- Home

- »

- Next Generation Technologies

- »

-

Access Control Market Size & Share, Industry Report, 2030GVR Report cover

![Access Control Market Size, Share & Trends Report]()

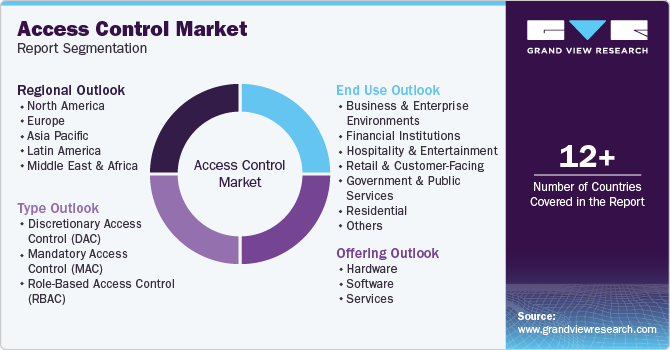

Access Control Market (2025 - 2030) Size, Share & Trends Analysis Report By Offering (Hardware, Software), By Type, By End-use (Business & Enterprise Environments, Financial Institutions, Hospitality & Entertainment), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-470-1

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Access Control Market Summary

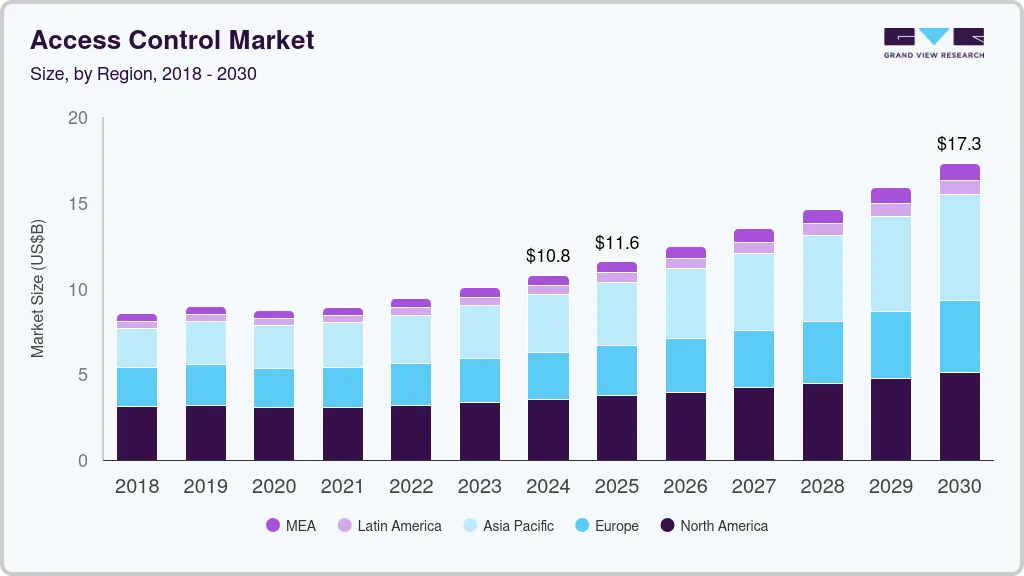

The global access control market size was estimated at USD 10.76 billion in 2024 and is projected to reach USD 17.30 billion by 2030, growing at a CAGR of 8.4% from 2025 to 2030. Heightened security threats, regulatory mandates, and the increasing integration of advanced technologies contribute to the demand for sophisticated access control systems.

Key Market Trends & Insights

- North America dominated with a revenue share of over 31% in 2024.

- The U.S. access control industry is anticipated to exhibit a significant CAGR over the forecast period.

- By offering, the hardware segment dominated the access control industry in 2024.

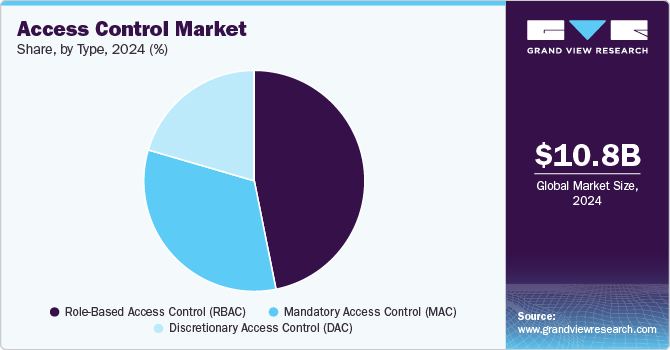

- By type, the Role-Based Access Control (RBAC) segment accounted for the largest revenue share in 2024.

- By end-use, the business & enterprise environments segment accounted for the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 10.76 Billion

- 2030 Projected Market Size: USD 17.30 Billion

- CAGR (2025-2030): 8.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Urbanization trends and smart city initiatives further amplify the need for effective access management solutions in residential, commercial, and public spaces. Moreover, the growing adoption of cloud-based and IoT-enabled systems provides scalable and efficient access control options, driving market expansion.

Organizations are increasingly moving towards biometric authentication such as fingerprint, facial recognition, iris scanning, and Multi-Factor Authentication (MFA) to strengthen security and reduce the risks associated with traditional access methods such as passwords or keycards. Moreover, the integration of IoT technology and cloud computing in access control systems allows for real-time monitoring, remote management, and scalability, driving growth within the access control industry as businesses seek more flexible and secure access solutions. This shift is further amplified by the declining costs of biometric technologies and increased awareness of the vulnerabilities associated with traditional security measures. In addition, advancements in AI and ML are improving the accuracy and efficiency of biometric systems, making them more reliable for diverse applications across industries

Rising incidents of data breaches, theft, and unauthorized access to physical and digital spaces are pushing organizations and governments to adopt advanced access control solutions for enhanced security. Moreover, the expansion of commercial, industrial, and residential construction globally is fueling the demand for access control systems to secure facilities. This is particularly strong in developing regions with increasing urbanization and construction activities. Modern access control systems are increasingly integrated with video surveillance, intrusion detection, and fire alarm systems, providing organizations with a more comprehensive and layered approach to security.

Offering Insights

The hardware segment dominated the access control industry in 2024, accounting for a revenue share of over 43%. Technological advancements, security demands, and regulatory requirements are key factors that shape the hardware segment. Moreover, biometric authentication technologies, such as fingerprint scanners, facial recognition, and iris scanning, are increasingly being used due to their accuracy and enhanced security. These systems are being adopted across various sectors, such as government, healthcare, and financial institutions, driving the demand for biometric hardware devices.

The services segment is anticipated to grow at the fastest CAGR over the forecast period due to the increasing need for ongoing support and maintenance of access control systems. Organizations require continuous technical assistance to ensure optimal performance and security of these systems, which includes services like authentication, authorization, auditing, and monitoring. The adoption of cloud-based access control solutions further necessitates service support to manage and analyze data effectively. As a result, the demand for services such as system upgrades, troubleshooting, and training is rising, driving the growth of this segment.

Type Insights

The Role-Based Access Control (RBAC) segment accounted for the largest revenue share in 2024. RBAC is widely adopted across various industries, including commercial, healthcare, education, and government, due to its simplicity and scalability. It allows organizations to assign access rights based on predefined roles, streamlining access management for large workforces. RBAC is easier to implement and manage compared to other segments, as access rights are associated with roles of administrator and user rather than individuals, making it highly efficient in environments with frequent role changes or new hires. RBAC is often a key component of compliance frameworks, making it a beneficial solution for organizations in industries that require stringent access control and auditing.

The Mandatory Access Control (MAC) segment is anticipated to exhibit the fastes CAGR over the forecast period. Various industries, such as government, military, and critical infrastructure, have stringent regulatory requirements for data protection and access control, driving the demand for MAC systems. For instance, in military security, MAC is exemplified when the classification of sensitive information, such as top-secret documents, is determined by a central authority rather than the individual data owner. This centralized control ensures that access permissions are managed and cannot be altered by individual users, maintaining the integrity and security of classified information. Moreover, growing awareness about the benefits of MAC and its role in enhancing security helps drive its adoption across industries with high-security needs. Furthermore, high-security data centers require MAC to ensure controlled access to sensitive data and infrastructure.

End-use Insights

The business & enterprise environments segment accounted for the largest revenue share in 2024. Business and enterprise environments encompass a broad range of organizations and industries that require access control solutions for managing employee access, securing sensitive areas, and protecting company data. Moreover, businesses and enterprises often require scalable access control systems to accommodate large numbers of users and various types of access permissions. Continuous investments in upgrading security infrastructure and adopting new technologies contribute to the growth of the access control industry within business and enterprise environments, driving significant demand for access control solutions.

The healthcare and life sciences segment is anticipated to exhibit the fastest CAGR over the forecast period. The rise in cyberattacks targeting healthcare data emphasizes the need for advanced access control systems to safeguard electronic health records and other sensitive data from unauthorized access. Moreover, the expansion of healthcare facilities, including hospitals, clinics, research labs, and long-term care facilities, drives demand for scalable and comprehensive access control systems. Thus, the growth of the healthcare & life sciences segment in the global access control industry is driven by stringent regulatory requirements, increasing cybersecurity threats, facility expansion, the need for patient safety, technological advancements, and a focus on operational efficiency.

Regional Insights

North America dominated with a revenue share of over 31% in 2024. Increasing concerns over workplace violence, school shootings, and general crime in public and private spaces are driving demand for access control solutions to enhance safety in this region. Moreover, AI and machine learning are being incorporated into access control systems to enhance security, with capabilities such as real-time threat detection, predictive analytics, and automated decision-making.

U.S. Access Control Market Trends

The U.S. access control industry is anticipated to exhibit a significant CAGR over the forecast period. With the rise of remote work and hybrid working environments in the U.S., companies are increasingly adopting cloud-based access control systems that enable secure, remote management of facilities and systems. This trend is expected to continue driving demand for flexible access control solutions. Moreover, continuous growth in commercial real estate, industrial facilities, and critical infrastructure projects in the U.S. requires access control systems for security and management, further contributing to market growth.

Europe Access Control Market Trends

The access control industry in Europe is expected to witness significant growth over the forecast period. Europe's strict data protection and privacy regulations, such as the General Data Protection Regulation (GDPR), are driving businesses to adopt compliant access control systems that can ensure the secure management of personal data. Additionally, numerous industries such as finance, healthcare, and defense face sector-specific regulations that require access control protocols. Moreover, with rising concerns about terrorism, crime, and workplace violence, there is a heightened demand for access control solutions across Europe.

Asia Pacific Access Control Market Trends

The access control industry in the Asia Pacific region is anticipated to register the highest CAGR over the forecast period. The Asia-Pacific region is witnessing extensive urbanization, leading to the development of smart cities and modern infrastructure projects. Governments and private sectors are investing heavily in access control systems to enhance security in new commercial buildings, residential complexes, transportation hubs, and public spaces. Furthermore, rapid industrialization in developing countries such as China, India, and Southeast Asian nations is fueling the need for access control systems.

China access control market dominated the regional market in 2024 driven by rapid urbanization, smart city development, and the need for security in large commercial and industrial sectors. The government's focus on enhancing security infrastructure and the increasing adoption of IoT-based solutions further contributed to this dominance. In addition, China's significant investment in technological advancements and its large consumer base create a favorable environment for access control solutions. For instance, in February 2024, Hangzhou Hikvision Digital Technology Co., Ltd. introduced its second-generation professional access control products, featuring enhanced web management, flexible authentication, and advanced access applications, marking a substantial advancement in access management.

Key Access Control Company Insights

Key access control companies include Allegion, ASSA ABLOY, and Axis Communications AB.

-

Allegion specializes in the development of innovative products that enhance safety and convenience. The company provides a comprehensive range of electronic locks, keyless entry systems, and advanced access control technologies tailored for residential, commercial, and institutional applications. Allegion's focus on integrating IoT and smart technologies into its offerings has positioned it as a key player in modernizing access management systems.

-

ASSA ABLOY is a world-renowned provider of access control and security solutions, offering a diverse portfolio that includes electronic locks, biometric systems, and cloud-based access management platforms. The company caters to various sectors such as commercial buildings, healthcare, and education, emphasizing sustainability and cutting-edge technology. Through continuous innovation and acquisitions, ASSA ABLOY has established itself as a leader in delivering comprehensive and scalable access control solutions.

Key Access Control Companies:

The following are the leading companies in the access control market. These companies collectively hold the largest market share and dictate industry trends.

- Allegion

- ASSA ABLOY

- Axis Communications AB

- Bosch Sicherheitssysteme GmbH

- dormakaba Group

- Honeywell International Inc.

- Identiv, Inc.

- Johnson Controls Inc.

- Nedap N.V.

- Siemens

Recent Developments

-

In April 2025, Rently and ASSA ABLOY announced a strategic partnership to launch the Smart Bolt Elite, a cutting-edge smart lock tailored for the rental housing sector. This device integrates Rently's expertise in leasing automation and smart home technology with ASSA ABLOY's advanced SmartKey Security re-keying solution.

-

In March 2025, Johnson Controls, a provider of smart, healthy, and sustainable building solutions, unveiled a series of enhancements to its Access Control And Video Surveillance (ACVS) offerings. These upgrades are designed to integrate with existing security systems, thereby improving the management of critical security operations and providing comprehensive protection for people, buildings, and assets.

-

In January 2025, dormakaba Group, announced the expansion of its partnership with technology company Rohde & Schwarz from the airport sector to the critical infrastructure domain. The two companies have developed an innovative automated personnel screening solution designed to enhance security checks while increasing capacity and efficiency.

-

In June 2024, Control iD, an access control system provider, partnered with Paravision, an AI software provider, and launched its new product, the iDFace Max, using facial identification technology. Key features of iDFace Max include advanced facial identification, design and connectivity, and embedded web software.

-

In June 2024, Carrier Global Corporation, an intelligent climate and energy solutions provider, announced the sale of its security division, Global access solutions, to Honeywell International Inc. It has been finalized with the transaction valued at USD 4.95 billion in enterprise value

Access Control Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 11.56 billion

Revenue forecast in 2030

USD 17.30 billion

Growth rate

CAGR of 8.4% from 2025 to 2030

Historical data

2017 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Offering, type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

Allegion; ASSA ABLOY; Axis Communications AB; Bosch Sicherheitssysteme GmbH; dormakaba Group; Honeywell International Inc.; Identiv, Inc.; Johnson Controls Inc.; Nedap N.V.; Siemens

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Access Control Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global access control market report based on the offering, type, end-use, and region:

-

Offering Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Software

-

Services

-

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Discretionary Access Control (DAC)

-

Mandatory Access Control (MAC)

-

Role-Based Access Control (RBAC)

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Business & Enterprise Environments

-

Financial Institutions

-

Hospitality & Entertainment

-

Retail & Customer-Facing

-

Government & Public Services

-

Residential

-

Education & Research

-

Healthcare & Life Sciences

-

Energy & Utility Infrastructure

-

Transportation & Logistics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the access control market include Allegion; ASSA ABLOY; Axis Communications AB; Bosch Sicherheitssysteme GmbH; dormakaba Group; Honeywell International Inc.; Identiv, Inc.; Johnson Controls Inc.; Nedap N.V.; and Siemens.

b. Numerous factors such as growth in urbanization and smart city projects, increasing security concerns, adoption of IoT and cloud-based solutions, and shift to biometric and multi-factor authentication are driving the growth of the access control market.

b. The global access control market size was estimated at USD 10.76 billion in 2024 and is expected to reach USD 11.56 billion in 2025.

b. The global access control market is expected to grow at a compound annual growth rate of 8.4% from 2025 to 2030 to reach USD 17.30 billion by 2030.

b. North America dominated the access control market with a share of 32.9% in 2024. Increasing concerns over workplace violence, school shootings, and general crime in public and private spaces are driving demand for access control solutions to enhance safety in this region. Moreover, AI and machine learning are being incorporated into access control systems to enhance security, with capabilities such as real-time threat detection, predictive analytics, and automated decision-making.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.