- Home

- »

- Next Generation Technologies

- »

-

5G In Aviation Market Size & Share, Industry Report, 2030GVR Report cover

![5G In Aviation Market Size, Share & Trends Report]()

5G In Aviation Market (2025 - 2030) Size, Share & Trends Analysis Report By Communication Infrastructure (Small Cells ), By Technology, By Connectivity Type (Air-to-Ground Communication, Ground-to-Ground Communication ), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-613-6

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

5G In Aviation Market Summary

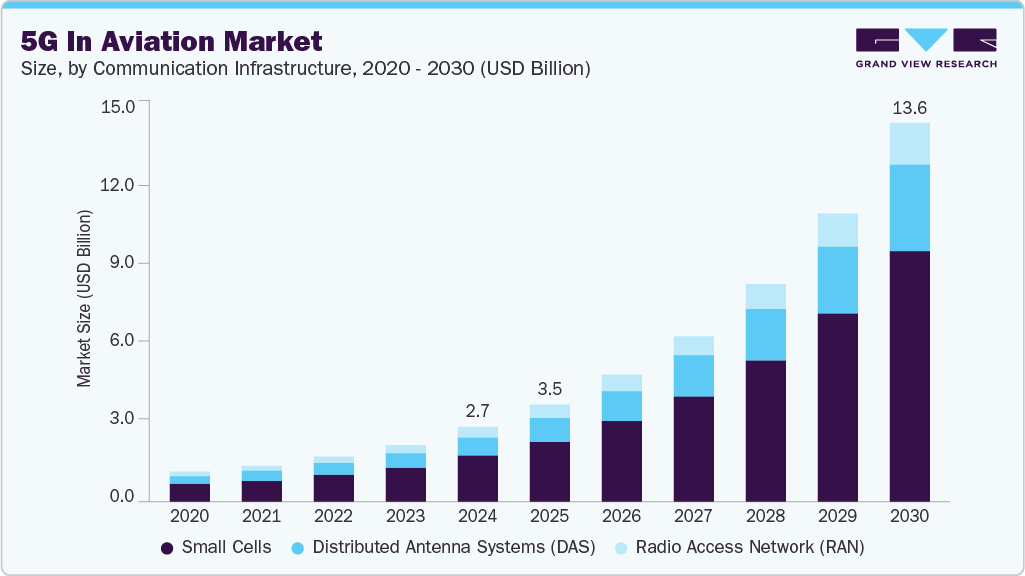

The global 5G in aviation market size was estimated at USD 2.68 billion in 2024 and is projected to reach USD 13.64 billion, growing at a CAGR of 31.4% from 2025 to 2030. The market is gaining momentum, driven by the rising need for rapid connectivity restoration in disaster zones, the expansion of non-terrestrial network (NTN) ecosystems, and advances in lightweight, high-throughput phased array antennas.

Key Market Trends & Insights

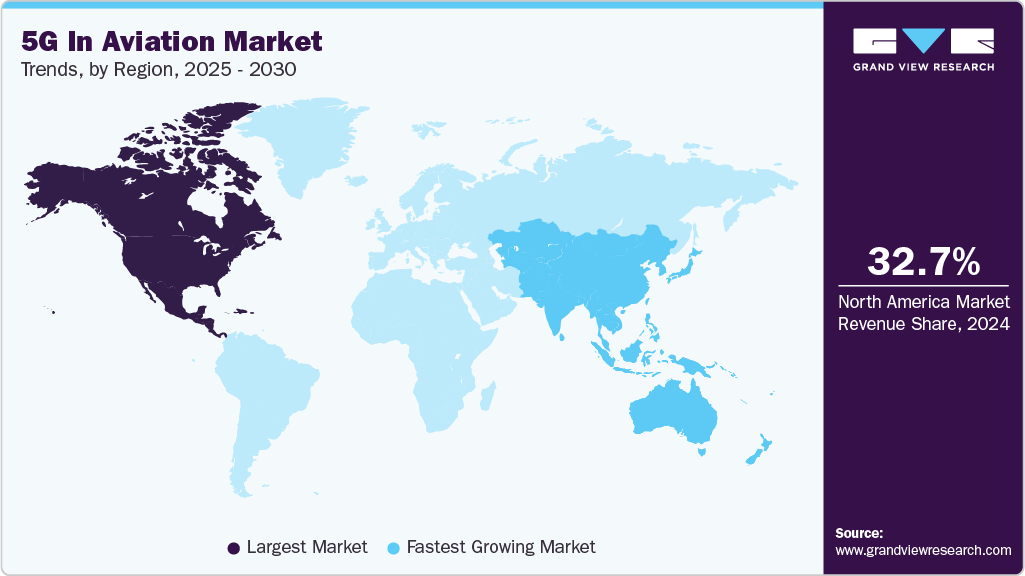

- North America dominated the market with a revenue share of over 32.7% in 2024.

- The U.S. 5G in aviation market held a dominant position in 2024.

- By communication infrastructure, the small cells segment accounted for the largest share of 62.3% 2024.

- By technology, the enhanced mobile broadband (eMBB) segment accounted for the largest share in 2024.

- By connectivity type, the air-to-ground communication segment accounted for the largest share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.68 Billion

- 2030 Projected Market Size: USD 13.64 Billion

- CAGR (2025-2030): 31.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Governments and defense agencies increasingly use airborne 5G systems for emergency communications. At the same time, investments in HAPS (High-Altitude Pseudo-Satellites) and aircraft-based 5G relays are accelerating digital inclusion across remote and underserved regions. Technological progress in compact antenna systems further enhances the feasibility of integrating 5G capabilities into commercial and military aircraft.

The ability to rapidly deploy connectivity has made airborne 5G a strategic asset in disaster management and resilience planning. However, regulatory and airspace certification complexities pose significant challenges. Growing demand from defense and emergency service communication infrastructure represents a major opportunity for the market. Natural disasters such as earthquakes, hurricanes, wildfires, and tsunamis often damage terrestrial communication infrastructure, leaving affected regions isolated. In such scenarios, airborne 5G platforms mounted on drones, aircraft, or HAPS (High-Altitude Pseudo-Satellites) can quickly re-establish high-speed networks. For example, connectivity gaps hindered emergency coordination after the 2023 earthquake in Turkey and Syria until temporary satellite and UAV-based communication systems were deployed. Similarly, during wildfires in California, aircraft equipped with communication payloads enabled situational awareness and real-time coordination among firefighting teams. These mobile 5G systems are increasingly considered critical tools for defense agencies, first responders, and humanitarian organizations, enabling real-time video transmission, GPS coordination, and data sharing when terrestrial networks are down.

Governments and private players are increasingly investing in HAPS, satellites, and other aerial platforms to extend mobile connectivity beyond the limitations of terrestrial networks. These NTNs enable 5G coverage in remote, maritime, or underserved areas and play a critical role in disaster response, defense, and rural broadband access. For instance, in May 2025, Space42’s subsidiary Mira Aerospace opened MENA’s first High Altitude Platform Stations (HAPS) manufacturing facility in Abu Dhabi. The 4,500 m² center will produce over 20 UAVs annually, boosting the UAE’s sovereign aerospace capabilities and supporting the National Space Strategy 2030 with advanced R&D and commercialization efforts.

Similarly, in September 2024, Ericsson joined the Mobile Satellite Services Association (MSSA), an initiative focused on advancing Direct-to-Device (D2D), IoT services, and NTNs through space-based systems. MSSA is working to build a global NTN ecosystem using L- and S-band spectrum integrated with mobile devices via 3GPP standards. These developments reflect a broader shift toward integrating aerial and orbital assets into terrestrial infrastructure. The expanding NTN ecosystem redefines aviation connectivity, extending 5G coverage to previously unreachable airspaces, supporting dynamic in-flight communication, and enabling mission-critical services in defense, disaster response, and remote operations.

Defense forces require high-bandwidth, low-latency links for ISR (intelligence, surveillance, and reconnaissance), UAV operations, and tactical coordination. Also, emergency agencies depend on real-time situational awareness and rapid connectivity restoration during crises such as earthquakes or wildfires. Airborne 5G relays and HAPS can establish mobile communication hubs over affected zones when terrestrial networks are compromised. For instance, deploying lightweight phased-array antennas on UAVs and aircraft enables quick setup of temporary 5G backhaul links in hostile or damaged environments. The opening of Space42’s HAPS facility in Abu Dhabi underlines growing defense-focused innovation, while Ericsson’s involvement in MSSA shows cross-sector commitment to building globally scalable, satellite-enabled mobile networks. This convergence of aerospace, telecom, and defense technologies unlocks new operational resilience across mission-critical environments.

The deployment of airborne 5G systems faces significant regulatory hurdles, especially concerning spectrum licensing, airworthiness certification, and cross-border airspace usage. High-Altitude Pseudo-Satellites (HAPS), which operate in the stratosphere (approximately 20 km above ground), fall into a grey zone between traditional aviation and satellite regulations. For example, SoftBank’s HAPS project encountered delays due to unclear jurisdictional policies on stratospheric flight operations and a lack of harmonized frequency allocations under ITU frameworks. In the U.S., all UAV-based systems require compliance with FAA Part 91 (general operating rules) or Part 107 (for small unmanned aircraft), which were not developed with high-throughput airborne networks in mind. Internationally, inconsistent licensing requirements and a standardized certification path for communication payloads further complicate deployment. This regulatory fragmentation hampers the global scalability of NTN platforms, causing extended delays and cost overruns for operators and technology developers alike.

Communication Infrastructure Insights

The small cells segment accounted for the largest share of 62.3% 2024. Factors driving this growth include the rising demand for enhanced in-flight connectivity requiring dense network coverage within airport terminals and aircraft, the increasing deployment of 5G-enabled small cells to support high data throughput and low latency communication, the need for improved passenger experience through seamless mobile broadband access, and growing investments by airlines and airport operators in upgrading legacy infrastructure to support next-generation wireless technologies.

The distributed antenna systems (DAS) segment is expected to grow at the highest CAGR from 2025 to 2030. DAS technology supports simultaneous connectivity for a large number of passengers and crew, enabling seamless communication and high-speed data services. This growth is driven by the increasing need for reliable and consistent wireless coverage inside aircraft cabins and airport facilities, where traditional macro cells face challenges due to structural interference. The rising adoption of DAS to comply with strict aviation safety and communication regulations further fuels market expansion, as airports and airlines strive to enhance operational efficiency and passenger experience.

Technology Insights

The enhanced mobile broadband (eMBB) segment accounted for the largest share in 2024. Factors such as the increasing demand for high-speed inflight internet, the growing use of bandwidth-intensive applications like video streaming and virtual meetings onboard aircraft, and the rising adoption of connected aircraft systems are fueling the segment’s growth. For example, airlines are partnering with providers, including Gogo and Panasonic Avionics, to offer seamless, high-quality broadband services that enhance passenger experience and enable real-time operational data exchange.

The ultra-reliable low-latency communication (URLLC) segment is expected to grow at a significant CAGR during the forecast period. Companies including Ericsson and Nokia are actively developing 5G URLLC solutions tailored for aviation, focusing on enhancing safety, operational efficiency, and seamless connectivity even in challenging environments. These advancements are enabling more reliable and secure communication links essential for modern aircraft and airport operations. The segment growth is driven by the increasing need for mission-critical applications in aviation, such as real-time flight control, remote pilot assistance, and emergency communication systems that require near-instantaneous data transmission.

Connectivity Type Insights

The air-to-ground communication segment accounted for the largest share in 2024, driven by increasing demand for in-flight connectivity and real-time data exchange between aircraft and ground stations. This includes services such as live video streaming, weather updates, and flight management system data transfer, enhancing passenger experience and operational efficiency. Companies such as Gogo Business Aviation and Panasonic Avionics are leading innovations in this space, providing high-speed broadband and communication solutions for business jets and commercial airlines.

The ground-to-ground communication segment is expected to register a notable CAGR from 2025 to 2030, fueled by the need for efficient communication infrastructure within airports and between airport facilities. This includes applications like air traffic control coordination, baggage handling systems, and security communications. Cisco Systems and Honeywell International are developing integrated ground communication networks to improve airport operations, safety, and passenger flow management.

End Use Insights

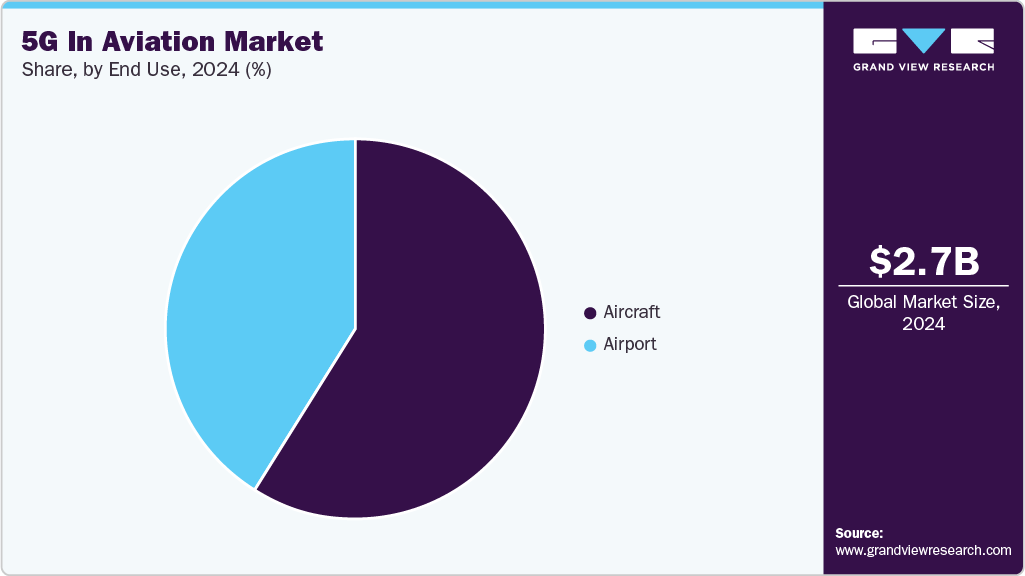

The aircraft segment accounted for the largest share in 2024, driven by the increasing need for seamless in-flight connectivity and advanced communication systems to enhance passenger experience and operational efficiency. The rapid growth of global air travel and rising demand for real-time data exchange between aircraft and ground stations are key factors propelling this segment. For example, major airlines, including Emirates and Lufthansa, are investing in 5 G-enabled connectivity solutions to offer passengers high-speed internet and improved entertainment options during flights. Additionally, the growing use of IoT devices onboard aircraft for monitoring and maintenance is further boosting demand for robust 5G communication infrastructure within the aircraft segment.

The airport segment is expected to register a notable CAGR from 2025 to 2030, driven by increasing investments in smart airport technologies and digital infrastructure. The growing demand for ultra-fast, low-latency connectivity to enhance passenger experience, optimize operations, and improve security is fueling this growth. For instance, in February 2025, TELUS partnered with Calgary Airport Authority to deploy Canada’s first airport-wide private 5G network at YYC. This long-term initiative leverages enterprise-grade wireless connectivity to enable real-time data exchange, operational efficiency, and future-ready, scalable aviation infrastructure, highlighting the critical role of 5G in modernizing airports worldwide.

Regional Insights

The North America 5G in the aviation market accounted for 32.7% of the global share in 2024. The 5G in the aviation market in North America is being driven by increasing regulatory approvals for 5G Supplemental Type Certificates (STCs) for business jets, expanding 5G ground station networks at major airports, and growing demand for enhanced in-flight connectivity to support real-time data transfer and passenger experience improvements. In August 2024, Gogo Business Aviation partnered with Skyservice to develop 5G Supplemental Type Certificates (STCs) for six business jet models. This initiative aims to enhance air-to-ground inflight connectivity across North America, supported by Gogo’s expanding 5G network, including nine sites in Canada. This partnership highlights the region’s focus on enabling seamless 5G adoption for aviation connectivity.

Canada 5G in Aviation Industry Trends

In Canada, the 5G in aviation market is driven by increasing deployments of private 5G networks in airports, rising government investments in digital aviation infrastructure, and growing demand for high-speed connectivity in remote and northern regions. In Mexico, the 5G in aviation market is supported by increasing nationwide 5G rollout, rapid urbanization driving smart airport development, and expanding domestic flight operations requiring enhanced passenger connectivity. These factors collectively accelerate the adoption of advanced 5G infrastructure in aviation, enabling better passenger experiences and more efficient airport operations. In February 2022, América Móvil launched 5G services through Telcel in 18 Mexican cities, aiming to reach 120 cities by year-end. The USD 1.8 billion rollout, using Ericsson and Huawei equipment, supports faster connectivity for 40 million users, which has implications for passenger mobility and smart airport infrastructure. This extensive network expansion underpins Mexico’s growing need for reliable 5G connectivity in aviation.

The U.S. 5G in aviation market held a dominant position in 2024. The market in the U.S. is witnessing significant transformation, driven by a surge in private business jet traffic, increasing demand for seamless low-latency inflight streaming, and strong federal investments in next-gen aviation infrastructure.

In March 2025, Gogo announced FAA PMA approval for its Galileo HDX antenna, enabling installation on over 30 aircraft types. The ESA system, leveraging Eutelsat OneWeb LEO satellites, delivers high-speed broadband for business jets, supporting globally consistent low-latency inflight connectivity through the Gogo AVANCE platform. This milestone reflects the U.S. market's shift toward high-throughput, satellite-based 5G systems aimed at enhancing passenger and crew experience across a wide range of aircraft.

Asia Pacific 5G in Aviation Market Industry Trends

The Asia Pacific 5G in aviation industry was identified as a lucrative region in 2024, driven by rapid airport infrastructure upgrades across emerging economies, rising air passenger volumes demanding better digital experiences, and strong government support for 5G-enabled smart aviation hubs. In November 2022, Bharti Airtel launched its Airtel 5G Plus service at Bengaluru’s Kempegowda International Airport Terminal 2. This made it the first airport in India with comprehensive 5G coverage, enabling passengers to enjoy high-speed connectivity throughout key areas without needing SIM upgrades. This development exemplifies the region's commitment to digital-first airport ecosystems and underscores how telco-airport collaborations accelerate the rollout of next-gen aviation connectivity solutions in Asia Pacific.

The China 5G in aviation market held a substantial market share in 2024. The market in China is experiencing rapid growth, driven by the country's aggressive 5G infrastructure deployment across major airports, increasing investment in smart aviation technologies, and a large domestic aviation fleet requiring enhanced digital connectivity. To support these advancements, key stakeholders are forming strategic partnerships to accelerate 5G adoption. For instance, in June 2022, Airbus signed MoUs with China Mobile and China Southern to develop and pilot 5G air-to-ground connectivity in China. The collaboration focuses on validating technical performance and boosting digital cabin services, aiming to provide fast, cost-efficient broadband onboard China’s expanding aircraft fleet. This highlights China's growing commitment to next-gen aviation connectivity and its efforts to lead in 5G-enabled air travel innovation.

The Japanese 5G in aviation market held a significant share in 2024. In Japan, the market is influenced by the steady integration of private 5G networks at major airports, national strategies for digital aviation transformation, and ongoing R&D investment in non-terrestrial network (NTN) infrastructure to extend connectivity beyond traditional ground systems. These trends are reinforced by real-world testing of advanced 5G technologies. In May 2024, a Japanese consortium including SKY Perfect JSAT, NTT DOCOMO, NICT, and Panasonic successfully demonstrated the world’s first 5G backhaul relay from 4 km altitude using the 38 GHz band via a Cessna aircraft. The test simulates future High-Altitude Platform Station (HAPS) use, advancing non-terrestrial 5G communications. This milestone illustrates Japan’s leadership in cutting-edge 5G aviation applications and its commitment to next-gen connectivity in both terrestrial and aerial domains.

Europe 5G in Aviation Market Industry Trends

The Europe 5G in aviation industry was identified as a lucrative region in 2024. The European 5G in Aviation market is witnessing significant transformation, driven by rising regulatory support for in-flight 5G services, rapid deployment of private 5G networks at key airports, and growing demand for digitally enhanced passenger experiences across intra-European routes.

Progressive policy moves support this momentum. In November 2022, the European Commission updated mobile communication regulations to allow airlines to provide 5G connectivity on flights across the EU. By enabling onboard pico-cell technology linked to satellite networks, this regulation now allows passengers to access full 5G services, significantly improving in-flight connectivity and accelerating digital innovation in European air travel. In parallel, on-ground initiatives are advancing digital infrastructure. In 2023, Aena and Cellnex launched Spain’s first airport-based private 5G network at San Sebastian Airport. This pilot project supports drone-based monitoring, real-time environmental data collection, and secure communications. Backed by Nokia and Inetum, the initiative exemplifies Europe's push toward smart, connected airport operations.

The German 5G in aviation market is being shaped by increasing adoption of smart maintenance practices, growing investments in private 5G campus networks at aviation hubs, and the push for remote diagnostics to enhance operational efficiency. The increasing focus on digital aviation infrastructure and predictive maintenance is exemplified by Lufthansa Technik’s advancement in private 5G deployment. In March 2022, the company expanded its 5G campus network in Hamburg to a second engine overhaul workshop. This upgrade enables remote engine inspections using high-resolution video and supports virtual maintenance operations through its AVIATAR platform. The deployment also confirmed that 5G connectivity does not interfere with aircraft systems, reinforcing its viability for mission-critical aviation environments.

The UK 5G in aviation market is gaining momentum due to growing investments in resilient communication networks, rising demand for airborne connectivity in remote areas, and strategic focus on dual-use 5G applications for civil and emergency aviation. In July 2024, Stratospheric Platforms Limited and Britten-Norman successfully completed flight trials for an airborne 5G system using the BN2T-4S Islander aircraft. The trials validated safe operation with a large phased array antenna, advancing high-speed 5G coverage over 15,000 km² for disaster recovery and underserved regions. This highlights the UK’s push toward leveraging airborne platforms to close connectivity gaps and support critical aviation operations.

Key 5G in Aviation Company Insights

Some of the key players operating in the market include Huawei Technologies Co., Ltd., Honeywell International Inc., Telefonaktiebolaget LM Ericsson, Nokia Corporation, and Cisco Systems, Inc.

-

Founded in 1987 and headquartered in Shenzhen, China, Huawei Technologies Co., Ltd. is a global telecommunications and information technology player. The company is actively involved in the 5G in Aviation sector through its advanced Radio Access Network (RAN), Small Cells, and end-to-end 5G infrastructure offerings. Huawei provides high-speed, low-latency wireless connectivity solutions supporting ground-to-ground and air-to-ground aviation communication. It collaborates with major airlines and airport authorities to deploy scalable, ultra-reliable 5G systems tailored to smart airport operations and in-flight connectivity, particularly across Asia and emerging markets.

-

Founded in 1906 and headquartered in North Carolina, U.S., Honeywell International Inc. is a diversified technology and manufacturing company with a growing footprint in the 5G in Aviation market. The company develops avionics systems, ultra-reliable low-latency communication (URLLC) platforms, and IoT-integrated sensors that enable connected aircraft and smart airport environments. Honeywell’s 5G-enabled technologies enhance predictive maintenance, real-time monitoring, and operational efficiency in aviation. Through its aerospace division, the company supports a range of commercial and defense aviation clients in integrating next-generation wireless communication into flight systems and airport infrastructure.

Key 5G in Aviation Companies:

The following are the leading companies in the 5G in aviation market. These companies collectively hold the largest market share and dictate industry trends.

- Huawei Technologies Co., Ltd.

- Honeywell International Inc.

- Telefonaktiebolaget LM Ericsson

- Nokia Corporation

- Cisco Systems, Inc.

- Gogo Inc. (formerly Gogo Business Aviation LLC)

- Panasonic Avionics Corporation

- Thales Group (Thales S.A.)

- OneWeb Group Limited

- Collins Aerospace (a unit of Raytheon Technologies Corporation)

Recent Developments

-

In March 2025, GSMA partnered with Safran Passenger Innovations and Seamless Air Alliance in Barcelona to co-develop advanced 5G connectivity services to improve in-flight communication and passenger experience.

-

In February 2025, the European Space Agency and Seamless Air Alliance advanced 5G Non-Terrestrial Network connectivity for aviation through joint satellite trials. The initiative validated space-based 5G performance and contributed to 3GPP standards, with Airbus, Vodafone, Telesat, and Eutelsat OneWeb support.

-

In January 2025, Saab, Ericsson, and Purdue University showcased their private 5G-powered “living laboratory” at Purdue University Airport. Key innovations include the SAFE Event Management Platform for drone detection, enhancing situational awareness and operational efficiency to safeguard airports and improve passenger safety.

-

In October 2024, Nokia and NTT DATA expanded their private 5G partnership to advance digital transformation at airports, following deployments at Köln Bonn and Frankfurt airports. The network supports use cases like faster aircraft turnaround, perimeter security, and IoT-driven enhancements to passenger experience and airport operations.

5G In Aviation Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.49 billion

Revenue Forecast in 2030

USD 13.64 billion

Growth rate

CAGR of 31.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments Covered

Communication infrastructure, technology, connectivity type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia (KSA); South Africa

Key companies profiled

Huawei Technologies Co., Ltd.; Honeywell International Inc.; Telefonaktiebolaget LM Ericsson; Nokia Corporation; Cisco Systems, Inc.; Gogo Inc. (formerly Gogo Business Aviation LLC); Panasonic Avionics Corporation; Thales Group (Thales S.A.); OneWeb Group Limited; Collins Aerospace (a unit of Raytheon Technologies Corporation)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global 5G In Aviation Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global 5G in aviation market report based on communication infrastructure, technology, connectivity type, end use, and region:

-

Communication Infrastructure Outlook (Revenue, USD Million, 2018 - 2030)

-

Small Cells

-

Distributed Antenna Systems (DAS)

-

Radio Access Network (RAN)

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Enhanced Mobile Broadband (eMBB)

-

Ultra-Reliable Low-Latency Communication (URLLC)

-

Massive Machine-Type Communication (mMTC)

-

-

Connectivity Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Air-to-Ground Communication

-

Ground-to-Ground Communication

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Aircraft

-

Airport

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global 5G in aviation market size was estimated at USD 2.68 billion in 2024 and is expected to reach USD 13.64 billion in 2030.

b. The global 5G in aviation market is expected to grow at a compound annual growth rate of 31.4% from 2025 to 2030 to reach USD 13.64 billion by 2030.

b. The North America 5G in aviation market accounted for 32.7% of the global share in 2024. The 5G in aviation market in North America is being driven by increasing regulatory approvals for 5G Supplemental Type Certificates (STCs) for business jets, expanding 5G ground station networks at major airports, and growing demand for enhanced inflight connectivity to support real-time data transfer and passenger experience improvements

b. Some key players operating in the 5G in aviation market include Huawei Technologies Co., Ltd., Honeywell International Inc., Telefonaktiebolaget LM Ericsson, Nokia Corporation, Cisco Systems, Inc., Gogo Inc. (formerly Gogo Business Aviation LLC), Panasonic Avionics Corporation, Thales Group (Thales S.A.), OneWeb Group Limited, Collins Aerospace (a unit of Raytheon Technologies Corporation).

b. Key factors that are driving the market growth include rising need for rapid connectivity restoration in disaster zones, the expansion of non-terrestrial network (NTN) ecosystems, and advances in lightweight, high-throughput phased array antennas. Governments and defense agencies are increasingly turning to airborne 5G systems for emergency communications, while investments in HAPS (High-Altitude Pseudo-Satellites) and aircraft-based 5G relays are accelerating digital inclusion across remote and underserved regions

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.