- Home

- »

- Pharmaceuticals

- »

-

Advanced Therapy Medicinal Products Market Report, 2030GVR Report cover

![Advanced Therapy Medicinal Products Market Size, Share & Trends Report]()

Advanced Therapy Medicinal Products Market Size, Share & Trends Analysis Report By Therapy Type (Cell Therapy, Gene Therapy, Tissue Engineered Product), By Region (North America, Europe, APAC, ROW), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-855-8

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Market Size & Trends

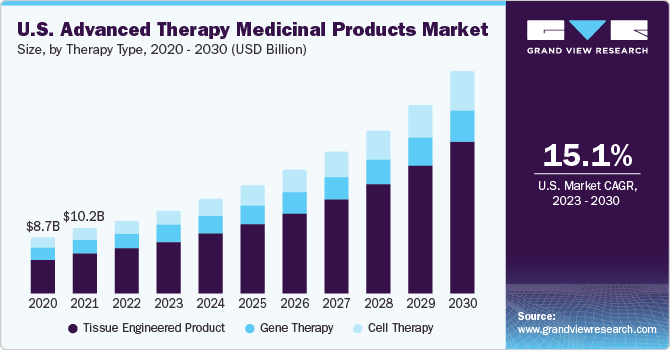

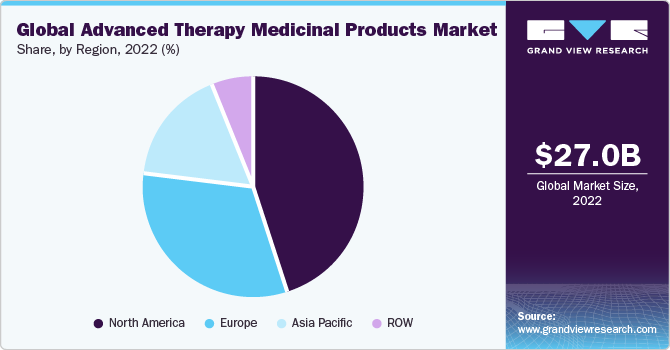

The global advanced therapy medicinal products market size was valued at USD 27.04 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 16.8% from 2023 to 2030. The emergence of Advanced Therapy Medicinal Products (ATMPs) has transformed the pharmaceutical industry and disease treatment landscape. It has opened new routes for the treatment of incurable diseases and several cancer types. The success of products such as Kymriah, Zolgensma, and others is the key factor driving the market. The COVID-19 pandemic has triggered the application of advanced therapies in virology research to a major extent. A study was issued in December 2020 which stated the potential of T-cell therapy for the treatment of high-risk COVID-19 infected individuals. Prior to this, in September 2020, the U.S. FDA approved the ALVR109 (an allogeneic T-cell therapy IND application) designed for the treatment of COVID-19 patients.

This is anticipated to drive investment in R&D of advanced therapy for SARS-CoV2 infections. Furthermore, a growing number of Mesenchymal Stromal/Stem Cells (MSCs) based clinical trials have been registered recently as a new treatment paradigm for SARS-CoV-2 infection. These therapies have shown promising results as the treatment modality in research programs, further supplementing the marketspace's organic revenue generation.

Although the market for advanced therapy medicinal products is currently in its nascent stage, it is continuously growing. Conventional drug manufacturers striving to gain a competitive edge are considering ATMPs as a lucrative source of revenue in future healthcare systems. Currently, this arena is very active, and companies are investing significantly in clinical trials of ATMPs post-success of approved products.

Over the past years, several proteins and small molecule-based developing companies have begun focusing on the development of adoptive cell T therapies. For instance, in February 2022, Recipharm, a contract development and manufacturing organization (CDMO), expanded its advanced therapy medicinal products (ATMP’s) offering into virotherapy with the acquisition of Vibalogics.

Therapy Type Insights

The tissue-engineered product segment dominated the market attributed to the incorporation of tissue-engineered products or procedures as an integral part of medicine and treatment procedures, particularly in treatments that require functional restoration of any diseased or injured part of the body.

This segment has witnessed significant traction over the past years, as evidenced by the remarkable increase in publications, research studies, clinical trials, and translational products. Furthermore, continuous advancements in technologies and products to advance the tissue engineering process aid in segment growth. For instance, in October 2022, The League of European Research Universities (LERU) announced that two of its members, Lund University, Leiden University Medical Centre (LUMC), along with Skne University Hospital, are joining forces to advance research, education, and development in the field of Advanced Therapy Medicinal Products (ATMPs).

On the other hand, the CAR-T therapy segment is gaining significant momentum in space and is expected to register the fastest CAGR over the forecast period. Key players such as Novartis AG, Gilead Sciences, Inc., and Bristol Myers Squibb are focused on expanding the reach of their CAR-T products across the globe. For instance, Novartis AG announced the approval of its Kymriah by the Health Sciences Authority as Singapore’s first commercially approved CAR-T therapy.

Kymriah is a CAR-T product designed for the treatment of patients with B-cell acute lymphoblastic leukemia and relapsed or refractory (r/r) diffuse large B-cell lymphoma. Similarly, Bristol Myers Squibb’s Breyanzi - a new CAR-T cell therapy for R/R B-Cell Lymphoma secured approval from Japan’s Ministry of Health, Labour, and Welfare (MHLW) in March 2021. This has resulted in a shift in the investment flow toward the development of CAR-T products, leading to significant segment growth.

Regional Insights

North America dominated the advanced therapy medicinal products industry and accounted for the largest revenue share of 44.5% in 2022. The increasing number of clinical trials in this new treatment modality in the U.S. supplements regional growth. Also, the favorable environment by regulatory agencies in various countries has introduced frameworks and guidelines to facilitate the development and commercialization of ATMPs. These regulations aim to streamline the approval process and ensure patient safety while encouraging investment and innovation in the field.As of March 2021, the U.S. accounts for around 57.0% of total clinical trials ongoing for gene therapy across the world. This high share indicates the increasing investment flow in this market thereby propelling revenue generation.

Asia Pacific is expected to grow at the fastest CAGR of 21.4%during the forecast period. The region has witnessed a significant increase in healthcare expenditure, leading to greater investment in research and development activities related to advanced therapy medicinal products. This has helped in the development of new and innovative products and technologies, which has boosted market growth. The region has witnessed significant advancements in gene editing technologies, stem cell research, and genetic engineering. Academic institutions, research organizations, and industry players are collaborating to promote research and development in the field of ATMPs, leading to accelerated innovation and market expansion.

Key Companies & Market Share Insights

The market for advanced therapy medicinal products has witnessed tremendous growth in the past few years. The increasing number of companies emerging in this arena is anticipated to intensify the competition in the market. Besides, recent approvals of ATMPs have accelerated the expansion in this area. The market players are undertaking various strategies to sustain their market position. Collaborations with contract manufacturing organizations are the current trend observed in this space. The CDMO/CMOs are witnessing high demand for their services owing to increasing R&D activity in this market.

Key Advanced Therapy Medicinal Products Companies:

- Spark Therapeutics, Inc.

- Bluebird Bio, Inc.

- Novartis AG

- UniQure N.V.

- Celgene Corporation

- Gilead Lifesciences, Inc.

- Kolon TissueGene, Inc.

- JCR Pharmaceuticals Co., Ltd.

- MEDIPOST

- Vericel Corporation

- PHARMICELL Co., Ltd

- Organogenesis Inc.

Advanced Therapy Medicinal Products Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 30.76 billion

Revenue forecast in 2030

USD 90.98 billion

Growth rate

CAGR of 16.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

December 2023

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Therapy type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Spark Therapeutics, Inc.; Bluebird Bio, Inc.; Novartis AG; UniQure N.V.; Celgene Corporation; Gilead Lifesciences, Inc.; Kolon TissueGene, Inc.; JCR Pharmaceuticals Co., Ltd.; MEDIPOST; Vericel Corporation; PHARMICELL Co., Ltd; Organogenesis Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Advanced Therapy Medicinal Products Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global advanced therapy medicinal products market report based on therapy type, and region:

-

Therapy Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Cell Therapy

-

Stem Cell Therapy

-

Non-stem Cell Therapy

-

-

Gene Therapy

-

Tissue Engineered Product

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global advanced therapy medicinal products market size was estimated at USD 27.04 billion in 2022 and is expected to reach USD 30.76 billion in 2023.

b. The global advanced therapy medicinal products market is expected to grow at a compound annual growth rate of 16.8% from 2023 to 2030 to reach USD 90.98 billion by 2030.

b. Some key players operating in the advanced therapy medicinal products market include Spark Therapeutics, Inc.; Bluebird Bio, Inc.; Novartis AG; UniQure N.V.; Celgene Corporation; Gilead Lifesciences, Inc.; Kolon TissueGene, Inc.; JCR Pharmaceuticals Co., Ltd.; MEDIPOST; Vericel Corporation; PHARMICELL Co., Ltd; and Organogenesis Inc.

b. Key factors driving the advanced therapy medicinal products market are the benefits offered by these therapies over conventional treatment options, increasing investment to expand product portfolio, and increasing strategic initiatives undertaken in the space.

b. The North America region dominated the advanced therapy medicinal products market and accounted for the largest revenue share of 44.51% in 2022.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."