- Home

- »

- Next Generation Technologies

- »

-

5G System Integration Market Size, Industry Report, 2033GVR Report cover

![5G System Integration Market Size, Share & Trends Report]()

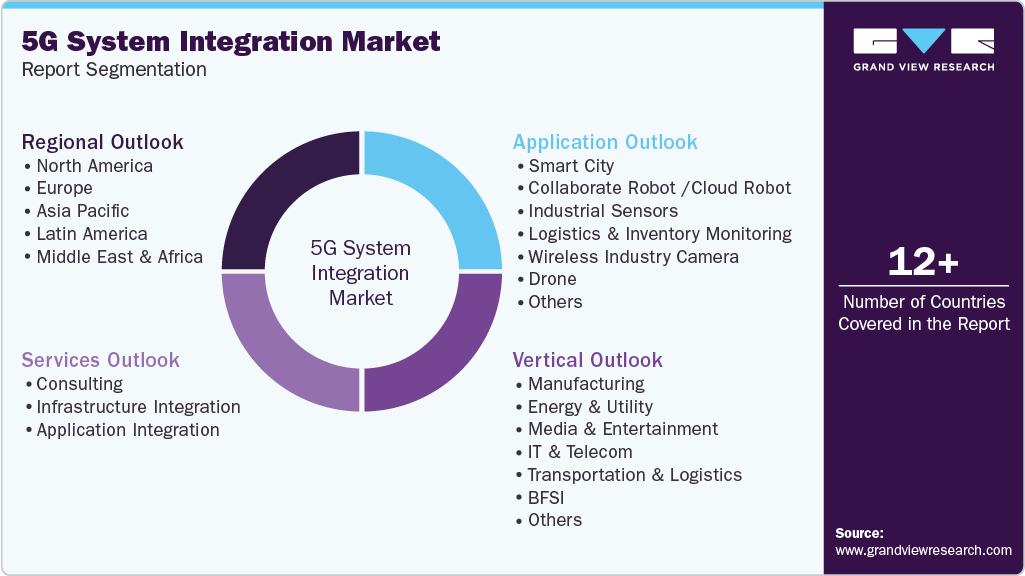

5G System Integration Market (2025 - 2033) Size, Share & Trends Analysis Report By Services (Consulting, Infrastructure Integration, Application Integration), By Vertical (Manufacturing, Energy & Utility, Media & Entertainment), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-149-8

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

5G System Integration Market Summary

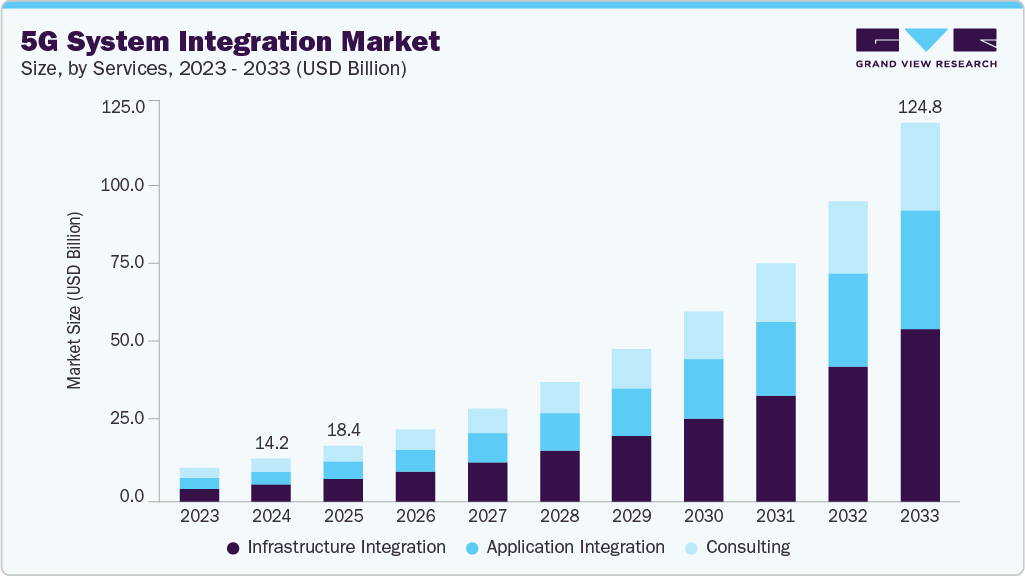

The global 5G system integration market size was estimated at USD 14.19 billion in 2024 and is projected to reach USD 124.81 billion by 2033, growing at a CAGR of 27.1% from 2025 to 2033. The increasing penetration of 5G networks globally is one of the major factors attributed to the growing demand for 5G system integration services.

Key Market Trends & Insights

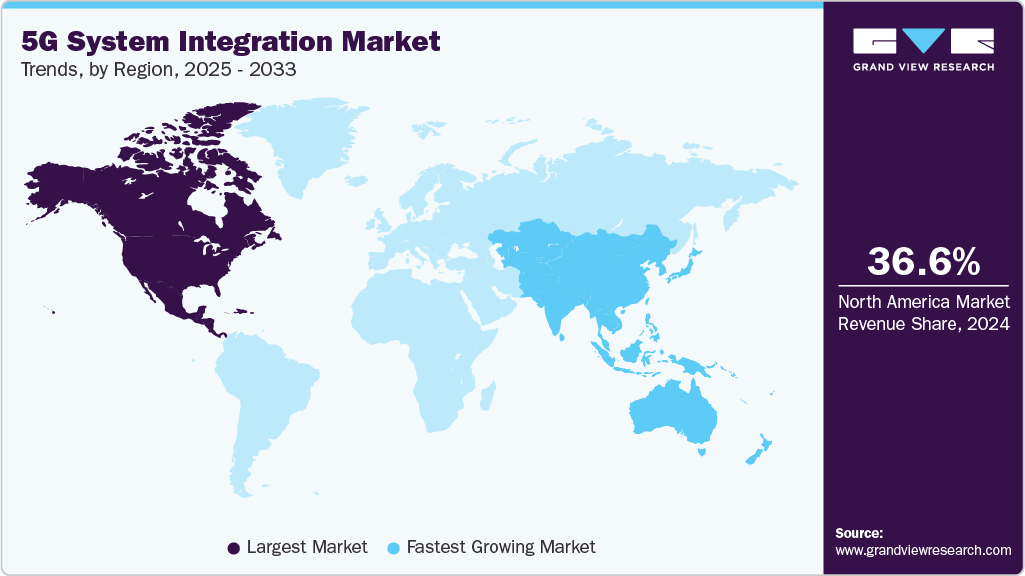

- North America dominated the 5G system integration industry and accounted for a share of 36.6% in 2024.

- The 5G System Integration industry in the U.S. is expected to grow significantly over the forecast period.

- By services, the infrastructure integration segment dominated the market in 2024 and accounted for the largest share of 40.5%.

- By vertical, the IT & telecom segment dominated the market in 2024.

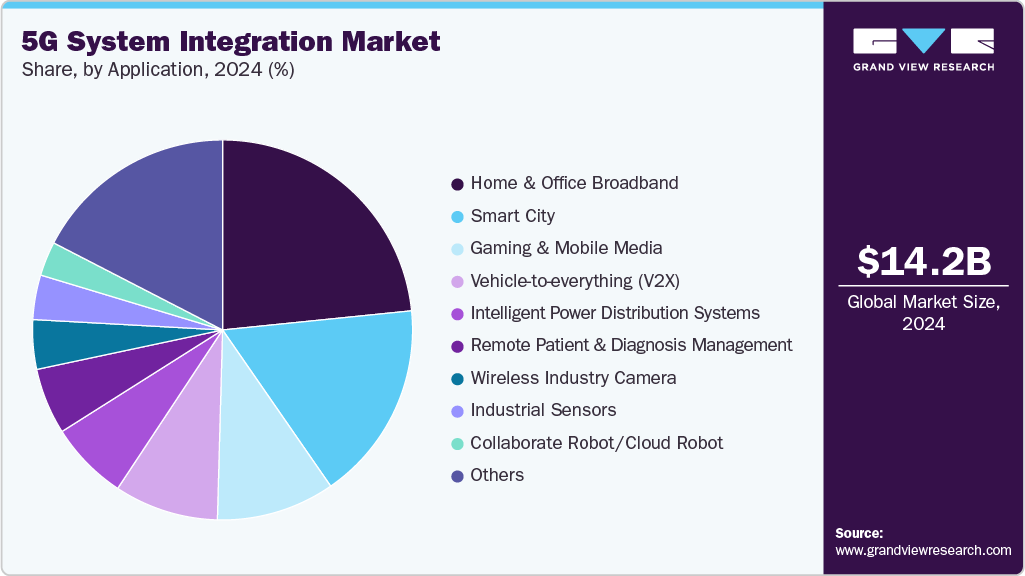

- By application, the home and office broadband segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 14.19 Billion

- 2033 Projected Market Size: USD 124.81 Billion

- CAGR (2025-2033): 27.1%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The growing penetration of 5G-supporting devices, including tablets, laptops, smartphones, routers, smart home devices, and many others, is expected to fuel the growth of the market. In addition, the market is also driven by the growing need for low-latency and high-reliable connectivity to support industrial internet of things (IIoT) applications such as industrial sensors, industrial cameras, and collaborative robots.

Major global manufacturers are seeking opportunities to speed up their operations by embracing modern digital technologies to empower the fourth industrial revolution (Industry 4.0). Technologies such as big data analytics, industrial wireless cameras, the Internet of Things (IoT), and collaborative robots are enabling manufacturing facilities to take a giant leap toward smart and data-driven flexible operations.

Several manufacturers have developed and implemented these aforementioned technologies to compete in a highly competitive environment. Manufacturers need to integrate them with next-generation networks to provide unified communication with these 5G technologies, which also helps reduce the overall operational downtime and costs through delivering continuous connectivity and remote monitoring. Thus, the robust deployment of the industrial internet of things (IIoT), along with the increasing demand for 5G services to deliver unified connectivity, is expected to bolster the demand for 5G system integration services during the forecast period.

With the evolution of fifth-generation mobile network services, various enterprises globally are aggressively focusing on integrating their legacy network infrastructure with the new upcoming 5G technologies. These companies are integrating their existing on-premise applications and cloud networks with modern 5G technologies to work seamlessly over a centralized network. This integration process allows enterprises to access high bandwidth capacity with low latency for their operations, thereby increasing the total operational efficiency by reducing the overall response time to customers. Therefore, a significant rise in demand for fast broadband to reduce overall response time is expected to drive the market for 5G system integration from 2025 to 2033.

The growing popularity of Network Function Visualization (NFV) and Software-Defined Networking (SDN) across enterprises is also expected to be one of the major factors driving the market for 5G system integration. NFV allows enterprises to deploy several virtual machines and firewalls to achieve an efficient economy of scale. On the other hand, SDN provides a smart network architecture that aims to reduce hardware constraints on the company premises. SDN allows these companies to manage the use of their network efficiently through an Application Program Interface (API). Thus, the rapid adoption of NFV and SDN technologies to minimize overall network infrastructure costs is anticipated to further surge the market growth. However, a rapidly increasing large chunk of datasets over the cloud, coupled with increasing demand for cloud-based application integration, creates a major security concern among consumers, which may hinder the 5G system integration industry growth in the future.

Services Insights

The infrastructure integration segment dominated the market in 2024 and accounted for the largest share of 40.0%. This is attributed to the surging demand for the integration of traditional network infrastructure with next-generation network infrastructure. Thus, integration of legacy infrastructure enables users to access the same hardware with enhanced features, thereby reducing the additional costs of hardware. In addition, the infrastructure system integration services consist of network integration, building management, and data center infrastructure management (DCIM).

The consulting segment is expected to grow at a moderate CAGR over the forecast period. With the rapidly increasing demand for 5G technologies, such as network equipment, business enterprises initially approach system integrators to build upgraded network architecture for their organizations. This architecture helps business enterprises to boost overall operational output in less time. Moreover, spiraling demand for multi-vendor cloud-based applications across enterprises is expected to augment the need for application integration services over the forecast period.

Vertical Insights

The IT and telecom segment dominated the market in 2024. This is attributed to surging demand for 5G integration services across various IT and telecom companies to support new radio (NR) waves. A healthy rise in demand for integrating enterprise network infrastructure and data center network hardware is anticipated to witness significant growth in demand for 5G system integration services in the IT and telecom segment. Moreover, 5G network services are expected to witness significant adoption across enterprises over the forecast period due to an increased focus on providing uniform connectivity during a virtual meeting to reduce the overall travel time of a specialist or consultant. Therefore, demand for 5G system integration services is estimated to witness a substantial rise in integrating an entire enterprise network to make it compatible with the next-generation network.

The manufacturing segment is expected to witness the fastest CAGR over the forecast period. This is owing to the growing requirement for system integration services to integrate the entire manufacturing facility with 5G carriers supporting the network. As digitalization is becoming popular in the manufacturing sector, production lines are being continuously automated to improve overall production efficiency. This has triggered the need for seamless wireless communication between industrial robots, actuators, sensors, and other devices mounted in manufacturing facilities, thereby driving the segment’s growth.

Application Insights

The home and office segment dominated the market in 2024. This is attributed to the growing need for 5G system integration services to deliver enhanced Mobile Broadband (eMBB) connectivity to consumers and enterprises. Moreover, a remarkable increase in IoT devices across rapidly developing smart cities worldwide is expected to surge the demand for 5G system integration services to make these devices compatible with next-generation network services. This factor is anticipated to further boost the growth of the smart city application segment from 2025 to 2033.

The industrial sensors segment is expected to witness the fastest CAGR over the forecast period. The segment’s growth is driven by the rapid adoption of smart manufacturing, Industry 4.0 initiatives, and real-time process automation. Industrial environments increasingly rely on 5G-enabled sensor networks to support low-latency, ultra-reliable machine-to-machine (M2M) communication, predictive maintenance, and real-time data analytics. System integrators play a critical role in bridging legacy industrial equipment with advanced 5G infrastructure, ensuring seamless connectivity and interoperability. This segment is expected to witness robust growth as companies seek to optimize operational efficiency, reduce downtime, and enable autonomous decision-making on the factory floor.

Regional Insights

North America 5G system integration industry accounted for a share of 36.6% in 2024. This is attributed to the presence of large IT and telecom players, such as IBM Corporation; Microsoft Corporation; and Cisco Systems, Inc. Moreover, rising investments in deploying 5G infrastructure by key market players, such as AT&T Inc. and Verizon Communications Inc., are expected to create a robust need to integrate overall infrastructure and applications across various verticals, such as IT and telecom, energy & utilities, and healthcare, to support 5G NR frequency bands. This factor is anticipated to boost the overall growth of the regional market.

U.S. 5G System Integration Market Trends

The 5G system integration market in the U.S. held a dominant position in the region in 2024, driven by a mature ICT ecosystem and aggressive investments from major telecom and cloud companies. The demand is particularly strong in defense, healthcare, and smart manufacturing, where low-latency and high-reliability networks are critical. Integration projects are also expanding in rural connectivity and infrastructure modernization, supported by federal programs.

Europe 5G System Integration Market Trends

The 5G system integration market in Europe is expected to register a moderate CAGR from 2025 to 2033. Europe’s 5G system integration market is driven by a pan-regional focus on digital sovereignty, industrial automation, and green connectivity solutions. The European Union’s funding initiatives and policy frameworks, such as the Digital Europe Programme, are encouraging the integration of 5G into cross-border infrastructure. System integrators are increasingly targeting energy, logistics, and automotive sectors with customized 5G deployment models.

The UK 5G system integration market held a substantial share in 2024. The UK is emerging as a strategic hub for 5G system integration, backed by national-level policies and innovation funding for telecom infrastructure. Enterprises in sectors such as logistics, healthcare, and creative industries are adopting 5G to boost productivity and digital capability. The country’s focus on open RAN and vendor diversification is also influencing the integration ecosystem.

The 5G system integration market in Germany is expected to grow at the fastest CAGR from 2025 to 2033. Germany’s industrial strength makes it a key market for 5G system integration, especially within manufacturing, automotive, and logistics sectors. The government’s support for private 5G networks in industrial parks is boosting demand for end-to-end integration services.

Asia Pacific 5G System Integration Market Trends

The 5G system integration market in Asia Pacific is expected to witness the fastest CAGR of 28.6% during the forecast period. Prominent telecom operators such as China Mobile Limited, China Telecom Corporation Limited, KT Corporation, and SK Telecom Co., Ltd. are making significant investments in rolling out fifth-generation networks in China, Japan, and South Korea. Most of these investments are envisioned to focus on implementing next-generation infrastructure for various industry verticals, including transportation, energy and utility, healthcare, media and entertainment, and manufacturing. Thus, rapidly growing investments in installing 5G infrastructure across the above-mentioned countries are expected to create a significant opportunity for system integrators in the market in the forthcoming years. Furthermore, a rapid increase in the number of small and medium IT companies in emerging countries, such as China and India, is estimated to propel regional market growth.

India 5G system integration market is expected to grow at the fastest growth rate during the forecast period. India’s market growth is driven by the commercial rollout of 5G networks and strong government support through initiatives such as Digital India and Make in India. Enterprises across manufacturing, logistics, and healthcare are engaging with integrators to modernize operations with private 5G networks. The demand for cloud-based services, combined with a growing ecosystem of tech startups, is accelerating 5G-driven enterprise digitalization.

The 5G system integration market in China held a substantial share in 2024, driven by state-backed investments and a national strategic focus on digital infrastructure. Major Chinese technology firms are driving large-scale deployments across sectors such as automotive, energy, and smart manufacturing. The integration of 5G with AI and edge computing is a key priority for enabling real-time, data-driven operations.

Key 5G System Integration Companies Insights

Key players operating in the 5G system integration market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key 5G System Integration Companies:

The following are the leading companies in the 5g system integration market. These companies collectively hold the largest market share and dictate industry trends.

- Accenture Inc.

- Cisco Systems, Inc.

- Huawei Technologies Co., Ltd.

- Infosys Limited

- Tata Consultancy Services Limited

- IBM Corporation

- Hewlett Packard Enterprise Development LP

- Wipro Limited

- Samsung Electronics Co., Ltd.

- Telefonaktiebolaget LM Ericsson

Recent Developments

-

In March 2025, Lockheed Martin, Verizon Communications Inc., and Nokia Corporation announced the integration of Nokia Corporation’s advanced, military-grade 5G solutions into Lockheed Martin’s 5G.MIL Hybrid Base Station. This collaboration enhances the ability to merge commercial 5G connectivity with military communication systems, enabling faster, more decisive information delivery to support national defense operations.

-

In October 2024, NEC Corporation, a prominent integrator of IT and network technologies, partnered with Cisco Systems, Inc. to launch a private 5G network solution for enterprise customers. The offering combines Cisco Systems, Inc.’s 5G Standalone (SA) Core and Cloud Control Center with NEC Corporation’s validated radio network and systems integration expertise, delivering a market-ready, end-to-end 5G architecture.

5G System Integration Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 18.37 billion

Revenue forecast in 2033

USD 124.81 billion

Growth rate

CAGR of 27.1% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Services, vertical, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Russia; Italy; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Accenture Inc.; Cisco Systems, Inc.; Huawei Technologies Co., Ltd.; Infosys Limited; Tata Consultancy Services Limited; IBM Corporation; Hewlett Packard Enterprise Development LP; Wipro Limited; Samsung Electronics Co., Ltd.; and Telefonaktiebolaget LM Ericsson

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

5G System Integration Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global 5G system integration market report based on services, vertical, application, and region.

-

Services Outlook (Revenue, USD Million, 2021 - 2033)

-

Consulting

-

Infrastructure Integration

-

Application Integration

-

-

Vertical Outlook (Revenue, USD Million, 2021 - 2033)

-

Manufacturing

-

Energy & Utility

-

Media & Entertainment

-

IT & Telecom

-

Transportation & Logistics

-

BFSI

-

Healthcare

-

Retail

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Smart City

-

Collaborate Robot /Cloud Robot

-

Industrial Sensors

-

Logistics & Inventory Monitoring

-

Wireless Industry Camera

-

Drone

-

Home and Office Broadband

-

Vehicle-to-everything (V2X)

-

Gaming and Mobile Media

-

Remote Patient & Diagnosis Management

-

Intelligent Power Distribution Systems

-

P2P Transfers /mCommerce

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Russia

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global 5G system integration market size was estimated at USD 14.19 billion in 2024 and is expected to reach USD 18.37 billion in 2025.

b. The global 5G system integration market is expected to grow at a compound annual growth rate of 27.1% from 2025 to 2033 to reach USD 124.81 billion by 2033.

b. The infrastructure integration segment dominated the market in 2024 and accounted for the largest share of 28.8%. This is attributed to the surging demand for the integration of traditional network infrastructure with next-generation network infrastructure.

b. The IT and telecom segment dominated the market in 2024. This is attributed to surging demand for 5G integration services across various IT and telecom companies to support new radio (NR) waves.

b. The home and office segment dominated the market in 2024. This is attributed to the growing need for 5G system integration services to deliver enhanced Mobile Broadband (eMBB) connectivity to consumers and enterprises.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.