- Home

- »

- Digital Media

- »

-

Over The Top Devices And Services Market Report, 2033GVR Report cover

![Over The Top Devices And Services Market Size, Share & Trends Report]()

Over The Top Devices And Services Market (2025 - 2033) Size, Share & Trends Analysis Report By Type, By Device, By Service Type, By OTT Business Models, By Platform, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-496-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Over The Top Devices And Services Market Summary

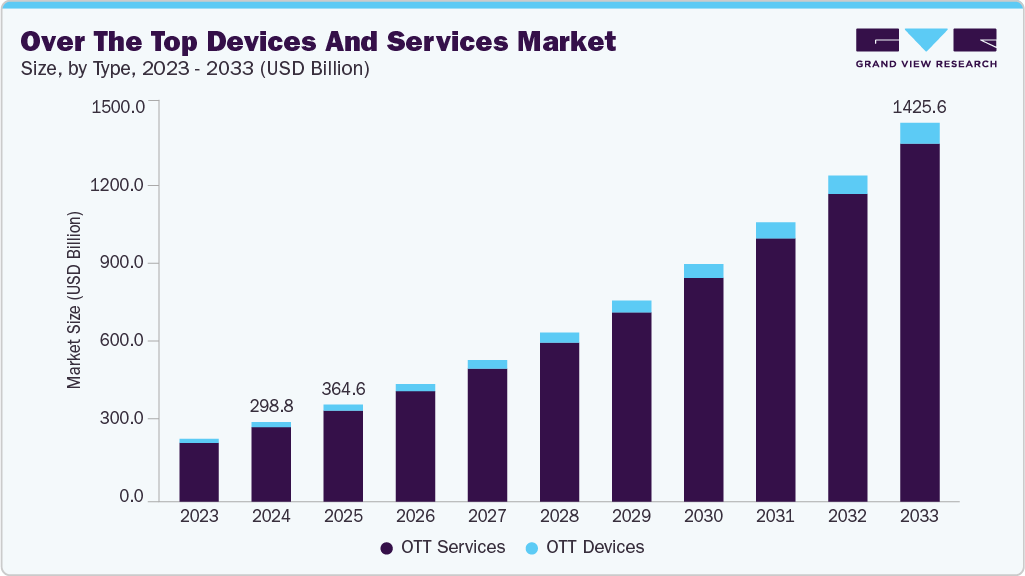

The global over the top devices and services market size was estimated at USD 298.84 billion in 2024 and is projected to reach USD 1,425.63 billion by 2033, growing at a CAGR of 18.6% from 2025 to 2033. The market growth is primarily driven by the increasing penetration of high-speed internet, rising demand for personalized and on-demand content, growing adoption of smart TVs and connected devices, continuous advancements in streaming technology and compression algorithms, and the expansion of original content production by OTT service providers to attract and retain subscribers.

Key Market Trends & Insights

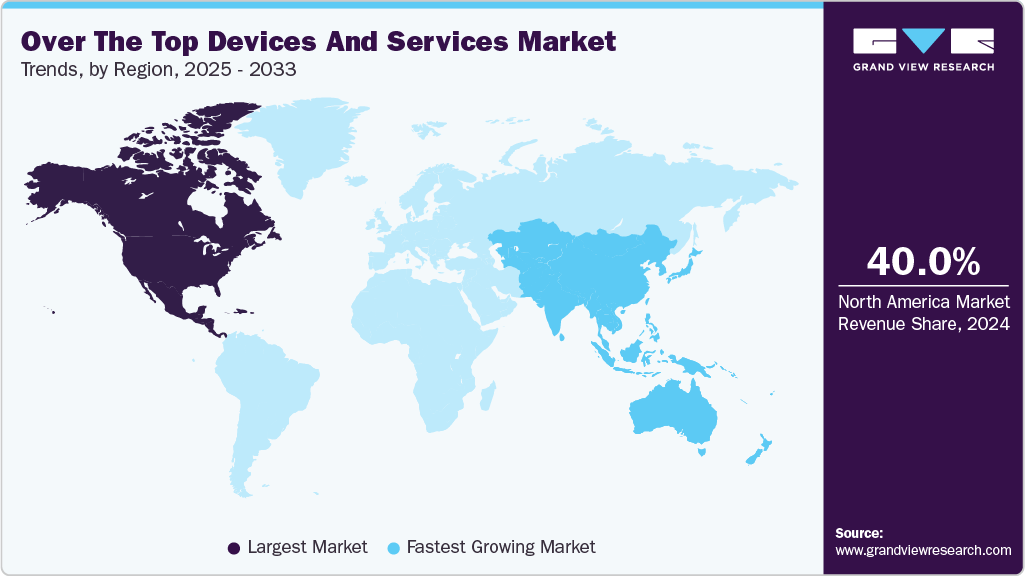

- North America dominated the global over the top devices and services market with the largest revenue share of over 40% in 2024.

- The over the top devices and services market in the U.S. led the North America market and held the largest revenue share in 2024.

- By type, the OTT services segment led the market and held the largest revenue share of over 93% in 2024.

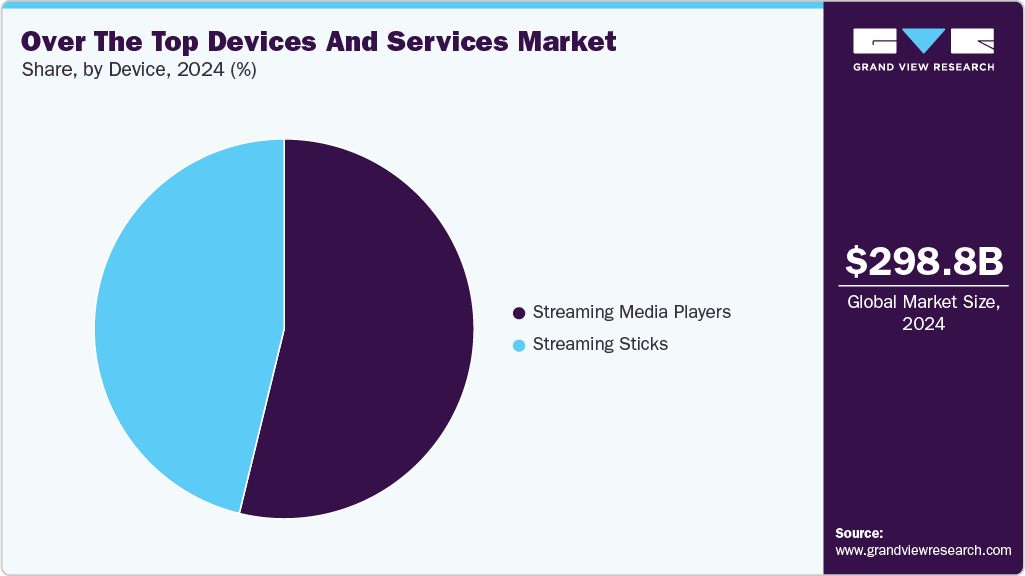

- By device, the streaming media players segment led the market and held the largest revenue share of over 53% in 2024.

- By service type, the OTT media services segment dominates the market and holds the largest revenue share of over 86% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 298.84 Billion

- 2033 Projected Market Size: USD 1,425.63 Billion

- CAGR (2025-2033): 18.6%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The market growth is primarily driven by the rising consumer preference for on-demand content and the global proliferation of internet-connected devices. The rapid adoption of smart TVs, streaming sticks, and mobile devices is enabling seamless access to OTT services, bypassing traditional cable and satellite models. The growing availability of localized content, personalized recommendations powered by AI, and flexible subscription models is attracting a diverse audience base. Integration with smart home ecosystems and voice-activated assistants is also expanding the functionality and appeal of OTT platforms, significantly contributing to market expansion.The rapid shift in consumer viewing preferences from traditional cable to on-demand digital content is a primary growth driver of the Over The Top (OTT) Devices and Services industry. Audiences, especially millennials and Gen Z, are favoring flexible, subscription-based or ad-supported platforms that allow them to watch content anytime. This consumer behavior is compelling to broadcasters, content producers, and tech companies to invest heavily in OTT services, increasing content variety and accessibility, and ultimately expanding the market footprint.

Additionally, the proliferation of smart TVs, streaming sticks, and connected devices is significantly bolstering market growth. Falling prices of internet-enabled televisions and streaming hardware from players like Roku, Amazon, and Google, more households are accessing OTT platforms with ease. These devices offer intuitive user interfaces, voice-controlled navigation, and seamless app integration, making OTT content more attractive and widely consumed across demographic segments, thereby fueling the growth of the over the top devices and services industry.

Furthermore, the rise in exclusive content and original programming by OTT platforms is a strong catalyst for market expansion. Services such as Netflix, Disney+, and Amazon Prime Video are heavily investing in localized and original content to capture specific regional markets and enhance user retention. This content differentiation strategy strengthens brand loyalty and drives new subscriptions, fueling over the top devices and services industry growth.

Moreover, advancements in network infrastructure, including the rollout of 5G and high-speed fiber optics, are dramatically improving the streaming experience. Low-latency, high-bandwidth internet is enabling smooth playback of high-definition and ultra-HD content, including 4K and 8K formats. This enhanced user experience is encouraging longer viewing durations and increased platform engagement, contributing significantly to the expansion of the OTT devices and services market.

Type Insights

The OTT services segment dominated the market with the largest market share of over 93% in 2024, owing to the growing internet penetration that enables users to subscribe to OTT services and stream their favorite content. The ongoing trend among internet providers in developing countries to provide low-cost internet services is boosting the use of OTT devices and services. There was a substantial increase in demand for OTT services as people want advertisement-free entertainment, reinforcing the segment’s leadership in the over the top devices and services industry.

The OTT devices segment is expected to witness a significant CAGR of over 17% from 2025 to 2033. The growth can be attributed to the ease of access to OTT content and affordability. An OTT device enables users to access OTT services and platforms even on non-smart devices. Furthermore, the trend of portability coupled with increased usage of small-sized plug-and-play OTT devices is expected to boost segment growth.

Device Insights

The streaming media players segment accounted for the largest market share in 2024. This growth is fueled by the rising consumer preference for affordable, plug-and-play devices that offer instant access to a wide range of OTT content without the need for smart TVs. Increased penetration of high-speed internet, HDR content, and the expansion of app ecosystems on devices such as Roku, Fire TV, and Chromecast are further driving demand. The integration of voice assistants, personalized recommendations, and cross-platform synchronization enhances user experience, boosting adoption across both urban and rural households.

The streaming sticks segment is expected to witness the fastest CAGR from 2025 to 2033, driven by their affordability, portability, and ease of installation, which appeal to a wide range of consumers globally. These devices offer seamless access to multiple OTT platforms without the need for bulky hardware, making them ideal for cost-conscious and space-limited users. Advancements such as 4K streaming support, voice control, and integration with smart home ecosystems have enhanced their value proposition. Growing demand in emerging markets and increased internet penetration further fuel adoption, solidifying their dominance in over the top devices and services market.

Service Type Insights

The OTT media services segment accounted for the largest market share in 2024, owing to the rising consumer preference for on-demand, personalized content across multiple devices. Advanced recommendation algorithms, multi-language support, and affordable pricing tiers have enhanced user retention and acquisition. The growing penetration of high-speed internet and smart devices further supports widespread access, solidifying the dominance of the OTT media services segment in the over the top devices and services industry.

The OTT communication services segment is expected to witness a significant CAGR from 2025 to 2033, driven by the surging demand for internet-based messaging, voice, and video calling applications that bypass traditional telecom networks. Remote work, online education, and digital socialization become more entrenched, and platforms such as WhatsApp, Zoom, and Telegram are experiencing exponential user growth. Enhanced encryption, multi-device support, and integration with enterprise productivity tools are further strengthening adoption, propelling the growth of OTT communication services.

OTT Business Model Insights

The subscription video-on-demand (SVOD) segment accounted for the largest market share in 2024, driven by its predictable pricing models, ad-free viewing experience, and expansive content libraries that cater to diverse audience preferences. Consumers increasingly favor SVOD services for their flexibility, allowing content access across multiple devices with personalized user profiles. The rise of exclusive and original content, coupled with improved recommendation algorithms, has strengthened user engagement and loyalty. Strategic bundling with telecom and internet services has made SVOD more accessible, fueling its dominance in the over the top devices and services market.

The ad-based video-on-demand (AVOD) segment is expected to witness the fastest CAGR from 2025 to 2033. This growth is driven by growing consumer demand for free, ad-supported content as an alternative to costly subscriptions. The surge in mobile and smart device users, particularly in emerging markets, is accelerating AVOD adoption due to its accessibility and low entry barriers. Advancements in programmatic advertising and data-driven ad targeting are enabling higher monetization potential for providers while offering relevant, engaging content experiences for viewers.

Platform Insights

The smart TVs & set-top box segment accounted for the largest market share in 2024, driven by the growing consumer preference for integrated entertainment solutions that eliminate the need for additional streaming hardware. Rising affordability, coupled with expanding smart home adoption and increasing availability of high-speed internet, has accelerated global penetration. Their compatibility with multiple OTT services and minimal setup requirements continues to make them the preferred choice for mainstream and first-time users in the OTT devices and services market.

The smartphones segment is expected to witness a significant CAGR from 2025 to 2033 in the over the top devices and services industry. This surge is driven by the widespread affordability and accessibility of smartphones, allowing users to stream OTT content on-the-go without requiring additional hardware. The rapid rollout of 5G networks, increasing screen resolutions, and growing app compatibility have further enhanced mobile streaming experiences. The integration of features such as offline downloads, adaptive streaming, and personalized content curation on mobile apps is amplifying user engagement, particularly among younger, mobile-first audiences.

Regional Insights

The North America over the top devices and services market accounted for the market share of over 40% in 2024, driven by high broadband penetration, strong consumer demand for on-demand entertainment, and a mature digital infrastructure. The region hosts leading OTT providers like Netflix and Disney+, which continue to invest heavily in exclusive content and user experience innovations. Rapid adoption of smart TVs, increasing cord-cutting trends, and the availability of bundled OTT packages from telecom providers further fuel market growth. Strong regulatory support for net neutrality ensures uninterrupted access to diverse streaming platforms, strengthening North America's market dominance.

U.S. Over The Top Devices And Services Market Trends

The over the top devices and services market in the U.S. held the largest market share of over 92% in 2024, fueled by high broadband penetration, rising cord-cutting trends, and a tech-savvy consumer base seeking flexible content options. The dominance of global OTT giants in the U.S. strengthens market growth through aggressive investment in original content and advanced streaming technologies. Increasing smart TV adoption, strong digital infrastructure, and supportive regulatory frameworks for streaming services further enhance market expansion across the country.

Europe Over The Top Devices And Services Market Trends

The over the top devices and services market in Europe is expected to grow at a significant CAGR of over 18% from 2025 to 2033. In Europe, the market is driven by increasing cord-cutting trends and a surge in demand for multilingual and region-specific content. The rise of local OTT players offering tailored subscription models, combined with the EU’s push for digital single market strategies, is enhancing cross-border content accessibility. Growing investments in broadband infrastructure and widespread adoption of smart TVs across key markets are accelerating platform usage. The shift towards ad-supported and hybrid monetization models further supports sustained growth across the region.

The UK over the top devices and services market is expected to grow at a significant rate in the coming years. Supported by high broadband penetration, strong digital infrastructure, and a tech-savvy population. The surge in cord-cutting trends, combined with increasing subscriptions to platforms like Netflix and Disney+ is boosting demand for OTT-enabled devices. Government initiatives promoting digital innovation and 5G rollout are further enhancing streaming quality and accessibility. The rise in smart TV adoption and the popularity of British original content are key factors accelerating market expansion across the country.

The over the top (OTT) devices and services market in Germany is driven by the country’s widespread broadband connectivity, high smart TV penetration, and growing demand for localized digital content. The increasing shift from traditional broadcasting to on-demand streaming, supported by tech-savvy consumers and a strong regulatory framework for data privacy, is boosting OTT adoption. Germany’s flourishing film and television industry, along with rising collaborations between local telecom providers and global streaming platforms, is further accelerating market growth.

Asia Pacific Over The Top Devices And Services Market Trends

The Asia Pacific over the top devices and services are expected to grow at the fastest CAGR of over 19% from 2025 to 2033, fueled by rapid urbanization, increasing smartphone penetration, and rising demand for localized content. The region’s diverse linguistic and cultural landscape is prompting OTT providers to invest in multilingual and regional programming, enhancing user engagement. The rollout of affordable data plans, expanding 5G infrastructure, and strategic partnerships between telecom operators and OTT platforms are driving widespread adoption across emerging economies in Asia Pacific.

The Japan over the top devices and services market is gaining traction, fueled by the country's high broadband penetration, widespread adoption of smart TVs, and a tech-savvy population. The popularity of domestic streaming platforms alongside global giants like Netflix and Amazon Prime has surged, driven by localized content, anime, and J-drama offerings. Japan’s advanced consumer electronics industry continues to innovate with cutting-edge OTT-enabled devices, while government initiatives supporting digital infrastructure further boost market expansion.

The over the top devices and services market in China is rapidly expanding, driven by the country's rapid digital transformation and increasing demand for on-demand video content. Government initiatives supporting 5G infrastructure, coupled with widespread adoption of smart TVs and affordable streaming devices, are enhancing content accessibility across urban and rural regions. China's tech-savvy population and rising disposable incomes continue to propel OTT consumption, solidifying the country's position as a key player in the global OTT landscape.

Key Over The Top Devices And Services Company Insights

Some of the key players operating in the market include Netflix, Inc., Amazon.com, Inc., and others.

-

Netflix, Inc. is a global leader in the OTT services market, offering a subscription-based streaming platform with a vast library of original and licensed content across various genres and languages. With over 250 Billion subscribers worldwide, Netflix leverages advanced recommendation algorithms and high-quality original productions to maintain its competitive edge. The company’s significant investment in localized content, mobile-friendly plans, and partnerships with smart TV manufacturers has enabled deep market penetration, making it a dominant force in global streaming.

-

Amazon.com, Inc. operates Amazon Prime Video, a key player in the OTT ecosystem, known for its wide content offerings, including exclusive movies, series, and regional programming. Integrated with Amazon Prime membership, the service provides added value through cross-platform access and bundled benefits. Amazon also offers Fire TV streaming devices, giving it a strategic advantage in both hardware and content delivery. Its global reach and investment in original content have helped it maintain a top position in the over the top devices and services industry.

Tencent Holdings Ltd. and Baidu, Inc. are some of the emerging market participants in the over the top devices and services market.

-

Tencent Holdings Ltd. is an emerging powerhouse in the OTT services space, particularly in Asia, through its platform Tencent Video. With a massive domestic user base, Tencent has leveraged its ecosystem spanning gaming, social media, and payments-to promote content and attract subscribers. The platform focuses on original Chinese dramas, anime, and variety shows, and is expanding globally through co-productions and licensing deals. Tencent’s integration of AI for content curation and personalized experiences is enhancing user engagement and driving growth.

-

Baidu, Inc. is gaining traction in the OTT market through its streaming service iQIYI, which has evolved into one of China’s leading video platforms. iQIYI focuses on AI-powered content recommendations, original productions, and interactive video formats to attract younger audiences. The company is also investing in overseas expansion and strategic content partnerships to broaden its appeal. Baidu’s expertise in AI and cloud services supports iQIYI’s infrastructure, positioning it as a growing player in the global over-the-top devices and services industry landscape.

Key Over The Top Devices And Services Companies:

The following are the leading companies in the over the top devices and services market. These companies collectively hold the largest market share and dictate industry trends.

- Netflix, Inc.

- Amazon.com, Inc.

- Disney + Hotstar

- Apple, Inc.

- Warner Bros. Discovery, Inc.

- Hulu, LLC

- Tencent Holdings Ltd.

- Roku, Inc.

- Akamai Technologies

- Baidu, Inc.

Recent Developments

-

In May 2025, Netflix, Inc. announced the rollout of its new first-party measurement tools at its 2025 Upfront event, aimed at enhancing advertiser engagement within the over the top devices and services market. The tools include advanced brand-lift metrics that allow advertisers to assess campaign performance directly on the Netflix platform. This development strengthens Netflix’s ad-supported tier by providing deeper audience insights and targeting capabilities, further solidifying its position in the competitive OTT ecosystem.

-

In April 2025, Roku, Inc. launched two new streaming devices Streamer and Streamer Plus-for the over the top devices and services industry. These compact sticks feature 4K streaming support and are 35% smaller in size, enhancing portability and user convenience. The launch also introduced software upgrades including a "Coming Soon to Theaters" content section, personalized sports highlights, and expanded smart-home integration with support for cameras and a smart projector reference design, reinforcing Roku’s position in the evolving OTT devices and services market.

-

In January 2025, Akamai Technologies announced significant enhancements to its global content delivery network aimed at optimizing performance for the over the top devices and services industry. The upgrade includes advanced edge computing capabilities and ultra-low latency delivery designed to support high-definition and ultra-HD video streaming. These improvements are intended to benefit OTT platform operators and device manufacturers by ensuring seamless content delivery and improved viewer experiences across connected ecosystems.

Over The Top Devices And Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 364.57 billion

Revenue forecast in 2033

USD 1,425.63 billion

Growth rate

CAGR of 18.6% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Report updated

July 2025

Quantitative units

Revenue in USD million/billion, Volume in Million Units, and CAGR from 2025 to 2033

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, device, service type, OTT business models, platform, and region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Netherlands; China; Japan; India; South Korea; Australia; Brazil; Mexico; Saudi Arabia; South Africa

Key companies profiled

Netflix, Inc.; Amazon.com, Inc.; Disney + Hotstar; Apple, Inc.; Warner Bros. Discovery, Inc.; Hulu, LLC; Tencent Holdings Ltd.; Roku, Inc.; Akamai Technologies; Baidu, Inc.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet you exact research needs. Explore purchase options

Global Over The Top Devices And Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technological trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the over the top devices and servicesmarket report based type, device, service type, OTT business models, platform, and region:

-

Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

OTT Services

-

OTT Devices

-

-

Device Outlook (Revenue, USD Billion; Volume, Million Units, 2021 - 2033)

-

Streaming Media Players

-

Streaming Sticks

-

-

Service Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

OTT Media Services

-

OTT Communication Services

-

-

OTT Business Model Outlook (Revenue, USD Billion, 2021 - 2033)

-

AVOD (Ad-based Video on Demand)

-

SVOD (Subscription Video on Demand)

-

TVOD (Transactional Video on Demand)

-

-

Platform Outlook (Revenue, USD Billion, 2021 - 2033)

-

Smart Phones

-

Smart TVs & Set-top Box

-

Desktop & Laptop

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021- 2033)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Netherlands

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global over the top devices and services market size was estimated at USD 298.84 billion in 2024 and is expected to reach USD USD 364.57 billion in 2025.

b. The global over the top devices and services market is expected to grow at a compound annual growth rate of 18.6% from 2025 to 2033 to reach USD USD 1,425.63 billion by 2033.

b. North America accounted for the largest market share of over 40% in 2024 and is anticipated to maintain its dominance over the forecast period. The regional growth can be credited to developed economies, such as the U.S., making significant investments and developments in new technologies.

b. Some key players operating in the OTT devices and services market include Netflix, Inc., Amazon.com, Inc., Disney + Hotstar, Apple, Inc., Warner Bros. Discovery, Inc., Hulu, LLC, Tencent Holdings Ltd., Roku, Inc., Akamai Technologies, Baidu, Inc. among others

b. Key factors that are driving the over the top devices and services market growth include the proliferation of OTT service platforms, substantial growth of the media & entertainment industry and the increasing demand for high-quality streaming content over smart devices.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.