- Home

- »

- Next Generation Technologies

- »

-

Active Optical Cable Market Size, Industry Report, 2030GVR Report cover

![Active Optical Cable Market Size, Share & Trends Report]()

Active Optical Cable Market (2024 - 2030) Size, Share & Trends Analysis Report By Form Factor (QSFR, SFP), By Application (High-performance Computing (HPC), Consumer Electronics), By Protocol, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-343-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Active Optical Cable Market Summary

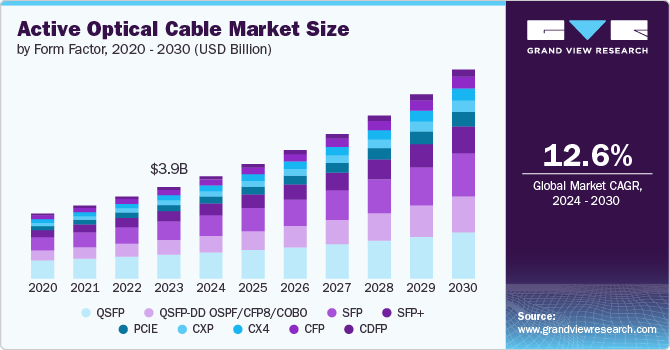

The global active optical cable market size was estimated at USD 3.97 billion in 2023 and is projected to reach USD 9.07 billion by 2030, growing at a CAGR 12.6% from 2024 to 2030. The higher reliability of active optical cables compared to traditional copper cables, along with the widespread adoption of cloud-based services, is driving market growth during the forecast period.

Key Market Trends & Insights

- The North America accounted for a significant share of the active optical cable market and accounted for a 37.39% share in 2023.

- Based on form factor, the QSFP segment led the market, accounting for 25.45% of the global revenue in 2023.

- Based on protocol, the infiniBand segment accounted for the largest market revenue share in 2023.

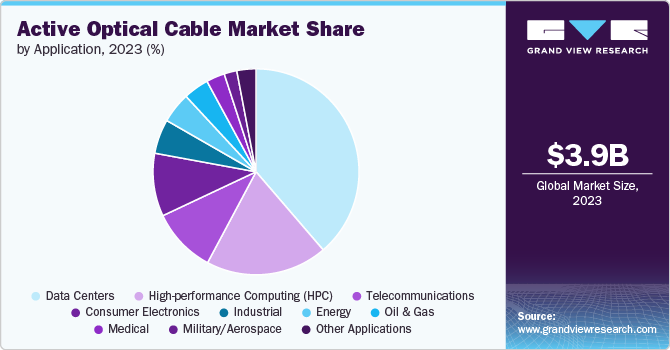

- Based on application, data centers dominated the market, accounting for the highest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 3.97 Billion

- 2030 Projected Market Size: USD 9.07 Billion

- CAGR (2024 to 2030): 12.6%

- North America: Largest market in 2023

In addition, factors such as digitalization and the rollout of 5G networks present significant growth opportunities for the market. The superior reliability of active optical cables over traditional copper cables, combined with the extensive adoption of cloud-based services, is propelling market growth during the forecast period. Furthermore, digitalization and the rollout of 5G networks offer significant growth opportunities for the market. Moreover, the widespread adoption of 4K and 8K Video Technologies is fueling the market growth. 4K and 8K video technologies have become prevalent in industries like medical imaging, gaming, broadcasting, and digital signage, leading to a substantial rise in the demand for high data rates and extended transmission distances. To meet these needs, Active optical cables have become essential solutions. These progressed optical interconnects offer seamless and reliable transmission of high-resolution video signals over long distances, ensuring the quality and integrity of the video content.

Form Factor Insights

The QSFP segment led the market, accounting for 25.45% of the global revenue in 2023. This growth is driven by several factors, including the use of QSFP modules, which are high-density transceivers employed in networking and data communication applications. They provide a compact and efficient solution for high-speed data transmission, typically over fiber optic cables. Commonly used in data centers, telecommunications, and high-performance computing environments, these modules feature four independent transmit and receive channels, enabling data rates of up to 40 Gbps (Gigabits per second). Their escalated ability makes QSFP modules especially valuable for bandwidth-intensive tasks such as large-scale data transfers, high-definition video streaming, and cloud computing. Moreover, the rapid adoption of cloud services, the rollout of 5G networks, and ongoing digital transformation across industries further boost the demand for QSFP-based Active optical cables. These factors ensure that QSFP modules continue to play a significant role in the development of high-speed data communication.

The SFP+ segment is estimated to grow significantly over the forecast period. The adoption of SFP+ (Small Form-factor Pluggable Plus) technology in Active Optical Cables (AOC) is showing significant growth and popularity in high-speed networking applications. This growth is attributed to expanding traction to their ability to provide high-speed 10Gbps connectivity over longer distances compared to traditional copper cables. This makes them ideal for data center and enterprise network applications requiring high bandwidth and low latency. Moreover, the growth of SFP+ in Active Optical Cables reflects the increasing demand for high-speed, reliable, and cost-effective connectivity solutions in modern data centers and enterprise networks. As data rates continue to increase and network architectures evolve, the adoption of SFP+ Active optical cables will likely continue its upward trend.

Protocol Insights

The InfiniBand segment accounted for the largest market revenue share in 2023. The growth of InfiniBand in active optical cables is driven by the increasing demand for high-speed, low-latency connectivity in data centers, cloud computing, and supercomputing environments. InfiniBand Active optical cables are now supporting data rates up to 200Gbps HDR (High Data Rate), enabling high-speed data transfer for high-performance computing applications. These cables offer superior performance compared to traditional copper cables, including higher speeds, lower latency, and improved signal integrity over longer distances. InfiniBand Active optical cables are designed to work seamlessly with major networking equipment, facilitating easy integration into existing infrastructure. InfiniBand Active optical cables are particularly valuable in data center environments, enabling high-speed connections between switches, servers, and storage systems, and allowing for more flexible and scalable network designs. As the demand for high-performance computing and data-intensive applications continues to rise, the growth potential for InfiniBand Active optical cables remains strong, particularly in sectors requiring cutting-edge connectivity solutions.

The HDMI segment is predicted to foresee significant growth in the forecast period. Significant market share is driven by the increasing demand for high-definition video and audio streaming services, gaming activities, and immersive virtual reality experiences, all requiring high-speed data transfer and connectivity. HDMI connectors are particularly popular because they transmit audio and video signals through a single cable, simplifying connections for consumer electronics like HDTVs, gaming consoles, Blu-ray players, and home theater systems. The HDMI segment is expected to continue its strong growth trajectory, with a projected CAGR of 18.65% during the forecast period. This growth is fueled by the rising adoption of 4K and 8K TV sets, the increasing popularity of online gaming and streaming services, and the growing demand for VR/AR applications.

Application Insights

Data centers dominated the market, accounting for the highest revenue share in 2023. The increasing adoption of cloud-based services fuels this growth, reliance on high-performance computing (HPC) and AI architectures, and the need for high-speed data transfer and low latency. Active optical cables offer superior reliability compared to traditional copper cables, providing higher-speed data communication, lightweight design, and resistance to electromagnetic interference (EMI). They support data transmission speeds of 100 Gbps or more, meeting the growing demands for fast data transfers in data centers. In addition, Active optical cables are designed to be compatible with widely available sockets, allowing for easy integration into existing infrastructure. They also contribute to improved energy efficiency, critical for reducing power consumption and operational costs.

Military/aerospace is projected to grow significantly over the forecast period. The military and aerospace sectors are witnessing substantial growth in adopting AOC, driven by the increasing demand for high-speed, reliable, and secure communication systems. This trend is part of a broader expansion in the use of fiber optic cables in these industries, with the global market for military and aerospace applications projected to grow significantly from 2024 to 2030. The growth is fueled by several factors, including increased data transmission needs for real-time processing and advanced sensor systems, the superior performance of Active optical cables compared to traditional copper cables, weight reduction benefits crucial for aerospace applications, improved reliability in harsh environments, and enhanced security against signal interception.

Regional Insights

North America accounted for a significant share of the active optical cable market and accounted for a 37.39% share in 2023. This is driven by the increasing demand for high-speed data transmission and connectivity solutions across various applications. Data centers are a major driver of AOC adoption in the region, as these cables enable high-speed connections between servers, switches, and storage systems. This region is at the forefront of adopting new technologies like 4K/8K video, cloud computing, and 5G networks, all of which require the high-bandwidth capabilities of Active optical cables. Major technology companies and network equipment manufacturers in North America are key players in the AOC market, both as suppliers and consumers of these products.

U.S. Active Optical Cable Market Trends

The active optical cable market in the U.S. is experiencing significant growth, driven by the increasing adoption of cloud computing and the need for high-speed data transmission in data centers, which are major drivers of AOC growth in the country. The rise of 4K/8K video, online gaming, streaming services, and virtual reality applications also fuel the demand for active optical cables in consumer electronics in the U.S.

Europe Active Optical Cable Market Trends

The active optical cable market in Europe is poised for significant growth, driven by several key factors. The increasing demand for high-speed data transmission in various sectors, such as data centers, high-performance computing, and consumer electronics, is a major driver of this growth. In addition, the growing adoption of cloud-based services and applications is fueling the demand for high-speed connectivity solutions, which in turn is driving the growth of the market.

Asia Pacific Active Optical Cable Market Trends

The active optical cable market in Asia Pacific is experiencing significant growth driven by several key factors. Countries like China, India, and Japan invest heavily in 5G infrastructure, driving the demand for high-speed, low-latency connectivity solutions provided by Active optical cables. The growing number of internet users in APAC is fueling the demand for reliable and efficient communication networks, which Active optical cables are well-suited to provide.

Key Active Optical Cable Company Insights

Prominent firms have used product launches and developments, expansions, mergers and acquisitions, contracts, agreements, partnerships, and collaborations as their primary business strategy to increase their market share. The companies have used various techniques to enhance market penetration and boost their position in the competitive industry. For instance, in March 2023, Broadcom (US) unveiled BCM85812, a transceiver optimized for 800G DR8, 2x400G FR4, and 800G AOC module applications. It enables high-performance and efficient active optical cable solutions for hyper-scale data centers.

Key Active Optical Cable Companies:

The following are the leading companies in the active optical cable market. These companies collectively hold the largest market share and dictate industry trends.

- 3M

- Amphenol Communications Solutions

- Broadcom

- Corning Incorporated

- Dell Inc.

- Eaton

- EverPro Technology Co. Ltd.

- Molex

- Sumitomo Electric Industries Ltd.

- TE Connectivity

Recent Developments

-

In February 2024, Dell Technologies and Nokia announced their strategic partnership expansion. This collaboration utilizes Dell's infrastructure solutions and Nokia's private wireless connectivity to advance open network architectures in the telecom ecosystem and improve private 5G use cases for businesses.

-

In March 2024, MaxLinear, Inc. announced the demonstration of 800G half re-timed linear receive optics (LRO) optical modules and active optical cables (Active optical cables), utilizing Optomind’s patented optical assembly capabilities and MaxLinear’s Keystone Multimode 5nm 800G Tx-ONLY DSP with integrated VCSEL drivers.

Active Optical Cable Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.44 billion

Revenue forecast in 2030

USD 9.07 billion

Growth rate

CAGR of 12.6% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Form factor, application, protocol, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

3M; Amphenol Communications Solutions; Broadcom; Corning Incorporated; Dell Inc.; Eaton; EverPro Technology Co. Ltd.; Molex; Sumitomo Electric Industries Ltd.; TE Connectivity

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Active Optical Cable Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global active optical cable market report based on form factor, application, protocol, and region:

-

Form Factor Outlook (Revenue, USD Million, 2018 - 2030)

-

QSFP

-

QSFP-DD OSPF/CFP8/COBO

-

SFP

-

SFP+

-

PCIE

-

CXP

-

CX4

-

CFP

-

CDFP

-

Other

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Data Centers

-

High-performance Computing (HPC)

-

Consumer Electronics

-

Telecommunications

-

Industrial

-

Energy

-

Oil & Gas

-

Medical

-

Military/Aerospace

-

Other Applications

-

-

Protocol Outlook (Revenue, USD Million, 2018 - 2030)

-

InfiniBand

-

Ethernet

-

Serial Attached SCSI (SAS)

-

DisplayPort

-

PCI Express (PCIe)

-

HDMI

-

Thunderbolt

-

USB

-

MIPI

-

Fiber Channel

-

Other Protocols

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Kingdom of Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global active optical cable market size was estimated at USD 3.97 billion in 2023 and is expected to reach USD 4.44 billion in 2024.

b. The global active optical cable market is expected to grow at a compound annual growth rate of 12.6% from 2024 to 2030 to reach USD 9.07 billion by 2030.

b. North America dominated the active optical cable market with a share of 37.39% in 2023. The Active Optical Cable (AOC) market in North America is experiencing significant growth, driven by the increasing demand for high-speed data transmission and connectivity solutions across various applications.

b. Some key players operating in the active optical cable market include 3M, Amphenol Communications Solutions, Broadcom, Corning Incorporated, Dell Inc., Eaton, EverPro Technology Co. Ltd., Molex, Sumitomo Electric Industries Ltd., TE Connectivity.

b. Key factors that are driving the market growth include the superior reliability of AOCs over traditional copper cables, combined with the extensive adoption of cloud-based services, is propelling market growth during the forecast period. Furthermore, digitalization and the rollout of 5G networks offer significant growth opportunities for the active optical cable market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.