- Home

- »

- Medical Devices

- »

-

Adhesion Barrier Market Size, Share, Industry Report, 2033GVR Report cover

![Adhesion Barrier Market Size, Share & Trends Report]()

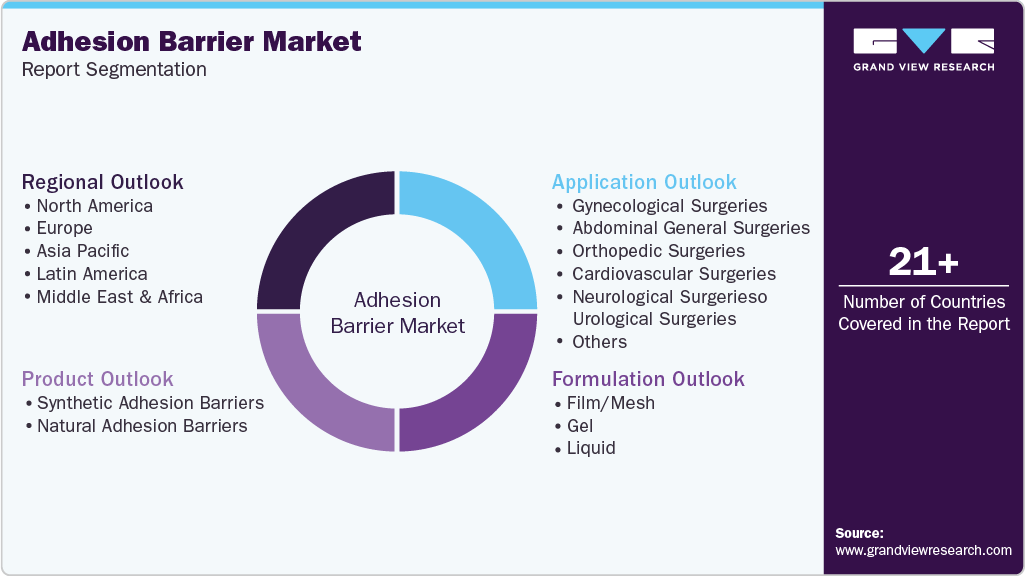

Adhesion Barrier Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Synthetic, Natural), By Formulation (Film/Mesh, Gel), By Application (Cardiovascular, Neurological Surgery), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-545-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Adhesion Barrier Market Summary

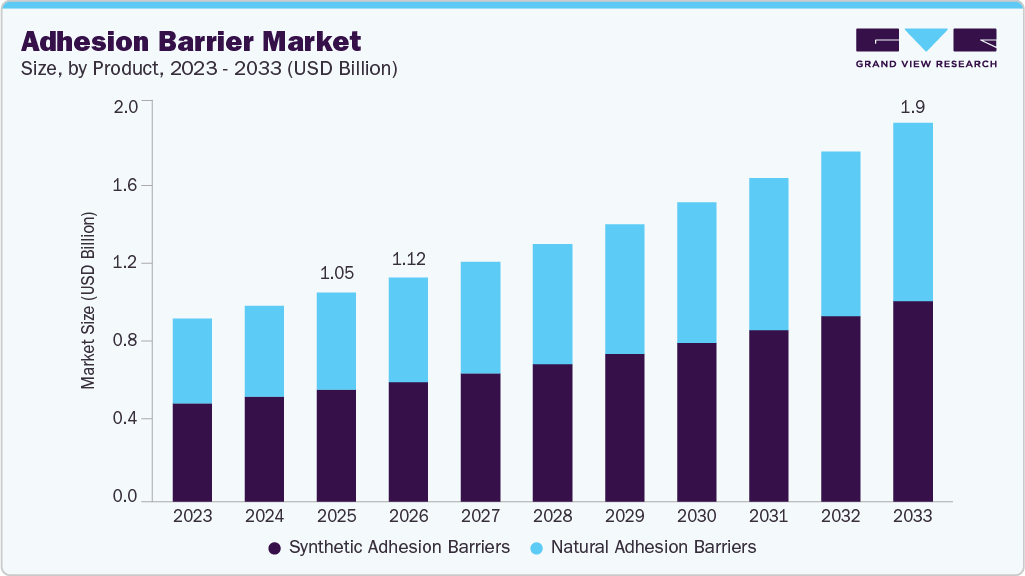

The global adhesion barrier market size was valued at USD 1.05 billion in 2025 and is projected to reach USD 1.90 billion by 2033, growing at a CAGR of 7.8% from 2026 to 2033. The key drivers of the market are the rising geriatric population, coupled with the increasing number of surgical procedures.

Key Market Trends & Insights

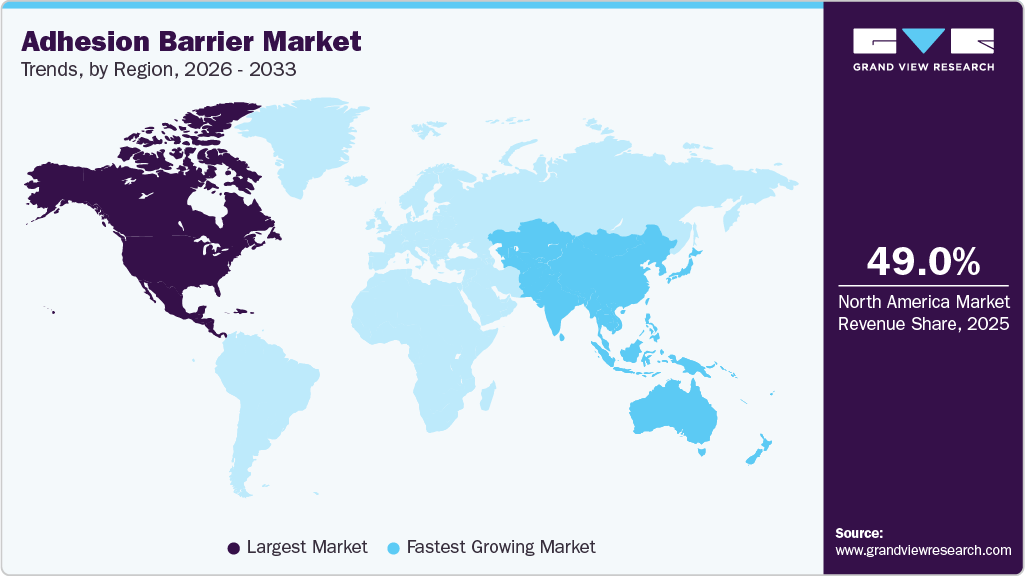

- The North America region held the largest revenue market share of 49.03% in 2025

- Based on product, synthetic adhesion barriers accounted for the largest market size in 2025.

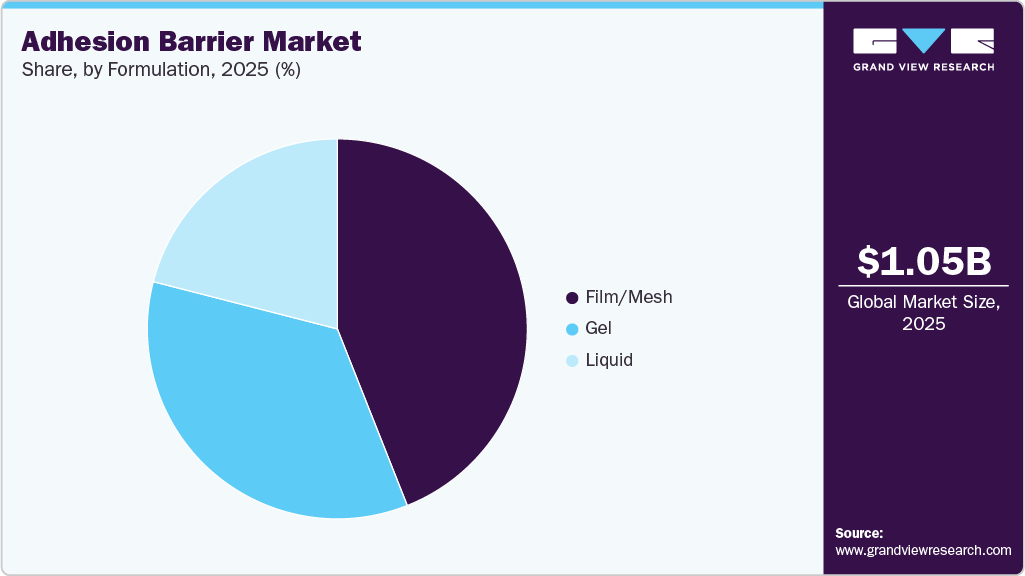

- Based on formulation, the film/mesh segment dominated the market and accounted for the largest market share in 2025.

- Based on application, the gynecological surgeries segment dominated the market in 2025.

Market Size & Forecast

- 2025 Market Size: USD 1.05 Billion

- 2033 Projected Market Size: USD 1.90 Billion

- CAGR (2026 to 2033): 7.8%

- North America: Largest market in 2025

- APAC: Fastest growing market

The surging frequency of invasive surgeries with a high risk of postoperative complications is anticipated to trigger market growth. However, with the rising risk of post-operation adhesion, the market is still witnessing barriers in terms of accessibility, lack of health education, and lack of awareness about the importance of treatment.

The adhesion barrier industry is expected to witness significant growth due to a few key factors. The improvement in healthcare infrastructure and the increasing availability of trauma care centers will drive the market forward. Additionally, the growing incidence of sports-related injuries is also expected to contribute to the growth of the market. Recent data from Stanford Children's Health shows that out of the approximately 30 million children who participate in some form of sports, over 10% experience injuries each year.

The global usage of adhesion barriers is anticipated to increase substantially over the forecast period, owing to the rising geriatric population, as they suffer from various diseases and injuries. According to estimates published by the WHO, the global elderly population is expected to increase from 841 million in 2014 to more than 2 billion in 2050. Elderly people are susceptible to respiratory diseases such as COPD and sleep apnea. For instance, according to the WHO, the prevalence of respiratory diseases is about 7.6% worldwide. Therefore, the growing geriatric population is expected to expand the patient pool for manufacturers and propel market growth.

The industry is witnessing growth due to several factors. Rising healthcare expenditure, along with increased FDA approval for various adhesion barrier products, is contributing to the market's expansion. In February 2023, Advanced Medical Solutions (AMS) acquired tissue adhesive specialist Connexicon Medical for around USD 7.5 million. The acquisition aims to strengthen AMS’s surgical wound care and adhesion barrier portfolio by integrating Connexicon’s technology and expertise into its global R&D and commercial operations, reinforcing AMS’s strategic objective of advancing leadership in innovative tissue-healing solutions.

The prevalence of diseases such as cancer, neurological disorders, gynecological disorders, ophthalmic disorders, and dental disorders is increasing year-on-year. The treatment of these disorders requires surgical procedures and microsurgery at certain times, increasing the demand for adhesion barriers. For instance, the prevalence of cancer is rising, as per the statistics published by the World Health Organization (WHO). Approximately 8.2 million die each year from cancer, which accounts for 13.0% deaths worldwide. Moreover, it is anticipated that there will be a 70.0% increase in the new cases of cancer over the next couple of decades, and over 100 types of cancer exist, which require unique therapy.

Product Insights

Based on product, the adhesion barrier market is segmented into synthetic and adhesion barrier and natural adhesion barriers. Synthetic adhesion barriers accounted for the largest market share of 53.6% in 2025, owing to the high bioresorbable and biocompatible properties. Synthetic adhesion barriers are cost-effective, which is expected to increase sales of the segment. Moreover, dominance of the segment is primarily attributed to the availability of commercial synthetic adhesion barriers. The segment is further divided into hyaluronic acid, regenerated cellulose, polyethylene glycol, and others. The hyaluronic acid segment dominates, owing to its capacity to attract and hold a vast amount of moisture.

The natural adhesion barrier segment also accounted for considerable market share in 2025 and is expected to grow at a lucrative rate during the forecast period. The segment is further divided into collagen & protein, and fibrin. The collagen & protein segment held the largest market size owing to its benefits, such as durability and safety. The fibrin segment is expected to grow at a rapid pace during the forecast period. The high growth rate of the fibrin segment is primarily attributed to the rising adoption of these products.

Application Insights

Based on applications, the market is segmented into gynecological surgeries, abdominal general surgeries, orthopedic surgeries, cardiovascular surgeries, neurological surgeries, urological surgeries, and others. The gynecological surgery segment held the largest market share in 2025 and is expected to maintain its dominance during the forecast period. Market dominance is primarily attributed to the rising number of gynecologic laparoscopy procedures. Furthermore, increasing the adoption of gel form and film form in various gynecological procedures, including endometriosis surgery, ovarian cystectomy, and ectopic pregnancy, is boosting market growth. Slow adoption of minimally invasive techniques in developing countries is expected to have a positive impact on the adoption of adhesion barriers. Minimally invasive surgeries require high-priced equipment such as cameras and robot-assisted devices. Adoption of these devices is expected to be moderate in developing countries because of price-sensitive customers.

Cardiovascular surgeries are expected to grow at the fastest CAGR of over 8.7% from 2026 to 2033. The rising incidence of heart-related diseases and the increasing use of adhesion barriers in cardiovascular surgeries are the main drivers for the advanced adhesion barrier market.

Formulation Insights

Based on formulation, the market is segmented into film/mesh, gel, and liquid. Film/mesh held the largest market share in 2025 with 44.1% and is expected to maintain its dominance during the forecast period. The large share of the segment is primarily attributed to its low cost and increasing use of film-form adhesion in various surgeries. In addition, much clinical evidence supports the efficiency and safety of this form of adhesion, thus adding fuel to the market growth.

Gel is expected to grow at the fastest rate during the forecast period. The high growth rate of the segment is primarily attributed to its advantages, such as affordability, resorbability, easy application, and safety. Moreover, increasing usage of gels in various surgeries, such as tendon, carpal tunnel, and joint or peripheral surgery, is expected to expand their applications in the upcoming years.

Regional Insights

North America currently accounts for the largest regional share, followed by Europe at roughly 30%, with Asia-Pacific identified as the fastest-growing region, outpacing the global average because of rapid expansion in China, India and Southeast Asia. Latin America and the Middle East & Africa remain smaller in absolute size but are consistently highlighted as emerging high-growth pockets due to increasing healthcare expenditure, expanding hospital infrastructure and rising adoption of anti‑adhesion products.

U.S. Adhesion Barrier Market Trends

The adhesion barrier market in the U.S. held the largest share of the North American region. Some factors responsible for its dominance are increasing awareness about the usage of adhesion barriers, the presence of key players in the country, and high disposable income. Johnson & Johnson, Baxter International, Integra LifeSciences, Anika Therapeutics, and FzioMed are some of the key players present in the market with huge market share. In addition, an increase in the number of orthopedic procedures related to sports injuries is anticipated to drive market growth.

Europe Adhesion Barrier Market Trends

The adhesion barrier market in Europe is driven by high disposable income owing to the presence of developed economies and the availability of well-established healthcare infrastructure & skilled professionals. Moreover, the presence of favorable reimbursement coverage has increased the affordability of various surgical procedures. As a result, Europe is expected to witness a lucrative growth in the market over the forecast period.

The UK adhesion barrier market is witnessing significant growth as the country has a universal healthcare system where the majority of the population is covered under free healthcare services offered by national healthcare centers. As a result, competition in the market is high as the government is the key customer for market players offering medical devices for sports injuries in the UK. On the other hand, free healthcare services offered by the government result in higher demand for advanced treatments due to an increase in affordability. Therefore, the presence of a large target population coupled with a favorable reimbursement structure boosts the market growth.

The Germany adhesion barrier market is expected to grow at a CAGR of 8.0% from 2026 to 2033. Germany has more advanced treatment options than other European countries, which is expected to fuel the sports medicine market. In addition, the increasing demand for various surgical procedures is also anticipated to drive growth.

Asia Pacific Adhesion Barrier Market Trends

The adhesive barrier market in Asia-Pacific is expected to grow at the fastest CAGR of 8.5% from 2026 to 2033 during the forecast period. The high growth rate in the region is primarily attributed to the rising geriatric population, increasing incidence of cardiac and neurosurgery which require surgical interventions. Moreover, rising private sector investment in healthcare and rapidly expanding medical tourism are expected to drive the growth of the adhesion barrier market in the region.

The Japan adhesion barrier market is witnessing growth due to the rising geriatric population in Japan is likely to drive the demand for adhesion barriers in this region over the forecast period. The aged population in Japan is prone to various diseases and disabilities, which may in turn propel themarket in this region. In addition, with the increasing healthcare spending, the adhesion barrier market is expected to register substantial growth in Japan over the forecast period.

The China adhesion barrier market is poised to be the fastest-growing region, projecting a CAGR of over 8.5% through 2033, primarily fueled by improvements in healthcare infrastructure and the availability of domestically produced solutions. China's medical device industry is experiencing significant expansion, driven by the availability of cost-effective resources and robust government support. By the end of 2023, the country had over 32,000 medical device manufacturers. By 2024, this number grew to over 33,000 enterprises, an increase of 27.8% compared to 2020. As a direct result of this and supportive state policies, the number of local medical device manufacturers, including specialized segments such as adhesion barrier manufacturers, is strongly anticipated to increase. The market

Latin America Adhesion Barrier Market Trends

The adhesion barrier market in Latin America is projected for significant expansion, driven by favorable economic conditions, strategic healthcare investment, and a flourishing medical tourism sector. The region's appeal for medical tourism, particularly in major economies like Mexico and Brazil, is a primary growth driver. The Latin America medical tourism market is projected to grow multifold over the next few years. The confluence of robust market growth, competitive pricing for advanced treatment options, and continuous government-backed improvement in healthcare quality positions Latin America as a rapidly growing hub, directly fueling the demand for complementary surgical products like adhesion barriers.

Brazil adhesion barrier market is identified as the largest in Latin America, and a principal driver of the region's adhesion barrier market growth. This is strongly supported by a thriving medical tourism sector, attracting patients from the U.S., Canada, and Europe who seek 50%–70% cost savings on high-complexity care. With a global reputation for surgical excellence, particularly in cosmetic surgery, bariatric, and cardiovascular treatments, all procedures with a high risk of post-operative adhesions, the significant volume of these surgeries in internationally accredited private hospitals directly ensures a high and sustained demand for sophisticated adhesion barriers, which are vital for mitigating complications like chronic pain and re-operation.

Middle East & Africa Adhesion Barrier Market Trends

The adhesion barrier market in the Middle East and Africa (MEA) is poised for considerable growth, with a CAGR of approximately 7.0% through 2033. This upward trend is fundamentally driven by robust healthcare investments in high-growth regional hubs, notably the UAE, Saudi Arabia, South Africa, Oman, and Egypt.

Another major contributing factor is the demographic shift. The geriatric population in the MEA region is growing rapidly, with the older population in South Africa alone expected to nearly double from 8% in 2022 to 15% by 2050, inherently leading to an increased number of surgical procedures for age-related conditions.

Key Adhesion Barrier Companies Insights

The global adhesion barrier market is characterized by intense competition among a core group of multinational medical device and pharmaceutical companies. To sustain and expand their market presence, these key players are executing strategies centered on product innovation, technological integration, strategic mergers and acquisitions (M&A), and fostering partnerships.

Baxter International, Inc. is a dominant force in the adhesion barrier market, primarily through its Advanced Surgery portfolio. The company cemented its leadership position in 2020 by acquiring the highly regarded Seprafilm Adhesion Barrier product line from Sanofi for $350 million.

Key Adhesion Barrier Companies:

The following are the leading companies in the adhesion barrier market. These companies collectively hold the largest Market share and dictate industry trends.

- Johnson & Johnson

- Baxter

- BD

- Integra Lifescience Holdings Corporation

- Anika Therapeutics

- Atrium Medical Corporation

- Fziomed, Inc.

- Sanofi

- PlantTec Medical GmbH

- Hangzhou Singclean Medical Products Co.,Ltd

Recent Developments

-

In August 2024, Integra launched a sprayable liquid adhesion barrier product in the U.S. market. This innovation is critical as liquid/gel barriers are preferred for minimally invasive (laparoscopic and robotic) surgeries due to their ease of application and ability to conform to complex anatomy, positioning Integra as a forward-looking competitor.

-

In January 2023, J&J announced the launch or expanded availability of Seprafilm Ultra (a next-generation version of the film barrier) in the United States. This highlights their commitment to enhancing performance and ease of use for their market-leading product.

Adhesion Barrier Market Report Scope

Report Attribute

Details

Market size in 2026

USD 1.12 billion

Revenue forecast in 2033

USD 1.90 billion

Growth rate

CAGR of 7.8% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, formulation, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark, Sweden, Norway, Netherlands, Greece; Russia; Poland; Switzerland; China; Japan; India; Australia; Thailand, South Korea; Singapore; Malaysia; Taiwan; New Zealand; Vietnam; Hong Kong; Brazil; Argentina; Colombia; Chile; South Africa; Saudi Arabia; UAE; Kuwait; Oman; Egypt

Key companies profiled

Johnson & Johnson; Baxter; BD; Integra Lifesciences Holdings Corporation; Anika Therapeutics; Atrium Medical Corporation; Fziomed, Inc.; Sanofi; PlantTec Medical GmbH; Hangzhou Singclean Medical Products Co.,Ltd

Customization scope

Free report customization (equivalent to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Adhesion Barrier Market Report Segmentation

This report forecasts revenue growth at global, regional, & country levels as well as provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global adhesion barrier market report on the basis of product, formulation, application, and region.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Synthetic Adhesion Barriers

-

Hyaluronic acid

-

Regenerated cellulose

-

Polyethylene glycol

-

Others

-

-

Natural Adhesion Barriers

-

Collagen & Protein

-

Fibrin

-

-

-

Formulation Outlook (Revenue, USD Million, 2021 - 2033)

-

Film/Mesh

-

Gel

-

Liquid

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Gynecological Surgeries

-

Synthetic Adhesion Barriers

-

Natural Adhesion Barriers

-

-

Abdominal General Surgeries

-

Synthetic Adhesion Barriers

-

Natural Adhesion Barriers

-

-

Orthopedic Surgeries

-

Synthetic Adhesion Barriers

-

Natural Adhesion Barriers

-

-

Cardiovascular Surgeries

-

Synthetic Adhesion Barriers

-

Natural Adhesion Barriers

-

-

Neurological Surgeries

-

Synthetic Adhesion Barriers

-

Natural Adhesion Barriers

-

-

Urological Surgeries

-

Synthetic Adhesion Barriers

-

Natural Adhesion Barriers

-

-

Others

-

Synthetic Adhesion Barriers

-

Natural Adhesion Barriers

-

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Switzerland

-

Russia

-

Poland

-

Netherland

-

Greece

-

Norway

-

Sweden

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Vietnam

-

New Zealand

-

Malaysia

-

Hong Kong

-

Thailand

-

Singapore

-

Taiwan

-

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Chile

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Oman

-

Egypt

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global adhesion barrier market size was valued at USD 1.0 billion in 2025 and is expected to reach USD 1.1 billion in 2026.

b. The global adhesion barrier market is projected to grow at a compound annual growth rate of 7.8% from 2026-2033 to reach USD 1.9 billion in 2033.

b. North America dominated the adhesion barrier market with a market share of 47.3% in 2025. This is attributable to the increase in the prevalence of orthopedic conditions coupled with the high adoption of advanced treatment procedures.

b. The leading players present in the adhesion barrier market are Sanofi S.A.; Becton Dickinson and Company; Baxter International, Inc.; Johnson and Johnson; Anika Therapeutics, Inc.; FzioMed, Inc; Mast Biosurgery, Inc.; Innocoll Holdings PLC; and Atrium Medical Corporation (A part of Getinge Group).

b. Key factors that are driving the adhesion barrier market growth include increasing surgical procedures, improvement in healthcare infrastructure, increasing prevalence of chronic diseases and sports-related injury.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.