- Home

- »

- Communications Infrastructure

- »

-

5G Base Station Market Size, Share & Growth Report, 2030GVR Report cover

![5G Base Station Market Size, Share & Trends Report]()

5G Base Station Market (2024 - 2030) Size, Share & Trends Analysis Report By Type, By Component, By Network Architecture, By Core Network, By Operational Frequency, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-448-4

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

5G Base Station Market Summary

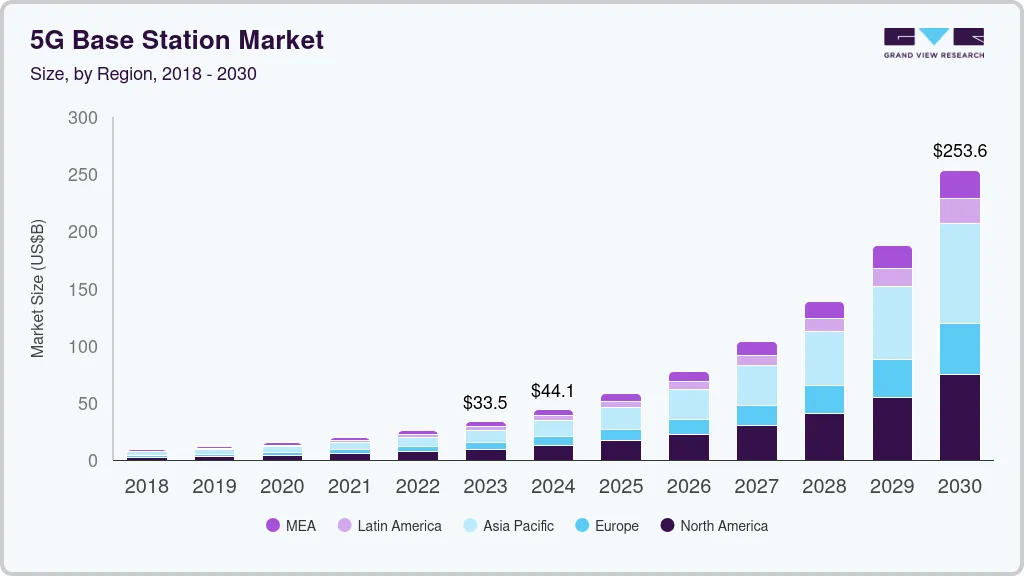

The global 5G base station market size was estimated at USD 33,472.5 million in 2023 and is projected to reach USD 253,624.3 million by 2030, growing at a CAGR of 33.5% from 2024 to 2030. The surging demand for high-speed connectivity is a significant factor driving the growth of the 5G base station market.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2023.

- In terms of segment, hardware accounted for a revenue of USD 33,472.5 million in 2023.

- Hardware is the most lucrative component segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 33,472.5 Million

- 2030 Projected Market Size: USD 253,624.3 Million

- CAGR (2024-2030): 33.5%

- Asia Pacific: Largest market in 2023

In today's increasingly digital world, there is an ever-growing need for faster, more reliable internet connections to support a wide range of activities, from streaming high-definition videos to playing online games, conducting video conferences, and using cloud-based applications. As more devices become connected to the internet, particularly with the rise of smart homes, autonomous vehicles, and advanced mobile applications, the limitations of existing 4G networks are becoming more apparent.

5G technology addresses these limitations by offering significantly higher data speeds, lower latency, and the ability to connect many devices simultaneously. These advantages are essential for enabling new technologies and services, such as virtual and augmented reality, telemedicine, and autonomous systems, which require near-instantaneous data transmission and processing. To meet the increasing demand for these capabilities, telecom operators invest heavily in deploying 5G base stations, the backbone of 5G networks, facilitating faster data transmission over wider areas.

Moreover, the expansion of the Internet of Things (IoT) and the development of smart cities are pivotal factors driving the growth of the 5G base station market. IoT refers to the interconnected network of devices communicating with each other and central systems to collect, share, and analyze data. These devices include everything from household appliances to industrial machines, requiring constant, high-speed connectivity to function effectively.

5G technology is crucial for the IoT as it provides the necessary infrastructure to support millions of connected devices simultaneously, offering high-speed data transfer and low latency. As the number of IoT devices continues to grow, particularly in sectors such as healthcare, agriculture, transportation, and manufacturing, there is an increasing need for a robust and expansive 5G network. This demand is driving the installation of more 5G base stations to ensure that IoT systems can operate efficiently and reliably.

Consumer and business expectations for seamless connectivity continue to rise, driven by the proliferation of data-intensive applications. As a result, the need for a robust and expansive 5G infrastructure becomes critical. This demand is propelling the rapid expansion of 5G base stations as telecom companies strive to deliver the high-speed, low-latency networks that modern digital activities require.

Component Insights

Based on component, the hardware segment led the market and accounted for 66.94% of the global revenue in 2023. Telecom operators and governments invest heavily in the infrastructure required to support 5G networks. These investments are not limited to software and spectrum but extend significantly to hardware, as robust and reliable equipment is essential for successfully deploying and operating 5G networks. Government initiatives and incentives to accelerate the 5G rollout are driving telecom companies to procure the necessary hardware, thereby fueling the growth of the hardware segment.

The services segment is expected to register significant growth from 2024 to 2030. Once 5G base stations are deployed, they require continuous maintenance and optimization to ensure peak performance. The demand for services related to network monitoring, troubleshooting, and upgrades is rising as operators strive to maintain the high standards expected from 5G networks. In addition, with the introduction of new features and capabilities, ongoing optimization services are essential to adapt the infrastructure to evolving technological requirements and user demands.

Type Insights

Based on type, the small cells segment accounted for the highest market revenue share in 2023. Small cells are essential for managing the high density of users and devices in urban environments, stadiums, shopping malls, airports, and other public spaces. As more devices connect to the network, the demand for individual base stations increases. Small cells help alleviate this pressure by off-loading traffic from macro cells, enhancing network capacity, and reducing congestion.

The macro cells segment is expected to grow significantly from 2024 to 2030. Macro cells are essential for broad coverage in 5G networks, especially in suburban and rural areas. These large cell towers cover extensive areas, which is critical for ensuring widespread 5G connectivity. As 5G networks expand beyond urban centers, the demand for macro cells rises to meet coverage requirements in less densely populated regions.

Network Architecture Insights

The 5G non-standalone segment accounted for the largest market revenue share in 2023. The relative ease and speed with which 5G non-standalone can be deployed compared to standalone 5G networks drives market growth. 5G NSA leverages existing 4G LTE infrastructure, allowing telecom operators to offer 5G services without needing a complete overhaul of their networks. This reduces the time and cost associated with rolling out 5G, making it an attractive option for operators looking to quickly enter the 5G market and meet growing consumer demand for high-speed connectivity.

The 5G standalone segment is expected to grow significantly from 2024 to 2030. The 5G standalone architecture is designed to fully leverage 5G's capabilities, providing ultra-low latency, higher data rates, and greater network flexibility. Unlike non-standalone (NSA) networks, which rely on existing 4G infrastructure, 5G SA operates independently, offering a more robust and optimized network experience.

Core Network Insights

The software defined networking segment accounted for the largest market revenue share in 2023. One of the primary benefits of SDN is its ability to automate network management, reducing the need for manual interventions. This automation leads to significant cost savings by lowering operational expenses and minimizing the complexity of managing large-scale 5G networks. By enabling more efficient use of network resources, SDN helps operators optimize their infrastructure, leading to cost-effective deployment and management of 5G base stations.

The network function virtualization segment is expected to grow significantly from 2024 to 2030. NFV allows telecom operators to virtualize network functions traditionally performed by dedicated hardware appliances, such as routers, firewalls, and load balancers. By moving these functions to software running on general-purpose servers, operators gain significant flexibility in deploying and managing their networks. This virtualization enables more efficient use of resources, as operators can scale up or down based on demand and quickly deploy new services without needing physical hardware changes.

Operational Frequency Insights

The sub-6 GHz segment accounted for a significant market revenue share in 2023. Deploying sub-6 GHz base stations is generally more cost-effective than millimeter-wave base stations. The equipment and technology required for sub-6 GHz deployment are less expensive, and the lower frequency bands are less affected by weather conditions and other environmental factors. This cost advantage makes sub-6 GHz an attractive option for telecom operators looking to expand their 5G networks efficiently and affordably, particularly in areas with high coverage requirements.

The above 6 GHz segment is expected to register significant growth from 2024 to 2030. The use of above 6 GHz frequencies enhances network performance by providing additional spectrum resources that can be used to offload traffic from more congested lower frequency bands. This helps to improve overall network efficiency and reduce latency, which is crucial for real-time applications and services.

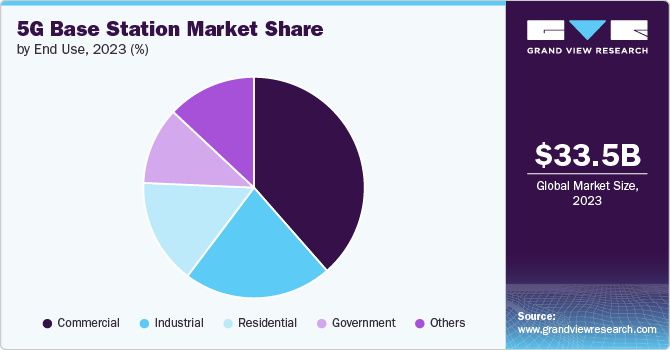

End Use Insights

The commercial segment accounted for a significant market revenue share in 2023. Businesses increasingly recognize that adopting 5G technology can provide a competitive edge. By offering enhanced services and capabilities, companies can differentiate themselves in the marketplace and attract customers. For example, retail businesses using 5G can provide enhanced in-store experiences with AR and VR, while logistics companies benefit from improved tracking and automation capabilities.

The residential segment is expected to register significant growth from 2024 to 2030. The growing demand for high-speed, reliable internet connections in residential areas is a significant driver for deploying 5G base stations. With the rise of remote work, online education, and streaming services, households require faster and more stable internet to support multiple users and high-bandwidth applications simultaneously. 5G technology, with its superior speed and capacity compared to previous generations, is well-suited to meet these needs, driving the expansion of 5G infrastructure into residential areas.

Regional Insights

North America 5G base station market accounted for a significant market share of the global revenue in 2023. The North American telecom market is highly competitive, with major operators such as Verizon, AT&T, T-Mobile, and Rogers vying for market share. To stay ahead of competitors and attract customers, telecom companies invest heavily in 5G technology to offer superior network performance and advanced services. This competitive pressure is a significant driver of 5G base station deployment as operators seek to provide cutting-edge connectivity and capture new revenue opportunities.

The U.S. 5G base station market is anticipated to register significant growth from 2024 to 2030. The U.S. government has been actively supporting the deployment of 5G technology through various initiatives and funding programs. Federal and state-level policies aim to accelerate 5G rollouts by providing financial incentives, streamlining permitting processes, and facilitating spectrum allocation.

Europe 5G Base Station Market Trends

The Europe 5G base station market is poised for significant growth from 2024 to 2030. The European regulatory environment supports 5G deployment, with policies designed to facilitate the rollout of 5G infrastructure. This includes streamlined permitting processes, clear spectrum allocation strategies, and efforts to reduce regulatory barriers. The spectrum availability in key frequency bands, including those above 6 GHz, is essential for successfully deploying 5G networks. Effective regulatory frameworks and spectrum management drive the demand of 5G base stations in Europe.

Asia Pacific 5G Base Station Market Trends

The Asia Pacific 5G base station marketdominated the global market in 2023 and accounted for 32.67% of the revenue share. Several Asia Pacific countries are investing in developing smart cities, which leverage technology to improve urban living through better infrastructure, transportation, and public services. 5G technology is a critical enabler of smart city initiatives, providing the necessary infrastructure for smart grids, intelligent transportation systems, and public safety applications.

Key 5G Base Station Company Insights

The 5G base station market is highly competitive, with market players constantly focusing on gaining an edge through unique service offerings and advanced technological innovations.

For instance, in January 2022, NEC Corporation launched two models of the UNIVERGE RV1000 series, all-in-one integrated compact base stations primarily designed for small-scale private 5G networks in Japan. These products aim to address the challenges of high initial investment costs and lengthy deployment times associated with conventional private 5G solutions. By integrating the baseband units (CU/DU) and radio units (RUs) into a single enclosure, the UNIVERGE RV1200 has been downsized to the size of an A4 paper, while the RV1300 measures 364×335×118 mm. This miniaturization allows for scalable, simple, and speedy network construction at a lower cost compared to separate-type base stations.

Key 5G Base Station Companies:

The following are the leading companies in the 5G base station market. These companies collectively hold the largest market share and dictate industry trends.

- Ericsson

- Huawei Technologies

- Nokia

- Samsung Electronics

- Qualcomm

- ZTE Corporation

- Cisco Systems

- Intel Corporation

- NEC Corporation

- Mavenir

5G Base Station Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 44.07 billion

Revenue forecast in 2030

USD 253.62 billion

Growth rate

CAGR of 33.9% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Type, component, network architecture, core network, operational frequency, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Ericsson; Huawei Technologies; Nokia; Samsung Electronics; Qualcomm; ZTE Corporation; Cisco Systems; Intel Corporation; NEC Corporation; Mavenir

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global 5G Base Station Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global 5G base station market based on type, component, network architecture, core network, operational frequency, end use, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Small Cells

-

Femto Cells

-

Pico Cells

-

Micro Cells

-

-

Macro Cells

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Radio Remote Unit (RRU)

-

Baseband Processing Unit (BPU)

-

MIMO

-

Others

-

-

Services

-

-

Network Architecture Outlook (Revenue, USD Million, 2018 - 2030)

-

5G Standalone

-

5G Non-Standalone

-

-

Core Network Outlook (Revenue, USD Million, 2018 - 2030)

-

Software Defined Networking

-

Network Function Virtualization

-

-

Operational Frequency Outlook (Revenue, USD Million, 2018 - 2030)

-

Sub 6 GHz

-

Above 6 GHz

-

-

End Use Frequency Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Residential

-

Industrial

-

Government

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global 5G base station market size was estimated at USD 33.47 billion in 2023 and is expected to reach USD 44.07 billion in 2024.

b. The global 5G base station market is expected to grow at a compound annual growth rate of 33.9% from 2024 to 2030 to reach USD 253.62 billion by 2030.

b. Asia Pacific dominated the 5G base station market with a share of 32.67% in 2023. Several Asia Pacific countries are investing in developing smart cities, which leverage technology to improve urban living through better infrastructure, transportation, and public services. This, as a result, is expected to drive the regional market growth.

b. Some key players operating in the 5G base station market include Ericsson; Huawei Technologies; Nokia; Samsung Electronics; Qualcomm; ZTE Corporation; Cisco Systems; Intel Corporation; NEC Corporation; and Mavenir.

b. Key factors that are driving the market growth include the surging demand for high-speed connectivity and the expansion of the Internet of Things (IoT) coupled with the development of smart cities.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.