- Home

- »

- Digital Media

- »

-

Action Camera Market Size & Share, Industry Report, 2033GVR Report cover

![Action Camera Market Size, Share & Trends Report]()

Action Camera Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Box Style, 360-degree, Cube Style, Bullet Style), By Resolution (HD & Full HD, Ultra HD, 4K And Above), By Distribution Channel, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-067-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Action Camera Market Summary

The global action camera market size was estimated at USD 7,272.0 million in 2025 and is projected to reach USD 18,044.1 million by 2033, growing at a CAGR of 12.1% from 2026 to 2033. This market expansion is primarily driven by the rising consumer demand for ultra-high-definition video recording, particularly 4K and 8K resolutions, continuous advancements in electronic and AI-based image stabilization, and increasing preference for rugged, waterproof, and shock-resistant camera designs, which are supporting adoption across extreme outdoor environments.

Key Market Trends & Insights

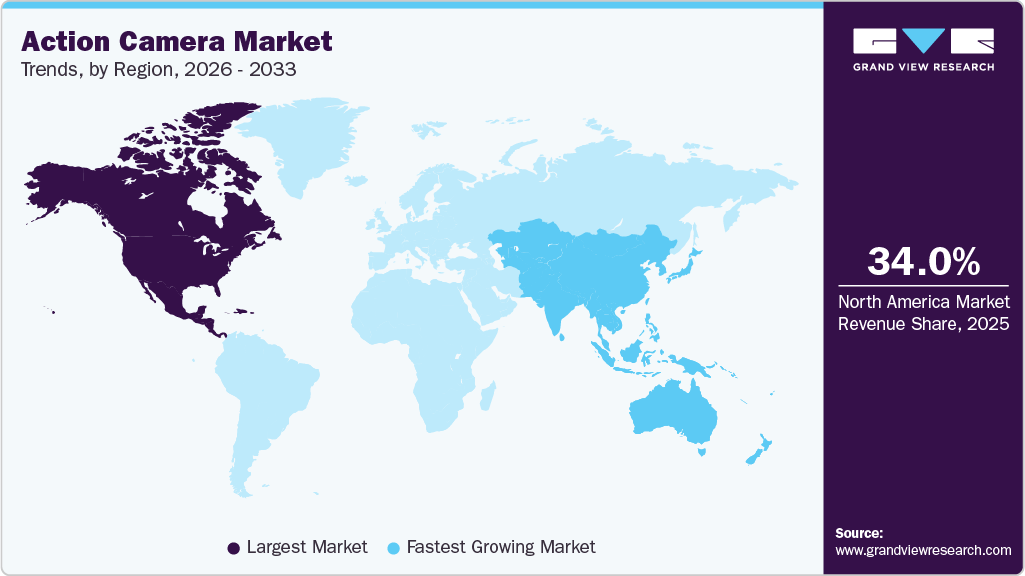

- North America dominated the global action camera market with the largest revenue share of over 34% in 2025.

- The action camera market in U.S. led the North America market and held the largest revenue share in 2025.

- By product, the box style camera segment led the market and held the largest revenue share of over 44% in 2025.

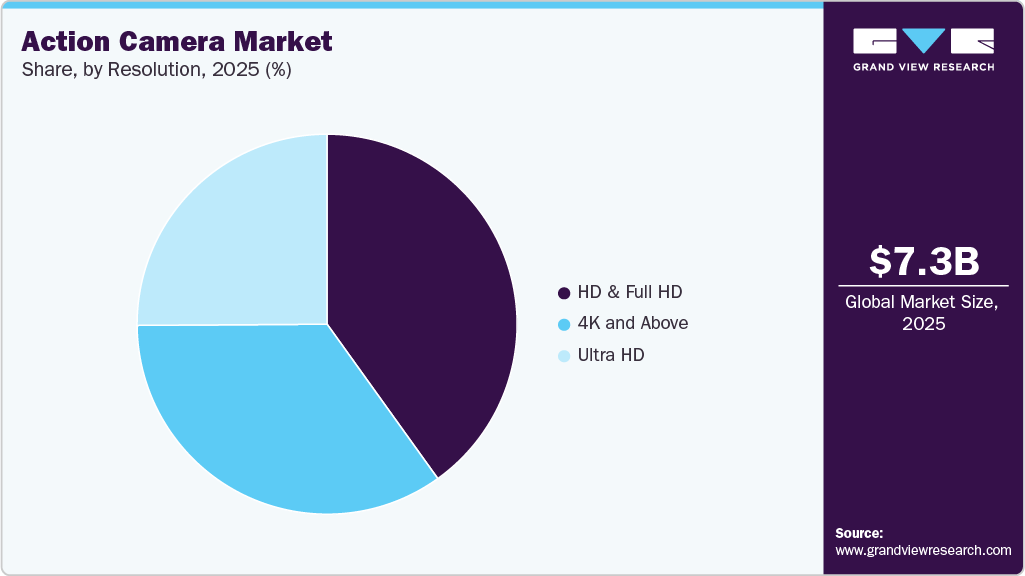

- By resolution, the HD and full HD segment led the market and held the largest revenue share of over 40% in 2025.

- By distribution channel, the e-commerce segment led the market and held the largest revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 7,272.0 Million

- 2033 Projected Market Size: USD 18,044.1 Million

- CAGR (2026-2033): 12.1%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Action camera market growth is driven by recent innovations in camera technology, including 4K/8K video capability, image stabilization, and compact design, have attracted consumers looking for high-performance and portable cameras. The device leverages an advanced nigh-specific lens that allows light intake of more than two times that available in other cameras. There has been substantial growth in the number of companies launching these products on both regional and global levels, enabling competitive pricing strategies that have helped in steadily expanding the user base.The growing global emphasis on fitness, wellness, and active lifestyles is significantly driving the growth of the action camera industry. Consumers are increasingly engaging in workouts, outdoor recreation, and adventure-based activities, creating strong demand for compact, durable cameras capable of capturing high-quality footage in dynamic environments. The rising popularity of extreme sports such as bungee jumping, rock climbing, mountain biking, and water sports, along with their expanding global viewership, has further accelerated adoption. Action cameras, which can be mounted on helmets or chests to deliver immersive first-person perspectives, enhance audience engagement and content authenticity, positioning these devices as essential tools for athletes and adventure enthusiasts.

In addition, the rapid expansion of influencer culture and social media–driven content creation is emerging as a growth driver for the action camera market. Influencers and content creators increasingly rely on action cameras to produce visually compelling footage during travel, outdoor adventures, and lifestyle activities. Their ability to demonstrate real-world performance, durability, and creative capabilities through vlogs, tutorials, unboxing videos, and reviews significantly influences consumer purchasing decisions. This peer-driven marketing ecosystem is amplifying product visibility and accelerating adoption across younger demographics and digitally native consumers.

Furthermore, intensifying market competition is compelling for manufacturers to invest heavily in technological innovation and strategic partnerships, strengthening the value proposition of action cameras. The integration of advanced stabilization technologies, such as electronic image stabilization, enables smooth footage even in high-motion scenarios, while next-generation sensor technologies enhance low-light performance and image clarity. Growing demand for real-time content sharing has also driven the incorporation of live-streaming features compatible with major social media platforms. As recording quality continues to improve and file sizes increase, brands are increasingly offering cloud-based storage and backup services, improving user convenience and reinforcing long-term ecosystem engagement, thereby sustaining market growth.

Product Insights

The box style camera segment accounted for the largest market share of over 44% in 2025, driven by the rugged form factor, modular mounting capability, and superior image stabilization performance. These cameras are widely preferred for adventure sports, vlogging, and professional content creation, as they accommodate larger sensors and advanced cooling systems. Increasing adoption of wearable cameras in motor sports and extreme environments drives this segment. The ability to integrate external accessories such as microphones and lighting further enhances usability in the action camera market.

The 360-degree camera segment is expected to witness the fastest CAGR of 13.6% from 2026 to 2033. The growth is driven by immersive content creation, virtual reality compatibility, and advanced stitching software. These cameras enable users to capture complete environments, allowing post-production framing flexibility and enhanced storytelling. Rising demand from travel vloggers, sports broadcasters, and real estate content creators accelerates adoption. The innovative push in the action camera market toward immersive capture technologies, fueling segment growth.

Distribution Channel Insights

The e-commerce segment accounted for the largest market share in 2025, owing to the rapid adoption of e-commerce channels, direct-to-consumer sales models, and the expansion of digital storefronts. Online platforms allow brands to showcase detailed product specifications, real-world footage, and bundled accessories, influencing purchase decisions. Rising influencer marketing and social media integration further amplify online conversions. These trends underscore the e-commerce segment as a dominant growth channel in the action camera industry.

The brick-and-mortar stores segment is expected to witness a significant CAGR from 2026 to 2033, driven by consumer preference for hands-on product evaluation in physical stores, enabling customers to assess build quality, mounting options, and image output before purchase. In-store demonstrations and expert assistance bolster premium product positioning, while retail outlets ensure immediate availability and seamless after-sales service access. These drives sustained relevance for professional and first-time buyers, sustaining trust-based purchasing in the action camera market.

Application Insights

The sports and adventure segment accounted for the largest market share in 2025, driven by rising participation in extreme and outdoor activities, need for rugged, waterproof cameras with advanced stabilization and high frame rates. Wearable mounting systems enable hands-free capture in dynamic conditions. Social media sharing of action footage further boosts adoption among enthusiasts, thereby fueling demand through targeted bundles and subscriptions in the action camera market.

The automotive segment is expected to witness the fastest CAGR from 2026 to 2033. The increasing use of motor sports, track days, and vehicle-based content creation drives the growth. Action cameras offer superior vibration handling and stabilization compared to traditional dashcams. Integration with GPS and telemetry enhances driving analytics. Action cameras are gaining traction in vehicles to boost safety, offer accident-proof, and capture journeys, thereby fueling the segmental growth in the market.

Resolution Insights

The HD and full HD segment accounted for the largest market share of over 40% in 2025, owing to the affordability, lower storage requirements, and extended battery life. These cameras cater to entry-level users, educational institutions, and casual recreational recording. Their compatibility with older devices and faster file transfer speeds support sustained demand. This segment benefits from emerging markets where cost sensitivity remains high. Manufacturers continue to enhance color accuracy and stabilization even at lower resolutions, thereby driving the growth in the action camera industry.

The 4K and higher resolutions segment is expected to witness the fastest CAGR from 2026 to 2033. The growth is driven by cinematic content demand and platform requirements, with professionals and enthusiasts demanding the highest possible video and image quality. High-resolution recording enables advanced stabilization, slow-motion capture, and detailed frame extraction. The rising demand for high-resolution content in professional filmmaking and the growing adoption of 4K displays and televisions are the key drivers expected to propel the segmental growth in the market.

Regional Insights

North America action camera market dominated the respective global market with a share of over 34% in 2025, owing to the rising consumer interest in outdoor recreational activities drives demand for action cameras across the region, supported by extensive national park networks and adventure tourism. Integration of advanced AI features, such as real-time object tracking and stabilization, meets the needs of content creators producing high-quality footage for social media platforms. Adoption of 5G connectivity enables seamless live streaming and instant sharing, aligning with digital lifestyle trends that are driving the growth opportunities in the North America region.

U.S. Action Camera Market Trends

The U.S. action camera market dominated with a share of over 72% in 2025, driven using cameras with drone integration for aerial videography in filmmaking and real estate surveying, and an increase in extreme conditions and weather. Technological advancements in 4K video resolution and image stabilization from leading manufacturers enhance product adoption among substandard and professional users, thereby sustaining the U.S. market’s position in the action camera industry.

Europe Action Camera Market Trends

Europe action camera is expected to grow at a CAGR of 11.4% from 2026 to 2033. The market growth is driven by the increasing adoption of action cameras for outdoor recreation, sports, and surveillance, with key trends including the growing popularity of 360-degree cameras and underwater cameras, as well as the rise of smart cameras with advanced features such as Wi-Fi connectivity, GPS, and image stabilization. Furthermore, the expanding use of action cameras in professional sectors, such as filmmaking and sports broadcasting, is contributing significantly to market growth.

The UK action camera market is expected to grow significantly in the coming years, driven by the growing use of these devices for vlogging and social media, with consumers showing strong interest in compact, high-definition models. Outdoor and adventure activities such as fell running, coasteering, and motocross further stimulate demand for weather-resistant and high-durability cameras. In addition, cycling and commuter activities are supporting demand for action cameras used in safety recording and route monitoring. These factors support the growth of the action camera market.

Action camera market in Germany is propelled by its strong outdoor culture and leadership in adventure tourism and motorsports. German consumers and brands are increasingly integrating rugged action cameras with automotive dashcams, drone mounts, and 4K/8K stabilization tech to capture extreme sports and travel footage. Germany’s focus on high-performance imaging, digital content ecosystems, and enthusiast communities continues to reinforce its pivotal role in the action camera industry.

Asia Pacific Action Camera Market Trends

Action camera market in APAC is expected to register the fastest CAGR of 13.4% from 2026 to 2033. The region experiences strong expansion fueled by surging interest in adventure sports across nations. Manufacturers prioritize affordable models packed with advanced features to address price-conscious consumers. Social media influencers and content producers amplify growth by showcasing action cameras for compelling video creation. Firms strengthen their regional footprint through local alliances and customized offerings, including multilingual interfaces and culturally tailored accessories.

The Japan action camera market is gaining traction owing to its strong investments in research and development, enabling companies to introduce advanced products and refine existing technologies. Continuous innovation helps manufacturers stand out by offering high-performance and feature-rich solutions that appeal to technology-focused consumers. Integration with analytics and motion-tracking software is also gaining traction in professional and training environments.

Action camera market in China is rapidly expanding over the forecast period. The market growth is supported by the rapid expansion of e-commerce and the growing adoption of live streaming among content creators. Strong momentum in digitalization and online content production, supported by platforms such as TikTok and Instagram, continues to stimulate demand for action cameras. Manufacturers are capitalizing on established domestic brand awareness and advanced imaging capabilities to launch high-resolution models. These factors together are contributing to sustained market growth.

Key Action Camera Company Insights

Some of the key players operating in the market are GoPro Inc. and Sony Group Corporation, among others.

-

GoPro Inc. is a leading player in the action camera market, known for pioneering rugged, high-performance cameras designed for adventure sports, outdoor activities, and content creation. The company focuses on advanced image stabilization, high-resolution video capture, waterproof designs, and seamless ecosystem integration through mobile apps and cloud-based subscription services. GoPro’s strong brand recognition, continuous product innovation, and deep penetration among athletes, influencers, and professionals position it as a dominant force driving market growth.

-

Sony Group Corporation is a key player in the action camera market, leveraging its expertise in imaging sensors, optics, and video processing technologies. Sony’s action cameras emphasize superior image quality, advanced low-light performance, and electronic stabilization, supported by the company’s vertically integrated sensor manufacturing capabilities. Its strong presence across consumer electronics, professional imaging, and content creation ecosystems enables Sony to deliver premium solutions that cater to both enthusiasts and experienced users.

ARASHI VISION INC. (Insta360) and AKASO Tech LLC are some of the emerging market participants in the action camera market.

-

ARASHI VISION INC. (Insta360) is an emerging player rapidly gaining traction in the action camera market through its focus on 360-degree cameras and immersive content creation solutions. The company emphasizes AI-powered editing, FlowState stabilization, and modular camera designs that simplify content production for creators and social media users. Insta360’s innovation-driven strategy and strong appeal among vloggers, travelers, and adventure enthusiasts are enabling it to expand its global footprint and challenge established brands.

-

AKASO Tech LLC is an emerging player in the action camera industry, primarily targeting cost-conscious consumers with feature-rich and affordable action camera solutions. The company focuses on delivering 4K recording, electronic image stabilization, waterproof designs, and accessory-rich packages at competitive price points. AKASO’s value-driven approach and expanding online distribution channels are helping it gain visibility and adoption among entry-level users and recreational outdoor enthusiasts.

Key Action Camera Companies:

The following are the leading companies in the action camera market. These companies collectively hold the largest market share and dictate industry trends.

- AKASO Tech LLC

- Arashi Vision Inc. (Insta360)

- Drift Innovation

- Procus

- GoPro Inc.

- Midland Europe S.r.l.

- OCLU

- Rollei GmbH & Co. KG

- SJCAM

- Sony Electronics, Inc.

- SZ DJI Technology Co., Ltd.

- Veho Technologies

- YI Technologies, Inc.

Recent Developments

-

In November 2025, Arashi Vision Inc. (Insta360) entered a strategic partnership with Leica Camera AG, deepening cooperation on optical engineering and lens development to enhance future generations of AI-powered action and 360° cameras, including imaging innovations seen in the Ace Pro 2 lineup. This alliance elevates Insta360's premium imaging capabilities, solidifying its competitive edge in the action camera market.

-

In October 2025, SZ DJI Technology Co., Ltd. announced the DJI Osmo Action 6, a next-generation action camera with a 1-inch sensor, support for 8K video at 30 fps, enhanced stabilization, waterproofing, and extended battery life, marking a significant upgrade in its action camera portfolio. This launch strengthens DJI's dominance in the action camera segment, driving e-commerce sales through superior specs tailored for professional adventurers and content creators.

-

In September 2025, GoPro Inc. launched GoPro Max2, a major upgrade to its 360° action camera lineup, offering True 8K 360° video at 30 fps, replaceable lenses, enhanced audio and stabilization, and a larger battery, thereby reinforcing its position in the immersive capture technology market for action cameras.

Action Camera Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 8,132.3 million

Revenue forecast in 2033

USD 18,044.1 million

Growth rate

CAGR of 12.1% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, volume, thousand units, and CAGR from 2026 to 2033

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, resolution, distribution channel, application, region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Austria; Belgium; Czech Republic; Denmark; Finland; France; Germany; Iceland; Ireland; Italy; Netherlands; Norway; Poland; Spain; Sweden; Switzerland; UK; Hungary; Romania; Portugal; Slovakia; Luxembourg; Croatia; Bulgaria; Greece; Ukraine; Australia; Hong Kong; China; India; Indonesia; Japan; Malaysia; New Zealand; Philippines; Singapore; South Korea; Taiwan; Thailand; Vietnam; Bangladesh; Kazakhstan; Pakistan; Uzbekistan; Brazil; Argentina; Chile; Colombia; Peru; Ecuador; Dominican Republic; Venezuela; Costa Rica; South Africa; Saudi Arabia; UAE; Kuwait; Turkey; Qatar; Nigeria; Morocco; Ethiopia; Egypt; Kenya; Angola; Oman; Israel; Algeria

Key companies profiled

AKASO Tech LLC; Arashi Vision Inc. (Insta360); Drift Innovation; Procus; GoPro Inc.; Midland Europe S.r.l.; OCLU; Rollei GmbH & Co. KG; SJCAM; Sony Electronics Inc.; SZ DJI Technology Co., Ltd.; Veho Technologies; YI Technologies, Inc.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet you exact research needs. Explore purchase options

Global Action Camera Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technological trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global action camera market report based on product, resolution, distribution channel, application, and region:

-

Product Outlook (Revenue, USD Million; Volume, Thousand Units, 2021 - 2033)

-

Box Style Camera

-

Cube Style Camera

-

Bullet Style Camera

-

360-degree Camera

-

Others

-

-

Resolution Outlook (Revenue, USD Million; Volume, Thousand Units, 2021 - 2033)

-

HD & Full HD

-

Ultra HD

-

4K and Above

-

-

Distribution Channel Outlook (Revenue, USD Million; Volume, Thousand Units, 2021 - 2033)

-

E-commerce

-

Brick and Mortar

-

-

Application Outlook (Revenue, USD Million; Volume, Thousand Units, 2021 - 2033)

-

Sports and Adventure

-

Travel and Tourism

-

Automotive

-

Emergency Services

-

Security

-

Others

-

-

Regional Outlook (Revenue, USD Million; Volume, Thousand Units, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Austria

-

Belgium

-

Czech Republic

-

Denmark

-

Finland

-

France

-

Germany

-

Iceland

-

Ireland

-

Italy

-

Netherlands

-

Norway

-

Poland

-

Spain

-

Sweden

-

Switzerland

-

UK

-

Hungary

-

Romania

-

Portugal

-

Slovakia

-

Luxembourg

-

Croatia

-

Bulgaria

-

Greece

-

Ukraine

-

-

Asia Pacific

-

Australia

-

Hong Kong

-

China

-

India

-

Indonesia

-

Japan

-

Malaysia

-

New Zealand

-

Philippines

-

Singapore

-

South Korea

-

Taiwan

-

Thailand

-

Vietnam

-

Bangladesh

-

Kazakhstan

-

Pakistan

-

Uzbekistan

-

-

Latin America

-

Brazil

-

Argentina

-

Chile

-

Colombia

-

Peru

-

Ecuador

-

Dominican Republic

-

Venezuela

-

Costa Rica

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Turkey

-

Qatar

-

Nigeria

-

Morocco

-

Ethiopia

-

Egypt

-

Kenya

-

Angola

-

Oman

-

Israel

-

Algeria

-

-

Frequently Asked Questions About This Report

b. The global action camera market size was estimated at USD 7,272.0 million in 2025 and is expected to reach USD 8,132.3 million in 2026.

b. The global action camera market is expected to grow at a compound annual growth rate of 12.1% from 2026 to 2033 to reach USD 18,044.1 million by 2033.

b. North America action camera dominated the market with a share of over 34% in 2025, owing to the rising consumer interest in outdoor recreational activities that drives demand for action cameras across the region, supported by extensive national park networks and adventure tourism. Integration of advanced AI features, such as real-time object tracking and stabilization, meets the needs of content creators producing high-quality footage for social media platforms. Adoption of 5G connectivity enables seamless live streaming and instant sharing, aligning with digital lifestyle trends that are driving the growth opportunities in the North America region.

b. Some key players operating in the action camera market include AKASO Tech LLC, Arashi Vision Inc. (Insta360), Drift Innovation, Procus, GoPro Inc., Midland Europe S.r.l., OCLU, Rollei GmbH & Co. KG, SJCAM, Sony Electronics, Inc., SZ DJI Technology Co., Ltd., Veho Technologies, YI Technologies, Inc.

b. Key factors that are driving the market growth include the rising consumer demand for ultra-high-definition video recording, particularly 4K and 8K resolutions, continuous advancements in electronic and AI-based image stabilization, and increasing preference for rugged, waterproof, and shock-resistant camera designs, which are supporting adoption across extreme outdoor environments.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.