group

- Techniolcor SA (Vantiva SA)

- Vestel Group (TVS Regza Corporation)

- ZTE Corporation

Recent Developments

-

In September 2024, ZTE Corporation launched its flagship set-top box (STB) 4K AI at the 2024 IBC Show, combining STB and soundbar functionalities to redefine home entertainment. Equipped with the advanced S905X5 SoC, the device offers a 67% boost in processing speed and a 50% reduction in power consumption, delivering exceptional performance. As an all-in-one solution, STB provides an immersive audio experience, supports voice and gesture-based applications as a computing center, and acts as a smart control hub for managing IoT devices. ZTE is focused on strengthening partnerships with global operators to accelerate innovation in home media solutions and enhance engagement in smart home ecosystems.

-

In February 2024, ZTE Corporation launched its new-generation 4K DVB Zapper Set-Top Box (STB) at MWC Barcelona 2024, designed to enhance the UHD TV viewing experience. This Linux-based STB features a high-performance System on Chip (SoC) based on Cortex-A35, offering larger memory and supporting advanced technologies such as H.265 decoding and HDR10. With the increasing demand for 4K content, this device aims to assist operators in delivering superior video services while improving user engagement. ZTE is committed to advancing home media solutions and plans to collaborate with global operators to innovate further in the smart home sector.

4K Set-top Box Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.66 billion

Revenue forecast in 2030

USD 4.13 billion

Growth rate

CAGR of 9.2% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, product, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

Amazon.com, Inc.; Arion Technology Ltd.; EchoStar Corporation; Infomir Group; Inspur Group; HUMAX Electronics Co., Ltd; Roku, Inc.; Sagemcom Group ; Techniolcor SA (Vantiva SA); Vestel Group (TVS Regza Corporation); ZTE Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global 4K Set-top Box Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global 4K set-top box market based on application, product, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Internet Protocol Television (IPTV)

-

Satellite

-

Cable

-

Digital Terrestrial (DTT)

-

Over The Top (OTT)

-

Hybrid

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global 4K set-top box market size was estimated at USD 2.48 billion in 2024 and is expected to reach USD 2.66 billion in 2025.

b. The global 4K set-top box market is expected to grow at a compound annual growth rate of 9.2% from 2025 to 2030 to reach USD 4.13 billion by 2030.

b. North America dominated the 4K set-top box market with a share of 21.35% in 2024. This is attributable to the presence of high-speed network infrastructure coupled with add-ons and features offered to users.

b. Some key players operating in the 4K set-top box market include Amazon.com, Inc., Arion Technology Ltd., EchoStar Corporation, Infomir Group, Inspur Group, HUMAX Electronics Co., Ltd., Roku, Inc., Sagemcom Group, Techniolcor SA (Vantiva SA), Vestel Group (TVS Regza Corporation), and ZTE Corporation.

b. Key factors that are driving the market growth include growing viewer emphasis on crystal-clear broadcast quality, rising demand for high-quality in-home entertainment, and the proliferation of OTT technologies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.