- Home

- »

- Consumer F&B

- »

-

Bottled Water Market Size And Share, Industry Report, 2033GVR Report cover

![Bottled Water Market Size, Share & Trends Report]()

Bottled Water Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Spring Water, Sparkling Water, Purified Water, Mineral Water), By Distribution Channel, By Packaging, By Packaging Size, By Price Range, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-411-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Bottled Water Market Summary

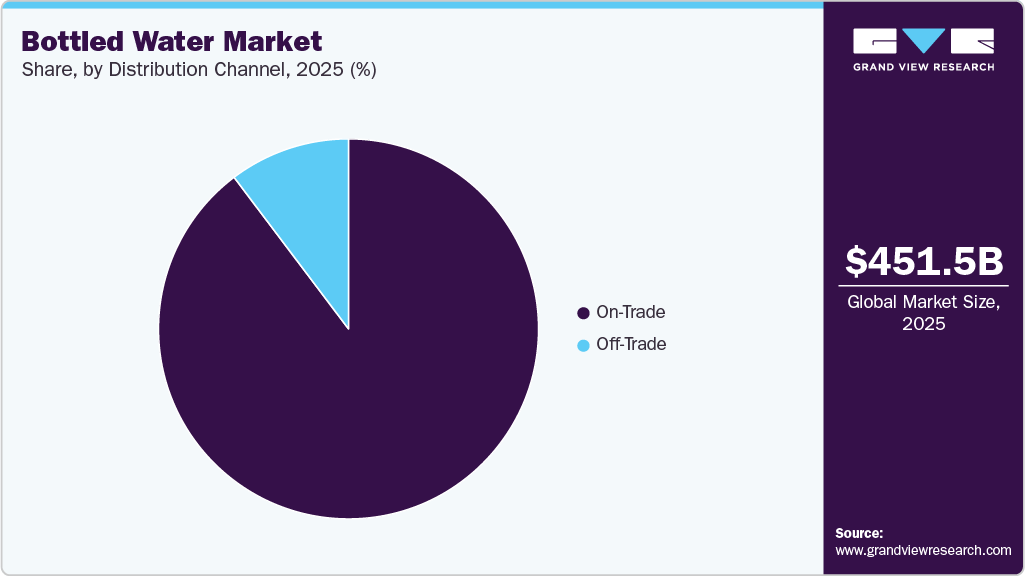

The global bottled water market size was estimated at USD 451.47 billion in 2025 and is projected to reach USD 611.03 billion by 2033, growing at a CAGR of 6.3% from 2026 to 2033. This can be attributed to increasing health and wellness trends among consumers, the rising need for convenience and accessibility, and robust production innovation.

Key Market Trends & Insights

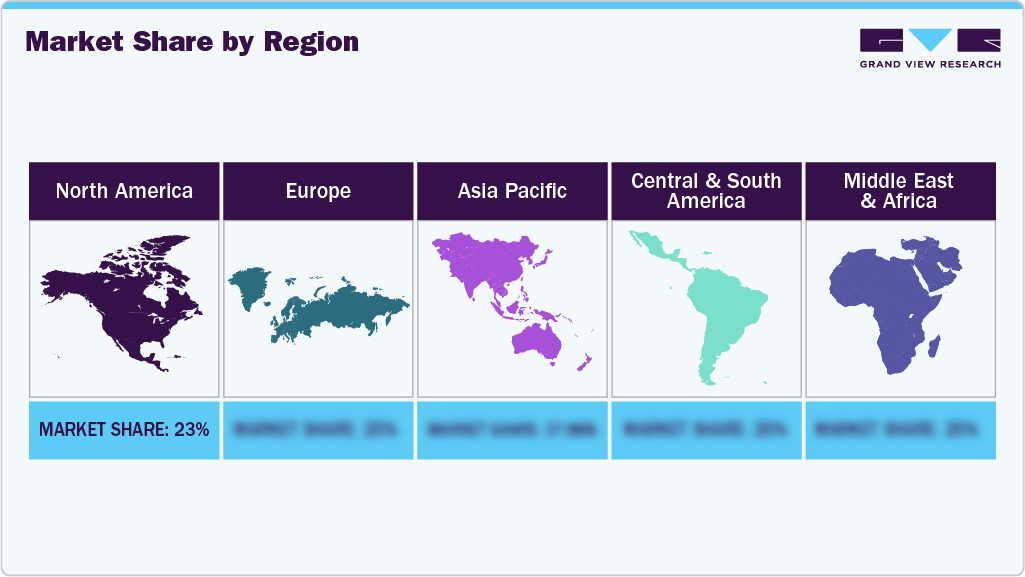

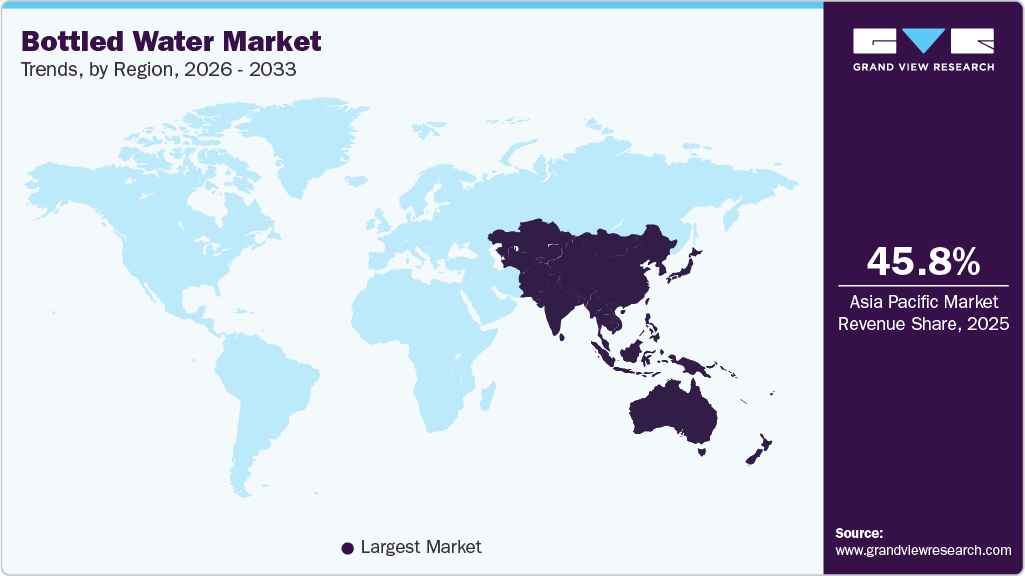

- Asia Pacific dominated the global bottled water market with the largest revenue share of 45.8% in 2025.

- By product, purified water led the market and accounted for a share of 41.9% in 2025.

- By packaging, the PET bottles segment led the market with the largest revenue share of 79.9% in 2025.

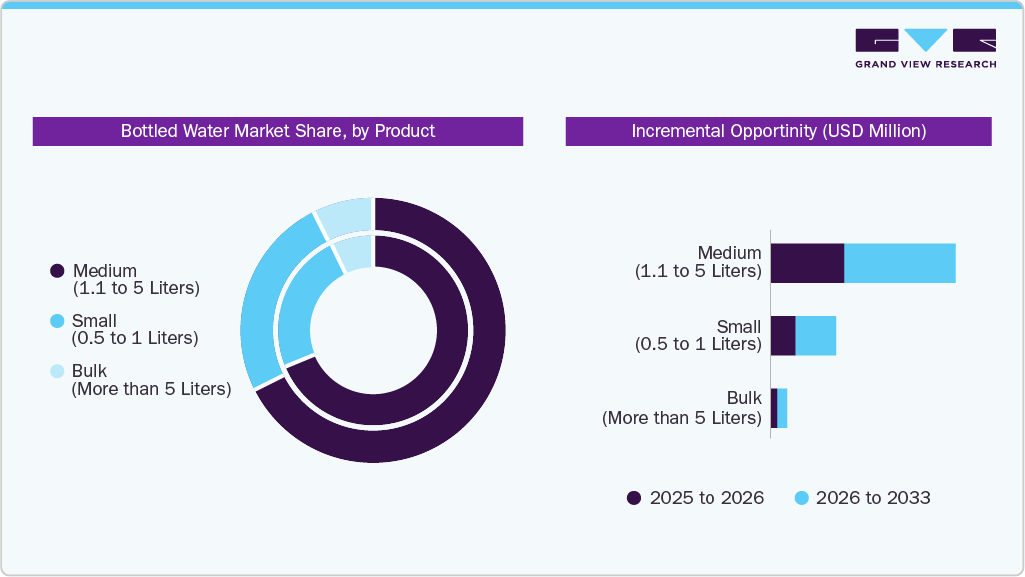

- By packaging size, medium (1.1 to 5 Liters) segment led the market with the largest revenue share of 72.6% in 2025.

- By price range, the mass-priced segment led the market with the largest revenue share of 89.5% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 451.47 Billion

- 2033 Projected Market Size: USD 611.03 Billion

- CAGR (2026-2033): 6.3%

- Asia Pacific: Largest market in 2025

The growing demand and consumption of bottled water can largely be attributed to increasing health consciousness among consumers. With rising awareness about the harmful effects of sugary beverages, such as sodas and juices, people are shifting towards healthier hydration options. Bottled water is viewed as a simple and effective way to stay hydrated without the added sugars, calories, or artificial ingredients associated with other drinks. As more individuals prioritize wellness and hydration in their daily lives, premium drinking water bottles have become a go-to choice, especially for those with active and health-conscious lifestyles.

One of the key factors driving the bottled water industry is the increasing health consciousness among consumers. As people become more aware of the importance of hydration and its role in overall health, they are opting for bottled water over sugary beverages such as sodas and juices. This shift is particularly evident among millennials and health-conscious individuals who prioritize natural and low-calorie options. The perception that bottled water is a healthier alternative has led to a surge in demand as consumers seek products that align with their wellness goals.

According to a survey by the International Bottled Water Association, in 2023, bottled water consumption in the U.S. reached 15.94 billion gallons, solidifying its position as the most consumed packaged beverage for the eighth year in a row. In contrast, carbonated soft drink sales totaled 11.84 billion gallons during the same period. This trend highlights a rising consumer preference for healthier hydration choices, with per capita bottled water consumption at 46.4 gallons, compared to 34.4 gallons for soft drinks.

The fast-paced lifestyle of modern consumers has also contributed significantly to the growth of the bottled water industry. With busy schedules, many individuals prefer convenient hydration solutions that can be easily carried and consumed on the go. Bottled water offers a practical option for staying hydrated during commutes, workouts, or outdoor activities. The availability of various packaging sizes- from single-serve bottles to larger family packs- further enhances convenience, making it easier for consumers to choose bottled water as their preferred beverage.

A notable factor propelling the growth of the bottled water industry is robust production innovation. This involves the introduction of enhanced manufacturing processes and the development of new product variants to meet diverse consumer demands and preferences. Innovations in packaging, such as eco-friendly materials and convenient designs, along with advancements in water purification and flavor infusion technologies, have significantly increased the appeal of bottled water to consumers. These innovative efforts not only aim to improve product quality and sustainability but also seek to differentiate offerings in a highly competitive market, thus driving consumer interest and market growth.

For instance, in March 2023, an India-based startup developed an innovative technology that allows for the extraction of drinking water from the atmosphere. This breakthrough is particularly significant in regions facing water scarcity, as it provides a sustainable and renewable source of clean water. The technology employs a combination of cooling and dehumidification processes. Air is drawn into the system and cooled below its dew point, causing moisture to condense. The collected water is then filtered and mineralized to meet drinking water safety standards.

Product Insights

Purified water accounted for a revenue share of 41.9% in 2025. Growing concerns over water contamination, aging municipal infrastructure, and the presence of impurities such as microplastics and heavy metals are driving households and commercial users to shift toward purified drinking water. At the same time, rising urbanization, higher disposable incomes, and busy lifestyles are reinforcing demand for convenient, ready-to-consume purified water formats, including bottled and dispenser-based solutions. Additionally, increased awareness of preventive health and wellness, accelerated by public health events and sustainability debates around water quality, has positioned purified water as a perceived safer and more reliable alternative to untreated tap water, supporting sustained market growth across both developed and emerging economies.

The sparkling segment is expected to grow at the fastest CAGR of 3.2% from 2026 to 2033. As consumers become more willing to spend on premium and artisanal products, sparkling bottled water companies that offer unique flavors and high-quality sourcing appeal to this growing market. Many people are shifting away from sugary sodas and other high-calorie beverages in favor of healthier alternatives.

For instance, in April 2024, PepsiCo launched Bubble Burst, a new lightly sweetened sparkling water beverage. The product comes in six fruit flavors, including Triple Berry, Peach Mango, Watermelon Lime, Pineapple Tangerine, Cherry Lemonade, and Tropical Punch. Each flavor contains 10 calories or less, has no added sugar, and comes in 100% recycled PET bottles. Sparkling water offers a refreshing, calorie-free option without added sugars or artificial ingredients.With the growing emphasis on eco-friendly packaging, brands that offer sustainable bottles or reusable options are attracting environmentally conscious consumers. This aligns with the wider trend of reducing plastic waste.

Packaging Insights

The PET bottled water segment led the market with the largest revenue share of 79.9% in 2025, owing to its significant advantages in convenience, recyclability, and lightweight nature compared to other packaging materials. The widespread preference for packaged natural mineral water bottles among consumers stems from their ease of transport and use, alongside a growing awareness and concern for environmental sustainability. PET bottles, being fully recyclable, align with global initiatives to reduce plastic waste and promote circular economies.

Furthermore, the lightweight nature of PET bottles reduces transportation costs and the carbon footprint, making them a favored choice among manufacturers and consumers alike, thereby driving their market. In October 2023, Coca-Cola India launched its first 100% recycled polyethylene terephthalate (PET) bottle, specifically for its Kinley packaged drinking water brand. This initiative marks a significant step towards promoting sustainability and plastic circularity in the country. The company introduced these bottles as part of its broader commitment to environmental responsibility and aims to reduce its carbon footprint.

The canned segment is expected to grow at the fastest CAGR of 5.8% from 2026 to 2033. This can primarily be attributed to increasing consumer awareness of environmental sustainability. It can offer an eco-friendlier alternative to plastic bottles due to their higher recyclability and greater efficiency in transportation, which helps reduce carbon emissions.

In addition, the convenience and durability of cans appeal to active and on-the-go lifestyles, making them a popular choice among consumers. As a result, both beverage companies and consumers are shifting towards canned water, driving significant growth in this market segment. For instance, in April 2024, Coca-Cola’s Smartwater brand unveiled 12-ounce aluminum cans with a new design, marking the first time vapor-distilled water was offered in this packaging format. The cans feature both Smartwater Original and Smartwater Alkaline with Antioxidant, catering to consumer preferences for convenient and environmentally friendly options.

Packaging Size Insights

The medium-sized segment led the market with the largest revenue share of 72.6% in 2025. The increasing demand for medium-sized bottled water (1.1 to 5 liters) can be attributed to a shift in consumer behavior toward convenience, value for money, and sustainability. These sizes are ideal for households, office spaces, and fitness enthusiasts who prefer larger quantities that can last longer, reducing the need for frequent purchases. In addition, there’s a growing awareness of the environmental impact of single-use plastics, leading to a preference for larger bottles that generate less plastic waste. Moreover, medium-sized bottles often offer a more cost-effective option compared to smaller ones, catering to both convenience and budget-conscious consumers.

The small-sized segment is expected to grow at the fastest CAGR of 6.2% from 2026 to 2033. The increasing popularity of small-sized bottled water (0.5 to 1 liter) is driven by the growing demand for on-the-go convenience and portability. These sizes are perfect for individual consumption during daily activities like commuting, exercising, or running errands. As consumers prioritize convenience and hydration throughout the day, smaller bottles offer a practical and easily accessible solution. In addition, they cater to impulse purchases and are often more affordable, making them appealing to a wide range of consumers. The rise in health-consciousness also plays a role, as people seek easy ways to stay hydrated without carrying larger, bulkier bottles.

Price Range Insights

The mass-priced bottled water segment led the market with the largest revenue share of 89.5% in 2025. The rise in mass-priced bottled water is driven by increasing consumer demand for affordable hydration options. As bottled water becomes a daily staple, many consumers seek budget-friendly options, especially in regions where clean drinking water may not be readily accessible. Mass-priced bottled water offers an economical solution, making it an attractive option for cost-conscious buyers. Additionally, retailers and manufacturers are responding to the growing trend of health-consciousness by offering more affordable, accessible hydration alternatives. This trend is further amplified by convenience, as mass-priced water is widely available in supermarkets and convenience stores.

The premium segment is expected to grow at the fastest CAGR of 6.5% from 2026 to 2033. The rise in premium-priced bottled water is fueled by growing consumer interest in health, wellness, and sustainability. Many consumers are increasingly seeking high-quality, mineral-rich, or specialty waters that offer perceived health benefits, such as enhanced hydration or added nutrients. Premium bottled water often comes from unique or pristine sources, and its branding emphasizes purity, luxury, and exclusivity, appealing to affluent customers. In addition, eco-conscious buyers are drawn to premium water brands that prioritize sustainable packaging and ethical practices. This segment's growth reflects a shift toward valuing quality, origin, and environmental impact alongside taste and health benefits.

Distribution Channel Insights

The off-trade outlets segment led the market with the largest revenue share of 89.7% in 2025. The availability of diverse brands and types of bottled water, coupled with the convenience of comparing products on the spot, makes off-trade channels such as hypermarkets, supermarkets, convenience stores, mini markets, and traditional stores highly attractive to consumers. Moreover, these retail outlets benefit from well-established supply chains and efficient distribution models, ensuring consistent product availability. This operational efficiency not only draws in a wider customer demographic but also solidifies the market share of the off-trade distribution channel. For instance, in March 2024, Greene Concepts announced plans to ship its BE WATER 6-packs to a Walmart distribution center, aiming for placement on store shelves. This strategic move is part of the company’s efforts to expand its market presence and increase product availability through one of the largest retail chains in the U.S.

Sales of bottled water through on-trade channels are expected to grow with a CAGR of 6.8% from 2026 to 2033. due to increasing health consciousness among consumers, a growing preference for convenient and portable hydration options, and the rising trend of premium bottled water offerings in restaurants and cafes. Additionally, the expansion of food service establishments and the integration of bottled water into dining experiences are further propelling this growth. As consumers seek healthier beverage alternatives, the demand for bottled water in on-trade settings continues to rise. For instance, in July 2024, Chipotle introduced a new lineup of ready-to-drink beverages available at all its U.S. restaurants. This includes Open Water, which is canned water in aluminum bottles.

Regional Insights

The bottled water market in North America is expected to grow at a significant CAGR of 5.7% from 2026 to 2033. Factors such as lifestyle trends towards hydration and wellness, coupled with the wide availability and variety of bottled water products, play significant roles in driving consumption in the region. In addition, the emphasis on portable and clean drinking water options for on-the-go consumers has bolstered the market's growth. To meet the growing customer demand for bottled water, several businesses have increased their investments in the bottled water processing market while also improving product quality and distribution channels. These advancements in processing technologies ensure higher purity, better taste, and compliance with health and safety standards, further driving the market's expansion. In April 2023, Premium Waters, Inc., a Minneapolis-based bottled water producer, announced a new bottling plant in Seguin City, Texas. Proposed at an investment of USD 80 million, the facility will span 27 acres, and the operations are expected to begin in 2024.

U.S. Bottled Water Market Trends

The bottled water market in the U.S. held a significant share in North America in 2025. This can be attributed to increasing health consciousness among consumers, shifting preferences from sugary drinks to healthier hydration options, and concerns over the safety and taste of municipal water supplies. In the U.S., premium bottled water marketing efforts highlighting quality and the perceived convenience and purity of bottled water are also key factors fueling the market's expansion.

Europe Bottled Water Market Trends

The bottled water market in Europe is expected to grow at a substantial CAGR of 5.5% from 2026 to 2033. The tourism industry in Europe significantly contributes to the demand for bottled water as tourists often rely on bottled water due to unfamiliarity with local tap water quality. Prominent European bottled water brands such as Evian (France), Perrier (France), San Pellegrino (Italy), and Vittel (France) are popular among both locals and visitors, renowned for their premium quality and mineral-rich content. These brands cater to the growing demand for natural and premium hydration, especially in tourism-heavy regions like France, Italy, and Spain, where bottled water is often preferred during travel and dining experiences.

In February 2024, the Haus Cramer Group, a well-known German brewery recognized for its Warsteiner brand, broadened its product range by entering the bottled water market with the introduction of its new mineral water brand, El Puro. This strategic initiative reflects the company’s aim to capitalize on a burgeoning segment within the gastronomy sector, which increasingly highlights the significance of premium beverages, including water.

Asia Pacific Bottled Water Market Trends

Asia Pacific dominated the global bottled water market with the largest revenue share of 45.8% in 2025 and is anticipated to grow at the fastest CAGR during the forecast period. This can largely be attributed to its vast population base, increasing urbanization, and a growing middle class with disposable income to spend on convenient, safe drinking water options. The region faces varied water quality issues and infrastructure challenges, leading to a high demand for bottled water as a reliable source of hydration. In October 2023, Clear Premium Water launched its new natural mineral water brand, NUbyClear (NU), in the Indian market. This product line is distinguished by its sourcing from the pristine Himalayas, aiming to deliver the essence of these mountains directly to consumers. The launch reflects a strategic response to evolving consumer preferences in the post-COVID era, where there is a growing inclination towards healthier lifestyle choices.

Key Bottled Water Company Insights

The global bottled water industry is characterized by numerous well-established and emerging players. Manufacturers in the bottled water market are actively engaging in a variety of strategic initiatives to keep pace with evolving bottled water market trends and shifting consumer demands.

Key Bottled Water Companies:

The following key companies have been profiled for this study on the bottled water market.

- Nestlé

- PepsiCo

- The Coca-Cola Company

- DANONE

- Primo Water Corporation

- FIJI Water Company LLC

- Gerolsteiner Brunnen GmbH & Co. KG

- VOSS WATER

- Nongfu Spring

- National Beverage Corp

- Keurig Dr Pepper Inc.

- Skechers U.S.A., Inc.

Recent Developments

-

In September 2024, Waterloo Sparkling Water launched a new Pomegranate Açaí flavor and brought back their seasonal Spiced Apple flavor. Both beverages are calorie-free, sugar-free, and made with non-GMO natural flavors.

-

In August 2024, Flow Beverage Corp. announced the launch of Flow Sparkling Mineral Spring Water. The product comes in 300ml aluminum bottles made with 70% recycled material, offering four varieties: OG, Blackberry + Hibiscus, Lemon + Ginger, and Cucumber + Mint. The zero-calorie, sugar-free beverages feature sustainable packaging that uses 30% less aluminum than competitors and requires 60% less energy to produce.

-

In July 2024, Source, a company based in Scottsdale, Arizona, unveiled a groundbreaking method to tackle the water crisis by generating canned water using air and sunlight. This initiative is part of the increasing trend towards sustainable technologies that aim to resolve environmental challenges while ensuring access to vital resources. The product will be branded as Sky Wtr and is designed to offer an off-grid solution for producing drinking water. Source intends to launch this water for public sale across the U.S. in major retail outlets around August or September 2024. The canned drinking water will be packaged in recyclable aluminum cans and bottles.

-

In February 2024, Gatorade announced the launch of its first unflavored water product, Gatorade Water in the U.S., marking a significant expansion into the bottled water category. This move is part of Gatorade’s strategy to diversify its offerings beyond traditional sports drinks and tap into the growing market for functional beverages. Gatorade Water is available nationwide across various retail platforms as well as on Amazon, and Gatorade.com.

Bottled Water Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 398.04 billion

Revenue forecast in 2033

USD 611.03 billion

Growth rate

CAGR of 6.3% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, packaging size, price range, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; Argentina; South Africa

Key companies profiled

Nestlé; PepsiCo; The Coca-Cola Company; DANONE; Primo Water Corporation; FIJI Water Company LLC; Gerolsteiner Brunnen GmbH & Co. KG; VOSS WATER; Nongfu Spring; National Beverage Corp.; Keurig Dr Pepper Inc.; Skechers U.S.A., Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bottled Water Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segments the global bottled water market report based on the product, distribution channel, packaging, packaging size, price range, and region.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Spring Water

-

Purified Water

-

Mineral Water

-

Sparkling Water

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

On-Trade

-

Restaurants

-

Cafes

-

Others

-

-

Off-Trade

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

Grocery Stores

-

Others

-

-

-

Packaging Outlook (Revenue, USD Million, 2021 - 2033)

-

PET

-

Cans

-

Others

-

-

Packaging Size Outlook (Revenue, USD Million, 2021 - 2033)

-

Small (0.5 to 1 Liters)

-

Medium (1.1 to 5 Liters)

-

Bulk (More than 5 Liters)

-

-

Price Range Outlook (Revenue, USD Million, 2021 - 2033)

-

Mass

-

Premium

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global bottled water market size was estimated at USD 348.64 billion in 2024 and is expected to reach USD 372.70 billion in 2025.

b. The global bottled water market is expected to grow at a compounded growth rate of 6.4% from 2025 to 2030 to reach USD 509.18 billion by 2030.

b. Sparkling bottled water is expected to growth with a CAGR of 7.9% from 2025 to 2030. The broad range of flavors and customization options in sparkling water has made it more appealing to consumers who enjoy variety in their beverages, contributing to its growing popularity..

b. Some key players operating in the bottled water market include Nestlé; PepsiCo; The Coca-Cola Company; DANONE; Primo Water Corporation; FIJI Water Company LLC; Gerolsteiner Brunnen GmbH & Co. KG; VOSS WATER; Nongfu Spring; National Beverage Corp.; Keurig Dr Pepper Inc.

b. Key factors that are driving the market growth include, increasing concerns regarding various health problems such as gastrointestinal diseases caused by the consumption of contaminated water is leading to increased demand for clean and hygienic packaged options.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.