- Home

- »

- Communications Infrastructure

- »

-

5G Radio Access Network Market Size & Share Report, 2030GVR Report cover

![5G Radio Access Network Market Size, Share & Trends Report]()

5G Radio Access Network Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Architecture Type, By Deployment, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-004-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2019 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

5G Radio Access Network Market Summary

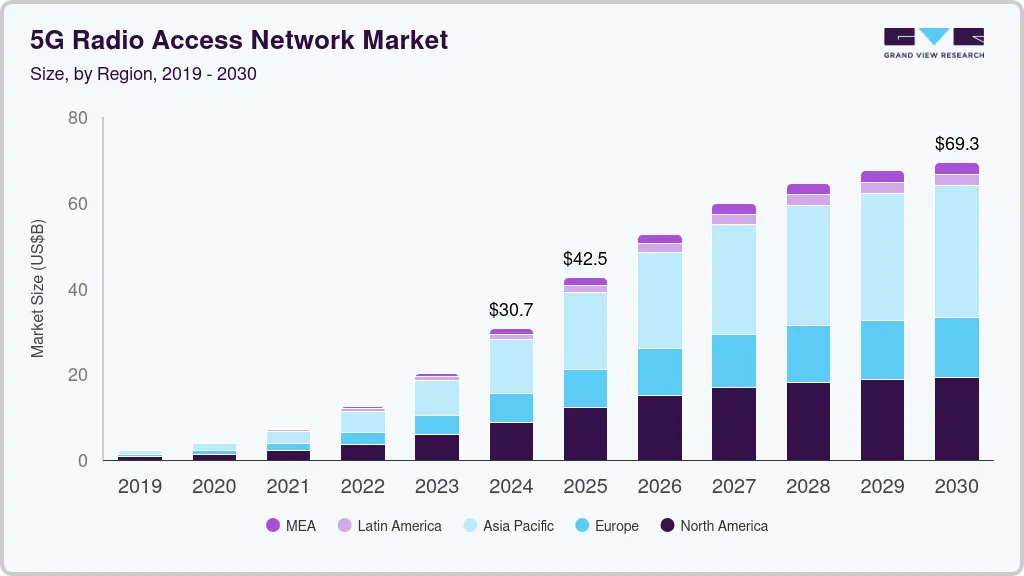

The global 5g radio access network market size was estimated at USD 30,650.3 million in 2024 and is projected to reach USD 69,297.1 million by 2030, growing at a CAGR of 10.3% from 2025 to 2030. The increasing demand for low latency bandwidth connection and increased focus on research and development activities by key organizations are some of the factors fueling the market growth.

Key Market Trends & Insights

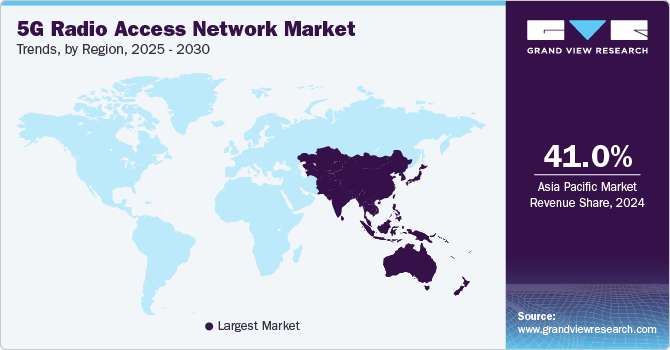

- The Asia-Pacific 5G radio access network market dominates with revenue share of 41% in 2024 and grow at a CAGR of 11.6%.

- The China 5G radio access network (RAN) market is expected to grow at a significant CAGR from 2025 to 2030.

- By components, the hardware segment dominated the overall market, gaining a market share of more than 60% in 2024 and witnessing a CAGR of 8.2% during the forecast period.

- By architecture, the Cloud Radio Access Network (CRAN) segment gained a market share of more than 32% in 2024, witnessing a CAGR of 2.8% during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 30,650.3 Million

- 2030 Projected Market Size: USD 69,297.1 Million

- CAGR (2025-2030): 10.3%

- Asia Pacific: Largest market in 2024

Moreover, the robust deployment of a 5G radio access network (RAN) with several small cells and macrocell base stations worldwide is propelling the growth of the market. The trend of deploying centralized RAN and virtual RAN (VRAN) is rapidly increasing among mobile network operators (MNOs) and network service providers to reduce overall infrastructure costs and network complexities. Furthermore, the RAN enables enterprises and mobile network operators utilizing private 4G or private 5G to offer network slicing solutions assigning capacities to individual enterprises to split network usage within a public mobile network. The industry is expanding at a tremendous growth rate owing to technological innovations coupled with users’ inclination towards 5G RAN solutions.Radio access networks comprise wireless telecommunications systems, including antennas and base stations, to provide high performing 5G network solutions. It utilizes 5G radio frequency division duplex (FDD) frequencies to connect individual devices through radio connections providing wireless connectivity. RAN encompasses different types, viz. evolved universal terrestrial RAN (E-UTRAN), Universal Radio Access Network (UTRAN), Virtualized Radio Access Network (VRAN), and Open Radio Access Network (ORAN), among others. The RAN base stations within a public mobile network are connected to a public mobile core network through microwave or fiber cables to aggregate signals. The latest RANs offer controllers utilizing software-defined networks (SDN), allowing them to control cellular device capacity and coverage.

This high market size is attributable to the growing deployment of private 5G Radio Access Network and core equipment across several use cases. These use cases include smart cities, remote surgeries, enterprises, wireless cameras, industrial robotics, and autonomous vehicles. Rapidly evolving RAN technologies have enabled several key telecom operators and end-use customers to deploy the virtualized network in order to diminish overall operating expenses. Also, several market players such as Qualcomm Technologies, Inc., Nokia, Verizon, and Cisco Systems, Inc., among others, are significantly focused on providing RAN solutions for private 5G networks, which help clients to transform their existing legacy network infrastructure into the next generation 5G network. For instance, in October 2022, Qualcomm Technologies, Inc. announced a collaboration with Vodafone Group to develop and integrate next-generation 5G radio units and distributed units with massive multiple-input multiple-output capabilities. The companies are also developing 5G ORAN infrastructure solutions powered by Qualcomm QRU100 5G radio access network platform and Qualcomm X100 5G RAN accelerator card.

COVID-19 Impact Analysis

The outbreak of the COVID-19 pandemic has significantly impacted the global economy and, subsequently, 5G roll-out and RAN deployments. During 2020, there was a notable decline in the imports and exports of hardware equipment from key countries such as the U.S., China, and other key European countries. Therefore, it further hindered the worldwide deployment process of the next-generation network infrastructure. The growth of the market was also impeded due to security concerns in maintaining network data, operational continuity, and new traffic patterns. Due to strict lockdown restrictions, the investments and research & development activities by the government and prominent organizations plummeted, causing disruptions in 5G-related trials, spectrum auctions, network automation, orchestration, network function virtualization, and cloud adoption in many countries.

Furthermore, the emerging use cases for 5G enabled applications to be efficient during COVID-19. 5G enabled the smooth functioning of tele-health/medicine, work from home, distance learning, online retail, and e-commerce. It also enabled telephone/video consultations, remote monitoring in hospitals, real-time communication, video conferencing for the working class, virtual education, and interactive & immersive in-store experience. Moreover, high reliability, extended coverage, ultra-low latency, efficient data transmission, and low cost associated with 5G services and solutions fueled the growth of the market. The aforementioned use cases & benefits reshaped consumer behavior trends, resuming the 5G roll-out & deployments in developed countries and accelerating the adoption of 5G in developing countries.

Component Insights

In terms of component, the market is classified into hardware, software, services, and others. The hardware segment dominated the overall market, gaining a market share of more than 60% in 2024 and witnessing a CAGR of 8.2% during the forecast period. The hardware segment is further categorized into antennas, radio units, baseband units, and others. The radio access network antenna systems are based on different frequency ranges that provide increased data-carrying capacity, better coverage, and reduced interference. Antenna systems are designed to receive transmissions from user equipment, such as 5G-enabled smartphones and computers, and send the data to the radio unit. Different types of antennas provide multiple configurations allowing transmission and reception of data with improved network performance and lower operational costs. The antennas are further categorized into multiple input, multiple output (MIMO) antenna, beamforming antenna, and other antenna systems, such as monopole, dipole, microstrip, and patch antennas.

The radio units are placed on top of base stations, receive data transmitted from the antenna, and convert it into digital format to send to the baseband unit. The baseband unit comprises centralized and distributed units. It enables telecom operators to accelerate and streamline the multi-phase cell site deployment process during installation. The growth of the hardware segment is primarily attributed to its ability to deliver massive machine-type communications (mMTC), ultra-reliable low-latency communications (URLLC), and enhanced mobile broadband (eMBB). Moreover, the emerging deployment of hardware equipment and growing use cases is fueling the growth of the market.

The services segment is anticipated to grow at a considerable CAGR of 13.9% throughout the forecast period. The services segment is further categorized into consulting, managed, and professional services. An increase in demand for consulting, maintenance services, design, and development due to the deployment of 5G radio access network telecom operators is anticipated to drive the growth of the market.

Architecture Type Insights

In terms of architecture type, the market is classified into CRAN, ORAN, and VRAN. The Cloud Radio Access Network (CRAN) segment gained a market share of more than 32% in 2024, witnessing a CAGR of 2.8% during the forecast period. Cloud radio access network (CRAN) maintains stable growth in the market owing to technological advances offered for optical, wireless, and IT communication systems. C-RAN is a cloud-based & centralized radio access network architecture. It utilizes proprietary hardware with embedded software to produce higher spectrum efficiency, flexible network, efficient network enhancements, monitoring, upgrades, testing, & maintenance, and achieve faster data speeds. However, C-RAN can be further categorized into partially centralized, fully centralized, and hybrid centralized as per processing and managed resources. Prominent MNOs are engaged in product developments, collaborations, and acquisitions to develop cloud RAN solutions delivering agility, automation, and sustainability. For instance, in May 2022, Telefonaktiebolaget LM Ericsson announced a strategic partnership with Intel Corporation to launch a C-RAN tech hub in California. The launch of the tech hub aims to accelerate the adoption of C-RAN solutions to improve network performance, create lucrative opportunities such as enterprise applications, reduce time-to-market, and energy-efficient solutions.

The Open RAN (ORAN) is expected to grow at a highest CAGR of 19.7% during the forecast period. Open Radio Access Network (ORAN) technology allows the creation of multi-supplier RAN solutions enabling disaggregation or separation of hardware equipment and software platforms with virtualization and open interface. It hosts software to update and control network configurations in the cloud enabling 5G solution flexibility, new capabilities, and supply chain diversity. ORAN is crucial for enterprises employing private 5G in vendor-neutral hardware and software-defined technology for time-sensitive functions, such as load balancing and Quality of Services (QoS) management.

Moreover, the O-RAN Alliance comprises almost 200 telecom operators, research & academic institutions, and vendors in the 5G Radio Access Network (RAN) industry. The alliance specifies next-generation radio access network principles and infrastructure toward building virtualized network elements, standardized interface, and white-box hardware fueling the segment's growth. In September 2022, NEC Corporation announced the launch of an Open RAN innovation hub in New Providence in North America. The creation of an innovation hub aims to develop products offering Open RAN solutions and build a multi-vendor ecosystem.

Deployment Insights

In terms of deployment, the market is classified into indoor and outdoor. Among these, the outdoor segment is expected to dominate in 2023, gaining a market share of more than 58%. It is expected to grow at a CAGR of 8.7% throughout the forecast period. The increasing use cases of 5G, such as smart cities, industrial robotics, autonomous vehicles, smart factories & manufacturing, are propelling the demand for outdoor 5G RAN deployment. The outdoor segment offers extended 5G coverage range support for outdoor deployments at public places such as transport hubs, shopping centers, and stadiums is driving the growth of the market. With the rising deployment of public and private 5G, users can travel with high-speed data connectivity, which results in improved quality of calls and provides real-time traffic information to users.

The indoor segment is anticipated to grow at a considerable CAGR of 12.3% throughout the forecast period. The growth of the segment is attributed to the growing demand for seamless RAN connectivity within closed environments, such as office buildings, enterprise shop floors, meeting rooms, and auditoriums. In addition, improving 5G technology for efficient indoor quality service, low latency, and higher data speeds are fueling the growth of the market. Moreover, the COVID-19 pandemic positively impacted the 5G rollouts and deployment owing to the gradual shift toward online education and remote workplaces. The adoption of the private 5G network and RAN increased significantly with the increasing number of smartphones, internet subscribers, and 5G use cases. In May 2024, MosoLabs introduced Moso Canopy 5GID2, a 5G indoor radio access point for private networks. It uses Qualcomm's FSM200 platform and will be showcased at Connect (X). MosoLabs also announced new partnerships to bring private 5G use cases to life.

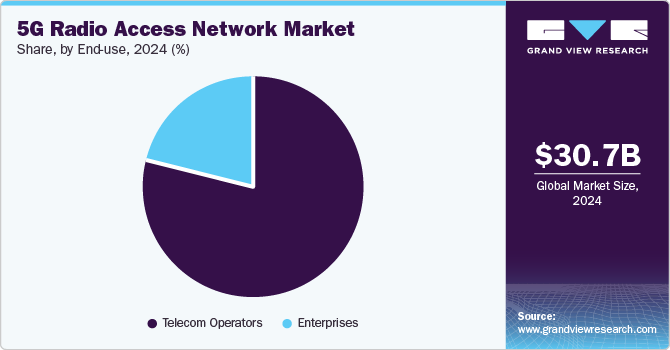

End-use Insights

In terms of end-use, the market is classified into telecom operators and enterprises. Among these, the telecom operators 5G RAN market is expected to dominate in 2024, gaining a market share of more than 79%. It is expected to grow at a CAGR of 8.0% throughout the forecast period. With the growing telecom industry and IT infrastructure, the adoption of 5G RAN is exponentially expanding worldwide. Telecom operators such as AT&T and Verizon, in order to provide 5G services and RAN, are placing orders for 5G gears. In addition, the growing adoption of smartphones, internet subscribers, and infrastructural developments are anticipated to propel the growth of the market in the forecasted period. Moreover, the rising competition between prominent telecom operators to enable seamless data speeds, accessibility, and efficient bandwidth connectivity is encouraging the adoption of 5G services and RAN in developing countries, fueling the growth of the market.

The enterprise segment is anticipated to grow at a considerable CAGR of 16.9% throughout the forecast period. The enterprise segment comprises BFSI, healthcare, media & entertainment, smart city, government, retail, manufacturing, transportation & logistics, aerospace & defense. The increasing demand for 5G RAN from the aforementioned enterprise end use is propelling the growth of the market. The utilization of 5G has enabled industry automation, online consultations, streamlined operations, and immersive experiences, among others, in multiple enterprise End use with advanced technologies such as IoT, AR/VR, AI, big data, and machine learning.

Regional Insights

The Asia-Pacific 5G radio access network market dominates with revenue share of 41% in 2024 and grow at a CAGR of 11.6%. The growth is attributed to the presence of several manufacturers, such as Huawei Technologies Co., Ltd., and Samsung, coupled with a multitude of investments that are expected toward building automated factories in the region. In addition, huge investments to acquire a 5G spectrum in key countries such as South Korea, China, India, Australia, and Japan are projected to contribute to regional growth. Furthermore, a gradual increase in the number of small and medium IT companies in emerging countries, such as India and South Korea, is projected to propel the adoption of 5G services in the region. In addition, the region's untapped potential is generating new investment opportunities for mobile network operators and communication service providers in the region.

The China 5G radio access network (RAN) market is expected to grow at a significant CAGR from 2025 to 2030. China has emerged as a global leader in 5G RAN deployment, showcasing rapid progress and extensive network coverage. The country's major telecom operators, such as China Mobile, China Telecom, and China Unicom, have made significant investments in 5G infrastructure, leveraging both domestic and international technologies. Huawei, a Chinese technology giant, has played a pivotal role in driving 5G development within China, providing end-to-end solutions and contributing to the country's technological advancements. While the US has imposed restrictions on Huawei's involvement in 5G networks, China has continued to expand its 5G footprint, focusing on domestic capabilities and alternative partnerships. The country's 5G deployment has paved the way for a wide range of applications and use cases, from smart cities and industrial automation to virtual reality and augmented reality experiences.

The 5G radio access network (RAN) market in India is expected to grow at a significant CAGR from 2025 to 2030. India's 5G RAN landscape is rapidly evolving, with significant strides being made in network deployment and coverage expansion. The country's major telecom operators, Reliance Jio, Airtel, and Vodafone Idea, have been actively investing in 5G infrastructure, leveraging technologies from various vendors. The government has also played a crucial role in supporting 5G development, allocating spectrum, and implementing favorable policies. While challenges such as spectrum availability and cost considerations persist, India's 5G rollout is gaining momentum. The country's vast population and diverse market present immense opportunities for 5G applications across various sectors, including healthcare, education, agriculture, and smart cities. As India continues to embrace 5G technology, it is poised to unlock new economic growth drivers and improve the quality of life for its citizens.

The 5G radio access network (RAN) market in Japan is expected to grow at a significant CAGR from 2025 to 2030. Japan has been at the forefront of 5G technology adoption, with a focus on providing high-speed and reliable connectivity to its citizens and businesses. The country's major telecom operators, NTT Docomo, KDDI, and Softbank, have made significant investments in 5G infrastructure, leveraging advanced technologies and deploying dense networks to ensure widespread coverage. Japan's 5G rollout has been driven by a strong emphasis on innovation and the development of new applications and services. The country has been a pioneer in areas such as autonomous vehicles, smart factories, and remote healthcare, leveraging 5G's capabilities to enhance efficiency and productivity. While challenges such as spectrum availability and cost considerations remain, Japan's 5G ecosystem is well-positioned to drive economic growth and improve the quality of life for its population.

North America 5G Radio Access Network Market Trends

North America 5G radio access network market gained a significant market share of around 29% in year 2024. The region is equipped with a highly developed 5G infrastructure and owns an extensive research and development base, allowing the region to be the top revenue contributor in the worldwide market during the projected period. A well-established 5G infrastructure has allowed the speedier implementation of modern 5G technologies, and substantial government investments in 5G rollouts and deployments have enabled significant adoption of 5G RAN in the U.S. and Canada. The considerable presence of small and medium players in North America, which offer 5G components and services to giants such as Intel Corporation, Verizon, and Mavenir, has also propelled the market growth. The U.S. is expected to retain its dominance over the forecast period owing to the inclination of consumers towards 5G services and growing technological investments in the region.

U.S. 5G Radio Access Network Market Trends

The U.S. 5G radio access network (RAN) market is expected to grow at a significant CAGR from 2025 to 2030. The U.S. 5G RAN landscape is currently undergoing significant transformation, driven by a combination of technological advancements and regulatory initiatives. Major players such as Ericsson, Nokia, and Samsung are actively investing in 5G infrastructure deployment, expanding network coverage and capacity. The introduction of Open RAN architecture has also been a key development, promoting interoperability and reducing vendor lock-in. However, challenges such as spectrum availability, cost considerations, and the need for a skilled workforce remain. Despite these hurdles, the U.S. 5G RAN market is poised for substantial growth, with the potential to drive innovation across various industries and enhance connectivity for consumers and businesses alike.

Key 5G Radio Access Network Company Insights

The market is consolidated and is anticipated to witness increased competition due to several players' presence. Major players are spending heavily on research and development activities to integrate advanced technologies within 5G services and RAN has intensified the competition among these players. Some prominent players in the market include Telefonaktiebolaget LM Ericsson, Qualcomm Technologies, Inc., Nokia, Intel Corporation, Samsung, Verizon, Cisco Systems, Inc., Huawei Technologies Co., Ltd., VMware, Inc., Rakuten Symphony Singapore Pte. Ltd, among others. These companies are also collaborating with local & regional players to gain a competitive edge over their peers and capture a significant market share.

Some of the key companies operating in the 5G radio access network (RAN) include Telefonaktiebolaget LM Ericsson, Qualcomm Technologies, Inc., and Verizon, among others.

-

Telefonaktiebolaget LM Ericsson, a Swedish multinational networking and telecommunications company, has a strong competitive edge in the 5G RAN market due to its extensive global presence, long-standing experience, and comprehensive product portfolio. The company's deep understanding of network infrastructure, coupled with its ability to deliver end-to-end solutions, has enabled it to establish strong partnerships with major telecom operators worldwide. Ericsson's commitment to research and development has also positioned it at the forefront of 5G technology advancements, ensuring that its offerings remain competitive and meet the evolving needs of the market.

-

Qualcomm Technologies, Inc., a U.S.-based semiconductor company, has a significant competitive advantage in the 5G RAN market due to its expertise in mobile chipsets and system-on-a-chip (SoC) technology. The company's innovative 5G modems and RF transceivers have been widely adopted by leading smartphone manufacturers and network equipment providers. Qualcomm's strong research and development capabilities have allowed it to continuously push the boundaries of 5G technology, delivering solutions that enable faster data speeds, lower latency, and enhanced network capacity.

-

Verizon, a major US-based telecommunications company, has a competitive edge in the 5G RAN market due to its extensive network infrastructure and early investments in 5G technology. The company's nationwide 5G coverage and commitment to providing high-quality services have positioned it as a leading player in the US market. Verizon's strategic partnerships with network equipment providers and its focus on developing innovative 5G applications have also contributed to its competitive advantage.

Samsung and VMware, Inc. are some of the emerging companies in the target market.

-

As a leading global technology conglomerate, Samsung has a strong competitive advantage in the 5G RAN market due to its vertical integration capabilities. The company's ability to design, manufacture, and distribute its own components, including modems, RF transceivers, and antennas, provides it with greater control over the entire value chain. This vertical integration allows Samsung to optimize costs, improve product quality, and accelerate time-to-market for its 5G solutions. In addition, Samsung's extensive experience in consumer electronics and semiconductor manufacturing positions it well to leverage its expertise and resources to drive innovation in the 5G RAN market.

-

VMware, a leading provider of virtualization and cloud computing solutions, has a competitive advantage in the 5G RAN market due to its deep expertise in software-defined infrastructure. The company's virtualization technologies can be applied to various components of the 5G network, including radio access networks, core networks, and transport networks. By virtualizing these components, VMware can help network operators reduce costs, improve flexibility, and accelerate the deployment of new services. In addition, VMware's partnerships with leading telecom equipment vendors and its strong presence in the enterprise market position it well to capitalize on the growing demand for 5G solutions.

Key 5G Radio Access Network Companies:

The following are the leading companies in the 5G radio access network market. These companies collectively hold the largest market share and dictate industry trends.

- Telefonaktiebolaget LM Ericsson

- Qualcomm Technologies, Inc.

- Nokia

- Rakuten Symphony Singapore Pte. Ltd

- Intel Corporation

- Samsung

- Verizon

- Cisco Systems, Inc.

- Huawei Technologies Co., Ltd.

- VMware, Inc.

Recent Developments

-

In October 2024, Du extended its contract with Nokia to expand its 5G network. The agreement will support Du in incorporating advanced 5G technologies like enhanced mobile broadband, network slicing, and edge computing. These capabilities will enable Du to provide future-ready network services to both consumer and enterprise customers.

-

In October 2024, Software Radio Systems (SRS) launched srsRAN Enterprise 5G, a portable, full-stack software solution for private 5G networks. This Open RAN solution offers flexible deployment options and supports diverse user networks. srsRAN Enterprise 5G is designed for quick deployment using off-the-shelf hardware and is compatible with various compute platforms.

-

In October 2024, Pegatron 5G, an O-RAN provider, launched the PR1450 O-RU and FHM, designed for indoor coverage in enterprise and public deployments. These solutions offer reliable connectivity, simplified network configurations, and flexibility for various 5G environments. The company is committed to supporting India's 5G infrastructure and "Make in India" policy.

5G Radio Access Network Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 42,481.2 million

Revenue forecast in 2030

USD 69,297.1 million

Growth rate

CAGR of 10.3% from 2025 to 2030

Historic year

2019 - 2023

Base year for estimation

2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, architecture type, deployment, end-use, region

Regional scope

North America, Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; South Korea; Australia; Brazil; UAE; KSA; South Africa

Key companies profiled

Telefonaktiebolaget LM Ericsson; Qualcomm Technologies, Inc.; Nokia; Intel Corporation; Samsung; Verizon; Cisco Systems, Inc.; Huawei Technologies Co., Ltd.; VMware, Inc.; Rakuten Symphony Singapore Pte. Ltd

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global 5G RAN Market Report Segmentation

This report forecasts revenue growths at global, regional, and country levels and provides an analysis of the industry trends in each of the sub-segments from 2019 to 2030. For the purpose of this study, Grand View Research has segmented the global 5G radio access network market based on component, architecture type, deployment, end-use, and region.

-

Component Outlook (Revenue, USD Million, 2019 - 2030)

-

Hardware

-

Antennas

-

MIMO

-

Beamforming

-

Others (Monopole, Dipole, Microstrip, Patch Antennas)

-

-

Radio Unit

-

Baseband Units

-

-

Software

-

Services

-

Managed Services

-

Consulting Services

-

Professional Services

-

Planning & Design Services

-

Integration & Validation Services

-

Deployment Services

-

Optimization and Performance Improvement Services

-

-

-

-

Architecture Type Outlook (Revenue, USD Million, 2019 - 2030)

-

CRAN

-

ORAN

-

VRAN

-

-

Deployment Outlook (Revenue, USD Million, 2019 - 2030)

-

Indoor

-

Outdoor

-

-

End-use Outlook (Revenue, USD Million, 2019 - 2030)

-

Telecom Operators

-

Enterprises

-

-

Regional Outlook (Revenue, USD Million, 2019 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global 5G radio access network market size was estimated at USD 30,650.2 million in 2024 and is expected to reach USD 42,481.2 million in 2025.

b. The global 5G radio access network market is expected to grow at a compound annual growth rate of 10.3% from 2025 to 2030 to reach USD 69,297.1 million by 2030.

b. The Asia-Pacific is expected to dominate the market and grow at a CAGR of 11.6%. The growth is attributed to the presence of several manufacturers, such as Huawei Technologies Co., Ltd. and Samsung, coupled with a multitude of investments that are expected toward building automated factories in the region.

b. Some key players operating in the 5G RAN market include Telefonaktiebolaget LM Ericsson, Qualcomm Technologies, Inc., Nokia, Intel Corporation, Samsung, Verizon, Cisco Systems, Inc., Huawei Technologies Co., Ltd., VMware, Inc., and Rakuten Symphony Singapore Pte. Ltd, among others

b. Key factors that are driving the growth of the 5G radio access network market are the increasing demand for low latency bandwidth connection and increased focus on research and development activities by key organizations are some of the factors fueling the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.